Brokers

How to Buy and Sell Stocks on eToro Easily?

If you are interested in investing in stocks, this post will explain how to buy and sell stocks on eToro, a global multi-asset investment platform with 20 million users from over 140 countries worldwide. With eToro, buying stocks is easy and there are no purchase commissions (nor selling).

What is it and how does it work?

Are you looking for a reliable platform to diversify your investment portfolio? eToro is your answer.

With more than 35 million users worldwide, eToro has established itself as one of the leading multi-asset investment platforms. It not only allows you to trade in a wide variety of markets, from more than 4,500 stocks to cryptocurrencies, but also offers innovative tools like CopyTrader, which allows you to automatically replicate the actions of other successful investors.

Additionally, its position as a global platform is reinforced by the trust provided by being regulated by various international authorities and having top-level security practices.

Given its high presence in the international market, and due to the trust of being supervised by top-level authorities, in this article, we will explain how to buy (and sell) stocks with eToro

👉 More information: eToro review - Is it the right trading platform for you?

How to buy eToro stocks in 5 steps (easily)?

Below, we will summarise in 5 simple steps how to buy stocks with eToro in a very simple way. No leverage, no hidden fees, 100% free, you will only pay the spread, which in highly liquid stocks, you will hardly notice.

These are the steps:

- Open an account on eToro

- Deposit funds

- Search for the stock ticker on eToro

- Set the order

- Buy the stock

Precisely to avoid an expensive spread, we will take as an example a highly traded stock like LVMH (MC.PA)

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

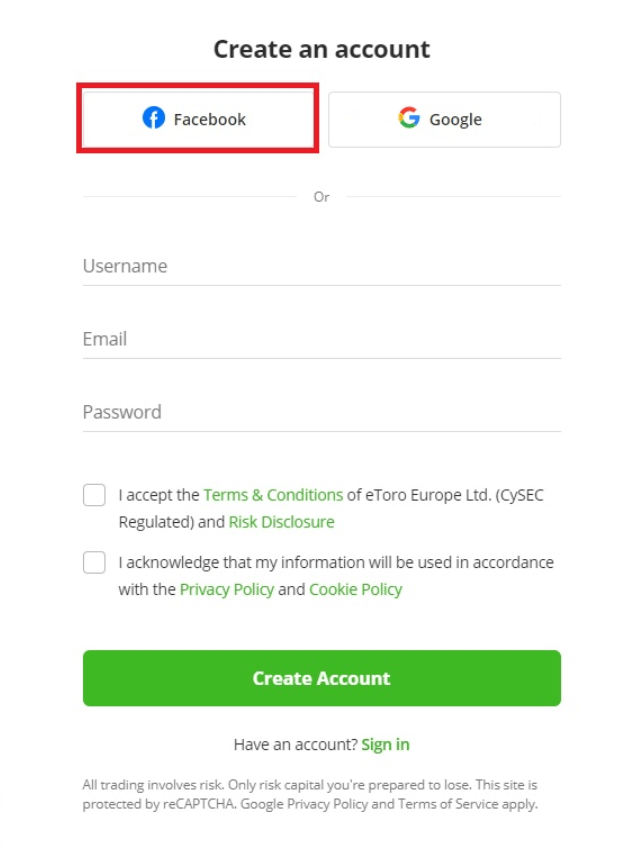

1. Open an account on eToro

The first thing, as usual, is to open an account with the broker.

To do this, we just need to follow these simple steps:

- We go to the eToro website, which you can visit by clicking here *Your capital is at risk.

