Reviews

Bestinvest Review 2025: Is It Worth It for Your ISA or SIPP?

If you're comparing platforms to manage your ISA, SIPP, or Junior ISA, Bestinvest is likely on your shortlist. Backed by Evelyn Partners, it's been around for decades, but recently it's stepped up its digital offer, combining low-cost investing with something you don’t often get for free: one-on-one investment coaching.

In this Bestinvest ISA review, we’ll break down what really matters—fees, fund options, usability, and whether the platform actually helps you grow your money, not just hold it.

Here’s why Bestinvest might actually be worth your time, especially if you’re thinking SIPP or ISA.

What is Bestinvest?

Bestinvest is an online investment service under the umbrella of Evelyn Partners, a well-established wealth management firm.

Bestinvest gives UK investors access to a wide range of investments, from funds, ETFs, and shares to investment trusts, VCTs, and IPOs. You can open a Stocks & Shares ISA, Junior ISA, SIPP or Junior SIPP, and even more specialist accounts like discretionary trusts or SSAS pensions.

What sets Bestinvest apart is that you can book free sessions with real financial planners to get tailored support with no hidden costs and no sales pitch.

👉 More information: Best Stocks and Shares ISA in the UK

Pros and Cons

| Pros of Bestinvest | Cons of Bestinvest | ||

| ✅Free investment coaching | ❌Not for active traders | ||

| ✅Low, transparent fees | ❌SIPP has a minimum fee | ||

| ✅Solid for UK investors | ❌No Lifetime or Cash ISA | ||

| ✅Beginner-friendly platform | |||

| ✅Ready-made portfolios |

| Pros of Bestinvest | Cons of Bestinvest |

| ✅Free investment coaching | ❌Not for active traders |

| ✅Low, transparent fees | ❌SIPP has a minimum fee |

| ✅Solid for UK investors | ❌No Lifetime or Cash ISA |

| ✅Beginner-friendly platform | |

| ✅Ready-made portfolios |

Main Features

- Regulation: Regulated by the FCA

- Investor protection: Up to £85,000 by the FSCS

- Financial assets: US shares, ready-made portfolios, funds, shares, ETFs, investment trusts, VCTs, and IPOs

- Markets: UK, US, and global markets.

- Account types: Stocks and shares ISA, Junior ISA, investment account, SIPP, Junior SIPP, bare trusts, discretionary trusts, SSAS pension

- Service fee: Up to 0.2% for ready-made portfolios, up to 0.4% for other investments

- Dealing fee: £4.95 per trade for UK shares and ETFs

- Minimum deposit: £50

- Platform: Web trading platform and iOS and Android mobile apps

- Address: Second Floor, Liver Building, Pier Head, Liverpool, L3 1NY.

- Email: [email protected]

- Phone: 020 7189 9999

- Live chat available

- Featured product: Free investment coaching sessions with qualified financial planners

Is it safe to use?

Bestinvest is fully authorised and regulated by the Financial Conduct Authority (FCA), which means it operates under strict UK financial rules. If something were to go wrong, your investments are also covered up to £85,000 through the Financial Services Compensation Scheme (FSCS).

This is the same level of protection you’d get with any major UK investment provider, and it's a solid reassurance if you're planning to hold long-term savings in a SIPP or ISA here.

Available financial products

Bestinvest offers a diverse range of financial products to cater to various investment strategies:

- Funds: A wide selection of mutual funds across different sectors and geographies.

- Shares: Direct investment in UK and US equities.

- Exchange-Traded Funds (ETFs): Access to various ETFs for diversified investment.

- Investment Trusts: Opportunities to invest in professionally managed portfolios.

- Venture Capital Trusts (VCTs): For investors seeking exposure to early-stage companies.

- Initial Public Offerings (IPOs): Participate in new stock listings.

- Ready-Made Portfolios: Pre-constructed portfolios tailored to different risk appetites.

Account types and fees

Whether you’re building a pension, starting your child’s Junior ISA, or investing through a flexible general account, Bestinvest has you covered.

- Stocks & Shares ISA: Annual service fee of 0.2%–0.4%, plus £4.95 for UK share trades. Fund trades are free.

- Junior ISA: Same fees as the adult version. According to several Bestinvest Junior ISA reviews, it stands out as one of the best Junior Isa options for long-term saving, offering low costs and flexible fund access.

- SIPP: Charges range from 0.2%–0.4%, with a £120/year minimum. UK share trades are £4.95, while US trades are free.

- Junior SIPP: Same pricing model as the main SIPP.

There are also options for bare trusts, discretionary trusts, and SSAS pensions.

Overall, the pricing structure is clear and competitive, especially for fund-focused investors. But if you’re starting with a small SIPP, that £120/year minimum could eat into your returns early on, which is the main con in so many Bestinvest SIPP reviews.

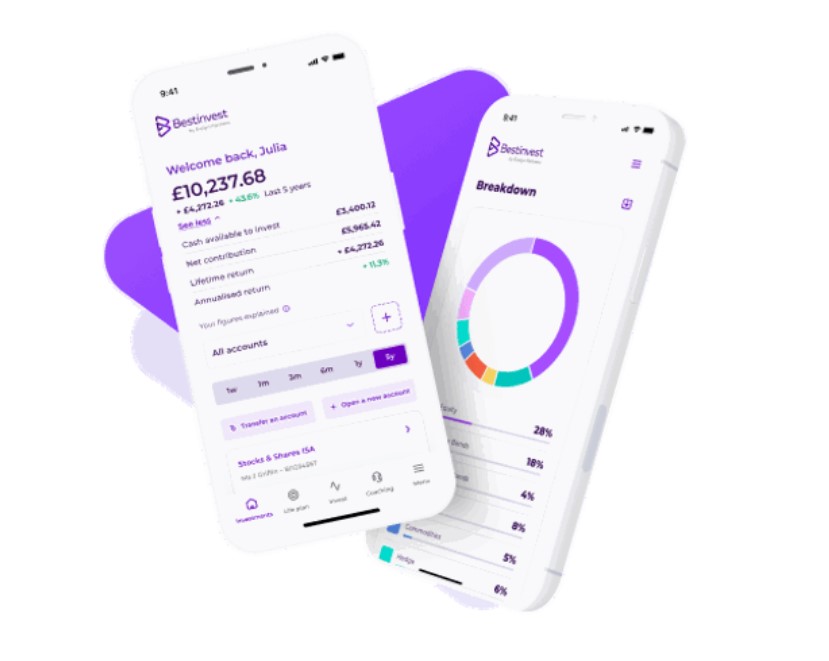

Trading platforms: Web and mobile access

Bestinvest’s web platform is clean and intuitive, making it easy to research funds, review your performance, or make adjustments to your portfolio without getting lost in jargon or complex tools — features that place it among the best trading platforms for everyday investors.

The mobile app brings that same simplicity to your phone. You can monitor your ISA, SIPP or Junior ISA, top up your account, or make changes on the go. You can also do things you wouldn’t expect from a DIY platform, like book a free coaching session, link accounts with family members, or use smart planning tools.

Customer service

Bestinvest offers more than just basic support lines. You can get help via phone, email, or live chat on weekdays, but what really sets it apart is the access to free investment coaching sessions.

You’ll speak to qualified financial planners who can guide you through building a portfolio, choosing between ISAs or SIPPs, or just understanding where to start. For beginners and self-directed investors alike, this kind of support is rare and incredibly useful.

- Phone: 020 7189 9999

- Email: [email protected]

- Live chat: Available Monday to Friday, 9 am–5 pm

Research and education

Bestinvest takes investor education seriously, with a full library of plain-English guides, expert articles, and easy-to-follow tools. You’ll also get access to:

- Interactive tools and calculators to model your goals

- Regular investment insights to keep up with market shifts

- A curated list of top-rated funds, updated by in-house experts

For many users, especially those managing their own SIPP or Junior ISA, this hands-on guidance adds serious value.

Bottom line: Is Bestinvest worth it in 2025?

If you want a low-cost ISA or SIPP, solid fund range, and hands-on support without the adviser price tag, Bestinvest is a strong choice. It’s not for day traders or stock-pickers chasing global shares, but for UK investors who value guidance, it delivers more than most.

That said, it’s not for everyone. There’s no Lifetime ISA, no Cash ISA, and it’s not built for active traders or those who want access to more global stocks.

If you’re a UK investor who values guidance, simplicity, and cost control, Bestinvest does a lot of things right, and better than many of its slicker-looking competitors.

FAQ

Is Bestinvest good for beginners?

Yes. In fact, it’s one of the best platforms for beginners thanks to its clean layout, free investment coaching, and curated fund lists. Many investor reviews mention how helpful the coaching sessions are when starting out.

Can I open a Junior ISA with Bestinvest?

Yes, and it’s a solid option. According to many Bestinvest Junior ISA reviews, we found fees to be low (starting at 0.2% annually), and the platform offers a good mix of passive and active funds for long-term growth.

Are Bestinvest fees really competitive?

Definitely. For fund investing, there are no trading fees at all, just a flat service charge of 0.2% to 0.4%. If you’re mostly investing in funds or ready-made portfolios, that’s hard to beat.

How to open a Bestinvest account

- Visit the website: Go to Bestinvest.co.uk.

- Choose an account type: Select the account that suits your investment goals (e.g., ISA, SIPP).

- Provide personal information: Enter your details, including name and address.

- Set up funding: Link your bank account and decide on your initial investment amount.

- Start investing: Once your account is set up and funded, you can begin selecting investments.