Investing

When Does The US Stock Market Open? Calendar 2025

The New York Stock Exchange (NYSE), often dubbed "the mother of all stock exchanges," isn’t just the backbone of American finance; its influence ripples across global markets. With trades on Wall Street often setting the tone for European and international markets, getting your timing right can make all the difference.

That’s why staying ahead of market hours and holiday closures is key to planning your investments strategically. In this guide, we’ll explore the official 2025 US Stock Exchange calendar, so you know exactly when Wall Street is open for business and when it's taking a break.

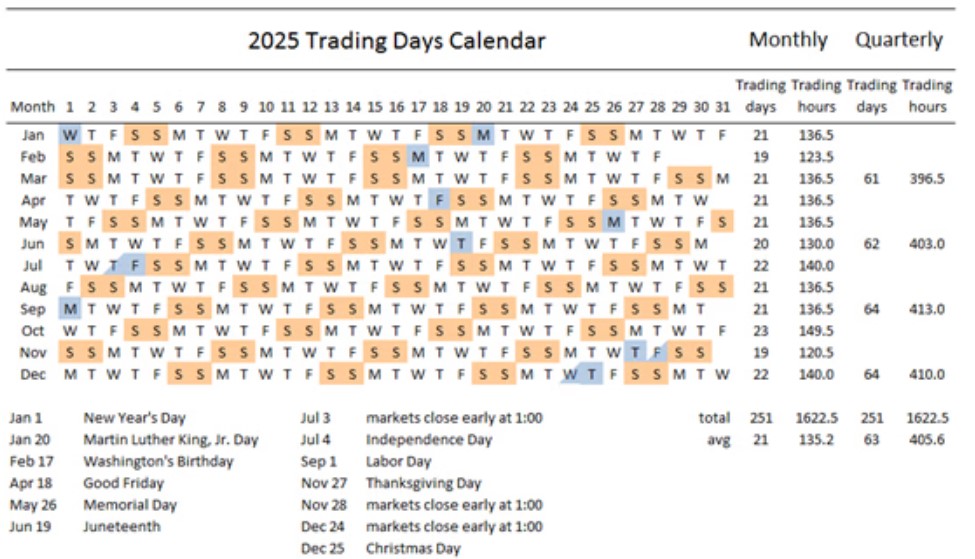

US Stock Exchange Calendar 2025

Stock exchanges worldwide follow their own schedules, shaped by their respective countries’ working calendars. But unlike regular businesses, financial markets operate on a leaner holiday schedule, with fewer days off. That means traders and investors need a clear breakdown of when the US stock market will pause its operations.

American Stock Exchange closure days in 2025

In 2025, Wall Street will observe several official closure days, aligning with the US holiday calendar. On these days, the market will remain completely shut, with no trading, no price updates, no movement. Marking these dates in your calendar ensures you’re not caught off guard when planning your trades.

This is the US Stock Exchange calendar for 2025:

- January 1: New Year's Day

- January 9: National day of mourning in honor of former President Jimmy Carter

- January 20: Martin Luther King Day

- February 17: Washington's Birthday

- April 18: Good Friday

- May 26: Memorial Day

- June 19: Juneteenth National Independence Day

- July 4: Independence Day

- September 1: Labor Day

- November 27: Thanksgiving Day

- December 25: Christmas Day

Early closing day Wall Street 2025

Furthermore, the US stock market will only operate for half a session on the following days:

- July 2 (day before Independence Day)

- November 28 (day after Thanksgiving)

- December 24 (Christmas Eve)

American Stock Exchange hours 2025: Trading at market close

While the NYSE has official trading hours, the market doesn’t entirely sleep when the bell rings. Investors still have access to key time slots before and after the standard session, allowing for strategic trading opportunities even when Wall Street isn’t fully open.

- Pre-market: from 4 AM to 9:30 AM New York time, or from

- 9 AM to 2:30 PM (UK time)

- After hours: from 4 PM to 8 PM New York time, or from

- 9 PM to 1 AM (UK time)

Featured broker of the month

Here is the top broker of this month:

Freedom24

- Regulated by: CySec

- Smart in EUR Account Commissions:

- US / Europe Stocks and ETFs: This rate applies to any US or European stock.

- Commission per share: 0.02$/€

- + Per order: 2$/€

- Asian Stocks and ETFs:

- Commission per share: 0.25%

- + Per oder: 10HK$

- USA Stock Options:

- + Per contract: 0.65$

- + Per order: 0$

- Bonds:

- Fee per bond: 0.15%

- + Per order: 5$/€

- Margin lending per day - 0.049315%

- SMS notification - 0.05€

- All inclusive in EUR Account Commissions:

- US / Europe Stocks and ETFs: This rate applies to any US or European stock.

- Commission per share: 0.5% + 0.012€

- + Per order: 1.2$/€

- Asian Stocks and ETFs:

- Commission per share: 0.25%

- + Per oder: 10HK$

- USA Stock Options:

- + Per contract: 3$

- + Per order: 10$

- Bonds:

- Fee per bond: 0.5%

- + Per order: 5$/€

- Margin lending per day - 0.041095%

- SMS notification - 0€

- Personal Manager - Yes

If you are interested in this broker and want to find out more about them, read our detailed Freedom24 review.

NYSE trading schedule: changes for standard time and daylight saving time

Time zones can throw a curveball into trading schedules, especially when daylight saving time (DST) kicks in. Unlike the UK and much of Europe, the US follows a slightly different DST calendar, which can cause a temporary shift in market hours.

During this two-week period (March 10 – March 30):

- Regular market hours shift from 2:30 PM – 9:00 PM UK time → 1:30 PM – 8:00 PM UK time.

- Pre-market trading shifts to 8:00 AM – 1:30 PM UK time.

- After-hours trading moves to 8:00 PM – 12:00 AM UK time.

Once the UK moves to DST on March 30 everything falls back into its usual place as mentioned above.

USA Stock Exchange Calendar 2025: What is NYSE & How companies access it

Wall Street is home to two of the world’s most powerful stock exchanges, the NYSE and Nasdaq, both operating under the same trading hours. Given the five-hour time difference between the UK and New York, here’s when the action happens:

- Opening: 9:30 AM (US Eastern Time) / 2:30 PM (UK Time)

- Closing: 4:00 PM (US Eastern Time) / 9:00 PM (UK Time)

With a daily trading volume of around $1.5 trillion, the New York Stock Exchange is the heartbeat of global finance. Situated on Wall Street, the NYSE plays host to some of the biggest names in business, setting the stage for high-stakes trading that influences markets far beyond the US.

The US stock market is made up of multiple indices, each tracking different sectors and company sizes. The most widely followed include:

- S&P 500 – Tracks the 500 largest publicly traded companies in the US.

- Nasdaq – Known for its heavy weighting in tech and innovation-driven stocks.

- Dow Jones Industrial Average (DJIA) – Includes 30 major US corporations.

- Russell 2000 – Focuses on small-cap stocks, providing insight into emerging companies.

What are the requirements to get listed on the New York Stock Exchange?

For companies aiming to list on the NYSE, the bar is set high. After completing the registration process, businesses must meet strict financial criteria, including:

- At least $10 million in pre-tax earnings over the last three years, with $2 million+ in the two most recent years.

- Companies can qualify with a global market cap of at least $200 million.

- At least 400 shareholders with 100+ shares or 2,200 total shareholders with 100,000 average monthly trading volume.

- A minimum of 1.1 million shares must be publicly traded.

- Must have a $4+ per share price at the time of listing.

Final Thoughts on the US Stock Market

Keeping an eye on market hours and movements is crucial for investors, whether they’re tracking Nasdaq’s opening, Wall Street’s closing, or the latest shifts in stock prices. Every fluctuation has the potential to impact portfolios, making it essential to stay informed.

The NYSE remains the global focal point of finance, with investors worldwide watching its every move, ready to react to news, earnings reports, and economic shifts that can send the market soaring or tumbling.