Brokers

IG vs Hargreaves Lansdown: Comparison

If you're weighing your options between IG and Hargreaves Lansdown, this comparison breaks down two of the UK's most prominent investment platforms. It highlights their differing strengths—from IG’s advanced trading tools, competitive fees, and access to speculative products like CFDs, to Hargreaves Lansdown’s broad range of investment services (including ISAs, SIPPs, funds, and bonds), deep research resources, and trusted reputation among long-term investors.

IG and Hargreaves Lansdown are both among the UK's most established financial companies but how do these brokers work? Use this comparison guide to understand the platforms and choose the one best suits your investment strategy.

IG vs Hargreaves Lansdown Compared

| Features | IG Broker | Hargreaves Lansdown | |||

| Regulation | Regulated in the UK by the Financial Conduct Authority (FCA). | Regulated by the UK's Financial Conduct Authority (FCA). | |||

| Financial Compensation Claims | £85,000 | £85,000 | |||

| Account types | Spread betting account CFD Trading account Share Dealing account Smart Portfolio account Demo Account | Stocks and shares ISA Share dealing account Lifetime ISA (LISA) Self-invested Personal Pension (SIPP) Junior SIPP Junior ISA (JISA) Active Savings | |||

| Market asset | Shares, Forex, Indices, Commodities, Cryptocurrencies, ETFs, Spot and Futures, CFDs, and Spread-betting | Funds, Shares, Investment trusts, Exchange-traded Funds (ETFs), Gift and corporate bonds, and Cash | |||

| Trading Platform | Proprietary trading platform and third-party platform (MT4 and ProRealTime, L2 Dealer) | Proprietary trading platform | |||

| Deposit and Withdrawal fee | Zero fee | Zero fee | |||

| Deposit Method | Debit card, Credit card, and Bank transfer | Debit card and Bank transfer | |||

| Demo Account | Yes | No | |||

| Minimum deposit | £1 for bank transfer and £250 for debit card | £1 for HL Fund and Share Account and £100 minimum into Funds | |||

| Currency Conversion fee | 0.5% | 0.25% to 1% depending on trade value | |||

| Inactivity Fee | No inactivity fee | No inactivity fee |

| Features | IG Broker | Hargreaves Lansdown |

| Regulation | Regulated in the UK by the Financial Conduct Authority (FCA). | Regulated by the UK's Financial Conduct Authority (FCA). |

| Financial Compensation Claims | £85,000 | £85,000 |

| Account types | Spread betting account CFD Trading account Share Dealing account Smart Portfolio account Demo Account | Stocks and shares ISA Share dealing account Lifetime ISA (LISA) Self-invested Personal Pension (SIPP) Junior SIPP Junior ISA (JISA) Active Savings |

| Market asset | Shares, Forex, Indices, Commodities, Cryptocurrencies, ETFs, Spot and Futures, CFDs, and Spread-betting | Funds, Shares, Investment trusts, Exchange-traded Funds (ETFs), Gift and corporate bonds, and Cash |

| Trading Platform | Proprietary trading platform and third-party platform (MT4 and ProRealTime, L2 Dealer) | Proprietary trading platform |

| Deposit and Withdrawal fee | Zero fee | Zero fee |

| Deposit Method | Debit card, Credit card, and Bank transfer | Debit card and Bank transfer |

| Demo Account | Yes | No |

| Minimum deposit | £1 for bank transfer and £250 for debit card | £1 for HL Fund and Share Account and £100 minimum into Funds |

| Currency Conversion fee | 0.5% | 0.25% to 1% depending on trade value |

| Inactivity Fee | No inactivity fee | No inactivity fee |

Investment Products

IG and Hargreaves Lansdown are financial institutions that offer investors several financial instruments.

| Hargreaves Lansdown | IG | ||||

| Share Trading | Yes | Yes | |||

| CFD Trading | No | Yes | |||

| ETFs | Yes | Yes | |||

| Funds | Yes | No | |||

| Bonds - Govt (Gilts) | Yes | No | |||

| Investment Trusts | Yes | Yes | |||

| Spread betting | No | Yes | |||

| Crypto Trading | No | No |

| Hargreaves Lansdown | IG | |

| Share Trading | Yes | Yes |

| CFD Trading | No | Yes |

| ETFs | Yes | Yes |

| Funds | Yes | No |

| Bonds - Govt (Gilts) | Yes | No |

| Investment Trusts | Yes | Yes |

| Spread betting | No | Yes |

| Crypto Trading | No | No |

👉 Read here for more information on the best CFD brokers

Account Types

IG Broker offers clients four major types of accounts, each focusing on different trading strategies to provide investors with the best options. Additionally, it offers a demo account for novice investors to try out strategies and become familiar with the platform.

The account types include:

| IG Account Types | Hargreaves Lansdown Account Types | ||

| Spread Betting Account | Stock and Shares ISA | ||

| CFD Trading Account | Lifetime ISA (LISA) | ||

| Share Dealing Account | Junior ISA (JISA) | ||

| Smart Portfolios Account | Self-invested Personal Pension (SIPP) | ||

| Demo Account | Junior SIPP | ||

| Retirement | |||

| Annuities |

| IG Account Types | Hargreaves Lansdown Account Types |

| Spread Betting Account | Stock and Shares ISA |

| CFD Trading Account | Lifetime ISA (LISA) |

| Share Dealing Account | Junior ISA (JISA) |

| Smart Portfolios Account | Self-invested Personal Pension (SIPP) |

| Demo Account | Junior SIPP |

| Retirement | |

| Annuities |

Trading Platforms

The beauty of financial brokers these days is their deviation from the traditional model of a physical trading system to an online trading platform you can access at your convenience. IG and Hargreaves Lansdown operate on online trading platforms, allowing investors to execute their transactions seamlessly.

You can access the IG market through its intuitive proprietary platform (web and mobile app) and other third-party trading platforms, including MetaTrader 4, ProRealTime, and L2 Dealer.

If you're unsure which platform suits you best MetaTrader 4 or ProRealTime—IG offers demo accounts to explore each and find what fits your trading style.

The IG online trading platform is a powerful browser and mobile device compatible with desktop, laptop, Android, and iOS devices. It contains research tools and technical indicators and boasts a super-fast trade execution time.

All third-party trading platforms are globally known for trading CFDs, Forex, and Spread betting. They consist of highly customised trading and analysing tools for professional traders to execute their positions.

The flexibility of the IG market and other third-party platforms gives clients the freedom to choose the platform that is best for them.

Hargreaves Lansdown has a well-designed and easy-to-navigate trading mobile app and website. The mobile app is compatible with Android and iOS devices and is secured with touch and face ID to prevent security breaches.

With the trading platforms, you can access your Hargreaves Lansdown online account and buy, sell, and manage transactions.

Deposit and Withdrawal

The IG broker provides seamless deposit and withdrawal methods with zero fees.

Deposit Methods

The payment methods IG accepts are:

- Debit or Credit card- This is the quickest way to fund your account. It's almost instant. You can have up to five cards listed on your account at a time, but they must be in your name and registered to the address you use for your IG account.

- Bank Transfer— You can return your IG funds to your verified bank account. This process takes 1-3 business days to clear, with no maximum or minimum withdrawal limit.

Withdrawal Methods

On the IG platform, you can withdraw:

- Back to Credit or Debit Card—This is like a form of refund to your card bank details. It usually takes 2-5 bank working days to receive the funds. The minimum you can withdraw from a card is $150. If you have less than $150 on your account, you can withdraw up to the amount available. The maximum card withdrawal per day is $25,000.

- Bank Transfer— You can transfer your available IG funds back to your verified bank account. This process takes 1-3 business days to clear, with no maximum or minimum withdrawal limit.

Hargreaves provides easy, free, and straightforward deposit and withdrawal methods.

Deposit Methods

- Debit Card: If you can access your Hargreaves Lansdown account online, you can add money using your debit card by selecting the 'add money' tab. This method is instant.

- Telephone: You can contact Hargreaves Lansdown on 0117 988 9965 with your debit card details.

- By Post: You can send a cover letter quoting your cheque, and it’s made payable to 'HLAM Client A/C.'

Withdrawal Methods

- Bank transfer – Provided your bank accepts Faster Payment, you can withdraw from the Hargreaves Lansdown app or website. The maximum amount you can request online per day is £9,999.

- Telephone: Hargreaves Lansdown must have cleared the Nominated Bank Account on record and set up your security details to use this method. You can contact them at 0117 980 9950 to request a withdrawal.

User Opinions and Reviews

What current customers say about the brokers' services is important when choosing any of them. Are the investors satisfied with their current service?

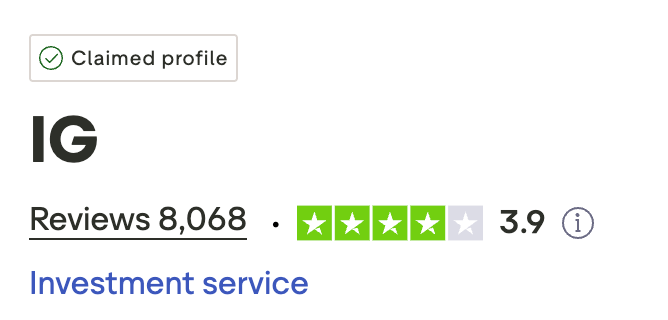

The IG investment services have over 8,000 reviews and ratings on Trustpilot, scoring 3.9 out of 5-star ratings.

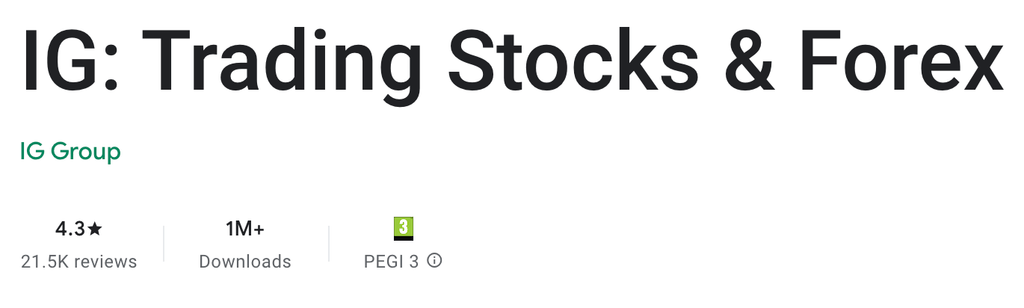

On Google Play Store, IG Trading Platform gathers over 21,500 reviews and ratings with 4.3 out of 5-star ratings.

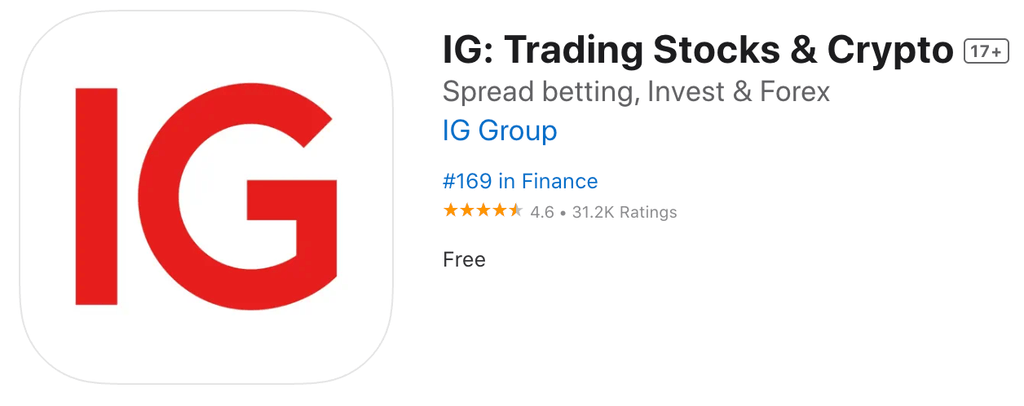

In addition, the IG trading platform has a 4.6 out of 5-star rating with over 31,200 reviews on the Apple App Store.

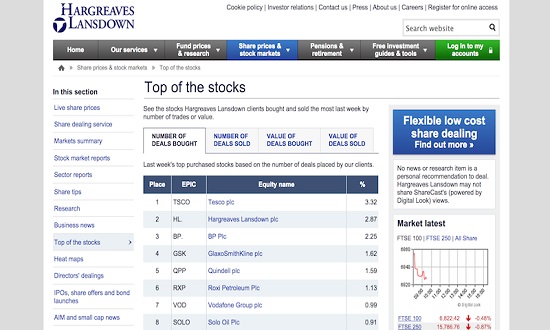

As an old financial institution still holding to its traditional styles of investment strategy, Hargreaves Lansdown has a 4.4 out of 5-star rating on Trustpilot from 17,000+ reviewers.

The majority of the reviews describe the platform's versatility and excellent customer service. However, it loses star ratings because it is expensive to manage for both small and large portfolios.

Also, the Hargreaves Lansdown app has 1M+ downloads on the Google Play Store and over 14,000 reviews and ratings, showing 4.5 out of 5-star ratings.

FAQs

What is IG?

IG Broker, part of IG Group and listed on the London Stock Exchange, is a leading provider of CFDs, forex, cryptocurrencies, and spread betting.

Founded in 1974 and headquartered in London, IG has grown to offer trading in gold and over 18,000 assets globally. It now operates in regions including Australia, the US, China, and across the EEA.

IG offers both trading and investment accounts. Trading accounts allow access to CFDs and spread betting, while investment accounts include share dealing, Stocks and Shares ISAs, and managed Smart Portfolios.

Regulated in all the countries it operates in, IG adheres to strict financial standards. It provides access through its own intuitive platform and third-party tools like MetaTrader. A free demo account is also available for practice with virtual funds.

Investors trading UK shares through IG can do so during London Stock Exchange hours: 8:00 AM to 4:30 PM (UK time), Monday to Friday.

What is Hargreaves Lansdown?

Hargreaves Lansdown, founded in 1981 and based in Bristol, is one of the UK’s oldest and most trusted financial firms. It’s listed on the London Stock Exchange and part of the FTSE 100, managing over £120 billion for 1.7 million clients.

The broker offers investment services to UK residents, with access to funds, shares, bonds, and ETFs across UK, Canadian, and European markets.

Clients can open an investment account to manage portfolios, use trading tools, and receive market updates. Its proprietary trading platform is easy to use and available on iOS and Android, allowing full control over investments on the go.

The website is user-friendly, offering investment guides, calculators, and the latest market news. With access to over 3,000 funds and a strong reputation, Hargreaves Lansdown remains a top choice for long-term investors.

You can trade UK shares during London Stock Exchange hours: 8:00 AM to 4:30 PM (UK time), Monday to Friday, directly through the platform.

Is Hargreaves Lansdown a good broker?

Hargreaves Lansdown offers several sophisticated research tools, a comprehensive selection of investment options, and a user-friendly mobile app. However, the company's pricing is expensive.

Is IG a good broker?

IG has one of the most complex offerings on the market when it comes to CFDs and spread betting. Regardless of their objectives, it may be the right choice for many investors and traders because of its broad offering in products, markets, tools and analysis, and platforms.

Are they safe?

The regulatory status of financial brokers is one of the most essential aspects to consider when choosing a broker. With a regulated broker, you're sure your investments are safe. A regulated broker adheres strictly to the rules of the regulation body.

IG Broker Regulation

IG is a UK-based financial broker regulated by the Financial Conduct Authority (FCA), which enforces strict standards for financial firms.

Its regulatory status across multiple countries offers added protection for investors. In the UK, IG is covered by the Financial Services Compensation Scheme (FSCS), which safeguards up to £85,000 in the event of bankruptcy.

IG is also listed on the London Stock Exchange, adding an extra layer of transparency and trust to its operations.

Hargreaves Lansdown Regulation

Hargreaves Lansdown is authorised and regulated by the FCA, ensuring high standards of financial conduct.

Investments are protected by the FSCS, covering up to £85,000 if the platform fails. Client funds are kept in segregated accounts, safe from company creditors.

A treasury committee oversees fund management, and assets are held in nominee accounts, with HL taking full responsibility for any defaults.

These safeguards make Hargreaves Lansdown a secure choice for UK investors.

What is their customer service like?

IG provides its customers with a detailed help section on its website, where it answers most of the commonly asked questions about the platform.

In addition, the platform offers alternative options for clients to contact customer support services. These alternatives include:

- Office in London, UK

- Contact Phone - You can speak to IG experts at +44 (20) 7633 5431. The service is available 24 hours, Monday to Friday

- Live Chat – The IG Trading platform has a live chat platform where you can discuss it with their experts.

- Email - You can contact IG through mail. You should respond usually within a day.

Hargreaves Lansdown offers highly-regarded and exclusive customer support via:

- Phone: Phone lines are available 8am to 5pm on business days and 9:30am - 12:30pm Saturday

- Email: Through the website