Reviews

Webull UK Review 2025

Webull is an online trading platform that has been around for about 8 years. Despite its relatively recent launch, it has quickly gathered followers and built a strong community of traders who support its operations.

Due to its growing popularity, we'll review some key details about Webull, focusing on its regulation, trading requirements, the products and platforms it offers, and other areas of interest.

What Is Webull?

Webull is an online brokerage launched in 2017 in New York. The platform aims to make stock and ETF trading accessible, cost-effective, and technology-driven. In 2021, Webull launched in the UK, offering British investors access to US markets with the same sleek tools and low fees.

Its core appeal lies in low-cost execution, a mobile-first user experience, and professional-grade charting tools not always available on retail apps.

UK clients, however, can only access US-listed equities and ETFs. So while it's ideal for those focused on American markets, it doesn’t serve those looking to invest locally or diversify globally.

Pros and Cons

Webull offers a range of strengths that make it appealing to a certain type of investor, though there are also notable limitations for UK clients.

| Pros of Webull | Cons of Webull | ||

| ✅ FCA Regulated: Webull Securities (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FRN 1002126). | ❌ No ISA or SIPP Options: Unlike other brokers like Freetrade or AJ Bell, Webull doesn’t support tax-efficient accounts. | ||

| ✅ Low-Cost Trading: Offers 0.025% commission per trade and no charges for deposits, withdrawals, or inactivity. | ❌ Limited Asset Access: Only US stocks and ETFs are available — no UK, European, or other global equities. | ||

| ✅ Advanced Tools: Features include real-time charting, over 50 technical indicators, and paper trading to practice without financial risk. | ❌ No Cash Interest or Savings Options: Funds held in your account do not earn interest. | ||

| ✅ User-Friendly Mobile App: Webull’s app is fast, clean, and well-designed for tracking portfolios and executing trades. |

| Pros of Webull | Cons of Webull |

| ✅ FCA Regulated: Webull Securities (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FRN 1002126). | ❌ No ISA or SIPP Options: Unlike other brokers like Freetrade or AJ Bell, Webull doesn’t support tax-efficient accounts. |

| ✅ Low-Cost Trading: Offers 0.025% commission per trade and no charges for deposits, withdrawals, or inactivity. | ❌ Limited Asset Access: Only US stocks and ETFs are available — no UK, European, or other global equities. |

| ✅ Advanced Tools: Features include real-time charting, over 50 technical indicators, and paper trading to practice without financial risk. | ❌ No Cash Interest or Savings Options: Funds held in your account do not earn interest. |

| ✅ User-Friendly Mobile App: Webull’s app is fast, clean, and well-designed for tracking portfolios and executing trades. |

Is it safe?

Yes, Webull is safe in terms of regulatory oversight and digital security — but there are a few caveats for UK clients to understand.

Webull is authorised and regulated by the FCA, which means it must adhere to UK standards for client fund protection, financial transparency, and operational conduct. However, UK users’ assets are custodied by Apex Fintech, a US-based firm. Unlike UK-based investment platforms that benefit from FSCS protection, Webull UK clients are not covered by the Financial Services Compensation Scheme (FSCS).

Instead, client assets are segregated and held securely in custody, and the platform follows best practices in data encryption and account protection. So while your investments are relatively safe, they may not be as protected as they would be with a UK-registered custodian.

Available Products

US Stocks

- Trade 10,000+ stocks listed on major US exchanges like Nasdaq, NYSE, and AMEX.

- Commission: 0.025% per trade, with no platform or inactivity fees.

- Fractional shares: Start investing from just $1, ideal for beginners and portfolio diversification.

US Equity Options

- Equity options available on thousands of US-listed companies.

- Supported strategies include:

- Long Call

- Long Put

- Covered Call

- No commissions or per-contract fees.

- Note: Advanced multi-leg strategies like spreads, iron condors, and straddles are not supported at this time.

US Index Option

- Access major US index options such as:

- SPX (S&P 500)

- NDX (Nasdaq-100)

- VIX (Volatility Index)

- Useful for experienced traders looking to hedge or speculate on broader market movements.

Emerging Asia

- Invest in major Asian companies listed on the Hong Kong Stock Exchange.

- Examples: Alibaba, Tencent, Meituan, and other high-growth Chinese firms.

- Commission: From HK$0.0003 x trade value.

- Transparent pricing structure with no hidden fees.

- Ideal for geographic diversification into emerging markets.

GBP Cash Savings

- Hold unused funds in GBP within your Webull UK account.

- Earn interest on your GBP balance — a low-risk way to park funds between trades.

Fees and Charges

Webull UK offers one of the most competitive pricing models for trading US equities from the UK. However, there are still some costs to keep in mind.

US Market: Stocks

| Fee Type | Charge | Charged by | |||

| Commission | 0.025% per trade (minimum $0.10) | Webull | |||

| Platform Fee | £0 | Webull | |||

| Regulatory Transaction Fee | $0.0000278 per $1 of trade value (min $0.01) | SEC | |||

| Trading Activity Fee | $0.000166 per $1 of trade volume (min $0.01, max $8.30) | FINRA | |||

| CAT Fee | $0.000040 per share | FINRA | |||

| Foreign Exchange Conversion | 0.35% of trade value | Webull |

| Fee Type | Charge | Charged by |

| Commission | 0.025% per trade (minimum $0.10) | Webull |

| Platform Fee | £0 | Webull |

| Regulatory Transaction Fee | $0.0000278 per $1 of trade value (min $0.01) | SEC |

| Trading Activity Fee | $0.000166 per $1 of trade volume (min $0.01, max $8.30) | FINRA |

| CAT Fee | $0.000040 per share | FINRA |

| Foreign Exchange Conversion | 0.35% of trade value | Webull |

US Market: Options

| Fee Type | Charge | Charged by | |||

| Options Commission | $0.50 per contract | Webull | |||

| Options Regulatory Fee | $0.02945 per contract | Options Exchanges | |||

| Options Clearing Fee | $0.025 per contract | OCC | |||

| SEC Fee | 0.00 | SEC | |||

| TAF Fee | $0.00279 per contract | FINRA | |||

| CAT Fee | $0.000046 per executed equivalent share | FINRA |

| Fee Type | Charge | Charged by |

| Options Commission | $0.50 per contract | Webull |

| Options Regulatory Fee | $0.02945 per contract | Options Exchanges |

| Options Clearing Fee | $0.025 per contract | OCC |

| SEC Fee | 0.00 | SEC |

| TAF Fee | $0.00279 per contract | FINRA |

| CAT Fee | $0.000046 per executed equivalent share | FINRA |

US Market: Index Option - Exchange Proprietary Fee

Webull passes through proprietary index option fees to clients on a per-contract basis. Certain exchanges charge a proprietary index option fee on select index options that only trade on their exchange.

HK Market: Stocks

| Fee Type | Charge | Charged by | |||

| Commission | 3 basis points | Webull | |||

| Trading Fee | HKD0.0000565 × Trade Value | Hong Kong Stock Exchange | |||

| Settlement and Delivery Cost | HKD0.00002 × Trade Value | Hong Kong Securities Clearing Company Limited | |||

| SFC Transaction Levy | HKD0.000027 × Trade Value | SFC | |||

| Stamp Duty | HKD0.001 × Trade Value | IRD | |||

| FRC Transaction Levy | HKD0.0000015 × Trade Value | FRC | |||

| Collection of Cash Dividend | 0.20% of the Dividend | Webull | |||

| Foreign Exchange Conversion | 35 basis points | Webull |

| Fee Type | Charge | Charged by |

| Commission | 3 basis points | Webull |

| Trading Fee | HKD0.0000565 × Trade Value | Hong Kong Stock Exchange |

| Settlement and Delivery Cost | HKD0.00002 × Trade Value | Hong Kong Securities Clearing Company Limited |

| SFC Transaction Levy | HKD0.000027 × Trade Value | SFC |

| Stamp Duty | HKD0.001 × Trade Value | IRD |

| FRC Transaction Levy | HKD0.0000015 × Trade Value | FRC |

| Collection of Cash Dividend | 0.20% of the Dividend | Webull |

| Foreign Exchange Conversion | 35 basis points | Webull |

Account Types and Availability

Webull UK offers a streamlined trading experience tailored for UK residents, providing access to US and Asian markets through a cash brokerage account. This account type is designed for self-directed investors seeking a straightforward platform to manage their investments.

Please note that Webull UK does not currently offer tax-efficient accounts such as ISAs or SIPPs. Additionally, while the platform provides access to US stocks, ETFs, and options, the range of available investment products may be more limited compared to other UK brokers.

There are no ISA, SIPP, or joint accounts, which limits its appeal for long-term investors aiming for tax efficiency. All trades are executed in USD, and profits must be declared to HMRC for capital gains or dividend income.

If you’re looking for tax-efficient options or want guidance on the best stocks and shares to invest in through ISAs, check out our review on the best stocks and shares ISA brokers.

Deposits, Withdrawals, and Payment

Webull supports bank transfers in GBP for deposits and withdrawals. Here's how it works:

- Funds are held in GBP until traded, then converted into USD at a 0.35% FX rate.

- Withdrawals can take 1–2 working days to process.

- Webull does not support debit/credit cards, Apple Pay, or PayPal at this time.

The process is straightforward, but the lack of fast payment options (like Open Banking or instant deposits) may frustrate some users.

Trading Tools and Features

Webull is ideal for active traders or investors who enjoy technical analysis. The app and desktop platform come with a wide array of features typically found on professional-grade platforms.

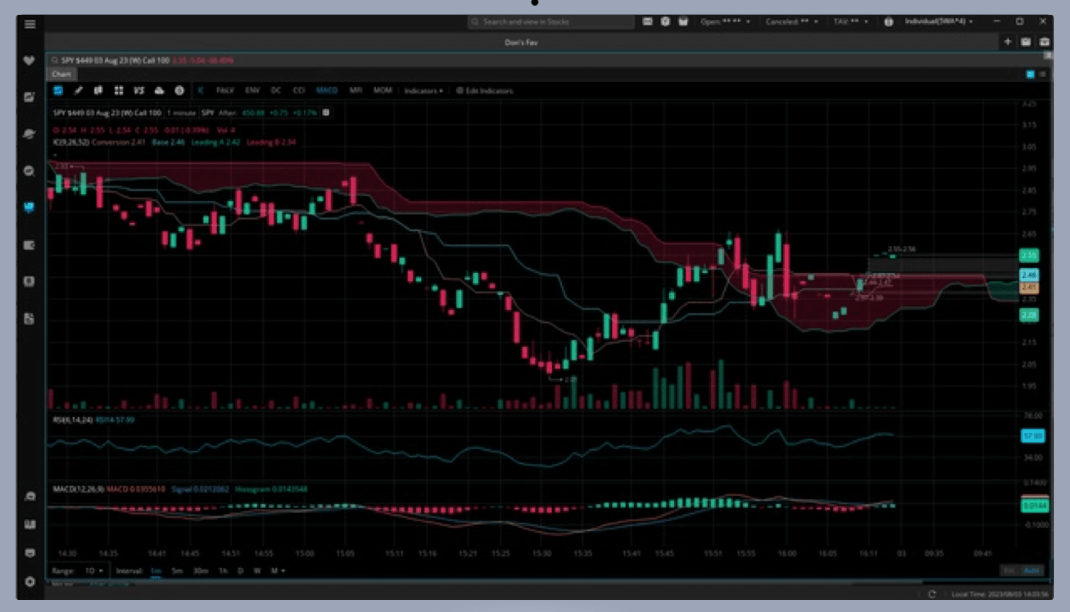

Charting and Analysis

Webull UK's Charts & Tools provide a powerful suite of advanced charting features designed to support traders in making well-informed decisions. With real-time market data and dynamic chart layouts, the platform allows users to analyse trends, price movements, and technical indicators across its mobile app, desktop software, and web-based platform.

Whether you're a novice or a seasoned trader, these tools are tailored to help you refine your trading strategies with accuracy and confidence.

Key Features Include:

- Advanced Charting Tools – Access over 60 technical indicators and more than 20 drawing tools, including trend lines and Fibonacci retracement.

- Live Market Data – Stay up to date with real-time pricing and market movements.

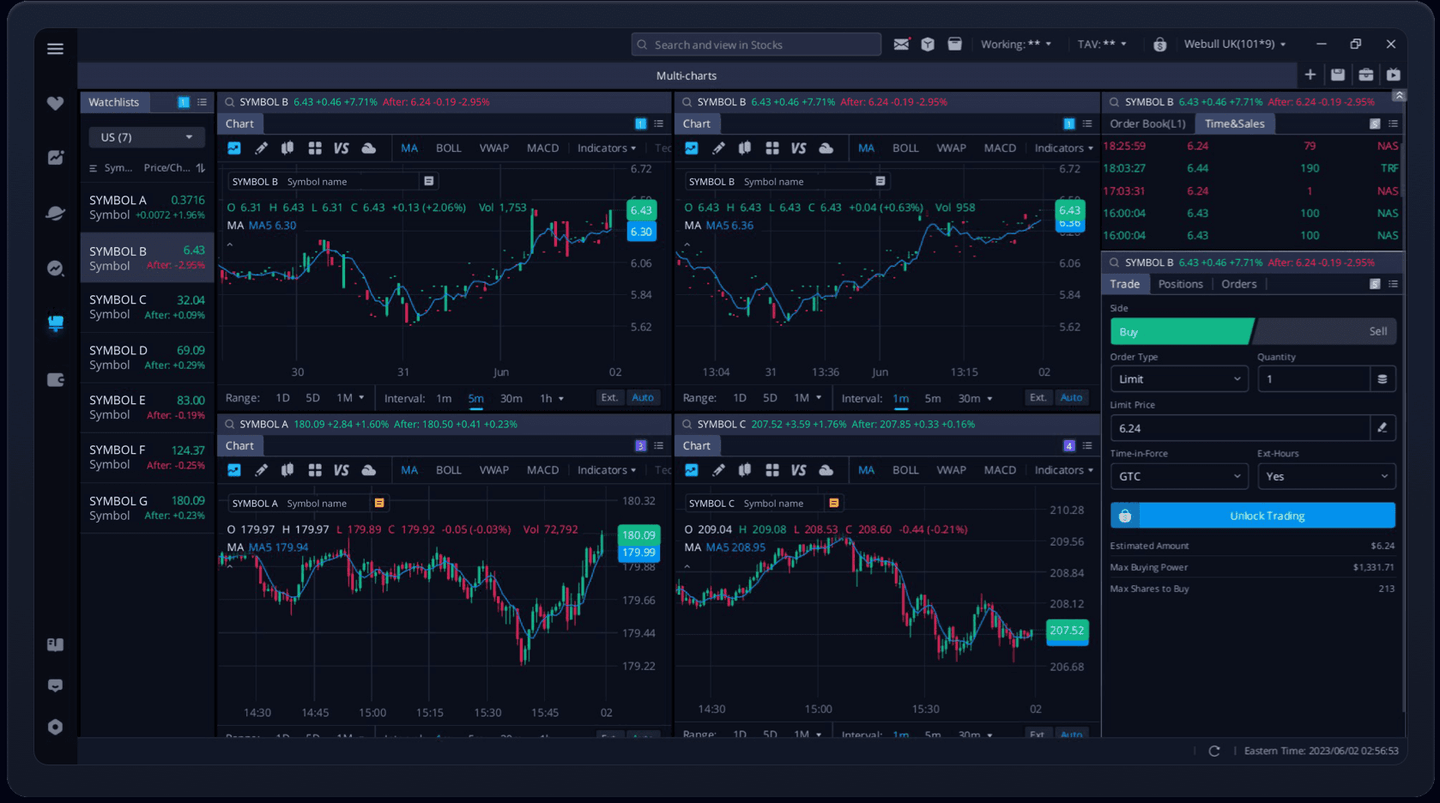

- Custom Multi-Chart Layouts – Track multiple stocks or indices at once using flexible grid configurations.

- Trade Directly from Charts – Place and manage trades directly through the chart interface.

- TradingView Integration – Enjoy even more robust charting through Webull's integration with TradingView.

These features are built to support thorough analysis and efficient trade execution, helping UK traders respond quickly and confidently to market shifts.

Paper Trading

Webull includes a built-in simulator, letting you practice strategies without risking real capital. It’s a valuable tool for both beginners and experienced traders testing new approaches.

Webull UK's Paper Trading feature offers a realistic, risk-free environment for both beginners and experienced traders to practise investment strategies. It provides unlimited virtual funds and simulates real market conditions using live data.

Available across desktop, tablet, and mobile devices, it includes a range of technical indicators and charting tools—ideal for building confidence without risking actual capital.

Key Features Include:

- Unlimited Virtual Funds – Practise trading without any financial risk.

- Live Market Data – Simulate trades using real-time prices and conditions.

- Advanced Charting Tools – Use over 60 technical indicators and 12+ chart types.

- Multi-Platform Access – Trade seamlessly across desktop, tablet, and mobile.

- Strategy Testing – Trial different techniques to see what works best for you.

This tool is perfect for learning how to trade, exploring new approaches, or simply getting comfortable with the Webull interface before going live.

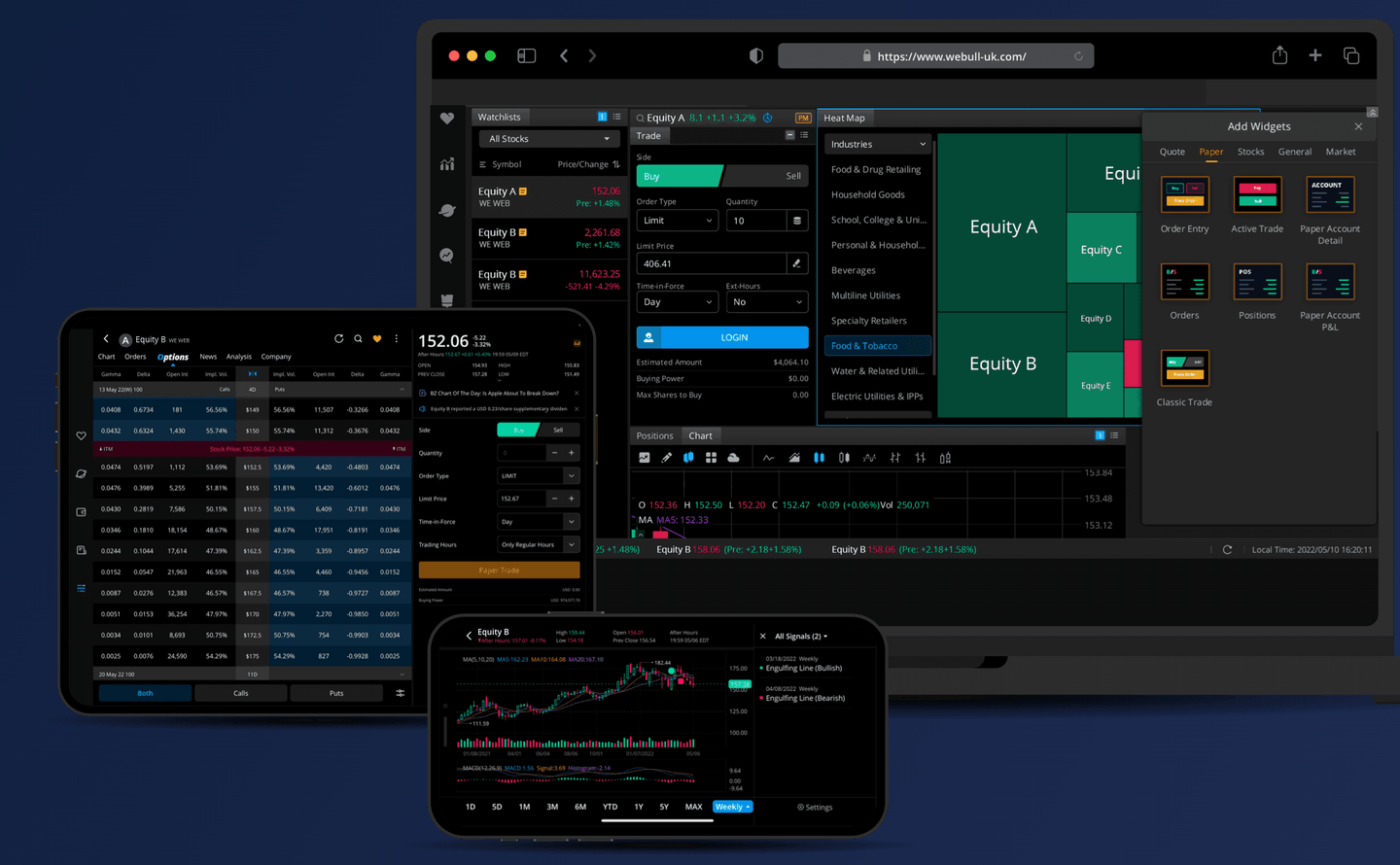

Platform and Usability

Webull UK offers one of the best trading platforms, providing flexible, commission-free trading via its desktop and mobile apps, providing users with access to US stocks, ETFs, options, and more. Both platforms are designed to deliver powerful tools for all types of traders, from beginners to experts.

Users can take advantage of features like fractional shares, extended hours trading, advanced charting, and paper trading, allowing them to practise strategies without risking real capital.

The Desktop App offers a highly customisable workspace with over 60 technical indicators and 12+ chart types, ideal for in-depth analysis and multiple monitors. Meanwhile, the Mobile App provides on-the-go access, enabling trading and analysis from anywhere with a user-friendly interface.

Both platforms sync seamlessly, so your data and trades are updated in real-time across devices, allowing for complete flexibility.

Education and Resources

Webull includes a modest but growing library of educational content designed for self-directed traders. These include:

- Short explainer articles within the app

- Video tutorials covering how to use chart tools and place trades

- Regularly updated market news and earnings calendars

While not as comprehensive as platforms like eToro or Trading 212, the resources are useful — particularly when paired with Webull’s practice trading environment.

FAQs

Can UK residents open a Webull account?

Yes. Webull officially launched in the UK in 2021 and accepts UK residents who pass standard identity verification checks.

Does Webull offer ISAs or SIPPs?

No. At this time, Webull does not offer tax-wrapped accounts for UK investors.

What is their customer service like?

Webull UK offers moderate customer support, though it's not the most responsive or comprehensive compared to competitors like Trading 212 or Freetrade.

Here’s what UK users should know:

Webull UK currently provides customer service during business hours, generally from Monday to Friday, 9:00 AM to 5:00 PM (UK time). There is no 24/7 live support as of 2025.

- Email Support:

You can reach them via email at [email protected]. Response times vary, but users generally report replies within 24–48 hours. - In-App Support Centre:

Inside the mobile and desktop apps, there’s a Help Centre offering:- FAQs

- How-to guides

- Option to submit a support ticket

- No Phone Support:

Unlike some other brokers, Webull UK does not offer telephone support at this time.