Brokers

Saxo Bank Review

Saxo Bank is a premium broker offering access to 71,000+ investments across global markets. It’s ideal for experienced investors, with advanced platforms (SaxoTraderGO/PRO), deep research tools, and tiered accounts. Regulated and secure, but fees can be high and the platform may feel complex for beginners.

In this article, we will review Saxo Bank, a Danish bank that also offers an online investment service. With this entity, you can access a wide variety of products to complement your investment portfolio.

Pros and Cons

| Pros of Saxo Bank | Cons of Saxo Bank | ||

| ✅ Regulated by reputable authorities (FCA, FSA, and more) | ❌ High minimum deposit for certain account types, especially VIP | ||

| ✅ Access to over 71,000 financial instruments including stocks, ETFs, bonds, and more | ❌ No direct cryptocurrency trading (only ETPs) | ||

| ✅ Advanced trading platforms with extensive tools and resources | ❌ Commissions and fees may be higher for lower account tiers | ||

| ✅ Low spreads (starting from 0.4 pips for forex) | ❌ Complicated fee structure that may not be transparent for beginners | ||

| ✅ Range of investment products, including cryptocurrency ETPs, options, and futures | ❌ Limited support for some countries (e.g., mutual funds only available in a few countries) | ||

| ✅ Comprehensive research and market analysis tools | |||

| ✅ Tiered account structure allows for customised service |

| Pros of Saxo Bank | Cons of Saxo Bank |

| ✅ Regulated by reputable authorities (FCA, FSA, and more) | ❌ High minimum deposit for certain account types, especially VIP |

| ✅ Access to over 71,000 financial instruments including stocks, ETFs, bonds, and more | ❌ No direct cryptocurrency trading (only ETPs) |

| ✅ Advanced trading platforms with extensive tools and resources | ❌ Commissions and fees may be higher for lower account tiers |

| ✅ Low spreads (starting from 0.4 pips for forex) | ❌ Complicated fee structure that may not be transparent for beginners |

| ✅ Range of investment products, including cryptocurrency ETPs, options, and futures | ❌ Limited support for some countries (e.g., mutual funds only available in a few countries) |

| ✅ Comprehensive research and market analysis tools | |

| ✅ Tiered account structure allows for customised service |

Is Saxo safe?

Yes, Saxo Bank is considered a safe broker for UK clients. It is regulated by the UK’s Financial Conduct Authority (FCA), ensuring it meets high standards for client protection and financial conduct. Additionally, Saxo Bank is regulated by the Financial Supervisory Authority of Denmark (FSA), where its headquarters are based, and is registered with Spain's CNMV for cross-border services. These regulatory bodies provide strong oversight to ensure a secure trading environment for clients.

As an FCA-authorised firm, Saxo Capital Markets UK Limited is subject to the UK's regulatory standards, which include client money protection and access to the Financial Services Compensation Scheme (FSCS). This means that if the firm were to become insolvent, eligible clients could claim compensation up to £85,000 per person.

Available Investment Products

These are the different products you can trade with at Saxo Bank.

Spot Stocks

Saxo Bank provides access to over 23,000 stocks across more than 50 global exchanges, including major markets like the London Stock Exchange—allowing UK investors to trade in line with official London Stock Exchange hours—as well as New York, Hong Kong, and Tokyo.

ETFs and Crypto ETPs

The platform offers more than 8,200 ETFs, ETCs, and ETNs, covering various sectors such as technology, healthcare, and more. Saxo Bank also provides trading in Crypto ETPs (Exchange-Traded Products), allowing exposure to cryptocurrencies like Bitcoin and Ethereum without direct ownership.

Bonds

Saxo Bank offers access to over 5,200 bonds from 26 countries in 21 currencies. The minimum investment for online bond trading is USD 10,000, and commissions start at 0.2%.

Investment Funds

The platform provides a wide range of mutual funds and actively managed portfolios from leading asset managers like BlackRock and Franklin Templeton. These funds are available in select countries, including the UK, Germany, Poland, and Denmark.

Options and Futures

Saxo Bank offers options and futures trading across various asset classes, including stocks, indices, and commodities. For example, it provides access to 45 FX options with maturities ranging from one day to 12 months.

Forex Trading

Saxo Bank supports trading in over 185 FX pairs, including major, minor, and exotic currencies. Retail clients can access competitive spreads, starting from 0.4 pips for major pairs.

Commodities

Saxo Bank offers a wide range of commodities, including energy, metals, and agricultural products. Traders can access these markets through CFDs, futures, options, spot pairs, or exchange-traded commodities (ETCs).

Account Tiers and Fees

Saxo Bank offers different account tiers—Classic, Platinum, and VIP—each with varying benefits and fee structures. For example, VIP accounts (requiring a deposit of £1,000,000 or more) enjoy the lowest transaction fees, such as $0.005 per share for US stocks and 0.03% for UK stocks and ETFs.

CFDs

Saxo Bank offers commission-free trading on index, Commodity or Bond CFDs with margin rates from 5% and a leverage up to 1:20 depending on the product.

