Brokers

XTB Review: Trading Fees, Platform, and Security

This article was updated as of April 29th 2025.

This XTB review will examine the broker's most relevant aspects, such as regulation, trading fees, available products, and more. XTB has been one of the best stock brokers, leading online due to its diverse offerings and competitive fees, especially since launching commission-free stock and ETF trading.

Let's see what makes XTB a relevant option for UK investors.

What is it and how does it work?

Starting with XTB's history, we see that the broker was founded in 2002 in Warsaw and has more than 1 million clients worldwide. It is regulated by the FCA and has been listed on the Warsaw Stock Exchange as X Trade Brokers (9PR.F) since 2016, so their accounts are public, and everyone has access to them.

They are market leaders in Poland, where they have their headquarters, and have offices in 13 other countries, including the United Kingdom, Germany, Spain, and Portugal.

In 2018, it launched its cash stock and ETF offer, diversifying the offer to its clients. Since October 5, 2020, this stock and ETF offer has had a 0% commission for buying and selling, which we will see later in the commissions section.

Main Features

Before progressing into an in-depth analysis, let's look at XTB's main characteristics:

- Regulation: Regulated by the FCA and KNF

- Guarantee fund: Up to 85,000 GBP by the FSCS

- Financial assets: Stocks, ETFs (fractional or not), investment plans, and interest on the balance.

- Markets: Access to 16 global exchanges

- Minimum deposit: 0 €

- Platform: xStation 5 and XTB App

Pros and Cons

| Pros of XTB | Cons of XTB | ||

| ✅ Local supervision by regulatory bodies in all the countries where it is present. | ❌Does not allow integration with professional trading platforms like Tradingview or ProRealTime | ||

| ✅ Interest on your balance account from 5.2% (in GBP), up to 5% (in dollars) | ❌ Its commission for currency exchange is 0.5%, relatively high. | ||

| ✅ 0% Commissions on stocks and ETFs | |||

| ✅ Investment very accessible from 10 euros, thanks to its fractional shares. | |||

| ✅ High-value training and specialised analyst team | |||

| ✅ Broker oriented to all types of investor profiles, from the pure trader to value one. |

| Pros of XTB | Cons of XTB |

| ✅ Local supervision by regulatory bodies in all the countries where it is present. | ❌Does not allow integration with professional trading platforms like Tradingview or ProRealTime |

| ✅ Interest on your balance account from 5.2% (in GBP), up to 5% (in dollars) | ❌ Its commission for currency exchange is 0.5%, relatively high. |

| ✅ 0% Commissions on stocks and ETFs | |

| ✅ Investment very accessible from 10 euros, thanks to its fractional shares. | |

| ✅ High-value training and specialised analyst team | |

| ✅ Broker oriented to all types of investor profiles, from the pure trader to value one. |

Regulation and Safety

XTB is highly regulated, ensuring the safety and security of your investments. In the UK, XTB is regulated by the Financial Conduct Authority (FCA) under the registration number FRN 522157. This regulation guarantees that XTB adheres to strict financial standards and practices, providing robust protection for UK investors.

Key Points:

- Regulation: The FCA regulates XTB, ensuring compliance with financial laws and safeguarding client interests. This regulation mandates that XTB operate with transparency and integrity.

- Guarantee Fund: XTB participates in the Financial Services Compensation Scheme (FSCS), which protects client funds up to £85,000 in the event of the broker’s insolvency.

- Segregated Accounts: Client funds are held in segregated accounts, separate from XTB’s operational funds. This means that in the unlikely event of XTB’s bankruptcy, client funds are protected and cannot be claimed by creditors.

Available Financial Products

XTB provides access to various financial instruments, allowing for a diversified investment portfolio. Here are the main product offerings:

Stocks and ETFs:

- Number of Stocks: XTB offers over 3,000 stocks on 16 global exchanges, including major markets like the UK, US, Germany, and others. This extensive selection allows investors to diversify their portfolios across different regions and sectors.

- ETFs: Around 400 ETFs are available, covering a broad range of asset classes, including equities, bonds, commodities, and more. ETFs are an excellent way to gain exposure to a diversified basket of assets with a single trade.

- Fractional Shares: XTB allows investment in fractional shares, making it possible to invest in high-value stocks from a minimum of £10. This feature particularly benefits investors seeking exposure to expensive stocks without committing large sums of money.

Other Products:

- Investment Plans: XTB offers customised investment plans that allow investors to combine up to 9 ETFs into a single plan. This feature enables investors to create diversified portfolios tailored to their risk tolerance and investment goals.

- Remunerated Balance Account: XTB provides an interest-bearing account on uninvested capital, offering interest rates of 4.5% (GBP), 1.25% (EUR), and 2% (USD). This feature allows investors to earn interest on idle funds, enhancing overall returns.

*Interest rates as of 29th of April 2025

Account Types

Standard Account

XTB only offers a Standard account type for UK clients. With this account, there are no commissions on most CFD markets—except for equity and ETF CFDs—where costs are instead built into slightly wider market spreads. When investing in real stocks and ETFs, XTB charges 0% commission on trades up to €100,000 in nominal value per calendar month. Once that threshold is exceeded, a 0.2% commission applies. Additionally, if you invest in assets denominated in a different currency from your base currency, a currency conversion fee of 0.5% will be applied.

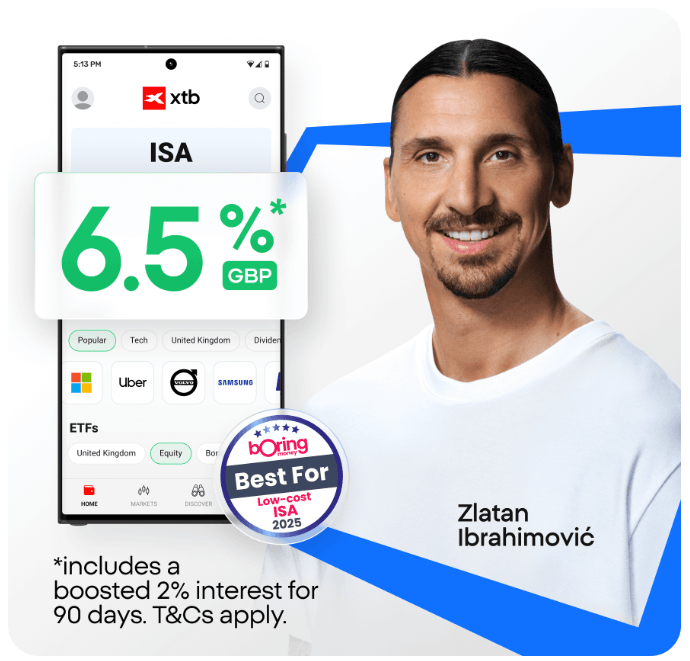

Flexible Stocks and Shares ISA

XTB does also now offer a flexible stocks and shares ISA account designed for UK residents, allowing tax-efficient investing in over 4,500 global stocks and ETFs. The ISA is accessible exclusively through the mobile app, requiring users to open a GBP-denominated account and provide their National Insurance number. Once set up, investors can deposit funds, select investments, and manage their portfolios directly from the app.

The ISA provides 0% commission on monthly trading volumes up to €100,000; beyond that, a 0.2% commission applies. Uninvested cash in the ISA earns a boosted 6.5% AER interest for the first 90 days, after which the rate reverts to 4.5% AER. Withdrawals are tax-free and flexible, allowing reinvestment within the same tax year without affecting the £20,000 annual contribution limit.

Demo Account

XTB offers a demo account, which is valid and free for 30 days from the moment you register. This option is good for testing the broker's features.

Fees, Minimum Deposit and Withdrawals

| Minimum Deposit | £0 | ||

| Commission for Stocks and ETFs | 0% for volumes up to £100,000 per month. 0.2% for volumes above £100,000 per month (minimum £10) | ||

| Minimum investment value on stocks | £10 | ||

| Derivatives Trading (CFDs) | Competitive spreads (check specific instruments for exact spreads) | ||

| Currency Exchange Fee | 0.5% | ||

| Withdrawal Fee | Free for amounts above £50 | ||

| Custody Fee | None for capital below £250,000. 0.2% annual fee for capital above £250,000 | ||

| Account Opening Fee | £0 | ||

| Capital Deposit | No limit | ||

| Commission for Spot Stocks | 0% for monthly volumes up to £100,000. 0.2% for volumes above £100,000 per month (minimum £10) |

| Fee Type | Details |

|---|---|

| Minimum Deposit | £0 |

| Commission for Stocks and ETFs | 0% for volumes up to £100,000 per month. 0.2% for volumes above £100,000 per month (minimum £10) |

| Minimum investment value on stocks | £10 |

| Derivatives Trading (CFDs) | Competitive spreads (check specific instruments for exact spreads) |

| Currency Exchange Fee | 0.5% |

| Withdrawal Fee | Free for amounts above £50 |

| Custody Fee | None for capital below £250,000. 0.2% annual fee for capital above £250,000 |

| Account Opening Fee | £0 |

| Capital Deposit | No limit |

| Commission for Spot Stocks | 0% for monthly volumes up to £100,000. 0.2% for volumes above £100,000 per month (minimum £10) |

Trading Platforms

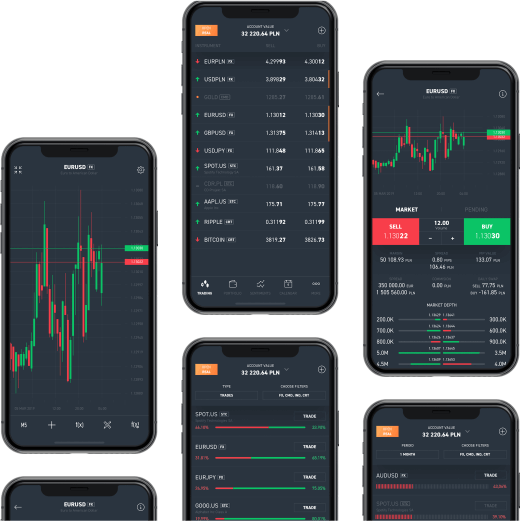

XTB offers two proprietary trading platforms: xStation 5 and the XTB App. Both platforms are known for their user-friendly interfaces and robust functionality, catering to both beginners and seasoned traders.

xStation 5

- Features: xStation 5 is renowned for its high execution speed, which is crucial for traders who require fast and efficient order execution. The platform is available on Windows and iOS and includes features such as real-time news, market analysis, and extensive training resources.

- Advantages: The platform's quick execution times make it ideal for short-term traders, including scalpers and day traders. It also offers advanced charting tools and technical indicators, which are beneficial for detailed market analysis.

XTB App

- Features: The XTB App allows traders to manage their accounts and execute trades from mobile devices. The app includes advanced charting tools, real-time news updates, price alerts, and the ability to manage savings plans directly from the app.

- Advantages: The mobile app allows for trading on-the-go, ensuring that traders can stay connected to the markets and make timely decisions no matter where they are. The app is designed to be intuitive and user-friendly, making it accessible for both novice and experienced traders.

Education

XTB offers a comprehensive suite of educational resources tailored to traders of all experience levels. Their Trading Academy provides over 200 video lessons covering topics such as forex, commodities, stocks, indices, ETFs, CFDs, and both technical and fundamental analysis.

These materials are structured by skill level—beginner, intermediate, and advanced—and include eBooks, articles, and platform tutorials. Additionally, XTB hosts regular live webinars and seminars led by financial experts, offering real-time insights into market trends and trading strategies .

For those seeking more interactive learning experiences, XTB's Trading Club meets weekly in London, providing a platform for traders to engage in live market analysis, share strategies, and receive one-on-one guidance from professional traders and analysts.

Furthermore, XTB offers a free two-day introductory course focusing on the basics of trading, including platform usage, fundamental and technical analysis, risk management, and market psychology. These resources are designed to equip traders with the knowledge and skills necessary to navigate the financial markets effectively

Reviews

Opinions about XTB have varied greatly in recent years. However, the company's focus on education and a group of reputable analysts, as well as its offer of commission-free stocks and ETFs, have made it one of the preferred brokers for investors in Europe. It currently ranks among the 5 largest European brokers by the number of active clients.

One of the most popular sites where people write reviews and rate various services is Trustpilot. On this website, we can find several opinions about XTB. Generally, we see that the opinion about this broker is good.

We highlight that XTB has a very high number of reviews, more than 1000, of which 58% consider it excellent. Its average rating is 4 stars (out of 5), which has continued to rise over the past year due to its commitment to closeness and educational actions for its audience.

On the other hand, if we look at the general opinion of XTB users in the app version of Google Play, we will see convergence with what is shown on Trustpilot. Thus, again, we see an average rating of 4.6 stars (out of 5), but in this case, for a total of more than 80,000 opinions.

Our opinion of XTB

XTB has grown into a well-regarded, FCA-regulated broker in the UK, offering over 3,000 stocks and 400+ ETFs—many commission-free and available as fractional shares. With up to 4.5% AER on uninvested GBP balances and strong educational support, it’s a solid choice for a wide range of investors.

Just be mindful of the 0.5% currency conversion fee when trading in foreign currencies.

FAQ

Is XTB safe and regulated?

Yes, XTB is regulated by the Financial Conduct Authority (FCA) in the UK, which ensures that it adheres to strict financial standards and practices. Additionally, client funds are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 in case of the broker’s insolvency. Client funds are held in segregated accounts, separate from the broker’s operational funds, providing an extra layer of security.

What is their customers service like?

The customer service is one of the most valued, with service 24 hours a day from Monday to Friday and can be in the following ways:

- ✅ Office in the UK: Level 9, One Canada Square

Canary Wharf, E14 5AA, London

United Kingdom - ✅ Contact phone: +44 2036953086

- ✅ Email: uksales @xtb.com

- ✅ Chatbot: Yes

Is XTB good for beginners?

Yes. XTB is ideal for both expert and beginner investors. XTB is a relatively easy-to-use online broker, as even a newbie trader would quickly become familiar with it. However, this does not mean it is the easiest broker on the market.

How do you open an account?

The account opening process at XTB is completely digital and easy. It takes no more than 10 minutes.

The steps to open an XTB account:

- Access the XTB website or download the xStation mobile app.

- Enter your email address and country of residence.

- Add your personal details, particularly those requested.

- Select the trading platform. You can initially choose the Demo Account, but you will always need to select your future choice so that you can continue with it after 30 days.

- Activate your account by verifying your identity and address.