Investing

The Best Covered Call ETFs

In recent months, a number of ETFs have grown increasingly popular. These not only keep your capital invested but also offer the potential to generate regular monthly income. But is this really possible?

The answer is yes — and in this article, we’ll explain what Covered Call ETFs are, how they can provide monthly passive income, and which ones are worth considering if you're looking to get started.

What are covered call ETFs?

Firstly it's important to know what an ETF is. An exchange-traded fund is an investment fund that’s traded on the stock market like a share. It typically holds a basket of assets—such as shares, bonds, or commodities—offering investors a simple, cost-effective way to diversify their portfolio.

A covered call ETF (also known as a buy-write ETF) takes this a step further. It not only holds a portfolio of shares or tracks an index, but also sells (or “writes”) call options on those same positions. The income earned from selling these options—known as the premium—is then distributed to investors on a regular basis.

In doing so, the ETF converts part of the underlying assets’ potential growth into cash income, all without requiring investors to manage options themselves. Many UCITS-compliant covered call ETFs distribute this income—often monthly—and in some cases include both the option premium and dividends from the underlying shares. This gives them the appeal of offering periodic returns, making them attractive to income-focused investors.

How do covered call ETFs work?

But do these ETFs really offer the seemingly magical ability to generate passive income on a regular basis? In fact, they do—and to show there’s no trickery involved, here’s how they work:

1. Portfolio of underlying assets

The fund holds a basket of shares (or in some cases, synthetic indices), typically linked to a specific stock market index or sector—such as the Nasdaq-100 or the S&P 500. This underlying portfolio allows the ETF to track, either fully or partially, the performance of that market.

2. Systematic sale of call options

The ETF regularly sells (or "writes") call options on the shares it holds, usually with a strike price slightly above the current market level. These option contracts are renewed monthly or quarterly, depending on the fund's policy, to generate ongoing premium income. Each ETF follows a clearly defined strategy outlined in its documentation—so there’s no guesswork or active trading during the contract period.

3. Collection of premiums and dividend distribution

Every time a call option is sold, the fund receives a premium, which is added to its overall assets. These premiums are then distributed to investors on a regular basis—typically monthly or quarterly—as an extra income payment. As a result, investors benefit from two potential sources of return: the regular dividends from the underlying shares and the option premiums collected by the fund.

- Invest globally with over 43,000 stocks and ETFs.

- Covered Call ETFs with a target yield of 8–12%.

- Open an account, deposit funds, and get up to 20 free stocks.

- Weekly investment ideas with a historical return of 16%.

- Grow with confidence with a broker chosen by over 500,000 clients.

Investing involves risk. Access subject to a suitability test. Promotion subject to T&Cs.

* Investments always involve the risk of loss of your capital.

👉 Discover here the best ETFs platforms to invest in

The 3 Best Covered Call ETFs with Monthly Dividend Distribution

Given their growing popularity, let’s take a look at three UCITS covered call ETFs available for investors across Europe.

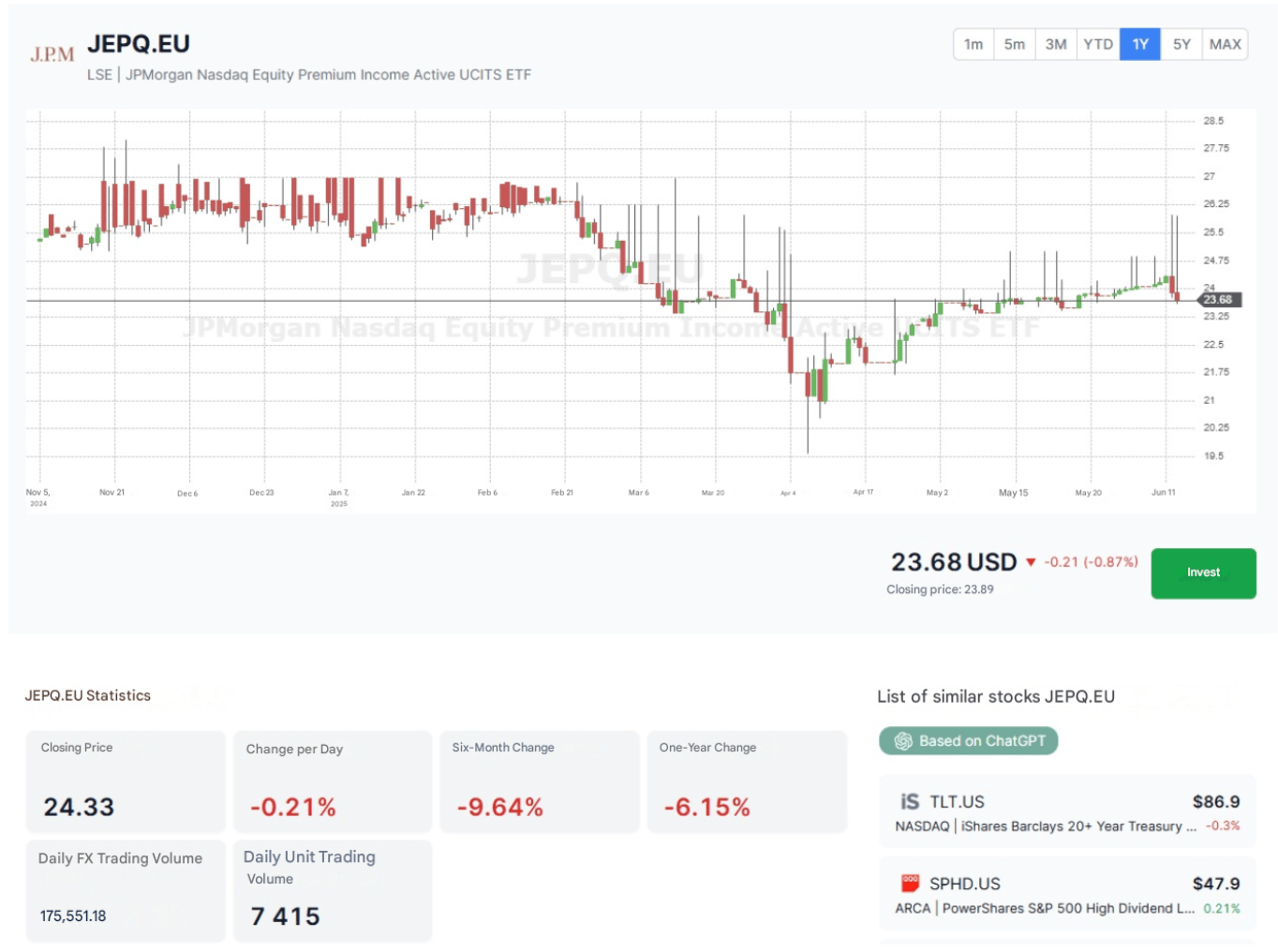

JPMorgan Nasdaq Equity Premium Income Active UCITS ETF

JEPQ is an ETF that aims to track the performance of the Nasdaq-100 index through a portfolio of 108 stocks. It also systematically sells call options with strike prices set just above the current market level to generate premiums, which are then distributed to investors monthly.

| ETF Features | Detail | ||

| ETF Name and Ticker | JPMorgan Nasdaq Equity Premium Income Active UCITS ETF (JEPQ.EU) | ||

| Max Return | –6% | ||

| Distribution (dividend) | Yes, monthly (9%) | ||

| TER | 0.35% | ||

| Volatility (1 year) |

| ETF Features | Detail |

| ETF Name and Ticker | JPMorgan Nasdaq Equity Premium Income Active UCITS ETF (JEPQ.EU) |

| Max Return | –6% |

| Distribution (dividend) | Yes, monthly (9%) |

| TER | 0.35% |

| Volatility (1 year) |

* Investments always involve the risk of losing your capital.

The fund’s stated goal is to provide long-term income and capital growth — but with less volatility than the Nasdaq-100 index, thanks to the cushion provided by selling call options.

The ten largest holdings make up half of the portfolio, featuring the familiar tech giants: Apple (9.2%), Microsoft (7.8%), Nvidia (7.6%), Amazon (5.9%), Alphabet Class C (4.7%), and others. Sector-wise, Technology dominates with 46%, followed by Communication Services at 15%, and Consumer Discretionary at 14%.

