Reviews

Capital.com Review

Capital.com stands out as a user-friendly and award-winning trading platform. Regulated by the UK's Financial Conduct Authority (FCA), it offers a secure environment for traders. With access to over 4,500 instruments, including CFDs on stocks, indices, forex, crypto, commodities and ETFs, Capital.com caters to a diverse range of trading preferences.

The platform boasts a sleek, intuitive interface, advanced trading tools, and seamless integration with TradingView, enhancing the trading experience. Additionally, Capital.com provides a comprehensive Education Hub, offering resources for both novice and experienced traders.

This review delves into the platform's features, fees, and overall suitability for traders in the UK.

Pros and Cons

| Pros of Capital.com | Cons of Capital.com | ||

| ✅ Access to 4,500+ instruments including CFDs on stocks, indices, forex, crypto, commodities, ETFs, and spread betting (UK only). | ❌ No support for MetaTrader 5 (MT5), which some advanced traders may prefer. | ||

| ✅ Regulated by FCA (UK), CySEC, ASIC, and FSA Seychelles – strong global regulatory coverage | ❌ Limited deep-dive research reports compared to traditional investment platforms. | ||

| ✅ User-friendly web and mobile platforms, supports MT4, TradingView, and API trading. | ❌ Overnight fees (swap rates) apply for holding CFD positions overnight. | ||

| ✅ Rich educational content via the Investmate app, video tutorials, webinars, and detailed market analysis. | ❌ Some users report slow response times during peak hours. | ||

| ✅ No commissions, tight spreads, and no deposit/withdrawal fees. | ❌ No traditional ISA or SIPP investment accounts. | ||

| ✅ 24/7 customer support available via live chat, phone, and email. | ❌ High leverage risk – not suitable for inexperienced traders without strong risk management. | ||

| ✅ Leverage up to 1:30 for retail clients (as per FCA rules) and up to 1:500 for professional clients. | |||

| ✅ Offers Retail and Professional accounts, and demo accounts for practice |

| Pros of Capital.com | Cons of Capital.com |

| ✅ Access to 4,500+ instruments including CFDs on stocks, indices, forex, crypto, commodities, ETFs, and spread betting (UK only). | ❌ No support for MetaTrader 5 (MT5), which some advanced traders may prefer. |

| ✅ Regulated by FCA (UK), CySEC, ASIC, and FSA Seychelles – strong global regulatory coverage | ❌ Limited deep-dive research reports compared to traditional investment platforms. |

| ✅ User-friendly web and mobile platforms, supports MT4, TradingView, and API trading. | ❌ Overnight fees (swap rates) apply for holding CFD positions overnight. |

| ✅ Rich educational content via the Investmate app, video tutorials, webinars, and detailed market analysis. | ❌ Some users report slow response times during peak hours. |

| ✅ No commissions, tight spreads, and no deposit/withdrawal fees. | ❌ No traditional ISA or SIPP investment accounts. |

| ✅ 24/7 customer support available via live chat, phone, and email. | ❌ High leverage risk – not suitable for inexperienced traders without strong risk management. |

| ✅ Leverage up to 1:30 for retail clients (as per FCA rules) and up to 1:500 for professional clients. | |

| ✅ Offers Retail and Professional accounts, and demo accounts for practice |

Is it safe?

Yes, Capital.com is considered a safe and reliable broker. It is regulated by several well-known financial authorities globally, which ensures strong client protection and compliance with strict financial standards. In the UK, it operates as Capital Com (UK) Limited, regulated by the Financial Conduct Authority (FCA).

It also holds licenses from CySEC (Cyprus), ASIC (Australia), FSA (Seychelles), and the SCB (Bahamas). This multi-jurisdictional regulation provides an added layer of security and transparency for traders.

Investment Products

Capital.com offers a range of investment products to UK residents, primarily through its CFD (Contract for Difference) and spread betting services.

Existing UK clients can continue trading and accessing their accounts.

Available Investment Products for UK Clients:

- CFDs (Contracts for Difference): Trade on the price movements of various financial instruments without actually owning the underlying assets.

👉 Read here for more on the best CFD brokers

- Shares: Over 2,500 global stocks, including companies like Tesla, Amazon, and Meta.

- Indices: Major indices such as the FTSE 100, S&P 500, and Euro Stoxx 50.

👉 How to invest in the S&P 500?

- Commodities: Including energies like crude oil, metals like gold and silver, and agricultural products.

- Forex: Over 120 currency pairs, providing access to global forex markets.

- ETFs: Exchange-Traded Funds are available, though accessing them requires contacting Capital.com support to set up a separate ETF trading account

- Spread Betting: Exclusively available to UK and Ireland clients, spread betting allows speculation on the price movements of various markets without owning the underlying asset. Profits from spread betting are generally tax-free in the UK, though individual tax circumstances may vary.

Important Considerations:

- Cryptocurrency Derivatives: Due to FCA regulations, cryptocurrency derivatives (such as CFDs on Bitcoin or Ethereum) are not available to UK retail clients.

- Account Access: While new UK client registrations are paused, existing clients can continue to trade and access their accounts as usual

Fees

Trading Costs:

Capital.com charges a spread on trades, which is the difference between the buy and sell price. There are no additional commissions on trades.

Overnight Funding Fees:

If you hold a leveraged position overnight, an overnight funding adjustment (also known as a swap fee) is charged. This is calculated based on the relevant interest-rate benchmark (like SOFR or SONIA), plus a daily fee of 4% annually. Non-leveraged (1:1) CFD and spread bet positions generally do not incur overnight fees, except for certain instruments like Natural Gas or Turkish Lira pairs.

Currency Conversion Fee:

A 0.7% fee applies when trading assets in a currency different from your account’s base currency. This fee is charged on activities such as closing positions, receiving dividends, or triggering a guaranteed stop.

Guaranteed Stop-Loss Fee:

A fee is applied only if the guaranteed stop-loss (GSL) is triggered. The amount depends on the market, position size, and the stop level, and is shown before confirming the trade.

Inactivity Fee:

£10 monthly fee after 12 months of inactivity (no open positions and no trading activity). To avoid this, you simply need to open or close a trade, or withdraw your funds before the inactivity period ends.

Account types

Retail Client

This is the default classification for most individual traders. Retail clients benefit from:

- Leverage restrictions (e.g., 30:1 for major currency pairs)

- Negative balance protection

- Access to investor compensation schemes

- Standard risk warnings and disclosures

Professional Client

Designed for experienced traders who meet specific criteria, such as:

- Executing a minimum number of significant trades over a specified period

- Holding a substantial investment portfolio

- Having relevant professional experience in the financial sector

Professional clients have access to:

- Higher leverage limits (e.g., up to 200:1 for mjaor indices)

- Cash rebates based on trading volume

- Exclusive webinars and events

- Reduced regulatory protections, including no negative balance protection

- Potential loss of access to compensation schemes like the Financial Services Compensation Scheme (FSCS)

Experienced Retail Client

This classification is available in certain jurisdictions, such as Poland, for traders who demonstrate:

- A significant number of trades over a specified period

- Relevant knowledge or certification in derivatives and CFDs

Benefits include:

- Increased leverage (e.g., up to 100:1 for currency pairs, indices and commodities)

- Continued access to investor compensation schemes

- Negative balance protection

This classification is subject to local regulatory requirements.

Capital.com also offers CFD corporate accounts for institutions and businesses. These accounts are tailored to the specific needs of corporate clients and may include:

- Dedicated account management

- Custom trading solutions

- Enhanced risk management features

- Access to institutional-grade tools and analytics

Deposit and withdrawal

Capital.com does not charge any fees for deposits or withdrawals. However, banks or payment providers may impose their own charges.

The minimum deposit that Capital.com requires for you to start trading is 20 GBP.

