Comparatives

Freetrade vs Trading 212: What UK Investors Need to Know

This article was updated as of May 19th 2025.

Freetrade and Trading 212 are major players in the UK's brokerage industry, known for their low-cost investment schemes. They offer investors commission-free investment, user-friendly apps, investment guides, tools, and necessary tools to aid investment yield.

But how do they differ? Which is better and, more importantly, which one should you choose?

If you're looking for these answers, this Freetrade vs. Trading 212 comparison review is for you. Here, we will compare the two brokers' differences, similarities, pros, and cons.

What Are They and How Do They Work?

Freetrade is a London-based fintech company offering commission-free trading on over 6,200 US and UK stocks and ETFs. Established in 2016, it operates on a freemium model, providing access to Self-Invested Personal Pensions (SIPPs), General Investment Accounts (GIAs) and Stocks and Shares ISAs across three pricing tiers: Basic, Standard, and Plus.

A standout feature is fractional share trading for US-listed stocks, allowing investments from as little as £1. This is particularly beneficial for accessing high-value stocks like Apple or Amazon. However, fractional shares are not yet available for UK or EU stocks.

As of January 2025, Freetrade was acquired by IG Group for £160 million, aiming to expand its offerings while maintaining its user-friendly platform.

Trading 212 Limited is a leading UK fintech, known for its commission-free trading across shares, ETFs, forex, and commodities.

Founded in 2004 in Bulgaria, the company is regulated in the UK (FCA), Bulgaria, and Cyprus, and operates across the UK, EU, and Australia. Its free, intuitive mobile app enables users to invest in a wide range of markets with ease.

The platform manages over 2 million funded accounts and more than £3.5 billion in client assets and cash. It offers several account types, including the Invest account, a tax-free Stocks & Shares ISA, and a CFD account.

While trading is commission-free, some fees apply. For example, a 0.7% deposit fee is charged on card, Apple Pay, and Google Pay deposits once a user’s total deposits exceed £2,000. Bank transfers remain free.

Key features include fractional share investing, interest on uninvested cash, and tools like AutoInvest and “Pies” — customisable portfolios that let users build diversified investments with ease.

Trading 212 stands out for its accessible platform and strong feature set, making it a solid choice for both new and experienced UK investors.

Main Characteristics

| Characteristics | Freetrade | Trading 212 | |||

| Regulations | Freetrade is regulated by the Financial Conduct Academy (FCA) in the UK (FRN: 738189) | Trading 212 is authorised and regulated by UK's FCA, Cyprus' (CYSEC), Bulgaria's FSC | |||

| Market and Assets | Stocks, Fractional shares, ETFs, investment trusts, OTC stocks, SPACs, REITs, IPOs | Stocks, Fractional shares, ETFs, Indexes, Commodities, Forex | |||

| Protection Scheme | Up to £85,000 | Up to £85,000 for UK's FSCS and up to 90% (but limited to 20,000 Euros) for ICF Cyprus and Bulgaria regulatory bodies | |||

| Account types | GIA, ISA, and SIPP | Standard Investment Account, ISA, and demo | |||

| Pricing Plan | Basic plan (free), Standard Plan (£5.99 monthly or £59.88 annually), and Plus Plan (11.99 monthly or £119.88 annually) | No pricing plan. All accounts are free*. | |||

| Minimum deposit | £0/$0 | £0/$0 | |||

| Deposit method | Bank transfer, debit card, Apple Pay, and Google Pay | Bank transfer, debit and credit card, Apple/Google Pay, Instant Bank transfers, OnlineBankingPL, Giropay, Carte Bleue, Blik, Direct eBanking, and iDEAL | |||

| Deposit and Withdrawal Fee | Zero-fee | Deposit is free until you have deposited 2,000 GBP/EUR. After this limit, there is a 0.7% fee. Zero withdrawal fee | |||

| Trading Platform | Proprietary in-app trading platform on mobile devices and web service | Proprietary in-app and web trading platform on mobile and desktop | |||

| Currency Exchange Fee | 0.99% fx fee for Basic plan 0.59% fx fee for Standard Plan 0.39% fx fee for Plus plan | 0.15% FX fee | |||

| Demi Account | No | Yes | |||

| Supported Currency | GBP | GBP, USD, CHF, DKK, NOK, PLN, SEK, CZK, RON, BGN, and HUF |

| Characteristics | Freetrade | Trading 212 |

| Regulations | Freetrade is regulated by the Financial Conduct Academy (FCA) in the UK (FRN: 738189) | Trading 212 is authorised and regulated by UK's FCA, Cyprus' (CYSEC), Bulgaria's FSC |

| Market and Assets | Stocks, Fractional shares, ETFs, investment trusts, OTC stocks, SPACs, REITs, IPOs | Stocks, Fractional shares, ETFs, Indexes, Commodities, Forex |

| Protection Scheme | Up to £85,000 | Up to £85,000 for UK's FSCS and up to 90% (but limited to 20,000 Euros) for ICF Cyprus and Bulgaria regulatory bodies |

| Account types | GIA, ISA, and SIPP | Standard Investment Account, ISA, and demo |

| Pricing Plan | Basic plan (free), Standard Plan (£5.99 monthly or £59.88 annually), and Plus Plan (11.99 monthly or £119.88 annually) | No pricing plan. All accounts are free*. |

| Minimum deposit | £0/$0 | £0/$0 |

| Deposit method | Bank transfer, debit card, Apple Pay, and Google Pay | Bank transfer, debit and credit card, Apple/Google Pay, Instant Bank transfers, OnlineBankingPL, Giropay, Carte Bleue, Blik, Direct eBanking, and iDEAL |

| Deposit and Withdrawal Fee | Zero-fee | Deposit is free until you have deposited 2,000 GBP/EUR. After this limit, there is a 0.7% fee. Zero withdrawal fee |

| Trading Platform | Proprietary in-app trading platform on mobile devices and web service | Proprietary in-app and web trading platform on mobile and desktop |

| Currency Exchange Fee | 0.99% fx fee for Basic plan 0.59% fx fee for Standard Plan 0.39% fx fee for Plus plan | 0.15% FX fee |

| Demi Account | No | Yes |

| Supported Currency | GBP | GBP, USD, CHF, DKK, NOK, PLN, SEK, CZK, RON, BGN, and HUF |

Are they safe?

A crucial factor in selecting the right broker involves the security regulations and reliability of the financial institution. Let's examine both fintech companies regarding investment security and platform reliability.

Freetrade Limited is authorised and regulated by the UK’s Financial Conduct Authority (FCA) and must follow strict rules to protect investors.

Client funds are held in segregated bank accounts, meaning they’re kept separate from Freetrade’s own money and can’t be used for business costs.

UK-listed stocks are held in a nominee account, while US-listed shares are safeguarded by a third-party custodian under US SEC regulations.

Freetrade is covered by the Financial Services Compensation Scheme (FSCS), protecting eligible assets up to £85,000 in the event of company failure.

The app also includes two-factor authentication (2FA) for added account security.

Trading 212 is authorised and regulated by the UK’s Financial Conduct Authority (FCA), which requires it to keep client funds in segregated bank accounts, separate from company finances.

UK investors are protected by the Financial Services Compensation Scheme (FSCS), covering up to £85,000 in the event the company fails.

In the EU, Trading 212 is regulated by CySEC (Cyprus) and the FSC (Bulgaria). Investors in these regions are covered by the Investors Compensation Fund (ICF), which protects up to 90% of funds, capped at €20,000.

With strong regulatory oversight and compensation schemes in place, Trading 212 is widely regarded as a secure and trustworthy platform for investors.

Investment Products available in UK

Both companies are known for their diverse array of investment products. Therefore, selecting which one is better for you also depends on the type of financial product you are interested in investing in.

