Reviews

City Index Trading Review

Online trading can be a bit of a maze these days, with countless platforms promising the best tools and lowest fees. But every so often, one stands out not just because of what it offers, but because it actually delivers on trust, innovation, and user experience. That’s where City Index UK steps in.

This review takes you through everything you need to know, from account types to fees and everything in between. If you’ve ever wondered what is City Index, or whether it suits your financial goals, this article will give you the answers in one comprehensive guide.

Pros and cons

| Pros of City Index | Cons of City Index | ||

| ✅ Inactivity fee after 12 months | ❌ Inactivity fee after 12 months | ||

| ✅ Wide range of instruments and markets | ❌ Only for traders (only CFD/spread betting accounts available) | ||

| ✅ Low fees and tight spreads | |||

| ✅ High-quality education and research | |||

| ✅ Excellent customer support |

| Pros of City Index | Cons of City Index |

| ✅ Inactivity fee after 12 months | ❌ Inactivity fee after 12 months |

| ✅ Wide range of instruments and markets | ❌ Only for traders (only CFD/spread betting accounts available) |

| ✅ Low fees and tight spreads | |

| ✅ High-quality education and research | |

| ✅ Excellent customer support |

Main features

Before we go deep, here’s a high-level look at what City Index UK brings to the table:

- Regulation: FCA (UK)

- Investor protection: FSCS coverage up to £85,000

- Financial assets: CFDs and spread betting (forex, shares, commodities, indices)

- Markets: 13,500+ global instruments

- Account types: Standard, MT4

- Fees: Spread-based, transparent pricing

- Minimum deposit: £0

- Platform: Web Trader, MetaTrader 4 (MT4), Mobile App

- Contact: UK-based support, 24/5 via live chat, phone, email

- Featured promotion: N/A

Now, let’s explore how all these features come together in real-world use.

Safety

A big part of what makes City Index UK a trusted choice is its strong focus on regulation and client protection. It’s fully authorised by the FCA, meaning it operates under strict UK financial rules designed to keep your money and data safe.

On top of that, it’s covered by the Financial Services Compensation Scheme (FSCS), which protects your funds up to £85,000 if the unexpected happens. For anyone, especially those new to trading, that kind of reassurance is hard to beat.

And with StoneX Group as its parent company, users benefit from the trust and resources of a multinational financial services provider. It’s this combination of robust regulation, client protection, and corporate backing that solidifies City Index’s reputation as a reliable broker — and earns it recognition among the best brokers for trading options, a point often highlighted in positive City Index trading review discussions.

Available financial products

When it comes to tradable assets, City Index UK doesn’t cut corners. With over 13,500 instruments available via spread betting or CFD accounts, you’ll find a diverse range of markets to explore:

- Forex: All the major and minor pairs

- Indices: Including the FTSE 100, S&P 500, and more

- Shares: UK, US, and global equities

- Commodities: Gold, oil, and agricultural products

Whether you're looking to speculate, hedge, or build a diversified portfolio, City Index offers flexibility and depth. It's not just quantity, the platform’s user-friendly interface makes accessing these assets smooth and efficient, which is a huge plus in any City Index broker review.

Account types and fees

City Index offers three main account types:

- Standard – Ideal for most UK retail traders, comes with TradingView charting

- MT4 account – Ideal for intermediate to experienced traders

The fees are transparent and largely based on spreads. Most markets, including forex and indices, are commission-free. Share trading may involve a small commission, but spreads remain competitive. The standard account has a spread starting at 0.8 pips and the MT4 account has a spread starting at only 0.5 pips.

There’s no fee to deposit or withdraw, but an inactivity fee kicks in after 12 months without trading, so keep that in mind. Overall, City Index strikes a great balance between cost and quality of service.

Deposits and withdrawals

City Index UK offers a simple and fee-free system for both deposits and withdrawals. You can fund your account using debit/credit cards, PayPal, or bank transfers, with no minimum deposit required for bank wire and at least £100 for cards. Card deposits are usually instant, while bank transfers typically clear within 1–2 working days.

Withdrawals must be sent back to the original funding method, with a minimum withdrawal amount of £100, and usually take 1–2 business days for bank transfers or 3–5 working days for cards and PayPal.

City Index doesn’t charge for any deposits or withdrawals, though your payment provider might. Transactions are processed during UK working hours, and accounts that remain inactive for 12 months incur a £12 monthly fee. Overall, it’s a user-friendly setup with fast turnaround and flexible payment methods.

Trading platforms

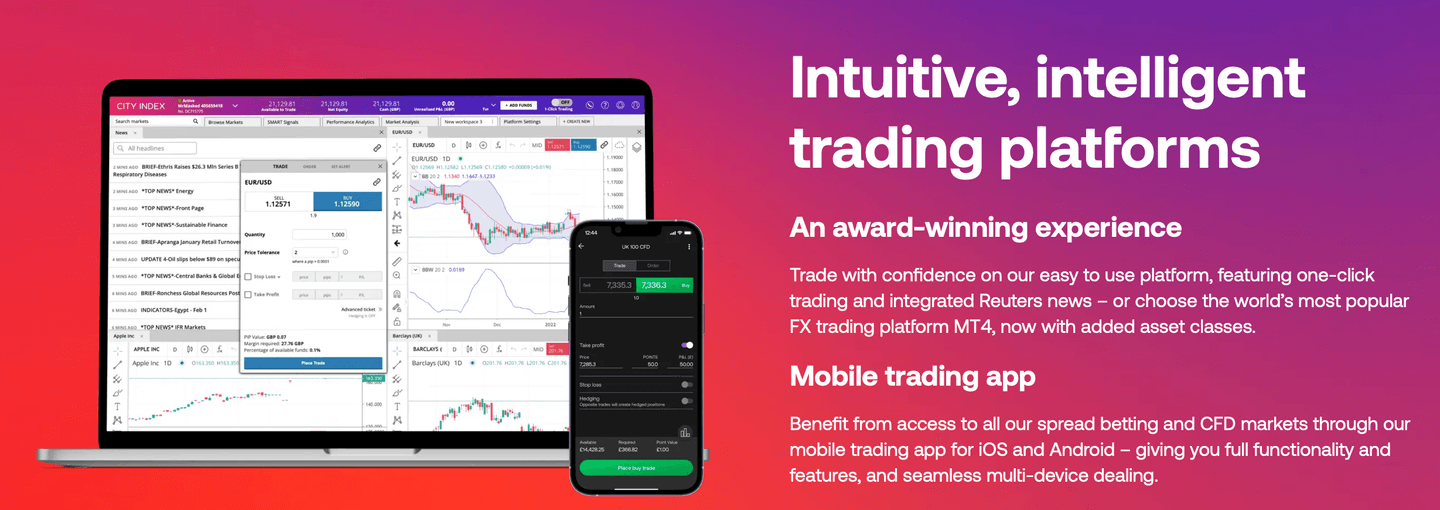

No matter your style, City Index has a platform to match:

- Web Trader – Simple yet powerful, with excellent charting tools

- MetaTrader 4 (MT4) – For forex lovers and algorithmic traders

- Mobile App – Fast, clean, and perfect for trading on the go

All platforms are intuitive and packed with useful features like watchlists, alerts, and advanced order types. Execution is fast, and switching between platforms is seamless.

Whether you're analysing charts at home or placing trades during your commute, City Index provides a consistent and reliable experience. It’s no surprise that it’s often recommended among the top trading platforms for beginners UK-wide, frequently earning high praise in City Index trading review articles.

Customer service

Customer support is another area where City Index UK shines. Available 24/5, you can reach the team via live chat, phone, or email. Support is UK-based, which means no frustrating time-zone issues or outsourced call centres.

They’re quick to respond, knowledgeable, and can assist with everything from account issues to market queries. In a sea of platforms with mediocre support, this is a refreshing standout.

Research and education

If you're brand new or refining your strategy, City Index has you covered. The platform offers:

- Live and on-demand webinars

- Daily market commentary

- Trading Central for technical research

- TradingView charting

The education section is practical and actionable. Instead of drowning you in jargon, it helps you trade smarter, not harder. It's a valuable resource that adds real long-term value, yet another highlight in this well-rounded City Index broker review.

Bottom line

So, who should consider City Index UK?

Any UK trader who wants a regulated, well-rounded platform that offers short-term trading — and is searching for the best CFD broker for spread betting or CFDs — would find City Index well worth their time.

It’s particularly great for:

- Retail traders who want low fees and powerful tools

- Forex and CFD traders seeking fast execution and strong support

While it’s not the flashiest platform on the market, it excels where it matters: security, usability, flexibility, and now, investment potential. If you’ve been hunting for a platform that balances serious performance with user-friendliness, City Index ticks all the right boxes.

FAQs

What is City Index?

Founded in 1983, City Index is a veteran in the online trading space. Based in London and regulated by the Financial Conduct Authority (FCA), it’s part of the StoneX Group, a global financial powerhouse listed on the NASDAQ. This backing gives City Index both credibility and stability, something that’s especially valuable when you’re trusting a platform with your money.

This CFD broker offers a wide array of products, including forex, indices, commodities, shares, and more. It’s noteworthy to mention here that City Index does not offer direct ownership; you can only open a spread betting or CFD account.

Is City Index good for beginners?

Yes, City Index offers a demo account, solid educational resources, and an intuitive interface, making it a great choice for beginners.

Can I use City Index on my phone?

Absolutely. The City Index mobile app is fast, reliable, and includes full trading functionality.

Does City Index offer leverage?

Yes, as a CFD broker, City Index offers leveraged trading, but leverage levels are capped based on FCA guidelines for retail traders.

How to open a City Index account in 5 steps

Getting started with City Index UK is a breeze. Here’s how:

- Go to the City Index website and click “Open an Account”

- Fill in your personal details

- Verify your identity by uploading the required documents

- Deposit your funds

- Start trading instantly

The onboarding process is user-friendly, FCA-compliant, and takes only a few minutes. Plus, a demo account with £10,000 in virtual funds is available if you’d like to test things out risk-free.