Comparatives

IG vs eToro: What are the differences?

IG and eToro are two of the most recognised brokers in the trading world, each with its own specialisation. IG focuses on financial derivatives and caters more to experienced traders, while eToro is designed for the general public and is particularly well-known for its copy trading feature.

In this comparison, we analyse both brokers’ offerings, fees, and services to help you decide which is the better choice for your investment needs.

Main Features

| Regulation | FCA (UK), BaFin (Germany), others | FCA (UK), CySEC (Cyprus), ASIC (Australia) | |||

| Market Access | 30+ markets | 140+ markets | |||

| Financial Products | Derivatives: Turbo24, warrants, options, multis | Shares, ETFs, crypto, indices, commodities | |||

| Minimum Deposit | £250 | $50 | |||

| Platforms | IG proprietary, MetaTrader 4, L2, ProRealTime | Web-based and mobile apps only | |||

| Demo Account | Yes | Yes | |||

| Customer Support | Phone, email, chatbot | Email, chatbot |

| Feature | IG | eToro |

|---|---|---|

| Regulation | FCA (UK), BaFin (Germany), others | FCA (UK), CySEC (Cyprus), ASIC (Australia) |

| Market Access | 30+ markets | 140+ markets |

| Financial Products | Derivatives: Turbo24, warrants, options, multis | Shares, ETFs, crypto, indices, commodities |

| Minimum Deposit | £250 | $50 |

| Platforms | IG proprietary, MetaTrader 4, L2, ProRealTime | Web-based and mobile apps only |

| Demo Account | Yes | Yes |

| Customer Support | Phone, email, chatbot | Email, chatbot |

Pros and Cons

| IG Pros | IG Cons | ||

| ✅ Advanced trading tools and platforms | ❌ Higher minimum deposit | ||

| ✅ Heavily regulated | ❌ Can be complex for beginners | ||

| ✅ Wide range of derivatives | ❌ Customer support can be slow at times |

| IG Pros | IG Cons |

| ✅ Advanced trading tools and platforms | ❌ Higher minimum deposit |

| ✅ Heavily regulated | ❌ Can be complex for beginners |

| ✅ Wide range of derivatives | ❌ Customer support can be slow at times |

| eToro Pros | eToro Cons | ||

| ✅ Excellent for beginners | ❌ Only operates in USD | ||

| ✅ Low minimum deposit | ❌ Charges a withdrawal fee | ||

| ✅ Social and copy trading features | ❌ Limited support options |

| eToro Pros | eToro Cons |

| ✅ Excellent for beginners | ❌ Only operates in USD |

| ✅ Low minimum deposit | ❌ Charges a withdrawal fee |

| ✅ Social and copy trading features | ❌ Limited support options |

Regulation

IG is one of the most heavily regulated brokers globally and holds authorisation from several top-tier regulators, including the UK’s Financial Conduct Authority (FCA), Germany’s BaFin, and Switzerland’s FINMA.

For UK clients, IG offers strong protection through the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 per person if the firm fails. In the EU (excluding the UK and Switzerland), clients are covered up to €20,000 via BaFin.

This makes IG a highly secure choice for UK traders seeking both regulation and investor protection.

eToro is regulated by CySEC, the UK’s Financial Conduct Authority (FCA), and ASIC in Australia.

Client protection varies by region:

- UK clients are covered up to £85,000 through the FSCS, with additional private insurance extending coverage to £1 million.

- EU clients are protected up to €20,000.

- Australian clients benefit from coverage of up to $1 million.

This strong regulatory framework ensures a high level of security for investors globally.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

Investment Options

IG caters to more experienced UK traders and investors, offering an advanced suite of derivative products and traditional investment options. These include:

- Turbo24 – Exchange-traded instruments with limited risk and 24/5 availability, based on a knockout level.

- Barrier options – Close automatically at a pre-set price, supporting defined-risk strategies.

- Vanilla options – Traditional contracts with flexible strike prices and expiries.

- Warrants – Enable speculation on stocks, indices, and commodities.

