Reviews

Halifax Share Dealing Review: Is It Right for You?

With so many UK investment platforms promising rock-bottom fees and sleek interfaces, it’s easy to feel lost in the noise. What most investors really want is something simple, trustworthy, and good value, especially if you’re managing your ISA, SIPP, or just starting out.

Backed by Lloyds Banking Group, Halifax Share Dealing offers a no-frills way to invest in UK and international markets. But is it too basic or just what you need?

In this Halifax Share Dealing review, we’ll look at what the platform actually delivers: from fees and functionality to account types, support, and where it stacks up (or falls short) compared to others in 2025.

What is Halifax Share Dealing?

Halifax Share Dealing is the online investing arm of Halifax Bank, part of Lloyds Banking Group. Originally created in 1997 to handle Halifax’s demutualisation share allocations, it’s grown into a straightforward brokerage service offering UK investors access to shares, funds, and ISAs through a trusted brand.

It’s not built for day traders or app addicts. Rather, it’s designed for people who want to invest steadily, manage their ISA or SIPP confidently, and get clear pricing without hidden costs.

Main Features

- Regulation: Regulated by the FCA

- Investor protection: Up to £85,000 by the FSCS

- Financial assets: UK and international shares, funds, ETFs, investment trusts, bonds

- Markets: UK, US, and European markets.

- Account types: Share Dealing account, Stocks and Shares ISA, Self-Invested Personal Pension (SIPP), 18-25 Investing Accounts, Ready-Made Investments, Ready-Made Pension

- Fees:

- Commission-free international trading

- FX charge of 1.25%

- £9.50 to buy and sell funds and UK stocks

- Admin fee for ISA and Share Dealing account of £36 per year

- SIPP annual charge of 0.25%, limited at £16.50 per month

- Minimum deposit: No minimum deposit required

- Platform: Web trading platform and iOS and Android mobile apps

- Address: Trinity Road, Halifax, HX1 2RG

- Phone: 0345 722 5525

- Live chat

- Featured product: Ready-Made Pension

Pros and cons

| Pros of Halifax Share Dealing | Cons of Halifax Share Dealing | ||

| ✅ Competitive trading fees | ❌ Limited educational resources for beginners | ||

| ✅ Access to a wide range of UK and international markets | ❌ No commission-free trading options | ||

| ✅ Tax-efficient account options (ISA and SIPP) | ❌ Annual administration fees apply | ||

| ✅ User-friendly web and mobile platforms | |||

| ✅ Strong regulatory oversight and investor protection |

| Pros of Halifax Share Dealing | Cons of Halifax Share Dealing |

| ✅ Competitive trading fees | ❌ Limited educational resources for beginners |

| ✅ Access to a wide range of UK and international markets | ❌ No commission-free trading options |

| ✅ Tax-efficient account options (ISA and SIPP) | ❌ Annual administration fees apply |

| ✅ User-friendly web and mobile platforms | |

| ✅ Strong regulatory oversight and investor protection |

Is it safe?

Yes, Halifax Share Dealing is fully regulated by the Financial Conduct Authority (FCA), and your investments are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS).

And because it’s part of Lloyds Banking Group, you’re not dealing with an untested fintech, you’re using a platform with serious backing and decades of stability.

Investment products

Halifax offers a broad investment menu covering both simple and more advanced options. You can invest in:

- UK and international shares

- Over 3,000 funds, including unit trusts and OEICs

- ETFs and investment trusts

- Bonds and gilts for income-focused portfolios

It’s enough to build a well-diversified portfolio, whether you're a beginner sticking with UK funds or a more experienced investor looking to branch out globally. But keep in mind, Halifax doesn’t offer access to things like fractional shares, forex, or crypto, so it's not ideal if you want newer asset types.

Account types and fees

Halifax keeps things relatively simple when it comes to accounts. You can open a standard Share Dealing Account, one of the best Stocks and Shares ISA, or a SIPP. Here's how they compare:

- Share Dealing Account: £36/year + £9.50 per trade. No tax wrapper, but good for general investing.

- Stocks & Shares ISA: Same fees as above, but with the obvious ISA tax advantages. No extra cost to hold it.

- SIPP: 0.25% annual charge, capped at £16.50/month. £9.50 per trade. Regular investments are commission-free.

One perk: investors aged 18–25 don’t pay the £36 platform fee, making it more accessible for younger users.

Compared to other UK brokers, Halifax isn’t the cheapest, especially with £9.50 trades, but it’s transparent, and you won’t get hit with inactivity fees or confusing small-print charges. If you value stability and clarity over rock-bottom costs, it may be a fair trade.

Online trading platforms

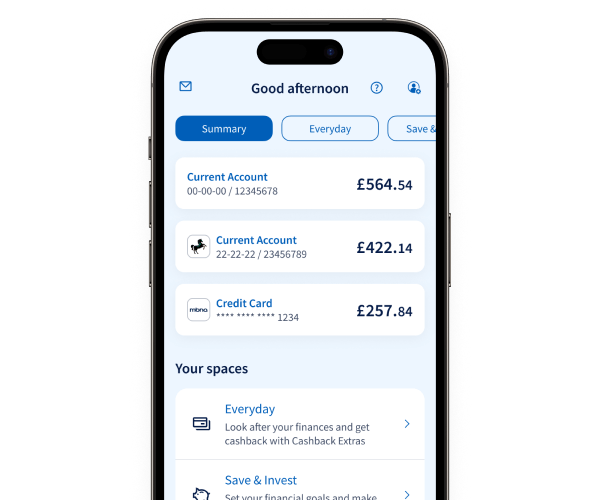

Halifax offers both a browser-based platform and a mobile app (iOS and Android), giving you the flexibility to manage your portfolio your way — whether you're at home or on the go — all through one of the best trading platforms available for everyday investors.

The web platform is clean and functional. You’ll get real-time data, basic stock screening tools, and account management features. It’s not flashy, but it’s stable and easy to navigate, ideal if you’re not after a feature-packed trading terminal.

The mobile app gives you full access to your portfolio on the go. You can buy and sell, check your balance, set up regular investments, and keep tabs on performance.

Overall, both platforms do what they’re meant to: no frills, no distractions, just solid tools for self-directed investing.

Customer service

Halifax Share Dealing offers phone support, live chat, and a web-based contact form.

- Phone: 0345 722 5525

- Email: Accessible through the website's contact form

- Live chat: Available during business hours

While there’s no 24/7 support, the extended weekday hours are better than many competitors. If you hit a technical snag or need help navigating the platform, their team is generally responsive and efficient.

Research and education tools

Halifax Share Dealing offers decent research tools for investors who already know what they’re looking for. You’ll find:

- A stock screener to filter by sector, dividend yield, and more

- Analyst recommendations for many UK and US stocks

- Market news to stay on top of broader trends

That said, if you’re a beginner hoping for step-by-step educational content, video explainers, or portfolio-building guides, you won’t find much here. This platform assumes you’re coming in with a basic understanding of investing.

Bottom line: Is Halifax Share Dealing right for you?

Halifax Share Dealing is a solid choice if you want a no-nonsense platform backed by a trusted name. It’s ideal for:

- Intermediate investors who value reliability over advanced features

- SIPP and ISA holders who want low annual fees and a simple experience

- Investors comfortable doing their own research

But if you’re just starting out and need educational guidance, or if you want the lowest trading fees in the UK, there are more beginner-friendly or cost-efficient options out there. Halifax won’t handhold you, but it won’t waste your time either.

FAQs

How much does it cost to trade on Halifax Share Dealing?

You'll pay £9.50 per deal on UK shares and ETFs, plus a £36 annual account fee (waived if you're aged 18–25). Fund trading is commission-free. SIPPs have a separate 0.25% annual fee, capped at £16.50/month.

Is Halifax Share Dealing good for beginners?

While the platform is easy to use, it doesn’t offer much in the way of beginner-friendly education or handholding. It’s better suited to investors who already understand the basics and want a reliable platform.

Are there any promotions or sign-up offers?

Halifax Share Dealing doesn’t typically run flashy promotions, but it’s worth checking their official site for any seasonal or limited-time offers. Their main draw is reliability, not incentives.

How do you open an account?

Setting up a Halifax Share Dealing account is all online and typically takes under 10 minutes. Here's how it works:

- Head to the Halifax Share Dealing site and click “Open an account.”

- Choose the right account for your needs—ISA, SIPP, or a general dealing account.

- Fill in your personal details, including your name, address, NI number, and bank info.

- Verify your ID—you’ll need to upload a document like a passport or driving license.

- Fund your account to start investing. You can make a one-off deposit or set up a regular investment plan.

It’s a straightforward setup, and you don’t need to already bank with Halifax to get started.