- Click on the "Open account" button

- We proceed to register, which we can do very easily, by linking our Facebook account with eToro

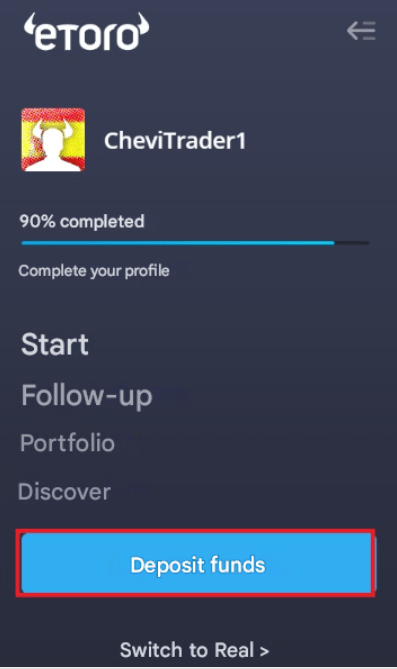

2. Deposit funds

With our account already open, we simply expand the main menu at the top left, and with it expanded, we click on the blue "deposit funds" button.

Next, it will send us to a payment gateway, where we can choose to send money in multiple ways:

- Credit or debit card

- Bank transfer

- Paypal (only available after the first minimum deposit)

Remember that any deposit you make is free of operational fees. However, you should keep the following in mind:

- It only has a dollar account, so if you deposit in any other currency, for example in euros, you will pay a currency exchange rate close to 0.25%

- The first mandatory minimum deposit is 50 dollars

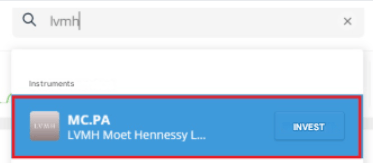

3. Find the stock to buy

With our account open, and the deposit loaded, it's time to buy our first batch of stocks on eToro to start setting up our portfolio.

To do this, on the main start screen, at the top of the magnifying glass, we will write the name of the company, or the ticker, or its ISIN. In this case, we will write the name of the company, LVMH (MC.PA), and select the correct option by clicking on it, as seen in the screenshot below:

Or if we wish, we can also click on the stock, but more specifically on the small box that says "invest"

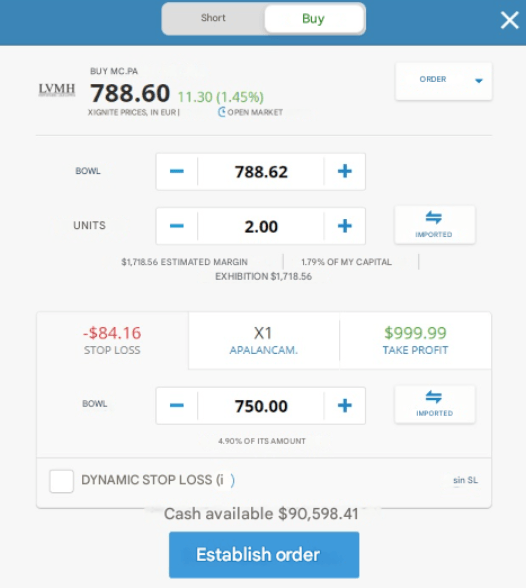

4. Set the purchase order

Before proceeding to set the purchase order on eToro, it is convenient to take a moment to study it a bit.

Consequently, already within the stock's profile, we have a series of sections that allow us to study it slightly:

- Summary sheet

- Chart

- Analyst

- News

- Statistics

For example, if we click on chart, the LVMH stock chart will open with Japanese candlesticks and a one-day timeframe, although both options can be modified to our liking (as seen in the red boxes in the following screenshot)

Having done this, we can proceed to buy it, for which it will be convenient to set the purchase order.

In this case, we will configure a market purchase order, with take profit and stop loss. Let's see it in the screenshot:

At this moment the stock is trading at 788.62 euros. So, let's go step by step:

- Rate: The price at which I want to buy it, in my case at market

- Units: The number of shares I am going to buy, in my case 2.

- Stop loss: The maximum amount I am willing to lose. I will set it at 750 euros. You just have to click on the "Set SL" button

- Leverage: I don't want leverage, to avoid overnight fees and such, so I will leave it as it is at "x1".

- Take profit: I will set it at 1,000 dollars (now the stock is worth 788.62$), so when it reaches 1,000 euros, the stock will be sold directly.

5. Buy shares on eToro

And finally, regarding the established order, we will just click on the blue button, which is seen in the screenshot above "set order". That's it.

And just like that, our purchase of LVMH shares on eToro will have been completed.

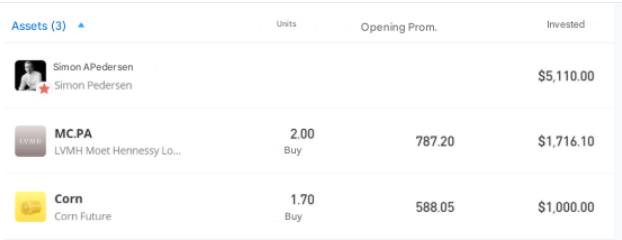

To ensure this, we can expand the main menu, and on the third option "portfolio" click.

Now it's your turn, by following these steps, you can buy any stock on eToro very easily, and without operational commissions.

What stocks does eToro offer?

eToro offers more than 4,500 assets to invest in, including shares of major publicly traded companies, commodities, ETFs, stock indices, and cryptocurrencies.

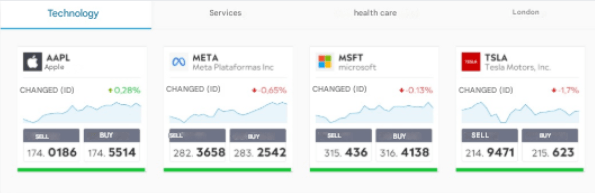

You will find stocks from more than 17 markets, and different sectors, such as technology, services, health...

And of course, you will also find the stocks with the highest trading volume such as Apple (AAPL), META (META), Microsoft (MSFT) or Tesla (TSLA).

To search for stocks, you just need to go to the eToro search engine, as detailed in step 3.

Additionally, you can choose the available actions by category from the top menu, which allows you to search for actions by industry and stock market to which they belong.

Once an asset is selected, it is possible to analyse it in detail by navigating through the different tabs. For example, in Statistics, you will find a summary with charts of the asset's trend over time, performance, variations, capitalisation, and other very useful data for fundamental analysis.

What type of stocks can I buy on eToro?

And now comes the big question, are the stocks I buy on eToro real? Let's see what possibilities the broker regulated in Cyprus offers

Buy real stocks on eToro

Indeed, buying real stocks on eToro means that you are acquiring a real stake in a company. By buying stocks, you own a small part of the company, and as such, you have the right to receive benefits through dividend payments.

As you already know, eToro offers its users more than 4,500 stocks in 17 different markets. You will be able to trade in markets ranging from the US, through Europe, to Japan and even Saudi Arabia.

When you open a BUY position (long) without leverage on a stock, you invest in the underlying asset, that is, in the stock itself.

Buy Fractional Shares on eToro

But on eToro, it is also possible to buy fractional shares, that is, to buy a percentage of the share instead of the full share. In other words, the minimum unit you can purchase is no longer 1 share, but a fraction of a share, up to 0.001, which means you can access shares that have a higher price and that you might not have been able to afford before, starting from amounts as small as 10 dollars.

However, within eToro's accounting, it is noteworthy that even if you only buy a fraction of its shares, in its record book you will appear as the owner of it, in the proportional part you have decided to acquire.

And if you were wondering, yes, through fractional shares, you have the right to receive dividends, but in proportion to your percentage of position in the share.

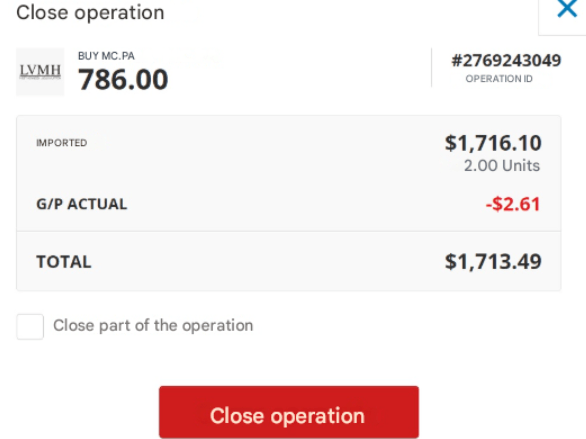

How to Sell Shares on eToro?

Selling stocks on eToro is even easier. To sell the purchased stocks, simply go to the portfolio section, click on the stock you want to sell, and finally, click on the "Close" button. And once again, positions can also be closed partially.

You will see the following:

If you agree, click on the button "Close position".

And if you only want to close part of the position, click on the dropdown "Close part of the trade", and set your partial sell order.

What fees does eToro charge for buying or selling stocks?

Buying stocks with eToro means protecting and multiplying your investment without paying more than necessary. The account opening is free and there are no additional charges for management or other events.

As a rule, eToro barely charges an operational fee (buying-selling stocks) of $1 per trade. However, it is summarised in the following list:

- Stocks: $1 per trade

- Stocks from Australia and Hong Kong: $2 per trade

- ETFs: No commissions

- Cryptocurrencies: 1% of the trade

- Dividend collection fee: $0

- Inactivity fee: $10/month (after 1 year without financial activity)

- Withdrawal fee: 5 USD

Additionally, the platform does not charge additional fees for renewing positions, not to mention other additional fees.

How much money do I need to invest in eToro?

Very little, actually. The minimum deposit to start investing with eToro is just $50. Since eToro is based in Cyprus and its base currency is US dollars, if you're investing from the UK, your pounds will be converted to dollars—subject to a 0.5% currency conversion fee.

As for investments, the minimum amount you can put into any product is $10. That includes fractional shares, ETFs, and more.

Are there fees for withdrawing money from eToro?

Unfortunately, yes. Again, if your bank account is in euros, it most likely is that eToro will charge you two fees:

- The first for the new currency conversion from dollars to euros, which will include a currency conversion fee of 0.5% of the amount.

- And the second of 5 USD, regardless of the amount you decide to withdraw to your bank.

An even easier way to invest in stocks with eToro

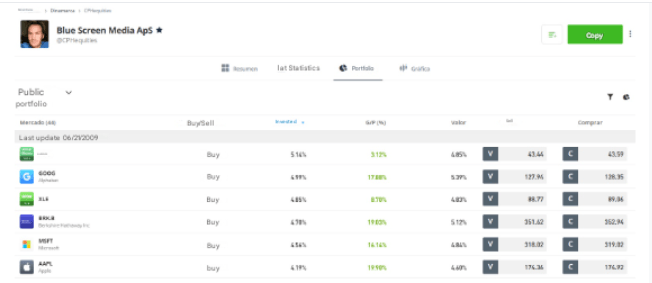

Finally, and as a gift for making it this far, on eToro you still have an alternative to be exposed to stocks - or any other asset - in a much easier way, thanks to its CopyTrader function.

This alternative is simply based on finding the trader that best suits your strategy and copying them.

👉 Here is an article where you can learn about the best trading platforms

Once this is done, you won't have to do anything else. The eToro trading console will open and close your positions based on what the copied trader is doing. Additionally, every operation that the copy trading platform of eToro performs for you will not be subject to any extra commission, beyond those of eToro itself, still, make sure and monitor that you have copied the correct trader.

However, to make the first copy trading operation, you will need to have a minimum of 200 dollars for that operation, and under no circumstances can you copy more than 100 traders simultaneously.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

👉 More information: Best copy trading platforms

Is eToro reliable for buying or selling stocks?

The truth is that according to our own criteria, eToro is one of the most reliable brokers today for buying and selling stocks. With 15 years of experience, it has become the top choice for thousands of clients.

Basically, the most striking qualities of eToro are its transparency and efficiency in executing its operations. As a client, you will always be informed about the status of your money and your transactions.

Finally, and not least, eToro is a regulated platform by top-tier financial authorities such as FCA and ASIC, and to a lesser extent by CySEC for Europe. And while this may be seen as one of its main weaknesses, eToro has shown itself to be both reliable and effective in resolving disputes with its clients.

Alternatives to eToro for buying stocks

👉 Trading212 vs eToro: which is the better broker?

👉 Freetrade vs eToro: which is the better broker?

Disclaimer: