Reviews

CMC Markets Reviews: Pros and Cons

Is CMC Markets a good broker for you? In this CMC analysis we will look in detail at how it works, what products it offers, commissions, security, and under what conditions.

At the end of the article, we will give you our opinion on CMC Markets discussing its advantages and disadvantages.

What is it and how does it work?

CMC Markets is a UK-based broker established in 1989, renowned for its expertise in forex trading and financial derivatives.

As one of the pioneers in the industry and consistently ranked among the best stock brokers in the UK that investors can choose from, it offers access to over 12,000 instruments, including spread betting, CFDs, and share dealing.

The company is listed on the London Stock Exchange under the ticker CMCX.L, enhancing its credibility and trustworthiness. Operating within the London Stock Exchange hours—from 8:00 AM to 4:30 PM Monday to Friday , CMC Markets caters primarily to professional traders, earning the trust of approximately 275,000 investors globally

Main features

Regulation: Regulated by the Financial Conduct Authority (FCA); also complies with regulations in other jurisdictions such as BaFin (Germany).

Client Money Protection: Up to £85,000 per client under the Financial Services Compensation Scheme (FSCS).

Financial Instruments: Over 12,000 instruments including forex, indices, commodities, shares, ETFs, and treasuries – mostly traded as CFDs or spread bets.

Account Types: Standard Retail Account, Demo Account, and CMC Pro (for eligible professional clients).

Trading Costs:

- Forex: Spreads from 0.5 pips (e.g. EUR/USD).

- Shares/ETFs (UK): Commission of 0.10% per trade (minimum £9.00).

- Spread betting and CFDs on indices and commodities: Variable spreads depending on the market.

Minimum Deposit: £0 – no minimum deposit required to open an account.

Trading Platforms:

- Next Generation (CMC’s proprietary platform)

- MetaTrader 4 (MT4)

Customer Support & Contact:

- Address: 133 Houndsditch, London, EC3A 7BX, United Kingdom

- Email: [email protected]

- Phone: +44 (0)20 7170 8200

Pros and Cons

| Pros of CMC Markets | Cons of CMC Markets | ||

| ✅ Local supervision by regulatory bodies | ❌ This broker is fully geared towards active trading, so it may not be suitable for beginners or those without a certain level of trading experience. | ||

| ✅ Allows trading in all kinds of assets and markets -more than 12,000 investment products-, albeit through derivatives, not the underlying asset. | ❌ Only investment through CFDs is possible, not even options, warrants... | ||

| ✅ High-value training | |||

| ✅ Competitive commissions and spreads | |||

| ✅ Company with extensive track record | |||

| ✅ First-class trading platforms (including MetaTrader 4) |

| Pros of CMC Markets | Cons of CMC Markets |

| ✅ Local supervision by regulatory bodies | ❌ This broker is fully geared towards active trading, so it may not be suitable for beginners or those without a certain level of trading experience. |

| ✅ Allows trading in all kinds of assets and markets -more than 12,000 investment products-, albeit through derivatives, not the underlying asset. | ❌ Only investment through CFDs is possible, not even options, warrants... |

| ✅ High-value training | |

| ✅ Competitive commissions and spreads | |

| ✅ Company with extensive track record | |

| ✅ First-class trading platforms (including MetaTrader 4) |

Is CMC Markets safe?

CMC Markets is a reputable UK-based broker, regulated by the Financial Conduct Authority (FCA) and listed on the London Stock Exchange under the ticker CMCX.L. The company has nearly 35 years of international experience and is also authorised by BaFin in Germany and the CNMV in Spain. Retail client funds are held in segregated accounts with reputable banks, ensuring that client money is separate from the firm's own funds.

In the unlikely event of insolvency, CMC Markets' client funds are protected by compensation schemes. In the UK, the Financial Services Compensation Scheme (FSCS) provides protection up to £85,000 per eligible claimant. In Germany, the Securities Trading Companies Compensation Scheme (EdW) covers up to 90% of claims, with a maximum of €20,000 per investor.

These measures, combined with strict regulatory oversight, contribute to CMC Markets' reliability and safety for investors.

Main financial assets

CMC Markets provides access to over 12,000 financial instruments, including CFDs, financial spread bets (available only in the UK and Ireland), and stockbroking services.

Please note that CMC Markets offers derivatives based on underlying assets such as stocks, indices, forex, commodities, and treasuries. Therefore, the offerings detailed below are derivatives on these underlying assets.

- Stocks and ETFs: Over 11,400 global stocks available for trading.

- Forex: Over 300 currency pairs.

- Indices: 80 indices across Europe, the US, and Asia.

- Bonds: 50 products on interest rates and bonds.

- Commodities: Over 100 commodities.

- Cryptocurrencies: Over 20 crypto assets, including Bitcoin and Ethereum.

