Investing

How to Invest in Luxury?

Do you think footballers, successful entrepreneurs, or prominent figures in the world of film and music are familiar with crises?

Spoiler: No.

The wealthy are no strangers to prosperity, even in times of crisis. That's why today, we're focusing on a sector that consistently thrives, no matter the economic climate. When the global economy is booming, it’s even better – more wealthy individuals are created, leading to even greater growth.

But if the economy is struggling, it doesn’t make a difference. There will always be a group of consumers eager to distinguish themselves from the crowd, demonstrating that, despite the turmoil, they’re still flourishing.

It’s much like if a new gold mine were discovered in your city; I’d tell you not to invest in gold itself, but in the tools to extract it. The same principle applies to stock markets:

Don't spend on luxury products, invest in the companies that provide them

In this article, we’ll delve into why the luxury sector is antifragile, highlighting a few companies in different stages, as well as an ETF option for more conservative investors.

Why invest in luxury?

Essentially, these are the 3 reasons that make investing in luxury interesting:

Increase in global wealth and emerging markets

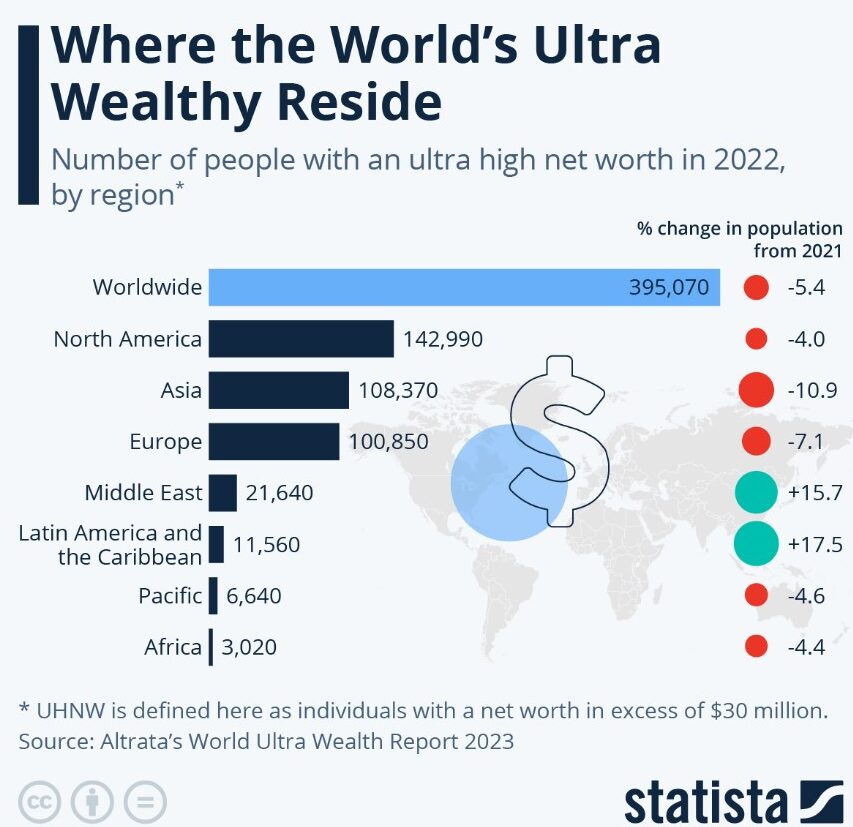

Simply put, the rich keep getting richer. Over recent decades, global wealth has surged, largely driven by increased productivity from technological advancements in production.

While much of this growth has been led by the USA, with an ever-growing number of wealthy individuals, it’s equally important to note that emerging economies like China, India, and Russia have also contributed significantly to this wealth boom.

And of course, all this increase has led to a greater demand for luxury goods in these markets, which has not only created an ever-growing market, but it is also expected to grow at an average rate of 6.5% between 2025 and 2030.

Brand Value and Status

Another key factor is that luxury brands are closely linked to social status and prestige.

Consumers aren’t just looking for high-quality products; they seek items that symbolise success and exclusivity. Have you ever attended a social event and pulled out that special watch you only wear on rare occasions, just so people take notice and immediately recognise your status? It might seem superficial, but it's undeniably true.

