Brokers

Freetrade vs eToro: Comparison for UK investors

This article was updated as of May 17th 2025.

If you're keen on low-cost and commission-free investment platforms, you probably have heard about Freetrade and eToro brokers. Both brokers are low-cost or commission-free and very customer-centric regarding features, user-friendly trading platforms, and services, but how do they differ?

In this article, we will provide a detailed comparison between Freetrade and eToro in terms of regulation, products and services, trading fees, account types, customer support, deposit and withdrawal policies as well as their user opinions.

What Are They and How Do They Work?

Freetrade

Freetrade Limited, founded in 2016, is a UK fintech offering commission-free trading on stocks and ETFs across the UK, US, and Europe. It’s built around a user-friendly mobile app (iOS and Android), with a web platform available on the Plus plan.

Freetrade offers three pricing tiers:

- Basic: Access to a General Investment Account (GIA)

- Standard: GIA + Stocks and Shares ISA

- Plus: GIA + ISA + SIPP for full tax-efficient investing

Users can invest in fractional shares and receive dividends on those holdings. With a clean interface and no trading commissions, it’s ideal for beginner to intermediate investors.

Want to learn more? Check out our full Freetrade review to see if it’s the right platform for your investing goals.

eToro

eToro is a financial company and online social investment platform founded in 2007 and headquartered in Tel Aviv, Israel. It is registered across multiple jurisdictions, including the UK, US, Australia, Europe, Cyprus, Gibraltar, Seychelles, and Malta.

The platform is best known for its social and copy trading features, allowing users to mirror the trades of expert investors in real-time—similar to following influencers on social media. This community-driven model makes eToro particularly appealing to beginners and hands-off investors.

With eToro, you can invest in full or fractional shares, as well as commodities, forex pairs, cryptocurrencies, and CFDs. It’s an all-in-one platform catering to various trading styles and strategies.

Account types include Personal, Professional, Corporate, Islamic, and Demo accounts, along with access to one of the best Stocks and Shares ISA options available for UK investors.

The platform is available on both web and mobile, offering a clean, intuitive interface loaded with essential tools and indicators for smart trading decisions.

Overall, eToro is a versatile, commission-free platform that suits both beginners and experienced investors alike. Want to know if it’s right for you? Read our full eToro review for an in-depth look.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

Key Features

| Features | Freetrade | eToro* | |||

| Regulation | UK's Financial Conduct Authority (FCA) | UK's FCA, Cyprus' CySEC, ASIC, and the US FinCEN and Money Services Business | |||

| Financial Assets | Stocks, shares, Exchange-traded Funds (ETFs), Fractional Shares, and Commodities | Stocks, Shares, ETFs, commodities, Cryptocurrencies, Fractional shares and CFDs | |||

| Services and Account types | ISA, General Investment Account, and SIPP | ISA, Personal account, Corporate Account, Professional account, Islamic account, Copytrading, Social trading | |||

| Minimum Deposit | £0 | $10 in the UK | |||

| Commission fee | Free | Spreads apply | |||

| Deposit and Withdrawal fee | Free | Free deposit fee with a $5 withdrawal fee on requests with a $30 minimum amount | |||

| Trading Platform | Proprietary in-app platform on mobile device and web service for top-tiered plan | Proprietary in-app platform and web service | |||

| Currency Exchange fee | 0.45% of the amount | 0.5% of the amount |

| Features | Freetrade | eToro* |

| Regulation | UK's Financial Conduct Authority (FCA) | UK's FCA, Cyprus' CySEC, ASIC, and the US FinCEN and Money Services Business |

| Financial Assets | Stocks, shares, Exchange-traded Funds (ETFs), Fractional Shares, and Commodities | Stocks, Shares, ETFs, commodities, Cryptocurrencies, Fractional shares and CFDs |

| Services and Account types | ISA, General Investment Account, and SIPP | ISA, Personal account, Corporate Account, Professional account, Islamic account, Copytrading, Social trading |

| Minimum Deposit | £0 | $10 in the UK |

| Commission fee | Free | Spreads apply |

| Deposit and Withdrawal fee | Free | Free deposit fee with a $5 withdrawal fee on requests with a $30 minimum amount |

| Trading Platform | Proprietary in-app platform on mobile device and web service for top-tiered plan | Proprietary in-app platform and web service |

| Currency Exchange fee | 0.45% of the amount | 0.5% of the amount |

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and

you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Pros and Cons

| Pros of Freetrade | Cons of Freetrade | ||

| ✅ Commission-Free Trading: UK and US stocks with no trading fees. | ❌ Limited Asset Classes: No mutual funds, crypto, or CFDs. | ||

| ✅ Simple Interface: Excellent mobile app for beginner investors. | ❌ Lacks Advanced Tools: Not ideal for active or technical traders. | ||

| ✅ Fractional Shares: Invest from as little as £2. | ❌ Fees for ISAs & SIPP: Monthly fees apply for tax-wrapped accounts. | ||

| ✅ FCA-Regulated & FSCS Protected: Strong security for UK users. | ❌ Basic Research/Data: Minimal analytics and no live pricing on free plan. | ||

| ✅ ISA and SIPP Options: Tax-efficient investing available. |

| Pros of Freetrade | Cons of Freetrade |

| ✅ Commission-Free Trading: UK and US stocks with no trading fees. | ❌ Limited Asset Classes: No mutual funds, crypto, or CFDs. |

| ✅ Simple Interface: Excellent mobile app for beginner investors. | ❌ Lacks Advanced Tools: Not ideal for active or technical traders. |

| ✅ Fractional Shares: Invest from as little as £2. | ❌ Fees for ISAs & SIPP: Monthly fees apply for tax-wrapped accounts. |

| ✅ FCA-Regulated & FSCS Protected: Strong security for UK users. | ❌ Basic Research/Data: Minimal analytics and no live pricing on free plan. |

| ✅ ISA and SIPP Options: Tax-efficient investing available. |

| Pros of eToro | Cons of eToro | ||

| ✅ Social & Copy Trading: Copy top investors’ trades automatically. | ❌ High Non-Trading Fees: $5 withdrawal fee; inactivity fees apply. | ||

| ✅ Wide Asset Selection: Includes stocks, ETFs, crypto, and CFDs. | ❌ USD-Only Accounts: Currency conversion fees for GBP users. | ||

| ✅ Zero Commission on Stocks: No fees for stock and ETF trades (non-leveraged). | ❌ Limited Research Tools: Basic compared to more advanced platforms. | ||

| ✅ User-Friendly Platform: Clean interface ideal for beginners. | ❌ CFD Risk: Heavy CFD focus can mislead inexperienced users. | ||

| ✅ Regulated: FCA-regulated and FSCS protection (up to £85,000). |

| Pros of eToro | Cons of eToro |

| ✅ Social & Copy Trading: Copy top investors’ trades automatically. | ❌ High Non-Trading Fees: $5 withdrawal fee; inactivity fees apply. |

| ✅ Wide Asset Selection: Includes stocks, ETFs, crypto, and CFDs. | ❌ USD-Only Accounts: Currency conversion fees for GBP users. |

| ✅ Zero Commission on Stocks: No fees for stock and ETF trades (non-leveraged). | ❌ Limited Research Tools: Basic compared to more advanced platforms. |

| ✅ User-Friendly Platform: Clean interface ideal for beginners. | ❌ CFD Risk: Heavy CFD focus can mislead inexperienced users. |

| ✅ Regulated: FCA-regulated and FSCS protection (up to £85,000). |

Are they safe?

Freetrade

Transparency, regulation, and security are at the core of the brokerage business to ensure clients understand the safety of their investments. Let's explore the regulation, reliability, and security of these brokers.

Freetrade is FCA-authorised and complies with UK regulations to protect client funds. It uses segregated accounts, meaning your money is kept separate from company finances and cannot be used to pay creditors.

Client assets are held in the Freetrade Nominee account, a non-trading custodian protected from company liabilities. UK stocks and ETFs are held via CREST, and US stocks via DTCC, both secure, regulated depositories.

Freetrade is also covered by the Financial Services Compensation Scheme (FSCS), protecting clients up to £85,000 in case of firm failure.

To ensure user safety, the platform uses bank-grade encryption and supports biometric logins like fingerprint and facial recognition.

In summary, Freetrade is a reliable and secure trading platform for UK investors.

eToro

eToro is a globally regulated trading platform, authorised by top-tier financial authorities, including the FCA (UK), CySEC (Cyprus), ASIC (Australia), FSAS (Seychelles), and FinCEN (US).

UK and EU investors benefit from protections like the FSCS and Investor Compensation Fund (ICF), which safeguard funds in case of platform failure.

To ensure user safety, eToro uses SSL encryption for all data and supports two-factor authentication (2FA) on both its app and web platforms.

With strong oversight across multiple jurisdictions and robust data protection, eToro is considered a reliable and secure platform for global investors.

Products Offered

The main objective of these brokers is to provide investors with various financial instruments. Both platforms offer an extensive array of assets.

Freetrade

Freetrade provides investors with a diverse selection of investment assets for trading (buying and selling), along with up-to-date information about the current market status of these financial instruments. These include:

- Stocks and Shares – Freetrade offers access to over 6,000 US and UK stocks.

- Fractional Shares – With Freetrade, you can invest in a portion of a company and receive dividends proportionate to your ownership share.

- ETFs – Freetrade offers more than 400 commission-free Exchange-traded Funds (ETFs).

- Investment Trusts – Choose from over 150 investment trusts with Freetrade to diversify your portfolio.

- Bonds – Freetrade provides the option to trade both government and corporate bonds ETFs across all pricing plans.

- Commodities – As a Freetrade investor, you can trade in US and UK commodities, including precious metals, oil, gas, agriculture, and renewable energy.

eToro

eToro offers a variety of financial assets that investors can buy outright to hold or use to capitalize on current prices to go long or short. These include:

- Stocks – eToro offers over 3,000 commission-free stocks and shares from 17 different exchanges, with a minimum trade amount of $10. Fractional shares are also available.

- Indices – Available via CFDs, eToro's indices can be traded 24/5 with options for leverage and short selling. eToro features over 20 high-profile indices.

- ETFs – eToro's ETFs provide a diversified portfolio at a low cost with no management fees, offering over 300 ETFs.

- Commodities – eToro allows trading in over 30 of the world's top commodities as CFDs.

- Forex – Known also as currency trading, eToro allows for long and short positions in over 50 currency pairs with leverage up to 1:30 for retail clients and up to 1:400 for professional clients.

- Cryptocurrencies – eToro provides access to over 70 crypto assets, making it a substantial platform for cryptocurrency investment.

Both Freetrade and eToro cover a wide range of investment products, although their offerings differ in specifics such as the types of assets and the trading conditions.

Account Types

When it comes to account types, Freetrade and eToro are very different. While Freetrade offers a tax-free and commission-free investment plan on stock, ETFs, and commodities, eToro provides an investment platform outside the ISA system.

Freetrade

1. Stock and shares ISA

Freetrade Stock and Shares ISA is a tax investment system that allows you to invest a particular amount during a tax year (e.g., you can invest up to £20,000 in the 2023/2024 tax year). With this investment, you do not pay Capital Gains Taxes on any dividend or return you might receive.

Via the Freetrade ISA, you can invest in over 6,000 US and UK stocks and ETFs with zero commission on all trades.

Freetrade Stocks and Shares ISA Charges

| Charges | Standard Plan | Plus Plan | |||

| Monthly fee | £5.99 (£59.88/yr) | £11.99 (£119.88/yr) | |||

| Share dealings | Free | Free | |||

| Overseas share dealings | Exchange rate +0.59% | Exchange rate +0.39% | |||

| Transfer in (Deposit) | Free | Free | |||

| Transfer out (Withdrawal) – UK stocks or cash | Free | Free | |||

| Transfer Out – US stock | £17 per holding | £17 per holding | |||

| Interests on uninvested cash | 3% AER up to £2K | 5% AER up to £3K |

| Charges | Standard Plan | Plus Plan |

| Monthly fee | £5.99 (£59.88/yr) | £11.99 (£119.88/yr) |

| Share dealings | Free | Free |

| Overseas share dealings | Exchange rate +0.59% | Exchange rate +0.39% |

| Transfer in (Deposit) | Free | Free |

| Transfer out (Withdrawal) – UK stocks or cash | Free | Free |

| Transfer Out – US stock | £17 per holding | £17 per holding |

| Interests on uninvested cash | 3% AER up to £2K | 5% AER up to £3K |

2. Self-invested Personal Pension (SIPP)

SIPP is a tax-efficient investment program scheduled for life after retirement. With the Freetrade SIPP program, you can take over your pension and grow the pot by investing in any stock, ETF, or commodity. You can only have access to your point from age 55.

With the Freetrade SIPP, you can commit up to £40,000 annually without incurring tax through your employer or by direct deposit from your bank.

Freetrade SIPP Charges

| Charges | Plus plan | ||

| Monthly fee | £11.99 (£119.88/yr) | ||

| Share dealing | Free | ||

| Overseas share dealing (Currency Exchange) | Exchange rate +0.39% | ||

| Transfer in (Deposit) | Free | ||

| Transfer out (Withdrawal) | Free | ||

| US stock transfer out | £17 per holding | ||

| Interests on uninvested cash | 5% AER up to £3K |

| Charges | Plus plan |

| Monthly fee | £11.99 (£119.88/yr) |

| Share dealing | Free |

| Overseas share dealing (Currency Exchange) | Exchange rate +0.39% |

| Transfer in (Deposit) | Free |

| Transfer out (Withdrawal) | Free |

| US stock transfer out | £17 per holding |

| Interests on uninvested cash | 5% AER up to £3K |

3. General Investment Account (GIA)

The GIA is a tax-incurring account for trading and managing Freetrade assets. As a tax-incurring account, you will be charged a Capital Gain Tax on every dividend or profit you obtain from your portfolio.

eToro

1. eToro Personal Account

This is the eToro default account type. With an eToro personal account, you can trade all financial assets eToro and use features eToro offers, including Smart Portfolios, Social and Copy trading. On the downside, eToro offers the highest level of client security on this account, limiting the level of leverage you can trade.

2. eToro Professional Account

eToro professional account holders have a personal account with the option to use higher leverage while opening trades. To qualify for this account, you need to meet certain criteria, including:

- You must have carried out transactions of significant size on the relevant market at an average of 10 per quarter over the previous four quarters.

- The value of your investment portfolio must be £500,000

- You must have worked in the financial sector professionally for at least one year.

3. eToro Corporate Account

eToro corporate accounts are intended for business purposes and are only available for legal entities. If you're managing the capital that belongs to a business, this is the best account type you should open on eToro.

4. eToro Stock and Shares ISA

In March 2023, eToro teamed up with Moneyfarm to provide all eligible UK clients a discretionary managed stock and share ISA. With the account, you can invest up to a particular amount determined by the UK government in a tax year without incurring tax. For example, in the 2023/2024 tax year, you invest up to £20,000

5. eToro Islamic Account

This is a special type of account for Muslim clients that operates in accordance with Sharia law. Here, eToro does not charge or credit overnight fees. If you are interested in this account type, register for a real account investing a minimum of $1,000 and provide all identification documents to complete account verification.

6. eToro Demo Account

All other eToro accounts come with a demo account, an account with a virtual portfolio. The account is a training site for novice or new platform members to learn the nature of the market and how the platform works.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

Trading Fees

Freetrade

The Freetrade broker has three pricing platforms: the Basic, Standard, and Plus plan. Below are the differences between the plans.

| Features | Basic Plan | Standard Plan | Plus Plan | ||||

| Plan Fee | £0.00 per month | £5.99 per month, £59.88 billed annually | £11.99 per month, £119.88 billed annually | ||||

| Number of Assets | 6,200 stocks, including popular shares and ETFs | Full range of 6,200+ US, UK, and EU stocks and ETFs | Full range of 6,200+ US, UK, and EU stocks and ETFs | ||||

| Account type | General Investment Account | General Investment Account Stocks and Shares ISA | General Investment Account Stocks and Shares ISA Self-invested Personal Pension | ||||

| Commission | Commission-free trades | Commission-free trades | Commission-free trades | ||||

| Range of Stocks | 1,500+ | 6,000+ | 6,000+ | ||||

| U.S Fractional shares | YES | YES | YES | ||||

| Automation Order Types | NO | YES | YES | ||||

| Exchange rate fee | Exchange rate +0.99% FX fee | Exchange rate +0.59% FX fee | Exchange rate +0.39% FX fee | ||||

| Customer Service | Basic | Basic | Priority | ||||

| Interest rate | 1% AER on uninvested cash up to £1,000 | 3% interest on uninvested cash up to £2,000 | 5% interest on uninvested cash up to £3,000 | ||||

| Advanced stock fundamentals | NO | YES | YES | ||||

| Trading app | In-app only | In-app only | In-app + Freetrade Web beta |

| Features | Basic Plan | Standard Plan | Plus Plan |

| Plan Fee | £0.00 per month | £5.99 per month, £59.88 billed annually | £11.99 per month, £119.88 billed annually |

