Brokers

Revolut Review

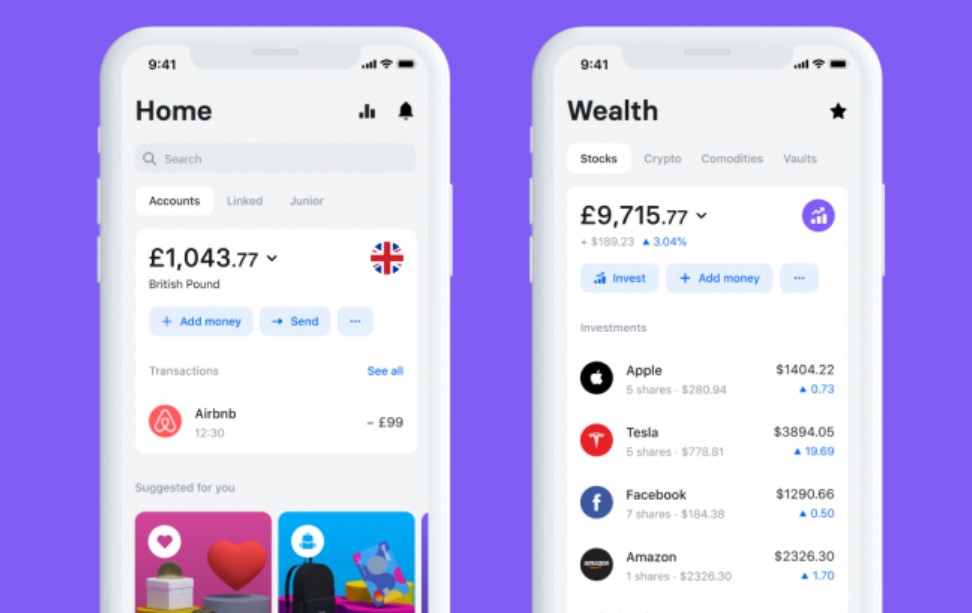

Revolut has become a popular choice for digital banking, offering a wide range of features, from currency exchange to personal finance management. In this review, we'll dive into the platform's key services, including its banking features, fees, customer experience and answer the most important question: is Revolut good?

But that’s not all—Revolut also offers a unique trading feature, allowing users to trade stocks, crypto, and commodities directly from the app. Whether you're looking for a versatile banking solution or a seamless way to manage your investments, we'll cover everything you need to know about Revolut’s offerings.

Pros and Cons

| Pros of Revolut | Cons of Revolut | ||

| ✅ Low Fees: Revolut offers low or no fees for many services, especially for international money transfers. | ❌ Limited Customer Support: Some users have reported slower response times and less helpful support, especially for complex issues. | ||

| ✅ Multi-Currency Support: Supports over 30 currencies and allows users to hold, exchange, and transfer them seamlessly. | ❌ Foreign Exchange Fees on Certain Plans: While Revolut offers free currency exchange within limits, there are additional fees for currency exchange outside the free limits, especially on weekends. | ||

| ✅ User-Friendly App: The mobile app is intuitive, making it easy for users to manage finances, track spending, and exchange currencies. | ❌ Limited Investment Options: The investment offerings (stocks, crypto, commodities) are limited compared to more traditional brokers or specialised investment apps. | ||

| ✅ Cryptocurrency Trading: Allows users to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, and others. | ❌ Withdrawals Fees: Free ATM withdrawals are limited to a set amount each month, after which additional fees apply. | ||

| ✅ Global Access: Provides international access with a physical and virtual debit card, ideal for traveling. | |||

| ✅ Budgeting & Analytics: In-app features like budgeting tools and spending analytics help users stay on top of their finances. | |||

| ✅ Free & Premium Plans: Offers both free and premium plans, with extra perks like travel insurance, airport lounge access, and higher withdrawal limits on the premium plans. |

| Pros of Revolut | Cons of Revolut |

| ✅ Low Fees: Revolut offers low or no fees for many services, especially for international money transfers. | ❌ Limited Customer Support: Some users have reported slower response times and less helpful support, especially for complex issues. |

| ✅ Multi-Currency Support: Supports over 30 currencies and allows users to hold, exchange, and transfer them seamlessly. | ❌ Foreign Exchange Fees on Certain Plans: While Revolut offers free currency exchange within limits, there are additional fees for currency exchange outside the free limits, especially on weekends. |

| ✅ User-Friendly App: The mobile app is intuitive, making it easy for users to manage finances, track spending, and exchange currencies. | ❌ Limited Investment Options: The investment offerings (stocks, crypto, commodities) are limited compared to more traditional brokers or specialised investment apps. |

| ✅ Cryptocurrency Trading: Allows users to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, and others. | ❌ Withdrawals Fees: Free ATM withdrawals are limited to a set amount each month, after which additional fees apply. |

| ✅ Global Access: Provides international access with a physical and virtual debit card, ideal for traveling. | |

| ✅ Budgeting & Analytics: In-app features like budgeting tools and spending analytics help users stay on top of their finances. | |

| ✅ Free & Premium Plans: Offers both free and premium plans, with extra perks like travel insurance, airport lounge access, and higher withdrawal limits on the premium plans. |

Is it safe?

Is Revolut regulated?

Yes, Revolut is regulated by the FCA and uses advanced security measures, such as biometric authentication, AI-powered fraud detection, and 24/7 monitoring to protect your account. Your funds are safeguarded as Revolut complies with Electronic Money Regulations, ensuring your main account balance is protected.

Revolut also offers proactive fraud alerts and secure payment methods, such as self-destructing virtual cards for online purchases, adding extra layers of security for users.

Main Features

Revolut simplifies financial transactions through its app. After downloading the app, you can open a free account and apply for a physical card for just £4.99. From the app, you can manage your finances, categorise expenses, activate real-time notifications and much more.

As well as this, through the app you will also be able to:

- Categorise expenses

- Split invoices

- Activate and deactivate the Revolut card

- Get real time notifications of your expenses

- Set up a spending limit

- Exchange currencies

- Set up recurring payments

- Send money instantly

Accounts and Fees

Revolut offers a range of account plans in the UK, each designed to cater to different financial needs and preferences. Below is a summary of these plans, highlighting their key features and associated fees:

| Plan | Monthly Fee | Currency Exchange Limit | Fair Usage Fee | ATM Withdrawal Limit | Commission-Free Trades | Savings Fund | |||||||

| Standard | £0 | £1,000/month | 1% after limit | £200/month (5 withdrawals) | 1/month | 3.51% AER | |||||||

| Plus | £3.99 | £3,000/month | 0.5% after limit | £200/month | 3/month | 3.51% AER | |||||||

| Premium | £7.99 | Unlimited | None | £400/month | 5/month | 3.75% AER | |||||||

| Metal | £14.99 | Unlimited | None | £800/month | 10/month | 4% AER | |||||||

| Ultra | £45 | Unlimited | None | £2,000/month | 10/month | 4.5% AER |

| Plan | Monthly Fee | Currency Exchange Limit | Fair Usage Fee | ATM Withdrawal Limit | Commission-Free Trades | Savings Fund | |||||||

| Standard | £0 | £1,000/month | 1% after limit | £200/month (5 withdrawals) | 1/month | 3.51% AER | |||||||

| Plus | £3.99 | £3,000/month | 0.5% after limit | £200/month | 3/month | 3.51% AER | |||||||

| Premium | £7.99 | Unlimited | None | £400/month | 5/month | 3.75% AER | |||||||

| Metal | £14.99 | Unlimited | None | £800/month | 10/month | 4% AER | |||||||

| Ultra | £45 | Unlimited | None | £2,000/month | 10/month | 4.5% AER |

Key Features by Plan:

- Standard Plan (£0/month):

- Ideal for basic banking needs.

- Fee-free currency exchange up to £1,000/month; 1% fee applies beyond this limit.

- Fee-free ATM withdrawals up to £200/month (5 withdrawals); 2% fee applies beyond this limit.

- Plus Plan (£3.99/month):

- Enhanced features for regular users.

- Fee-free currency exchange up to £3,000/month; 0.5% fee applies beyond this limit.

- Fee-free ATM withdrawals up to £200/month; 2% fee applies beyond this limit.

- 20% discount on international transfer fees.

- Premium Plan (£7.99/month):

- Comprehensive benefits for frequent travelers and spenders.

- Unlimited fee-free currency exchange.

- Fee-free ATM withdrawals up to £400/month; 2% fee applies beyond this limit.

- 20% discount on international transfer fees.

- Access to premium customer support.

- Metal Plan (£14.99/month):

- Premium benefits with additional rewards.

- Unlimited fee-free currency exchange.

- Fee-free ATM withdrawals up to £800/month; 2% fee applies beyond this limit.

- 40% discount on international transfer fees.

- Enhanced rewards program with increased cashback rates.

- Ultra Plan (£45/month):

- Exclusive benefits for high-end users.

- Unlimited fee-free currency exchange.

- Fee-free ATM withdrawals up to £2,000/month; 2% fee applies beyond this limit.

- Unlimited fee-free international transfers.

- Access to luxury perks, including unlimited airport lounge access and global medical insurance.

*Please note that fees and limits are subject to change.

Card Features

Each Revolut plan offers a unique card designed to complement the plan's benefits:

- Standard Plan: Provides a free standard debit card suitable for everyday transactions.

- Plus Plan: Offers an exclusive Plus card with personalised design and additional benefits.

- Premium Plan: Includes a personalised Premium card with enhanced features and higher transaction limits.

- Metal Plan: Features a personalised Metal card made from premium materials, offering superior benefits and higher transaction limits.

- Ultra Plan: Provides a platinum-plated card with exclusive perks and the highest transaction limits.

Depositing and Withdrawing

Revolut offers various methods for depositing funds into your account, each with specific limits and potential fees. Here's an overview tailored for UK users:

1. Bank Transfers:

- Receiving Funds: There is no maximum amount for incoming bank transfers, whether local or international. However, certain transfers may have limits, which Revolut will notify you about within the app.

- Sending Funds: While there are generally no daily or monthly limits for sending money from your Revolut account, limits may apply based on your account activity and verification status. Revolut's automated system adjusts these limits as you build a financial history with them.

2. Card Deposits:

- Limits: Revolut's automated security system sets a daily card deposit limit for all customers, which resets on a rolling 24-hour basis. For security reasons, the exact limit isn't disclosed but is adjusted based on your account activity.

- Fees: Depositing funds via debit or credit card is generally free. However, fees may apply depending on your location and the card type used. For instance, adding money with a debit card issued outside the UK may incur a fee of up to 3% of the transaction amount.

3. Cash Deposits:

- Availability: Cash deposit services are limited and may not be available in all regions. It's advisable to check within the Revolut app or contact customer support for specific information regarding cash deposits in the UK.

Important Considerations:

- Deposit Limits: Deposit limits are personalised based on your account activity and verification status. If you plan to transfer large sums, especially those significantly higher than your usual transactions, it's recommended to inform Revolut in advance and provide any necessary documentation to ensure smooth processing.

- Fees: While many deposit methods are free, certain transactions, especially those involving international transfers or specific card types, may incur fees. It's essential to review the details within the Revolut app or consult customer support for information tailored to your situation.

Revolut allows users to withdraw funds from their accounts via bank transfers, ATMs, and external wallets. Withdrawals to a linked bank account are typically free, though limits may apply depending on your account plan.

ATM withdrawals are also free up to a certain limit, with fees applying beyond that limit or for non-UK ATMs. For cryptocurrency withdrawals, there may be network fees.

| Account Plan | Free withdrawal allowance | Fee after allowance | |||

| Standard | Up to £200 or 5 withdrawals | 2% of the amount, min £1 | |||

| Plus | Up to £200 | 2% of the amount, min £1 | |||

| Premium | Up to £400 | 2% of the amount, min £1 | |||

| Metal | Up to £800 | 2% of the amount, min £1 | |||

| Ultra | Up to £2,000 | 2% of the amount, min £1 |

| Account Plan | Free withdrawal allowance | Fee after allowance |

| Standard | Up to £200 or 5 withdrawals | 2% of the amount, min £1 |

| Plus | Up to £200 | 2% of the amount, min £1 |

| Premium | Up to £400 | 2% of the amount, min £1 |

| Metal | Up to £800 | 2% of the amount, min £1 |

| Ultra | Up to £2,000 | 2% of the amount, min £1 |

Mobile App

Revolut's mobile app offers a comprehensive suite of financial services, enabling users to manage their money efficiently. Key features include:

- Multi-Currency Accounts: Users can hold, exchange, and transfer funds in over 25 currencies, facilitating seamless international transactions.

- Budgeting and Analytics Tools: The app provides budgeting features and spending analytics to help users monitor and control their expenses effectively.

- Instant Payments and Transfers: Send and receive money globally in real-time, with the ability to split bills and request payments easily.

- Security Features: Advanced security measures, including biometric authentication and the ability to freeze/unfreeze your card instantly, ensure user protection.

- 24/7 Customer Support: Access to customer support at any time through the in-app chat feature.

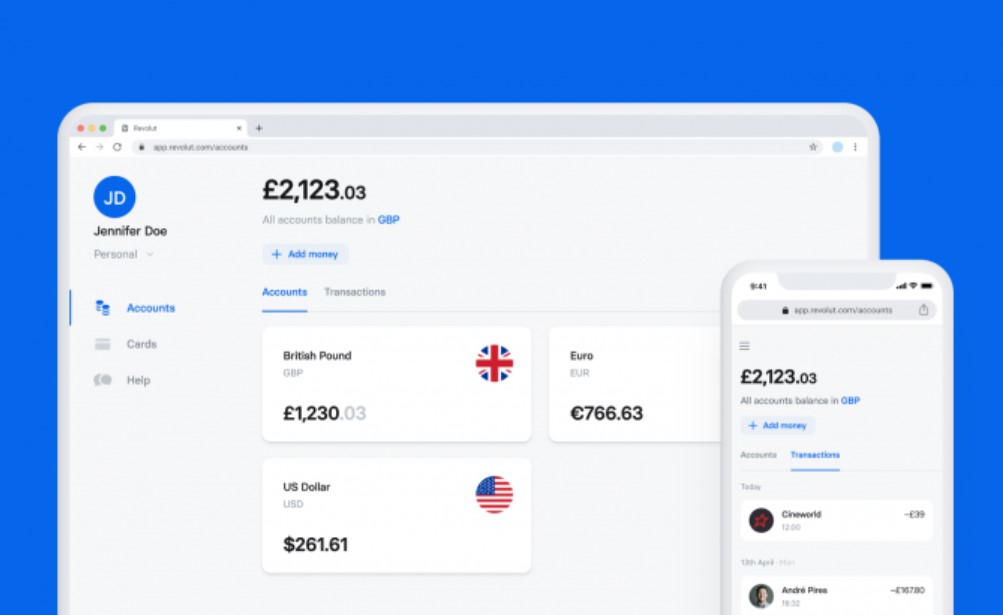

Desktop Platform

Revolut's desktop platform extends the functionalities of the mobile app, providing a user-friendly interface for managing finances from a computer. Features include:

- Comprehensive Account Management: View balances, transaction histories, and manage account settings with ease.

- Investment Tracking: Monitor and manage investments in stocks, ETFs, and cryptocurrencies with detailed analytics.

- Secure Access: Enjoy secure login options and data protection measures to safeguard your financial information.

- Seamless Synchronisation: Changes made on the mobile app are reflected on the desktop platform, ensuring a consistent experience across devices.

Trading Platform

Revolut offers a straightforward and accessible platform for trading, making it one of the best trading platforms for users to invest in stocks, ETFs, and cryptocurrencies directly from the app. With commission-free trades on certain plans, users can easily buy and sell a wide range of assets, including fractional shares of popular stocks.

Revolut’s trading platform is designed to be user-friendly, offering tools for tracking investments and real-time market data.

Whether you’re a beginner or an experienced investor, Revolut provides a convenient and cost-effective way to manage your investments and build a diversified portfolio.

Available Trading Products

Revolut offers a range of trading products, allowing users to diversify their investment portfolios. Available products include:

- Stocks: Access to over 2,500 stocks from global markets, including US and European companies, with the ability to invest in fractional shares.

- ETFs: Invest in a variety of Exchange-Traded Funds to gain exposure to different sectors and asset classes.

👉 Read here for more information on the best ETF platforms in the UK.

- Commodities: Trade commodities such as gold, silver, platinum, and palladium, with options for automatic investments through round-ups.

- Cryptocurrencies: Buy, hold, and sell popular cryptocurrencies like Bitcoin, Ethereum, and others directly within the app.

- Trading Plans: Revolut offers different trading plans, including Standard, Premium, and Metal, each providing varying benefits such as commission-free trades, higher trading limits, and access to advanced trading tools.

- American Depositary Receipts (ADRs): Revolut allows users to invest in American Depositary Receipts (ADRs), which represent shares of foreign companies traded on U.S. stock exchanges. This offers an easy way to invest in international companies without dealing with foreign exchange.

- Stocks and Shares ISA: Explore over 4,000 UK, US and EEA stocks, fractional shares and ETFs and build a Stocks and Shares ISA portfolio.

These offerings are designed to provide users with a flexible and comprehensive platform for managing their finances and investments.

Opinions

The strengths of Revolut Trading are widely acknowledged for their competitive features:

- Commissions: Revolut’s fee structure is one of its most notable strengths. For users with certain account types, it allows a specific number of trades per month without any associated costs. The number of commission-free trades increases depending on the account level, with the Metal account offering unlimited commission-free trades. This makes Revolut a strong choice for those looking for a low-cost way to invest in markets.

- User-Friendly Application: Another standout feature is the Revolut app, which is designed with simplicity and ease of use in mind. The interface is intuitive, making it accessible to both beginners and seasoned traders. The app’s clean layout and smooth functionality make it a convenient platform for managing trades, investments, and finances all in one place.

However, there are a few areas where Revolut Trading could improve:

- Customer Service: One area where Revolut falls short is in customer support. Users have reported that customer service representatives are often overwhelmed, which leads to delayed response times. In some cases, users have to wait several minutes before being connected to an agent, which can be frustrating, especially when urgent assistance is needed. This is a significant drawback that Revolut may need to address to enhance user satisfaction.

- Range of Products: While Revolut offers a selection of stocks, the variety is somewhat limited. Currently, the platform is heavily focused on U.S. stocks, which may not appeal to traders seeking access to a wider range of global markets. Additionally, there are fewer options for Exchange-Traded Funds (ETFs) and European stocks, though Revolut has indicated that they are working on expanding their offerings in these areas. This development is eagerly anticipated by users looking for more diverse investment opportunities.

In summary, Revolut offers great value in terms of commission structure and a well-designed app, but improvements in customer support and product range would enhance its appeal to a broader group of investors.

FAQs

What is Revolut?

Revolut is a financial technology company that offers a wide range of digital banking services through its app, including multi-currency accounts, international payments, cryptocurrency trading, stock investments, and budgeting tools.

It provides users with a prepaid debit card, low fees for currency exchange, and the ability to manage finances globally. Revolut also offers paid plans (Plus, Premium, and Metal) with additional features like higher withdrawal limits and travel insurance.

It's a modern, user-friendly alternative to traditional banks, especially for those seeking flexibility and low-cost international financial services.

What is their customer service like?

Customer Service for Revolut Trading is channeled through Revolut's contact methods. You can contact them via phone at +44 20 3322 8352 or through the chat within the app, which is available 24 hours a day, 7 days a week, although Premium and Metal users will have priority.

What is the history of Revolut and trading?

Revolut is a British fintech founded in 2015 that offers banking services through its app, among which we can find prepaid debit cards, currency exchange, cryptocurrency exchange, and peer-to-peer payments.

In December 2018, the company obtained a license from the European Central Bank to accept deposits and offer consumer loans.

In July 2019, the company announced that it was going to launch a commission-free trading service for stocks listed on the NYSE and NASDAQ.

How to open an account in Revolut trading?

To start trading with Revolut Trading, it is first necessary to be a Revolut client. Below, are the steps to follow to start trading with Revolut Trading:

- First of all, it is necessary to download the Revolut app, as they do not offer the possibility to trade through the web browser. It is also necessary to be over 18 years old.

- Next, it is necessary to complete all the steps to register as a Revolut user and verify our account with a front and back photo of our identity document. Verification, if there are no issues with the photos, usually takes between 5 and 10 minutes.

- Once we have access to our Revolut account and the account is verified, we can start our registration in Revolut Trading. To do this, we must go to the Dashboard of Revolut, located at the far right of the bottom bar of the application. Once there, we can see the Investments section.

- To start trading, it is necessary to provide a series of personal data. Many of these personal data are required by the regulator. Among the personal data to be provided are:

- the nationality

- the tax identification number (in the case of being Spanish, the DNI)

- the employment status. We must indicate if we are students, workers, retirees, or unemployed.

- indicate if we have any relationship or work for any listed company

- our annual income

- our assets

- our investment objectives: long-term, day trading, new to investments, etc.

- Once all the personal information is filled out, it is necessary to open all the broker documentation to be able to continue with the registration. If you don't have time at that moment, you can open them and close and read them later, as they send you all the documentation by email.

- Next, we will be asked to sign with our name declaring that we comply with a series of conditions.

- Finally, we must do the same with the broker documentation as with the documentation of the markets we are going to operate in.

For the moment, Revolut does not offer the possibility to transfer accounts from other brokers, but they are working on it.

How do I avoid currency exchange fees?

- Upgrade to Premium/Metal: These plans offer free currency exchange up to a certain limit.

- Exchange During Market Hours: Avoid weekend exchange fees by trading on weekdays.

- Hold Multiple Currencies: Exchange currencies when rates are favourable and hold them in your Revolut account.

- Pay in Local Currency: Always choose local currency when paying abroad to avoid extra fees.

- Avoid ATM Withdrawal Fees: Stay within your plan’s free ATM withdrawal limits to prevent fees.