Definitions

ICT Trading

ICT Trading, short for Inner Circle Trader, is a trading methodology that focuses on institutional price behavior and market structure. Unlike traditional retail strategies, ICT aims to decode how banks and large institutions move markets, using concepts like Fair Value Gaps (FVGs), liquidity zones, and order blocks. The approach emphasises smart money principles, precision entries, and understanding when the market is likely to reverse or continue.

Popular among forex and futures traders, ICT strategies require deep market study and are used to anticipate price action with institutional-level insight.

👉 More here on the best forex brokers

This article will cover what ICT Trading is, the core principles behind it, and some of the most popular tools and strategies traders use to apply this methodology effectively.

What is ICT Trading?

ICT trading, also known as Smart Money Concepts (SMC), is a trading methodology rooted in the behaviour of algorithms used by large financial institutions.

This approach is based on price action, meaning it does not rely on traditional indicators—not even volume. One of its key strengths is the ability to identify and interpret market manipulation, enabling traders to position themselves accordingly and potentially benefit from institutional activity. Understanding how to read these patterns forms a core part of what technical analysis is, a method that helps traders forecast future price movements using historical market data.

Pros and Cons

| Pros of ICT Trading | Cons of ICT Trading | ||

| ✅ Focus on institutional action: The method focuses on identifying areas where the big players (banks, funds, etc.) operate, which can help understand where the "smart money" is moving. | ❌ Steep learning curve: The ICT methodology is complex and requires an in-depth study of advanced concepts. | ||

| ✅ Clarity in imbalance zones: Concepts like Order Blocks and Fair Value Gaps allow identifying areas where the market has left inefficiencies. | ❌ Requires time and dedication: Mastering the concepts and applying them in real-time demands constant practice, hence the importance of having previously studied some technical analysis. | ||

| ✅ Risk management: ICT emphasises the importance of proper capital management. | |||

| ✅Structured strategy: It offers clear guidelines for determining entries and exits, based on market structure and liquidity. |

| Pros of ICT Trading | Cons of ICT Trading |

| ✅ Focus on institutional action: The method focuses on identifying areas where the big players (banks, funds, etc.) operate, which can help understand where the "smart money" is moving. | ❌ Steep learning curve: The ICT methodology is complex and requires an in-depth study of advanced concepts. |

| ✅ Clarity in imbalance zones: Concepts like Order Blocks and Fair Value Gaps allow identifying areas where the market has left inefficiencies. | ❌ Requires time and dedication: Mastering the concepts and applying them in real-time demands constant practice, hence the importance of having previously studied some technical analysis. |

| ✅ Risk management: ICT emphasises the importance of proper capital management. | |

| ✅Structured strategy: It offers clear guidelines for determining entries and exits, based on market structure and liquidity. |

In general, the only disadvantage visible is the complexity. ICT may seem like a very simple methodology but it is not. Most ICT students stick to OB and FVG, which are just tools. ICT goes much further, and this requires many hours of charts until you understand the potential it has as a trading philosophy.

In short, ICT trading is a type of trading that emphasises detecting inefficiencies created by institutional traders' algorithms, to take advantage of those gaps when the price seeks to start its path towards the next liquidity zone.

What are the Fundamental Principles?

A core principle underpins the entire ICT trading methodology: price action serves one of two purposes—to take liquidity or to rebalance. While this may initially sound complex, it simply means that price is continually seeking counterparties, often found among retail traders. ICT trading offers insights into the seemingly random manipulations observed daily in price charts.

Several key concepts define this approach:

- Market Structure: ICT trading examines recurring patterns and market cycles to identify trend shifts and potential reversal points.

- Liquidity Zones: These are areas where buy or sell orders are concentrated, often acting as key support or resistance levels.

- Order Blocks: These refer to specific price zones where institutional players are believed to have executed significant orders—making them useful reference points for entry or exit.

- Risk Management: A cornerstone of the methodology, ICT places strong emphasis on capital protection through disciplined risk control.

Who is Inner Circle Trader?

ICT (Inner Circle Trader) is the alias of American trader Michael Huddleston, who developed and popularised the ICT trading methodology. This approach, known for its focus on institutional trading behaviours and smart money concepts, has gained a significant following among traders seeking deeper market insight.

