Brokers

Robinhood UK Review

Robinhood is a US-based broker offering shares, cryptocurrencies, options, and ETFs. It was founded in 2013 by computer scientists Vlad Tenev and Baiju Bhatt, and has since gained popularity for its commission-free trading and user-friendly platform.

Discover how Robinhood has brought its data‑driven, commission‑free trading model to the UK—offering streamlined access to thousands of US equities, fractional shares, and real‑time insights through a sleek, mobile-first interface. In this review, we'll break down how Robinhood compares with established platforms, spotlight its innovative features, and examine key limitations UK investors should know. Drawing on global fintech insights and UK-specific regulatory context, we'll help you decide if Robinhood is the right fit for your investment journey in 2025.

Pros and Cons

| Pros of Robinhood | Cons of Robinhood | ||

| ✅Commission-Free Trading: Robinhood pioneered commission-free trading for shares, ETFs, and options, saving investors money. | ❌Customer Support: While support is available via chat and phone, it’s often difficult to reach someone directly. | ||

| ✅User-Friendly Interface: The intuitive design makes it accessible to beginners. | ❌Limited Analysis Tools: May not meet the needs of advanced traders requiring more in-depth research too. | ||

| ✅Cryptocurrency Access: Allows users to buy and sell select cryptocurrencies, which is not common among traditional brokers. | ❌No Desktop Platform: Primarily mobile-based, which may not suit all investors. | ||

| ✅Fractional Shares: Enables users to invest in high-priced shares without needing to buy whole units. | ❌Account Type Limitations: Lacks joint, retirement, or educational account options. | ||

| ✅IPO Access: Offers opportunities to invest in initial public offerings. | ❌Payment for Order Flow: Robinhood’s practice of routing trades to market makers for payment has drawn criticism for potentially compromising trade execution quality. |

| Pros of Robinhood | Cons of Robinhood |

| ✅Commission-Free Trading: Robinhood pioneered commission-free trading for shares, ETFs, and options, saving investors money. | ❌Customer Support: While support is available via chat and phone, it’s often difficult to reach someone directly. |

| ✅User-Friendly Interface: The intuitive design makes it accessible to beginners. | ❌Limited Analysis Tools: May not meet the needs of advanced traders requiring more in-depth research too. |

| ✅Cryptocurrency Access: Allows users to buy and sell select cryptocurrencies, which is not common among traditional brokers. | ❌No Desktop Platform: Primarily mobile-based, which may not suit all investors. |

| ✅Fractional Shares: Enables users to invest in high-priced shares without needing to buy whole units. | ❌Account Type Limitations: Lacks joint, retirement, or educational account options. |

| ✅IPO Access: Offers opportunities to invest in initial public offerings. | ❌Payment for Order Flow: Robinhood’s practice of routing trades to market makers for payment has drawn criticism for potentially compromising trade execution quality. |

Fees and Commissions

Robinhood offers commission-free trading on stocks, ETFs, options, and cryptocurrencies, making it an attractive choice for cost-conscious investors. However, certain fees apply in specific situations.

Regulatory Fees

Robinhood passes on mandatory regulatory fees, including:

- SEC Fee: $27.80 per $1 million of principal for sell orders, rounded up to the nearest penny. Sales with a notional value of $500 or less are exempt from this fee.

- Trading Activity Fee (TAF): $0.000166 per share for equity sells, with a maximum of $8.30 per trade. Sales of 50 shares or less are exempt from this fee.

American Depositary Receipt (ADR) Fees

When trading foreign stocks listed in the U.S. through ADRs, investors may incur a custodial fee ranging from $0.01 to $0.03 per share, as charged by the issuing banks.

Options Trading Fees

The Options Clearing Corporation charges Robinhood a combined fee of $0.04 per options contract, which Robinhood collects from customers. Additionally, Robinhood charges a Consolidated Audit Trail (CAT) fee of $0.0035 per options contract.

Margin Interest Rates

The standard margin interest rate is 11.75% annually. However, Robinhood Gold subscribers benefit from a reduced rate of 7.75%, with rates subject to change based on market conditions.

Transfer Fees

Robinhood does not charge fees for standard bank transfers. However, instant bank withdrawals and transfers to external debit card accounts may incur a fee of up to 1.75% of the transfer amount, with a minimum fee of $1 and a maximum fee of $150.

These fees are subject to change, and it's advisable to review Robinhood's official fee schedule for the most current information.

Range of Investments

Robinhood offers a diverse range of investment options suited for both beginner and intermediate investors. Users can trade the following iwht no commission or FX fees: U.S. exchange-listed stocks, US exchange-listed stock options and index options, and American Depositary Receipts for over 650 globally-listed companies that are listed on US exchanges or the Over-the-Counter Market.

However, Robinhood UK currently doesn’t support the following assets:

- Closed-end funds

- Exchange-traded funds (ETFs)

- Cryptocurrency

- Non-US-domiciled stocks

- Select OTC equities

- Preferred stocks

- Mutual funds

- Bonds and fixed-income trading

- Stocks that trade on non-US exchanges

Minimum Deposits and Withdrawal

According to its website, Robinhood doesn’t impose a minimum deposit or withdrawal amount. However, it only supports a limited number of payment methods — mainly bank transfers and VISA/MasterCard.

Standard transfers between banks and the Robinhood system are free of charge. However, a “faster withdrawal” option is available, which charges a 1.5% fee for expedited transactions.

Trading Platforms

Robinhood operates primarily through its mobile app and web-based platform 'Legend', both of which are designed to be simple and user-friendly. The interface is clean and intuitive, making it ideal for beginners, and includes basic charts, real-time market data, and straightforward order placement. Users can set price alerts, create watchlists, and view basic performance information.

In many Robinhood trading review discussions, the platform is frequently praised for its accessibility and design, especially for those new to investing. For new investors looking for an easy entry point, Robinhood stands out as one of the best trading platforms in terms of accessibility and design. Those subscribed to Robinhood Gold gain access to enhanced features such as Level II market data and professional research from Morningstar.

While it may lack some advanced tools and a desktop version, it delivers a strong overall experience for casual and first-time traders.

Education

Robinhood offers a range of educational content aimed at helping beginner investors build their knowledge of the markets. Its ‘Learn’ section features easy-to-understand articles on investing basics, financial terminology, trading strategies, and economic concepts. The content is written in a straightforward and accessible style, making it suitable for those new to investing.

Additionally, Robinhood provides in-app explanations and tooltips to guide users through different features and order types. While the educational offering is helpful for getting started, more advanced investors may find it somewhat limited compared to platforms that offer in-depth courses, webinars, or interactive learning tools.

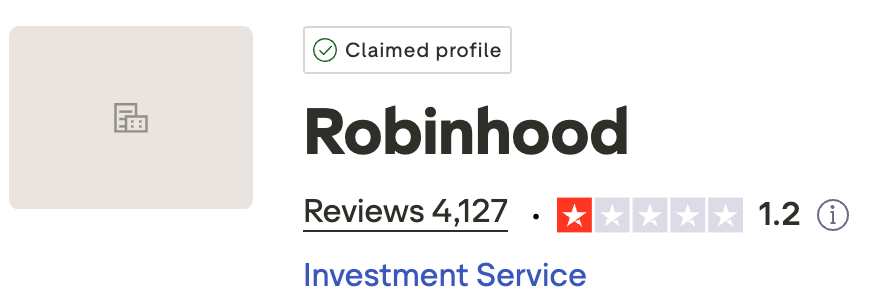

Reviews

Upon deeper investigation, we found that reviews for Robinhood are mixed, with a slight lean towards negative experiences. Positively, users highlight the platform’s flexibility and range of financial products.

For example, Robinhood has received overwhelmingly negative feedback on Trustpilot, with a poor rating of just 1.2 stars based on over 4,000 reviews, reflecting widespread dissatisfaction among users.

Robinhood has faced serious criticism over its customer support, which appears to be one of the most commonly cited issues. Between 2020 and 2022, the broker was fined by the SEC, FINRA, and the New York Department of Financial Services (DFS) for multiple breaches related to customer protections.

Alternatives to Robinhood

Robinhood offers access to shares, options, ETFs, and cryptocurrencies, making it a versatile choice for retail investors. However, depending on your investment preferences, there are several strong alternatives that cater to different needs and experience levels.

For those interested in equities, there are top online brokers for buying shares. If you prefer diversified funds, consider the best brokers for ETF investing.

Curious about ETFs? Take a moment to explore what an ETF is and how it can play a role in your investment strategy

Recommended platforms include:

- Interactive Brokers (8.75) for its comprehensive tools and global access

- Fintual (8.5) for simplified investing

- XTB (9.0) for its strong educational content and low-cost structure

- Tradeview Markets (8.5) for multi-asset trading

- Tickmill (8.0) for low spreads

- Admirals (8.5) for a well-rounded offering with strong research features

FAQs

What Can You Do with Robinhood?

Investors using Robinhood can buy and sell shares, trade options, invest in the best ETFs and IPOs, and deal in cryptocurrencies — even through fractional shares.

One of Robinhood’s main attractions is its mostly commission-free trading, or very competitive fees, all accessible via its proprietary platform available on both iOS and Android.

Robinhood also recently introduced a cash card that can earn users up to 8% cashback at participating retailers, with bonus rewards ranging from 10% to 100%.

Is your money safe with Robinhood?

Robinhood offers a sleek, beginner-friendly trading platform with commission-free access to stocks, ETFs, options, and cryptocurrencies. Its intuitive mobile app, fractional share investing, and IPO access make it an attractive choice for new investors looking for a low-barrier entry into the markets. The added protection from SIPC and regulatory oversight by the SEC and FINRA also provide a layer of reassurance.

However, Robinhood has faced criticism over its customer service and past security breaches. Its revenue model—payment for order flow—raises questions about trade execution quality, and advanced traders may find its research tools lacking. While it’s generally safe and easy to use, users should be aware of the risks and limitations before committing significant capital.

How to Open a Robinhood Account

Opening a Robinhood account involves three main steps (after downloading the app for iOS or Android):

- Submit an application via the Robinhood app.

- Within a few days, you’ll receive an email confirming approval or requesting further information.

- You’ll be asked to upload identity verification documents via a secure link. Robinhood claims account review typically takes 5 to 7 working days.

The broker collects personal, tax, and financial information to comply with US government regulations and FINRA rules. It also adheres to the SEC’s customer identification rule under the USA PATRIOT Act (2001), requiring brokers to verify new account holders.

What is their customer service like?

You can access Robinhood’s customer service primarily through the app or website. In the app, go to your Account, then Support, and tap Contact Support to start a live chat or request a callback. On the website, log in, click Help, and follow the same process.

While 24/7 in-app support is available, phone support is limited to certain hours and services. For general enquiries, you can call +44 808 196 6880 (Monday to Friday, 7 AM – 9 PM ET), though many users report long wait times and limited assistance.

Is Robinhood good for beginners?

Yes, Robinhood is well-suited for beginners. Its simple, user-friendly mobile app and commission-free trading make it easy to get started with investing in stocks, ETFs, options, and cryptocurrencies.

The platform offers basic educational resources and straightforward tools, making it an ideal choice for new investors.

Can you trade interantioanl stocks with Robinhood?

No, Robinhood does not currently offer direct access to international stocks. While you can trade U.S.-listed stocks and ETFs, foreign stocks can only be traded indirectly through American Depositary Receipts (ADRs), which may involve additional fees.