The ETF systematically sells call options on Nasdaq-100-related stocks and indices, and the premiums collected—combined with dividends from the underlying companies—fund monthly payments to shareholders, which currently yield over 9%. In exchange, the ETF sacrifices some upside potential if the tech sector rallies strongly. This is reflected in its relatively flat, and occasionally negative, performance so far. However, with less than a year since launch, it’s still early days, and a significant track record has yet to develop.

Finally, the annual cost (TER) stands at 0.35%, placing it close to its “sister” fund JEPI (which tracks the S&P 500) and well below other covered call ETFs such as QYLD, which charges 0.60%.

* Investments always involve the risk of loss of your capital.

🔎 Who is this ETF recommended for?

The ideal investor for this ETF would be:

- Someone seeking a high monthly income and willing to sacrifice some capital growth during exceptional market rallies.

- An investor comfortable with exposure to the technology sector, able to withstand short-term volatility, but focused on generating regular income.

- Those with a medium to high risk appetite who understand how options work and want to add a semi-diversified strategy to their equity portfolio.

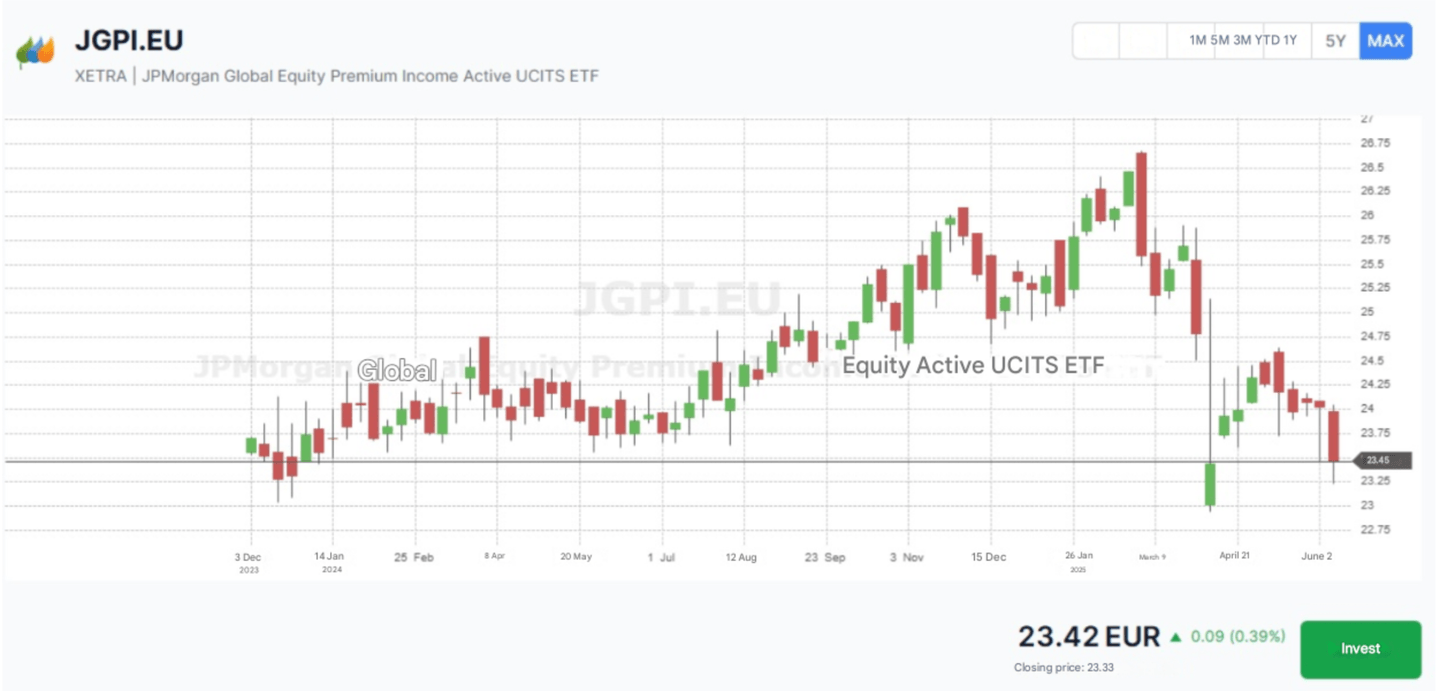

JPMorgan Global Equity Premium Income Active UCITS ETF

JEPG closely tracks the MSCI World Index, holding a portfolio of 248 large-cap and blue-chip stocks spread across various sectors and regions.

On top of this global exposure, the ETF employs a near-the-money call selling strategy with monthly expiries, generating a steady stream of premiums that are paid out to investors as dividends.

| ETF Characteristics | Detail | ||

| ETF Name and Ticker | JPMorgan Global Equity Premium Income Active UCITS ETF (QYLD.US) | ||

| Max Yield | 0% | ||

| Distribution (dividend) | Yes, monthly (7.5%) | ||

| TER | 0.35% | ||

| Volatility (1 year) | 11% |

| ETF Characteristics | Detail |

| ETF Name and Ticker | JPMorgan Global Equity Premium Income Active UCITS ETF (QYLD.US) |

| Max Yield | 0% |

| Distribution (dividend) | Yes, monthly (7.5%) |

| TER | 0.35% |

| Volatility (1 year) | 11% |

* Investments always involve the risk of losing your capital.

This time, the base portfolio consists of over 100 of the world’s most significant stocks, selected with a defensive approach. The overlay strategy involves selling out-of-the-money (OTM) call options on the MSCI World Index. The combined income from these premiums and dividends funds the monthly distributions.

The portfolio is primarily weighted towards the US (65%), the Eurozone (15%), and Japan (10%), with the technology, financials, and healthcare sectors standing out at 15.6%, 18.6%, and 17.2% respectively.

What’s particularly notable is that, despite paying monthly dividends, the fund has generally delivered positive returns over the long term.

Investors benefit from a cushion during market downturns, but in return, part of the upside potential is capped when markets rise sharply.

* Investments always involve the risk of loss of your capital.

🔎 Who is this ETF recommended for?

- Those who wish for diversified global exposure with monthly income generation.

- Investors with a moderate profile looking to reduce the absolute volatility of a 100% equity portfolio, in exchange for sacrificing some upside potential.

- UK-based wealth funds or investment portfolios that may benefit from the UK’s tax-efficient wrappers (such as ISAs or SIPPs) or from the favourable tax treatment of dividends within certain pension schemes.

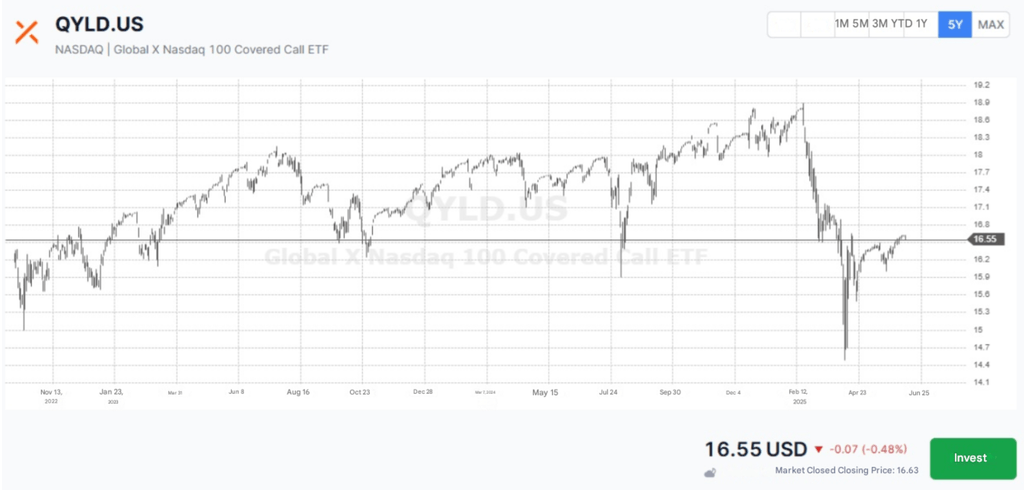

Global X NASDAQ 100 Covered Call ETF

QYLD closely tracks the CBOE NASDAQ-100 Buy Write V2 index, which involves selling at-the-money (ATM) call options on the Nasdaq-100 every month. This means the fund sells ATM calls on its entire portfolio at each expiration. Because the options are at-the-money, the premiums it earns are higher than if they were slightly out-of-the-money (OTM). However, this also increases the chance of missing out on capital gains, making the trade-off more noticeable.

