Comparatives

DEGIRO vs Interactive Brokers: Comparison

Interactive Brokers and DEGIRO are two of the most respected and widely used brokers in the investing world. Both are known for their broad range of available assets and highly competitive fees.

In this article, we’ll compare Interactive Brokers and DEGIRO, highlighting the key features, pros and cons of each platform. At the end, we’ll share our view on which broker may be better suited to different types of investors.

What are they and how do they work?

The main thing to establish a good comparison of DEGIRO vs Interactive Brokers is to know how each of them works, where they come from, and where they are going.

How does Interactive Brokers work?

Interactive Brokers (IB) has been operating since 1977 and is now one of the world’s leading online brokerages. It was founded by Thomas Peterffy, who emigrated from Hungary to the United States in the 1960s with just $100 and went on to build one of the most successful brokerage firms in the industry — a story fit for the big screen.

Headquartered in Greenwich, Connecticut, Interactive Brokers has grown significantly over the decades. The company now has a market capitalisation of nearly $30 billion, is publicly listed on the NASDAQ under the ticker IBKR, and employs over 1,500 people worldwide.

IB has a truly global presence, with offices across major financial centres including London, as well as Australia, Canada, China, Estonia, Hong Kong, Hungary, India, Japan, Russia, and Switzerland — making it a strong option for UK investors looking for global access and institutional-grade tools.

👉 Read our Interactive Brokers review to learn more.

How does DEGIRO work?

DEGIRO was founded in 2008, initially serving professional clients. In 2013, it opened to retail investors in the Netherlands and expanded rapidly across Europe, including a UK launch in 2015.

Today, DEGIRO is available in major markets such as Germany, France, Spain, Italy, Poland, and the United Kingdom, where it continues to operate through its European structure following Brexit. UK investors can still open and manage accounts thanks to DEGIRO’s EU passporting and partnership with Flatex AG, a listed German broker that acquired DEGIRO in 2020.

The merged firm, FlatexDEGIRO AG, is now headquartered in Germany and regulated by BaFin and the Dutch AFM.

With its low-cost model, wide European reach, and user-friendly platform, DEGIRO has attracted over 2.5 million clients and received more than 100 international awards — making it a strong option for cost-conscious UK retail investors.

👉 Read our DEGIRO review to learn more.

Main Features

Now that you know where each broker comes from, let's see a summary of their most important conditions and features:

Interactive Brokers

- Regulation: Interactive Brokers (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the UK.

- Minimum Deposit: There is no minimum deposit required to open an account.

- Commissions:

- UK Stocks: From £6 per trade for trades up to £50,000. For trades above £50,000, it's £6 plus 0.05% of the incremental value.

- US Stocks: From $0.0035 per share, with a minimum of $1 per order.

- Forex: Competitive spreads starting from 0.1 pips.

- Cryptocurrency: From 0.12% of trade value.

- Account Types:

- Individual Accounts

- Joint Accounts

- Trust Accounts

- SIPP (via administrator)

- ISA: Available for UK residents aged 18 or over.

- Platforms:

- Trader Workstation (TWS)

- IBKR Mobile

- Client Portal

- GlobalTrader

- IBKR WebTrader

- Customer Support:

- Phone: +44 (0) 20 7190 1652 (UK)

- Chatbot: Available 24/5

- Email: Support via the Client Portal

- Funding Options:

- GBP Bank Transfers

- Debit/Credit Cards

- Online Banking (Faster Payments)

- SEPA Transfers

DEGIRO

- Regulation: DEGIRO operates in the UK through its European passport and is regulated by the Financial Conduct Authority (FCA) and also by the Dutch Authority for the Financial Markets (AFM).

- Minimum Deposit: There is no minimum deposit required to open an account.

- Commissions:

- UK Stocks: From £1 + 0.038% per trade.

- US Stocks: From $0.50 + $0.004 per share.

- ETFs: Many ETFs can be traded commission-free on the first transaction of each month, depending on the ETF list.

- Forex: DEGIRO does not offer direct forex trading; currency conversion fees apply when trading assets in different currencies.