- Stocks - 11,000+ stocks to buy

UK clients can also invest in global shares and ETFs via SIPP and Stocks and Shares ISAs, combining tax efficiency with IG’s professional-grade platforms.

eToro is designed for a broader audience, including beginners and long-term investors. Its user-friendly platform offers access to a wide range of real, non-derivative assets, including:

- Over 3,100 shares across 18 global stock markets, available within an ISA

- 300 ETFs

- 70+ cryptocurrencies

- Major commodities, including energy, metals, and agriculture

- Key indices such as the S&P 500, Nasdaq, and VIX

Additionally, eToro features its own crypto wallet and is well known for its social trading tools, making it easy for new investors to discover and copy the strategies of experienced traders.

With no commission on real stocks and ETFs, eToro is especially appealing for UK investors starting their journey into global markets with a low barrier to entry.

👉 Read here to find out more about the best platforms for ETFs

Account Types

IG offers two categories of account types, allowing traders to choose based on their experience and trading style:

Leveraged Accounts

- Spread Betting account: Trade tax-free on price movements of thousands of global markets without owning the underlying asset. Profits (or losses) are based on the amount you bet per point of price movement.

- CFD account: Contracts for Difference (CFDs) let you speculate on the rising or falling prices of financial instruments with leverage. You can trade shares, indices, forex, commodities, and more.

Non-leveraged Accounts

- Share Dealing account: Buy and own real shares from over 11,000 global stocks. Ideal for long-term investors who want to build a portfolio without leverage.

- Stocks and Shares ISA account: Invest in UK and international stocks tax-efficiently, with no capital gains tax or income tax on profits, up to your annual ISA allowance.

- IG Smart Portfolio account: An investment account that builds a diversified portfolio for you, based on your risk profile, using iShares ETFs by BlackRock.

- IG Smart ISA Portfolio account: Combines IG’s Smart Portfolio with ISA tax benefits—automated, diversified investing with no capital gains tax within your ISA allowance.

These accounts can be held simultaneously, offering flexibility to trade different instruments based on your individual preferences and goals.

eToro keeps things simple by offering a single main account for all trading activities, whether you're investing in stocks, ETFs, cryptocurrencies, or other assets. In addition, all users have access to a free demo account, which is ideal for practising strategies without risking real money.

eToro also offers:

- Personal account: This is the standard eToro account for individual traders and investors. It allows access to all features, including stocks, ETFs, crypto, CFDs, and copy trading. Suitable for retail clients with standard protections like negative balance protection and limited leverage.

- Professional account: Designed for experienced traders who meet specific eligibility criteria (like trading volume, experience, and portfolio size). Offers higher leverage and fewer regulatory protections (e.g., no negative balance protection), in exchange for more trading flexibility.

- Corporate account: Intended for businesses or institutions wanting to trade through a registered company. Offers custom account management, higher funding limits, and access to eToro’s full suite of investment products under a corporate structure.

For those with larger balances, eToro offers access to the eToro Club—a tiered membership programme that provides added benefits such as priority customer support, market insights, and exclusive tools, with perks increasing based on your account equity.

Fees and Charges

IG’s fees vary depending on the product traded. For example:

- Turbo24: Low, fixed commission per trade (e.g. £0.80 per contract in some markets)

- Vanilla options: 0.1 units per contract

- Share CFDs: Commission applies (e.g. £3 for UK shares)

- Forex: IG charges a spread (variable by currency pair)

- Indices/commodities/crypto: Spread-based pricing – varies by market

Possible Additional Fees

- Currency conversion fee: If you trade assets in a currency other than your base account currency (e.g. trading US shares in a GBP account), a conversion fee of 0.5% typically applies.

- Overnight financing (swap/rollover fee): Charged on positions held overnight for leveraged products like CFDs and options. This varies daily and is shown in your platform.

- Guaranteed stop-loss order fee: Only charged if the guaranteed stop is triggered.

- ProRealTime advanced charting: Free if you place 4+ trades per month, otherwise £30/month

- MetaTrader 4 usage: No fee for using the platform itself, but third-party plugins or premium indicators may cost extra.

👉 Read here for more information on: MT4 vs ProRealTime

For UK clients, IG charges no fees for deposits or withdrawals, and there is no inactivity fee, making it a cost-effective choice for both active and occasional traders.

eToro charges no commission on real shares or ETFs. However:

- Cryptocurrencies: 1% spread (included in the buy/sell price)

- Stock indices: From 0.75 points

- Commodities: From 2 pips

- Forex: Variable spreads, depending on the currency pair

- Leveraged positions (CFDs): Spread-based and subject to overnight fees

- Currency conversion fee: Since eToro accounts are in USD only, any deposit or withdrawal in GBP incurs a conversion fee. For GBP to USD, this is typically 50 pips (0.5%).

- Withdrawal fee: $5 per withdrawal

- Inactivity fee: $10/month after 12 months of no login or trading activity

- Minimum withdrawal: $30

For UK clients, eToro does not charge fees for deposits. eToro remains a competitive option, especially for investors trading real stocks and ETFs without commission.

Minimum Deposit and Withdrawals

IG requires a minimum deposit of £250 for UK clients when funding via debit/credit card or bank transfer. Deposits are generally free of charge, and funds usually arrive instantly when using cards.

IG does not charge any fees for withdrawals, which are typically processed within 1–3 business days. There are also no inactivity fees, making IG suitable for both active and occasional traders.

eToro has a lower minimum deposit requirement of $50 for UK clients. Deposits can be made via various methods including credit/debit cards, PayPal, and bank transfers, all free of charge. However, withdrawals incur a fixed fee of $5, and the minimum withdrawal amount is $30.

Additionally, eToro charges a $10/month inactivity fee if no trading or login activity occurs for 12 months. Currency conversion fees apply since accounts are held in US dollars.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

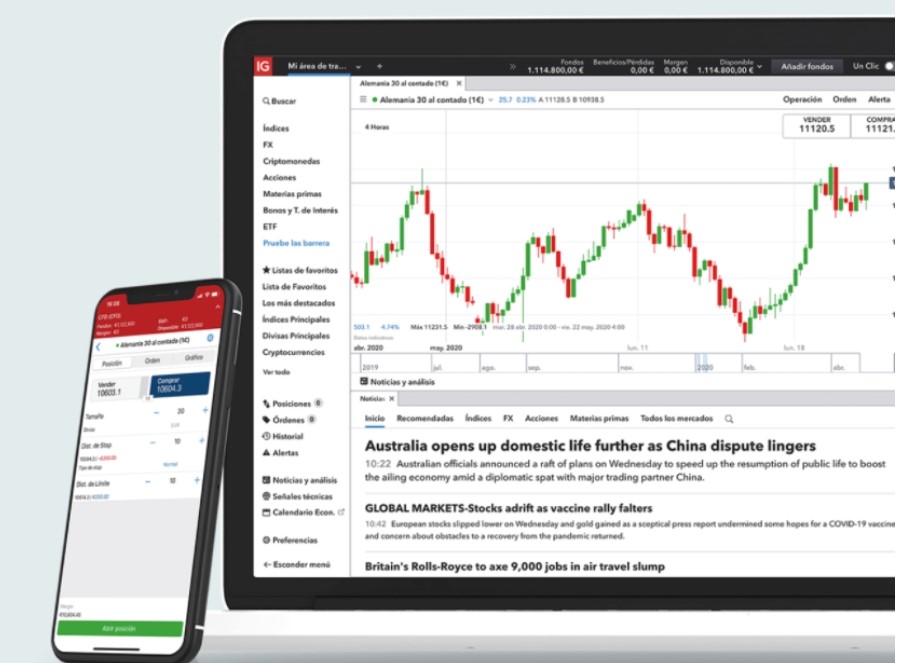

Trading Platforms

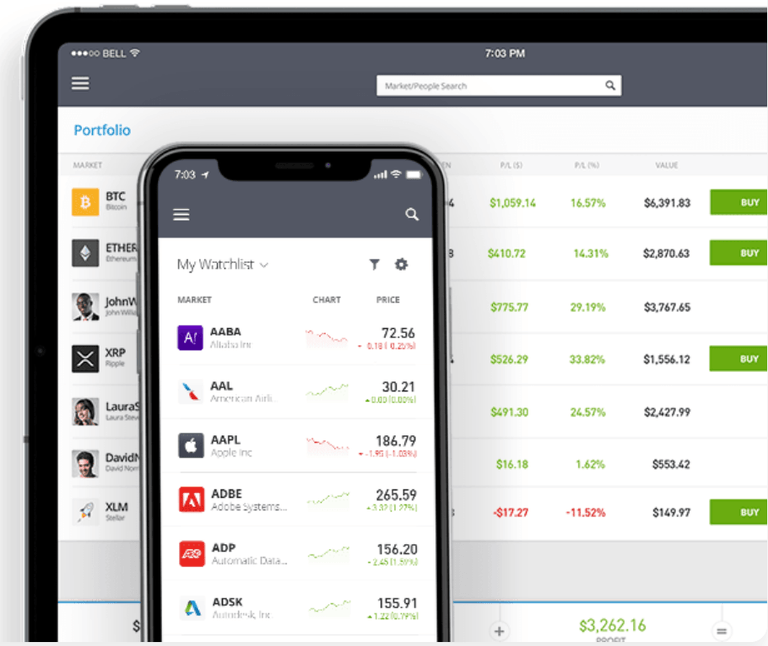

IG offers a powerful, professional-grade trading platform suitable for both beginners and experienced traders. Its web platform is highly customisable, allowing users to create watchlists, set alerts, and arrange multiple windows. IG also supports MetaTrader 4 (MT4) for advanced charting and automated trading.

Mobile apps for iOS and Android provide full functionality on the go. The platform is available in English and designed to meet the needs of serious traders.

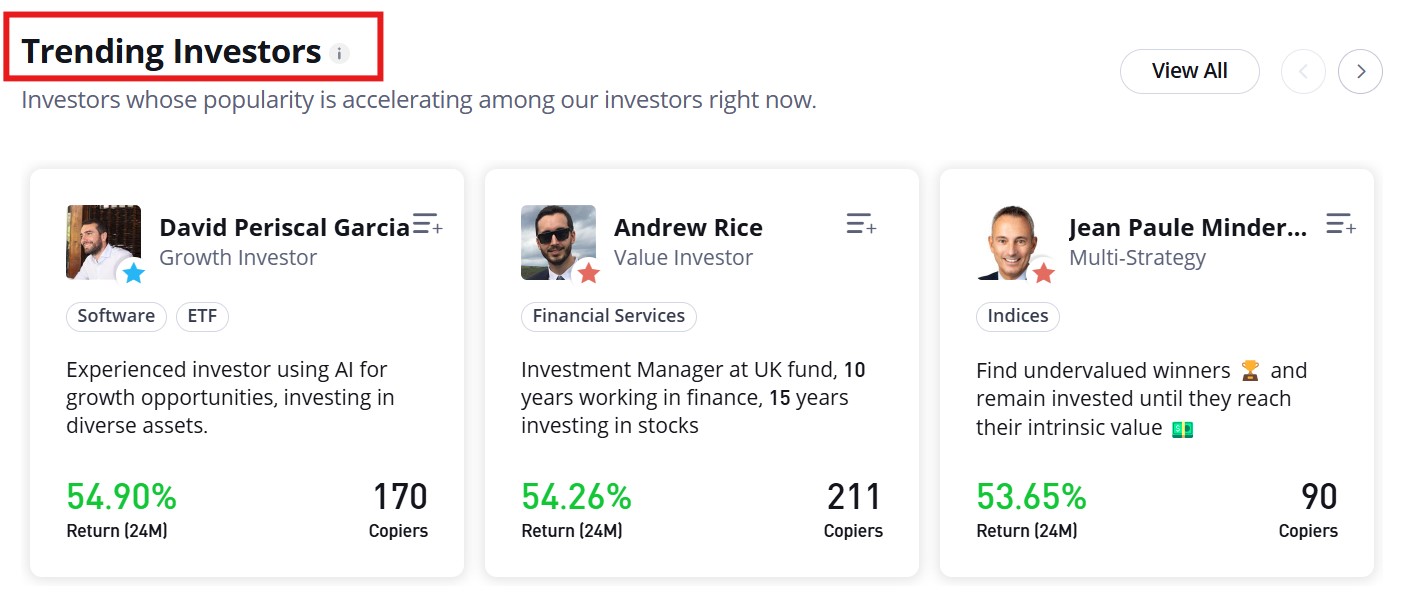

eToro’s proprietary platform focuses on simplicity and social trading. It is user-friendly, ideal for beginners and casual investors, and includes features like CopyTrading, which lets users follow and replicate top traders’ portfolios.

