Reviews

Barclays Smart Investor Review

Barclays Smart Investor is the investment platform linked to one of the UK’s most recognisable banks. It gives individuals the tools to manage their money independently, but without stepping too far from the language and layout of traditional banking. It’s not trying to compete with high-frequency trading platforms or experimental fintech, it stays closer to familiar ground, but with more control than a savings account allows.

This review looks at how Barclays Smart Investor works day to day: what it does well, what feels limited, and how it fits into the wider landscape of UK investing options. It’s not about checking off features, but rather if this setup makes sense for the kind of investor who doesn’t want complexity but still wants to be involved.

Pros and Cons

| Pros of Barclays Smart Investor | Cons of Barclays Smart Investor | ||

| ✅ Reputable UK bank with FCA regulation | ❌ £6 dealing fees add up for active traders | ||

| ✅ FSCS-protected investments | ❌ No live chat or weekend customer support | ||

| ✅ Seamless for existing Barclays customers | ❌ Limited advanced tools for serious traders | ||

| ✅ Tax-efficient ISA and SIPP options | |||

| ✅ Ready-made portfolios for passive investors |

| Pros of Barclays Smart Investor | Cons of Barclays Smart Investor |

| ✅ Reputable UK bank with FCA regulation | ❌ £6 dealing fees add up for active traders |

| ✅ FSCS-protected investments | ❌ No live chat or weekend customer support |

| ✅ Seamless for existing Barclays customers | ❌ Limited advanced tools for serious traders |

| ✅ Tax-efficient ISA and SIPP options | |

| ✅ Ready-made portfolios for passive investors |

Barclays Smart Investor at a glance

Let’s take a quick look at the essentials, the bits people usually want to know right off the bat:

- 🏆 Regulation: Regulated by the Financial Conduct Authority (FCA), so it ticks the compliance boxes.

- 🔒 Investor protection: FSCS protection up to £85,000, so your money’s got a safety net.

- 💼 Financial assets: Shares, ETFs, funds, bonds — plenty to choose from.

- 🌐 Markets: UK-focused with access to global investments.

- 💻 Account types: ISA, SIPP, and General Investment Account.

- 💲 Fees: 0.25% annual platform fee up to £200,000 and 0.05% beyond £200,000; £6 fee for share dealing

- 💰 Minimum deposit: £50

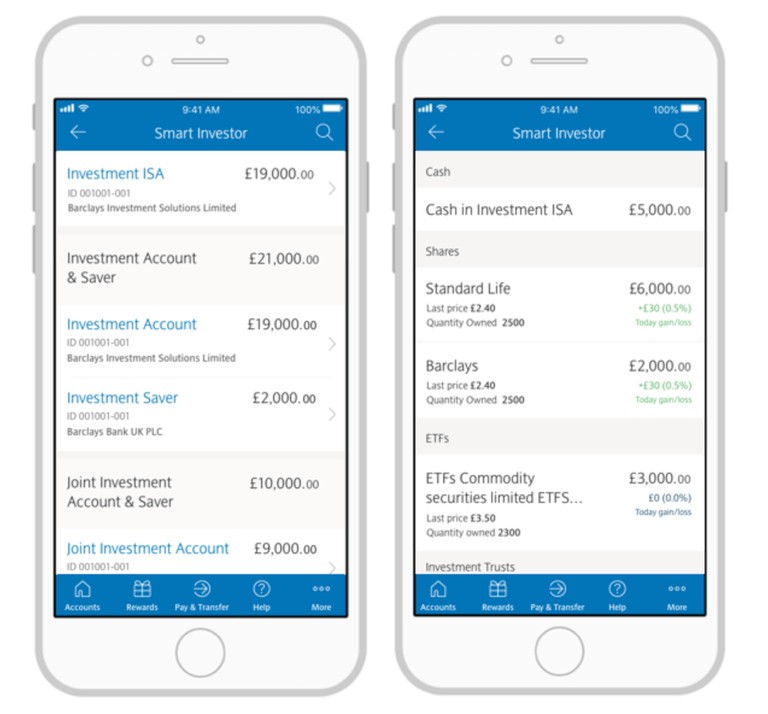

- 📈 Platform: Works on both web and mobile.

- 📧 Contact: Phone, secure messaging, or pop into a Barclays branch.

- 🌟 Featured product: Ready-made portfolios.

Is Barclays Smart Investor Safe?

When it comes to investing, trust matters a lot. Thankfully, Smart Investor doesn’t cut corners on safety.

If Barclays ever went under, up to £85,000 of your investments would be covered by the FSCS. That’s separate from how your money is held day to day; the platform is regulated, and client assets aren’t mixed with the bank’s own. This means your investments are held in separate nominee accounts, so they’re not lumped in with Barclays’ own funds.

You can invest knowing your money is in a regulated, well-managed environment, and that’s half the battle won.

Range of Products

You want choices when investing, and Smart Investor delivers. The platform gives you access to a mix of:

- UK and international shares

- Funds and index trackers

- Exchange-traded funds (ETFs)

- Corporate bonds and gilts

- LSE companies

But what really stands out are their ready-made portfolios. You can start with as little as £50 and choose from five different risk profiles. The entire portfolio is managed by professionals, so if you are new to investing or simply don’t have enough free time to do your own research, Barclays Smart Investor could be an excellent choice.

Account Types and Fees

Barclays keeps it simple with three core account types:

- Stocks & Shares ISA – A tax-free wrapper, perfect for your first £20,000 each tax year.

- Investment Account – A standard taxable account for anything over the ISA allowance.

- SIPP – A personal pension with investment flexibility and tax relief.

Now let’s talk cost, and this is where our Barclays Smart Investor fees review comes in.

Platform and Investment Fees

So, how much does it all cost?

- Service fee: 0.25% annually (or 0.05% for over £200,000)

- Dealing fee: £6 per online trade (shares and ETFs)

Beyond that, there are no other fees for funds, dividend reinvestments, holding cash or withdrawals.

In this Barclays Smart Investor fees review, we found the platform’s pricing to be fair for long-term, low-frequency investors. But if you’re planning to trade regularly, those £6 charges can add up. Still, if you want to invest in exchange-traded funds, bonds, or gilts, the offer is unbeatable as you’d only have to cover 0.25% fees per year (service fees).

Trading Platforms

Most of what you need is easy to get to. The layout doesn’t distract, and the mobile version keeps that same clarity. So, many may find it rather dry and not a trading platform per se. If you are into price charts, technical or fundamental analysis, live prices, and others, you need to supplement with a third-party platform.

Still, for most people looking for straightforward investing, it more than does the job.

Customer Service

There’s no live chat, and support isn’t available outside working hours. For simpler queries, that’s rarely a problem. More complex issues, like account transfers or pension questions, can take longer to resolve. The response feels less like tech support, more like dealing with a bank: sometimes efficient, sometimes not.

Research and Education

Barclays has built a surprisingly solid content hub for Smart Investor users. The Research Lab adds a bit of structure with plenty of insight into shares, funds, indices, and others, but it stays in the background unless you go looking for it.

Simply put, it shows the essentials without turning it into a research project. You won’t find advanced charts or filters for professional trading.

Who is Barclays Smart Investor for?

This Smart Investor Barclays review makes one thing clear: it’s perfect for Barclays customers looking to keep everything in one place. It’s also a solid choice for beginners and passive investors who want a trustworthy, user-friendly way to grow their money.

Smart Investor isn’t trying to compete with high-spec trading platforms. The tools are basic, the pricing isn’t the lowest unless you invest in funds, bonds, or gilts, and fast-paced investors might find it limiting. But if your goal is to build and hold a long-term portfolio with minimal fuss, it does the job without getting in the way.

FAQs

What is Barclays Smart Investor?

Barclays Smart Investor gives you access to shares, funds, and ISAs through a separate platform from your day-to-day banking. It’s aimed at people who want to manage their own investments but still stay within a system they already know. The setup is clean, the tools are basic but reliable, and the whole experience feels like it was made for regular investors, not for those trying to outsmart the market.

It’s especially handy for those already banking with Barclays as Smart Investor integrates neatly with your existing accounts, so you can manage your money and investments side by side. But even if you're not a Barclays customer, you can still sign up and benefit from their trusted infrastructure.

Can I use Barclays Smart Investor without a Barclays current account?

Yes, anyone in the UK can open an account, but Barclays customers get a more streamlined setup.

How to open a Barclays Smart Investor account in 5 steps

Getting started is refreshingly straightforward:

- Go to the Barclays Smart Investor website.

- Choose your preferred account type (ISA, SIPP, or Investment Account).

- Fill in your details and take a short investor questionnaire.

- Verify your ID, either through the app or by uploading documents.

- Fund your account and you’re ready to invest.

Barclays customers can do this directly via online banking, which makes the process even smoother.

Are dividends automatically reinvested?

Not by default. You can opt into a Dividend Reinvestment Plan (DRIP) for eligible holdings.

Can I transfer my existing investments to Barclays Smart Investor?

Yes. ISAs or SIPPs, and other accounts can be transferred in, with support from the Barclays team.