Reviews

Admirals Review

Admirals is a well-established online broker with a strong track record in the industry. But is it the right choice for your investments?

In this review, we break down everything you need to know: how Admirals works, the range of products it offers, its platform features, and its fee structure. And of course, we’ll wrap up with our honest opinion on whether Admirals is worth considering.

Pros and Cons

| Pros of Admirals Markets Review | Cons of Admirals Markets Review | ||

| ✅ Specialist trading broker | ❌ The trading platform may not be ideal for beginners | ||

| ✅ Competitive commissions | ❌ Limited selection of spot stocks | ||

| ✅ Access to a wide range of markets and products | ❌ No interest-bearing account available | ||

| ✅ High-quality educational and analysis services | |||

| ✅ Professional trading tools and platforms |

| Pros of Admirals Markets Review | Cons of Admirals Markets Review |

| ✅ Specialist trading broker | ❌ The trading platform may not be ideal for beginners |

| ✅ Competitive commissions | ❌ Limited selection of spot stocks |

| ✅ Access to a wide range of markets and products | ❌ No interest-bearing account available |

| ✅ High-quality educational and analysis services | |

| ✅ Professional trading tools and platforms |

Main features

These are the features and main data of Admirals:

- Regulation: British FCA, CySEC of Cyprus for Europe and CIRO in Canada

- Guarantee fund: Up to £85,000

- Financial assets: +8,000 instruments; stocks, fractional shares, ETFs, and others.

- Account types: 6 (Demo, Trade.MT5, Invest.MT5, Zero.MT5, Trade.MT4, and Zero.MT4)

- Commissions: €0 for stocks and ETFs

- Minimum deposit: €1 to €25 depending on the account

- Platform:

- MetaTrader 4

- MetaTrader 5

- MetaTrader Web Trader

- Admiral mobile App

- Contact:

- Email: [email protected]

- Phone: +44 20 8157 7344

- Contact through the Customer Help Center

Is it safe?

Yes – Admirals is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, one of the most respected financial regulators globally. This ensures strict oversight and adherence to UK financial laws.

Client funds are held in segregated accounts, meaning they are kept separate from the company’s own funds and cannot be used for other purposes.

UK retail clients are also covered by negative balance protection, so your account can never fall below zero—even in highly volatile market conditions.

Additionally, as an FCA-regulated broker, Admirals offers access to the Financial Services Compensation Scheme (FSCS), which protects deposits up to £85,000 per person in the event of firm failure.

Available Financial Products

What can you invest in with Admirals? The trading platform offers a wide variety of financial products that can be traded. Moreover, the catalog is continuously expanding.

Currently, it allows investing in more than 8,000 different financial instruments. These are the assets Admirals works with.

Admirals offers nearly 5,500 stocks and ETFs from the 15 main stock exchanges in the world that can be traded on the spot.

Forex CFDs: Over 80 currency pairs, including majors like EUR/GBP, GBP/USD, USD/JPY

Cryptocurrency CFDs: Popular pairs such as BTC/USD, ETH/USD, LTC/USD, XRP/USD

Index CFDs: Access to global indices (e.g. FTSE 100, S&P 500, NASDAQ, Germany 40, DJI30)

Share (Stock) CFDs: Thousands of global stocks—top listings include Apple, Google, BP, HSBC, etc.

ETF CFDs: Hundreds of ETF options (US, EU, UK) via CFDs

Commodity CFDs: Trade gold, silver, platinum, oil, natural gas, agricultural commodities

Bond CFDs: Government bonds like US T‑Notes and German Bunds with up to 1:5 leverage

Types of Accounts

Demo Account

- Free demo trading with unlimited access for verified real-account holders.

- For new users: access lasts 30 days, extendable by logging in each month.

- Mirrors real-market conditions using virtual funds—no real capital at risk.

MetaTrader 5 Accounts

(All require initial funding equivalent to £90 / £100 USD, except Invest.MT5 which is just £0.90 / £1 USD)

- Trade.MT5

• Standard MT5 trading: currencies, CFDs (FX, metals, cryptos, indices, etc.)

• Leverage: Retail 1:30–1:20; Pro clients up to 1:500

• Minimum spread from ~0.5 pips; no commission on non‑stock CFDs - Zero.MT5

• Same range of instruments as Trade.MT5

• Leverage as above

• Zero pip spreads, with trading commissions:- Forex & metals: ~USD 1.8–3.0 per standard lot

- Indices, energy CFDs: flat‑rate commissions

- Invest.MT5

• Minimum deposit only ~£0.90

• Access to over 4,500 real stocks and 200+ ETFs (no CFDs)

• Cash-only trading with zero leverage

MetaTrader 4 Accounts

(All require £90 / £100 USD minimum deposit)

- Trade.MT4

• Standard MT4 account: FX, metals, indices, stock CFDs, etc.

• Leverage: Retail 1:30–1:20; Pro up to 1:500

• Spreads from ~0.5 pips; no commission on non-stock CFDs - Zero.MT4

• Same instruments as Trade.MT4

• Zero pip spreads + commission structure like Zero.MT5

Common Features Across All Accounts

- Islamic account option available (no swap interest)

- Market execution via STP (straight-through processing) – no dealing desk

- Negative balance protection for retail clients

- Hedging capability, Expert Advisors, Supreme Edition add-on

- Platforms supported: MT4/MT5, WebTrader, iOS & Android

Fees and Commissions

Stocks & ETFs (Invest.MT5 / Trade.MT5 / Trade.MT4)

- US shares: £0.02 per share per side (minimum £0.80, equivalent to €1) – includes one daily commission‑free trade; then standard applies.

- UK stocks: £8 per one‑sided deal (minimum £8) and ~0.07% for ETFs; one commission‑free trade daily, then standard fee.

- EU shares: 0.10% per side (min €1, ~£0.80).

Stock & ETF CFDs (Trade.MT4/5 & Zero.MT4/5)

- Share & ETF CFDs: from $0.02 per share per side; Trade accounts include daily commission-free trades (3 round-turns on MT4, 6 deals on MT5).

- Forex & metals (Zero accounts): £1.40 - 2.40 per standard lot per side ($1.8-$3)

- Indices & commodities: Index CFDs ~£0.04–£2.40/lot per side; energy CFDs ~£0.80/lot per side.

- Spread costs: Typical EUR/USD spread ~0.1 pips, GBP/USD ~0.5 pips; S&P 500 CFD ~0.6 points.

Other Charges

- Currency conversion fee: 0.3% (min approx £0.01) on settlements or payouts in a different currency.

- Inactivity fee: £10/month after 24 months with no trades and a positive balance.

- Swap/over‑night fees: Applied to CFDs, varying by asset and position; disclosed in contract specs.

Minimum Deposit and Withdrawal

| Invest.MT5 min deposit | £1 | ||

| Other accounts min deposit | £90–£100 | ||

| Deposit fees | None | ||

| Free monthly withdrawals | 1 per method | ||

| Withdrawal fee (bank) | £10 per extra withdrawal | ||

| Withdrawal fee (card/e‑wallet) | 1% (min £1) | ||

| Bank withdrawal time | 1–3 business days | ||

| Conversion fee | 0.3% (min £0.01) | ||

| Internal transfer between currencies | 1% | ||

| Inactivity fee | £10/month after 24 months |

| Feature | Details |

|---|---|

| Invest.MT5 min deposit | £1 |

| Other accounts min deposit | £90–£100 |

| Deposit fees | None |

| Free monthly withdrawals | 1 per method |

| Withdrawal fee (bank) | £10 per extra withdrawal |

| Withdrawal fee (card/e‑wallet) | 1% (min £1) |

| Bank withdrawal time | 1–3 business days |

| Conversion fee | 0.3% (min £0.01) |

| Internal transfer between currencies | 1% |

| Inactivity fee | £10/month after 24 months |

Trading Platforms

One of Admirals’ key strengths is its trading platforms. The broker supports four versions of MetaTrader: MetaTrader 4, MetaTrader 5, MetaTrader Supreme Edition, and MetaTrader WebTrader.

In addition, Admirals offers its own mobile app, which includes full support for MT4 and MT5 on both Android and iOS devices, allowing you to trade wherever you are.

The MetaTrader Supreme Edition is available to all Admirals account holders. It enhances the standard MetaTrader 4 and 5 platforms with a range of advanced features and custom add-ons designed to give traders more control and insight.

Thanks to this comprehensive platform offering and smooth integration, Admirals is often considered one of the best brokers to use MetaTrader 5, especially for those looking for a professional and flexible trading experience.

- Trading Central.

- Connect Tool.

- Mini Terminal.

- Trade Terminal.

- Tick Chart Trader.

- Global Opinion.

- Advanced indicators package.

The WebTrader version of MetaTrader allows you to trade entirely online, with no need to download or install any software.

It includes a range of advanced technical tools and supports automated trading, giving you the flexibility to adapt strategies to suit your own system.

The features that make MetaTrader one of the best trading platforms can be summed up as follows:

- User-friendly interface that’s fully customisable, with a wide range of add-ons

- Advanced interactive charts for in-depth market analysis

- A comprehensive suite of technical indicators

- The ability to generate detailed trade reports

- Support for multiple order types

- Suitable for all trading strategies, including scalping and hedging

- With Expert Advisors (EAs), you can set up algorithmic trading easily—no coding knowledge required to install or use them

Customer Service

Undoubtedly, one of the strengths of the British broker. Let's see how it responds to the following services:

- ✅ Contact phone: +44 20 8157 7344

- ✅ Email: [email protected]

- ✅ Chatbot: Yes

Admirals generally offers solid customer service, with support available via live chat, email, and phone across multiple regions. Most users report fast response times, especially through live chat, and emails are typically answered within 24 hours. However, one limitation is that Admirals does not offer 24/7 customer service, which may be a downside for traders who operate outside regular business hours.

While many clients are satisfied, online reviews show mixed experiences, particularly regarding withdrawals and support during peak times. Some users have shared negative experiences, citing delays in withdrawals or feeling that support was slow or unhelpful in resolving issues. In a few cases, users have even raised concerns about account fund handling, although these appear to be isolated incidents rather than widespread problems.

Overall, Admirals' customer service is generally reliable and well-rated, especially for those who operate during standard UK or EU hours. Still, potential clients should be aware of the lack of round-the-clock support and the occasional user complaints regarding withdrawal processes.

Education

One of Admirals’ strongest selling points is its commitment to education. The broker offers a comprehensive Education section packed with free resources, including beginner, intermediate, and advanced courses, webinars, articles, tutorials, e‑books, and videos—all available on-demand and designed to fit your schedule.

They regularly host live webinars, both for trading and investing topics, as well as in-depth technical sessions. A standout feature is the monthly webinars with Dr Alexander Elder, famed author of Trader for a Living, who shares expert trading strategies, the Triple Screen system, impulse techniques, and the Force Index.

Admirals also offers structured online courses—such as Forex 101 and Zero-to-Hero—that are praised by Traders Union for their clarity and practical insight, covering essential topics like what is technical analysis and fundamental analysis, risk management, and trading psychology. These courses guide users in translating theory into action on MetaTrader platforms.

The education suite is fully complemented by the analysis portal, featuring market reports and timely financial news—ideal for staying informed and improving decision-making.

User Reviews

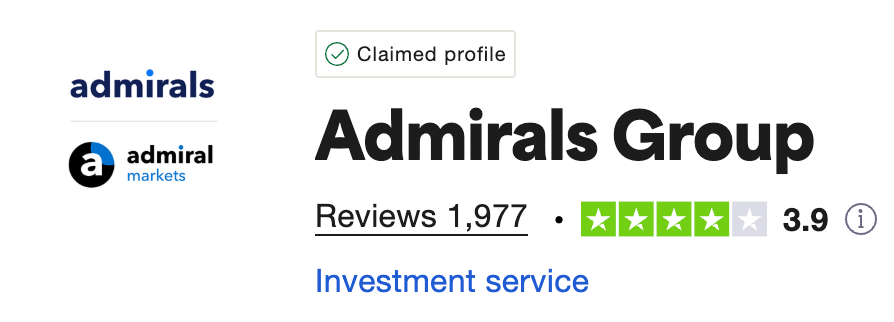

Wondering what actual users say about Admirals? Overall, client satisfaction is fairly high.

On Trustpilot, Admirals holds a rating of 3.9 out of 5, based on nearly 2,000 reviews—most of which are positive. Users frequently praise the broker for its efficient customer service and professional support.

Feedback on the mobile app is also generally favourable. On the Google Play Store, Admirals' app has an average rating of 3.4 stars from over 2,000 reviews, with users highlighting its ease of use and functionality, though some mention occasional technical issues.

Our opinion

Admirals is a well-rounded broker, both in terms of products and services. The account opening process is straightforward, and users can choose from a range of account types, each with its own trading conditions—offering flexibility for different profiles.

One of Admirals’ key strengths is its proven track record—with over 20 years of experience in financial brokerage(formerly known as Admiral Markets). This long history is backed by a strong focus on security, competitive pricing, and a clear commitment to client support and innovation. Recent additions like fractional share trading and a copy trading service are good examples of this forward-thinking approach.

If there’s one drawback worth mentioning, it's that Admirals only supports the MetaTrader platform. While it offers multiple versions (MT4, MT5, WebTrader, and Supreme Edition), it doesn't provide an alternative trading platform. Although MetaTrader is highly respected and widely used for its functionality and reliability, some users may prefer a more modern or intuitive interface.

That said, based on this review, Admirals stands out as a secure, experienced, and globally trusted broker with competitive fees—a solid option for both new and seasoned traders.

FAQs

What is it?

Admirals is a globally established online broker founded in 2001, previously known as Admiral Markets. Since rebranding in 2021, it has expanded its offering to include spot trading in stocks and ETFs.

Known for its reliability, flexible account options, and educational resources, Admirals operates under a No Dealing Desk (NDD) model with Straight Through Processing (STP), ensuring fast and transparent order execution.

It supports a wide range of trading strategies—including scalping and hedging—making it a solid choice for both beginners and experienced traders.

Does Admirals offer a demo account?

Yes, Admirals offers free demo accounts on both MT4 and MT5, allowing you to practise with virtual funds in real market conditions.

Are spreads and commissions competitive?

Admirals offers tight spreads starting from 0.0 pips on ECN-style accounts, with a commission-based pricing model. Standard accounts offer commission-free trading with slightly wider spreads.