Reviews

Hargreaves Lansdown SIPP Review 2025

Hargreaves Lansdown was founded in 1981 and has steadily grown into one of the UK’s largest and most trusted investment platforms. Initially focusing on fund research, the company has expanded into providing a broad range of investment services including ISAs, SIPPs, and general investment accounts. Their reputation rests on delivering strong customer support, user-friendly tools, and a wide selection of investment choices.

In this article, we will dive deeper into the Hargreaves Lansdown SIPP — exploring its features, fees, flexibility, and whether it might be the right pension solution for you.

What Is a Hargreaves Lansdown SIPP?

A Hargreaves Lansdown SIPP (Self-Invested Personal Pension) is a flexible pension product designed for individuals who want full control over their retirement savings. Unlike traditional pensions, a SIPP lets you choose where to invest your money from a wide selection of assets including stocks, funds, ETFs, and bonds.

This means you can tailor your pension to match your risk appetite, financial goals, and investment preferences. With a Hargreaves Lansdown SIPP, you benefit from tax advantages on contributions and growth, as well as a regulated framework ensuring your investments are protected.

As of 2025, Hargreaves Lansdown is one of the top platforms for SIPPs in the UK, managing billions in client assets. Their extensive research capabilities, combined with a strong digital platform, make them a popular choice for both novice and experienced investors looking to manage their pensions independently.

For more information on Hargreaves Lansdown and other alternatives to a SIPP, read our Hargreaves Lansdown review.

Main Features

Types of Investments Available

The Hargreaves Lansdown SIPP supports an extensive range of investments. You can choose from thousands of UK and international shares, investment trusts, unit trusts, ETFs, and government or corporate bonds. The platform also allows holding cash within the SIPP, and in response to the common question, does Hargreaves Lansdown pay interest on cash in SIPP? – yes, but the interest rates on cash balances within the SIPP tend to be modest compared to external savings accounts.

Flexibility & Withdrawal Options

HL offers flexible options for taking your pension benefits. From age 55 (increasing to 57 in 2028), you can withdraw lump sums or set up regular income payments. You’re entitled to take 25% of your pension pot tax-free, with subsequent withdrawals taxed as income. This flexibility helps retirees tailor their income to their lifestyle and financial needs.

Tax Implications

Investments within a SIPP grow free of capital gains tax and income tax. Contributions attract tax relief based on your income tax bracket, making SIPPs a tax-efficient vehicle for retirement saving. Withdrawals after age 55 are taxed as income, except for the tax-free lump sum, so planning your withdrawals is important to manage tax liabilities.

Fees and charges

When considering a Hargreaves Lansdown SIPP, understanding the associated costs is essential. The platform is known for transparent pricing but has higher fees compared to some competitors. Their charges are structured on a tiered basis, rewarding larger portfolios with reduced platform fees. Additional dealing fees and fund charges also apply, which can impact your overall returns.

Hargreaves Lansdown’s fees have evolved but remain competitive given the breadth of services offered. The platform fee is 0.45% annually on the first £250,000 invested, reducing to 0.25% on the next £750,000, and 0.10% on amounts up to £2 million. Beyond £2 million, no platform fee is charged. Trading shares incurs a fee of £11.95 per deal, though this drops to £5.95 for frequent traders.

Importantly, there are no fees for fund purchases or switches, making fund investors well-served. Understanding these Hargreaves Lansdown SIPP charges helps investors balance cost with service quality.

The fee structure includes platform fees, dealing fees for shares, and no charges on fund purchases. While the fees might be higher than discount brokers, they are balanced by the quality of service, research, and support.

Available Investment Products

Hargreaves Lansdown offers one of the broadest investment selections among UK SIPP providers:

- Thousands of options, including UK and international shares, funds (over 2,500), ETFs, investment trusts, bonds, and a cash management feature

- “Ready-Made Pension Plan” portfolios are available as a passive, low-cost option with predefined risk levels (e.g., Cautious, Pension Builder, Adventurous, Ethical)

- Recently, HL began offering access to Long Term Asset Funds (LTAFs)—private-market, blended funds (e.g., private equity, infrastructure)—though these require a higher minimum investment and have notice periods for withdrawals

Who Is Hargreaves Lansdown's SIPP Best Suited to?

| Novice Investors | For beginners, Hargreaves Lansdown provides extensive educational materials, model portfolios, and investment advice, making the SIPP approachable and easier to understand. | ||

| Expert Investors | More experienced investors appreciate the vast investment universe and advanced research tools HL offers, allowing for highly customised portfolios. | ||

| Retirees | Retirees benefit from the flexible withdrawal options and the ability to hold a diversified mix of investments within the SIPP to match their income needs. |

| Novice Investors | For beginners, Hargreaves Lansdown provides extensive educational materials, model portfolios, and investment advice, making the SIPP approachable and easier to understand. |

| Expert Investors | More experienced investors appreciate the vast investment universe and advanced research tools HL offers, allowing for highly customised portfolios. |

| Retirees | Retirees benefit from the flexible withdrawal options and the ability to hold a diversified mix of investments within the SIPP to match their income needs. |

Comparing Hargreaves Lansdown's SIPP With Other Providers

AJ Bell

AJ Bell offers a similar service but generally with lower platform fees, making it attractive for smaller pension pots. It also provides a broad investment range and decent research tools, though some investors find HL’s platform more intuitive.

👉 For more information, read our AJ Bell review

Barclays

Barclays is a well-established SIPP provider, known for its strong brand and integrated banking services. While it offers a solid investment platform and convenient access for existing Barclays customers, its SIPP offering is less flexible and has a more limited investment range compared to providers like Hargreaves Lansdown.

👉 Read our Barclays smart investor review for more information

Vanguard

Vanguard is a strong SIPP provider for investors looking for a low-cost, simplified approach. It’s particularly well-suited for beginners and long-term, passive investors, offering access exclusively to its own high-quality index and ETF funds. While the fees are among the lowest in the market (0.15% capped at £375 per year), the limited investment range may not suit those looking for individual shares or third-party funds. It’s ideal for those who want to "set and forget" their investments, but less appropriate for active or advanced traders.

👉 If you're interested in Vanguard, read our Vanguard review to learn more

Interactive Investor (ii)

Interactive Investor stands out for its flat-fee pricing model, making it one of the best options for larger portfolios. Investors pay a fixed monthly fee, which can be more cost-effective than percentage-based platforms over time. ii offers a wide investment range, including shares, funds, investment trusts, and ETFs, along with strong research tools. However, it may not be the most intuitive platform for beginners, and the fixed fee can be relatively expensive for those with smaller pots. That said, its transparent pricing and flexibility make it a favourite among more experienced investors.

👉 Read here for more on ii: interactive investor review

How to open a SIPP account?

Who Is Eligible?

Anyone aged 18 or over can open a SIPP with HL. Parents or guardians can open SIPPs on behalf of minors, managing the account until the child turns 16.

What Is the Process?

Opening a SIPP is straightforward via the HL website. You complete an application, provide identification, and transfer funds either from an existing pension or through new contributions. The platform guides you through investment choices and paperwork efficiently.

Platform

User Interface & Experience

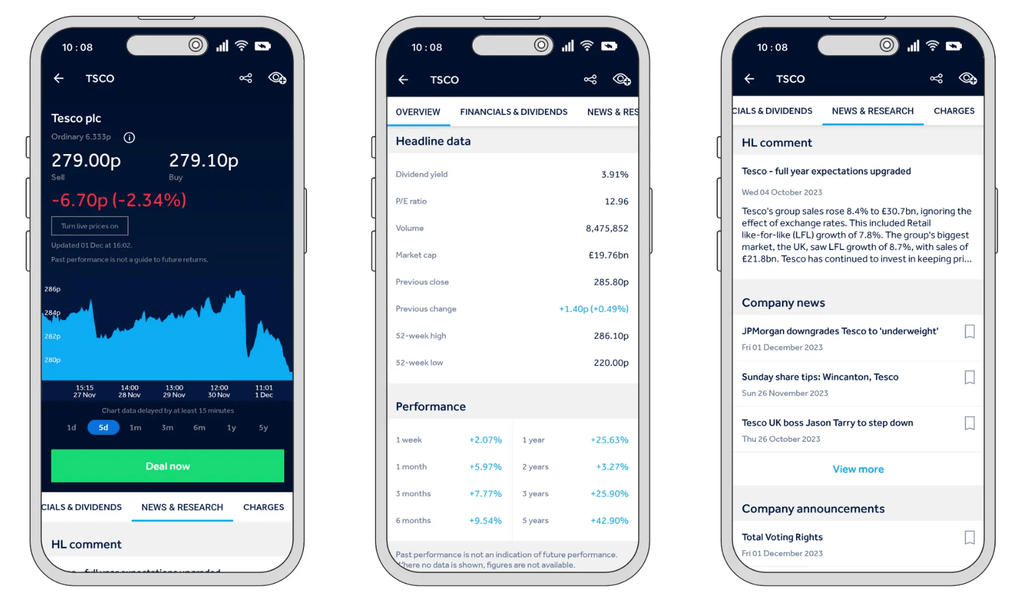

HL’s platform is praised for being intuitive and user-friendly, suitable for both desktop and mobile users. Investors can easily track portfolio performance, make trades, and access research reports.

Tools & Resources Available

HL offers a range of tools such as retirement calculators, portfolio health checks, and expert market commentary, supporting informed decision-making.

Mobile App Review

The mobile app mirrors the desktop experience well, allowing on-the-go portfolio management, research access, and trade execution, which many users find convenient.

Customer Service

Hargreaves Lansdown offers highly-regarded and exclusive customer support via:

- Phone: 8am till 5pm on business days and 9:30am -12:30pm Saturday.

- Via message on their website

You can also book an in-person meeting with Hargreaves Lansdown’s financial advisor at their London office, by telephone, or through one of their Bristol representatives.

FAQs

Is my money safe with HL SIPP?

Hargreaves Lansdown is fully regulated by the Financial Conduct Authority (FCA), ensuring strict oversight and protection for investors.

Does Hargreaves Lansdown offer alternative accounts?

Yes, beyond SIPPs, HL also offers ISAs, Junior ISAs, Lifetime ISAs, and general investment accounts. This ecosystem allows investors to manage various savings and investment goals in one place, simplifying financial planning.

Can I manage my investments online with a Hargreaves Lansdown SIPP?

Yes, you can manage your SIPP completely online. The platform supports a variety of convenient features like automated monthly investing via Direct Debits from as little as £25, plus easy pension transfers and a seamless user interface

You have full access to their platform via both web and mobile app, allowing you to monitor your portfolio, make contributions, adjust investments, and trade in real time.