- Account Types:

- Individual Accounts

- Joint Accounts (limited availability)

- Custody Accounts (non-lending of securities)

- Basic and Active Trader accounts (based on trading activity)

- Platforms:

- DEGIRO Web Platform (user-friendly browser-based)

- Mobile App (iOS and Android)

- Customer Support:

- Phone: +44 20 3137 1125 (UK)

- Email: [email protected]

- Live Chat: Available during UK business hours

- Funding Options:

- GBP Bank Transfer (Faster Payments supported)

- SEPA Bank Transfers (for EUR deposits)

Pros and Cons

| Pros of DEGIRO | Cons of DEGIRO | ||

| ✅ Low-cost trading fees | ❌ Limited product range (no forex or futures) | ||

| ✅ Commission-free ETFs (select list) | ❌ Currency conversion fees apply | ||

| ✅ User-friendly web and mobile platforms | ❌ Limited customer support hours | ||

| ✅ No minimum deposit | ❌ No cryptocurrency trading | ||

| ✅ Simple account opening process |

| Pros of DEGIRO | Cons of DEGIRO |

| ✅ Low-cost trading fees | ❌ Limited product range (no forex or futures) |

| ✅ Commission-free ETFs (select list) | ❌ Currency conversion fees apply |

| ✅ User-friendly web and mobile platforms | ❌ Limited customer support hours |

| ✅ No minimum deposit | ❌ No cryptocurrency trading |

| ✅ Simple account opening process |

| Pros of Interactive Brokers | Cons of Interactive Brokers | ||

| ✅ FCA regulated in the UK | ❌ Platform may be complex for beginners | ||

| ✅ Access to 150+ global markets | ❌ Minimum withdrawal fee ($5) | ||

| ✅ Advanced trading platforms (TWS, GlobalTrader) | |||

| ✅ Wide range of asset classes (stocks, options, futures, forex, crypto) | |||

| ✅ Supports ISAs and SIPPs | |||

| ✅ Competitive commissions on US and UK stocks |

| Pros of Interactive Brokers | Cons of Interactive Brokers |

| ✅ FCA regulated in the UK | ❌ Platform may be complex for beginners |

| ✅ Access to 150+ global markets | ❌ Minimum withdrawal fee ($5) |

| ✅ Advanced trading platforms (TWS, GlobalTrader) | |

| ✅ Wide range of asset classes (stocks, options, futures, forex, crypto) | |

| ✅ Supports ISAs and SIPPs | |

| ✅ Competitive commissions on US and UK stocks |

Are they safe?

Both DEGIRO and Interactive Brokers are duly regulated and reliable platforms. They have a significant history that supports them and, they are publicly traded, which provides an additional point of security.

This is what you need to know about each of them.

Regulation of DEGIRO

DEGIRO is considered a safe and regulated broker for UK investors, despite being based outside the UK.

- Regulation: DEGIRO operates in the UK under the EU's passporting rules and is a Dutch branch of flatexDEGIRO Bank AG, a German bank. As such, it is regulated by BaFin (Germany’s financial authority) and overseen by the Dutch Authority for the Financial Markets (AFM). Though the UK is no longer part of the EU, DEGIRO has maintained market access for UK investors through its established structure.

- Deposit Protection:

- Cash deposits are held in a personal account at Flatex Bank in Germany and are protected by the German Deposit Guarantee Scheme, which covers up to €100,000 per investor.

- Invested assets (like stocks and ETFs) are protected separately under an investor compensation scheme, which covers up to 90% of the value, with a cap of €20,000.

Regulation and reliability of Interactive Brokers

FCA Authorised: Interactive Brokers (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA) — the UK’s top financial regulator. This ensures adherence to strict UK financial rules, client fund protection, and operational transparency.

Global Oversight: IBKR is also regulated in the US (SEC & FINRA), Ireland (Central Bank of Ireland), Australia (ASIC), and other key financial centres. This multi-jurisdictional regulation adds extra layers of oversight and accountability.

Account Security & Fund Protection:

- Segregated Accounts: Client funds are held in segregated accounts separate from the broker’s own assets. This means your money is protected even if the broker faces financial trouble.

- Investor Compensation:

- Under FCA rules, eligible UK clients are protected by the Financial Services Compensation Scheme (FSCS), covering up to £85,000 if IBKR were to fail.

Investment Products

In this case, we are looking at the two brokers with the largest product and market offerings, also at a very competitive price.

Products and markets available with Interactive Brokers

Interactive Brokers allows you to access more than 150 markets worldwide in 33 locations and with 26 different currencies. In general terms, the catalog of Interactive Brokers is broader and with more products, although DEGIRO has become a reference for investing in stocks and ETFs within Spain.

- Stocks (whole and fractional).

- Investment funds.

- ETFs.

- Interest-bearing account at 4.83% (in dollars)

- Futures.

- Bonds.

- Options.

- Structured products.

- Forex.

- Commodities.

- Fixed income products.

- Cryptocurrencies

In addition to all these products, Interactive Brokers is one of the first platforms to offer spot Bitcoin ETFs, recently approved by U.S. authorities, precisely because it is headquartered in that country.

On the other hand, its offer of a remunerated account in dollars stands out, offering a yield of no less than 4.86%.

Products and markets available with DEGIRO

DEGIRO is a very comprehensive broker with which you can trade a wide range of products, mainly in cash.

These are your options with DEGIRO:

- Stocks: from about 50 exchanges located in 30 countries

- ETFs: more than 2,000 ETFs

- Bonds: about 500 corporate bonds (does not have sovereign bonds)

- Investment funds: more than 250 investment funds

- Futures: 14 futures markets

- Options: 12 options markets

- Cryptocurrency trackers: cryptocurrency ETFs and ETNs

- Structured products

- Commodities: wide range of commodities

In terms of markets, DEGIRO allows access to 25 different locations

Account Types

Both Interactive Brokers and DEGIRO offer a range of account types designed to suit different kinds of investors. However, Interactive Brokers has a more complex account structure compared to DEGIRO.

Interactive Brokers Account Options

- Demo Account: A practice account where you can trade without risking real money. Ideal for beginners wanting to get familiar with the platform.

- Cash Account: The most basic account, allowing you to trade only with the cash you have deposited. No minimum deposit required, but you must be 18 or over. Note: funds from sales take time to settle before they can be reused.

- Margin Account: Allows trading with leverage. You must be 21 or older and deposit a minimum of $2,000 (approximately £1,600).

- Portfolio Margin Account: Similar to the Margin Account but designed for experienced investors with a minimum deposit of €100,000. It also has no custody fees.

DEGIRO Account Options

DEGIRO offers four main account types, each with different levels of access and risk:

- Basic Account: Suitable for beginners or those not trading derivatives. Gives access to most products except derivatives like futures and options. This is the default account upon registration.

- Active Account: Adds the ability to trade leveraged products with short cash positions limited to 50%.

- Trader Account: Similar to Active but allows short cash positions up to 100%.

- Day-Trader Account: Designed for advanced traders with fewer leverage restrictions and higher risk tolerance. Must be activated by contacting DEGIRO support.

Fees and charges

The fees and commissions of each broker are one of the main features that investors consider to decide which one interests them more. In the case of both DEGIRO and Interactive Brokers, this information is found transparently on their website, unlike other platforms:

DEGIRO Fees

DEGIRO is popular in the UK for its low trading costs and offers commission-free trading on a changing selection of ETFs. Key fees include:

- Stocks:

- UK & US stocks: Around €2 (~£1.70) (includes €1 commission + €1 handling fee)

- Other markets: Between €3.90 and €5 + €1 management fee

- ETFs:

- Selected ETFs: €1 (~£0.85) (no commission + €1 handling fee)

- Other ETFs: €3 (€2 commission + €1 handling fee)

- Bonds: €3 (€2 commission + €1 handling fee)

- Investment funds: €3.90 + 0.20% service fee

- Leveraged products & warrants: €0.50

- Options & futures: €0.75 per contract

Additional fees:

- Currency exchange: 0.25% (online) or €10 + 0.25% (manual)

- Market connectivity: €2.50 per year per market with open positions

No fees for deposits, withdrawals, custody, or inactivity.

Interactive Brokers Fees

Interactive Brokers offers extensive global market access with competitive commissions:

- Stocks:

- UK stocks: From £1.70 per trade (0.05% minimum)

- US stocks: $0.0035–$0.005 per share (min $1, max 1%)

- Other major markets vary similarly

- Funds: $3 to $14.95 depending on trade size

- Bonds: Varies by market, e.g. UK corporate bonds typically 0.10% (min £2)

- Options: £1.70 per contract (min £1.70) in the UK

- Futures: From £0.15 per contract (min £1.70) in the UK

- Bitcoin futures: $5 per contract

Currency exchange fees:

- Tiered from 0.08 to 0.2 pips based on volume

No fees for account opening, deposits, custody, or inactivity. One free withdrawal per month; additional withdrawals cost $10.

Minimum Deposit and Withdrawals

Opening an account with either DEGIRO or Interactive Brokers is straightforward for UK investors. Here's what you need to know:

DEGIRO

- Minimum Deposit: £0.01 (or €0.01 equivalent) — this small amount is used to verify your bank account.

- Ongoing Use: There’s no required minimum deposit to begin trading once your account is verified.

- Withdrawals: Free and typically processed within 2–3 working days to your linked UK bank account.

Interactive Brokers

- Minimum Deposit:

- Cash Account: £0 minimum — no deposit is required to open or maintain the account.

- Margin Account: Requires a $2,000 (approx. £1,570) minimum deposit due to FCA leverage rules.

- Withdrawals: One free withdrawal per calendar month; additional withdrawals incur a small fee. Transfers to UK bank accounts are available and processed quickly.

Trading Platforms

Regarding the platforms, we are not going to elaborate much, as there is little to say about their pros and cons, and there is almost consensus throughout the investor community about these.

Interactive Brokers Platforms

Interactive Brokers provides a suite of trading platforms catering to various levels of experience:

- IBKR Desktop

A powerful, user-friendly platform designed for active traders. It offers customizable workspaces, advanced charting tools, and access to over 150 markets. Ideal for those seeking precision and control in their trading strategies. - IBKR GlobalTrader

A mobile-first platform tailored for global stock and ETF trading. Users can invest with as little as $1 and trade fractional shares. It provides access to 90+ stock exchanges worldwide, including the NYSE, NASDAQ, and LSE. - IBKR Mobile

Offers advanced order types and trading tools on the go. Suitable for experienced traders who need access to markets anytime, anywhere. - Client Portal

A web-based platform for managing accounts, viewing balances, and accessing reports. It provides a simple interface for monitoring investments. - IMPACT

A mobile app focused on ESG (Environmental, Social, and Governance) investing, allowing users to align their portfolios with their values.

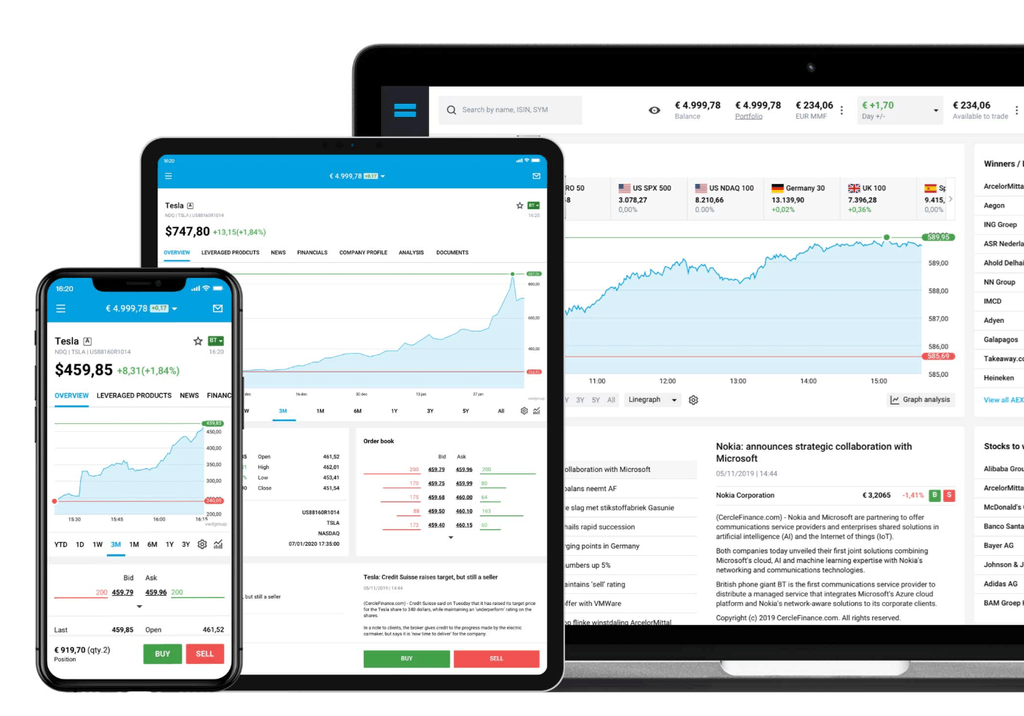

DEGIRO Platforms

DEGIRO offers a streamlined trading platform suitable for both beginners and experienced investors:

- WebTrader

A user-friendly web-based platform providing access to a wide range of financial instruments. It includes features like real-time quotes, interactive charts, and financial data. - Mobile App

The DEGIRO mobile app mirrors the web platform's functionalities, allowing users to trade on the go. It offers access to real-time data and order execution.

Customer Service

Customer service and training services are important when you need them. This is a clear area for improvement for both brokers.

Interactive Brokers Customer Service

Interactive Brokers provides several ways to contact their customer support:

Contact Methods

- Phone Support: Available Monday to Friday, 8:00 AM to 5:00 PM (UK time).

- UK Direct Dial: +44 20 3744 7220

- Institutional Clients: +44 20 3744 7300

- Live Chat: Accessible via the Client Portal. This feature is available 24/5, excluding weekends. It's a secure and efficient way to address account-specific inquiries.

- Email Support: For general inquiries, use the contact form on their website.

- WebTicket System: For prompt attention, especially for urgent issues like trading problems, it's recommended to use the WebTicket system through the Client Portal.

- Phone Support: Monday to Friday, 8:00 AM to 5:00 PM (UK time).

- Live Chat: 24/5, excluding weekends.

- Email and WebTicket: Available 24/7, with response times varying based on the nature of the inquiry.

DEGIRO Customer Service

DEGIRO offers the following customer support options for UK clients:

Contact Methods

- Phone Support: Available Monday to Friday, 7:00 AM to 9:00 PM (UK time).

- UK Phone Number: +44 (0) 20 3695 7834

- Email Support: For general inquiries, email:

- General Email: [email protected]

Phone Support: Monday to Friday, 8:00 AM to 5:00 PM (UK time).

Live Chat: 24/5, excluding weekends.

Email and WebTicket: Available 24/7, with response times varying based on the nature of the inquiry.

User Reviews

DEGIRO is generally well-received by UK investors for its low-cost trading and user-friendly platform, especially for stocks and ETFs. Many appreciate the straightforward interface and competitive fees. However, some users note that the platform lacks advanced tools and real-time support can be slow during busy periods.

Interactive Brokers offers powerful tools and access to global markets, but reviews are mixed. UK users praise its wide product range and competitive pricing but often highlight a steep learning curve, outdated interface, and inconsistent customer service. Better suited for experienced traders than casual investors.

DEGIRO vs Interactive Brokers: Which is better?

The choice of the best platform will entirely depend on the investor's profile. Both brokers pass in terms of guarantees and regulation, as they are backed by several financial authorities in addition to their long track record.

If we look at the catalog, Interactive Brokers offers much more breadth, clearly because it is a larger broker operating worldwide. This also allows it to have lower commissions on some products, although DEGIRO's are very competitive with other European brokers.

Regarding the interface, we recommend DEGIRO if you are a beginner, without a doubt, and Interactive Brokers if you have experience and are looking to trade more complex products, such as leveraged ones or simply if you want to do day trading.