Brokers

eToro vs XTB: Comparison

What are they and how do they work?

How does eToro work?

eToro is a broker of Israeli origin created in 2007. Two years later, it launched an online investment platform through Webtrader technology (no download needed), although it wasn't until 2010 that its social trading platform came to light, which is what set it apart from the competition.

Originally, the idea of its founders was to make online trading more accessible, but by designing the first tool that allowed Copy Trading (copying the trades of other traders), called OpenBook, it caused a revolution in the world of short-term financial investments.

Since that date, eToro has been recognised as one of the leading social trading brokers.

In 2015, it decided to integrate into a single platform the functions of Webtrader and OpenBook. Thus, its current investment platform was born, which we will discuss later.

In 2019, they added cryptocurrencies to their product portfolio, in 2021 they launched the eToro Money investment service, and in 2022 they expanded their offering with US shares, fractional shares, and commission-free ETFs.

Currently, eToro has 35 million users and has a presence in more than 140 countries.

👉 Read our eToro review to learn more.

How does XTB work?

XTB has a much longer track record than eToro. It was created in 2002 and is a company of Polish origin, with more than 20 years of experience.

XTB is one of the largest and most popular brokers in the world, which is why it is already used by more than 1 million investors and has offices in 13 countries.

It began its journey in Europe and later expanded its borders to establish itself in Latin American countries. In 2016, it began trading on the Warsaw Stock Exchange (Poland’s stock exchange).

Today, it has a multi-product catalogue, where you can find more than 3,600 shares and ETFs on contact (and also fractionally), investment plans, and one of its flagship products: its interest-bearing balance account.

👉 Read our XTB review to learn more.

Main Features

eToro

Regulation: FCA, CySEC (Cyprus) and registered with the CNMV

Guarantee fund: £85,000

Financial assets: Shares, ETFs, cryptocurrencies, and interest-bearing account

Markets: 140+

Account types: Standard and demo

Fees:

- Shares: From $1 per buy-sell transaction

- ETFs: $0

- Cryptocurrencies: 1% per transaction

Minimum deposit: $100

Platform: Proprietary + App

Contact:

- Office: 24th floor, One Canada Square, Canary Wharf, London E14 5AB

eToro is a multi-asset investment platform. The value of your investments can go up or down. Your capital is at risk.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

XTB

Regulation: Regulated by the FCA and KNF, and supervised by the CNMV

Guarantee fund: Up to £85,000

Financial assets: Shares, ETFs, interest-bearing account, and investment plans

Markets: 16+ stock exchanges

Account types: 1 standard

Commissions: £0 (also fractional)

Minimum deposit: £0

Platform: xStation 5, Mobile App

Contact:

- Office: Level 9, One Canada Square, Canary Wharf, London E14 5AA.

- Phone: +44 2036953086.

- Email: [email protected]

Pros and Cons

| Pros of eToro | Cons of eToro | ||

| ✅ User-friendly and beginner-friendly platform | ❌ Only offers USD-denominated accounts (currency conversion fees apply) | ||

| ✅ Commission-free trading on stocks and ETFs | ❌ $5 withdrawal fee | ||

| ✅ Unique social and copy trading features | ❌ Limited advanced charting tools | ||

| ✅ Wide range of assets including stocks, ETFs, crypto, and CFDs | ❌ Inactivity fee after 12 months of no trading | ||

| ✅ Regulated by FCA and has a UK office |

| Pros of eToro | Cons of eToro |

| ✅ User-friendly and beginner-friendly platform | ❌ Only offers USD-denominated accounts (currency conversion fees apply) |

| ✅ Commission-free trading on stocks and ETFs | ❌ $5 withdrawal fee |

| ✅ Unique social and copy trading features | ❌ Limited advanced charting tools |

| ✅ Wide range of assets including stocks, ETFs, crypto, and CFDs | ❌ Inactivity fee after 12 months of no trading |

| ✅ Regulated by FCA and has a UK office |

| Pros of XTB | Cons of XTB | ||

| ✅ No minimum deposit | ❌ Limited access to non-CFD ETFs and stocks | ||

| ✅ Commission-free trading on stocks and ETFs (up to €100,000/month) | ❌ No copy trading or social investing features | ||

| ✅ Advanced xStation 5 platform with professional-grade tools | ❌ Inactivity fee after 12 months | ||

| ✅ FCA-regulated with UK-based support | ❌ Only one standard account type for retail clients | ||

| ✅ Strong educational content and training resources | ❌ ETF selection smaller compared to some UK-focused platforms |

| Pros of XTB | Cons of XTB |

| ✅ No minimum deposit | ❌ Limited access to non-CFD ETFs and stocks |

| ✅ Commission-free trading on stocks and ETFs (up to €100,000/month) | ❌ No copy trading or social investing features |

| ✅ Advanced xStation 5 platform with professional-grade tools | ❌ Inactivity fee after 12 months |

| ✅ FCA-regulated with UK-based support | ❌ Only one standard account type for retail clients |

| ✅ Strong educational content and training resources | ❌ ETF selection smaller compared to some UK-focused platforms |

Are they safe?

Both eToro and XTB are properly regulated brokers and far from being considered financial scams. Even so, there are differences you should be aware of.

eToro Regulation

eToro is a well-regulated broker and operates under several regulatory bodies. For UK clients, the key point is that eToro (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FCA), one of the most respected regulators in the world. The broker is also regulated by CySEC in Cyprus and ASIC in Australia, ensuring it meets strict compliance standards across multiple jurisdictions.

Client funds are protected under the FSCS (Financial Services Compensation Scheme) in the UK, covering up to £85,000 per investor in the event of firm insolvency.

Regulation of XTB

XTB is also fully regulated and operates under XTB Limited, which is authorised and regulated by the FCA in the UK. Headquartered in Poland, the broker is also regulated by the Polish Financial Supervision Authority and complies with MiFID II and ESMA guidelines across the EU.

UK client funds are held in segregated accounts at reputable institutions such as J.P. Morgan SE, and benefit from negative balance protection. Funds are safeguarded under the applicable compensation schemes, offering coverage of up to £85,000 per account.

Financial products

eToro Products

- Shares and ETFs: eToro offers over 3,000 stocks and ETFs from global markets, including fractional shares.

- Cryptocurrencies: One of eToro’s standout features is its wide crypto offering, with more than 60 cryptocurrencies available to trade.

- Indices: Popular indices such as the S&P 500, NASDAQ, and FTSE 100 can be traded via CFDs.

- Commodities: Gold, silver, oil, and other commodities can be traded through CFDs.

- Forex: Over 50 currency pairs available for CFD trading.

- Copy Trading: eToro’s hallmark feature allowing users to automatically copy the portfolios or trades of successful investors.

- Social Trading: Interactive community features for sharing ideas and strategies.

XTB Products

- Shares and ETFs: Over 3,600 shares and ETFs available for direct purchase, including fractional shares.

- Investment Plans: Automated, diversified investment plans based on ETFs and shares, aimed at long-term investors.

- Interest-Bearing Account: An innovative feature where uninvested funds earn interest.

- CFDs: Wide variety of CFDs including forex, indices, commodities, and cryptocurrencies.

- Forex: 49 currency pairs available.

- Cryptocurrencies: CFD trading on popular cryptos, though direct crypto purchase is not available.

- No Copy Trading: XTB does not offer social or copy trading features.

Trading platforms

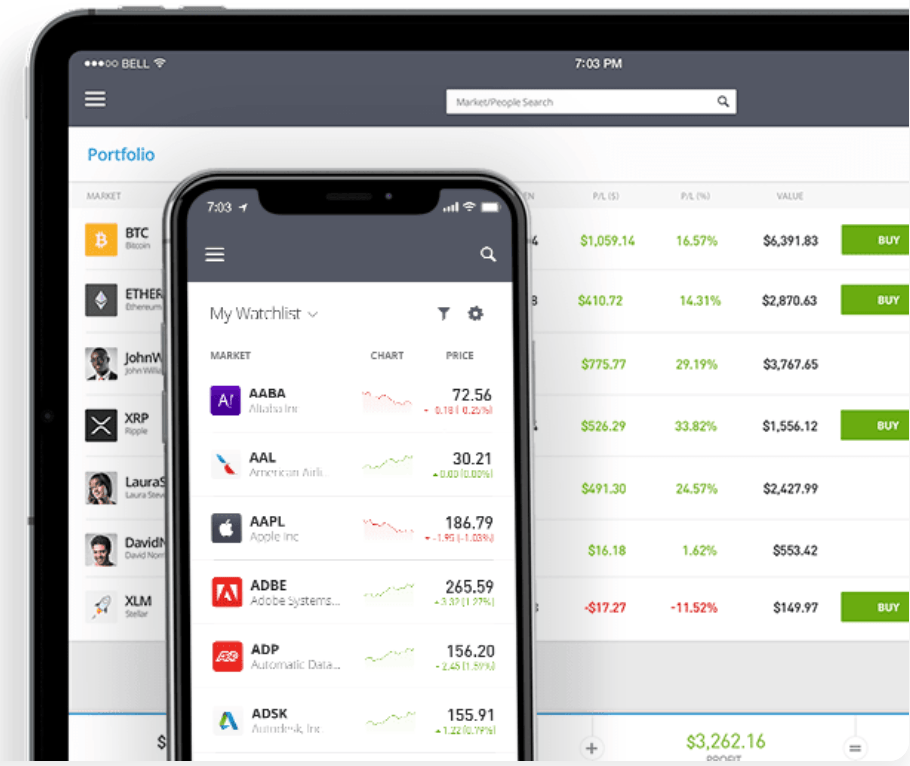

eToro Platform

- Web Platform: Intuitive, user-friendly with integrated social trading features. No download required.

- Mobile App: Available for iOS and Android, includes all main functionalities including copy trading.

- Unique Features: eToro offers the CopyTrader™ system — widely regarded as one of the best copy trading platforms available — along with advanced charting tools, a real-time news feed, and an interactive social community for sharing insights and strategies.

XTB Platform

- xStation 5: Highly rated proprietary platform designed for both beginners and advanced traders. Available on desktop, web, and mobile.

- Mobile App: Includes real-time quotes, advanced charting, alerts, and a news section.

- Additional Tools: Trading calculators, sentiment indicators, economic calendar, and educational resources.

- MT4: MetaTrader 4 is also supported for those who prefer the classic trading platform.

Commissions and fees

| Shares | From $1 per transaction | €0 (zero) | |||

| ETFs | $0 | €0 (zero) | |||

| Cryptocurrencies | 1% spread | CFD spread (variable) | |||

| Forex (CFDs) | Spread only | Spread only | |||

| Minimum Deposit | $100 | £0 | |||

| Inactivity Fee | Yes, $10/month after 12 months | No inactivity fee | |||

| Withdrawal Fee | $5 | €0 |

| Product | eToro Fees | XTB Fees |

|---|---|---|

| Shares | From $1 per transaction | €0 (zero) |

| ETFs | $0 | €0 (zero) |

| Cryptocurrencies | 1% spread | CFD spread (variable) |

| Forex (CFDs) | Spread only | Spread only |

| Minimum Deposit | $100 | £0 |

| Inactivity Fee | Yes, $10/month after 12 months | No inactivity fee |

| Withdrawal Fee | $5 | €0 |

Minimum Deposit and Account Types

eToro

eToro requires a minimum deposit of $100, which applies to UK clients opening a retail account. This relatively low threshold makes the platform accessible for beginners who want to start investing without committing a large sum. eToro offers two main types of accounts: the standard live account, which gives access to all the platform's features including stock, ETF, and crypto trading; and a free demo account, which comes preloaded with $100,000 in virtual funds.

The demo account is especially useful for beginners to practice trading strategies and get familiar with the platform before committing real capital. eToro also provides options for professional, corporate, and Islamic accounts, though these require meeting specific eligibility criteria.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

XTB

XTB stands out by offering no minimum deposit, making it especially appealing for investors who want flexibility in how much they start with. This allows users to open an account and begin trading at their own pace, without the pressure of an upfront funding requirement. XTB offers a standard live account that includes access to a wide range of assets, including stocks, ETFs, forex, and CFDs, all available via its proprietary trading platform, xStation 5. Like eToro, XTB also provides a demo account, which is valid for 30 days and includes virtual funds to simulate real trading conditions. This feature is ideal for testing strategies and becoming comfortable with the platform. Additionally, XTB supports both GBP and USD base currencies for accounts, offering more flexibility to UK investors.

Customer Support and Service

eToro Customer Service

eToro provides UK clients with customer support primarily through its online Help Center and live chat function, which is available once logged into the platform. Customer service hours are Monday to Friday, 9:00 AM to 6:00 PM, with the office closed on weekends. While eToro offers a comprehensive Help Center and live chat support, some users have reported that direct phone support may not always be available.

However, many clients have praised the platform's responsiveness and the quality of assistance provided by account managers. eToro's UK office presence underscores its commitment to serving UK investors with a localised support structure.

XTB Customer Service

XTB offers a more robust and localised customer service experience for UK clients. The broker has a dedicated UK office and provides support via phone, email, and live chat during trading hours, with assistance available five days a week. UK clients benefit from access to a professional support team based in London, offering help in English with a quick response time.

Additionally, XTB enhances its customer service through one-on-one consultations, webinars, and an extensive educational section tailored to various experience levels, making it one of the more client-focused brokers in the UK market.

Final comparison: Which broker should you choose?

| Regulation | CySEC, FCA, CNMV | FCA, KNF, CNMV | |||

| Product Range | Shares, ETFs, crypto, indices, forex | Shares, ETFs, investment plans, CFDs | |||

| Copy Trading | Yes | No | |||

| Minimum Deposit | $100 | £0 | |||

| Fees | Moderate fees on shares & crypto | Mostly zero commissions | |||

| Platforms | Proprietary with social features | xStation 5 + MT4 | |||

| Customer Support | 24/5 live chat | Phone, email, live chat | |||

| Account Types | Standard + demo | Standard + demo |

| Feature | eToro | XTB |

|---|---|---|

| Regulation | CySEC, FCA, CNMV | FCA, KNF, CNMV |

| Product Range | Shares, ETFs, crypto, indices, forex | Shares, ETFs, investment plans, CFDs |

| Copy Trading | Yes | No |

| Minimum Deposit | $100 | £0 |

| Fees | Moderate fees on shares & crypto | Mostly zero commissions |

| Platforms | Proprietary with social features | xStation 5 + MT4 |

| Customer Support | 24/5 live chat | Phone, email, live chat |

| Account Types | Standard + demo | Standard + demo |

Disclaimer: