Investing

Warren Buffet Retires: His 5 Lessons as an Investor

Warren Buffett, the legendary “Oracle of Omaha,” confirmed that he will step down as CEO of Berkshire Hathaway at the end of the year, culminating more than six decades at the helm of the investment conglomerate. At 94 years old, Buffett took advantage of the last annual shareholders meeting of Berkshire 2025 to announce his retirement and explain that the decision is due to the need to ensure an orderly transition and “that the company remains alive long after me.”

Thus, his successor already has a name: Greg Abel, aged 62, currently vice-chairman in charge of non-insurance operations and a key figure at the company since 1999. He will take the reins as CEO. The decision reinforces the message of continuity that Buffett has been sending to shareholders for years. “Greg possesses the right combination of judgment, energy, and passion for Berkshire,” the investor said during the annual meeting held on Saturday.

But Buffett will not completely disengage. He will remain as chairman of the board — a role that, as he emphasised, will allow him “to be available for strategic consultations and maintain the organisation’s culture” — while stepping back from day-to-day management. Berkshire noted in a statement that this structure is intended to reassure markets and maintain the group’s long-standing decentralised approach.

Although he is in good health, the investor acknowledged that age takes its toll.

“No one is immortal; the best legacy is to ensure that the ship sails with a steady helm when I am no longer here.”

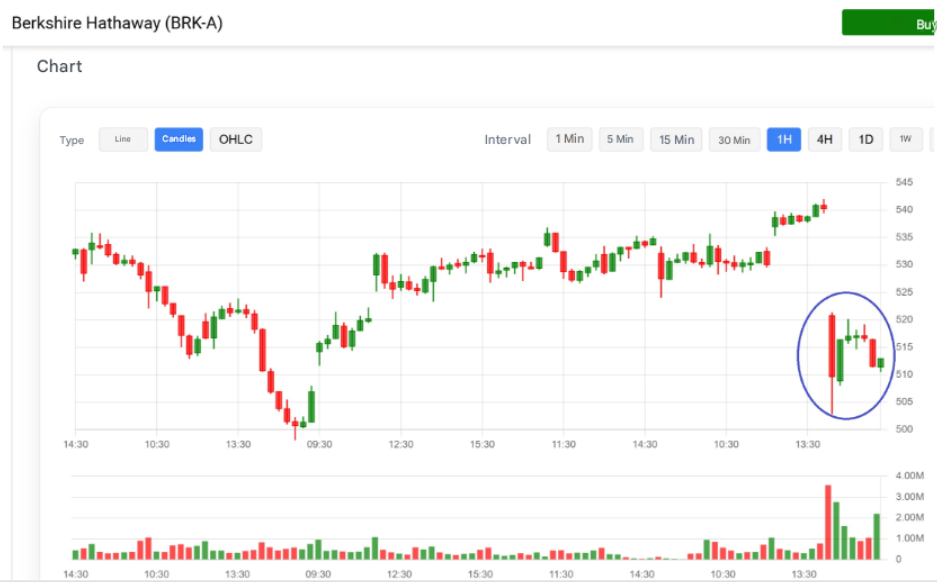

As expected, the news came as a surprise to both insiders and the wider market — even though Buffett himself had hinted back in 2024 that “the moment was approaching.”

In any case, Berkshire Hathaway’s shares initially dropped by as much as 6%, before eventually closing flat in after-hours trading, finishing the session right back where they started.

Buffett's Greatest Legacy: Berkshire Hathaway

Warren Buffett’s legacy is impossible to separate from the story of Berkshire Hathaway — a company he transformed from the brink of collapse into one of the world’s most valuable conglomerates.

When Buffett took control of Berkshire Hathaway on 10 May 1965, he acquired little more than a struggling textile manufacturer. Today, that same name sits atop a business empire worth roughly $1.15 trillion, encompassing 189 companies, from BNSF Railway to a massive holding in Apple.

Since that pivotal day, Berkshire’s Class A shares have soared by over 5,500,000%. To put it another way, every $1 invested then would now be worth around $55,000. Over nearly 60 years, the stock has achieved a compound annual growth rate (CAGR) of 19.9%, far outpacing the S&P 500’s 10.4% (with dividends).

Buffett’s Multiplier

To illustrate: $100 invested in 1965 would be worth approximately $5.5 million today.

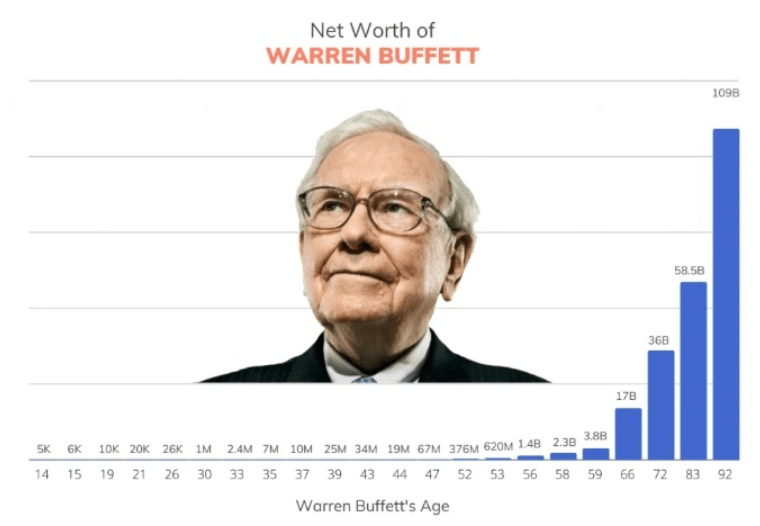

The same principle of compound interest has powered Buffett’s personal fortune. At 37 years old in 1967, he was worth around $10 million. Today, at 94, despite having donated more than half his shares, his net worth still exceeds $168 billion.

That’s a nearly 17,000-fold increase — and tellingly, over 99% of his wealth was accumulated after the age of 50. It’s perhaps the most powerful real-world example of why time is the greatest ally of capital.

Buffett's 5 investment lessons

However, beyond the wealth he was able to create for himself and his partners, we are left with all the value, both economic and intellectual, that he was able to convey to the rest of society, summarised in these five teachings

Circle of competence

This philosophy is summed up neatly in one of Buffett’s most famous maxims: “Invest only in what you understand.”

For Buffett, clear accounting and a straightforward business model are the best safeguards against costly errors. That’s why he avoided companies he couldn’t, as he put it, “draw on a napkin”. Instead, he placed big bets on simple — and highly profitable — businesses like Coca‑Cola (KO), McDonald’s (MCD), and American Express (AXP).

Look for companies with a “moat” (competitive advantage)

The concept of a “moat” — a term Buffett popularised — refers to the protective barrier that defends a company’s long-term profitability. This moat can take many forms: iconic brands with deep social value, unmatched cost efficiency, regulatory barriers that keep competitors out, or self-reinforcing networks.

Buffett isn’t just looking for companies with moats — he looks for moats that grow wider over time. That’s why he favours businesses like Apple, with its sticky ecosystem that keeps users loyal, or Marmon, whose industrial components dominate niche markets brick by brick.

Buy with a margin of safety

Borrowed from his mentor Ben Graham, this principle encourages investors to pay less than a company’s true intrinsic value.

Think of the margin of safety as a financial cushion — a buffer that protects investors from both their own misjudgements and market volatility. If Buffett believes a business is worth 100, he’ll aim to buy it for 70 or 80.

That’s exactly how he transformed American Express (AXP) into one of his most successful investments — snapping up shares after the 1964 salad oil scandal, when most others were running for the exits.

Be contrarian

It’s not that Buffett was deliberately contrarian — but he was never comfortable following the crowd, especially during moments of irrational exuberance.

Throughout his career, he’s shown a clear pattern of acting during periods of maximum fear or overconfidence. For instance, he invested $5 billion into Goldman Sachs during the 2008 financial crisis, when panic was at its peak. On the flip side, he scaled back on tech stocks in 2021, just as market euphoria was hitting new highs.

His approach isn’t about avoiding risk — it’s about paying the right price for it.

He’s always summed it up with one of his most iconic lines:

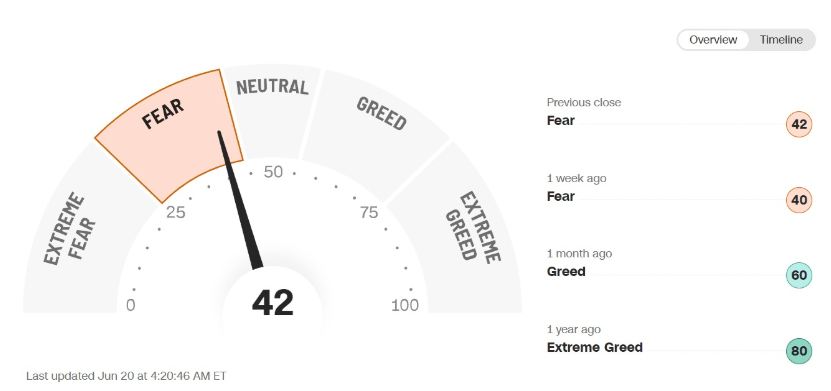

“Be fearful when others are greedy, and greedy when others are fearful.”

Be fearful when others are greedy and greedy when others are fearful

Remember that a good way to know the current market temperature is through the Fear & Greed Index made by CNN daily.

Monitor the general economic situation

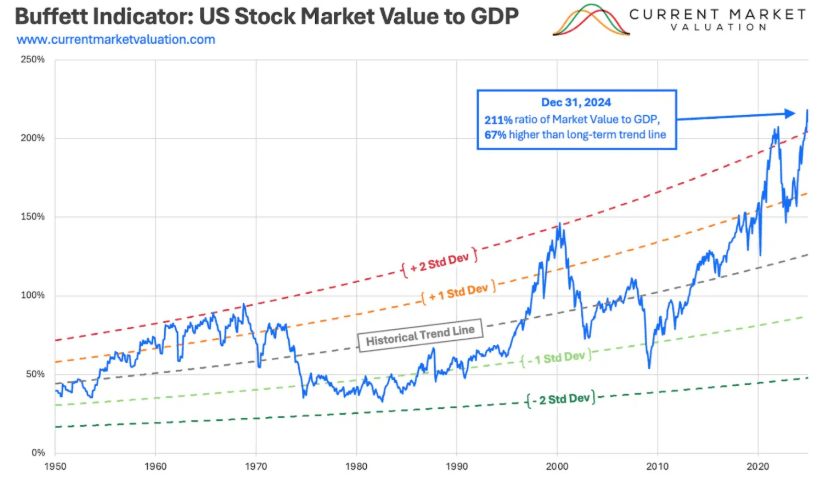

Back in 2001, Buffett introduced what’s now widely known as the Buffett Indicator — the ratio of total market capitalisation to GDP — which he once called “probably the best single measure of where valuations stand.” Since then, many analysts have used it as a macro-level gauge of market valuation.

At the moment, the indicator remains historically elevated. After surpassing 200% in 2024, it has eased slightly in recent months to around 180%–190%, but still sits well above its long-term average. This likely explains Berkshire Hathaway’s current caution, along with its substantial cash reserve of $334 billion.

Investing for the Future Using Buffett´s principles

With the UK’s investment landscape providing several opportunities for growth, Buffett’s principles of patience, discipline, and compound interest are highly relevant for British investors looking to navigate the stock market. Whether you’re considering opening the best Stocks and Shares ISA or working with the best stock brokers in the UK can help you maximise returns, even with Buffett’s long-term approach.

In short, Buffett’s retirement as CEO of Berkshire Hathaway doesn’t just mark the end of an era — it hands Greg Abel the responsibility of safeguarding a value-generating machine that has become legendary.

That machine rests on three core principles, which Buffett has repeated to shareholders every May: discipline, patience, and the magic of compound interest. It will now be Abel’s job to ensure those pillars continue to uphold the Berkshire legacy.