Comparatives

Hargreaves Lansdown vs Trading 212: Comparison

In the UK, investing is no longer just the turf of City professionals or individuals with six-figure portfolios. With a phone in your pocket and a few quid to spare, you can start building your financial future today. But choosing the right platform can make or break that journey.

That’s where two heavyweights come in: Hargreaves Lansdown, the seasoned veteran known for depth and reliability, and Trading 212, the disruptor that’s made commission-free trading feel effortless.

Whether you’re in it for the long haul or just looking to test the waters, this side-by-side breakdown will help you figure out which investment platform best fits your vibe in 2025.

Main Features

Before we get into the details, let’s lay out the basics:

| Feature | Hargreaves Lansdown | Trading 212 | |||

| Founded | 1981 | 2013 | |||

| Regulation | FCA-regulated | FCA-regulated | |||

| Fees | Tiered % account charges | Commission-free | |||

| Platform Type | Traditional broker | App-first investing platform | |||

| Investment Options | Funds, stocks, ISAs, SIPPs | Stocks, ETFs, CFDs, ISAs | |||

| Minimum Deposit | No minimum | £1 |

| Feature | Hargreaves Lansdown | Trading 212 |

| Founded | 1981 | 2013 |

| Regulation | FCA-regulated | FCA-regulated |

| Fees | Tiered % account charges | Commission-free |

| Platform Type | Traditional broker | App-first investing platform |

| Investment Options | Funds, stocks, ISAs, SIPPs | Stocks, ETFs, CFDs, ISAs |

| Minimum Deposit | No minimum | £1 |

Right away, it’s easy to notice they are focused on different types of investors. One’s designed for structure, planning, and in-depth research. The other is all about simplicity, speed, and low-cost access to the markets. So, let’s have a closer look at what they offer.

Pros and Cons

| Pros of Hargreaves Lansdown | Cons of Hargreaves Lansdown | ||

| ✅ Highly reputable – Established UK firm with strong regulation (FCA-regulated, FSCS protection). | ❌ High fees – £11.95 per trade (can drop to £5.95 depending on volume), fund management fees apply. | ||

| ✅ Comprehensive investment options – Access to UK and global stocks, funds, ETFs, bonds, SIPPs, and ISAs. | ❌ No fractional shares – Can be harder for new investors with smaller budgets. | ||

| ✅ Excellent customer service – UK-based support with a strong reputation for responsiveness. | ❌ No fractional shares – Can be harder for new investors with smaller budgets. | ||

| ✅ In-depth research & tools – Quality analyst reports, calculators, and news. | |||

| ✅ Strong mobile and desktop platforms – User-friendly with robust functionality. |

| Pros of Hargreaves Lansdown | Cons of Hargreaves Lansdown |

| ✅ Highly reputable – Established UK firm with strong regulation (FCA-regulated, FSCS protection). | ❌ High fees – £11.95 per trade (can drop to £5.95 depending on volume), fund management fees apply. |

| ✅ Comprehensive investment options – Access to UK and global stocks, funds, ETFs, bonds, SIPPs, and ISAs. | ❌ No fractional shares – Can be harder for new investors with smaller budgets. |

| ✅ Excellent customer service – UK-based support with a strong reputation for responsiveness. | ❌ No fractional shares – Can be harder for new investors with smaller budgets. |

| ✅ In-depth research & tools – Quality analyst reports, calculators, and news. | |

| ✅ Strong mobile and desktop platforms – User-friendly with robust functionality. |

| Pros of Trading 212 | Cons of Trading 212 | ||

| ✅ Commission-free trading – No fees on stocks, ETFs, or forex (spread applies). | ❌ Customer support can be slow – Reported delays in resolving some issues. | ||

| ✅ Fractional shares – Invest from as little as £1, ideal for beginners. | ❌ Fewer account types – No SIPP option, limited tax-efficient wrappers. | ||

| ✅ User-friendly app – Clean, intuitive interface, easy to navigate. | |||

| ✅ Wide asset access – Global stocks, ETFs, forex, and even pies for auto-investing. | |||

| ✅ Quick setup – Easy account opening and fast verification. |

| Pros of Trading 212 | Cons of Trading 212 |

| ✅ Commission-free trading – No fees on stocks, ETFs, or forex (spread applies). | ❌ Customer support can be slow – Reported delays in resolving some issues. |

| ✅ Fractional shares – Invest from as little as £1, ideal for beginners. | ❌ Fewer account types – No SIPP option, limited tax-efficient wrappers. |

| ✅ User-friendly app – Clean, intuitive interface, easy to navigate. | |

| ✅ Wide asset access – Global stocks, ETFs, forex, and even pies for auto-investing. | |

| ✅ Quick setup – Easy account opening and fast verification. |

Are they safe?

Hargreaves Lansdown Regulation

Hargreaves Lansdown is considered very safe. It’s regulated by the FCA, offers FSCS protection up to £85,000, and holds client money in segregated accounts. As a long-established and publicly listed UK firm, it has a strong reputation, transparent operations, and no major past issues, making it a trusted choice for cautious and long-term investors.

Trading 212 Regulation

Trading 212 is also regulated by the FCA and provides FSCS protection, with client funds kept separate from company funds. It’s generally safe for most users, but it has a shorter track record and faced criticism in 2021 for restricting trading during market volatility. While secure, it may not feel as reassuring for more risk-averse investors.

Available Investment Products

Next, let’s have a look at options, not just financial ones, but the ones that match your investing style.

Hargreaves Lansdown

Hargreaves Lansdown rolls out the red carpet when it comes to investment choices. From UK and international stocks to a massive menu of funds, bonds, ETFs, and even Lifetime ISAs and SIPPs, it’s built for the investor who wants to go deep. And with portfolio tools, expert tips, and a fund screener, it feels like having a financial adviser in your pocket (without the small talk).

Trading 212

Trading 212, on the other hand, keeps things lean but powerful. You can trade UK and US stocks, explore a wide range of ETFs, and even buy fractional shares, so if a full share of Apple or Amazon is out of reach, you can still invest in these companies for a fraction of the cost.

There’s also a demo account to practise with zero risk, plus the option to trade CFDs if you’re up for something more advanced (handled through a separate account).

So, if you're searching for a long-term investment platform with fund variety, Hargreaves Lansdown is your go-to. But for simple, beginner-friendly investing, Trading 212 is an exceptionally popular broker among many traders and investors.

Fees & charges

When it comes to investing, fees matter and especially over the long haul. And this is where the gap between Hargreaves Lansdown and Trading 212 starts to widen.

Hargreaves Lansdown Fees and Charges

Hargreaves Lansdown sticks to a traditional fee model. You’ll pay a 0.45% platform fee, plus £11.95 per trade unless you’re an active trader, in which case it drops to £5.95 (at least 20 deals per month). This approach makes sense if you're looking for premium support, extensive research tools, and a structured approach to wealth building. You're paying for service, not just access.

Trading 212 Fees and Charges

Trading 212 is a platform that’s proudly commission-free. With no account fees and no trading charges, there’s just a 0.15% FX fee on non-GBP transactions. For budget-conscious traders or first-timers with smaller pots, that zero-commission promise is a big win. However, depending on what you trade, you’ll have to cover different fees (such as spreads, for instance).

So, if your priority is low-fee trading platforms UK or you’re just getting started, Trading 212 is easy on the wallet. But if you prefer the comfort of a full-service broker, HL still has its perks.

Trading Platforms

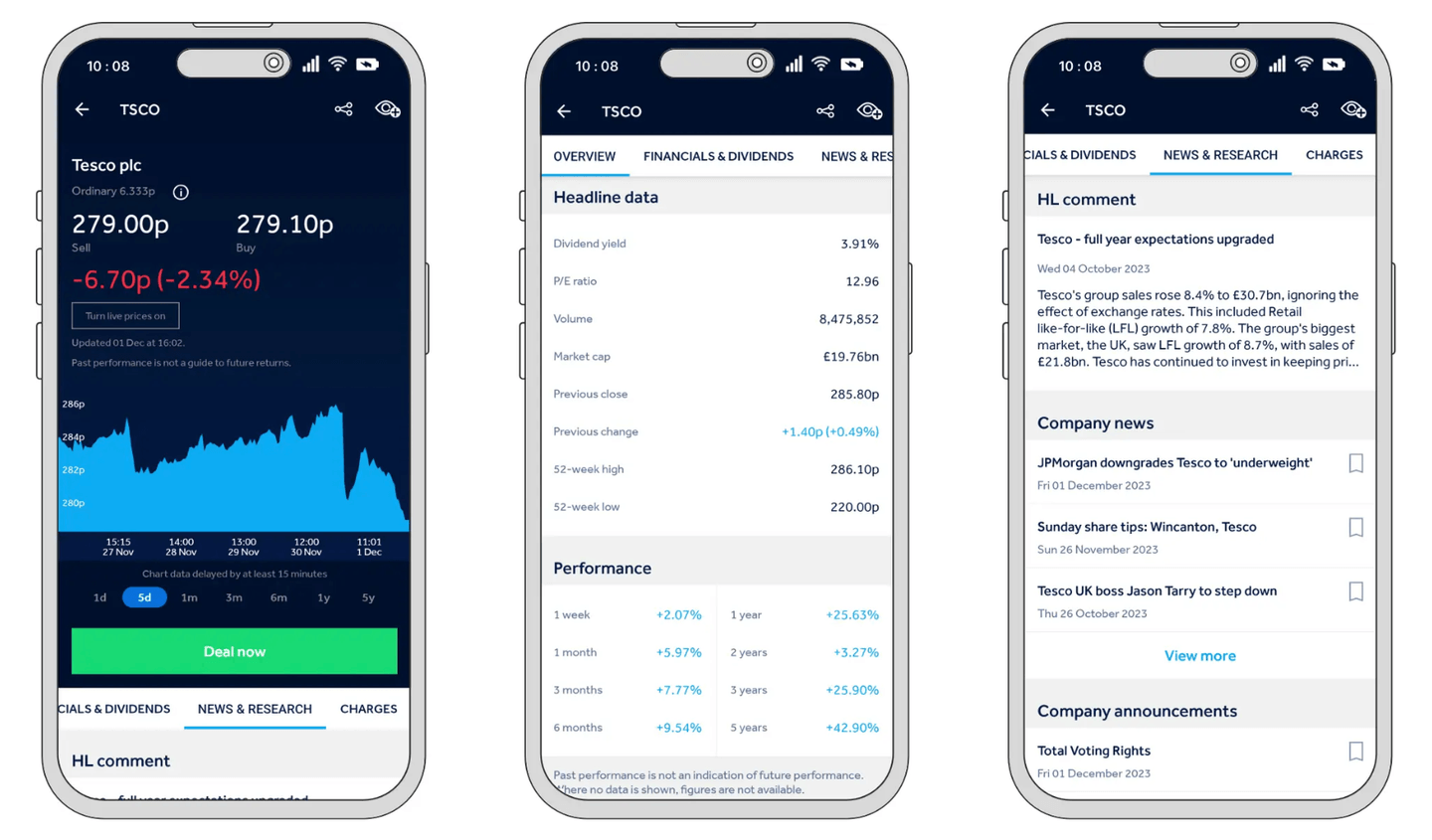

Hargreaves Lansdown Platform

Hargreaves Lansdown keeps it traditional: clear layouts, detailed portfolio views, and loads of research to sink your teeth into. It’s ideal for methodical investors who enjoy digging into fund factsheets and analyst reports. The app works fine, but it’s the web experience that shines.

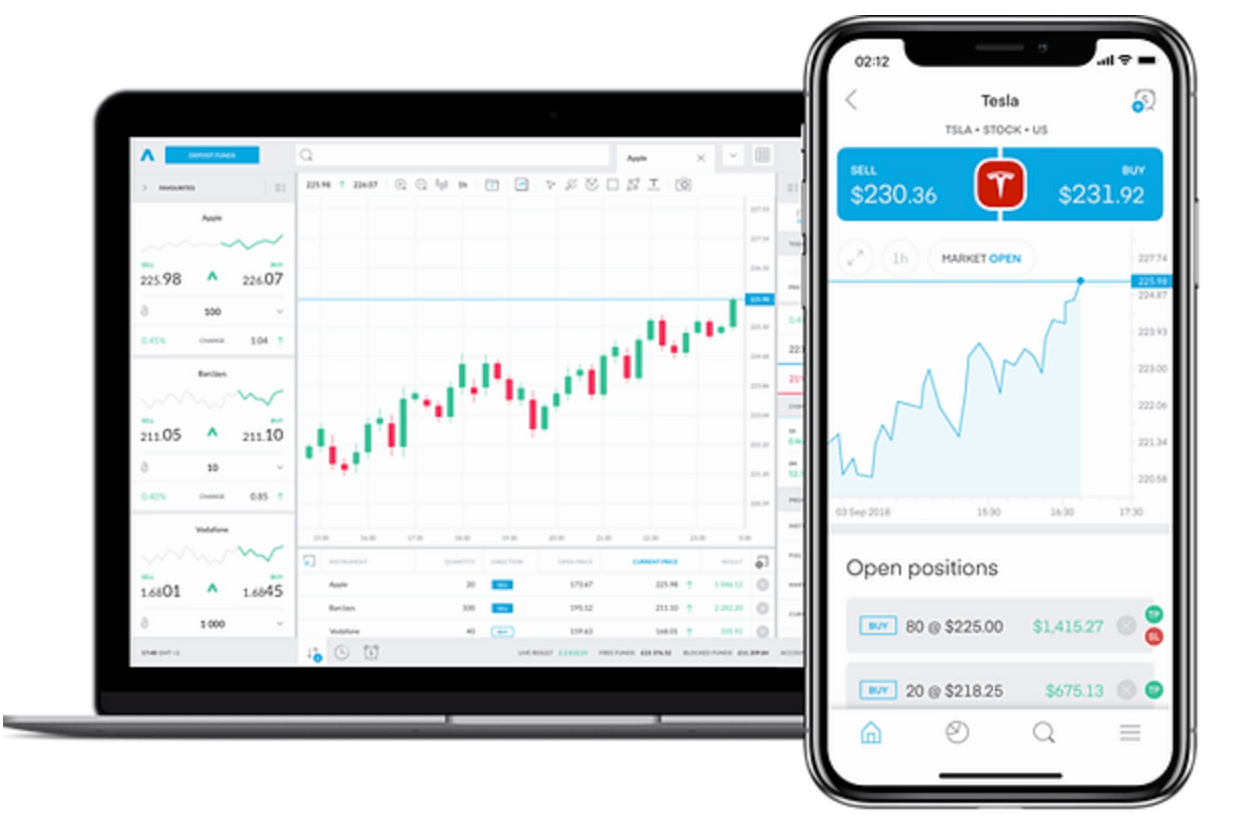

Trading 212 Platform

Meanwhile, Trading 212 is an entirely different option. Built mobile-first, the app feels more like a modern fintech experience than a broker. It’s intuitive, slick, and fast, perfect if you want to check markets on the train or buy shares in under a minute. You won’t find deep research tools here, but you will find a user-friendly flow that makes investing feel accessible, not overwhelming.

If your idea of investing includes spreadsheets and strategy, HL will feel like home. But if you want a beginner-friendly investment app that fits in your pocket, Trading 212 delivers.

Deposits and Withdrawals

Hargreaves Lansdown

Deposits: HL does not charge fees for deposits.

Withdrawals: HL does not charge fees for withdrawals.

Additional Notes: HL does not charge fees for deposits or withdrawals; however, be aware that fund management fees may apply to the investments held within your HL account. These fees vary depending on the specific investment and are outlined in the fund's Key Investor Information Document (KIID).

Trading 212

Deposits: Trading 212 does not charge fees for deposits via bank transfer, debit/credit card, or other supported methods.

Withdrawals: Trading 212 does not charge fees for withdrawals to your linked bank account.

Additional Notes: While Trading 212 does not charge fees for deposits or withdrawals, be aware that currency conversion fees may apply if your deposit or withdrawal involves a currency conversion. Additionally, some users have reported that intermediary banks may charge fees for international transfers, which are beyond Trading 212's control.

Education and Resources

Hargreaves Lansdown Education

Educational Resources:

- HL Academy: Provides a range of educational materials, including articles, guides, and videos, covering topics from basic investing principles to more advanced strategies.

- Webinars and Events: Occasionally hosts live and recorded webinars featuring industry experts discussing various investment topics.

- Investment News and Insights: Offers daily market updates, expert commentary, and analysis to help investors stay informed.

Research Tools:

- Fund and Stock Research: Access to comprehensive research reports, ratings, and analysis on a wide range of funds and individual stocks.

- Interactive Tools: Features like the "Fund Finder" and "Share Dealing" tools allow users to compare and analyze investment options.

Technical Analysis:

- Limited Technical Analysis: While HL provides fundamental analysis and stock screening tools, its offerings in technical analysis are more limited compared to platforms dedicated to trading.

Trading 212 Education

Educational Resources:

- YouTube Channel: Offers a variety of free video tutorials covering topics such as technical analysis, chart patterns, indicators, and trading strategies.

- Community Forum: A platform where users can discuss strategies, share insights, and learn from each other's experiences.

- Demo Account: Allows users to practice trading strategies without risking real money, providing a hands-on learning experience.

Research Tools:

- Real-Time Data: Provides access to real-time market data, including price charts, volume indicators, and historical data.

- Technical Indicators: Offers a range of built-in technical indicators such as RSI, MACD, moving averages, and Bollinger Bands to assist in technical analysis.

Technical Analysis:

- Comprehensive Tools: Trading 212 is well-suited for those interested in technical analysis, offering a user-friendly interface with a wide array of charting tools and indicators.

- Educational Content: The platform's educational resources are particularly beneficial for beginners looking to understand and apply technical analysis in their trading strategies.

Customer service

When it comes to trust, both platforms are FCA-regulated and offer protection under the Financial Services Compensation Scheme (FSCS). But the way they support you day to day is very different.

Hargreaves Lansdown has been serving UK investors for over 40 years. They’ve got customer service teams on the phone, offices you can visit, and a reputation that’s hard to shake. They’re the kind of broker you call when you want to talk about pensions, not meme stocks.

Trading 212 leans on technology. There’s no phone support, but live chat and email queries are usually handled quickly. It’s built for digital natives, those who’d rather tap a screen than wait on hold.

So, whether you’re after trusted UK brokers with heritage or you’re happy with online support, both options are dependable, just in very different ways.

Which one's for you?

There is no “one size fits all” answer here. But here’s a quick way to think about it:

- Pick Hargreaves Lansdown if you're building wealth for the long term, care about tax wrappers like SIPPs and ISAs, and want professional support along the way. It’s ideal for investors who like planning, researching, and thinking big-picture.

- Pick Trading 212 if you’re all about low fees, fast trades, and investing on your terms. Whether you're buying fractional shares of Tesla or setting up your first ISA, Trading 212 makes it easy, affordable, and fast.

If HL is the sharp-suited wealth manager, Trading 212 is the fintech disruptor in a hoodie. Both get the job done, it just depends on your expectations, experience, strategy, and how comfortable you are with technology.

Final thoughts

In the end, the best investment platform in the UK is the one that fits your goals, not just your budget. If you want a full-service, research-driven experience that can grow with your portfolio, Hargreaves Lansdown offers depth, trust, and reliability. But if you’re chasing low-cost trades and a breezy mobile experience, Trading 212 is tough to beat.

Either way, you’re in good hands. Just be clear on what matters most to you, and let your platform do the heavy lifting from there.

FAQs

Is Trading 212 really free to use?

Yes, stock and ETF trades are commission-free. Just watch out for the 0.15% FX fee when trading in non-GBP currencies.

Does Hargreaves Lansdown have a mobile app?

It does, and it’s solid for tracking and managing your investments, though it leans more toward analysis than trading.

Can I use ISAs on both platforms?

Yes, but HMRC rules mean you can only contribute to one Stocks and Shares ISA per tax year, so you'll need to pick or transfer accordingly.