Investing

The 3 Best Small Cap Stocks UK

If you’re only watching the big names in the FTSE 100, you could be overlooking where the real growth stories are starting to unfold. While it’s easy to learn how to invest in the FTSE 100—through index funds, ETFs, or individual shares—the UK’s small cap market is full of lesser-known companies with huge potential that often fly under the radar.

If you’re after more than the typical slow-and-steady options, some of the most promising small-cap stocks are flying under the radar. These are young companies with strong foundations and big plans for growth. And the right ones can deliver growth far beyond what large-cap portfolios typically see.

Let’s see why small cap investments are printing green candles, how to find small cap stocks with real upside, and highlight three UK-listed picks with huge potential for gains this year.

What is a Small Cap Stock?

In the UK, a small cap stock typically refers to a company with a market cap below £500 million. That might not sound huge, but these are often the companies where innovation starts and momentum builds, quick to adapt, and even quicker to grow when the timing’s right. And when they get it right, the market tends to catch on late, which means early investors can ride serious momentum.

Small cap investments aren’t a one-way bet: they’re riskier, often more volatile, and can dip just as fast as they climb. With smaller market caps come thinner trading volumes and potentially sharper price swings. Not every small cap is destined to thrive. That’s why the next step is crucial, knowing how to find small cap stocks that actually have real potential.

How to find Small Cap Stocks with Real Potential

The LSE and AIM are packed with small companies, but only a select few really stand out as the best small cap stocks to buy. Keep in mind that trading follows standard LSE hours (8:00 am to 4:30 pm, UK time), so timing your research and trades accordingly can be important.

To spot real potential — not just hype — stick to the fundamentals. Focus on growing revenue, better margins, and a solid balance sheet. Early-stage companies often burn cash, but there should be a clear path to turning a profit.

Insider buying is also a powerful signal, when management is loading up on shares, that’s usually worth your attention.

Next, consider the sector. Many of the most exciting small cap stocks with huge growth potential are concentrated in specific verticals right now. AI infrastructure, clean tech, digital services, and advanced manufacturing are all worth digging into.

Don’t forget about market sentiment. While screeners and financial reports are key, investor discussions on forums and small cap newsletters often spot momentum early. These pockets of crowd insight can give you a head start, just don’t rely on them alone.

Once you’ve narrowed it down, it’s time to look at the real standouts. Let’s explore three companies that could be worth watching.

3 Small Cap Stocks

These are companies with actual traction, strong narratives, and catalysts that could spark further gains. If you're hunting for the best small cap stocks to buy now, these three have strong cases behind them.

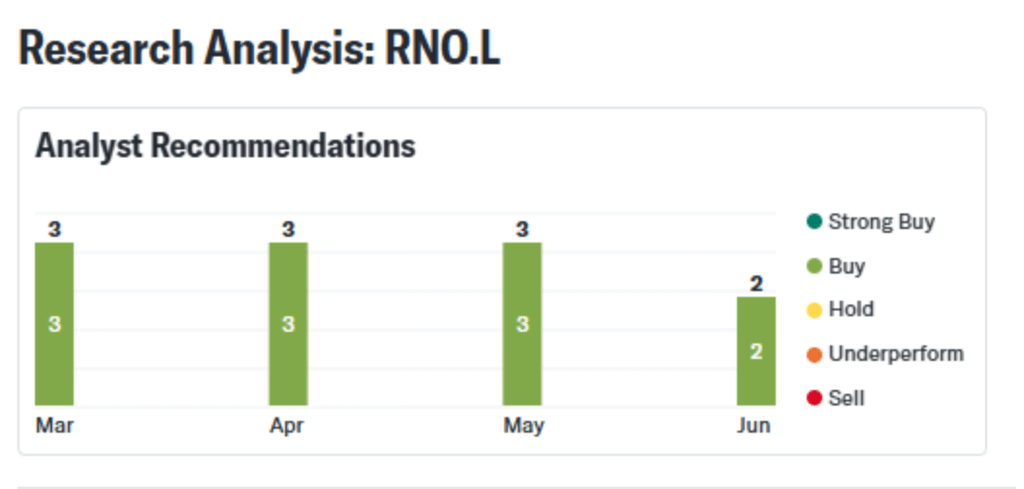

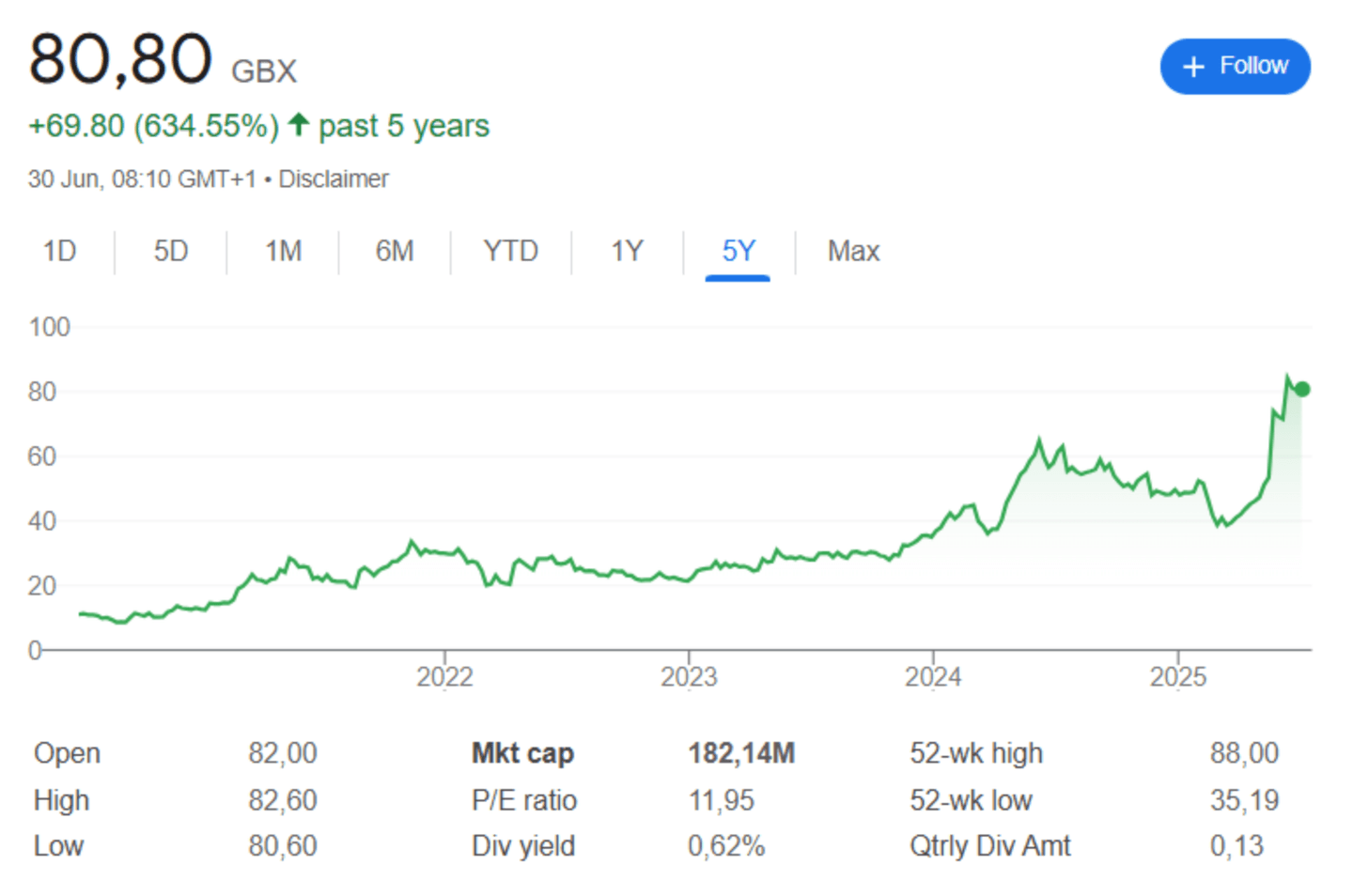

Renold (LSE: RNO)

It’s not always the flashy sectors that deliver the strongest returns, but sometimes, it’s the workhorses. With a market cap of around £180 million, Renold makes chains, couplings, and gearboxes that are essential in everything from rail systems to manufacturing lines. It might not grab headlines, but it’s deeply embedded in the backbone of UK industry.

What makes Renold particularly interesting right now is its positioning. As companies reinvest in infrastructure, automate processes, and bring production closer to home, Renold is right in the middle of the action. After years of steady progress, it’s now gaining recognition as one of the best small cap stocks to buy, especially for investors looking for exposure to industrial recovery themes.

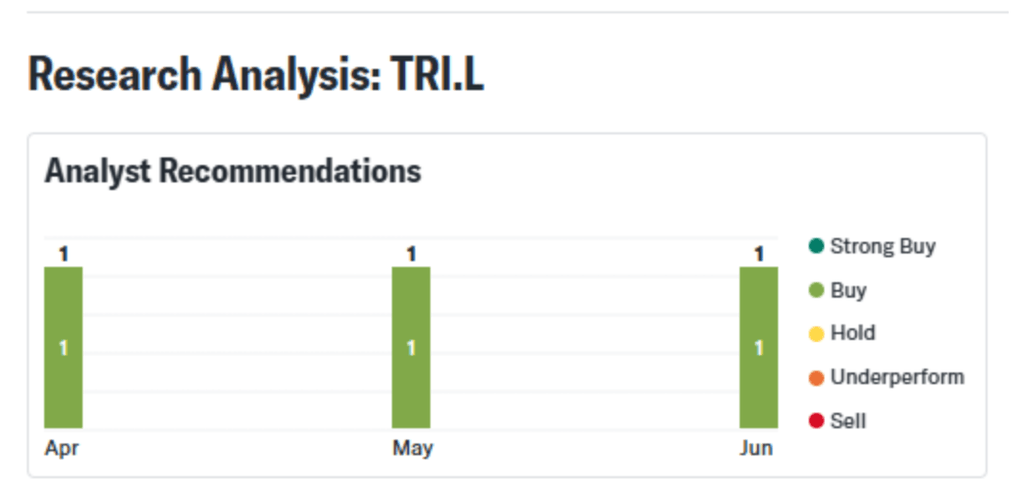

Trifast (LSE: TRI)

Staying in the industrial space, Trifast might not be a household name, but chances are, its products are holding together something you use every day. With a market cap of £93 million, this UK-based engineering firm supplies precision fasteners used in everything from cars and laptops to medical devices and solar panels.

Trifast stands out as a small cap investment with depth. It works across 20+ countries, supplying some of the most demanding industries. It’s built strong, long-term partnerships with global manufacturers, and as companies start putting more focus on quality and traceability in their supply chains, Trifast’s reputation for reliability really sets it apart. It is a steady-growth business that’s perfectly placed to benefit from industrial reshoring and global manufacturing upgrades.

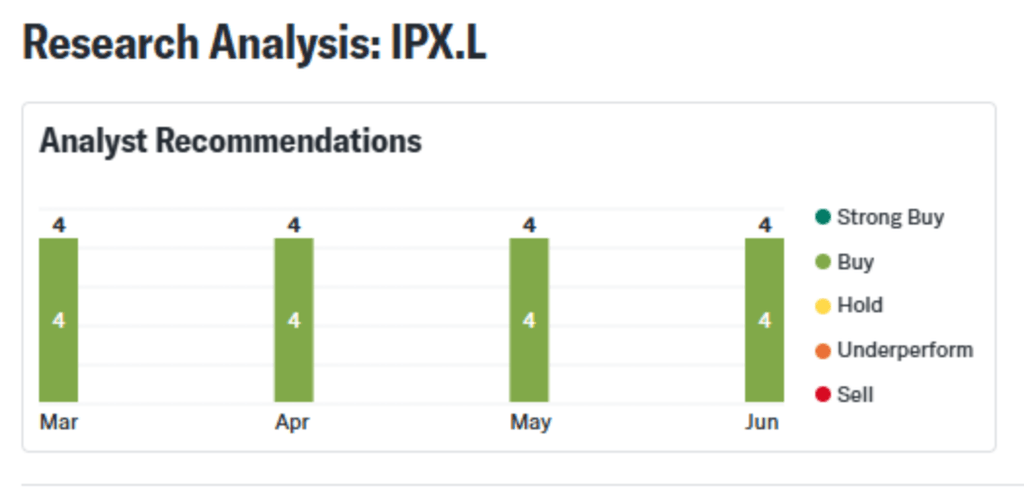

Impax Asset Management (LSE: IPX)

Rounding out the list is something a bit different: a financial firm with an environmental edge. With a market cap of £250 million, Impax is an asset manager focused entirely on sustainability, running investment funds that back clean energy, water solutions, circular economy models, and more. It’s one of the longest-standing ESG firms in the UK market.

After a turbulent couple of years in ESG investing, Impax is looking increasingly undervalued. It remains cash-rich, debt-free, and highly respected in the industry. As institutional interest in responsible investing stabilises and grows, Impax is positioned to cash in on this opportunity.

For investors who want exposure to finance, climate, and long-term global shifts, it’s one of the small cap stocks with huge growth potential, especially from its current levels.

Final pointers

By now, you’ve got a solid sense of where opportunity lives in the UK small cap space, but a smart approach makes all the difference.

First, diversify. Don’t throw everything into one or two names, no matter how good they look. Small caps can be volatile, spreading your risk helps smooth the ride.

Second, build positions slowly. Use limit orders, avoid chasing sharp spikes, and revisit your holdings regularly.

And finally, consider your tax wrapper. Holding small cap investments inside an ISA or SIPP lets any gains grow tax-free, an easy win for long-term returns.

Bottom line

The UK’s small cap scene is buzzing with stories worth paying attention to. Whether it’s an energy rebirth, a digital transformation play, or a tech-forward manufacturer making real revenue moves, there are companies setting up for their breakout moment.

The key is spotting them early, before the rest of the market catches on. With a bit of research and a long-term view, the best small cap stocks to buy can offer exposure to growth that’s hard to find elsewhere.

Start building your shortlist, do the homework, and position yourself for the next bull cycle.

FAQs

Are small cap stocks suitable for beginner investors?

Yes, but with caution, as small caps can be volatile, so beginners should start with small allocations and focus on companies with solid fundamentals.

How long should I hold small cap stocks?

They’re best held with a medium to long-term view. Many small caps need time to execute their growth plans and scale effectively.

What’s the difference between AIM and FTSE small caps?

AIM stocks often carry more risk but more flexibility, while FTSE small caps tend to be more established. Both can offer strong growth potential.

Should you invest in small cap stocks?

Potentially, if it fits your risk profile. Small-cap stocks can deliver strong growth but are typically more volatile and less stable than large-cap stocks. They're better suited for long-term investors comfortable with higher risk.