Similarly, the smallest amount you can withdraw to your card or bank account is 50 GBP. This is if you have the sufficient amount. In case you have under 50 GBP on your trading account, you can only withdraw the whole balance.

Trading platforms

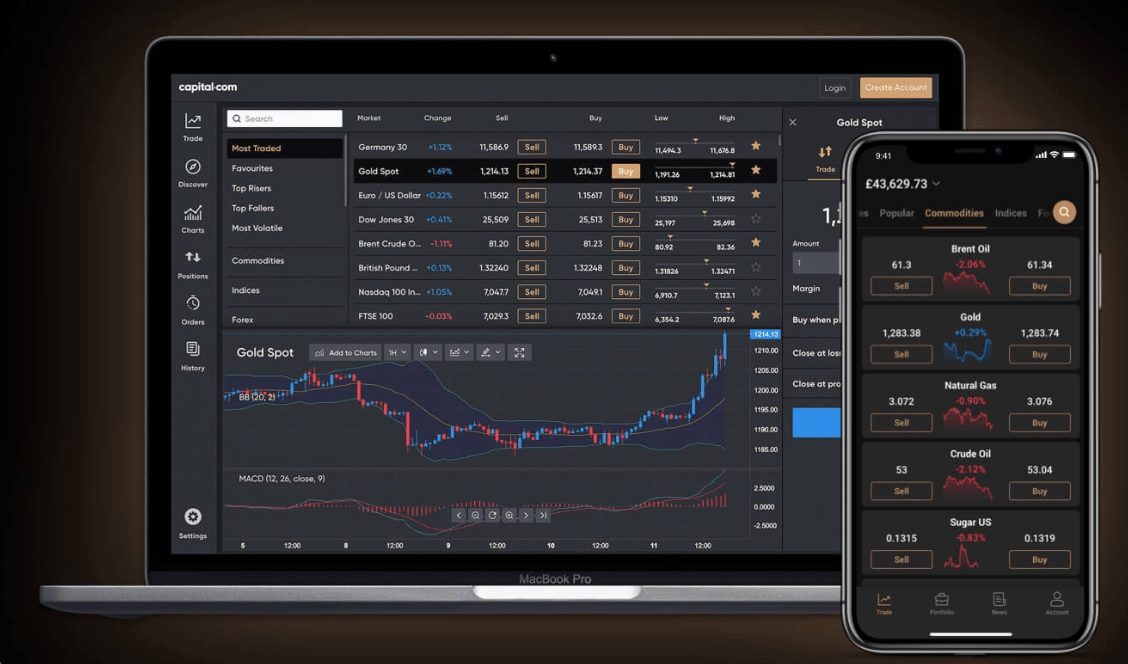

Capital.com offers a comprehensive suite of some of the best trading platforms designed to cater to traders of all experience levels. Their offerings include a user-friendly web platform, mobile apps for on-the-go trading, and integrations with advanced charting tools like TradingView and MetaTrader 4 (MT4).

Web Platform

The Capital.com web platform provides a clean and intuitive interface, making it accessible for both beginners and experienced traders. It features over 75 technical analysis indicators, multiple chart types, and unlimited watchlists to monitor preferred markets.

Traders can also access real-time market data, set stop-loss and take-profit orders, and benefit from integrated educational resources to enhance their trading skills.

Mobile Apps

Capital.com's mobile apps for iOS and Android devices offer the flexibility to trade CFDs across more than 4,500 global markets, including shares, indices, and currency pairs. The apps include features such as instant price alerts, 75+ technical indicators, and a smart feed delivering relevant financial news.

Stock Market and Finance boasts strong user feedback on Google Play, with over 64,000 reviews and an impressive 4.6-star rating, reflecting its reliability and ease of use.

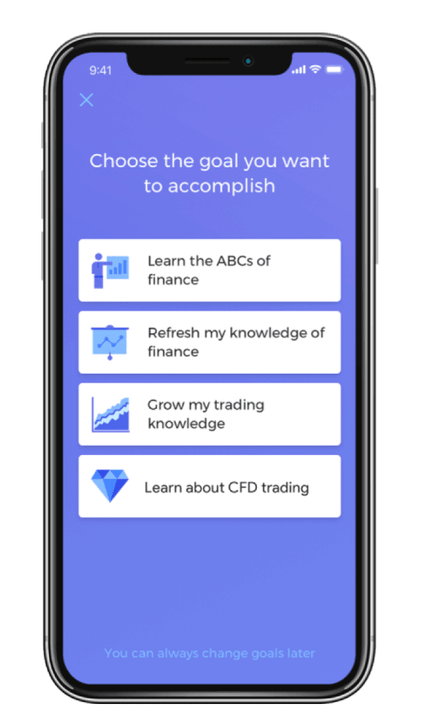

Additionally, users can manage risk with stop-loss and take-profit orders, and access educational content through the Investmate app.

Investmate also presents itself as a really good app. With a score of 4.8 stars and over 30 thousand reviewers, it’s widely praised for its intuitive design, educational content, and ability to help beginners build confidence in trading.

TradingView Integration

For traders seeking advanced charting capabilities, Capital.com allows integration with TradingView. This provides access to world-class charts, over 50 smart drawing tools, and a community for sharing trading ideas and strategies.

MetaTrader 4 (MT4)

Experienced traders can connect their Capital.com account to MT4, gaining access to advanced charting tools, automated trading through Expert Advisors (EAs), and a wide range of technical indicators. MT4 is known for its fast order execution and real-time market data, making it suitable for high-frequency and professional traders.

Capital.com’s diverse range of trading platforms ensures that traders can choose the tools that best fit their trading style and experience level. Whether trading from a desktop or mobile device, or integrating with advanced charting platforms, Capital.com provides the necessary resources to support informed and flexible trading decisions.

If you're curious about how MT4 compares to other platforms like ProRealTime, read our comparison on Metatrader 4 vs ProRealTime to learn more.

Education

Capital.com’s Education Hub is a standout feature that reflects the platform’s strong commitment to informed and responsible trading. Whether you’re a complete beginner or an experienced investor looking to sharpen your skills, the hub offers a structured and user-friendly learning environment. New traders can start with easy-to-understand guides covering the basics of financial markets, types of assets, and key trading terminology. Interactive tutorials, explainer videos, and a built-in demo account allow users to apply what they learn in real time, without risking real capital.

For more advanced traders, Capital.com’s educational offering goes several layers deeper. The platform includes a wide range of resources on technical analysis, trading psychology, risk management, and strategy development, as well as daily market insights and news. Traders can also benefit from the Investmate app, a mobile learning companion that delivers bite-sized lessons and quizzes, or explore expert-led webinars, workshops, and video tutorials available directly on the site. Whether you prefer structured courses or on-demand content, Capital.com’s education suite is designed to help users build both confidence and competence in their trading journey.

FAQs

What is it and how does it operate?

Capital.com presents itself as an online broker that provides a trading platform for trading a wide range of financial instruments, including stocks, indices, currencies and cryptocurrencies. The platform's interface is intuitive, designed to allow users to trade efficiently.

This platform is notable for incorporating technical analysis and fundamental analysis tools, as well as up-to-date news and market analysis, allowing traders to make informed decisions and keep abreast of the latest trends.

What is their customer service like?

To reach Capital.com you can call them on this number: +44 2037697865.

Email them on: [email protected]

Or they also have live chat available 24/7 via the Capital.com website or mobile app.

While many users report positive experiences with prompt and helpful responses, some have encountered delays or issues, particularly concerning withdrawal processes. For instance, some traders have reported delays in receiving withdrawal funds, with one user mentioning a wait of over five weeks without resolution.

Does it offer a demo account?

Capital.com allows users to practice with a demo account that simulates real market conditions. To open a live account, basic personal details and valid identity documents are required.