Comparatives

Revolut vs eToro: Comparison

eToro or Revolut, two of the best brokers currently available in the markets. In fact, more and more clients are inquiring about their services, so the demand for these platforms is spectacular.

This leads to users questioning which is the best alternative between the two options: eToro vs Revolut. What are the differentiating elements of each? To this end, we will conduct a comparison to clarify the most important points of the two brokers.

What are they?

What is Revolut?

Revolut is a UK-based fintech company, originally launched in 2014 as a neobank. It began by offering fee-free currency exchange at market rates, ATM withdrawals, payments, budgeting tools, and expense tracking. Since then, it has expanded significantly into broader financial services.

Now operating as a licensed bank in Lithuania, Revolut allows users to trade over eight cryptocurrencies, invest in stocks, commodities, and other assets. It also supports QR code payments for business accounts, insurance products, and more. From its start as a digital bank, Revolut has grown into a comprehensive financial platform.

👉Read our Revolut review to learn more.

What is eToro?

eToro is a global investment platform launched in 2007 and based in Gibraltar. It allows individuals to trade over 75 cryptocurrencies, as well as stocks, commodities, ETFs, and other assets across international markets.

Regulated by major authorities like the UK’s FCA and Australia’s ASIC, eToro is widely regarded as the best copy trading platform, known for pioneering social trading. Its unique CopyTrading feature allows users to replicate the trades of successful investors. Since launching its social platform in 2010, eToro has grown rapidly and is now used by millions of traders in over 140 countries.

👉Read our eToro review to learn more.

Main Features

| Feature | Revolut | eToro | |||

| Regulation | FCA (UK, e-money), Lithuania CB (EU) | FCA (UK), CySEC (Cyprus), ASIC (Australia) | |||

| Market Access | US and some European markets | 140+ global markets | |||

| Financial Products | Shares, ETFs, cryptocurrencies, forex | Shares, ETFs, crypto, forex, indices, commodities | |||

| Minimum Deposit | No minimum (Standard plan) | $50 | |||

| Platforms | Mobile app, simplified in-app trading interface | Proprietary web-based and mobile platforms | |||

| Demo Account | No demo account | Yes | |||

| Customer Support | 24/7 live chat (in-app), no phone support | Chatbot, email; live chat for Silver tier and above |

| Feature | Revolut | eToro |

| Regulation | FCA (UK, e-money), Lithuania CB (EU) | FCA (UK), CySEC (Cyprus), ASIC (Australia) |

| Market Access | US and some European markets | 140+ global markets |

| Financial Products | Shares, ETFs, cryptocurrencies, forex | Shares, ETFs, crypto, forex, indices, commodities |

| Minimum Deposit | No minimum (Standard plan) | $50 |

| Platforms | Mobile app, simplified in-app trading interface | Proprietary web-based and mobile platforms |

| Demo Account | No demo account | Yes |

| Customer Support | 24/7 live chat (in-app), no phone support | Chatbot, email; live chat for Silver tier and above |

Pros and Cons

| Pros of Revolut | Cons of Revolut | ||

| ✅ 24/7 in-app chat support | ❌ No demo account | ||

| ✅ No minimum deposit | ❌ Limited market access | ||

| ✅ Low-cost FX & crypto trading | ❌ Basic trading tools | ||

| ✅ Integrated with banking app | ❌ Bank transfer only for funding trading account |

| Pros of Revolut | Cons of Revolut |

| ✅ 24/7 in-app chat support | ❌ No demo account |

| ✅ No minimum deposit | ❌ Limited market access |

| ✅ Low-cost FX & crypto trading | ❌ Basic trading tools |

| ✅ Integrated with banking app | ❌ Bank transfer only for funding trading account |

| Pros of eToro | Cons of eToro | ||

| ✅ Wide range of assets & markets | ❌ $5 withdrawal fee | ||

| ✅ Social trading (CopyTrader™) | ❌ Account in USD – conversion fees apply | ||

| ✅ Regulated in UK, EU, Australia | ❌ Limited live chat (not 24/7) | ||

| ✅ Includes a demo account | ❌ No phone support |

| Pros of eToro | Cons of eToro |

| ✅ Wide range of assets & markets | ❌ $5 withdrawal fee |

| ✅ Social trading (CopyTrader™) | ❌ Account in USD – conversion fees apply |

| ✅ Regulated in UK, EU, Australia | ❌ Limited live chat (not 24/7) |

| ✅ Includes a demo account | ❌ No phone support |

Are they safe?

Regulation of Revolut

Revolut is authorised in the UK by the Financial Conduct Authority (FCA) for certain financial services and operates its banking services in Europe via Revolut Bank UAB, regulated by the Bank of Lithuania and the European Central Bank. In the UK, customer funds are safeguarded in segregated accounts held with major banks like Barclays and Lloyds. While Revolut is not currently a fully licensed UK bank, it adheres to strict regulatory standards to ensure your money is protected.

Regulation of eToro

eToro is fully regulated by the Financial Conduct Authority (FCA), ensuring it meets strict standards for investor protection. The platform also operates under additional oversight in Europe (CySEC) and Australia (ASIC), reflecting its global presence.

Client funds are held securely in tier-1 banks, and eToro uses encryption and optional two-factor authentication (2FA) to safeguard accounts. While eToro (Europe) serves most EU users, UK clients are covered directly under FCA regulation, offering reassurance around safety and compliance.

Additionally, eToro offers investor compensation coverage based on the user's country of residence and the applicable local regulations. For example:

| United Kingdom | £85,000 + £1 million | Financial Conduct Authority (FCA) | Financial Services Compensation Scheme (FSCS) + Lloyd's | ||||

| Australia | $1 million | Australian Securities and Investments Commission (ASIC) | Lloyd's | ||||

| Rest of countries | €20,000 + €1,000,000 | Cyprus Securities and Exchange Commission (CySEC) | Cyprus Investor Compensation Fund + Lloyd's |

| Countries | Amount insured | Regulator | Coverage Fund |

|---|---|---|---|

| United Kingdom | £85,000 + £1 million | Financial Conduct Authority (FCA) | Financial Services Compensation Scheme (FSCS) + Lloyd's |

| Australia | $1 million | Australian Securities and Investments Commission (ASIC) | Lloyd's |

| Rest of countries | €20,000 + €1,000,000 | Cyprus Securities and Exchange Commission (CySEC) | Cyprus Investor Compensation Fund + Lloyd's |

Investment Products

Revolut

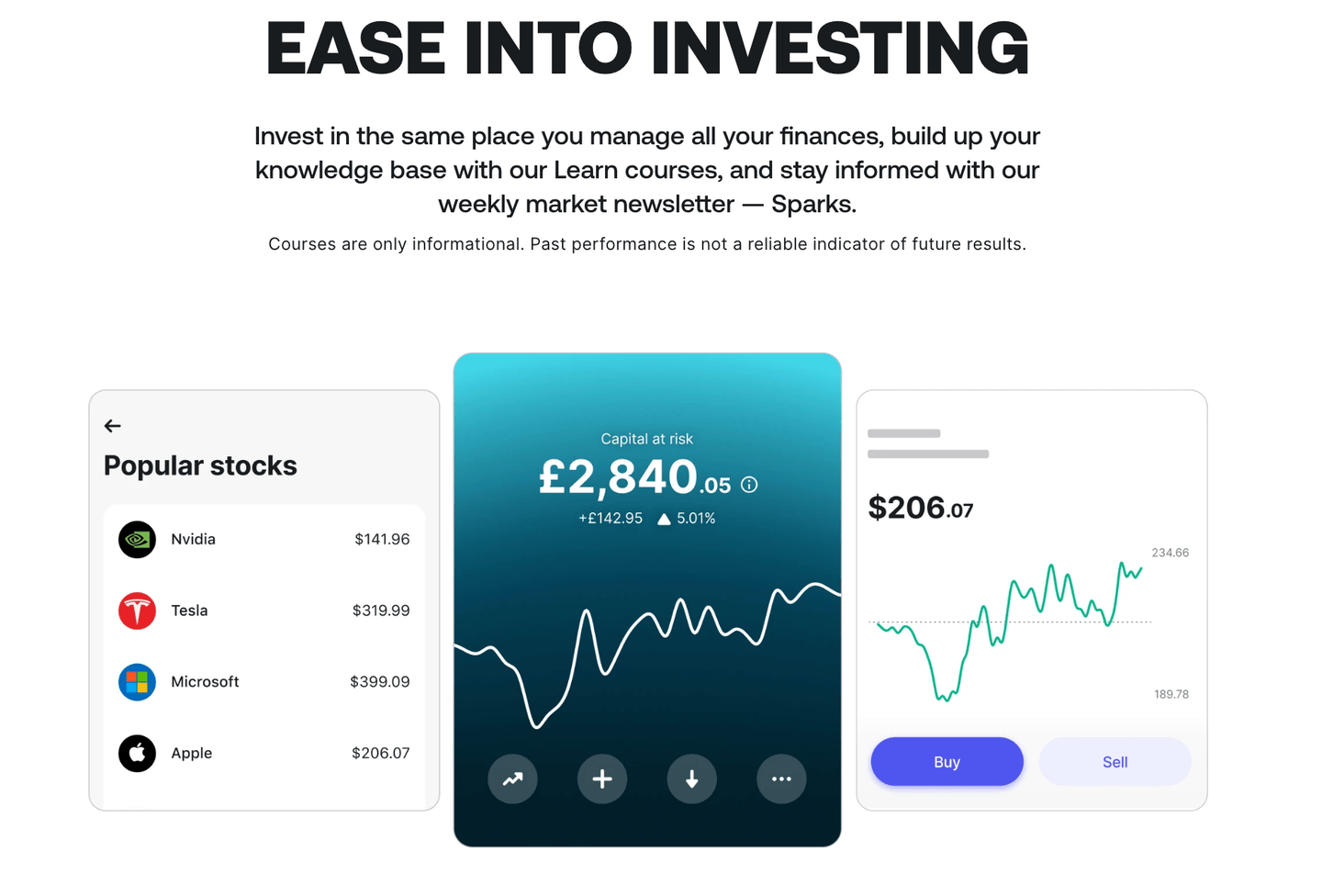

Revolut, originally launched as a digital banking app, has since expanded into a multi-asset trading platform. It now offers users access to a broad range of financial instruments—from stocks and cryptocurrencies to forex—directly within its mobile app. Designed for ease of use, Revolut is especially popular among beginner investors and travellers seeking low-cost currency exchange.

1. Stocks

- Access to major US-listed stocks (NYSE & NASDAQ)

- Expanding range of European stocks and ETFs

- Fractional shares available (from just $1)

- Commission-free trading (depending on plan: Standard, Premium, or Metal)

- Real ownership of shares (not derivatives or CFDs)

- Executed via third-party brokers (Revolut is not a Direct Market Access broker)

- Stocks & Shares ISA available for UK customers aged 18+, allowing investments up to the annual ISA allowance (£20,000 for the 2024/25 tax year) with all capital gains and dividends free from UK income and capital gains tax

- ISA funds are held separately by the appointed ISA manager in a nominee account

- Investments within the ISA are subject to Revolut’s standard fees and terms, including withdrawal restrictions and eligibility requirements

2. Cryptocurrencies

- Trade 200+ cryptocurrencies, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Cardano (ADA)

- Simple interface for buying, selling, and holding crypto

- Available directly in the app with instant execution

3. Forex (Currency Exchange)

- Over 150 currency pairs

- Real-time exchange at interbank rates

- Fee-free conversion (within monthly limits, depending on plan)

- Especially useful for travel and international transfers

eToro

eToro, originally launched as a social trading platform, has evolved into a comprehensive multi-asset brokerage offering a wide variety of financial instruments. It is well-known for its unique social trading features that allow users to follow and copy the trades of experienced investors. eToro provides access to stocks, cryptocurrencies, forex, and more, all integrated into an intuitive web and mobile app designed for investors at all levels.

In the UK, eToro also supports tax-efficient accounts such as SIPPs and ISAs, helping investors grow their wealth with tax advantages.

1. Stocks

- Access to 2,400+ global stocks from major exchanges including NYSE, NASDAQ, LSE, and more

- Fractional shares available, allowing investments with as little as £10

- Commission-free stock trading for UK and US stocks (fees may apply for other regions)

- Real ownership of shares, not CFDs, when buying stocks outright

- Option to trade stock CFDs for leverage and short-selling

- Executed via eToro’s proprietary platform with regulatory oversight

- Available within Stocks & Shares ISAs and SIPPs, enabling tax-free growth and income for UK investors

2. Cryptocurrencies

- Trade 90+ cryptocurrencies including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Cardano (ADA)

- Dogecoin (DOGE)

- Both buying and selling directly within the platform

- Ability to hold crypto in eToro Wallet (separate app) for secure storage and transfers

- Instant execution with transparent fees

- Access to crypto CFDs for leveraged trading and short positions

3. Forex (Currency Trading)

- Over 50 currency pairs including majors, minors, and exotics

- Competitive spreads and low trading commissions

- Real-time pricing and execution with leverage options

- Integrated within the same account for seamless asset diversification

- Advanced charting and analysis tools suitable for all skill levels

- Social features allow users to follow top forex traders and strategies

Tax-efficient accounts:

- eToro offers Stocks & Shares ISAs and Self-Invested Personal Pensions (SIPPs) for UK investors, allowing individuals to invest in a tax-efficient way. These accounts benefit from tax-free capital gains and dividends (ISA), or tax relief on contributions (SIPP), making eToro suitable for long-term retirement and wealth-building strategies.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

Fees and charges

Revolut Fees and Charges

It should be noted that the broker's service does not have trading commissions for buying and selling stocks, but the conditions vary depending on the account we have as users.

In this regard, Revolut offers five types of accounts, with the Standard account being the free and basic account. The Plus, Premium, Metal and Ultra accounts are paid, but they offer a greater number of advantageous conditions.

| Standard | 1 free trades/month | £0 | |||

| Plus | 3 free trades/month | £3.99/month | |||

| Premium | 5 free trades/month | £7.99/month | |||

| Metal | 10 free trades/month | £14.99/month | |||

| Ultra | 10 free trades/month | £45/month |

| Account | Conditions | Price |

|---|---|---|

| Standard | 1 free trades/month | £0 |

| Plus | 3 free trades/month | £3.99/month |

| Premium | 5 free trades/month | £7.99/month |

| Metal | 10 free trades/month | £14.99/month |

| Ultra | 10 free trades/month | £45/month |

eToro Fees and Charges

eToro is a popular online trading platform that offers commission-free trading for stocks and ETFs. However, it's important to be aware of various fees associated with different asset classes and services.

Stocks & ETFs (CFDs)

- Commission: 0% commission on stock and ETF trades.

- Spread: 0.09% for CFD trading on stocks and ETFs.

- Note: CFD trades do not involve ownership of the underlying asset.

Currencies (CFDs)

- Spread: From 1 pip for major currency pairs like EUR/USD.

Cryptocurrencies

- Transaction Fee: 1% fee on both buy and sell transactions.

- Spread: Varies by cryptocurrency; for example, Bitcoin has a spread starting from 0.75%.

- Example: If you buy £1,000 worth of Bitcoin, you'll pay a £10 fee (1% of £1,000). When you sell, another £10 fee applies.

Indices (CFDs)

- Spread: From 0.75 points for major indices like the S&P 500.

Commodities (CFDs)

- Spread: From 2 pips for commodities like oil and gold.

Additional Fees

- Deposit Fee: Free for UK users.

- Withdrawal Fee: $5 (approximately £3.63) per withdrawal.

- Currency Conversion Fee: From 50 pips for currency conversions.

- Inactivity Fee: $10 (approximately £7.26) per month after 12 months of inactivity.

Important Notes

- Currency Conversion: eToro operates in USD, so currency conversion fees may apply when depositing or withdrawing funds in GBP.

- CFD Trading: CFD trades do not involve ownership of the underlying asset and may incur additional fees such as overnight charges.

- Crypto Trading: Crypto transactions are subject to both a 1% transaction fee and a spread fee, which can vary by cryptocurrency.

Trading Platforms

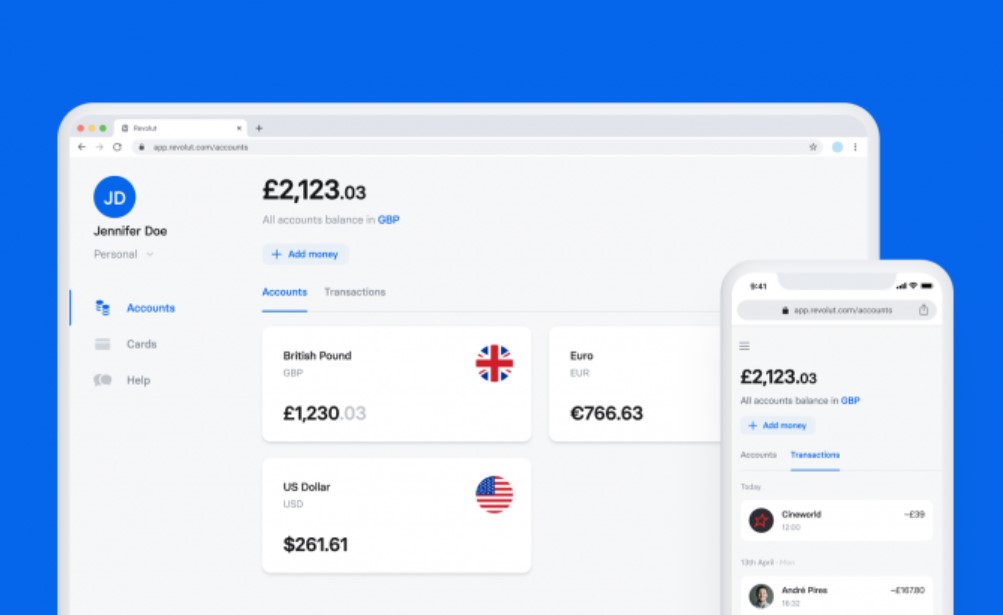

Revolut Platform

Revolut is designed primarily for non-professional individual clients, so it doesn’t offer advanced trading features. However, its biggest strength lies in convenience — it’s a best trading platform for users who want to manage all their finances and investments in one app, saving time and effort.

Converting euros to other currencies or cryptocurrencies is straightforward. Just go to the Accounts section, tap Convert currency, and choose the currencies you want to exchange.

For buying and selling shares, head to the Control Panel section and select the trading option. After accepting the terms and conditions, you’ll get access to a dedicated account for stock trading, with a simple platform available in several languages.

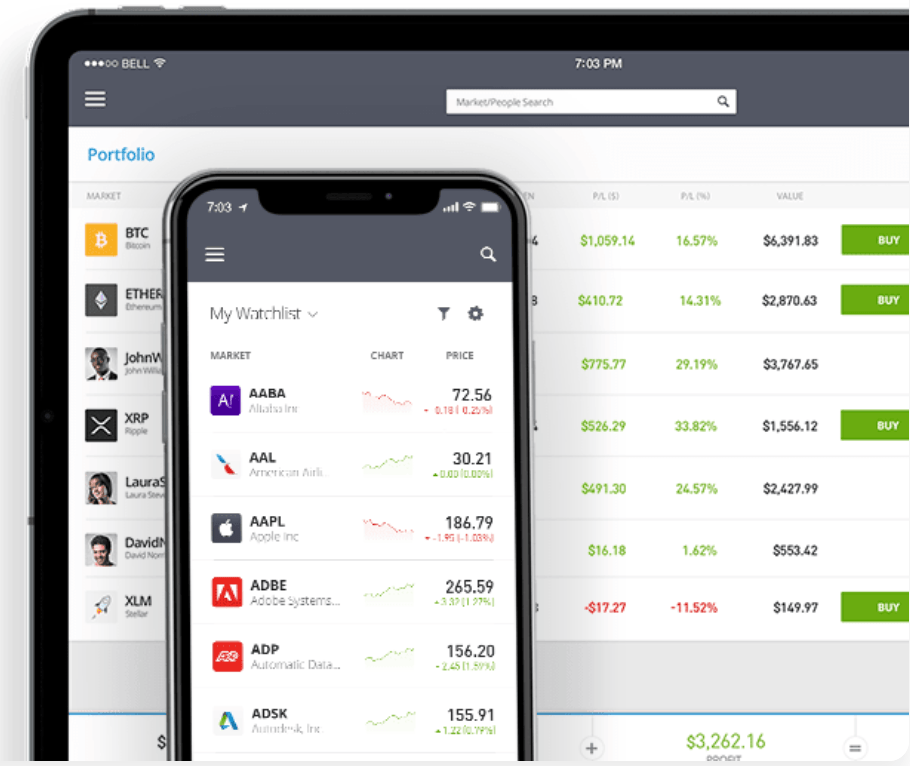

eToro Platform

The eToro platform is designed to be intuitive, social, and accessible for traders of all experience levels. It’s a web-based platform with no need to download additional software, and it’s also available via a fully-featured mobile app for iOS and Android.

What makes eToro stand out is its social trading functionality. This unique feature allows users to follow, interact with, and even automatically copy the trades of experienced investors through its CopyTrader™ system — ideal for beginners or passive investors looking to learn from others.

Key features include:

- Clean, user-friendly interface

- Real-time price charts and customisable watchlists

- Integrated news feed and market sentiment tools

- Portfolio performance tracking and detailed trade history

- Access to a wide range of assets: stocks, ETFs, forex, crypto, commodities, and indices

While it doesn't offer advanced charting or third-party integration (like MetaTrader), eToro’s strength lies in its community-driven approach to investing and its all-in-one platform for multi-asset trading.

Deposits and withdrawals

Revolut

To trade with Revolut, you’ll need to open and verify one of its account types:

- Standard (free)

- Plus

- Premium

- Metal

- Ultra

Depositing Funds

Once your Revolut account is set up, you can fund it via:

- Bank transfer (UK Faster Payments, SEPA for EEA)

- Linked bank accounts (via Open Banking)

- Card top-ups (for general use, but not supported for stock trading accounts)

Note: While Revolut allows card top-ups for day-to-day app use, stock trading accounts can only be funded via bank transfer. Revolut does not accept cash deposits.

Funds transferred into your Revolut account can then be used to invest in stocks, crypto, or other available assets. Transfers are typically instant or processed within a few hours, depending on the method used.

Withdrawing Funds

After selling a stock, your cash proceeds will appear in your account, but you cannot withdraw them until the transaction settles — this usually takes two business days.

However, you can reinvest those proceeds immediately into another stock without waiting for settlement.

Once settled, funds become available in your Revolut e-money account and can be withdrawn via:

- Bank transfer to your linked UK account

- Spending directly using your Revolut card

eToro

Moving on to eToro, we must initially indicate that the account is denominated in United States dollars. When carrying out cash operations, the broker applies currency conversion charges.

Deposit Methods

eToro supports a variety of payment options for adding funds to your account, including:

- Credit/debit card

- PayPal

- Neteller

- Skrill

- Rapid Transfer

- Klarna / Sofort Banking

- Electronic funds transfer

- Online banking / Trustly (for EU users)

- POLi (for AUD deposits only)

Note: Deposits via bank transfer must be at least $500.

Withdrawal Options

Withdrawal options are slightly more limited. You can withdraw funds using:

- Credit card

- PayPal

- Bank transfer

A minimum withdrawal amount of $30 applies, along with a flat withdrawal fee of $5 per transaction.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

Education and Resources

Revolut Education

Revolut has been enhancing its educational offerings through its in-app Learn feature. This feature provides users with interactive courses covering various topics, including cryptocurrency basics, blockchain technology, and stock trading fundamentals. For instance, Revolut has launched a Stock Learn module that covers the basics of stocks, why people invest in them, and how to invest in stocks. After each lesson, users can take a short quiz to test their understanding. Additionally, Revolut offers short-form content blogs written by research and investment professionals, covering topics such as stock splits and how to read earnings reports. Since its launch, over 3.8 million customers across Singapore, Australia, the UK, and the EEA have used the Learn feature .

Furthermore, Revolut has introduced the "Learn & Earn" initiative, which rewards users with cryptocurrency for completing educational courses. For example, users can earn up to $50 AUD worth of crypto by completing six free in-app educational crypto courses focused on various tokens and protocols

eToro Education

eToro stands out with its dedicated eToro Academy, a comprehensive learning platform offering a wide range of educational materials. This includes video tutorials, webinars, trading guides, and market analysis, all designed to support traders at different skill levels — from beginners to advanced investors. The Academy covers topics such as fundamental and technical analysis, risk management, and social trading strategies.

Additionally, eToro’s social trading platform allows users to learn directly by observing and copying experienced traders, offering a practical, community-driven learning experience.

Customer Service

Revolut Customer Service

- Live Chat: Available 24/7 through the app. To access, tap your profile icon, select 'Help', and choose 'Get more help'.

- Phone Support: Automated line for card-related issues: +44 20 3322 8352. Note: This line doesn't connect to a human agent.

- Email: For general inquiries: [email protected]. Response times may vary.

- Social Media: Direct messaging via official channels like @RevolutApp on Twitter.

eToro Customer Service

- Live Chat: Temporarily limited to Silver Club members and above due to high demand.

- Support Ticket: Accessible through the platform's Help Center. Response times may be extended during peak periods.

- Phone Support: Available at +44 20 3326 9900 for UK clients.

- Social Media: Engage via @eToroTeam on Twitter for assistance.

Which broker is better: Revolut or eToro?

eToro offers a more complete, regulated trading experience with access to stocks, ETFs, forex, and real crypto. Its standout feature is social trading, allowing users to copy top investors — ideal for passive investing.

Revolut, while less regulated, is more cost-effective for currency and crypto exchange. It offers access to 150+ currency pairs and lower fees, but requires more hands-on management.

In short:

- Choose Revolut for low-cost currency and crypto trades.

- Choose eToro for regulated investing and social trading features.

Disclaimer: