Investing

How to Invest in Rare Earths?

Artificial intelligence, blockchain, and cutting-edge technological treatments in healthcare—did you know that all of this relies on a series of elements that, far from being "in the cloud," are actually found underground?

We are talking about a group of elements known as rare earths, which are essential for driving the technological revolution we are starting to experience.

However, it's not as simple as just setting up a mine wherever these elements are found. Quite the opposite, there are significant challenges, both in terms of the economic viability of these projects and due to certain monopolistic practices by China, which are making the hoarding of these resources a real struggle for many of the companies leading the charge in shaping our technological future.

And as we all know, where there is demand coupled with scarcity, there lies an investment opportunity. That’s why, in this article, we’ll be exploring the current situation of these materials, which is quite fascinating, as well as how you can invest in rare earths in a simple way.

What are Rare Earths and why are they called that?

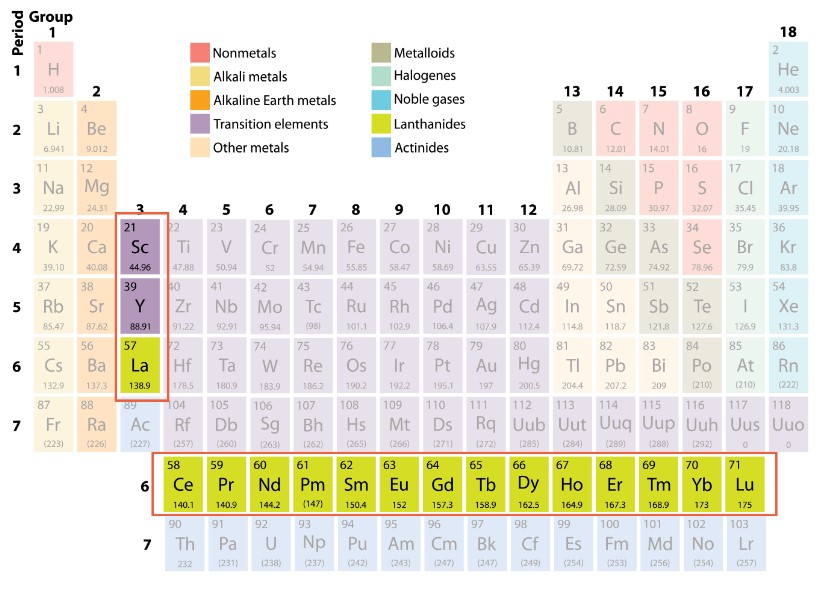

Rare earths refer to a group of 17 chemical elements, which include the 15 types of lanthanide materials (lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium), along with scandium and yttrium.

Despite their name, and somewhat paradoxically, these elements are not particularly "rare" in terms of their abundance in the Earth's crust. However, they are often found scattered and mixed with other minerals, which makes their extraction challenging and drives up production costs.

Their true significance lies in the unique physical and chemical properties they possess, such as high magnetic and electronic conductivity, as well as resistance to corrosion. These characteristics make them crucial components in the manufacture of high-tech products, such as:

- Electric vehicle motors

- Wind turbines

- Electronic devices (phones, tablets, computers)

- Defense systems and military equipment

- High-definition television screens and LED lights

And, of course, due to their increasing demand in the technological and energy sectors, rare earths are regarded as a valuable and strategic asset, presenting appealing investment opportunities.

What is the big problem with rare earths that China has understood better than anyone else?

Although rare earths are found all over the world, extracting and processing them is neither simple nor cheap. It requires a significant investment in infrastructure, technology, and specialised labour. Back in the mid-1980s, China was one of the first countries to recognise the strategic value of these elements and, as a result, focused on developing the entire production and refinement chain.

