Comparatives

Trading 212 vs eToro Comparison

Platforms like eToro and Trading 212 have become popular names—especially among UK investors seeking cost-efficient, beginner-friendly ways to grow their portfolios. Both offer commission-free trading, intuitive apps, and strong regulatory backing.

Yet, their core philosophies diverge: eToro is renowned for its social and copy‑trading capabilities, making it ideal for those looking to learn from experienced investors or diversify into crypto. In contrast, Trading 212 shines with ultra-low fees, fractional shares starting from just £1, and features like ISAs, interest on uninvested cash, and automated investing through its “Pies” tool.

This head-to-head aims to break down their strengths and limitations—so you can decide which platform is best aligned with your investing goals and style.

Trading 212 vs eToro

Both eToro and Trading 212 are two online brokers that offer the possibility to invest in different types of assets, such as stocks, funds, ETFs, cryptocurrencies, and others. Both stand out for the reliability offered by their regulation, as well as for their trading platforms.

Both brokers have both a web version and a mobile app for investing from your phone, a convenience that most financial intermediaries now offer. While Trading 212 stands out for being an easy-to-use alternative, the good reputation of eToro has been strengthened thanks to its social trading option, being the preferred choice of many users.

👉 For more information, read our eToro review

👉 Read here to find out whether Trading 212 is good for you

Main features

| Features | Trading 212 | eToro | |||

| Regulation | FCA CySEC FSC | CySEC FCA ASIC | |||

| Market Access (countries) | USA, Spain, Switzerland, United Kingdom, Germany, Netherlands, Italy, Belgium | 18 markets, including: USA, Frankfurt, London, Paris, Madrid, Milan, Amsterdam | |||

| Financial Assets | Stocks ETFs | Stocks ETFs Cryptocurrencies | |||

| Minimum Deposit | 1 GBP | 10 USD in the UK | |||

| Account Types | 2: Stocks and ETFs | 4: Personal, Professional, Corporate, Islamic | |||

| Commissions (currency exchange) | 0.15% | 100 pips (deposit) 50 pips (withdrawal) | |||

| Platform | Trading 212 | eToro | |||

| Demo Account | Yes | Yes |

| Features | Trading 212 | eToro |

| Regulation | FCA CySEC FSC | CySEC FCA ASIC |

| Market Access (countries) | USA, Spain, Switzerland, United Kingdom, Germany, Netherlands, Italy, Belgium | 18 markets, including: USA, Frankfurt, London, Paris, Madrid, Milan, Amsterdam |

| Financial Assets | Stocks ETFs | Stocks ETFs Cryptocurrencies |

| Minimum Deposit | 1 GBP | 10 USD in the UK |

| Account Types | 2: Stocks and ETFs | 4: Personal, Professional, Corporate, Islamic |

| Commissions (currency exchange) | 0.15% | 100 pips (deposit) 50 pips (withdrawal) |

| Platform | Trading 212 | eToro |

| Demo Account | Yes | Yes |

Pros and Cons of eToro

| Pros of eToro | Cons of eToro | ||

| ✅ Wide asset selection | ❌ Fees and spread structure | ||

| ✅ Beginner friendly and social trading | ❌ Limited advanced tools | ||

| ✅ Commission-free trading for Stocks and ETFs | ❌ Limited customer support | ||

| ✅ Strong regulatory oversight | |||

| ✅ Mobile trading and educational tools |

| Pros of eToro | Cons of eToro |

| ✅ Wide asset selection | ❌ Fees and spread structure |

| ✅ Beginner friendly and social trading | ❌ Limited advanced tools |

| ✅ Commission-free trading for Stocks and ETFs | ❌ Limited customer support |

| ✅ Strong regulatory oversight | |

| ✅ Mobile trading and educational tools |

Pros and Cons of Trading 212

| Pros of Trading 212 | Cons of Trading 212 | ||

| ✅ Commission-free trading and low fees | ❌ Fee structure for CFD Trading | ||

| ✅ Broad asset access and platform functionality | ❌ Customer support limitations | ||

| ✅ Regulation and investor safety | ❌ Platform suitability and advanced features | ||

| ✅ Account flexibility | |||

| ✅ Ease of use and strong ratings |

| Pros of Trading 212 | Cons of Trading 212 |

| ✅ Commission-free trading and low fees | ❌ Fee structure for CFD Trading |

| ✅ Broad asset access and platform functionality | ❌ Customer support limitations |

| ✅ Regulation and investor safety | ❌ Platform suitability and advanced features |

| ✅ Account flexibility | |

| ✅ Ease of use and strong ratings |

How safe are these platforms?

Trading 212 is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC) for the EU and the Financial Supervision Commission of Bulgaria (FSC) for the rest of the countries where it operates.

Additionally, Trading 212 is a member of the Investor Compensation Fund (ICF) which protects client funds, up to 90% of the client's investment, which would be £85,000 if from the UK, in case the broker becomes insolvent.

| Client Country | Protection Amount | Regulator | |||

| United Kingdom | £ 85,000 | Financial Conduct Authority (FCA) | |||

| EEA | 90% of your funds, maximum €20,000 | Cyprus Securities and Exchange Commission (CySEC) | |||

| All other countries | 90% of your funds, maximum €20,000 | Financial Supervision Commission of Bulgaria (FSC) |

| Client Country | Protection Amount | Regulator |

| United Kingdom | £ 85,000 | Financial Conduct Authority (FCA) |

| EEA | 90% of your funds, maximum €20,000 | Cyprus Securities and Exchange Commission (CySEC) |

| All other countries | 90% of your funds, maximum €20,000 | Financial Supervision Commission of Bulgaria (FSC) |

eToro is a regulated broker and is authorised to provide services throughout the EU and other countries by the Cyprus Securities and Exchange Commission (CySEC). However, for the United Kingdom, eToro UK is authorised and regulated by the Financial Conduct Authority (FCA), while for Australia, eToro AUS Capital Pty Ltd is authorised by the Australian Securities and Investments Commission (ASIC)

Regarding the guarantee of investors' money, eToro adheres to the Cyprus Investor Compensation Fund, which guarantees coverage of up to €20,000 in case of bankruptcy.

In the following summary table, you can see all the regulatory bodies to which it is affiliated and how much coverage they guarantee.

| Client Country | Protection Amount | Regulator | Legal Entity | ||||

| United Kingdom | £85,000 + £1,000,000 | Financial Conduct Authority (FCA) | eToro (UK) Ltd. | ||||

| Australia | $1,000,000 | Australian Securities and Investments Commission (ASIC) | eToro AUS Capital Pty Ltd. | ||||

| Other countries | €20,000 + €1,000,000 | Cyprus Securities and Exchange Commission (CySEC) | eToro (Europe) Ltd. |

| Client Country | Protection Amount | Regulator | Legal Entity |

| United Kingdom | £85,000 + £1,000,000 | Financial Conduct Authority (FCA) | eToro (UK) Ltd. |

| Australia | $1,000,000 | Australian Securities and Investments Commission (ASIC) | eToro AUS Capital Pty Ltd. |

| Other countries | €20,000 + €1,000,000 | Cyprus Securities and Exchange Commission (CySEC) | eToro (Europe) Ltd. |

There is no protection for cryptocurrency investors.

Investment Choices

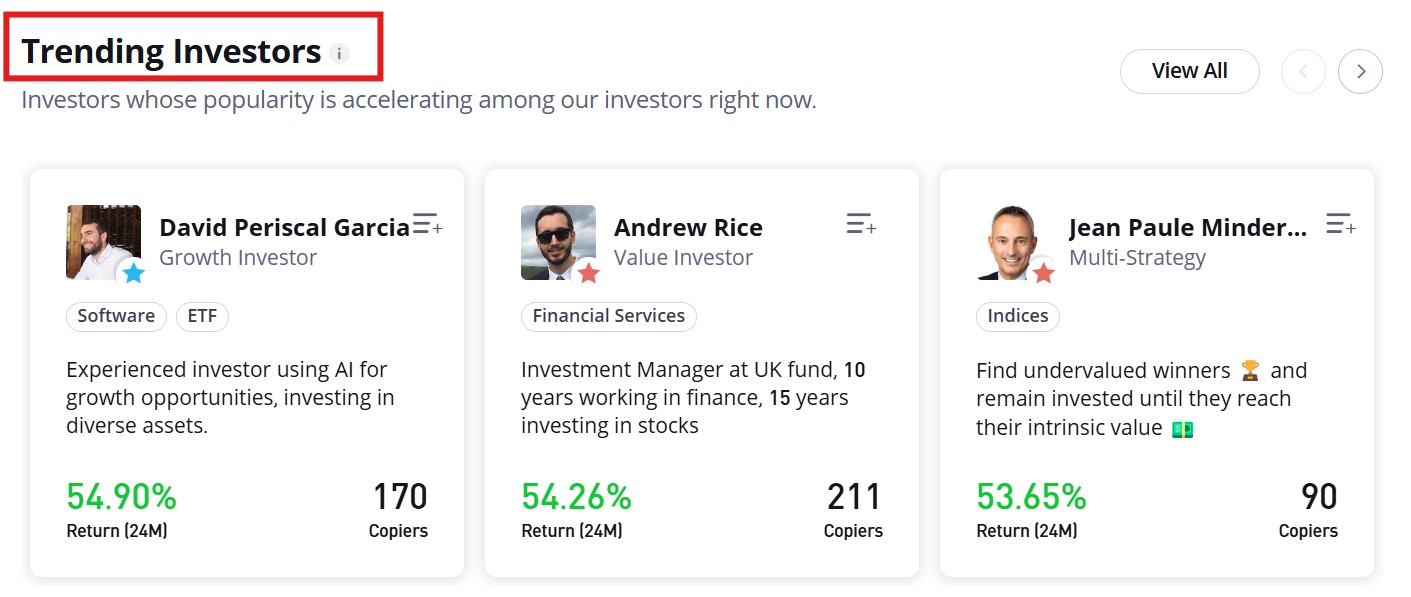

eToro is well known as a forex broker, but it also offers a variety of other assets for trading. You can invest in real stocks, ETFs, and a wide range of cryptocurrencies. One of the standout features of eToro is its social trading options, including Copy Trading and Smart Portfolios, which allow users to follow and replicate the strategies of experienced traders.

- Stocks: Access to 18 global markets, including the USA (Nasdaq, NYSE, and Chicago), Frankfurt, London, Paris, Madrid, Milan, Amsterdam, Zurich, Lisbon, Oslo, Stockholm, Copenhagen, Helsinki, Hong Kong, Brussels, and Saudi Arabia.

- Fractional Shares: From as little as £1.

- ETFs: Over 250 ETFs available.

- Currencies: Trade in 50 different currency pairs.

- Cryptocurrencies: Over 75 cryptocurrencies, including popular altcoins and stablecoins.

The platform’s CopyTrader feature is particularly popular, allowing users to automatically copy the trades of verified successful traders on the platform. This makes eToro an ideal platform for beginners looking to learn and invest without needing extensive experience.

Trading 212 offers a range of real assets, primarily focused on stocks and ETFs. The platform provides access to more than 13,000 global stocks and ETFs across various global markets, making it a solid choice for investors seeking diversified exposure.

- Real Stocks and ETFs: Access to a range of markets including:

- NYSE (USA)

- Nasdaq (USA)

- Madrid Stock Exchange (Spain)

- SIX Swiss (Switzerland)

- London Stock Exchange (UK)

- US OTC Markets (USA)

- Xetra (Germany)

- LSE AIM (UK)

- Euronext Netherlands (Netherlands)

- Borsa Italiana (Italy)

- Euronext Brussels (Belgium)

- Fractional Shares: Available from as little as £1.

Trading 212 does not offer cryptocurrencies or forex as eToro does, focusing instead on a more traditional range of assets. However, its extensive stock and ETF options make it an attractive platform for UK investors looking to trade across a broad range of well-established markets.

What Account Types do eToro and Trading 212 offer?

Trading 212 offers three types of accounts, making it easy to find an option suited to your needs:

Invest Account: Ideal for passive investors looking for long-term value with minimal speculation. This account allows you to trade stocks and ETFs without any purchase or sale commissions.

Demo Account: If you'd prefer to practice before committing your own money, Trading 212 offers a demo account with virtual funds of £10,000. This is a great way to test the platform and develop your investment strategies without the risk.

eToro offers two main account types, with different options depending on your experience and trading preferences:

Virtual Account: A great option for beginners, allowing you to test the platform and explore financial investments without risking real money.

Real Account: This is for actual investments or trades, where you can activate the social trading feature. The real account has four subtypes:

- Standard Account: Best for retail investors and beginners. A demo option is available.

- Islamic Account: Tailored for Muslim investors, with no interest on trades. A demo option is available.

- Professional Account: Designed for experienced traders. No demo option available.

- Corporate Account: Intended for businesses. No demo option available.

Commissions and Fees

The commissions and fees with eToro are as follows:

- Stocks & ETFs: eToro offers commission-free trading on stocks and ETFs for UK traders. However, it charges a spread, which typically ranges from 0.09% for stocks and ETFs to 1% or more for cryptocurrencies.

- Cryptocurrency: eToro charges a spread of 1% for buying and selling cryptocurrencies.

- Withdrawal Fee: eToro charges a withdrawal fee of $5 (approximately £4).

- Inactivity Fee: eToro charges a $10 monthly inactivity fee after 12 months of account inactivity.

- Leverage Fees: When using leverage, eToro charges overnight fees (swaps) on positions that are held for more than one day, and these can vary depending on the asset.

The commissions and fees with Trading 212 are as follows:

- Stocks & ETFs: Trading 212 offers commission-free trading on stocks and ETFs. There is no charge for buying or selling these assets, but they do charge a spread on each trade.

- CFDs & Leverage: Trading 212 offers CFDs with leverage, and charges an overnight financing fee for holding leveraged positions overnight. These fees can range from 0.02% to 0.1% depending on the asset.

- Currency Conversion Fees: When trading in foreign currencies, Trading 212 charges a small currency conversion fee if the base currency of your account is different from the asset you're trading.

- Withdrawals: Trading 212 does not charge any withdrawal fees, which makes it a more cost-effective option for traders who make regular withdrawals.

- Inactivity Fee: Trading 212 does not charge an inactivity fee.

Trading Platforms

To assess which broker best suits your needs and investment profile, you should also understand how their trading platforms work.

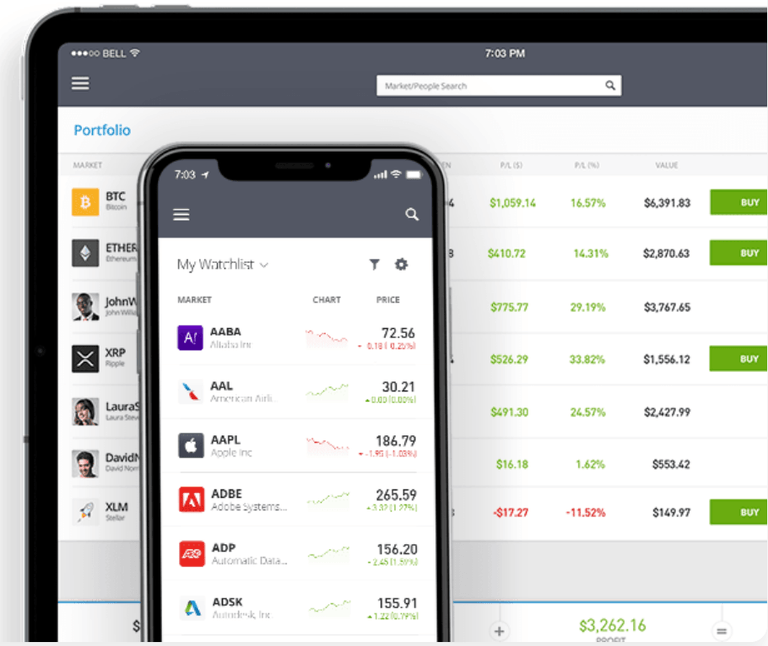

The eToro platform is available in over 140 countries and supports more than 20 languages, offering both a web version and a mobile-adapted version.

The web platform has a clean and intuitive design, with menus and buttons placed where you would expect them to be, making it easy to navigate. However, eToro operates with its own proprietary platform and does not integrate third-party systems like MT4 or MT5.

Despite this, many users highlight the platform's simplicity and user-friendly technology. What stands out most about eToro is its social trading feature, which is highly valued by its clients and is often regarded as one of the best trading platforms in the UK for social interaction and copy trading.

The mobile version, available for both Android and iOS, is equally functional, supporting the same 20 languages as the web version. It offers the same core features, along with added benefits like automatic notifications and smooth touch interactions, allowing you to manage your investments on the go with ease.

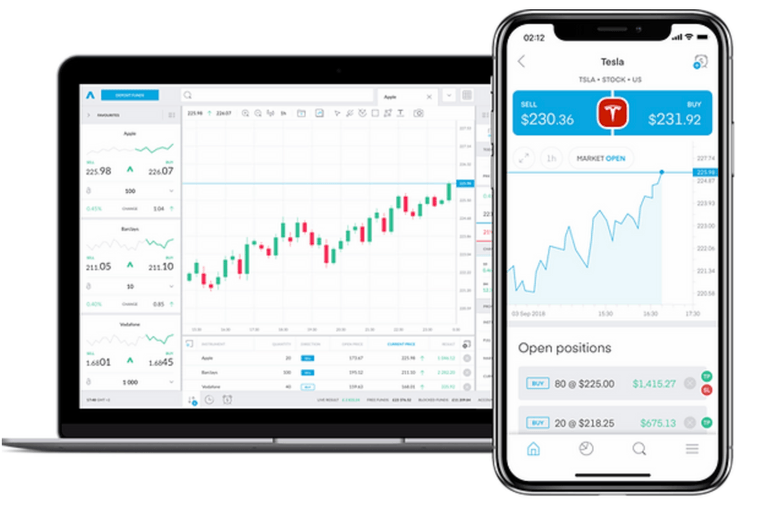

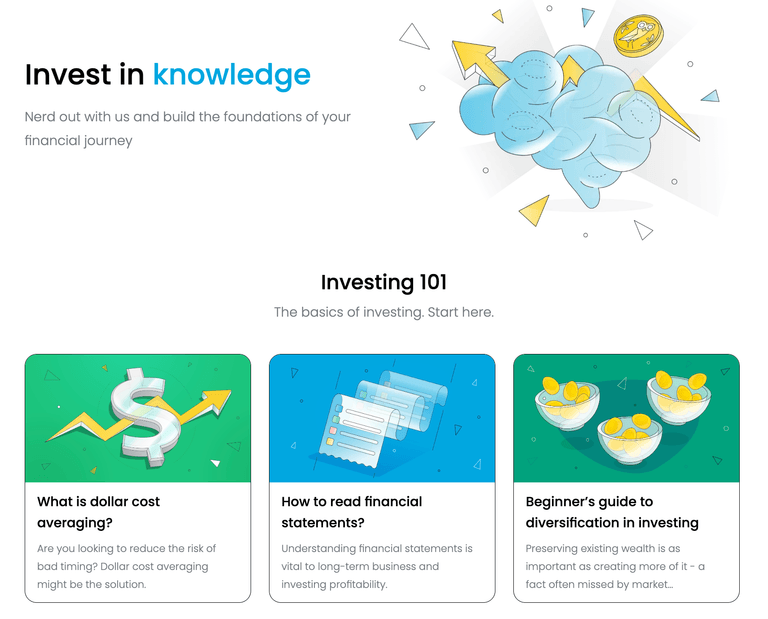

The Trading 212 platform is user-friendly, offering access to real-time market data. Clients can also trade on the go with its mobile app, although some features, particularly charting tools, are limited compared to the web version. In addition to its trading services, Trading 212 provides educational resources to help users understand the markets and make informed decisions.

The platform offers strong charting tools, helping users identify trends and make well-informed choices. With over 1,800 assets available, it's a simple yet powerful platform. It's no surprise that Trading 212 has won awards such as 'Best Trading Platform' at the Forex Expo Awards in 2019 and 'Best Mobile Trading Platform' at the Finance Magnates Awards in the same year.

In addition to its proprietary platform, Trading 212 also supports trading on MetaTrader4. Available in over 20 languages and offering a wide range of payment methods, the platform is accessible to users worldwide. Trading 212 also provides a demo account with $10,000 in virtual funds to test out the platform risk-free. You can trade from both the website and the mobile app, with the latter also featuring an alert system for easy monitoring.

Trading Tools

eToro provides a robust suite of trading tools designed to cater to both beginner and experienced traders. The platform offers a social trading feature, allowing users to interact with other traders, view their portfolios, and copy their trades. This makes it ideal for beginners who may want to follow the strategies of more experienced traders. eToro’s charting tools are comprehensive, providing a wide range of technical indicators and analysis options.

For those interested in automated trading, eToro also supports copy trading, which is widely regarded as one of the best copy trading platforms, and a feature called CopyPortfolios, which groups assets into themed investment portfolios for easier management. The platform's user interface is clean and intuitive, making it easy to navigate and execute trades.

In addition, eToro has a mobile app that mirrors the functionality of the desktop platform, enabling users to trade on the go.

Trading 212 offers a solid range of trading tools designed for ease of use and accessibility. The platform provides a variety of charting tools with customisable indicators and drawing tools, which can help traders analyse market trends effectively. It also offers risk management features such as stop loss, take profit, and guaranteed stop orders, ensuring users can manage their positions safely.

Trading 212’s interface is user-friendly, making it easy for beginners to place trades, while advanced traders will appreciate the more in-depth charting capabilities and order types. Additionally, Trading 212 provides a practice account that allows new users to test out trading strategies before committing real money.

While the platform lacks social trading features like eToro, its extensive range of tools is ideal for UK traders looking for straightforward, no-fee investing.

Deposits and Withdrawals of Funds

eToro offers a range of convenient deposit and withdrawal methods, making it easy for UK investors to fund their accounts. You can deposit funds using a variety of methods including debit and credit cards, bank transfers, PayPal, and other e-wallet options like Neteller and Skrill. The platform accepts GBP, which eliminates the need for currency conversion for UK traders.

Deposits are typically processed instantly for card payments, while bank transfers may take a few business days.

Withdrawals from eToro are also straightforward, but they do involve a small fee of $5 per withdrawal. It's important to note that eToro has a minimum withdrawal amount of $30, which may be a consideration for smaller investors. Withdrawals are processed within a few business days, but it can take longer depending on the payment method.

Trading 212 offers similar deposit and withdrawal options, including debit/credit cards, bank transfers, and e-wallets like PayPal and Skrill. For UK traders, deposits can be made in GBP, and there are no fees for making deposits.

Trading 212 stands out with its lack of withdrawal fees for most payment methods, although bank transfers may take a few days to process. The minimum withdrawal amount is £1, which makes it more accessible for smaller investors compared to other platforms.

Deposits are typically processed quickly, but it can take a bit longer for bank transfers.

Trading 212 prides itself on offering a transparent and efficient withdrawal process with no hidden charges, making it a user-friendly option for UK investors.

Research

When it comes to research tools, both Trading 212 and eToro provide useful resources, but they cater to different types of investors.

Trading 212 offers a solid range of research tools, especially for beginners. It includes real-time charts, price alerts, and a stock screener to help you find potential investment opportunities. The platform also provides access to educational content to help users better understand the markets.

eToro, on the other hand, provides a more comprehensive suite of research tools. In addition to real-time market data and charts, eToro offers a social trading feature, allowing users to see and follow the strategies of successful traders. The platform also provides a news feed, analysis from financial experts, and economic calendars, making it ideal for those looking for a more social and data-rich trading experience.

In short, Trading 212 is perfect for those who want a straightforward approach to research, while eToro is suited for traders looking for deeper insights and community-driven content.

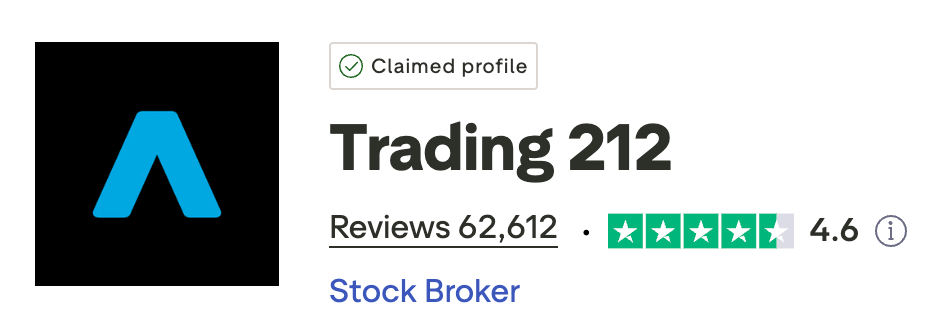

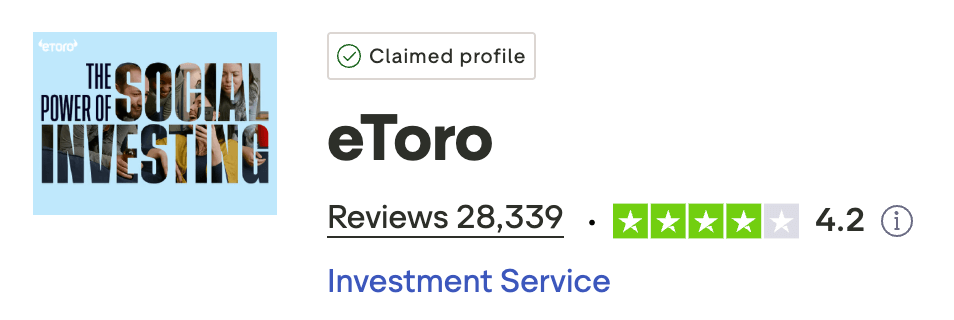

Trading 212 vs eToro reviews

So far, we've compared the two brokers based on their features, but what do actual investors think? Let’s take a look at user reviews on platforms like Trustpilot.

Trading 212 generally has positive reviews on Trustpilot, with a rating of 4.6 out of 5. Users often praise its simple interface, low commissions, and responsive customer service. However, some negative feedback revolves around issues with the fund withdrawal process.

eToro, on the other hand, has a slightly lower rating of 4.1 out of 5, but this is still a very solid score, especially with nearly 27,000 reviews. Users tend to appreciate eToro's customer service and the platform’s ease of use.

Which broker is better?

Both Trading 212 and eToro are similar but have distinct features that might make one more appealing depending on your needs.

Neither broker has a UK office, but both are regulated by CySEC in Cyprus. While both offer customer support in English, Trading 212 is typically faster in responding.

eToro stands out with its social trading feature, allowing you to copy the portfolios of successful investors. This offers a more hands-off approach compared to Trading 212, where building a profitable portfolio requires more effort.

When it comes to fees, Trading 212 is more cost-effective, especially since eToro charges withdrawal fees and higher currency exchange rates. Trading 212 allows trading directly in euros, reducing costs for European market investments.

If you're after a wider selection of financial products, eToro wins with access to stocks, ETFs, currencies, and cryptocurrencies. Trading 212, however, only offers stocks and ETFs from a smaller number of markets.

In short, both platforms are designed for tech-savvy traders. The best choice depends on your individual needs.

FAQs

What is their customer service like?

Trading 212:

Trading 212 provides communication via email (info@trading212. com) and phone ( +44 7385 762101).

Additionally, the user has access to a live chat on their website via official contact form or via the Chat with us button in the Trading 212 app, where they can ask any questions they have, and Trading 212 usually responds in less than 24 hours.

eToro:

eToro provides communication via email (support@etoro. com) and phone (+44 20 3608 9051).

Additionally, users can access live chat through the eToro platform or app, where they can ask any questions.

However, eToro has previously limited the live chat feature to Silver Club members and above due to high demand. Response times via live chat have varied, with reports suggesting delays of up to several days during peak times.

How does eToro work?

eToro is a financial asset investment platform founded in 2007 by brothers Yoni and Ronen Assia and David Ring. The company is headquartered in Tel Aviv (Israel) and has offices in Cyprus, the United Kingdom, and the United States.

A large part of its global success is due to the social trading feature, which allows users to trade various assets, such as stocks, commodities, currencies, and cryptocurrencies, by replicating the trades of other successful investors.

Overall, eToro has more than 20 million registered users from over 140 countries and has received several awards, including:

- Best social trading platform by the Financial Times

- Most innovative financial product by World Finance magazine.

How does Trading 212 work?

Trading 212 is an online broker that was founded in 2004 in Sofia, Bulgaria. The company has a mobile trading app and a web-based platform. Over the past decade, the company has won the following awards:

- Best Trading Platform at the Forex Expo Awards 2019.

- Best Mobile Trading Platform at the Finance Magnates Awards 2019.

- Most Reliable Broker by FX Empire in 2019.

On the other hand, Trading 212 allows its clients to trade a wide range of financial instruments, including currencies or cryptocurrencies and offers a demo account with virtual money.

The platform is available in more than 20 languages and has numerous payment methods. It does not charge trading or custody fees, but it does charge for currency exchange. Most of its income comes from the difference between the buying and selling price (spread).

In 2023, the Bulgarian broker has 2 million clients and more than 3.5 billion euros in financial assets.

Disclaimer: