Brokers

Interactive Brokers Review

Interactive Brokers has been a significant player in the brokerage world since its establishment over 46 years ago. Based in Greenwich, Connecticut, the company has expanded globally, boasting offices in multiple countries including the United Kingdom.

In this detailed review, we'll explore the critical elements that UK traders should consider, including regulation and safety, the range of markets and products, as well as the company's structure of commissions and fees.

Pros and Cons

| Pros of IBKR | Cons of IBKR | ||

| ✅ Regulated by the SEC, FCA and the Central Bank of Ireland | ❌ May seem quite complex for beginners | ||

| ✅ Access to a large number of products and markets | ❌ It is not the cheapest broker for retail traders | ||

| ✅ Multiple base currencies, including GBP | ❌ Interest on cash balances only for $100,000 and up | ||

| ✅ Many trading platforms available | |||

| ✅ Broker for professionals |

| Pros of IBKR | Cons of IBKR |

| ✅ Regulated by the SEC, FCA and the Central Bank of Ireland | ❌ May seem quite complex for beginners |

| ✅ Access to a large number of products and markets | ❌ It is not the cheapest broker for retail traders |

| ✅ Multiple base currencies, including GBP | ❌ Interest on cash balances only for $100,000 and up |

| ✅ Many trading platforms available | |

| ✅ Broker for professionals |

Key features

Here is a quick overview of the main features of Interactive Brokers UK:

| Features | Explanation | ||

| Regulations | IBKR is regulated by the FCA in the UK, SEC in the US and the Central Bank of Ireland (CBI) in the European Union. | ||

| Investor Protection | Coverage up to £85,000 under the FSCS. | ||

| Products | A diverse range includes stocks, ETFs, mutual funds, forex, and more across over 160 global markets. | ||

| Markets | More than 160 global markets | ||

| Minimum deposit | £0 | ||

| Buy/Sell Commission (UK stocks) | Minimum 4 GBP/share | ||

| Buy/Sell Commission (EU stocks) | Minimum 4 EUR/share | ||

| Withdrawal fee | Free (one withdrawal per month) | ||

| Inactivity fee | £0 | ||

| Platforms | Global Trader, Client portal, IBKR Mobile, Trader Workstation, and IBKR API, IMPACT, IBKR Campus Platform, IBKR Desktop |

| Features | Explanation |

| Regulations | IBKR is regulated by the FCA in the UK, SEC in the US and the Central Bank of Ireland (CBI) in the European Union. |

| Investor Protection | Coverage up to £85,000 under the FSCS. |

| Products | A diverse range includes stocks, ETFs, mutual funds, forex, and more across over 160 global markets. |

| Markets | More than 160 global markets |

| Minimum deposit | £0 |

| Buy/Sell Commission (UK stocks) | Minimum 4 GBP/share |

| Buy/Sell Commission (EU stocks) | Minimum 4 EUR/share |

| Withdrawal fee | Free (one withdrawal per month) |

| Inactivity fee | £0 |

| Platforms | Global Trader, Client portal, IBKR Mobile, Trader Workstation, and IBKR API, IMPACT, IBKR Campus Platform, IBKR Desktop |

Is it safe?

The robust regulatory framework surrounding Interactive Brokers extends to protection schemes for investors, which are essential in the unlikely event of bankruptcy. In the UK, the Financial Services Compensation Scheme (FSCS) protects investments up to £85,000 per client, offering a significant safety net.

The regulation and coverage in case of bankruptcy of interactive brokers for each of the markets in which it operates are defined in the following table:

Is it regulated?

Interactive Brokers is regulated by several of the world's most stringent regulatory bodies. In the United States, it is overseen by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), while in the UK, it is regulated by the Financial Conduct Authority (FCA). These agencies ensure that Interactive Brokers adheres to strict financial and ethical standards, providing significant security reassurances for its clients.

The presence of Interactive Brokers on the New York Stock Exchange (NYSE) under the ticker IBKR further elevates its transparency and accountability. Being publicly listed mandates the broker to disclose financial information regularly, ensuring continuous regulatory scrutiny and fostering trust among investors.

Available Investment Products

Interactive Brokers boasts one of the most comprehensive product offerings in the brokerage industry, making it a standout choice for traders and investors seeking versatility and depth in their investment options. This diversity is a significant competitive advantage, providing flexibility that caters to a wide array of investment strategies and needs.

Interactive Brokers offers a broad range of financial products, all accessible through a single, integrated platform. This inclusivity ensures that investors can manage a diverse portfolio without needing multiple accounts or platforms, simplifying the investment process. Here’s a closer look at what Interactive Brokers has to offer:

- Stocks (including fractional shares): Trade in a wide range of global stocks, including the option to buy fractional shares, which is particularly beneficial for UK investors looking to invest in high-value stocks without committing to a full share.

- Investment Funds: Access to different investment funds, providing opportunities for portfolio diversification and risk management.

- ETFs: A wide array of exchange-traded funds (ETFs), including sector-specific, commodity, and international ETFs, are tailored to meet different investment goals and strategies.

👉 What is an ETF? Read here to find out more!

- Futures: Trade on future contracts across commodities, indices, and more, suitable for those looking to hedge other investments or speculate based on future price movements.

- Bonds: A robust selection of government and corporate bonds, offering a reliable income stream and safety in volatile markets.

- Options: Flexibility with options trading, allowing investors to leverage their positions or hedge against potential losses.

- Forex: Trade on the global forex market with competitive spreads and access to major and exotic currency pairs.

👉 For more on the best forex brokers, read here!

- Commodities: Opportunities to invest in physical goods such as gold, oil, and agricultural products, which can diversify investment strategies and hedge against inflation.

- CFDs are contract-for-differentials products for traders who prefer to speculate on price movements without owning the underlying asset.

- Fractional Shares: This feature allows investors, especially from the UK, to purchase fractions of ETFs and US and European stocks, enabling the building of balanced and diversified portfolios even with limited capital. It’s an excellent way for new investors to gain exposure to higher-priced stocks and ETFs at a fraction of the cost.

- Spot Currencies: Trade major and minor currency pairs with competitive spreads, ideal for those looking to speculate on currency price movements or hedge against currency risk.

- Mutual Funds: Invest in a wide selection of mutual funds from global markets, offering diversification and professional management to suit various investment strategies.

- Metals: Gain exposure to precious metals like gold and silver, providing a safe haven during economic uncertainty and a hedge against inflation.

Account Types

Interactive Brokers offers various account types designed to cater to the diverse needs of individual investors, whether they're trading individually or jointly. Below, we break down the specifics of each available account type, including Lite, Pro, Cash, Reg T Margin, Portfolio Margin, and the Demo account, focusing on their features and requirements to help UK investors make informed decisions.

IBKR Lite Account

The IBKR Lite account is a great option for casual or beginner investors who are looking for a straightforward, cost-effective way to trade. It offers commission-free trading for stocks and ETFs, making it ideal for UK traders looking to avoid fees while maintaining simplicity:

- Transaction Basis: Trades are executed commission-free on stocks and ETFs. However, there may be wider spreads compared to IBKR Pro, which can affect the overall cost of each trade.

- Trading Limitations: While options and other asset classes can be traded, the Lite account is geared more towards simple stock and ETF investing. Advanced features such as futures and forex trading are not as readily available, and the account is less suited for active or complex traders.

- Settlement Period: Like most accounts, funds from sales will not be available for trading until the typical settlement period of 2 days in the UK has passed.

IBKR Pro Account

The IBKR Pro account is designed for more active and experienced traders who require access to advanced tools and a wider range of investment options. It offers significantly more flexibility compared to IBKR Lite, including access to a broad selection of asset classes:

- Transaction Basis: IBKR Pro charges commissions on trades, but the rates are extremely competitive, especially for larger trades or active traders. This account is ideal for those who need more comprehensive trading features and real-time data.

- Trading Limitations: With IBKR Pro, traders can engage in a full range of products, including stocks, ETFs, options, futures, and forex. It also offers access to advanced features such as margin trading and risk management tools, making it ideal for traders looking to implement more complex strategies.

- Settlement Period: Similar to the Lite account, funds from sales are subject to the typical settlement period, lasting 2 days in the UK. However, the additional tools and advanced features available with IBKR Pro make it more suited for active traders who need real-time liquidity.

IBKR Cash Account

The Cash Account is the most basic type of account you can open with Interactive Brokers. It's ideal for investors who prefer simplicity and are cautious about taking on debt:

- Transaction Basis: Trades are executed using the available funds in the account. There's no leverage available, meaning you cannot borrow funds or engage in short selling.

- Trading Limitations: Options trading is restricted, and futures trading is not permitted. This could influence investment strategies, particularly for those looking to engage in more sophisticated trades.

- Settlement Period: After selling shares, the funds from the transaction will not be available for trading until after the settlement period, which typically lasts 2 days in the UK.

IBKR Reg T Margin Account

A step up in terms of flexibility and potential for higher returns, the Reg T Margin Account allows more experienced traders to leverage their investments:

- Age and Deposit Requirements: Investors must be at least 21 years old and deposit a minimum of $2,000.

- Leverage: This account type allows investors to borrow against the value of the securities in their account to open new positions or engage in short sales.

IBKR Portfolio Margin Account

For investors looking for even greater leverage and the ability to undertake riskier trades, the Portfolio Margin Account offers advanced features:

- Capital Requirement: A significant initial investment of $100,000 is needed to open this type of account.

- Enhanced Leverage: Provides higher leverage limits, enabling the execution of more aggressive trading strategies.

- Additional Benefits: No custody fees are charged, and interest is paid on uninvested cash balances within the account.

Interactive Brokers Demo Account

Interactive Brokers also offers one of the best Demo Accounts in the industry, ideal for both new and experienced traders who wish to test strategies without financial risk:

- Simulation: This account simulates real-market conditions, allowing traders to practice and refine their trading techniques.

- Tools and Features: Provide access to a real account's trading tools and features, ensuring a comprehensive learning experience.

Fees and Commissions

Interactive Brokers has a straightforward pricing plan. You can opt for fixed or tiered prices, whose fees decrease with trading volume. In the tables below, you will find the fixed fees of the most popular products.

Stock/Shares Fees

The trading fees on stocks in the main world markets are the following:

| Market | Fixed commission | Minimum per order | Maximum per order | ||||

| United States | 0,005 per share | $1 | 1% of the traded value | ||||

| United Kingdom | 0,05% of the traded value | £3 | N/A | ||||

| Canada | CAD 0,01 per share | CAD 1 | 0,5% of the traded value | ||||

| France | 0,05% of the traded value | €3 | N/A | ||||

| Germany | 0,05% of the traded value | €3 | N/A | ||||

| Spain | 0,05% of the traded value | €3 | N/A | ||||

| Australia | 0,08% of the traded value | AUD 6 | N/A | ||||

| Hong Kong | 0,08% of the traded value | HKD 18 | N/A |

| Market | Fixed commission | Minimum per order | Maximum per order |

| United States | 0,005 per share | $1 | 1% of the traded value |

| United Kingdom | 0,05% of the traded value | £3 | N/A |

| Canada | CAD 0,01 per share | CAD 1 | 0,5% of the traded value |

| France | 0,05% of the traded value | €3 | N/A |

| Germany | 0,05% of the traded value | €3 | N/A |

| Spain | 0,05% of the traded value | €3 | N/A |

| Australia | 0,08% of the traded value | AUD 6 | N/A |

| Hong Kong | 0,08% of the traded value | HKD 18 | N/A |

Forex commissions

Regarding forex commissions, Interactive Brokers charges a single commission based on volume. The commission is expressed in basis points (pips), where one basis point is 0.0001. Forex also incurs variable spread fees, which start at 1/10 of a pip.

The higher the trading volume, the lower the commission. Here are some of the main currency pairs:

| Amount traded each month | Commission | Minimum commission | |||

| Less than $1,000,000 | 0.20 pips | $2 | |||

| Between $1,000,000 and $2,000,000 | 0.15 pips | $1.5 | |||

| From $2,000,000 to $5,000,000 | 0.10 pips | $1.25 | |||

| More than $5,000,000 | 0.08 pips | $1 |

| Amount traded each month | Commission | Minimum commission |

| Less than $1,000,000 | 0.20 pips | $2 |

| Between $1,000,000 and $2,000,000 | 0.15 pips | $1.5 |

| From $2,000,000 to $5,000,000 | 0.10 pips | $1.25 |

| More than $5,000,000 | 0.08 pips | $1 |

Mutual funds Fees

The mutual fund market provides access to more than 48,000 mutual funds, including more than 17,000 free transaction funds. The free mutual fund search tool, available to customers and non-customers, allows investors to filter mutual funds by several categories, such as fund type, fund family, fees charged, and country of origin.

The commission for most of the other funds is $4.95 per transaction. There is a fixed rate of 0.1% of trade value for European mutual funds and a minimum of €4 per trade.

| No-Transaction-Fee U.S. Mutual Funds | 0% | N/A | N/A | ||||

| Euronext Fixed Price Structure | 0.1% of market value | €4 | €29.00 | ||||

| Other funds | €4.95 | N/A | N/A |

| No-Transaction-Fee U.S. Mutual Funds | 0% | N/A | N/A |

| Euronext Fixed Price Structure | 0.1% of market value | €4 | €29.00 |

| Other funds | €4.95 | N/A | N/A |

Bonds & Fixed Income Trading Fees

Interactive Brokers' bond market offers a fully transparent universe of over 1 million bonds worldwide and provides low-cost direct market access to a wide range of corporate, municipal, and government bonds, among others.

Investors can filter by maturity, yield, and quality using Interactive Brokers' bond search tool. The tool is free on IBKR's website and accessible to both clients and non-clients.

| US Corporate | ≤ $10,000 | 0.10% | $1 | $250 or 1% of the trade value, whichever is lower | |||||

| US Treasuries | ≤ $1,000,000 | 0.002% | $5 | N/A | |||||

| United Kingdom | ≤ £10,000 | 0.10% | N/A | N/A | |||||

| Hong Kong Government | ≤ HKD 15,000,000 | 0.08% | HKD 18 | N/A |

| US Corporate | ≤ $10,000 | 0.10% | $1 | $250 or 1% of the trade value, whichever is lower | |||||

| US Treasuries | ≤ $1,000,000 | 0.002% | $5 | N/A | |||||

| United Kingdom | ≤ £10,000 | 0.10% | N/A | N/A | |||||

| Hong Kong Government | ≤ HKD 15,000,000 | 0.08% | HKD 18 | N/A |

Options Trading Fees

The commissions for trading options are as follows:

| Market | Options on Stocks | Minimum Commission | |||

| United Kingdom | £1.70/contract | £1.70/contract | |||

| Spain | €0.90/contract | €4.50 | |||

| Germany | €1.70/contract | €1.70/contract | |||

| Hong Kong | 0.2% + variable fee | HKD 18 | |||

| France | €1.50 per contract | €1.50 per contract | |||

| United States | $0.65 per contract (less than 10,000 contracts per month) | 1$ per contract | |||

| Canada | CAD 1,25 per contract (less than 10,000 contracts per month) | CAD 1,5 | |||

| Australia | AUD 2 per contract | AUD 2 |

| Market | Options on Stocks | Minimum Commission |

| United Kingdom | £1.70/contract | £1.70/contract |

| Spain | €0.90/contract | €4.50 |

| Germany | €1.70/contract | €1.70/contract |

| Hong Kong | 0.2% + variable fee | HKD 18 |

| France | €1.50 per contract | €1.50 per contract |

| United States | $0.65 per contract (less than 10,000 contracts per month) | 1$ per contract |

| Canada | CAD 1,25 per contract (less than 10,000 contracts per month) | CAD 1,5 |

| Australia | AUD 2 per contract | AUD 2 |

Futures Trading Fees

The commissions on futures are the following:

| Market | Contract Commission | Minimum per order | |||

| United Kingdom | £1.70 | £1.70 | |||

| United States | $0.85 | N/A | |||

| Canada | CAD 2.40 | CAD 2.40 | |||

| France | €2.00 | N/A | |||

| Australia | AUD 5 | N/A | |||

| Spain and Italy | €3 | N/A | |||

| Hong Kong | HDK 20 | HDK 20 |

| Market | Contract Commission | Minimum per order |

| United Kingdom | £1.70 | £1.70 |

| United States | $0.85 | N/A |

| Canada | CAD 2.40 | CAD 2.40 |

| France | €2.00 | N/A |

| Australia | AUD 5 | N/A |

| Spain and Italy | €3 | N/A |

| Hong Kong | HDK 20 | HDK 20 |

CFDs Trading Fees

As with other products above, CFDs follow a volume-tiered pricing structure. The table below contains CFDs commissions on stocks:

| CFDs | Traded Amount | Commission | Minimum | ||||

| US Stocks | Less than $300,000 | $0.005 | $1 | ||||

| European Stocks | Less than €10,000,000 | 0.05% | £3 | ||||

| Australian Stocks | Less than AUD 10,000,000 | 0.05% | AUD 5 | ||||

| Japanese Stocks | JPY 9,000,000 | 0.03% | JPY 100 | ||||

| CFDs on US500 Index | N/A | 0.005% | $1 |

| CFDs | Traded Amount | Commission | Minimum |

| US Stocks | Less than $300,000 | $0.005 | $1 |

| European Stocks | Less than €10,000,000 | 0.05% | £3 |

| Australian Stocks | Less than AUD 10,000,000 | 0.05% | AUD 5 |

| Japanese Stocks | JPY 9,000,000 | 0.03% | JPY 100 |

| CFDs on US500 Index | N/A | 0.005% | $1 |

Additional Fees and Charges

Finally, let's see what fees Interactive Brokers charges for opening an account, depositing, withdrawing money or custody:

| Other costs | |||

| Account opening fee | No | ||

| Custody fee | No | ||

| Deposit fee | No | ||

| Withdrawal fee | No* |

| Other costs | |

| Account opening fee | No |

| Custody fee | No |

| Deposit fee | No |

| Withdrawal fee | No* |

Overall, Interactive Brokers does not charge a commission for these services. However, it should be noted that there is a limit of one free withdrawal per month, and all subsequent ones are charged £10.

Trading Platforms

Interactive Brokers offers one of the best trading platforms with a wide range of tools suitable for traders of all experience levels and strategies. From Trader Workstation to IBKR Mobile, IBKR provides powerful platforms that are ideal for professional investors but accessible to everyone.

Besides Trader Workstation and IBKR Mobile, IB provides access to the Client Portal, a web-based platform designed to serve as a one-stop destination for checking quotes, placing trades, viewing account balances, reporting, and more. Additionally, IB has recently introduced the IBKR GlobalTrader and IMPACT Apps.

Before evaluating them, it should be noted that for most investors, these platforms may have a steep learning curve if you are inexperienced, so you may require time to learn how to use them. In any case, let's take a look at all the platforms.

Trader Workstation Platform (TWS)

The Trader Workstation (TWS) is Interactive Brokers' flagship desktop platform, designed for active traders and investors who need precision and flexibility. It offers a wide range of advanced tools and features:

- Comprehensive Trading Tools: Supports trading in multiple asset classes, including stocks, options, futures, and forex, with advanced order types and customisable layouts.

- Advanced Charting & Analysis: Includes powerful charting, technical indicators, and real-time data for in-depth market analysis.

- Customisation: Users can personalise the interface, set up custom workspaces, and use multiple monitors to fit their trading style.

- Risk Management: Real-time margin monitoring and advanced stop-loss orders help manage risk effectively

- Direct Market Access (DMA): Provides fast, direct access to global markets for quick execution.

- Detailed Reporting: Tracks performance with reports on profit-and-loss, transactions, and tax documents.

TWS is ideal for traders looking for a flexible and comprehensive trading platform with professional-level features.

Client Portal Platform

The Client Portal is an all-in-one online platform designed for Interactive Brokers (IBKR) clients to manage and monitor their accounts. Key functionalities include:

- Account Overview: View real-time balances, open positions, and market performance, providing users with a comprehensive snapshot of their portfolio.

- Trading: Clients can place trades directly from the portal, including stocks, options, futures, and other asset classes.

- Performance Metrics: The portal provides detailed reports on profit and loss, performance metrics, and real-time data, which helps investors track their trading activity and financial progress.

- Reports & Documents: Users can access a wide range of reports, including tax documents, statements, and trade confirmations. This is particularly useful for managing tax filings or reviewing past trades.

- Risk Management & Financing: The portal offers tools to monitor margin levels, financing costs, and any associated risks, helping clients make informed decisions about their trading strategies.

GlobalTrader

GlobalTrader is a mobile platform designed to make investing in stocks, mutual funds, and ETFs easier on both iOS and Android devices. Key features include:

- User-Friendly Interface: The app’s interface is designed to be intuitive, enabling easy navigation for both beginner and experienced investors.

- Access to Global Markets: With GlobalTrader, users can access international markets, making it simple to invest in a wide range of global assets.

- Trading Flexibility: Users can buy and sell stocks, ETFs, and mutual funds directly from their mobile devices, allowing for quick and efficient trading on the go.

- Real-Time Market Data: The app provides up-to-the-minute market data and performance tracking, helping users make informed trading decisions.

IMPACT

The IMPACT mobile application is tailored for investors interested in aligning their portfolios with Environmental, Social, and Governance (ESG) values. Key features include:

- Portfolio Alignment: IMPACT allows users to build portfolios that reflect their values by investing in companies with strong environmental and social practices.

- Impact Analysis: The app offers insights into how companies operate and how their business practices align with sustainability goals, including details on a company's carbon footprint, social responsibility initiatives, and corporate governance.

- Socially Responsible Investing: Investors can explore different companies, read reports on their ESG performance, and select investments that match their ethical or sustainability preferences.

- Easy Portfolio Management: The app simplifies the process of investing in ESG assets, making it easier to manage and track socially responsible investments.

IBKR API

The IBKR API allows developers to build custom trading applications and integrate Interactive Brokers' brokerage services into their systems. Features include:

- Automated Trading: Developers can automate various aspects of trading, including placing orders, tracking positions, and managing risk.

- Custom Solutions: The API enables the creation of personalised tools and software solutions tailored to individual needs, from complex algorithms to simple trading assistants.

- Integration with Third-Party Platforms: The API allows seamless integration with other platforms, software, or databases, enabling a more holistic approach to managing trading strategies and portfolios.

- Access to IBKR Data: Developers can use the API to pull market data, historical performance, and other critical information from IBKR to enhance their custom applications.

IBKR Campus Platform

The IBKR Campus Platform is an educational resource designed to help investors develop their financial knowledge. It’s not a trading platform but provides valuable tools and content to support investors' learning. Key features include:

- IBKR Academy for Investors: A collection of 61 courses covering a wide range of topics, from basic investment principles to advanced trading strategies. The academy is designed to help users build foundational knowledge or deepen their expertise.

- Free Learning Resources:

- IBKR Webinars: Interactive webinars hosted by industry experts on a variety of trading and financial topics, offering clients valuable insights and strategies.

- IBKR Insight: A platform offering market analysis, research reports, and expert commentary on global financial trends.

- IBKR Radio Podcast: A podcast featuring interviews and discussions on current market conditions, investment strategies, and financial topics.

- IBKR Quant: A section dedicated to quantitative analysis and algorithmic trading, offering insights into data-driven trading strategies.

- IBKR Trading Lab: An experimental space for traders to test strategies and gain hands-on experience with real market data.

- Interactive Learning Experience: Through its diverse content offerings, IBKR Academy ensures that investors have access to a wealth of knowledge, whether they are new to investing or seasoned professionals looking to stay updated on the latest trends.

IBKR Desktop

The IBKR Desktop platform is a powerful, comprehensive solution for active traders. It includes features such as:

- Advanced Trading Tools: IBKR Desktop provides professional-level trading tools for managing multiple asset classes. It includes advanced charting, technical analysis, and real-time market data.

- Customisable Interface: The platform allows for heavy customisation, so traders can tailor the layout, tools, and workflows to their specific needs.

- Comprehensive Reporting: Users can access detailed reports, including P&L, margin, and tax documents, making it easier to manage complex portfolios and make data-driven decisions.

- Global Market Access: The desktop platform supports trading on a wide range of global markets, making it ideal for international investors and traders looking for global diversification.

Mobile App

The IBKR Mobile platform allows users to manage their accounts and execute trades from their mobile devices, available for both iOS and Android users. Key features include:

- Trading on the Go: The app is ideal for investors who need to manage their portfolios remotely. With this platform, users can trade stocks, options, and other financial products from anywhere.

- Access to Account Information: View balances, margin levels, account history, and performance metrics in real-time.

- Advanced Features: Users can place orders, track positions, and get market updates through push notifications. The app is designed to give clients access to most features found on the desktop version of IBKR, ensuring comprehensive functionality.

- Mobile-First Interface: The app’s user interface is optimised for smartphones and tablets, with a focus on user experience while on the move.

Depositing and withdrawing funds

Depositing and withdrawing funds from an Interactive Brokers (IBKR) account is a straightforward and cost-free process. The platform offers a seamless way to manage your funds, whether you are depositing money to start trading or withdrawing profits.

- No Fees for Deposits and Withdrawals: Interactive Brokers does not charge any fees for depositing or withdrawing funds. This is a major advantage for traders, as many other platforms impose charges for these transactions, especially when converting currencies. With IBKR, you can avoid such costs, allowing you to retain more of your funds for trading.

- Multiple Base Currencies: IBKR offers the flexibility to open an account in more than 20 base currencies. This includes popular currencies like:

- GBP (British Pound)

- EUR (Euro)

- USD (US Dollar)

- AUD (Australian Dollar)

- HKD (Hong Kong Dollar)

- NOK (Norwegian Krone)

- CHF (Swiss Franc)

- Currency Flexibility: When you open an account, you can choose to have it denominated in any of these available currencies, allowing you to avoid unnecessary currency conversion fees when depositing or withdrawing funds. For example, if you open an account in GBP and deposit funds in GBP, there will be no currency conversion charges applied.

- Direct Deposits in Your Chosen Currency: Once your account is set up in your selected currency, deposits made in that currency will be credited to your account without any exchange fees. This is particularly beneficial for clients who wish to avoid conversion costs, as some brokers charge extra fees for currency exchanges.

- Efficient International Transfers: Whether you're depositing or withdrawing in your local currency or in a different one, IBKR provides efficient international transfers. This makes it easier for users in different countries to fund their accounts or withdraw profits, with no additional burden of conversion fees.

- Wide Range of Payment Methods: IBKR supports various methods for depositing and withdrawing funds, including bank transfers, wire transfers, and other secure payment methods. This ensures flexibility for clients around the world, whether you're making a domestic or international transfer.

- Transparent Process: The process of depositing and withdrawing funds is transparent, with real-time updates on the status of your transactions. Users can track the progress of their funds through the platform, giving them peace of mind when managing their finances.

Ratings

Interactive Brokers' reviews tend to be mixed but overall positive among investors. Its many training resources and access to many types of markets and products make it one of the top brokers preferred by American and European investors alike.

However, the level of difficulty involved in using so many products and platforms, especially for beginners, makes it, more suitable for professionals.

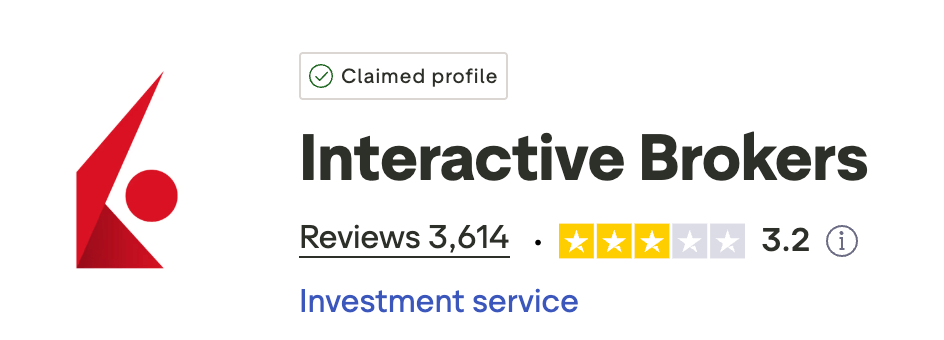

On Trustpilot.com, one of the most popular sites where people write reviews and rate various services, we can find several reviews about Interactive Brokers.

The community rated it an average of 3.2 stars based on a total of more than 3,500 reviews.

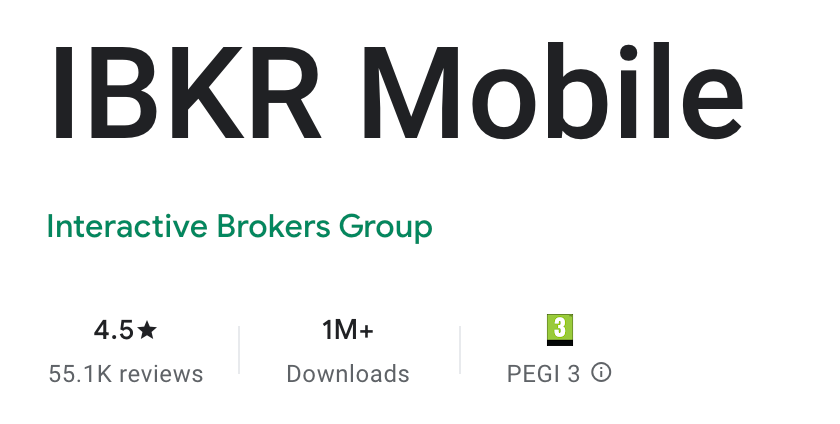

On the other hand, if we go to Google Play, the mobile phone app enjoys a much higher rating:

In this case, out of more than 55,000 reviews, the average score of 4.5 suggests that the IBKR mobile phone app is performing very well.

Opinions

Interactive Brokers is renowned globally for its security, low commissions, and advanced portfolio analysis services. Although not perfect, its stringent requirements for opening margin accounts provide an extra layer of security, helping to prevent beginner traders from taking excessive risks.

Key Highlights IBKR UK:

- Security and Low Commissions: A strong reputation for safeguarding client assets and offering some of the lowest commission rates in the industry.

- High Interest on Cash Balances: Earn up to 4.58% interest on cash balances, though this is primarily for accounts with a net asset value (NAV) of at least $100,000.

- Awards and Recognition:

- Named the best online broker by Barron's for five consecutive years as of March 25, 2022.

- Voted the best broker for futures and options in the Rankia Awards for two consecutive years (2018 and 2019).

Interactive Brokers appeals to professional traders with its complex products and sophisticated platforms, making it ideal for implementing complex trading strategies. Despite the high entry barriers, the benefits for professional traders are significant, making it a top choice for many.

FAQs

What is Interactive Brokers?

Interactive Brokers was founded in 1977 by current CEO Thomas Peterffy. Over the years, the firm has built a strong reputation and is now recognised as one of the most prestigious brokers worldwide.

The company has significantly grown its equity, now exceeding $16.6 billion, and employs over 2,975 people globally, with its services reaching from the USA to the UK and beyond.

The broker became a public entity in 2007 and is listed on the NASDAQ under the ticker IBKR. This listing assures transparency, allowing investors to access regular financial reports that provide insights into the company's financial health and operations.

Why choose IBKR?

Interactive Brokers (IBKR) offers low-cost trading, access to global markets, advanced tools, a wide range of asset classes, and no fees on deposits/withdrawals, making it ideal for active and professional traders.

How to open an account with IBKR in the UK?

Opening an account with Interactive Brokers UK is a quick process, you just have to follow these simple steps:

- Visit the Interactive Brokers website.

- Click on "Open Account" in the top menu and select "Start Application".

- Fill out the application form with your personal and financial details.

- Provide the required documents, such as a copy of your ID and proof of residence.

- Complete the account verification process.

- Once verified, your account will be opened and you can start trading.

IBKR available markets

Interactive Brokers offers an impressive scope of market access that few other brokers can match. Here are the key features of its global market reach:

- Over 150 Markets: UK investors can execute trades across more than 150 markets, providing a vast range of trading opportunities in equities, bonds, futures, and more.

- 33 Countries: The ability to trade in 33 countries enables investors to diversify their portfolios internationally, reducing risk by spreading investments across different economic regions.

- 23 Currencies: Trading in 23 different currencies enhances flexibility and allows UK traders to take advantage of currency fluctuations and exchange rate differentials.

Taxes with IBKR UK

When dealing with brokers for the first time, many people have one main question: How do I declare my broker's investment portfolio to the Tax Authorities?

Thankfully, IBKR makes it easy for you by compiling all the tax forms you need. You can view and download the relevant documents by accessing Performance and Reports in your Client Portal, then navigate to the Tax Forms area to see the tax forms available for your account. Based on your activity, you can then report your capital gains, losses, and other income to the relevant authority.

What is their customer service like?

Interactive Brokers' customer service is quick and available through several channels. Interactive Brokers website provides a thorough FAQ page that explores the most common questions and issues. The resourceful section guides visitors through topics related to creating an account, withdrawals, deposits, demo accounts, tax forms, and more.

You can also contact Interactive Brokers by phone, website form, or live chat, according to your preference:

- Office in the United Kingdom: Address: 20 Fenchurch Street, Floor 12, London EC3M 3BY, United Kingdom

- Phone: Available 24 hours a day, the number is free: 00800-42-27653.

- Inquiry form on the website: You can complete an online form on the website stating your issues or inquiries, and the team will reach out to you via e-mail. However, this method may take the longest to receive the help you need, so it's best to use it only if your inquiries are not urgent.

- Live chat: You can request any type of available information, apart from passwords or other private data. The chat is available only for Interactive Brokers' clients. The live chat is perhaps the quickest method to contact the support team if you are experiencing any issues.

How much money do you need to open an Interactive Brokers account?

Interactive Brokers does not require any minimum deposit, so you can start your journey with any amount of money. It has also introduced the option to buy fractional shares and ETFs, which is ideal for creating a diversified portfolio with a small initial investment.

Is Interactive Brokers suitable for beginners?

Interactive Brokers is among the few brokers on the market with a huge offering of products, platforms, and many tools and features. Although it may seem overwhelming, beginners may want to open a demo account first and get some market experience before trading with real money.

Are Interactive Brokers fees high?

Interactive Brokers has a variable fee structure which depends mostly on your trading volume, chosen products, and markets. In general, the more trades you place, the lower the fees.