Below you will find each broker's products and we will provide you with information about them.

| Asset | Freetrade | Trading 212 | |||

| Stocks & Shares | Over 6,000 UK and US stocks | Over 9,000 stocks across 15 exchanges, including UK, US, Germany, France, Spain | |||

| Fractional Shares | Available for US stocks | Available for US and UK stocks | |||

| ETFs | Over 400 commission-free ETFs | Over 1,800 ETFs | |||

| Investment Trusts | 150+ investment trusts | Available via Investment Trusts and REITs | |||

| Commodities | US and UK commodities (e.g., oil, gas, metals) | Over 20 commodities, including gold, silver, oil, and agricultural products | |||

| Forex (Currency Pairs) | Not available | Over 210 currency pairs (CFDs) | |||

| Indices | Not available | Over 30 indices (CFDs) | |||

| Bonds | Government and corporate bond ETFs | Not available | |||

| Cryptocurrencies | Not available | CFDs on cryptocurrencies (e.g., Bitcoin, Ethereum) | |||

| AutoInvest & Pies | Available via Auto Invest feature | Available via AutoInvest and Pies features |

| Asset | Freetrade | Trading 212 |

| Stocks & Shares | Over 6,000 UK and US stocks | Over 9,000 stocks across 15 exchanges, including UK, US, Germany, France, Spain |

| Fractional Shares | Available for US stocks | Available for US and UK stocks |

| ETFs | Over 400 commission-free ETFs | Over 1,800 ETFs |

| Investment Trusts | 150+ investment trusts | Available via Investment Trusts and REITs |

| Commodities | US and UK commodities (e.g., oil, gas, metals) | Over 20 commodities, including gold, silver, oil, and agricultural products |

| Forex (Currency Pairs) | Not available | Over 210 currency pairs (CFDs) |

| Indices | Not available | Over 30 indices (CFDs) |

| Bonds | Government and corporate bond ETFs | Not available |

| Cryptocurrencies | Not available | CFDs on cryptocurrencies (e.g., Bitcoin, Ethereum) |

| AutoInvest & Pies | Available via Auto Invest feature | Available via AutoInvest and Pies features |

Account Types

Freetrade Account Types

1. Stock and shares ISA

The Freetrade ISA is a tax-free and zero-commission account that allows you to invest in several stocks and shares. You can invest up to £20,000 in assets in the 2023/2024 tax year.

With one of the best Stocks and Shares ISA account, you can access over 6,000 US and UK assets with no commission on purchase, access to fractional shares, and no income tax on dividends.

Freetrade Stocks and Shares ISA account - Fees applicable

| Charges | Standard Plan | Plus Plan | |||

| Monthly fee | £5.99 | £11.99 | |||

| Share dealings | Free | Free | |||

| Overseas share dealings | Exchange rate +0.59% | Exchange rate +0.39% | |||

| Transfer in (Deposit) | Free | Free | |||

| Transfer out (Withdrawal) – UK stock or cash | Free | Free | |||

| Portfolio Transfer (Out) – US stock | £17 per position | £17 per position |

| Charges | Standard Plan | Plus Plan |

| Monthly fee | £5.99 | £11.99 |

| Share dealings | Free | Free |

| Overseas share dealings | Exchange rate +0.59% | Exchange rate +0.39% |

| Transfer in (Deposit) | Free | Free |

| Transfer out (Withdrawal) – UK stock or cash | Free | Free |

| Portfolio Transfer (Out) – US stock | £17 per position | £17 per position |

2. Self-invested Personal Pension (SIPP)

The SIPP is a tax-free pension/retirement plan that enables you to manage your pension and grow it through investments. Contributions can be made directly or through your employer during your working years.

Access to the funds is permitted starting at age 55. At that point, you can choose to grow a portion or all of the pension pot by investing it in various assets.

With the Freetrade SIPP account, you can access a broader range of investment options and contribute up to 100% of your salary. Contributions under £40,000 annually are eligible for tax relief.

Freetrade SIPP - Applicable fees

| Charges | Plus plan | ||

| Monthly fee | £11.99 | ||

| Share dealing | Free | ||

| Overseas share dealing (Currency Exchange) | Exchange rate +0.39% | ||

| Transfer in (Deposit) | Free | ||

| Transfer out (Withdrawal) | Free | ||

| US stock Portfolio transfer (out) | £17 per holding |

| Charges | Plus plan |

| Monthly fee | £11.99 |

| Share dealing | Free |

| Overseas share dealing (Currency Exchange) | Exchange rate +0.39% |

| Transfer in (Deposit) | Free |

| Transfer out (Withdrawal) | Free |

| US stock Portfolio transfer (out) | £17 per holding |

3. General Investment Account (GIA)

The GIA (General Investment Account) is designed to buy, sell, and manage your investment portfolio. With this account, you will be subject to Capital Gains Tax (CGT) on dividends received or profits made from trades. The tax amount will vary based on the size of the profits.

The Freetrade GIA account is included in all Freetrade pricing plans, enabling you to trade up to 6,000 stocks depending on your chosen plan. However, with the free GIA account, trading is limited to approximately 1,500 financial instruments.

Trading 212 Account Types

1. Trading 212 Invest Account

Like the Freetrade General Investment Account (GIA), the Trading 212 Invest account does not offer tax-free benefits for buying stocks, shares, or funds, and you will be subject to Capital Gains Tax (CGT).

With the Trading 212 Invest account, you can invest in thousands of stocks with zero commission. However, Trading 212 charges fees for transactions conducted in currencies other than the platform's base currency.

2. Trading 212 ISA Account

Like all ISAs, the Trading 212 ISA Account allows you to save tax-free up to £20,000 per tax year. You can invest these funds in stocks and other financial instruments for profit, enjoying dividends and gains without paying Capital Gains Tax.

3. Trading 212 Pro Account

The Trading 212 Pro account is available exclusively to experienced traders who meet at least two of the following requirements:

- Trade Volume: You must have placed an average of 10 significantly sized trades per quarter over the past year.

- Portfolio Size: You possess a portfolio of financial instruments (assets) exceeding £500,000.

- Financial Sector Experience: You have worked in the financial sector in a role that requires knowledge of leveraged trading for at least a year

4. Trading 212 Account

This is a free training account for novice investors to learn the nature of the market and how Trading 212 works. The platform provides demo account users with £50,000 virtual money to invest and try out strategies without risk.

Pricing Plans and Fees

Commissions and fees are among the main factors investors consider when selecting an investment platform. Understanding each platform's pricing plans, regulatory fees, and other associated charges is essential.

Let's explore the financial commissions for both Freetrade and Trading 212:

Freetrade Pricing Plan and Broker Fee

The Freetrade broker has three pricing platforms: the Basic, Standard, and Plus. Below are the differences between the plans.

| Features | Basic Plan | Standard Plan | Plus Plan | ||||

| Plan Fee | £0.00 per month | £5.99 per month, £59.88 billed annually | £11.99 per month, £119.88 billed annually | ||||

| Number of Assets | 6,200 stocks, including popular shares and ETFs | Full range of 6,200+ US, UK, and EU stocks and ETFs | Full range of 6,200+ US, UK, and EU stocks and ETFs | ||||

| Account type | General Investment Account | General Investment Account Stocks and Shares ISA | General Investment Account Stocks and Shares ISA Self-invested Personal Pension | ||||

| Commission | Commission-free trades | Commission-free trades | Commission-free trades | ||||

| Range of Stocks | 1,500+ | 6,000+ | 6,000+ | ||||

| U.S Fractional shares | YES | YES | YES | ||||

| Automation Order Types | NO | YES | YES | ||||

| Exchange rate fee | Exchange rate +0.99% FX fee | Exchange rate +0.59% FX fee | Exchange rate +0.39% FX fee | ||||

| Customer Service | Basic | Basic | Priority | ||||

| Interest rate on uninvested cash | 1% AER on uninvested cash up to £1,000 | 3% interest on uninvested cash up to £2,000 | 5% interest on uninvested cash up to £3,000 | ||||

| Advanced stock fundamentals | NO | YES | YES | ||||

| Trading app | In-app | In-app | In-app Freetrade Web beta |

| Features | Basic Plan | Standard Plan | Plus Plan |

| Plan Fee | £0.00 per month | £5.99 per month, £59.88 billed annually | £11.99 per month, £119.88 billed annually |

| Number of Assets | 6,200 stocks, including popular shares and ETFs | Full range of 6,200+ US, UK, and EU stocks and ETFs | Full range of 6,200+ US, UK, and EU stocks and ETFs |

| Account type | General Investment Account | General Investment Account Stocks and Shares ISA | General Investment Account Stocks and Shares ISA Self-invested Personal Pension |

| Commission | Commission-free trades | Commission-free trades | Commission-free trades |

| Range of Stocks | 1,500+ | 6,000+ | 6,000+ |

| U.S Fractional shares | YES | YES | YES |

| Automation Order Types | NO | YES | YES |

| Exchange rate fee | Exchange rate +0.99% FX fee | Exchange rate +0.59% FX fee | Exchange rate +0.39% FX fee |

| Customer Service | Basic | Basic | Priority |

| Interest rate on uninvested cash | 1% AER on uninvested cash up to £1,000 | 3% interest on uninvested cash up to £2,000 | 5% interest on uninvested cash up to £3,000 |

| Advanced stock fundamentals | NO | YES | YES |

| Trading app | In-app | In-app | In-app Freetrade Web beta |

Trading 212 Pricing Plan and Broker Fees

The Trading 212 platform has no specific pricing plan, and all account types are free to open. However, certain services incur fees. These include:

| Services | Fees applicable | ||

| Forex | 0.15% | ||

| Deposits via bank transfers | Free | ||

| Deposit via Cards, Google/Apple Pay/Other | Free up to £2,000/$2,000 // 0.7% over | ||

| Withdrawals | Free | ||

| UK stamp duty | 0.5% | ||

| PTM levy | £1.50 per trade | ||

| French Financial Transaction Tax | 0.4% | ||

| FNRA fee | $0.000145 per share | ||

| SEC fee | 0.00229% |

| Services | Fees applicable |

| Forex | 0.15% |

| Deposits via bank transfers | Free |

| Deposit via Cards, Google/Apple Pay/Other | Free up to £2,000/$2,000 // 0.7% over |

| Withdrawals | Free |

| UK stamp duty | 0.5% |

| PTM levy | £1.50 per trade |

| French Financial Transaction Tax | 0.4% |

| FNRA fee | $0.000145 per share |

| SEC fee | 0.00229% |

Trading Platform

Another significant aspect when comparing Freetrade and Trading 212 is the best trading platform for your needs. Let’s compare their trading platforms.

Freetrade Trading Platform

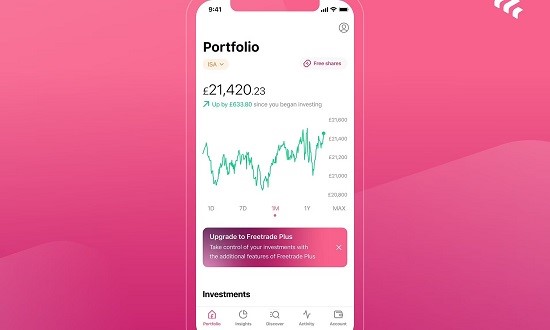

Freetrade Limited offers a proprietary online trading application compatible with iOS and Android devices. This user-friendly app allows you to buy, sell, and manage your investments with ease, all from the palm of your hand.

Recognised for its simple design and ease of use, Freetrade's app has won the title of the best online trading app in the UK for three consecutive years. It includes features such as real-time market data, price alerts, and customisable watchlists, helping investors stay on top of their trades. Two-factor authentication (2FA) also ensures a secure experience for all users.

While Freetrade doesn't have a dedicated desktop app, the platform is accessible via a web browser, though only Plus plan customers can trade using the web platform.

Currently available to UK residents, Freetrade has plans to expand into additional European markets, making it a growing option for international investors.

Trading 212 Trading Platform

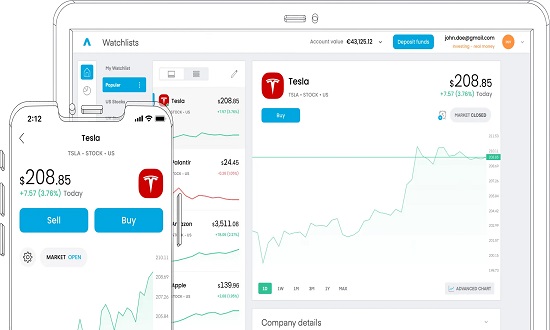

Trading 212 offers a proprietary trading platform, similar to Freetrade, which includes both a mobile app and a web interface. The platform is equipped with a variety of charts, technical indicators, and tools that empower investors to make informed decisions. These features are ideal for both beginners and advanced traders who require access to real-time data and advanced trading functionalities.

