Comparatives

IG vs Interactive Brokers Comparison

Choosing between IG and Interactive Brokers hinges on the kind of trader you are. IG, with its roots in London and decades of experience, offers access to a vast suite of over 17,000 global markets—ranging from CFDs and forex to traditional stock dealing, with polished tools like IG Academy, demo accounts, and DMA execution for seasoned investors.

Meanwhile, Interactive Brokers stands out for its ultra‑low commission structure, institutional‑grade security, and unmatched reach—spanning 135+ markets across 33 countries, with deep support for stocks, futures, options, bonds, ETFs, and more.

In essence: for traders who value research, simplicity, and educational backing, IG shines; but for the cost‑conscious, globally diversified active trader, IBKR remains a strong favorite. So, in this article, we compare two leaders in the financial brokerage industry: IG and Interactive Brokers. We will examine various factors that allow for a thorough evaluation of each broker.

👉 For more information, read our Interactive Brokers review

👉 For more information, read our IG Group review

Main Features

| Characteristics | Interactive Brokers | IG | |||

| Regulation | FCA, SEC, CNMV and others | Cyprus Securities and Exchange Commission (CySEC) and FCA | |||

| Minimum Deposit | None | £250 | |||

| Commissions (UK stocks) | $0.01 per trade | £3 per stock | |||

| Commissions (currency exchange) | Auto FX 0.25% Without Auto FX 10€ + 0.25%. | Starting from 6 pips | |||

| Financial Instruments | Stocks ETFs Options Futures and FOPs Spot Forex Metals Bonds Investment Funds Cryptocurrencies Fractional Shares | Stocks ETFs Indices Commodities Currencies Cryptocurrencies Investment Funds Bonds Turbo24 | |||

| Strengths | ✅Low commissions. ✅Platforms adapted to your trading. ✅Access to a multitude of markets and products. | ✅Very low commissions. ✅Access to a multitude of markets and products. ✅More professional broker | |||

| Weaknesses | ❌No minimum initial investment. | ❌Not very intuitive platform | |||

| User Profile | Expert investors who seek access to various markets and assets | Specialists in financial derivatives such as futures and options. |

| Characteristics | Interactive Brokers | IG |

| Regulation | FCA, SEC, CNMV and others | Cyprus Securities and Exchange Commission (CySEC) and FCA |

| Minimum Deposit | None | £250 |

| Commissions (UK stocks) | $0.01 per trade | £3 per stock |

| Commissions (currency exchange) | Auto FX 0.25% Without Auto FX 10€ + 0.25%. | Starting from 6 pips |

| Financial Instruments | Stocks ETFs Options Futures and FOPs Spot Forex Metals Bonds Investment Funds Cryptocurrencies Fractional Shares | Stocks ETFs Indices Commodities Currencies Cryptocurrencies Investment Funds Bonds Turbo24 |

| Strengths | ✅Low commissions. ✅Platforms adapted to your trading. ✅Access to a multitude of markets and products. | ✅Very low commissions. ✅Access to a multitude of markets and products. ✅More professional broker |

| Weaknesses | ❌No minimum initial investment. | ❌Not very intuitive platform |

| User Profile | Expert investors who seek access to various markets and assets | Specialists in financial derivatives such as futures and options. |

Regulation

IG Group Holdings operates through subsidiaries worldwide to comply with regional licensing requirements. In Europe, services are provided by IG Europe GmbH, registered in Germany and regulated by Deutsche BundesBank and BaFin (Reg. No. 148759), and also supervised by Spain’s CNMV (Reg. No. 121).

Client funds are held by regulated banks, separate from IG’s assets, protecting them from IG’s creditors. IG is covered by the UK Financial Services Compensation Scheme (FSCS), offering protection up to £85,000. Additionally, accounts are protected from going negative, so clients can't incur debt with IG.

Interactive Brokers Group is a well-established, reputable broker regulated by top-tier authorities, including the U.S. SEC, UK FCA, and the Central Bank of Ireland.

In Europe, services are provided by Interactive Brokers Ireland Limited, based in Dublin and regulated by the Central Bank of Ireland (Reg. No. 657406), and supervised by Spain’s CNMV (Reg. No. 5023).

Client funds are protected by the SIPC in the U.S. (up to $500,000, including $250,000 in cash), and by the Irish Investor Compensation Scheme (ICS) in Europe.

Account Types

IG offers a variety of accounts:

1. Retail Client Accounts

Designed for individual traders and investors, these accounts offer access to a wide range of financial instruments.

- Spread Betting Account: Speculate on price movements of various markets without owning the underlying assets.

- CFD Trading Account: Trade on the price movements of financial instruments without owning the underlying assets.

- Share Dealing Account: Buy and sell shares on the stock market.

- Smart Portfolios: Invest in a diversified portfolio managed by experts.

These accounts are subject to the protections afforded to retail clients under UK financial regulations.

2. Joint Accounts

IG offers joint accounts for spread betting, CFDs, and share dealing. To set up a joint account, both parties must first have individual accounts. After that, they can complete and submit a joint account application form.

3. Professional Client Accounts

If you meet certain criteria, you can apply to be classified as a professional client. To qualify, you need to meet two out of the following three criteria:

- Professional Experience: Worked in the financial sector in a professional position for at least one year.

- Investment Portfolio: Have a financial instrument portfolio of €500,000 or more.

- Trading Experience: Placed 40 trades of significant size in the last year.

Professional clients may have access to higher leverage but do not receive the same regulatory protections as retail clients.

4. Demo Account

IG provides a free demo account with virtual funds, allowing you to practice trading strategies without financial risk. This is an excellent way to familiarise yourself with the platform and trading tools.

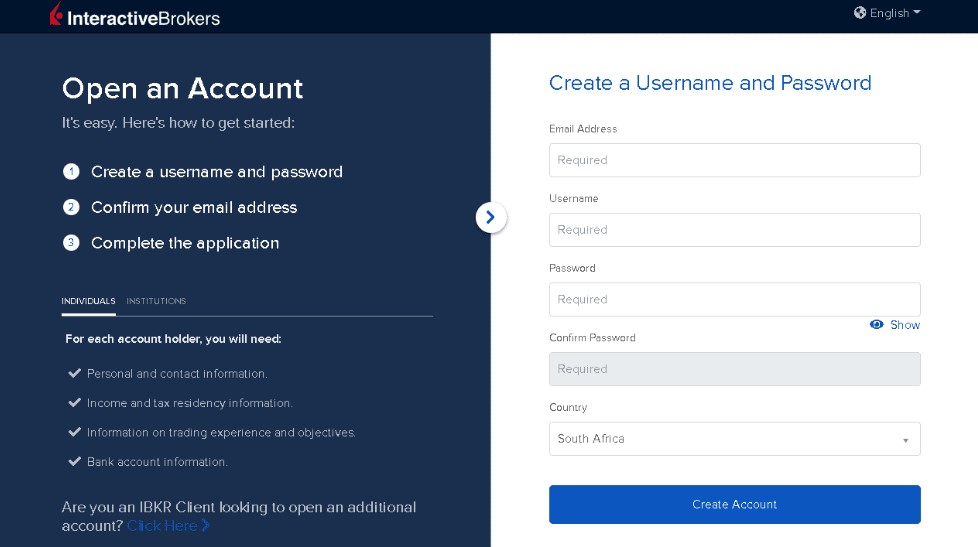

Below are the account types Interactive Brokers offer:

1. Individual Account

A standard account for individual traders or investors. You musst be 18 years for a cash account and 21 years for a margin account. This account provides access to a wide range of financial instruments including stocks, options, futures, forex, and bonds.

2. Joint Account

This account is shared between two individuals. It also allows for shared trading and investment decisions.

3. Trust Account

An account managed by a trustee on behalf of a beneficiary. It is suitable for estate planning and asset management purposes.

4. Family Account

An account structure allowing a "Family Head" to manage up to 15 sub-accounts. It´s designed for families to consolidate and manage investments collectively.

5. Advisor Account

Best for financial advisors managing multiple client portfolios. An advisor account provides tools for portfolio management and reporting.

6. Broker Account

For introducing brokers facilitating trades on behalf of clients. A broker account offers access to IBKR's trading platforms and infrastructure.

7. Corporate Account

An account for corporations and businesses. Allows businesses to manage trading and investment activities.

8. Limited Liability Company (LLC) Account

An account for LLCs to manage trading activities. Additioanlly provides flexibility in managing company investments.

9. Partnership Account

An account for partnerships to manage collective investments. It facilitates joint trading and investment decisions.

10. EmployeeTrack Account

A program for employees of companies that participate in IBKR's EmployeeTrack program. This account offers trading benefits and access to IBKR's platforms.

Available Products

Next, we will explore the entire product portfolio offered by both brokers, which, as investment brokers for professionals, provide a wide variety of investment assets, including the best stocks and shares ISA options for UK investors looking to maximise their tax-efficient investments.

IG:

Trading Products

- Spread Betting

- Contracts for Difference (CFDs)

- Share Dealing

- US Options and Futures

Investment Products

- Shares

- Exchange-Traded Funds (ETFs)

- Investment Trusts

- Stocks and Shares ISAs

Markets available

IG provides access to over 17,000 markets, including:

- Indices

- Forex (FX)

- Commodities

- Shares

- ETFs

- ESG Investments

Interactive Brokers:

Trading Products

- Stocks

- Options

- Futures

- Forex (FX)

- Bonds

- Exchange-Traded Funds (ETFs)Investment Funds

- Cryptocurrencies

Markets Available

Interactive Brokers provides access to over 135 markets worldwide, including:

- Stocks

- Forex (FX)

- Commodities

- Futures & Options

- Bonds

- ETFs & Funds

Fees and Charges

IG Group Fees:

Commission Rates

- UK Shares: £3 per trade (if 3+ trades made in the previous calendar month)

- US Shares: £0 per trade (if 3+ trades made in the previous calendar month)

- International Shares: £0 per trade (if 3+ trades made in the previous calendar month)

- Phone Dealing: £40–£50 per trade

Custody Fees

- Standard Custody Fee: £24 per quarter (waived if 3+ trades made in the previous quarter or if holding £15,000+ in IG Smart Portfolio)

Foreign Exchange Fee

- FX Conversion: 0.5% spread on currency conversions

Additional Charges

- PTM Levy: £1 per trade over £10,000 (increased to £1.50 from December 2024)

- Stamp Duty: 0.5% on UK share purchases

- Physical Share Dematerialisation/Rematerialisation: £100 each (inclusive of VAT)

- Bank Transfers: Free (standard); £15 for transfers under £100

Interactive Brokers Fees:

Commission Rates

- UK Shares: £3 per trade

- US Shares: £3 per trade

- European Shares: Commission varies by exchange; for GBP-denominated stocks, it's £0.01 per share or 0.1% of trade value, whichever is greater

Custody Fees

- Stocks & Shares ISA: £3 minimum monthly activity fee (waived if at least £3 in commission is paid per month)

- General Accounts: No annual custody fee

Additional Charges

- PTM Levy: £1.50 per trade over £10,000

- Bonds: 0.1% for trades under £10,000; 0.025% for trades over £10,000

Deposit and Withdrawals

| Feature | IG Group | IBKR | |||

| Deposit Methods | Debit/Credit Cards, Bank Transfer, PayPal | Bank Wire Transfer (GBP only) | |||

| Minimum Deposit | £250 | None | |||

| Deposit Fees | Free | Free | |||

| Deposit Processing | Instant (Cards/PayPal), 1–3 days (Bank) | 1–4 business days | |||

| Withdrawal Methods | Debit/Credit Cards, Bank Transfer, PayPal | Bank Wire Transfer (GBP only) | |||

| Minimum Withdrawal | £100 | None | |||

| Withdrawal Fees | Free | Free (1st per month), £7 thereafter | |||

| Withdrawal Processing | 3–5 business days (Cards), Same day to 3 days (Bank), 1 business day (PayPal) | 1–4 business days |

| Feature | IG Group | IBKR |

| Deposit Methods | Debit/Credit Cards, Bank Transfer, PayPal | Bank Wire Transfer (GBP only) |

| Minimum Deposit | £250 | None |

| Deposit Fees | Free | Free |

| Deposit Processing | Instant (Cards/PayPal), 1–3 days (Bank) | 1–4 business days |

| Withdrawal Methods | Debit/Credit Cards, Bank Transfer, PayPal | Bank Wire Transfer (GBP only) |

| Minimum Withdrawal | £100 | None |

| Withdrawal Fees | Free | Free (1st per month), £7 thereafter |

| Withdrawal Processing | 3–5 business days (Cards), Same day to 3 days (Bank), 1 business day (PayPal) | 1–4 business days |

ISAs and SIPPs

IG

Stocks & Shares ISA (Share Dealing ISA)

- Commission-free trading on UK and global shares and ETFs within the ISA.

- Flexible ISA: you can withdraw funds and still reclaim them within the tax year without reducing your allowance.

- No fees for ISA transfers or exits. £0.50–0.70% FX conversion (increasing April 2025).

- Access to over 11,000 global stocks and ETFs, plus expert-backed Smart Portfolio ISAs managed using BlackRock’s asset allocation.

SIPP (Self-Invested Personal Pension)

- Offers a share dealing SIPP with zero commission on global share trades and access to 11,000+ investments.

- Includes ready-made SIPP portfolios, offering diversified exposure managed via BlackRock.

- Administered through Options UK, with a £210 annual administration fee. Transfers from existing pensions are supported.

Fees & Platform Overview

- Platform fee of £96/year (if under 3 trades per quarter), waived with 3+ trades per quarter.

- Trading fees: approx. £8 for UK shares, £10 for US shares (if under 3 trades/month); free thereafter.

Interactive Brokers

- Low-cost trading: £3 per trade for UK/EU stocks; USD 0.005/share for US stocks.

- No custody or transfer fees and transparent low FX conversions (e.g., ~0.03%).

- Offers interest on idle cash balances and mobile/in-depth trading tools with FSCS protection (£85,000).

SIPP

- IBKR does not offer SIPPs directly—you must route through an approved SIPP administrator.

- These admins onboard and manage your SIPP, allowing you to trade through IBKR's platform.

- Clients negotiate fees and terms with administrators; IBKR acts as trading platform only.

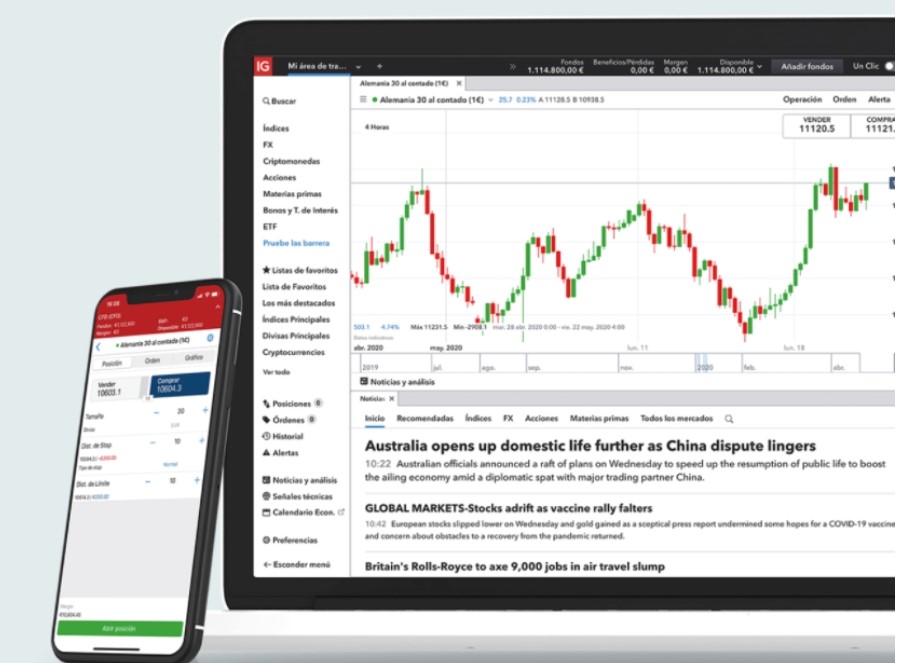

Trading Platforms

Both Interactive Brokers (IBKR) and IG Group offer some of the best trading platforms in the UK, catering to both beginners and experienced traders. These platforms are designed to provide seamless access to a wide range of financial instruments and markets, with advanced tools and intuitive interfaces.

| Platform | Details | ||

| IG Web Platform | -Highly customisable with the ability to set alerts and notifications. -Ideal for traders of all experience levels who want a comprehensive, yet easy-to-use platform without the need to download any software. | ||

| IG Trading App | - Available for both Android and iOS, one of the best investment apps allowing full account management and trading capabilities. - Designed for traders who want to trade from anywhere and need the flexibility of a mobile device. | ||

| L2 Dealer | - Offers tools like Level 2 pricing, in-depth charting, and complex order types. - Suitable for advanced traders who need access to deep liquidity and advanced trading tools. - Downloadable desktop platform for more focused trading. | ||

| ProRealTime | - Free for the first month; after that, a subscription fee of £30/month applies unless certain trading criteria (such as CFD trades) are met. - Ideal for technical traders who require extensive charting and analysis tools. | ||

| MetaTrader 4 | - Offers advanced charting, technical analysis tools, and a large user base. - Free to download and available for Windows, Mac, and mobile devices. - Suitable for traders looking for an established, highly customisable forex platform. |

| Platform | Details |

| IG Web Platform | -Highly customisable with the ability to set alerts and notifications. -Ideal for traders of all experience levels who want a comprehensive, yet easy-to-use platform without the need to download any software. |

| IG Trading App | - Available for both Android and iOS, one of the best investment apps allowing full account management and trading capabilities. - Designed for traders who want to trade from anywhere and need the flexibility of a mobile device. |

| L2 Dealer | - Offers tools like Level 2 pricing, in-depth charting, and complex order types. - Suitable for advanced traders who need access to deep liquidity and advanced trading tools. - Downloadable desktop platform for more focused trading. |

| ProRealTime | - Free for the first month; after that, a subscription fee of £30/month applies unless certain trading criteria (such as CFD trades) are met. - Ideal for technical traders who require extensive charting and analysis tools. |

| MetaTrader 4 | - Offers advanced charting, technical analysis tools, and a large user base. - Free to download and available for Windows, Mac, and mobile devices. - Suitable for traders looking for an established, highly customisable forex platform. |

| Platform | Details | ||

| Trader Workstation (TWS) | - Includes features like algorithmic trading, advanced charting, risk management, and custom order types. - Designed for active, institutional, or professional traders who need sophisticated trading capabilities. | ||

| IBKR Desktop | - Offers multi-asset trading capabilities with access to equities, options, futures, forex, and more. - Great for traders who want robust and flexible tools while ensuring a balance between user experience and performance. | ||

| Client Portal | - Provides access to essential tools like research, account management, and trade execution for all levels of traders. - No download required, and it’s ideal for those who want an easy-to-use, straightforward experience. | ||

| IBKR Mobile | - Offers advanced order types, account management, and real-time alerts. - Available on both Android and iOS, making it ideal for traders on the go. | ||

| IBKR GlobalTrader | - Ideal for beginner to intermediate traders who want to trade on their mobile devices with a user-friendly interface. - Available on Android and iOS, offering a streamlined trading experience. | ||

| IBKR APIs | - Offers extensive documentation to build custom solutions. - Ideal for quantitative traders or anyone interested in automating their trades. | ||

| IBKR ForecastTrader | - Provides tools to help traders make decisions based on macroeconomic trends. - Ideal for traders who prefer to base their strategy on event-driven or macroeconomic factors. | ||

| IMPACT (Socially Responsible Investing) | - Available for beginner to intermediate investors looking to invest based on sustainability. - Available on Android and iOS for easy access to responsible investment opportunities. |

| Platform | Details |

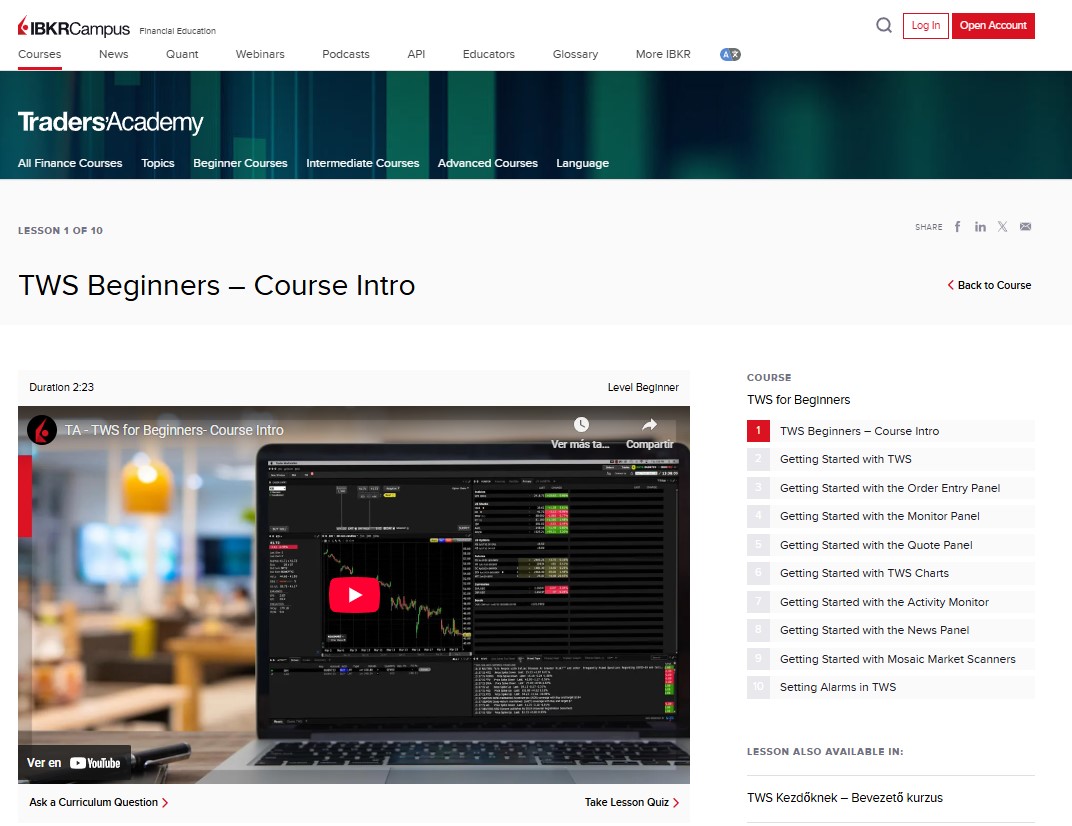

| Trader Workstation (TWS) | - Includes features like algorithmic trading, advanced charting, risk management, and custom order types. - Designed for active, institutional, or professional traders who need sophisticated trading capabilities. |

| IBKR Desktop | - Offers multi-asset trading capabilities with access to equities, options, futures, forex, and more. - Great for traders who want robust and flexible tools while ensuring a balance between user experience and performance. |

| Client Portal | - Provides access to essential tools like research, account management, and trade execution for all levels of traders. - No download required, and it’s ideal for those who want an easy-to-use, straightforward experience. |

| IBKR Mobile | - Offers advanced order types, account management, and real-time alerts. - Available on both Android and iOS, making it ideal for traders on the go. |

| IBKR GlobalTrader | - Ideal for beginner to intermediate traders who want to trade on their mobile devices with a user-friendly interface. - Available on Android and iOS, offering a streamlined trading experience. |

| IBKR APIs | - Offers extensive documentation to build custom solutions. - Ideal for quantitative traders or anyone interested in automating their trades. |

| IBKR ForecastTrader | - Provides tools to help traders make decisions based on macroeconomic trends. - Ideal for traders who prefer to base their strategy on event-driven or macroeconomic factors. |

| IMPACT (Socially Responsible Investing) | - Available for beginner to intermediate investors looking to invest based on sustainability. - Available on Android and iOS for easy access to responsible investment opportunities. |

Education and Research

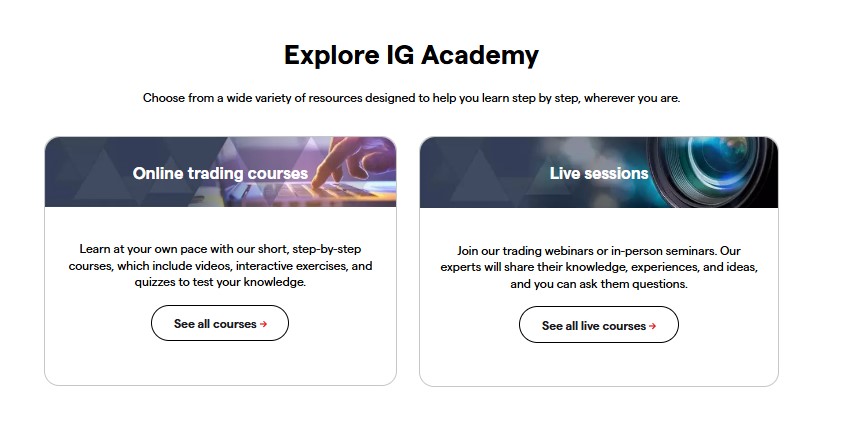

IG Group provides a comprehensive suite of educational resources tailored for traders of all experience levels. Through IG Academy, users gain access to free online courses, interactive lessons, webinars, and live sessions covering everything from trading basics to advanced strategies.

Additionally, IG offers in-depth market analysis, news updates, and expert insights to help clients make informed decisions.

Interactive Brokers is well-regarded for its robust research tools and educational content. Its Trader’s Academy features structured, self-paced courses on trading, investing, and platform navigation. Clients also benefit from access to third-party research providers, real-time news feeds, and customisable analytics tools.

IBKR’s research suite is ideal for active and professional traders seeking data-driven strategies and deep market insights.

Customer Service

IG Group offers comprehensive customer support tailored for UK clients:

Phone Support

- General Inquiries: Call 0207 663 0323.

- New Account Opening: Reach out at 0800 195 3100 (available Monday to Friday, 9 am to 5 pm UK time).

Live Chat

- Available 24/5, from 8 am Saturday to 10 pm Friday.

- Access via the IG Help & Support page.

Email Support

- General Queries: Send to [email protected].

- New Account Inquiries: Email [email protected].

WhatsApp Support

- For non-urgent queries, contact via WhatsApp by scanning the QR code on the IG Contact Us page.

IBKR provides a range of support channels for its UK clients:

Phone Support

- Contact the IBKR Help Desk via the IBKR Contact Page.

Live Chat

- Available for existing clients through the "Support" menu in the Client Portal.

- Prospective clients can use the "I have a general inquiry" option.

- Chat hours: Sunday 8:00 pm – Friday 8:00 pm US Eastern Time.

Email Support

- For non-urgent inquiries, use the IBKR Message Center within the Client Portal.

- Note: Security-related issues (e.g., password or account access problems) should be addressed via phone for verification purposes.

FAQs

What is the history of IG vs Interactive Brokers?

IG is a UK-based Forex broker founded in 1974. Originally known as IG Index, it helped retail traders access the gold market. Over time, it expanded globally and now has offices in 17 countries and over 313,000 clients. IG is part of IG Group Holdings, listed on the London Stock Exchange, with trading occurring during London Stock Exchange hours (8:00 AM to 4:30 PM GMT), and included in the FTSE 250.

Interactive Brokers was founded in 1977 and is headquartered in Greenwich, Connecticut. It's the largest broker in the U.S., executing over 2 million trades daily. With offices in multiple countries and over 2,400 employees, it’s listed on Nasdaq (IBKR). Known for advanced technology, low costs, and a broad product range, it has been rated Best Online Broker by Barron’s for four years running.

Can you trade cryptocurrency with IG or Interactive Brokers?

IG allows cryptocurrency trading via CFDs only (e.g. Bitcoin, Ethereum, Litecoin), meaning you speculate on price movements without owning the actual crypto. This is available for professional clients only, due to UK FCA restrictions on crypto CFDs for retail traders.

Interactive Brokers UK offers direct crypto trading (e.g. Bitcoin, Ethereum, Litecoin, Bitcoin Cash), including spot crypto, through regulated partners like Paxos. This means eligible UK clients can buy and sell actual crypto assets—not just derivatives.

Which platform is better for ISA investors?

IG is ideal for beginners or long-term investors seeking simplicity, commission-free UK trades, and smart portfolio options.

Interactive Brokers UK offers lower global trading fees, tighter FX rates, and more powerful tools—better suited to active or internationally focused investors.

Which is better for advanced traders?

Interactive Brokers is widely regarded as better for advanced traders due to:

- Direct market access (DMA),

- Professional-grade tools (like Trader Workstation),

- Support for options, futures, bonds, and multi-currency accounts.

IG offers good functionality and DMA too, but is more beginner-friendly overall.