Huddleston shares his strategies through his Inner Circle Trader YouTube channel, which has attracted over one and a half million subscribers. The channel offers hundreds of hours of free educational content, where he breaks down his trading philosophy and tools.

For those with the time and interest, it's a valuable resource worth exploring.

How does the ICT Methodology work in Trading?

The ICT (Inner Circle Trader) methodology centres on two core concepts: liquidity and rebalancing. Every tool and strategy within the ICT framework ultimately revolves around these principles.

In this context, liquidity refers to the concentration of uninformed traders’ positions—often found near support and resistance levels—where institutions may look to trigger large moves. Rebalancing, meanwhile, relates to how price adjusts after seeking out this liquidity.

ICT is more than just a trading system; it’s a complete trading philosophy. It combines diverse concepts with the aim of interpreting and leveraging algorithmic market behaviour. The methodology seeks to help traders understand how and why price moves toward liquidity, and how to position themselves for the move that follows.

What Are the Key Tools and Concepts in ICT Trading?

It’s impossible to fully explain all the tools within the ICT methodology in a single article, so here’s a brief overview of the two most important concepts: the Order Block (OB) and the Fair Value Gap (FVG).

Order Block

An order block refers to a price zone where the algorithm has manipulated the market to prompt retail traders to take positions against the true direction of the trend. This manipulation helps the algorithm collect significant counter-orders. To better understand this, let’s break it down:

- Creation of a range-bound or consolidating zone

- A sharp “euphoria” or “panic” candle that generates counterparty interest

- The real move: continuation of the underlying trend

In the image below, you’ll see an actual trade made while this was being written. Notice a larger consolidation within an uptrend and a smaller one just after it breaks out.

Both areas represent order blocks, as each includes candles driven by fear or euphoria followed by a swift reversal. This occurs within an MMBM buying model during phase 2 of distribution—making it highly probable that price will move towards the marked liquidity.

There are various types of Order Blocks (OB). The one previously described is the most common, but within the ICT methodology, others exist as well—such as mitigation blocks, propulsion blocks, and trend initiation blocks. Each type has distinct characteristics, and their appearance on a chart carries different implications for market behaviour and potential trading opportunities.

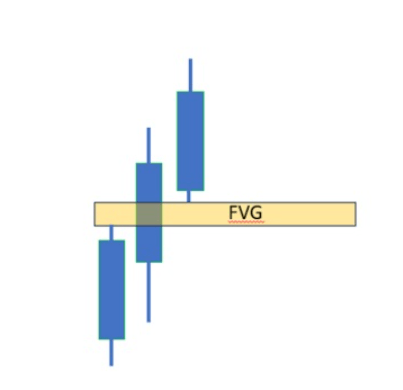

Fair Value Gap (FVG)

The Fair Value Gap (FVG) refers to a section of the price chart where, due to intense buying or selling pressure, the price moves so quickly (whether due to supply or demand force) that it leaves a gap without trading at certain levels. This inefficiency can be interpreted as an area where the market might return to balance the price action.

In colloquial terms, it could be said that in an FVG there have been only buys or only sells. This last statement, of course, is not entirely accurate, as if there has been a buy, there has also been a sell, and vice versa.

The schematic representation of a bullish FVG is what can be seen in the following image: a zone where the price has only risen. The bearish one is the same, but the price has only fallen.

Charts are full of these movements, and understanding the reason why they form will give traders a significant advantage. The existence of an FVG will always indicate intention, but there can be two types of intentions: manipulation or movement. What can be assured is that algorithms are active, and therefore, sideways markets should be avoided.

The FVG, particularly within the framework of FVG ICT trading, helps in detecting manipulations and pinpointing entry zones for trades. In the example used earlier with the OB, it was observed that when the price broke down, it did so with a -FVG, and when it re-entered, it did so with another +FVG.

The existence of the +FVG in that area indicated that the -FVG was intended to manipulate the lower part of the OB. Subsequently, a new +FVG appeared, signalling an intention to continue rising. The entry was made in a third bullish +FVG with a limit order on the manipulation of a small OB, and from there, the price moved towards the target. This can be seen in the following image.

How to Understand the Concept of Manipulation in ICT?

Manipulation is an inherent feature of financial markets. In what is often considered a zero-sum game, one participant’s gain typically comes at another’s expense. This dynamic creates opportunities for powerful market players to influence price movements—often temporarily—according to their interests.

Such manipulation can involve luring retail investors into false breakouts or reversals. The ICT methodology offers tools to help traders distinguish between genuine price moves and manipulative ones, particularly around key levels like support and resistance—areas where misleading signals and liquidity grabs are most common.

What are the best strategies within ICT Trading?

There are many different strategies in ICT known as models, and it is important to differentiate between directional models and operational models.

Directional models provide insight into where the price is most likely to go, while operational models help define where to position oneself in order to initiate a trade.

Some of the most well-known directional models include MMXM, Next Day Bar, and Romeo (the latter being from an ICT student).

The most well-known operational model is the ICT 2022.

While there are many other models within the ICT framework, the ones mentioned above are considered the most significant. However, as previously noted, ICT is more of an investment philosophy than a mere trading system. This means that while the models are valuable tools, ICT encompasses a broader approach, aiming to understand nearly any type of price movement.

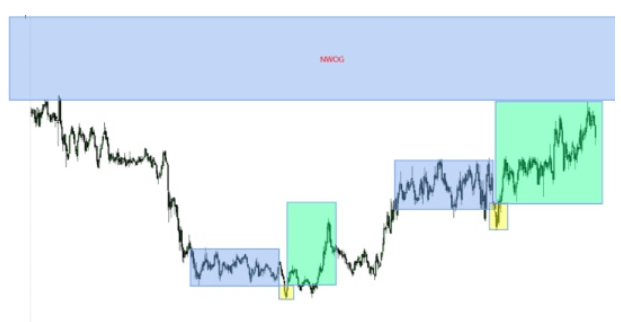

PO3 Strategy

PO3 is halfway between a directional model and an operational model, but its relevance within the ICT world is so important that it deserves its own section. Its power is such that by understanding its functioning, one can predict many market movements.

PO3 is the acronym for Power of three, and it explains the three phases of a movement, from when it is manipulated until it reaches the desired target by the algorithm. The three phases are: Consolidation, Manipulation, and Distribution.

Practically any trending market movement can be explained based on this concept

The phases of the PO3 strategy

- The consolidation (lateral) is used for retail traders to position themselves and place Stop orders.

- The manipulation is the deceptive movement that extracts market liquidity. This liquidity is extracted through the stop runs of already positioned traders and those who position themselves with market orders due to panic or euphoria.

- The distribution is the real price movement. It is the movement that the algorithm intended to make.

In the following image you can see two consecutive PO3. Consolidation (blue), manipulation (yellow), and distribution (green).

This process occurs in all timeframes and in all assets.

FAQs

Is it necessary to have prior experience to use the ICT method?

It is not necessary, but it is recommended.

Does ICT Trading work for scalping or only swing trading?

It works in all timeframes.

How long does it take to master ICT strategies?

Mastering ICT strategies can vary from trader to trader, depending on their prior experience and commitment to learning. Generally, it may take several months to a year to become proficient, as ICT strategies involve understanding market structure, liquidity, price action, and various models. Consistent practice, backtesting, and real-time application of the strategies are essential to mastering them. It's important to note that becoming fully skilled in ICT is an ongoing process, with continuous learning and adaptation as market conditions evolve.

Is it suitable for all markets?

ICT is suitable for all assets with high liquidity, including indices, commodities, cryptocurrencies, forex, and stocks. This can be stated with confidence, as many profitable students across these asset classes have found that ICT played a crucial role in helping them make the final leap to profitability.

Is it worth learning ICT Trading?

Yes, without any doubt. However, as mentioned earlier, it is highly beneficial to have prior knowledge of technical analysis and to have spent some time observing how traditional systems often fall short. This foundation ensures that traders dedicate the necessary time to truly understand the philosophy behind ICT.

Who is ICT Trading suitable for?

From the perspective of many experienced traders, ICT is more suited to those with a solid background in the markets.

Traders who have explored different methodologies often recognise the true power of ICT. Those new to trading, however, may not fully appreciate this until they have spent time trying to make consistent profits using tools like the RSI or similar indicators. It is through these experiences that many traders come to realise the effectiveness of the ICT approach.