👉 Read here for more information on the best CFD brokers

Account Types

Saxo Bank offers a range of account types tailored to different trading and investment needs:

Individual Account

- Classic: Default tier with no minimum deposit. Offers competitive pricing and access to all asset classes.

- Platinum: Requires a minimum deposit of £200,000. Provides reduced transaction fees and additional benefits.

- VIP: Requires a minimum deposit of £1,000,000. Offers the lowest fees and exclusive services.

Specialised Accounts

- ISA (Individual Savings Account): Allows UK residents to invest up to £20,000 per tax year with tax-free returns.

- SIPP (Self-Invested Personal Pension): Enables individuals to manage their pension investments.

- Trust Account: Designed for managing investments on behalf of a trust.

- Joint Account: Allows two individuals to share an account for trading and investing.

- Corporate Account: Tailored for businesses seeking to invest and trade.

- Professional Account: For clients qualifying as professional investors, offering enhanced services and lower margin rates.

Saxo Bank also offers a 20-day free demo account in a simulated environment with USD 100,000.

Each account type provides access to Saxo Bank's comprehensive trading platforms, including SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO.

Fees and Commissions

Let’s take a look at one of the most important aspects of Saxo Bank: its fees. Are they affordable, or are there better options out there?

Here’s a quick summary of Saxo Bank’s main trading commissions:

- Stocks: From $1 per transaction

- ETFs: From $1 per transaction

- Futures: From $1 per contract

- Bonds: 0.05% of the bond value

- Options: From $0.75 per contract

- Investment Funds: From $0

At first glance, Saxo Bank’s fees appear to be reasonably competitive. However, let’s take a closer look at some additional key charges.

Non-Trading Fees

Like many brokers, Saxo Bank charges additional service fees:

- Currency Conversion Fee: 0.25%

- Custody Fee (for holding assets):

- 0.15% for Classic accounts

- 0.12% for Platinum accounts

- 0.09% for VIP accounts

- Inactivity Fee: Not charged

Deposit and Withdrawals

Saxo Bank UK requires a minimum deposit of £500 to open a Classic account. Platinum and VIP accounts necessitate higher minimum deposits of £200,000 and £1,000,000.

Deposits can be made via bank/wire transfer or debit card, with initial funding needing to be via bank transfer. Subsequent deposits may be made using a debit card .

Withdrawals are processed to accounts in the client's name and typically take 1–2 business days if requested before 2:00 PM CET; otherwise, processing may take up to 3 business days .

There are no fees charged by Saxo Bank for deposits or withdrawals; however, clients should be aware of potential fees from their own banks or payment providers.

Trading Platforms

Regarding the trading platforms of the Danish broker—widely considered among the best trading platforms available - this Saxo Bank trading platform review covers its three main options, which are the following:

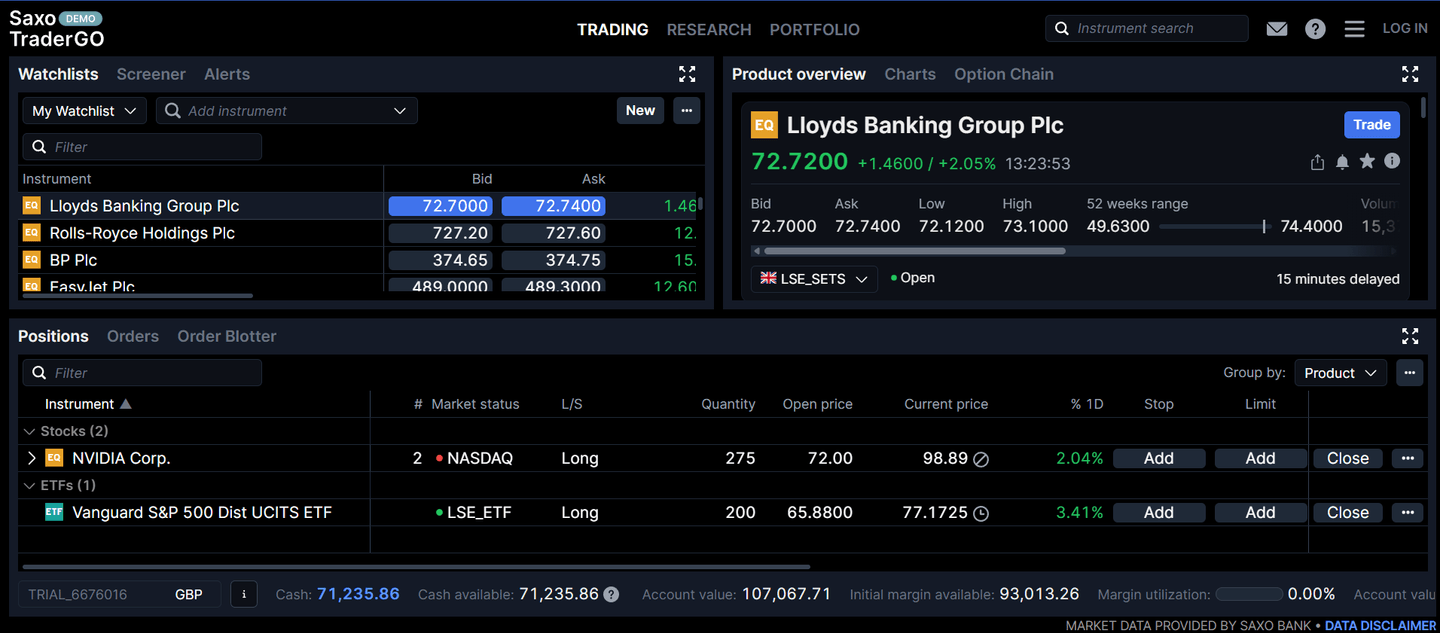

Saxo Trader Go

This platform is the recommended option for individual investors. It features a very simple interface that allows you to access an overview of your account, a portfolio summary, a profitability analysis, and a breakdown of the returns obtained.

Additionally, it gives you access to relevant news, an analysis center, Global Sales Trading market updates, and notifications to your mobile. Altogether, these are some of the particular services you will enjoy with Saxo Trader Go:

- Fundamental analysis reports and tools: To obtain ratios that help you discover the intrinsic value of companies.

- Expert news

- Technical analysis: with more than 40 technical indicators and drawing tools. If you're new to this area, it's worth exploring what technical analysis is.

Saxo Trader PRO

This option is recommended for professional investors, and it includes everything mentioned plus advanced tools, among which the following stand out:

- Order flow: time and sales data

- Development of algorithmic orders

- Charting package

- An options chain

Saxo Investor

The Saxo Investor platform is designed for individual investors seeking a straightforward and easy-to-use interface. It provides access to a comprehensive portfolio overview, including an analysis of your investments, performance tracking, and a clear breakdown of your returns.

The platform also offers essential services such as real-time news updates, market analysis, and notifications directly to your mobile. With Saxo Investor, you can access:

- Comprehensive investment insights: Including portfolio performance and detailed analytics.

- Market news: Stay updated with expert commentary and trading updates.

- Tools for analysis: Access fundamental and technical analysis tools, including company ratios and more than 40 technical indicators and drawing tools.

This platform provides all the essential tools to help you manage and track your investments effectively.

Education and Research

Saxo Bank provides a robust suite of educational resources and research tools for UK clients. Their Saxo Academy offers free courses, videos, and webinars covering trading basics, strategies, and platform tutorials.

For more advanced users, Saxo delivers in-depth market analysis, daily news updates, trade ideas, and expert commentary from their global strategy team—helping traders make informed decisions across various asset classes.

Saxo Bank Opinions

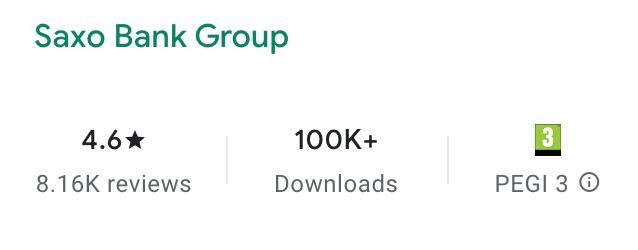

The opinions of Saxo Bank users seem mixed according to what clients indicate on TrustPilot. Its average rating is 3.7/5 from a total of more than 7,300 comments. This indicates that their service is not considered bad, but not excellent either.

However, it should be added that the opinions from users who downloaded the mobile App on the Google Play Store are slightly more positive, with an average rating of 4.6 stars (out of 5) from a total of more than 8,000 user reviews.

FAQs

What is Saxo Bank?

Saxo Bank is a Danish investment bank specialising in online trading services. This is because it was founded as a broker initially, specifically in the year 1992, which guarantees that it is a brand with a lot of experience in the sector.

The company grew from its founding to obtain a banking license, and currently offers its services in 72 countries, also having 15 offices outside Denmark.

Its online trading platform, called SaxoTrading, was launched in 1998 and has an option for retail and another for professionals. With it, clients have access to more than 71,000 financial instruments, being able to invest in stocks, ETFs, cryptocurrencies, bonds, funds, commodities, derivatives, and more.

What is their customer service like?

Saxo Bank offers customer support via phone, email, and live chat (for funded accounts). UK clients can call +44 (0)207 151 2100 or email [email protected].

Support is generally responsive, though user reviews are mixed—some praise the helpfulness, while others mention delays or generic replies.

Is this broker good for beginners?

Yes, Saxo Bank is suitable for beginners, especially with its Saxo Trader Go platform, which offers a simple, user-friendly interface. It provides easy access to key features like portfolio summaries, profitability analysis, and essential tools for trading.

However, beginners should be aware that some advanced tools and features on Saxo’s platform might be more suited for experienced traders.

Is Saxo a good investment platform?

Yes, Saxo is a highly regarded investment platform offering access to a wide range of financial instruments, including stocks, ETFs, bonds, options, and more. It is known for its competitive fees and robust trading tools.

Saxo Bank’s platforms provide excellent research, educational resources, and advanced charting capabilities, making it a solid choice for both beginner and professional investors.