| ETF Characteristics | Detail | ||

| ETF Name and Ticker | JPMorgan Global Equity Premium Income Active UCITS ETF (QYLD) | ||

| Max Profitability | 10% | ||

| Distribution (dividend) | Yes, monthly (12%) | ||

| TER | 0.45% | ||

| Volatility (1 year) | 18.75% |

| ETF Characteristics | Detail |

| ETF Name and Ticker | JPMorgan Global Equity Premium Income Active UCITS ETF (QYLD) |

| Max Profitability | 10% |

| Distribution (dividend) | Yes, monthly (12%) |

| TER | 0.45% |

| Volatility (1 year) | 18.75% |

* Investments always involve the risk of losing your capital.

More or less the same. The 10 largest positions weigh 52% and are practically a mirror of the Nasdaq-100 with the well-known names of Apple (9.6%), Microsoft (8.8%), Nvidia (8%), Amazon (5.9%), Broadcom (4.5%). While by sectors, technology dominates (≈ 50%), followed by communication (16%) and consumer discretionary (14%).

Simply note that although the monthly collections are slightly higher - because they are sold at the same price as the underlying -, the possibilities for appreciation are much more limited. And since it allows for higher monthly collections, it also charges a higher management fee.

Furthermore, the fact that it is highly concentrated around technology stocks means that its volatility may be higher than that of the other ETFs seen here, during times of index declines, as you can see in the following chart:

* Investments always involve the risk of losing your capital.

🔎 Who is this ETF recommended for?

- Those with a high aversion to declines in sideways or bearish markets, seeking maximum income generation in a technological universe.

- Profiles that accept the volatility of the technology sector and prefer recurring monthly profits to a pure buy & hold strategy in the Nasdaq-100.

- Investment portfolios focused on obtaining cash to cover current expenses, pensions, or liquidity needs, aware that capital appreciation will be very limited.

And what can happen with the ETF given different market scenarios?

- Sideways market or with moderate rises: if the stock price does not exceed the strike of the options at expiration, the ETF keeps the stocks and receives the full premium. In this way, the investor earns an additional return without incurring capital losses (beyond the inherent fluctuations of the portfolio).

- Strongly bullish market: if at expiration the stock price exceeds the strike, the fund sells the stocks at the exercise price, or the ETF rolls the position to the corresponding strike, limiting the gain to that level. The participant sacrifices potential for additional appreciation above the strike in exchange for having received the premium.

- Bearish market: in the event of sharp declines, the sale of options offers some protection, as the premium partially offsets the portfolio losses. However, if the decline is very intense, capital losses may exceed the premiums received.

In summary, during sideways or moderately growing markets, covered call ETFs help you keep your underlying portfolio while collecting premiums that boost your returns. However, in strong bullish markets, you give up some potential gains above the strike price in exchange for more stable income.

The success of covered call ETFs in the stock market

As a result, Covered Call ETFs have grown in popularity in recent months. In fact, assets under management increased from $44.5 billion at the start of 2023 to $70.7 billion by mid-2024, surpassing $75 billion by mid-2025, as investors look for strategies that offer enhanced returns amid a low-yield, volatile equity market.

The covered call ETFs have become more popular in recent years. According to data from Morningstar Direct, the net assets of the 'derivative income' group currently amount to 70.7 billion dollars, compared to 44.5 billion a year ago.

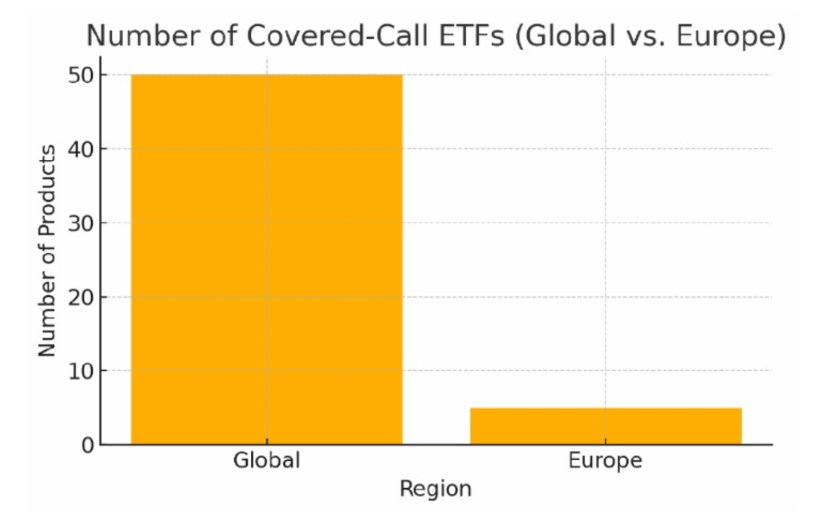

Covered Call ETFs are much more popular in the United States, where around 50 such funds are currently trading. In contrast, Europe is still in the early stages of adopting this strategy, with only five products available under the UCITS framework—indicating there may be room for new launches in the market.

Covered call with options vs covered call ETFs: Which option is better?

Since we’re seeing ETFs that apply a well-established options strategy automatically, the question arises: is it better to implement a covered call strategy yourself by buying stocks and selling options, or to delegate this to a UCITS ETF that automates the process?

To help answer this, let’s consider the following key points:

| Aspect | Manual covered call | UCITS covered call ETFs | |||

| Minimum capital required | High: Minimum lots are needed to sell options, usually lots of 100 shares, and additional margins. | Low: Fractions of ETFs can be purchased from small amounts in Europe, and there is no need to resort to margin. | |||

| Commissions and costs | Commissions generated in the buying/selling of shares and options. | Annual TER (≈0.60%–0.65%). - Broker commissions for buying and selling ETFs are generally low. | |||

| Diversification | Limited to available capital; the most common is to do covered call on a few stocks. | UCITS portfolios group dozens or hundreds of securities, spreading sectoral and geographical risk. | |||

| Operational complexity | Requires at least medium knowledge in options, their Greeks, and variables | Very simple: the strategy is executed by the manager; just buy and hold the ETF share. | |||

| Strike flexibility | Maximum: the investor chooses expirations, OTM/ATM or ITM strikes, dates, position size, has the ability to roll, or close trades at any time | None: the selection of strikes, expirations, and the underlying depends on the prospectus and manager's decisions. | |||

| Transparency and tracking | The investor sees each option and stock position, can adjust in real-time. | Quarterly or semi-annual portfolio transparency, without details of each option sold. | |||

| Tax aspect | In the UK, option premiums are generally treated as capital gains and taxed under Capital Gains Tax rules when the options are exercised or expire. Gains from the sale of stocks are also subject to Capital Gains Tax, following standard HMRC regulations. | The monthly dividends of the ETF are taxed as such (dividend taxes), and the sale of the share generates capital gain. It may be easier to declare. | |||

| Liquidity | It depends on the action and the option; some underlyings have low liquidity in distant strikes or long expirations. Generally, UCIT's ETFs do not have options, so one would have to work with American ETFs | High intrinsic liquidity of the ETF (listed on European exchanges), with tight spreads. | |||

| Protection against declines | Limited: a premium is obtained by selling the option, but in strong declines, the capital loss accumulates. Here, if a CALL has already paid a lot, new ones can continue to be opened at the pace of the decline, which provides a bit more protection | Similar: the premium from the calls partially cushions, the manager has different timings to adjust new CALLS. | |||

| Financing costs | In bearish markets, the guarantees for the options prevent taking advantage of all the capital for other investments (immobilised margin). | The fund accumulates the financing cost internally; for the investor, there is no requirement to provide guarantees. |

| Aspect | Manual covered call | UCITS covered call ETFs |

| Minimum capital required | High: Minimum lots are needed to sell options, usually lots of 100 shares, and additional margins. | Low: Fractions of ETFs can be purchased from small amounts in Europe, and there is no need to resort to margin. |

| Commissions and costs | Commissions generated in the buying/selling of shares and options. | Annual TER (≈0.60%–0.65%). - Broker commissions for buying and selling ETFs are generally low. |

| Diversification | Limited to available capital; the most common is to do covered call on a few stocks. | UCITS portfolios group dozens or hundreds of securities, spreading sectoral and geographical risk. |

| Operational complexity | Requires at least medium knowledge in options, their Greeks, and variables | Very simple: the strategy is executed by the manager; just buy and hold the ETF share. |

| Strike flexibility | Maximum: the investor chooses expirations, OTM/ATM or ITM strikes, dates, position size, has the ability to roll, or close trades at any time | None: the selection of strikes, expirations, and the underlying depends on the prospectus and manager's decisions. |

| Transparency and tracking | The investor sees each option and stock position, can adjust in real-time. | Quarterly or semi-annual portfolio transparency, without details of each option sold. |

| Tax aspect | In the UK, option premiums are generally treated as capital gains and taxed under Capital Gains Tax rules when the options are exercised or expire. Gains from the sale of stocks are also subject to Capital Gains Tax, following standard HMRC regulations. | The monthly dividends of the ETF are taxed as such (dividend taxes), and the sale of the share generates capital gain. It may be easier to declare. |

| Liquidity | It depends on the action and the option; some underlyings have low liquidity in distant strikes or long expirations. Generally, UCIT's ETFs do not have options, so one would have to work with American ETFs | High intrinsic liquidity of the ETF (listed on European exchanges), with tight spreads. |

| Protection against declines | Limited: a premium is obtained by selling the option, but in strong declines, the capital loss accumulates. Here, if a CALL has already paid a lot, new ones can continue to be opened at the pace of the decline, which provides a bit more protection | Similar: the premium from the calls partially cushions, the manager has different timings to adjust new CALLS. |

| Financing costs | In bearish markets, the guarantees for the options prevent taking advantage of all the capital for other investments (immobilised margin). | The fund accumulates the financing cost internally; for the investor, there is no requirement to provide guarantees. |

If an investor has the time, knowledge, and sufficient capital, executing a covered call strategy independently offers several advantages. It allows full control over strike prices, expiration dates, and position sizes, enabling a tailored approach that can potentially maximise the balance between premium income and risk. However, this approach is not suitable for everyone: the learning curve is steep, and operational and financing costs can be higher than initially expected.

For most retail investors, opting for ETFs that implement covered call strategies is a more practical choice. These funds offer simplicity, diversification, and eliminate the need to manage each trade manually. That said, a notable limitation exists in Europe: investors cannot directly access American ETFs that actively trade options. Instead, European UCITS ETFs hold the underlying shares when options are assigned, but cannot engage in direct options trading within the fund. Despite this, these ETFs usually have reasonable fees and remove the complexity of managing option expirations and order execution.

- Invest globally with over 43,000 stocks and ETFs.

- Covered Call ETFs with a target yield of 8–12%.

- Open an account, deposit funds, and get up to 20 free stocks.

- Weekly investment ideas with a historical return of 16%.

- Grow with confidence with a broker chosen by over 500,000 clients.

Investing involves risk. Access subject to a suitability test. Promotion subject to T&Cs.

* Investments always involve the risk of loss of your capital.

Freedom24: Best broker to buy covered call ETFs

Freedom24 offers a portfolio of over 3,600 ETFs, making it one of the most comprehensive investment platforms in Europe. But it doesn’t stop at ETFs — through Freedom24, you can also invest in more than 40,000 stocks across Europe, America, and Asia, as well as over 147,000 bonds, including corporate, sovereign, and municipal options.

Moreover, Freedom24 is one of the few European brokers that provide access to UCITS covered call ETFs, a niche category with only five products currently available across the continent.

| Features of Freedom24 | Definition | ||

| Regulation | CySEC with CIF license 275/15, and also registered with CNMV and BaFin | ||

| Financial Assets | 40,000 stocks, 3,600 ETFs, and up to 147,000 bonds. | ||

| Commissions | All Inclusive: 0.5% +0.012€ per ETF/stock (+1.2€/$ per order) Smart in EUR: 0.02€/$ per ETF/stock (+ 2€/$ per order) | ||

| Platform | Proprietary; Web and Mobile App | ||

| Advantage | Free personal investment assistant assigned to clients from account opening. | ||

| Promotion for new consumers | Open your account at Freedom24 now (it only takes 10 minutes) and get up to 20 free shares for funding your account |

| Features of Freedom24 | Definition |

| Regulation | CySEC with CIF license 275/15, and also registered with CNMV and BaFin |

| Financial Assets | 40,000 stocks, 3,600 ETFs, and up to 147,000 bonds. |

| Commissions | All Inclusive: 0.5% +0.012€ per ETF/stock (+1.2€/$ per order) Smart in EUR: 0.02€/$ per ETF/stock (+ 2€/$ per order) |

| Platform | Proprietary; Web and Mobile App |

| Advantage | Free personal investment assistant assigned to clients from account opening. |

| Promotion for new consumers | Open your account at Freedom24 now (it only takes 10 minutes) and get up to 20 free shares for funding your account |

* Investments always involve the risk of losing your capital.

Is it worth buying a Covered Call ETF instead of managing the strategy yourself?

- The goal is to generate recurring income: In a low-interest-rate environment or during prolonged sideways markets, selling options can add income to a portfolio that might otherwise be lacking.

- The aim is to simplify management: Understanding how to evaluate implied volatility, select appropriate strike prices, manage margins in sometimes illiquid markets, or handle option rollovers is not straightforward for everyone. With an ETF, investors simply buy and hold, leaving the complex tasks to the management team. For traders who spend much of their time analysing flows, volume, and price, delegating this process allows them to focus on entry and exit decisions for other assets. For example, a long-term portfolio published recently includes two such ETFs: QYLD and JEPQ.

- A willingness to sacrifice some upside potential: Investors expecting a significant rally in the Nasdaq-100 may miss out on some gains. However, in return, they can receive up to 10%–12% annually, paid monthly. In very bullish markets, some prefer to invest directly in leading stocks and use covered calls selectively at resistance levels or potential peaks. But in sideways or declining markets, premiums from covered calls provide both an emotional and financial buffer.

- Managing emotional volatility: Systematic option selling means accepting that if the price rises, the asset may be sold at the strike price. This can be frustrating during euphoric market phases. However, holding the ETF means owning a diversified package of stocks settled according to prospectus rules at expiration, enabling a long-term perspective without the need to constantly manage premiums or positions.

For all these reasons, it is recommended that those who are not yet familiar with the mechanics of options trading begin with a UCITS covered call ETF (such as JEPQ or QYLD) to gain an understanding of how the strategy works before attempting to implement it manually. Direct management should only be considered once key concepts like “implied volatility,” “assignment risk,” and “options rollover” have been fully mastered, because:

- It requires time and dedication to monitor margin levels and adjust positions.

- It affects taxation. Option premiums and capital gains/losses of each expired or assigned stock must be declared in detail.

- It demands sufficient capital to cover trades, especially if you want to operate in underlyings with very tight strikes (ATM).

In conclusion, covered call ETFs are a very attractive solution for most portfolios: they offer periodic income, diversification, and simplicity of execution.

This content is sponsored by Freedom24. Keep in mind that all investments carry the risk of losing your capital. Forecasts or past results do not guarantee future returns. Be well-informed before investing. It is important to seek financial advice before making any investment decision.

While these ETFs can generate regular income through option premiums and dividends, they also involve the risk of capital loss, especially in markedly bearish markets. Additionally, covered call strategies can limit potential gains in strongly bullish markets, as underlying assets may be exercised if they exceed the strike price. This information does not constitute financial advice or a recommendation to buy or sell any financial product. Furthermore, this particular product is subject to a suitability assessment to determine if it is appropriate for your knowledge and experience in financial instruments.