The mobile app and web platform allow users to trade across Trading 212's range of financial instruments, including stocks, ETFs, commodities, and forex. The platform also offers built-in tools such as price alerts, notifications, portfolio reports, and commission breakdowns, helping users track their investments and manage their portfolios efficiently.

An additional convenience for users is the Google Chrome plugin, which provides quick access to the platform directly from the browser. The plugin can be easily added from the Chrome Web Store, making it simpler for users to trade without opening the full browser platform.

Since its launch, the Trading 212 mobile app has been downloaded over 14 million times and has consistently held the title of the UK’s number-one trading app since 2016. This achievement highlights the platform's strong presence and user trust in the market.

Overall, Trading 212's powerful combination of features, user-friendly interface, and widespread popularity makes it one of the leading trading apps globally.

Deposit and Withdrawal Policy

Freetrade provides straightforward deposit and withdrawal methods:

Freetrade Deposit Options and Charges

- Bank Transfer: You can link a UK-authorised bank account to your Freetrade account for deposits.

- Debit Card Transfer – You can deposit funds using a debit/credit card.

- Apple and Google Pay—You can deposit funds directly using Google Pay or Apple Pay. This method allows instant deposits but has a lifetime limit of £250. Ensure that the default billing address in your Google or Apple Pay settings matches your Freetrade address.

Freetrade generally doesn't charge a deposit fee; additional fees (e.g., exchange rates) might apply.

Freetrade Withdrawal Options and Fees

You can withdraw funds from Freetrade only through bank transfer. Typically, withdrawals take 2-3 business days to reach your linked bank account but can occasionally take up to 5 business days.

Trading 212 Deposit Options and Charges

Trading 212 offers a wide range of deposit methods, including:

- Bank Transfer

- Instant Bank Transfer

- Credit and Debit Card Payment

- Paypal

- Giropay

- Carte Bleue

- OnlineBankingPL

- Blik

- Direct Banking

- Apple and Google Pay

- iDEAL

Deposits via Bank transfer are free. However, other funding methods (Credit/Debit card) are free up to £2,000/$2,000. After this threshold, Trading 212 charges a 0.7% fee over the additional cummulative amount.

Trading 212 Withdraw Options and Charges

For security reasons, Trading 212 processes withdrawals via the same payment method initially used to fund the account, which should be verified when funding the account.

If you've deposited funds using multiple methods, you can choose from any of those available for your withdrawal.

Customer Care Service

Freetrade provides customer-dedicated support through its website and app's "Help" section. Various options are available for contacting customer support:

- Help Hub and Community – The Help Hub contains answers to common questions, so you can often find solutions without contacting customer support. The Freetrade community also provides a space for investors to share advice and seek help.

- Social Media – Freetrade is active on Twitter, Instagram, LinkedIn, and Facebook, where you can chat with support, share complaints, and receive updates about the broker and market news.

- Email Support – Email Freetrade customer support at [email protected]. Expect a response within 24 working hours.

- In-App Chat – The live chat feature in the Freetrade app connects you to a customer service representative. It's the quickest and most convenient way to address issues or questions.

Trading 212 offers efficient and responsive customer support through various channels:

- Trading 212 Community – The community is a forum where investors can share ideas and get answers from Trading 212 representatives.

- Live Chat—Click the "Chat with us" button in the menu to access Trading 212 representatives 24/7 who can directly address your inquiry topic.

- Email – Contact customer support at [email protected] with your concerns, and you'll receive a response from the team.

Users' Opinions and Reviews

Customer reviews and opinions are essential when evaluating fintech platforms like Freetrade and Trading 212.

How satisfied are investors with the services?

To find out, we'll look at the Trustpilot investment community for honest ratings and comments and we will have a look the Google Play Store and Apple App Store for insights into the mobile apps.

Freetrade User Opinions and Reviews

- Trustpilot: With over 5,000 reviews on Trustpilot, Freetrade scores 4.1 out of 5. The primary concern among users is the lack of CFD and cryptocurrency trading options.

- Mobile App: The Freetrade mobile app scores 4.7 out of 5 on the Google Play Store and 4.3 out of 5 on the Apple App Store, indicating a generally positive user experience.

Trading 212 User Opinions and Reviews

- Trustpilot: Trading 212 has more than 53,000 reviews, with a scoring of 4.6 out of 5. Investors appreciate the ability to trade stocks and forex and recommend the fast and efficient customer support.

- Mobile App: The Trading 212 app scores 4.6 out of 5 on the Google Play Store from over 198,000 reviews and 4.6 out of 5 on the Apple App Store, demonstrating customer satisfaction.

Research and Education

Freetrade takes a minimalist approach to research and education, focusing primarily on simplicity and accessibility. While it doesn’t offer in-depth analytical tools or advanced charting features, it provides basic company information, market data, and a brief snapshot of individual stocks within the app.

Educational content is mainly delivered through the Freetrade Learn section and its blog, which features beginner-friendly articles explaining investment concepts, tax wrappers like ISAs, and market trends. This makes it suitable for new investors looking to understand the fundamentals of investing without being overwhelmed by data-heavy platforms.

Trading 212 provides a more comprehensive approach to research and education, offering users access to a range of tools for better decision-making. The platform includes real-time market data, advanced charting, and technical indicators, giving investors a detailed view of their investments. Basic company information and key financial data are readily available, allowing users to stay informed about their assets.

Educational content is primarily found in the Trading 212 Learning Center, which offers beginner-friendly resources on trading basics, investment strategies, and how to use the platform effectively. While it’s suitable for new investors, Trading 212 also includes advanced tools that cater to more experienced traders who want deeper market insights.

Our Opinion

Freetrade and Trading 212 provide commission-free investment services, each excelling in different areas. Here's a closer look at where they stand out:

- Regulation and Security: Both brokers are fully regulated by the UK's Financial Conduct Authority, ensuring high security and reliability. Trading 212's operations in Bulgaria and Cyprus mean it's regulated under those jurisdictions. For UK investors, FCA applies as the regulatory body

- Products and Instruments: Freetrade focuses on beginner investors with lower-risk investments, offering stocks, ETFs, bonds, and commodities. Investors can hand-pick their stocks, which aligns with a more conservative strategy. Trading 212, however, targets both beginner and experienced investors.

- Fees and Pricing Structure:

- Freetrade: Commission model based on subscription and pricing plans.

- Trading 212: it offers a more open structure, with pay-per-use service plans and most of the available products free of charge*.

- Trading Platform: Both brokers offer user-friendly and efficient proprietary platforms. While the Freetrade app is basic and only a mobile plan (unless a plan is contracted) for seasoned traders due to fewer technical indicators, it serves its intended audience well. Trading 212's platform has more technical tools suitable for experienced traders and a desktop version.

Conclusion:

Freetrade and Trading 212 target different types of investors, with Trading 212 focusing on experienced traders ready for higher-risk strategies, and Freetrade providing a safer environment for beginners. Each broker is excellent in its niche, and your choice should align with your experience level and investment strategy.

NOTE: "Interest applies on cash in an investment account. Terms apply. When investing, your capital is at risk."

FAQs

Is Freetrade a Good Broker?

Freetrade's freemium business model provides access to fractional share trading via a user-friendly mobile app, along with high-quality educational content. However, the platform's investment research and product range are somewhat limited, and the web trading platform is still in beta, restricting its availability to a subset of customers.

Can I Transfer Shares on Trading 212?

Yes, Trading 212 now supports transferring shares to and from other brokers, including Freetrade, as part of their portfolio transfer feature.

Can I Transfer my portfolio to Freetrade?

The broker accepts asset and cash transfer from other brokers at no fee. Also, if you decide to leave Freetrade, you can transfer your assets to other brokers (fees may apply).