While this may be less common in Western societies today, it remains a widespread behaviour in emerging markets, where clear wealth gaps exist between social classes. Anyone with the means to distinguish themselves from their original social group and appear part of a wealthier one will likely do so without hesitation.

This perception enables luxury brands to maintain high profit margins and build strong customer loyalty. In fact, many luxury consumers become brand evangelists, happily discussing their purchases—such as why they bought that Ferrari—at length at social events. Furthermore, a PwC study found that 67% of luxury consumers consider exclusivity to be a key factor when choosing a brand.

Alternative Investment in Luxury Assets

Even more interesting is the acquisition of luxury goods such as art, fine wines, watches, and jewelry not only as products of personal desire but as investment assets in themselves. Something that some now call alternative investment.

If you can't invest in a limited edition Ferrari that only four sheikhs and two Russian oligarchs will have access to. Be the smartest in the class, and invest in the company that creates the fantasy that this edition is limited. It is limited because they want it to be. This provides a double value to the company—the sale of the limited series itself, and its positioning as a top-of-mind brand in the luxury sector.

And well, if we take a look at the Knight Frank index, which measures the performance of luxury goods, this is its evolution during the period 2012-2022.

But which companies sell those cars, or produce those fashion accessories? Are they publicly traded? And how are they doing? That's exactly what we're going to see now.

How to Invest in the Luxury Sector?

As in any other mature sector, you have several options, including stocks, ETFs, and a wide range of funds. Here, we’ll take a look at 3 ideas that might be of interest to you.

I am not a professional financial advisor. My goal is to share information and analysis based on reliable sources to help you make informed decisions. However, this is just an opinion, and I encourage you to do your own research before investing.

Ferrari (RACE)

Ferrari N.V. (RACE) is the second largest company in Italy and one of the most legendary luxury car and racing brands in the world, recognised for its iconic ‘Cavallino Rampante’ and its rich tradition in Formula 1. In recent years, the company has successfully transferred its motorsport prestige to high-end models, while maintaining the air of exclusivity that defines it.

Similarly, Ferrari has strengthened its commitment to innovation, exploring the hybridisation of its engines and the introduction of cutting-edge electric components, as seen in the SF90 line. This approach to next-generation technologies aims to preserve its leadership in exclusivity, without compromising its sporting DNA.

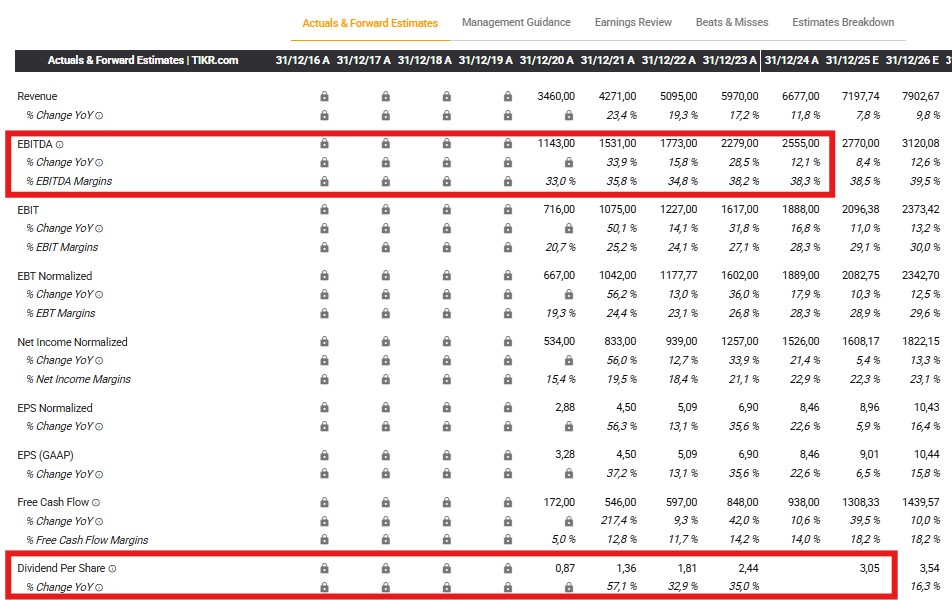

Financially, the company has shown impressive growth:

EBITDA: In a word, impressive. Ferrari has seen a growth of 43% in just two years, with Free Cash Flow doubling in just 3 years.

Dividends: While its dividend yield is relatively low at just 0.61%, it has increased its dividend by over 40% in the last 3 years, with a current payout ratio of 30.5%.

Such solid financial health is reflected in its price, which is near historical highs. In fact, there is currently a strong entry position right at a support line that has been respected for the past 3 years (marked by the green circle). If it strongly breaks the $450 USD per share barrier, which would mark a new historical high with an 18-high RSI, a second entry could be considered.

Kering (KER.PA)

Kering (KER.PA) is one of the most prestigious luxury conglomerates in the world, encompassing iconic brands such as Gucci, Saint Laurent, and Bottega Veneta. Its strong presence in the luxury market has allowed it to secure a privileged position, driven by growing demand in key regions like Asia.

However, on a financial level, the company is currently facing challenges, particularly due to the collapse of its sales in China, caused by the irregular situation in the country’s economy. This may present an opportunity for investors, given the current circumstances.

EBITDA: It has declined by approximately 11% over the past year, yet it remains at the same level as in 2021, when its stock price was nearly double what it is today. Moreover, Kering still maintains a solid solvency ratio of 1.60.

Dividends: Kering offers a dividend of €2.88 per share, with a dividend yield of 4.4%, making it an attractive option for income-seeking investors.

Additionally, with a P/E ratio of just 15, the company seems to offer a unique opportunity, especially if there is an anticipated recovery in consumption in its Asian markets.

Technically, Kering appears to have found a market floor around €250 - €260 per share, marked by unusual volume (red circle) and over 6 months of bullish RSI divergences compared to the price (green line).

It’s true that entering right now after a 70% pullback from highs may seem daunting. However, this is precisely where opportunities lie in financially healthy companies. The chart appears to indicate a potential reversal pattern, though it would be wise to set a stop loss around the €200 - €205 per share level.

And to help with your investment research, below is a table of other luxury sector stocks that might be of interest to you.

| Companies | Ticker | ISIN | |||

| LVMH | MC.PA | FR0000121014 | |||

| Swatch Group | UHR.SW | CH0012255151 | |||

| Richemont | CFR.SW | CH0210483332 | |||

| Hermes | RMS.PA | FR0000052292 | |||

| Christian Dior | CDI.PA | FR0013261054 |

| Companies | Ticker | ISIN |

| LVMH | MC.PA | FR0000121014 |

| Swatch Group | UHR.SW | CH0012255151 |

| Richemont | CFR.SW | CH0210483332 |

| Hermes | RMS.PA | FR0000052292 |

| Christian Dior | CDI.PA | FR0013261054 |

The Luxury Brands ETF: Amundi S&P Global Luxury UCITS ETF

Let’s now turn our attention to luxury brand ETFs. Unfortunately, from Europe (under UCITS regulation), there is not a great variety. In fact, the most interesting option is the one below.

The Amundi S&P Global Luxury UCITS ETF (AFID), managed by Amundi, is one of the most popular choices for gaining exposure to the global luxury sector. Its objective is to replicate the S&P Global Luxury index, which includes leading companies in the premium products and services industry. Notably, the top 10 companies alone account for almost 50% of the ETF's holdings, and they are as follows:

Since this index is valued in dollars, it’s important to note that the mentioned ETF offers a synthetic replication through a swap, ensuring it closely tracks the evolution of the S&P Global Luxury index. With a TER of 0.25% per annum, it stands out as the most competitive and largest ETF following this index.

As a result, this ETF has delivered an impressive 79% return over the last 5 years.

In short, investing in luxury results in growth. There are sectors that are highly correlated with the economic cycle, such as technology, but without a doubt, one of the least correlated is luxury, because as we said at the beginning of this article, there is no crisis in luxury.