Account Types

Live Account

The standard account offered by CMC Markets, providing access to a wide range of financial instruments. Key features include:

- Instruments: Over 12,000 products across various asset classes.

- Leverage: Up to 30:1 for retail clients, in line with FCA regulations.

- Trading Platforms: Next Generation platform and MetaTrader 4 (MT4).

- Technical Analysis Tools: Access to over 80 technical indicators and drawing tools.

- Market Access: Trade on indices, forex pairs, shares, commodities, and treasuries.

- Client Protection: Retail client protections apply, including negative balance protection.

CMC Pro Account

Designed for experienced traders seeking enhanced trading conditions. To qualify, clients must meet at least two of the following criteria:

- Trading Experience: Completed at least 10 significant trades per quarter in the past year.

- Portfolio Size: Hold a financial instrument portfolio exceeding €500,000.

- Professional Experience: Have worked in the financial sector for at least one year.

Benefits of a CMC Pro account include:

- Higher Leverage: Access to increased leverage, beyond the standard 30:1.

- Personalised Service: Dedicated account manager for tailored support.

- Additional Benefits: Potential for cash rebates, bonuses, and priority access to new products.

- Client Protections: Note that certain retail client protections, such as negative balance protection, do not apply.

Demo Account

A risk-free environment to practice trading strategies. Features include:

- Virtual Funds: £10,000 in virtual funds to simulate real market conditions.

- Access to Instruments: Trade on indices, forex pairs, shares, commodities, and treasuries.

- Platform Familiarisation: Explore the Next Generation platform and MT4.

- Duration: Demo accounts remain active indefinitely; however, share CFDs are available for a limited period (30 days for most countries, up to a calendar month for UK and Italy shares).

Fees and Commissions

CFD & Spread Betting

- Spreads: CMC Markets offers competitive spreads starting from:

- Forex: From 0.5 pips

- Indices: From 1.0 points

- Commodities: From 0.2 points

- Treasuries: From 2.0 points

- Share CFDs:

- Commission: 0.10% of the trade value

- Minimum Commission: £9.00 per trade

Additional Trading Costs

- Overnight Holding Costs: Positions held overnight may incur a holding cost, which can be either a debit or a credit, depending on the direction of the position and the applicable holding rate.

- Guaranteed Stop-Loss Orders (GSLOs): A premium is charged for GSLOs, which guarantee closure at a set price. If the GSLO is not triggered, 50% of the premium is refunded.

Inactivity Fee

- Dormant Account Fee: £10 per month is charged if there has been no trading activity for 12 months. The fee continues until the account balance reaches zero or trading activity resumes.

Deposit & Withdrawal Fees

- Deposits:

- Bank Transfers: Free

- Credit/Debit Cards: Free

- eWallets (e.g., Neteller, Skrill): Free

- Withdrawals:

- Bank Transfers: Free for UK domestic; international transfers may carry a fee

- Credit/Debit Cards: Free for debit cards; credit cards may incur a fee

- eWallets: Free

Trading Platforms

CMC Markets is a broker that specialises in trading and offers access to one of the best trading platforms through its proprietary Next Generation platform, as well as integration with MetaTrader 4. Let’s take a closer look.

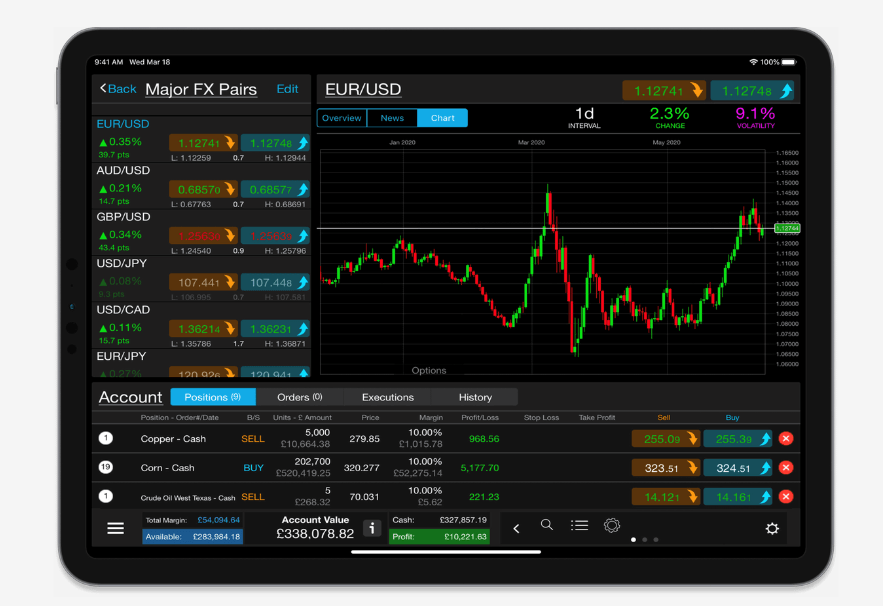

Next Generation by CMC Markets

This is CMC Markets’ own trading platform, designed to cater to both beginner and professional traders.

The Next Generation platform includes over 115 technical indicators, more than 70 chart patterns, and 35 integrated drawing tools. One of its key strengths is its high level of customisation, allowing users to create and manage up to five distinct workspaces. The platform is also available on iPhone, iPad, and Android devices.

Additionally, it provides access to CMC’s client sentiment tool, which shows how many traders are currently positioned long or short on specific instruments.

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most widely used trading platforms globally, well-known for its robust functionality.

It supports the use of automated trading systems (Expert Advisors), whether developed in-house or sourced from third parties, and allows strategy replication from other traders. The platform is available in 22 languages, making it suitable for international users. It’s particularly well-suited to algorithmic trading strategies.

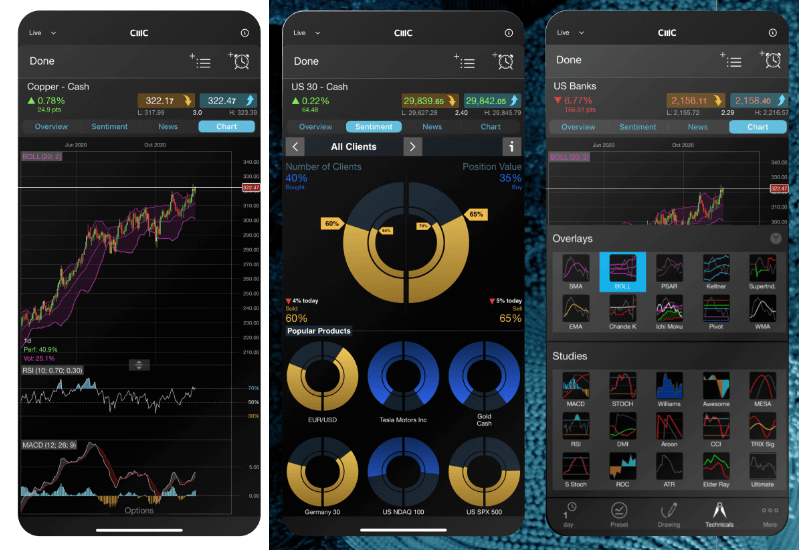

Mobile App

CMC Markets has also developed a mobile version of its Next Generation platform. This mobile app includes most of the core functionalities found on the desktop version and was recognised by ForexBrokers.com in 2021.

It enjoys a strong reputation among users, holding a 4 out of 5-star rating on the Google Play Store, with over 1,200 five-star reviews standing out

Education

CMC Markets offers a comprehensive educational suite tailored for both beginner and experienced traders. Their "Learn Hub" features a wide range of resources, including articles, videos, webinars, platform tutorials, and trading strategy guides. Topics cover everything from basic trading concepts to advanced technical analysis, helping users build confidence and improve their skills.

In addition, market insights and daily analysis from CMC’s experts keep traders informed of key events and trends. The platform’s demo account also allows users to practise in real-time market conditions without risking capital.

Reviews

What are the opinions of CMC Markets users? Are they happy with the platform? Well, in general terms, it should be noted that they seem to be more than satisfied.

In fact, if we look at their score on the Trustpilot forum, we will see that they have a rating of 4.0 out of 5 stars, out of a total of over 2,000 reviews.

Our Opinion

Is CMC Markets a good broker? Absolutely, yes. Not surprisingly, it has been awarded by trading platform endorsers with forex trading.

The platform offers a wide range of analysis instruments and advanced tools for traders, as well as access to countless markets.

Thus, if you already have some training in the world of finance, this can be one of the most interesting platforms to gain market exposure through derivatives, as it combines the three requirements, in the following order:

- Completely safe broker: Regulated, covered by a guarantee fund in case of bankruptcy, and publicly traded.

- Extensive proprietary platform: And with the possibility of trading with Metatrader 4

- Competitive spreads.

Like any platform, it has points to improve, but it is undeniable that we are talking about a good trading broker: Safe and competitive.

FAQ

What is their customer service like?

CMC Markets offers strong customer support via phone, email, and live chat, with fast response times (often under 40 seconds on chat). Support is available 24/5.

While generally well-reviewed, a few users report delays in account updates.

Is this broker good for beginners?

Yes, CMC Markets is beginner-friendly thanks to its educational resources, intuitive platform, and demo accounts. However, some users find the platform a bit complex initially due to its range of features.

How does CMC Market make money?

CMC earns revenue through spreads, commissions on share CFDs, overnight financing charges, and income from managing risk on client trades. In FY 2023, most revenue came from CFD trading, stockbroking, and client interest.