| Number of Assets | 6,200 stocks, including popular shares and ETFs | Full range of 6,200+ US, UK, and EU stocks and ETFs | Full range of 6,200+ US, UK, and EU stocks and ETFs |

| Account type | General Investment Account | General Investment Account Stocks and Shares ISA | General Investment Account Stocks and Shares ISA Self-invested Personal Pension |

| Commission | Commission-free trades | Commission-free trades | Commission-free trades |

| Range of Stocks | 1,500+ | 6,000+ | 6,000+ |

| U.S Fractional shares | YES | YES | YES |

| Automation Order Types | NO | YES | YES |

| Exchange rate fee | Exchange rate +0.99% FX fee | Exchange rate +0.59% FX fee | Exchange rate +0.39% FX fee |

| Customer Service | Basic | Basic | Priority |

| Interest rate | 1% AER on uninvested cash up to £1,000 | 3% interest on uninvested cash up to £2,000 | 5% interest on uninvested cash up to £3,000 |

| Advanced stock fundamentals | NO | YES | YES |

| Trading app | In-app only | In-app only | In-app + Freetrade Web beta |

eToro

eToro has no tier pricing system, but like Freetade, eToro offers investors commission-free investment on all stocks and ETFs. However, eToro makes most of its profit from spreads and other fees. Below are eToro fes explained simply as possible in the table below:

| Feature | Charges | ||

| Crypto Fee | 1% flat fee for buying and selling crypto assets, 0.2% tax burn mechanism, and 0.1% is added to eToro's bid and ask price for LUNC | ||

| Spread Fee | CFD Currencies - 0.01%+ // CFD Commodities – 0.05% // CFD stock & ETFs – 0.09% | ||

| Deposit Fee | Free | ||

| Withdrawal Fee | $5 with a $30 minimum withdrawal | ||

| Conversion Fee | 0.5 % on any deposit or withdrawal that is non-USD | ||

| Inactivity Fee | $10 per month | ||

| Overnight fee | This fee is calculated according to market conditions and can change daily. |

| Feature | Charges |

| Crypto Fee | 1% flat fee for buying and selling crypto assets, 0.2% tax burn mechanism, and 0.1% is added to eToro's bid and ask price for LUNC |

| Spread Fee | CFD Currencies - 0.01%+ // CFD Commodities – 0.05% // CFD stock & ETFs – 0.09% |

| Deposit Fee | Free |

| Withdrawal Fee | $5 with a $30 minimum withdrawal |

| Conversion Fee | 0.5 % on any deposit or withdrawal that is non-USD |

| Inactivity Fee | $10 per month |

| Overnight fee | This fee is calculated according to market conditions and can change daily. |

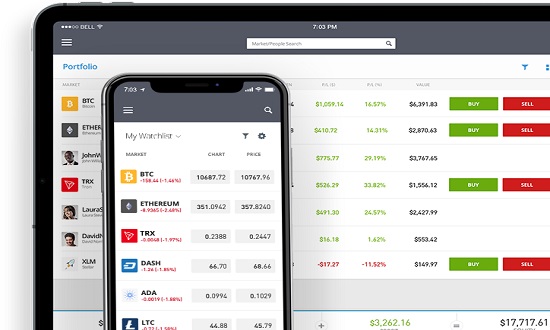

Trading Platform

The broker's trading platform is where users trade and invest in whatever asset they want. Freetrade and eToro have a proprietary trading platform where clients can trade and manage their investments.

However, all broker apps are not similar. Their features, ease of use, and user-friendliness differ. Let's discuss the Freetrade and eToro platform.

Freetrade

Depending on the pricing plan you trade, the Freetrade trading platform is both an app and a web-based platform. The Freereade app is a mobile-based platform that operates perfectly on Android and iOS devices.

The app is designed with simplicity, offering an exclusive and intuitive interface to help users navigate the platform. It allows you to trade any stocks, ETFs, and commodities Freetrade offers.

In addition, trading on the web platform is available only for customers on the Plus pricing plan.. This implies that you can trade laptops and desktops with the online-based web platform if you're on the Plus plan. It is a limitation of the Freetrade platform.

eToro

eToro offers a Mobile app and a web-based trading platform for all account types and customers.

eToro offers its users a complete, easy-to-use, and efficient web trading platform. The platform allows clients to access various financial instruments and execute trade quickly.

The web platform also features social trading, including the CopyTrader and CopyPortfolios.

The mobile app is available for Android and iOS devices. It's designed to provide a seamless trading experience for users and features all the functionalities and features of the web platform. You can invest, trade, and manage your portfolio on the mobile app.

*eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Deposit and Withdrawal

Freetrade

Freetrade provides straightforward depositing and withdrawal methods:

Deposit Options and Charges

- Bank Transfer – You can link a UK-authorized bank account to your Freetrade account.

- Debit Card Transfer – You can deposit with a debit card.

- Apple and Google Pay – You can deposit funds directly to Freetrade with Google or Apple Pay. The deposit is instant, and there is a 250-lifetime limit on this method. The default billing address in the Google or Apple Pay Settings must match the Freetrade address.

Generally, Freetrade does not charge a deposit fee, although they may include other additional fees.

Withdrawal Options and Charges

You can only withdraw from Freetrade through bank transfer, and it typically takes 2-3 business days to reach the linked bank account and sometimes up to 5 business days.

eToro

eToro offers a USD-based account that allows deposits and withdrawals using various payment methods.

eToro Deposit Options

You can deposit to your eToro account through eToro Money, , Klarna/Sofort Banking, Bank Transfer, przelwy24, and Online Banking – Trustly.

All these deposit-available methods are instant except for bank transfers, which may take 3-7 business days to reflect on your account. You can use any available method in your region.

eToro Withdrawal Options

You can withdraw your funds from eToro to your original deposit method. If eToro cannot process funds to the original deposit method, you will be asked to provide an alternative payment method.

In addition, you can also withdraw to your eToro Money account, from which you can add your payee bank account where you want to send your funds.

Typically, you will receive an email confirming your withdrawal status and payment within two business days of your request. However, your withdrawal may take up to 10 business days to reach its destination.

Research and Education

Freetrade

Freetrade takes a minimalist approach to research and education, focusing primarily on simplicity and accessibility. While it doesn't offer in-depth analytical tools or advanced charting features, it provides basic company information, market data, and a brief snapshot of individual stocks within the app.

Educational content is mainly delivered through the Freetrade Learn section and its blog, which features beginner-friendly articles explaining investment concepts, tax wrappers like ISAs, and market trends. This makes it suitable for new investors looking to understand the fundamentals of investing without being overwhelmed by data-heavy platforms.

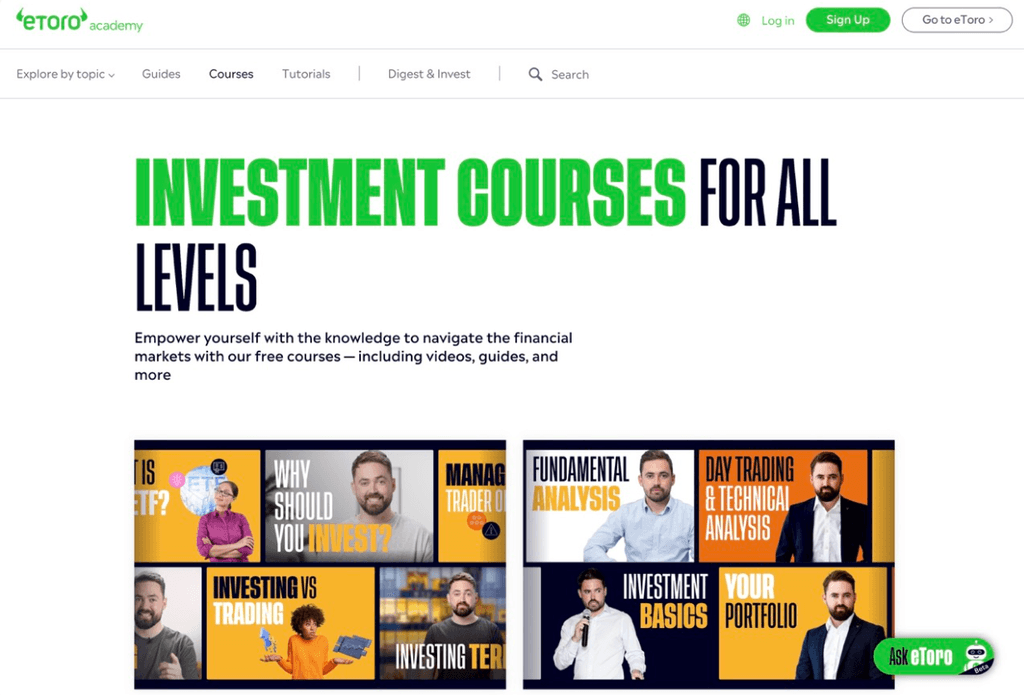

eToro

In contrast, eToro provides a comprehensive suite of research and educational tools tailored to both beginners and experienced traders. The platform offers detailed market analysis, interactive charts, and access to financial reports, as well as a vibrant social trading community where users can exchange insights. Its educational resources include a dedicated eToro Academy, featuring video tutorials, webinars, and written guides on topics ranging from trading strategies to market psychology.

This extensive offering, combined with real-time news feeds and analyst ratings, makes eToro one of the more informative and community-driven platforms on the market.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

Customer Service

Freetrade

Freetrade offers customer-dedicated customer service through the 'Help' section on the website and app. There are several alternatives to contacting customer service support:

- Help Hub and Community – The Help Hub contains answers to questions you may ask. So you don't have to text customer support and wait for their response. Also, you can visit the Freetrade community of investors to look for solutions, support, and advice.

- Social Media – The Freetrade customer support is active on Twitter, Instagram, LinkedIn, and Facebook. You can use these channels to make complaints through the chatbox and get updates about the broker, latest news, and market updates.

- Email Support – You can email Freetrade customer support through [email protected]. You should expect a response from the team in less than 24 hours.

- In-App Chat – The Freetrade app has a live chat feature that lets you speak with a customer service representative. It's the quickest and the most convenient way to get help with any issue or question.

eToro

- Help Center—The eToro help centre contains various informative articles and answers to common questions and issues clients may encounter while navigating the platform.

- Live Chat – eToro live chat customer service is only available to Club members, a privilege you can attain by having at least $5,000 in equity in your account.

- Email and Ticket System – Clients can submit support tickets through the trading platform and send emails to the customer support team. Response time usually varies, but generally, you will receive a response in 1-3 days.

- Social Media – eToro maintains a presence on social media, and users can easily send direct messages to address their issues. Also, they provide updates to clients on social media.

User Opinions and Ratings

Let's look at the Trustpilot Investment community, a reputable website investors use to provide honest ratings and comments. In addition, we will check the Google Play Store and Apple Store to see what app users say about the broker's mobile apps.

Freetrade

The Freetrade platform, which boasts over 5,000 reviews and ratings on Trustpilot, holds an average rating of 4.1 out of 5. A common grievance among investors is the lack of options to trade CFDs and cryptocurrencies.

Similarly,

The Freetrade mobile app is highly regarded, receiving a rating of 4.7 out of 5 on both the Google Play Store and the a rating of 4.3 on Apple App Store.

eToro

eToro, the social investment platform, has accumulated over 27,000 reviews and ratings on Trustpilot, achieving a 4.1 out of 5-star rating. User reviews generally express satisfaction with the trading platform, although a few people report experiencing app glitches.

Similarly, the eToro app has been downloaded over 10 million times on the Google Play Store and has received more than 147,000 reviews and ratings, earning a 3.6 out of 5-star rating.

Also, on the Apple App Store, eToro has almost 3,000 reviews, where it scores 4 out of 5 stars.

Our Opinion

Both Freetrade and eToro offer attractive features for investors, notably their commission-free trading plans, which have become a standard in the industry. They provide robust trading platforms and responsive customer support.

eToro stands out with its diverse product offerings. It is a multi-asset platform that includes stocks, shares, funds, and a cryptocurrency investment program, along with the ability to trade Contracts For Difference (CFD). This variety caters to different investor types and strategies. Conversely, Freetrade is somewhat limited; it only allows trading in shares, stocks, funds, and commodities, with no option for cryptocurrency investments.

eToro also excels with its advanced trading tools, social trading features, copy-trading capabilities, and extensive range of research tools, making it more suitable for both novice and experienced investors seeking comprehensive trading resources.

Service-wise, the platforms differ significantly. Freetrade offers an investment account and other accounts within a tax-free wrapper (SIPP and ISA).eToro has recently begun offering ISAs alongside other account types thanks to a collaboration with MoneyFarm.

Ultimately, choosing Freetrade and eToro will depend on your specific investment needs, goals, and risk tolerance. Both platforms excel in their respective offerings and cater to different types of investors, so it's important to consider what features are most important to you when deciding.

Disclaimer: