Investing

Next FED meeting: global uncertainty… and more inflation?

The Federal Reserve (FED) is the central bank of the United States and one of the most influential financial institutions in the world. We will now explain what the FED is, what decisions it makes, how its meetings affect the markets, and provide the 2025 calendar of FED meetings.

Let’s explore what the Federal Reserve is likely to do—not just at its next meeting, but throughout the rest of the year. It’s one of the most closely watched events by investors, as its decisions have a direct impact not only on markets—such as stocks, currencies and indices—but also on the wider economy.

FED Meeting Calendar 2025

The Federal Reserve meets 8 times a year with approximately 40 days between each meeting. Below is the FED meeting calendar for 2025:

- January 28-29

- March 18-19

- May 6-7

- June 17-18

- July 29-30

- September 16-17

- November 28-29

- December 9-10

Last FED meeting: total uncertainty... and a new inflation surge?

The Federal Reserve held interest rates steady at 4.25%–4.50% yesterday for the fourth consecutive meeting, while signalling fewer rate cuts beyond 2025. At the same time, the central bank warned that a slowing economy, combined with ongoing tensions in the oil market, could lead to a resurgence in inflation.

FED Chair Jerome Powell stressed the importance of proceeding with caution, highlighting the delicate balance between supporting growth and keeping inflation under control.

“No one holds these … rate paths with a great deal of conviction, and everyone would agree that they’re all going to be data dependent.”

New inflationary threat due to rising oil prices

In fact, the FED raised its inflation forecasts for 2025–2027 by up to 0.3 percentage points, while at the same time lowering its expected GDP growth for 2025 to 1.4%, down from the 1.7% previously projected just a few months ago.

Looking further ahead, the central bank also anticipates slightly weaker GDP growth in 2026, with a downward revision of 0.2 percentage points, while inflation (CPI) is now expected to be 0.2 points higher than earlier estimates.

In any case, Powell acknowledged the challenge, stating: “Making GDP forecasts at the current moment is very complex.”

This uncertainty is further heightened by rising tensions in the Middle East. Should the situation escalate further, it could push oil prices back towards $120 a barrel, potentially triggering a fresh surge in inflation.

If this scenario does materialise, it would be particularly concerning, especially given the recent decline in oil prices to around $55–$60 per barrel (highlighted in the chart with the orange circle). That drop had sparked hope that inflation might ease sooner than expected—a hope that could now be undermined if oil prices rebound sharply.

Additionally, geopolitical tensions are not the only risk. Trade policy shifts—such as the renewed USA–China tariffs—can also impact inflation and global supply chains, further complicating the Federal Reserve’s task of balancing growth and price stability.

Is Trump running for the FED?

As expected, Trump’s demands stood in stark contrast to the Fed’s more cautious approach. Even before the meeting, he called for ten consecutive rate cuts of 25 basis points—a full 2.5 percentage points—which would have brought interest rates down to 1.75%–2%. This was clearly unrealistic, and after the Fed declined to act on it, Trump went so far as to call Jerome Powell “stupid.”

In a further swipe, he ironically suggested himself as the next head of the Federal Reserve.

“Am I allowed to appoint myself at the Fed? I'd do a much better job than these people.”

According to the US President, his intentions were clear: "— wait till this guy gets out, get the rates way down and then go long term".

What to expect from the next FED meeting?

Following the June meeting, there have been changes to the long-term dot plot, although the short-term outlook remains the same as in March 2025. In other words, most Federal Reserve officials still expect two rate cuts of 25 basis points each during 2025—reflecting a continued sense of uncertainty in the macroeconomic outlook.

If that forecast holds, interest rates would end the year in a range of 3.75% to 4%.

However, the real shift lies in the longer-term projections. According to the updated forecast, there would be just one rate cut in 2026, bringing rates down to around 3.5%–3.75% by year-end. Then, in 2027, another single cut is expected, placing rates between 3.25% and 3.5%. In total, the latest dot plot suggests just four cuts of 25 basis pointsbetween now and the end of 2027.

Meanwhile, the futures market is even more cautious, pricing in at most two 25-basis-point cuts before the end of this year. The first is not expected at the next meeting, but likely after the Jackson Hole symposium, possibly in September, with a second cut only anticipated towards the very end of 2025.

What impact do FED meetings have on the market?

The FED is, therefore, a crucial institution for the economic health of the United States and has a significant impact on global financial markets. The FED meetings, where monetary policies are determined, especially in relation to interest rates, can have a relevant impact on financial markets.

For those looking to act on these market movements, understanding what a broker is and how they facilitate trades in shares, forex, and commodities is essential. Brokers serve as intermediaries between individual investors and financial markets.

What happens when there is an interest rate hike?

When the Federal Reserve (FED) raises interest rates or implements other measures to reduce liquidity in the financial system, the goal is typically to bring inflation under control. However, these actions often result in an economic slowdown.

Higher interest rates make borrowing more expensive, which in turn discourages individuals and businesses from taking out loans. As access to credit tightens, both consumer spending and business investment tend to fall. This leads to a decline in aggregate demand, which helps ease inflationary pressure—but can also slow overall economic growth.

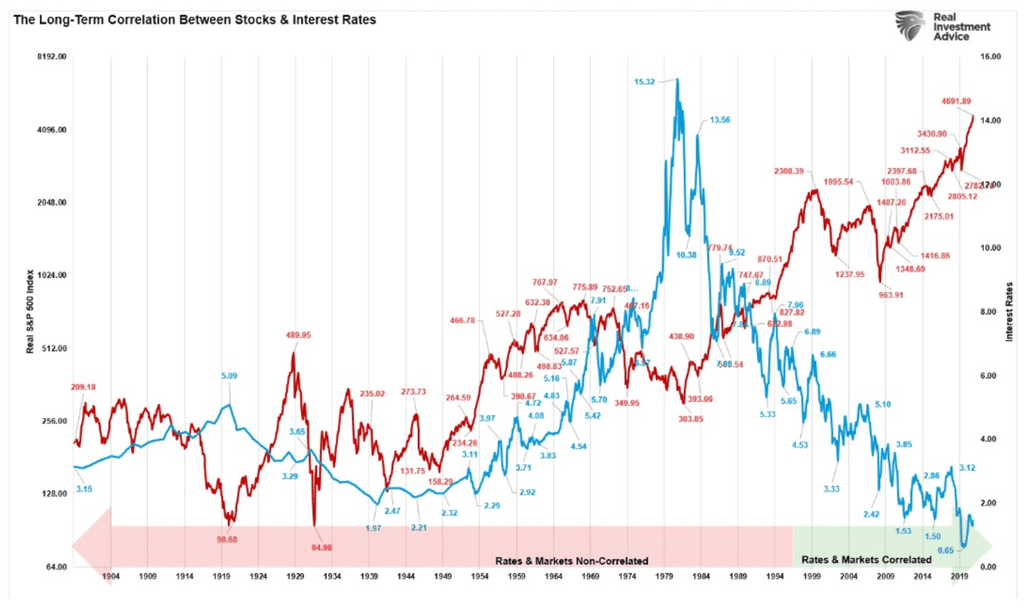

A reduction in liquidity also tends to impact the stock market. With less money circulating in the system, there are fewer resources available for investment, which often leads to a decline in share prices. For this reason, interest rate hikes are generally associated with falling stock market valuations.

However, markets don’t always react sharply. In many cases, the rate hike has already been “priced in”—meaning investors anticipated the move based on signals from the Federal Reserve’s earlier guidance. When that’s the case, the actual announcement may have a more moderate effect on market movements.

During periods of uncertainty—such as those following a rate increase—investing in defensive stocks can be a wise strategy. These are companies that tend to perform steadily regardless of the economic cycle, such as utilities or consumer staples. Similarly, safe-haven assets like gold, which are less correlated with economic downturns, can provide valuable portfolio protection.

What happens when there is a rate cut?

Conversely, when the Federal Reserve (FED) or another central bank cuts interest rates, the aim is typically to stimulate the economy—the opposite effect of a rate hike. Lower rates are designed to encourage borrowing, boost spending, and support investment. The main consequences of a rate cut generally include:

- Stimulating the economy: Lower interest rates make borrowing more affordable, encouraging both businesses to invest and consumers to spend. This helps boost overall economic activity during periods of slowdown.

- Increase in consumer spending: Cheaper loans may lead consumers to make larger purchases—such as homes, cars, or renovations—which increases aggregate demand and supports economic growth.

- Impact on stock markets: Rate cuts tend to lift equity markets. Lower financing costs and improved consumer demand can lead to higher corporate earnings expectations, pushing share prices up.

- Currency depreciation: A reduction in interest rates can weaken the national currency, as investors seek better returns elsewhere. While this can help boost exports, it may also increase the cost of imports.

- Inflation risk: As spending and investment rise, prices may follow—especially if supply can't keep up with demand. While stimulating growth, rate cuts can therefore carry the risk of rising inflation.

FED Meetings: FOMC Meetings

When discussing the Federal Reserve (FED), it’s important to understand four key concepts to fully grasp what happens during its meetings:

FOMC (Federal Open Market Committee)

This is the monetary policy-making body of the Federal Reserve, made up of 12 members. The FOMC is responsible for setting interest rates and steering monetary strategy to meet the Fed’s objectives, such as price stability and full employment. It meets eight times a year, roughly every six weeks, in Washington D.C. Typically, half of these meetings are followed by a press conference.

FED Minutes

These are the detailed summaries of each FOMC meeting, published three weeks after the meeting takes place. The minutes provide insights into the discussions and highlight the range of views held by committee members, helping markets interpret the Fed’s policy direction.

Beige Book

A collection of economic data and anecdotal reports compiled from the 12 regional Federal Reserve Banks. It is released around two weeks before each FOMC meeting and is used to support decision-making on monetary policy.

Dot Plot

A chart showing individual projections from each FOMC member regarding where they expect interest rates to be over the coming years. Published after select meetings, it offers insight into the Fed's thinking and interest rate trajectory. The dot plot was introduced in 2011 under then-Chairman Ben Bernanke and has since become a key tool for understanding the Fed’s outlook.

In short, keeping track of the Federal Reserve’s meeting schedule is essential for anyone looking to respond to changes in monetary policy—whether the decisions are expansionary or contractionary. Understanding how and when the FED acts puts you in a better position to interpret market movements and make informed investment decisions.

FAQs

When is the next FED meeting?

The next meeting of the FED will be on July 29 and 30, 2025

When will the FED lower interest rates?

This year, two interest rate cuts of 25 bps each are expected, the first possibly in the September meeting, after the summer (post-Jackson Hole meeting), and a second in December. Additionally, in 2026 there could be a third interest rate cut.

When does the FED announce interest rates?

The FED meets to determine policies on interest rates 8 times a year, on predetermined dates. Many traders closely follow these announcements in real time. Knowing when the US stock market opens can be helpful for reacting to FED decisions as they impact major indices like the S&P 500 or Nasdaq.