Available on web and mobile (iOS and Android), eToro’s platform includes basic charting tools and alerts but lacks some advanced features favoured by professional traders. Its social community features are a key attraction for those new to investing.

Education and Resources

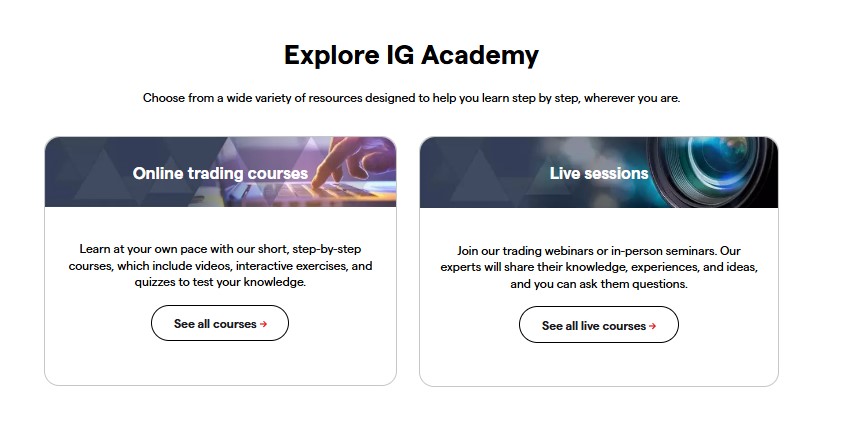

IG stands out for its robust educational offering, especially for traders looking to develop their skills over time. The IG Academy provides structured learning through free online courses, webinars, tutorials, and quizzes.

Topics range from beginner basics to advanced trading strategies. IG also offers daily market analysis, trading signals, and insights from in-house experts — ideal for both new and experienced traders looking to stay informed.

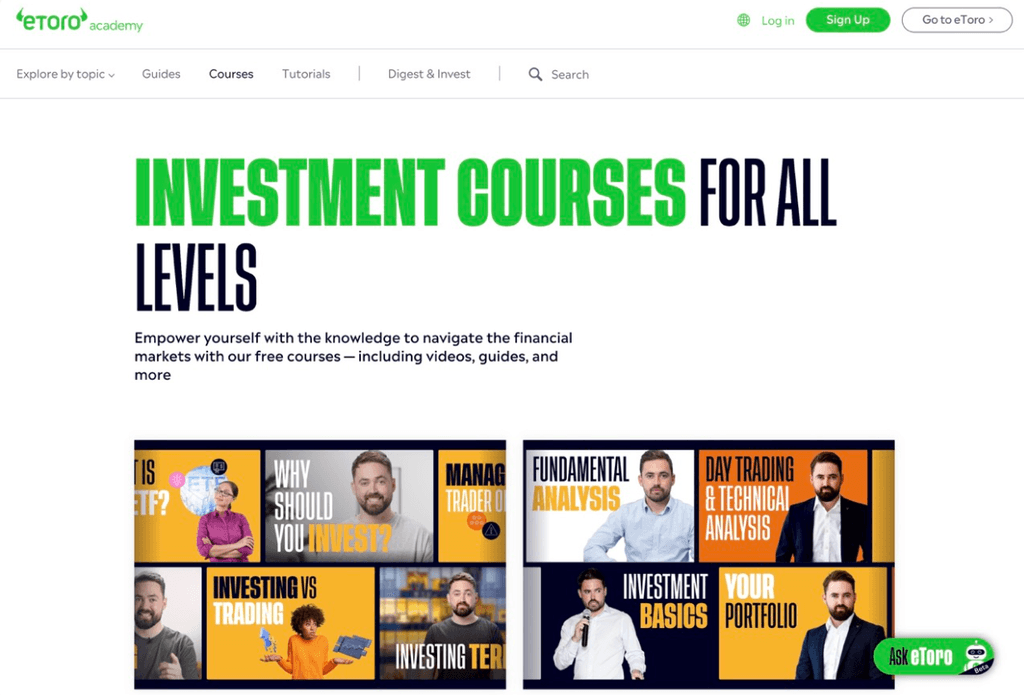

eToro also provides a range of educational tools, but with more emphasis on accessibility and community learning. Its Education Centre includes video tutorials, trading guides, and articles covering the essentials of investing.

A unique aspect of eToro is its social trading environment, where users can learn by observing and copying top-performing traders. It’s a more hands-on, real-time approach that suits beginners and those who prefer a community-driven experience.

Customer Support

IG offers a broad range of customer support options tailored for UK traders. Support is available via phone and email, providing direct and personal assistance when needed. Their dedicated help centre is comprehensive, featuring FAQs, guides, and troubleshooting resources to quickly resolve common issues. Beyond basic support, IG’s standout feature is the IG Academy — a free training platform offering webinars, tutorials, and courses designed to help traders at all levels sharpen their skills and trading knowledge.

eToro’s customer service options are more limited. There is no phone support available in the UK; instead, customers can get help through email and an AI-powered chatbot. While this setup can handle many queries, it may not suit those who prefer real-time human interaction. eToro does provide a detailed Help Centre with educational content and guides, which is useful for new investors, but overall, their customer support is less extensive compared to IG.

User Opinions

IG also maintains a solid standing, with a Trustpilot rating of 3.9 out of 5 from more than 8,000 reviews. Traders praise IG for its professional-grade tools, extensive market access, and high regulatory standards. While some users find the platform more complex, it's often preferred by more experienced or active traders who value advanced features and flexibility.

eToro enjoys a strong reputation among retail investors, with a Trustpilot rating of 4.2 out of 5 based on over 28,000 reviews. Users often highlight its intuitive platform, wide range of available assets, and the convenience of its CopyTrader™ feature. It’s particularly well-regarded by beginner and intermediate investors for its ease of use and accessibility.

Conclusion

Both IG and eToro are safe, regulated platforms. The better broker for you depends on your trading style and goals. IG suits traders seeking control and advanced features. eToro appeals to beginners and those interested in social investing.

FAQs

What is IG?

Founded in London in 1974, IG began as a broker specialising in gold trading—hence the name "Investors Gold Index." Now operating as IG Group (since 2000), it has grown into a global brand with 17 offices worldwide.

IG offers platforms for both retail and institutional investors, with a strong focus on trading derivatives like Turbo24, warrants, and options. Widely regarded as one of the best trading platforms in the industry, it also supports MetaTrader 4, a popular choice for technical analysis. IG is listed on the London Stock Exchange, reinforcing its reputation for security and transparency.

👉Read our IG review to learn more.

What is eToro?

Established in 2007 and headquartered in Cyprus, eToro also has offices in the UK, Israel, and the US. It rose to global prominence during the pandemic, thanks largely to its easy-to-use platform and social trading features.

eToro supports investment in shares, ETFs, commodities, currencies, and cryptocurrencies. It's particularly notable for pioneering copy trading—widely recognised as one of the best copytrading platforms—allowing users to replicate the strategies of successful investors directly on the platform.

👉Read our eToro review to learn more.

Can you trade cryptocurrency with IG or eToro?

eToro

- Yes, you can trade real cryptocurrencies (e.g., Bitcoin, Ethereum, etc.) as well as crypto CFDs (in some regions).

- Offers crypto wallets, social trading, and access to dozens of coins.

- Available to retail and professional traders, depending on location.

IG

- You can trade cryptocurrency CFDs (like BTC, ETH, LTC) with IG, but not the actual coins.

- No crypto wallet provided — you're speculating on price, not owning the asset.

- Crypto CFDs may be restricted for retail clients in the UK due to FCA regulations.

Disclaimer: