Reviews

Oanda Review

When it comes to top trading brokers, OANDA is consistently among the names that stand out. With 28 years of experience in the investment world, it has built a strong reputation for reliability and expertise.

In this review of OANDA, we’ll explore whether its reputation is truly deserved. We’ll take a look at the range of products it offers, its fee structure, and how the platform operates.

Pros and Cons

| Pros of Oanda | Cons of Oanda | ||

| ✅ International supervision: It is a highly regulated broker in all the countries where it operates. | ❌ It has significantly reduced its influence as a professional forex broker | ||

| ✅ Zero commission stocks and competitive spreads. | ❌ Less known broker. | ||

| ✅ Integration with professional platforms like MT5. | ❌ Only has real US stocks. However, about 2,200. | ||

| ✅ Variety of deposit methods in balance account | |||

| ✅ Great customer service |

| Pros of Oanda | Cons of Oanda |

| ✅ International supervision: It is a highly regulated broker in all the countries where it operates. | ❌ It has significantly reduced its influence as a professional forex broker |

| ✅ Zero commission stocks and competitive spreads. | ❌ Less known broker. |

| ✅ Integration with professional platforms like MT5. | ❌ Only has real US stocks. However, about 2,200. |

| ✅ Variety of deposit methods in balance account | |

| ✅ Great customer service |

Main features

Before diving into a deep analysis, let's see what Oanda offers.

- Regulation: FCA UK

- Guarantee fund: Up to £85,000 per account

- Financial assets: US stocks, currencies, and derivatives

- Markets: +50 markets

- Account types: 2 (Oanda account and elite)

- Commissions:

- US Stocks: €0

- EU Stocks: 0.15%

- Platform: MT5, TradingView, and Mobile App

- Contact:

- Email: [email protected]

- Phone: +44 020 3151 2050

- Featured product: More than 1,600 American stocks with zero commissions.

Is it safe?

Yes—OANDA Europe Limited is authorised and regulated by the Financial Conduct Authority (FCA) (FRN: 542574) and registered in England (No. 7110087).

As an FCA-regulated broker, OANDA is required to follow strict rules on client fund protection and transparency. Importantly, UK investors are also covered by the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 per person if the broker were to fail.

While OANDA operates globally and is regulated in several countries, UK residents should ensure they open an account with OANDA Europe Limited to benefit from FCA oversight and FSCS protection.

Tip: Always double-check you're on OANDA’s official UK site before registering.

Available Investment Products

Following its recent headquarters change, here’s a look at the full range of products you can now trade on OANDA—including newly added assets like US stocks:

- American stocks: +1600 securities

- Forex: Up to 44 currency pairs

- Derivatives: +1,800

American Stocks

With Oanda, you can invest in more than 2,200 stocks from markets like the Nasdaq or the Nyse with zero euro commissions, excluding additional commissions for euro accounts.

Additionally, if you are registered with the broker, you will receive weekly reports and analyses about markets and stocks. On the other hand, for high liquidity stocks, spreads tend to be quite narrow

Forex or Currencies

With OANDA, users have the opportunity to trade 44 of the world’s major currency pairs — and that means trading the actual currencies, not just derivatives based on them (though those are available too). These include:

- USD/EUR

- USD/GBP

- EUR/CFH

Additionally, by being registered on the platform, users also receive currency recommendations and forecasts from award-winning analysts through the OANDA mobile app.

Derivatives

As a former derivatives-focused broker during its time under Maltese regulation, derivatives remain at the core of OANDA’s offering. Today, it provides access to over 4,000 financial derivatives across a wide range of underlying assets — including commodities, cryptocurrencies, shares, and indices.

Account Types

Oanda offers two types of accounts to its users. The most common is the standard account, which does not involve special requirements, but has more limited operations than the elite one.

OANDA Standard Account

With the Oanda Account, you will have more than 4,000 instruments to trade. From derivatives on currencies, indices, and commodities to individual stocks.

On the other hand, with the OANDA account activated, you will receive exclusive information and recommendations directly on your mobile, courtesy of award-winning analysts. Additionally, Oanda's convenient mobile app puts mobile trading, market news, and recommendations at your fingertips.

The Standard Account allows you to access all of Oanda's products and services, including customer support in multiple languages 24 hours a day, 5 days a week.

- +50 currency pairs.

- Minimum account balance.

- Web and desktop platforms, such as TradingView, MT5, and mobile apps.

- 100,000 quotes per month

- Automated execution.

- Variable contract sizes.

- Oanda's performance analysis panel.

- Joint account.

Elite Trader Account

OANDA's Elite Trader account is designed for high-volume traders seeking enhanced benefits and personalised support. This account offers:

- Leverage: Up to 200:1 for certain instruments .

- Rebates: Cash rebates of up to $17 per million traded, depending on monthly trading volume .

- Trading Platforms: Access to OANDA's proprietary platform, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView .

- Dedicated Support: A personal relationship manager and priority service line for expedited assistance .

- Additional Benefits: Free Virtual Private Server (VPS) hosting, monthly TradingView subscription reimbursement, and access to premium order book features .

Eligibility Criteria:

To qualify for the Elite Trader account, you must meet at least two of the following criteria:

- Trading History: Have placed at least 10 trades per quarter over the previous four quarters, each with a minimum notional value of £50,000.

- Portfolio: Maintain an investment portfolio exceeding €500,000.

- Professional Experience: Have at least one year of professional experience in a role requiring knowledge of FX and CFD trading .

Fees and Commissions

Let's look at their commission structure:

Stock Commissions

This is one of the great advantages of trading real stocks with OANDA, as like many other brokers, they do not charge a commission for buying or selling any of their 1,400 stocks within the American market.

And best of all, no maximum limit on trading volume.

Currency Trading Commissions

Below are some of the spreads Oanda offers on their most popular FX pairs:

| FX pair | Spread | ||

| AUD/USD | 1.6 | ||

| EUR/GBP | 1.7 | ||

| EUR/JPY | 1.8 | ||

| EUR/USD | 1.4 | ||

| GBP/JPY | 3.1 | ||

| GBP/USD | 2.0 | ||

| NZD/USD | 1.7 | ||

| USD/CAD | 2.2 | ||

| USD/CHF | 1.8 | ||

| USD/JPY | 1.4 |

| FX pair | Spread |

| AUD/USD | 1.6 |

| EUR/GBP | 1.7 |

| EUR/JPY | 1.8 |

| EUR/USD | 1.4 |

| GBP/JPY | 3.1 |

| GBP/USD | 2.0 |

| NZD/USD | 1.7 |

| USD/CAD | 2.2 |

| USD/CHF | 1.8 |

| USD/JPY | 1.4 |

Minimum Deposit and Withdrawal Fees

Debit Card

The procedure for deposits from debit cards VISA / Mastercard is as follows:

Payments are instant

- Deposit in different denominations: EUR, USD, GBP, CZK.

- Maximum amount: 50,000 EUR

- Minimum deposit: 25 EUR/USD/GBP or 500 CZK.

- Security: OANDA guarantees the security of your data and processes payments with internationally certified PCI-DSS Level 1 providers.

Bank Transfer

Bank transfer is another convenient option to fund your Oanda Account:

- This is the most suitable method for the initial account opening deposit

- There is no maximum amount

- Transfers are processed in up to 3 business days and are available in EUR, USD, GBP, CZK denominations. OANDA

- No extra charges for bank transfers

- Currently, it is the only possible way for capital withdrawal

Trading Platforms

Let's take a look at the trading platforms that Oanda primarily works with:

- TradingView

- OANDA Account (proprietary platform)

- Metatrader 5

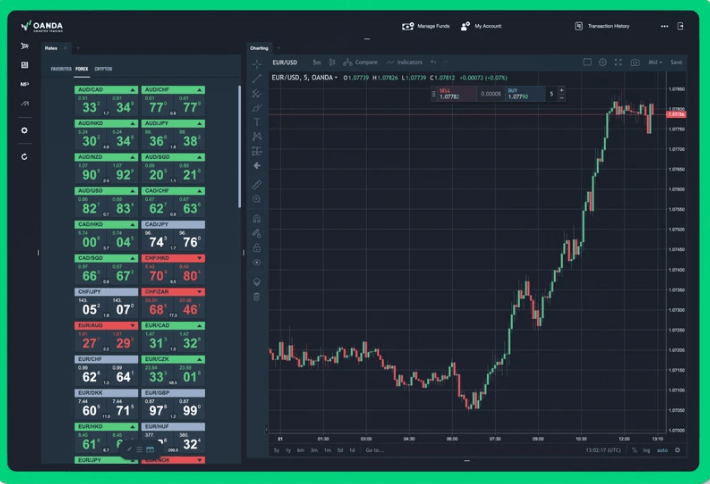

Oanda Platform

OANDA has its own platform that allows trading on desktop, web, and mobile. The platform includes technical analysis tools—ideal for traders looking to apply chart-based strategies or learn more about what technical analysis is—as well as customisation options for different trading profiles.

You can also trade directly through the charts and set various purchase orders.

The Oanda platform allows for fast execution, although according to user reviews, there is room for improvement.

Tradingview

OANDA continues in its professionalisation process, allowing you to integrate your broker with the TradingView platform. This makes it easier to trade in a much more technical and informed way.

TradingView is widely recognised as one of the best trading platforms for its intuitive charting tools, making it ideal for beginners and advanced users alike. As you explore its features, you’ll discover just how powerful and in-depth it really is.

Thus, with TradingView you can make use of the following features:

- More than 400 technical indicators for your trading strategies, in addition to those you can customise

- 110 drawing tools

- 15 types of charts

- Up to 8 charts in a single view, to analyse different time frames.

- And several fundamental analysis ratios

MetaTrader 5

OANDA offers the most widely used multi-broker platform in the world, MetaTrader 5. Frequently cited as a best broker for MetaTrader 5, OANDA provides access to this powerful platform equipped with the latest technology in technical and fundamental analysis. It allows clients to use a wide variety of technical indicators and graphic objects, expert advisors (EAs), execute OCO orders, tick-chart and keyboard trading, trading with alerts, and more.

Mobile App

The OANDA mobile app, available for both iOS and Android devices, offers traders full access to their accounts with a user-friendly and customisable interface. It features advanced charting tools, including over 50 technical indicators, drawing tools, and multiple chart types, allowing users to analyse markets and manage trades directly from their mobile devices. Real-time alerts and push notifications keep traders informed about price movements and important economic events, ensuring they never miss key opportunities.

In addition to its robust trading features, the app allows seamless account management, including deposits, balance monitoring, and trade history reviews. Security is a priority, with industry-standard encryption and two-factor authentication available to protect user data. The app is compatible with most modern devices, making it a convenient and reliable choice for traders who want to stay connected to the markets wherever they are.

Customer Service

And if previously one of OANDA's major shortcomings was its customer service. Today, nothing to do with it after its restructuring and focus on being a multi-product broker.

As we will see below, it has a comprehensive customer service that is extensive, fast and close.

- ✅ Contact phone: +44 020 3151 2050

- ✅ Email: [email protected]

- ✅ Chatbot: Yes

Additionally, as a traditional derivatives broker, it also offers training for traders, with a specific learning area that covers everything from the first steps in trading to more advanced tools for proper capital management.

Our opinion

OANDA is a reliable broker where you can invest with confidence, thanks to its strong regulation and oversight. Following its evolution into a multi-product broker, it has become an appealing choice for investors. Whether you’re seeking a more relaxed approach with commission-free US stock trading or looking to trade a wide range of derivatives with competitive spreads, OANDA offers the flexibility to suit different investment styles.

As a trading platform, OANDA is already comprehensive, but it also allows seamless integration with two of the most professional platforms available: MetaTrader 5 and TradingView. This means you can manage your trades effortlessly from a single app. One area for improvement is its stock offering, which, while commission-free, is limited to companies listed on the NYSE and Nasdaq, restricting the ability to build a globally diversified portfolio.

Overall, OANDA stands out as a well-regulated, cost-effective broker with solid customer support, and advanced traders will appreciate the option to integrate with MetaTrader 5.

FAQs

What is it?

OANDA is a global online broker founded in 1996 by computer scientist Dr. Michael Stumm and economist Richard Olsen. Originally launched as a free online currency exchange platform, it was built on the vision that the internet would open up financial markets to a global audience.

Key features that set OANDA apart include:

- A wide forex offering with competitive spreads

- Commission-free trading on US stocks

- Integration with professional platforms like TradingView and MetaTrader 5

Since 2001, OANDA has expanded into a full financial services platform serving millions of clients worldwide.

What research and analysis tools does OANDA provide?

OANDA offers advanced charting, daily market news, economic calendars, and technical analysis tools directly on its platform.

Can UK traders use OANDA’s spread betting service?

Yes, UK clients can choose spread betting accounts, which offer tax advantages like no capital gains tax.