Brokers

Best Brokers for Trading Options 2025

It is undeniable that financial options are a booming asset among speculators and investors. Whether due to their versatility as a hedging asset, the leverage capacity they grant the operator, or the versatility in creating strategies, the demand for this instrument as an operational vehicle is increasing.

Precisely for this reason, in this article we are going to review which are the best options brokers, as well as what you should consider when selecting an options broker.

What are financial options?

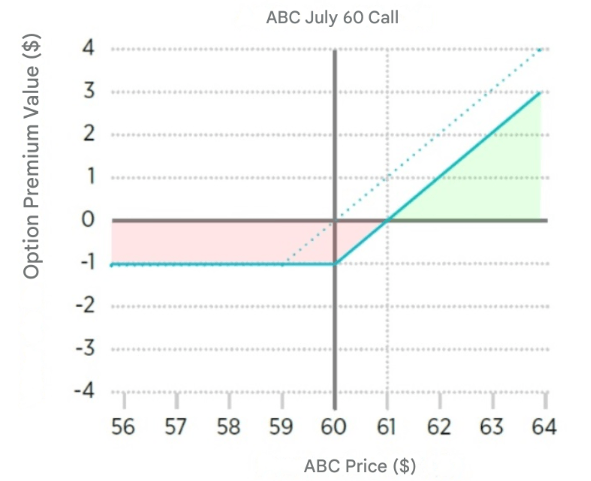

Financial options are contracts that give the buyer the right to buy or sell an asset at a specific price on a future date. The buyer of a call option has the right to buy the asset at that price, while the buyer of a put option has the right to sell the asset at that price. The seller of an option is known as a writer and is obligated to buy or sell the asset if the buyer decides to exercise their option. Options are often used as a way to hedge risk or to gain speculative profits.

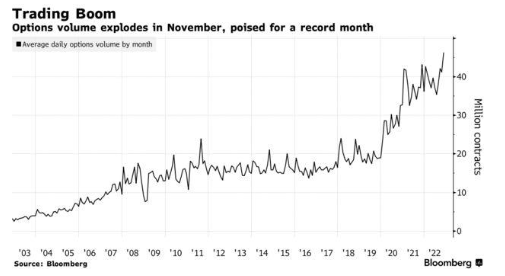

We can see in this Bloomberg chart how options trading is skyrocketing, and how records are being broken for the last 25 years.

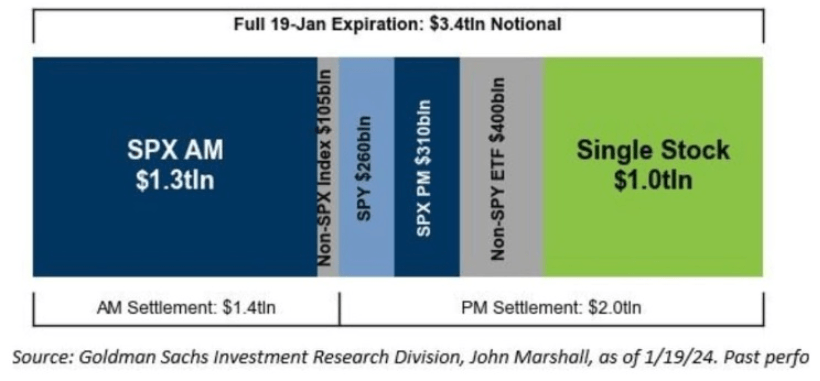

It is very striking that with the appearance of daily expirations in options on $SPX, $SPY, and $XSP, trading in these skyrockets, and especially the vast majority of open contracts have less than 24 hours until their expiration:

This revolution necessitates a review of which intermediaries can respond to an increasingly specific and characteristic demand in the most optimal way possible, and of course, at the lowest cost.

Brokers for trading options in 2025

There are few brokers that offer a complete and unrestricted operation with financial options.

While we can distinguish between national and international ones, it is also interesting to distinguish those with headquarters in Europe, and subject to MiFID 2 regulations from those that allow their use from Europe, but have their headquarters in the United States and are subject to FINRA regulations.

Generally, their greatest weakness tends to be customer service and the management of tax reports in case of doubts.

Interactive Brokers options

Interactive Brokers is one of the largest and most famous brokers in the world. It offers access to almost all markets available for European clients and has very competitive prices for any product. It also has a platform for analysis and trading that is among the most comprehensive in terms of options.

- Regulation: ICB for Europe (Ireland).

- Markets: Up to 34; MEFF, EUREX, Hong Kong, CME Group, ASX...

- Commissions:

- Minimum Commission: £1.00 per order, which applies to smaller trades or low-volume orders.

- Per contract: £1.70

- This is a flat fee charged for each options contract you trade, regardless of the underlying asset or the volume of your trades.

- Tiered Rate Commission (for higher-volume traders):

- Execution Fee: £1.00 per contract

- Exchange Fee: £0.37 per contract

- Clearing Fee: £0.03 per contract

- Regulatory Fee: £0.00 per contract

- Platform: Trader WorkStation.

- Broker profile: For professional traders.

Let's see what the pros and cons are of using Interactive Brokers for your options trading:

| Pros of Interactive Brokers | Cons of Interactive Brokers | ||

| ✅ Platform with exposure to 34 options markets, practically all markets of interest to investors. | ❌ Difficulty of use for new users, which makes its learning curve not quick. | ||

| ✅ Competitive prices for the quality they offer. | |||

| ✅ Very suitable tools for options analytics: Portfolio Analyst, Option Strategy Lab, and Probability Lab. | |||

| ✅ Lower margin loan requirements, from 5.83% to 6.83%, which is very interesting due to the leverage possibilities offered by the American broker. |

| Pros of Interactive Brokers | Cons of Interactive Brokers |

| ✅ Platform with exposure to 34 options markets, practically all markets of interest to investors. | ❌ Difficulty of use for new users, which makes its learning curve not quick. |

| ✅ Competitive prices for the quality they offer. | |

| ✅ Very suitable tools for options analytics: Portfolio Analyst, Option Strategy Lab, and Probability Lab. | |

| ✅ Lower margin loan requirements, from 5.83% to 6.83%, which is very interesting due to the leverage possibilities offered by the American broker. |

If you are interested in this broker and want to know more, read our Interactive Brokers review.

AvaTrade

Next is AvaTrade, one of the best brokers for trading financial options.

In this way, the broker, with tax residency (for traders operating from Europe) in Ireland, offers several subaccounts within its individual trading account, with Ava Options standing out (although Ava Futures and AvaTrade Go can also be found).

As a result, the broker provides two types of options: vanilla options (standard option contracts) and barrier options. With barrier options, you can set a barrier level from which the option is activated (knock-in) or deactivated (knock-out or kick), allowing you to protect your entire capital.

Through the Ava Options platform, you can gain exposure to a wide range of underlying assets, including over 40 currency pairs, up to 30 indices, as well as stocks and other commodities. Additionally, you can trade with up to 12 pre-configured strategies, including credit/debit spreads and strangles.

- Regulation: Central Bank of Ireland (CBI) for European investors (including Spanish), FCA (United Kingdom), IIROC (Canada), and ASIC (Australia), among others.

- Markets: Forex, indices, commodities, and stocks.

- Commissions: Contract premium (consult conditions*)

- Platform: Ava Options, MT4, and MT5.

- Broker profile: For professional traders, also caters to retail clients with educational resources and more accessible trading features for beginners.

Let's see the pros and cons of using this broker alternative.

| Pros of AvaTrade | Cons of AvaTrade | ||

| ✅ Includes various types of options; vanilla and barrier, somewhat more professional. | ❌ The non-operational fees can be high. | ||

| ✅ Has several pre-programmed strategies for beginner traders. | |||

| ✅ Good customer service, and with continuous educational material. | |||

| ✅ Allows incorporating copy-trading or automated trading (for the more professional) into our options trading. |

| Pros of AvaTrade | Cons of AvaTrade |

| ✅ Includes various types of options; vanilla and barrier, somewhat more professional. | ❌ The non-operational fees can be high. |

| ✅ Has several pre-programmed strategies for beginner traders. | |

| ✅ Good customer service, and with continuous educational material. | |

| ✅ Allows incorporating copy-trading or automated trading (for the more professional) into our options trading. |

Freedom24 options

Freedom24 is one of the brokers offering the largest number of stock options contracts, and it also has one of the simplest operational processes available.

It boasts more than 850,000 US stock options. What makes this broker stand out, however, is not only its wide range of stock offerings at competitive fees but also the fact that its website provides a detailed written tutorial on how to trade options on Freedom24 in just 7 steps.

- Regulation: CySEC (Cyprus)

- Markets: +850,000 stocks (all US stocks)

- Fees: $0.65/contract

- Platform: Proprietary.

- Broker profile: Ideal for beginner investors in the world of options. However, its platform has depth to start professionalising.

These are some of the advantages and disadvantages of trading options with Freedom24:

| Pros of Freedom24 | Cons of Freedom24 | ||

| ✅ Easy and intuitive platform, perfect for beginners. | ❌ It's not very clear in how many markets (MEFF, CME, Eurex...) you can trade. | ||

| ✅ Very low commissions, from $0.65/contract | ❌ It only includes options on stocks. No commodities, indices, energy... | ||

| ✅ Includes all US stocks | |||

| ✅ Includes a step-by-step tutorial on how to trade options |

| Pros of Freedom24 | Cons of Freedom24 |

| ✅ Easy and intuitive platform, perfect for beginners. | ❌ It's not very clear in how many markets (MEFF, CME, Eurex...) you can trade. |

| ✅ Very low commissions, from $0.65/contract | ❌ It only includes options on stocks. No commodities, indices, energy... |

| ✅ Includes all US stocks | |

| ✅ Includes a step-by-step tutorial on how to trade options |

If you are interested in this broker and want to know more, read our Freedom24 review.

IG

IG is another of the most professional trading brokers available. In fact, their offerings include not only traditional options, or as they refer to them, vanilla options, but also a proprietary product called barrier options.

Unlike vanilla options, these can only be bought (whether as a put or a call option), and are characterised by the fact that you set the barrier level – or knockout – at which the option will be activated. If the price of the underlying asset (on which the option is based) touches the barrier you’ve set, the derivative is automatically sold.

In other words, these are options that allow you to limit your exposure risk to a level you are comfortable with.

Additionally, thanks to IG options, you can invest in thousands of assets around the world. And when it comes to regulation, it is one of the most thoroughly audited, with notable oversight from the supervisory bodies such as BaFin (for European countries) and the FCA in the United Kingdom.

- Regulation: FCA (UK), BaFin (Germany)

- Markets: Index markets, commodities, or American and European stocks.

- Commissions:

- on European stocks: 0.06% (minimum 5€)

- US stocks: $0.02 per share (minimum $15).

- Wall Street indices: 1.4 points of spreads.

- DAX40: 0.8 points of spread.

- Platform: Proprietary platform, Metatrader 4, and ProRealTime.

- Broker profile: For professional traders.

With all this, let's look at the pros and cons of using this broker to trade financial options:

| Pros of IG | Cons of IG | ||

| ✅ Quality: Wide range of products, there are even two types of options (vanilla and barrier) | ❌Not very intuitive: The downside of professional brokers is that they are not the best possible option for someone starting out in the world of trading. | ||

| ✅ Quantity: Possibility to invest in thousands of underlying assets including stocks or indices. | |||

| ✅ Security: It is one of the most reliable brokers, audited by the main supervisory authorities, such as BaFin and FCA. | |||

| ✅ Professional: Additionally, it allows connection with the best trading platforms, such as ProRealTime or Metatrader 4. |

| Pros of IG | Cons of IG |

| ✅ Quality: Wide range of products, there are even two types of options (vanilla and barrier) | ❌Not very intuitive: The downside of professional brokers is that they are not the best possible option for someone starting out in the world of trading. |

| ✅ Quantity: Possibility to invest in thousands of underlying assets including stocks or indices. | |

| ✅ Security: It is one of the most reliable brokers, audited by the main supervisory authorities, such as BaFin and FCA. | |

| ✅ Professional: Additionally, it allows connection with the best trading platforms, such as ProRealTime or Metatrader 4. |

If you are interested in this broker and want to know more, read our IG review.

DEGIRO options

DEGIRO is an online broker that allows users to become familiar with options trading. While it may not be the best broker for these types of derivatives, its ability to simplify a process that can be quite complex makes it a good entry point for beginners, and this is why it earns a place in this ranking.

- Regulation: AFM (NEtherlands), BaFiN (Germany)

- Markets: 12 in total; MEFF, EUREX, OMX, CME...

- Commissions:

- Mini-Ibex: €0.75/contract

- EUREX: €0.75/contract

- Euronext: €0.75/contract

- OMX: €0.75/contract

- CME: €0.75/contract

- Platform: Proprietary.

- Broker profile: Ideal for beginner investors with little knowledge of options.

Let's see what the pros and cons of using DEGIRO for your options trading are:

| Pros of DEGIRO | Cons of DEGIRO | ||

| ✅ Easy and intuitive platform: | ❌Simplistic trading platform | ||

| ✅ Low operational commissions, usually not exceeding €0.75/contract. | ❌Geographical limitations, beyond Europe and the USA, there is not much access. | ||

| ✅ Wide variety of markets in Europe | |||

| ✅ OTC trading (over The Counter) |

| Pros of DEGIRO | Cons of DEGIRO |

| ✅ Easy and intuitive platform: | ❌Simplistic trading platform |

| ✅ Low operational commissions, usually not exceeding €0.75/contract. | ❌Geographical limitations, beyond Europe and the USA, there is not much access. |

| ✅ Wide variety of markets in Europe | |

| ✅ OTC trading (over The Counter) |

If you are interested in this broker and want to know more, read our DEGIRO review.

Exante options

Exante is a very comprehensive broker with very fair prices. It offers access to practically all markets. It allows both retail and institutional clients to work with the same platform.

- Regulation: MSFA for Europe (Malta)

- Markets: 9 in total; EUREX, CME ASX...

- Commissions:

- EUREX: €1.5/contract

- CME Group: $1.5/contract.

- Stamp Duty: 0.5% of the transaction value (for buy-side transactions)

- PTM Levy: £1 per contract where the gross value of the trade exceeds £10,000

- Platform: Proprietary.

- Broker profile: For professional investors

Once again, let's look at its pros and cons in options trading:

| Pros of Exante | Cons of Exante | ||

| ✅ Platform with exposure to 9 global options markets, including Japan or Australia | ❌High inactivity fee of €50/month is charged if no trading activity occurs for 6 months | ||

| ✅ Low commissions, starting from €/$1.5 | |||

| ✅ User-friendly and intuitive platform. |

| Pros of Exante | Cons of Exante |

| ✅ Platform with exposure to 9 global options markets, including Japan or Australia | ❌High inactivity fee of €50/month is charged if no trading activity occurs for 6 months |

| ✅ Low commissions, starting from €/$1.5 | |

| ✅ User-friendly and intuitive platform. |

What options markets can be traded from the UK?

- LSE (London Stock Exchange): The UK’s premier exchange offers a variety of derivatives products, including options on stocks and indices. One notable contract is the FTSE 100 options. The LSE is regulated by the Financial Conduct Authority (FCA), ensuring a high level of investor protection for traders based in the UK. The LSE is one of the largest and most liquid exchanges in Europe, making it a popular choice for options trading. Additionally, being mindful of the London Stock Exchange hours is crucial for traders, as these hours define when the market is open for trading and can influence the execution and pricing of options.

- CME: It is the exchange par excellence with its mini and micro contracts with options on the main indices. CME Group is the largest financial derivatives exchange in the world, and it trades futures and options on futures in assets such as currencies, energies, agricultural products, indices, metals, interest rates, and cryptos. The trading platform for these products is CME Globex, while for fixed income it uses BrokerTec and for currency trading it has the EBS platform.

- Eurex: It is gaining more prominence with the star contract being those related to the DAX and Eurostoxx. It is one of the world's leading financial derivatives clearing exchanges and the largest market for such products in Europe. It was established in 1998 as a result of the merger of DTB and SOFFEX.

- Other markets such as: ASX (Australia), CBOE, ICE

What criteria should a good options broker meet?

There are several factors to consider when evaluating a financial options broker:

Regulation and security

When we talk about financial options, we're referring to complex derivatives that often carry a high degree of uncertainty—particularly for less experienced investors.

For this reason, it's essential to ensure that your options broker is regulated by a reputable financial authority.

Moreover, if you're new to options trading, it's especially important that the regulator is as local as possible. Ideally, the broker should be authorised by the CNMV (Spain’s National Securities Market Commission), although regulation by any recognised European supervisory authority would generally be acceptable.

Trading Platform

It's no longer just about the platform being easy and intuitive—though it certainly should be, if possible—but ease of use is no longer the most important factor. What really matters now is that the best trading platform integrates a broad range of tools and resources to support informed decision-making.

In this respect, brokers such as Interactive Brokers stand out, thanks to their integration with platforms like MetaTrader, TradingView, or Visual Chart, which allow you to develop your own advanced options strategies.

For instance, the platform you use should include access to the Greeks. As you may already know, the Greeks are a set of metrics used in options theory to measure how sensitive an option is to various market factors. They’re called the "Greeks" because many of the letters used to name them come from the Greek alphabet.

Some of the most commonly used Greeks include:

- Delta: measures how sensitive an option’s price is to changes in the price of the underlying asset.

- Gamma: measures how sensitive the delta is to movements in the underlying asset’s price.

- Vega: measures how sensitive an option’s price is to changes in volatility.

- Theta: measures how much an option’s price declines as time passes.

- Rho: measures how sensitive an option’s price is to changes in interest rates.

A comprehensive trading platform should offer access to a full options chain, showing all available strike prices and expiry dates for a given underlying asset—similar to the one shown in the screenshot below.

In this example, we’re going to buy a TSLA call option with a delta close to 0.4 and the nearest available expiration date.

Upon selecting the strike price, the order entry window will appear, allowing us to specify both the type of order (in this case, a purchase) and the limit price we’re willing to pay.

Once everything is set up, all that remains is to click “send” to place the order in the market, where it will await execution.

This is just one example of an options strategy using Interactive Brokers, which is widely regarded as one of the best platforms for this type of trading. A high-quality options broker should allow you to configure and execute trades like the one described above with precision and ease.

Range of products and markets

Another important factor to consider is the range of products and markets your broker can give you access to.

On the one hand, there are the financial instruments themselves—such as stocks, indices, forex, and commodities. Options are an excellent way to gain exposure to these assets, as they also allow you to implement various hedging strategies.

On the other hand, access to global markets is equally vital. A broker that offers connectivity to major international exchanges at competitive rates becomes a far more attractive choice. Some of the key markets to look for include:

- Chicago Board of Trade (CBOT)

- Chicago Board Options Exchange (CBOE)

- Chicago Mercantile Exchange (CME)

- EUREX

- Hong Kong Exchange (HKEX)

- Osaka Securities Exchange (OE)

Commissions and Spreads

And of course, there’s the matter of commissions. While this is an important consideration, it’s not the most critical—rather, it should be seen as a complementary factor.

Your priority shouldn't be finding the cheapest broker, but rather one that meets all the key criteria mentioned earlier. However, once those essential requirements are satisfied, it makes perfect sense to seek out the most cost-effective option available.

What are the risks of investing in financial options?

Investing in financial options involves several risks, including the following:

- Leverage risk: Options typically involve leverage, allowing investors to control a larger position with a relatively small outlay. While this can amplify returns, it also increases risk—since even a minor movement in the underlying asset’s price can result in significant gains or losses.

- Risk of total loss: Closely related to leverage, options carry the potential for a complete loss of the capital invested. If the underlying asset does not move in the anticipated direction, the option may expire worthless.

- Volatility risk: Options prices are highly sensitive to market volatility. Increased volatility can drive up option premiums, potentially reducing profitability or increasing the likelihood of loss.

- Liquidity risk: Some options may be thinly traded, leading to low liquidity. This can make it difficult to exit a position at the desired time or price, complicating risk management.

- Counterparty risk: In the case of over-the-counter (OTC) options, there is a risk that the counterparty may fail to meet their obligations, which could result in financial loss.

Final thoughts

Overall, it is important that you understand these risks before investing in financial options and ensure that you understand how options work and how they can be effectively used in your investment strategy. Precisely for this reason, you must make sure to choose a regulated and reliable broker.