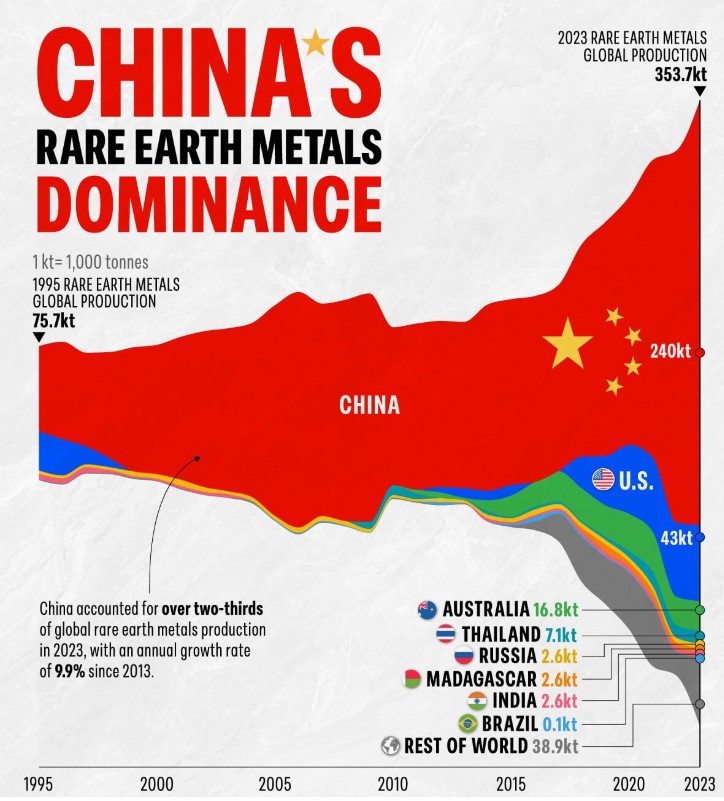

The outcome is that today, China dominates around 80% of the world’s rare earth production, giving it control over a crucial resource for the technological and energy industries across much of the globe.

China's privileged position in the global market is further reinforced by the economies of scale it has developed in this sector. Having made early and consistent investments, it has managed to create a value chain that is highly efficient in the extraction and refining of rare earths. This makes it economically unviable for other regions of the world to start similar projects, which are incredibly capital-intensive.

Additionally, if we factor in the current geopolitical context, which is increasingly focused on the formation of economic “blocks,” the reliance on Chinese rare earths poses a risk for many countries. For example, trade frictions — including potential tariffs of up to 25%, as discussed during the Trump administration — could raise costs or restrict access to these critical materials, destabilising sectors such as electronics, electric vehicle manufacturing, and the defence industry.

USA gets to work & Europe… perhaps not so much

Okay, so if rare earths are so essential for the development of the technological and military industries, is their production really not being subsidised in the West?

Well, as is often the case, there’s both good and bad news.

On the one hand, the USA virtually abandoned its production for many years due to the high environmental costs and the competitiveness of China, with some mines even being closed down.

However, after the start of Trump’s second term, this situation appears to have changed drastically. Under the argument of an "energy emergency," there has been an intention to revitalise the industry, with subsidies to support the sector.

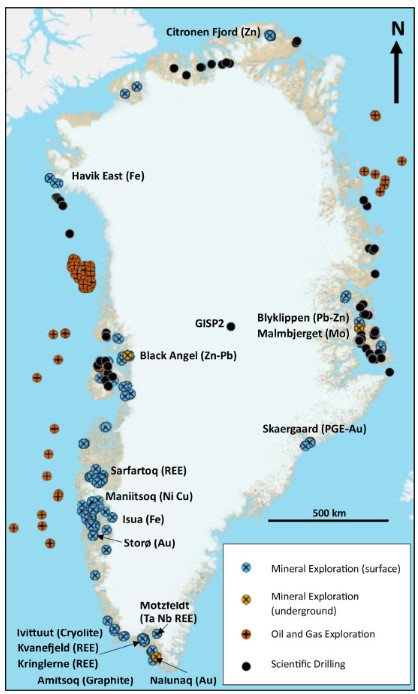

Perhaps the most notable proposal, however, was the famous idea of buying Greenland from the Kingdom of Denmark. While this might seem like another one of Trump’s more outlandish ideas, it turns out that Greenland holds 43 of the 50 materials the US government considers essential for the development of its industries. Moreover, when it comes to rare earths, we know that 2% of the world’s reserves are located there. More recent surveys suggest that beneath the icy surface, those reserves could actually be much higher — somewhere between 15% and 25%.

Meanwhile, in Europe, it’s pretty much the same old story. It’s true that some plans are being pushed forward, and feasibility reports have already been drawn up as part of exploration processes… but not much beyond that. We seem far more focused on regulating the environmental impact than on striving for any sort of energy sovereignty.

How to invest in rare earths?

But let’s get to the important bit. If there’s so much concern about the scarcity of these elements, and at the same time, China — which controls 80% of global production — could shut off the supply at will if tensions with the Trump administration escalate, then perhaps investing in companies or funds focused on their production might not be such a bad idea.

But how is this possible?

Rare earth companies listed on the stock exchange

In reality, there are only three companies in the world that focus primarily on the extraction and processing of rare earths as the core activity of their business. The first is based in China, the second in the USA, and the third in Australia.

| Companies | ISIN | Ticker | |||

| China Northern Rare Earth Group | 600011.SH | CNE000000T18 | |||

| MP Material | MP | US5533681012 | |||

| Lynas Corp | LYC . AX | AU000000LYC6 |

| Companies | ISIN | Ticker |

| China Northern Rare Earth Group | 600011.SH | CNE000000T18 |

| MP Material | MP | US5533681012 |

| Lynas Corp | LYC . AX | AU000000LYC6 |

Vaneck Rare Earth and Strategic Metals UCITS ETF A

However, if you’re looking for exposure to such a niche market as rare earths, rather than picking individual stocks, a much more interesting option could be to invest in an ETF that tracks the sector's performance.

And what is an ETF? An ETF (Exchange-Traded Fund) is a type of investment fund that holds a collection of assets, like stocks or bonds, and trades on stock exchanges, similar to individual stocks.

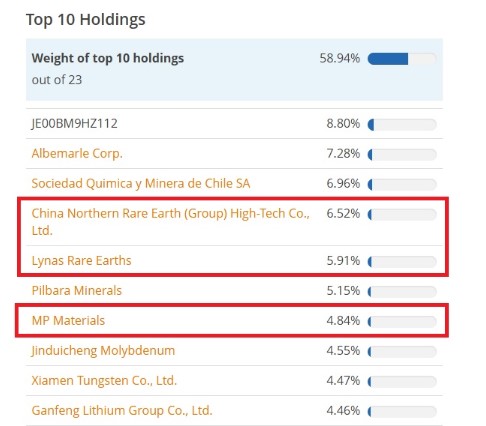

So, here is a much more compelling alternative: the VanEck Rare Earth and Strategic Metals UCITS ETF (REMX) with ISIN IE0002PG6CA6. This is the only UCITS exchange-traded fund that follows the MVIS Global Rare Earth/Strategic Metals Index — an index made up of the largest and most liquid companies in the rare earths and strategic metals sector.

With a Total Expense Ratio (TER) of 0.59% per year, this ETF stands out as a relatively cost-effective choice, especially within such a specialised segment.

Moreover, the ETF includes the previously mentioned companies, giving them a 17% weighting. The remaining components, while they may have business lines related to rare earths, are certainly not the core of their operations.

It’s also worth mentioning that the ETF follows a physical replication strategy, meaning it directly acquires all the securities that make up the index. The dividends generated by these shares are reinvested into the fund itself, allowing investors to benefit from long-term compound growth.

However, it’s important to highlight that the performance of this ETF has not been the best in recent years, having lost more than 50% since it began trading. That said, considering the strategic importance of natural resource mining — including rare earths — for a wide range of everyday consumer products, it could present a good opportunity at this time.

In short, rare earths are one of those essential elements for our immediate technological future. It seems difficult to revolutionise artificial intelligence, or improve our defence systems, without relatively abundant access to these materials, whose production is now paradoxically controlled by China, the US's number 1 enemy.