Investing

Understanding the Jackson Hole Symposium 2025

Once again, the eyes of the financial world turns towards a small town in the state of Wyoming (USA): Jackson Hole.

What might seem like a common tourist destination is actually the setting for one of the most important meetings for central banks and, consequently, for financial markets.

In this article, we will explore what exactly the Jackson Hole Symposium is, who its main figures are, and what decisions were made in the latest edition of 2025, as well as how they affected the main stock indices.

👉 Read here for more information on when the US Stock Market opens

What is the Jackson Hole Symposium?

The Jackson Hole event is an annual meeting organised by the Federal Reserve of Kansas City with the idea of bringing together leading central bankers, finance ministers, economists, and financial leaders from around the world to discuss global economic trends, monetary policies to be implemented, and other topics that directly affect the global economy.

And why is the meeting held in Jackson Hole?

Its origin dates back to 1978, but it gained worldwide relevance when in 1982 it was moved to Jackson Hole to attract the then Federal Reserve Chairman, Paul Volcker, who was a great fishing enthusiast and showed great interest in attending the meeting, as long as it was in a place that could combine his professional work with his love for nature.

With all that said, although no monetary policy decisions are made at the event, the speeches and debates that take place there often strongly influence subsequent official decision-making, and of course, market expectations (we must never forget that investor expectations are the main driver of price movements in the markets, especially in the short and medium term).

In fact, Powell's speech in 2022 was famous, when after adopting a strongly hawkish approach, stock indices like the S&P 500 or the Nasdaq plummeted 16% and 20% respectively.

👉 Read here to learn how to invest in the the S&P 500

When is the Jackson Hole meeting held?

The Jackson Hole symposium is held every year at the end of August. Normally, the event lasts three days, starting on a Thursday and ending on a Saturday. The exact dates vary, but they are always within the last weeks of the month.

In 2025, Jackson Hole was held from Thursday, August 21, to Saturday, August 23, following its usual schedule.

When did Powell speak at the Jackson Hole 2025?

The Chairman of the Federal Reserve, Jerome Powell, delivered his main speech at his usual time, on Friday, August 22, 2025, at 10:00 a.m. (Eastern Time – ET). Or at 4:00 p.m. (Madrid Time)

Which central bankers attend this meeting?

The Jackson Hole event is attended by some of the most influential people in the world economy. Among the most notable attendees are the presidents of the main central banks, who in 2024 are:

- Jerome Powell, Chairman of the United States Federal Reserve (Fed)

- Christine Lagarde, president of the European Central Bank (ECB)

- Kazuo Ueda, governor of the Bank of Japan (BOJ)

- Other central bank leaders from countries like Canada, the United Kingdom, Australia, and representatives from multilateral institutions such as the International Monetary Fund (IMF).

- And in addition to the central bankers, renowned academics and economists usually attend as well.

Although the sessions are closed to the public, the key speeches, especially those of the Fed president, are broadcast live and are closely followed by the markets.

What were the main conclusions?

Powell appeared at a press conference with a clear message for financial markets and Western stock exchanges: from now on there would be a significant change where the “average inflation targeting”, or target of an average inflation of 2% over time, would be eliminated.

In other words, now the focus returns to the traditional model, according to which each year inflation cannot exceed 2%.

This represents an important change in monetary policy, as since the 2008 crisis, the aim was a model of average inflation targeting of 2% over the years. For example, if between 2015 and 2019 inflation had remained around 1.5%, with the strategy applied from 2008 until now, the Fed could allow inflation in 2021-2022 to be at 2.5% or even 3% - which was not the case - as long as the average balanced out and did not deviate too much from 2%

With the change announced now, what Powell makes clear is that this flexibility disappears. It is no longer valid to say that 3% can compensate for the years of 1.5%. The commitment is more rigid: to maintain inflation consistently around 2%, without looking at historical averages.

- If today it is at 2.5%, the Fed must act to lower it.

- And conversely, if it falls to 1.5%, it must stimulate the economy to raise it.

Independence of the central bank and... the beginning of cuts soon?

On the other hand, and in a clear message to President Trump, there was also an opportunity to declare the independence of the Fed's decisions, in such a way that they will continue to be guided exclusively by economic data, without yielding to political pressures.

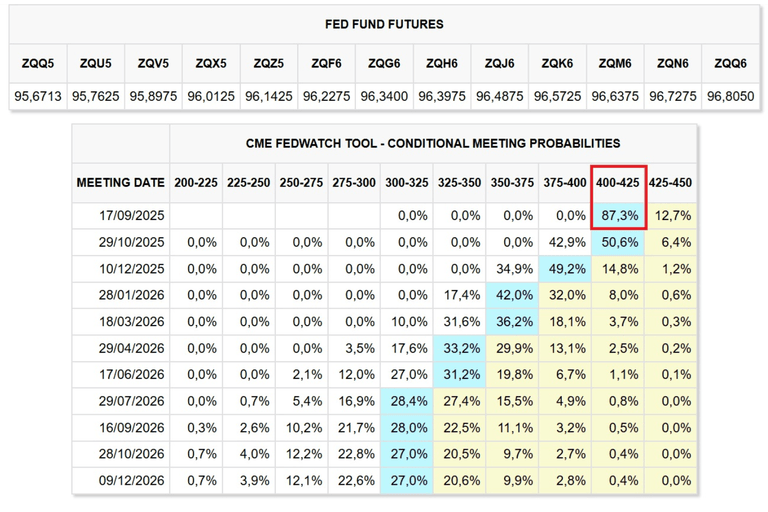

Finally, he gave a breather to the financial markets, anticipating that a new cycle of interest rate cuts might begin with the need to ease monetary policy, as long as the economic data supports it. Consequently, futures markets quickly readjusted their expectations by placing a probability of a 25 basis point cut at the next Fed meeting in September.

👉 When is the next Fed meeting?

And how did the markets take it?

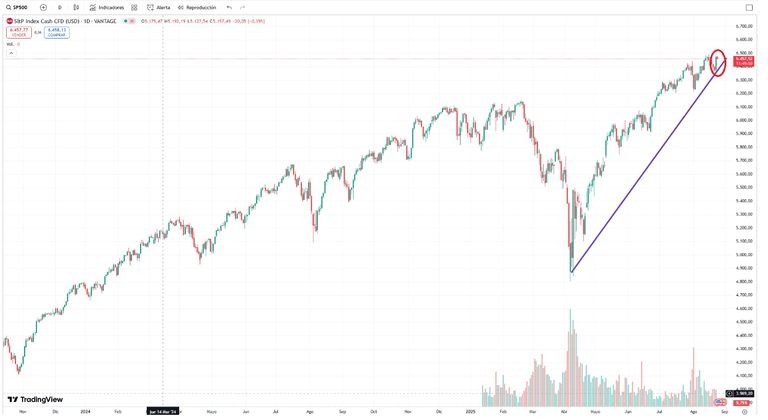

The truth is that in Friday's session, the reaction of the markets, parallel to Powell's intervention, was quite positive. On one hand, the S&P 500 climbed 1.5% reaching levels close to its all-time highs, while the Nasdaq had one of the best performances of the year, with increases close to 2%, especially supported by the technology and AI sector.

Additionally, this boost was accompanied by a mild celebration in the fixed income market, translated into declines in long-term bond yields by 0.3 tenths, and a weaker dollar, which especially favored technology stocks.

This optimism carried over to the weekend, reflected in the futures for Monday, August 25, which showed only a minimal setback, giving authority to the good session on Friday against Powell's influential speech.

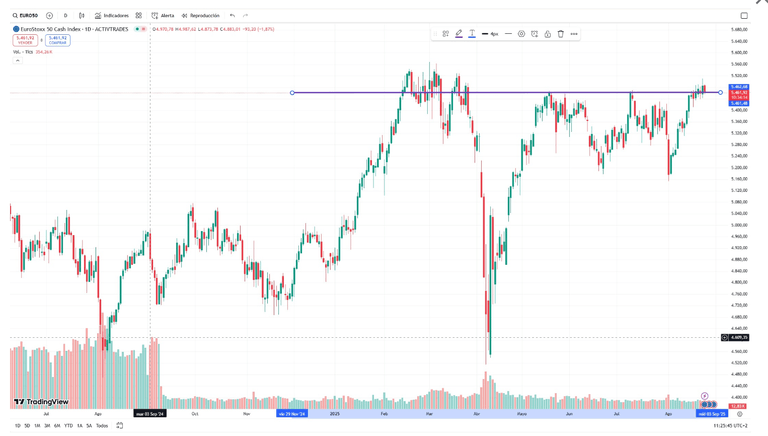

Meanwhile in Europe, markets showed little reaction to the comments from ECB President Christine Lagarde. Her speech largely reflected on the successful containment of inflation, highlighting that it had been achieved without significant disruption to the labour market or wage growth.

As a result, European indices opened the week relatively flat on Monday, 25 August, with modest declines of 0.3% to 0.5% across benchmarks such as the DAX 40, IBEX 35, and Euro Stoxx 50.

In short, the latest Jackson Hole meeting seems to have marked a new phase of interest rate cuts by the Fed, as long as the data supports it, with the aim of achieving a target inflation of 2% each year (and not on a long-term average), in addition to reaffirming the independence of central banks from political power, which the market accepted with enthusiasm.

FAQs

When is the next Jackson Hole meeting?

The next Jackson Hole meeting will be next year, specifically and as usual at the end of August 2026. The exact dates will be announced in the first half of 2026, but following the usual pattern, it is likely to occur between August 20th and 22nd, or between the 27th and 29th.

What time does Jackson Hole start?

The symposium generally begins on Thursday morning, around 8:00 AM local time (Eastern Time – ET), with a series of speeches and presentations. The event usually ends on Saturday at noon.

Why do bankers go to Jackson Hole?

Unlike other conferences, which tend to focus on more immediate monetary policy issues, Jackson Hole allows for a broader debate on the future of the global economy and the policies needed to address it, in a more relaxed environment than usual, and enables central bank leaders to send key messages to the markets and manage expectations without the pressure of announcing formal monetary policy decisions.