Reviews

Lightyear Investing Review

Lightyear is a modern, low-cost investing platform that has rapidly emerged in the UK and Europe to challenge traditional brokers.

The platform allows individuals (and now businesses) to invest in thousands of stocks and ETFs globally, earning interest on cash and avoiding the typical hassles of currency conversion and high commissions.

Next, we’ll provide you with an in-depth Lightyear UK review and everything you should know about this investment platform.

Pros and Cons

| Pros of Lightyear | Cons of Lightyear | ||

| ✅Transparent, ultra-low fee structure and user-friendly experience | ❌Not for active day traders | ||

| ✅ISA accounts and interest-bearing Vaults (idle-cash grow) | ❌No advanced instruments | ||

| ✅Best for everyday investors looking to grow their wealth in a simple way | |||

| ✅Smooth trading platform and excellent mobile apps | |||

| ✅Fractional shares and global market access |

| Pros of Lightyear | Cons of Lightyear |

| ✅Transparent, ultra-low fee structure and user-friendly experience | ❌Not for active day traders |

| ✅ISA accounts and interest-bearing Vaults (idle-cash grow) | ❌No advanced instruments |

| ✅Best for everyday investors looking to grow their wealth in a simple way | |

| ✅Smooth trading platform and excellent mobile apps | |

| ✅Fractional shares and global market access |

Main Features

- Regulation: Regulated by the FCA

- Investor protection: Up to £85,000 by the FSCS

- Financial assets: Over 3,500-4,000 tradeable instruments (fractional shares included), excluding crypto, CFD, and derivatives

- Markets: UK, US, Europe, and money market funds, plus some Asia/Australia stocks via ADRs

- Account types: General Investment Account for standard investing, Stocks and shares ISA, cash ISA, and Business account

- Fees: No account or custody fees

- Stock trading: US stocks incur 0.1% per trade (capped at $1)

- UK stocks £1/trade

- EU stocks €1/trade

- ETF trading fees: £0 (no commission or custody fee on ETFs)

- FX conversion: 0.35% fee on currency conversions (only charged when converting currencies to invest)

- No deposit or withdrawal fees via bank transfer

- Minimum deposit: £0

- Platform: Web trading platform and iOS and Android mobile apps

- Contact:

- Address: London, UK (256–260 Old Street, London EC1V 9DD)

- Email: [email protected]

- No phone or live chat

- Featured product: High-yield cash “Vaults” , an easy-access interest-bearing account within Lightyear. Uninvested GBP balances earn ~4.34% AER (variable) by being swept into money market funds

- Featured promotion: N/A

Safety

When it comes to regulation and safety, Lightyear not only adheres to the rules but exceeds them. Fully authorised and regulated by the UK’s Financial Conduct Authority (FCA) (FRN 987226), it operates under the same strict standards as traditional brokers.

Investor protection is a top priority, with client funds safeguarded under the Financial Services Compensation Scheme (FSCS), meaning if Lightyear ever went under, up to £85,000 of your cash is covered. But insolvency protection is just the backup plan; your money is kept secure in segregated accounts at NatWest and invested in AAA-rated BlackRock money market funds, ensuring it’s never mixed with company funds.

Lightyear uses bank-grade encryption, biometric logins, and two-factor authentication to keep accounts locked down. On top of that, if you’re trading U.S. stocks, your holdings might even be SIPC-protected for added coverage. In short, Lightyear is built for peace of mind, letting you invest with confidence, not questions.

Available Financial Products

Lightyear keeps things simple, global, and cost-effective, giving UK investors access to thousands of stocks and ETFs across the US, UK, and Europe.

For those looking to park cash strategically, Lightyear offers money market funds (MMFs) from BlackRock, letting you earn daily interest on uninvested GBP, USD, or EUR balances. The multi-currency wallet is another standout, allowing users to hold and invest in multiple currencies without getting hit by conversion fees on every trade.

With no crypto, no CFDs, and no leveraged trading, Lightyear keeps it clean and focused on long-term investing. Whether you’re buying fractional shares for £1 or building a diversified ETF portfolio, it’s built for smart, hassle-free investing.

Account Types and Fees

Essentially, for retail investors, there is only one type of account, known as GIA. The General Investment Account is a standard taxable brokerage account:

- No account opening fee, no platform fee, no inactivity fee

- Trading fees apply per trade: £1 per UK stock trade, €1 per EU stock trade, 0.1% (max $1) per US stock trade

- All ETFs are £0 commission to trade.

- FX conversion fee of 0.35% applies if you convert currencies (e.g. to buy US stocks with GBP).

- No minimum balance; you can fund any amount (even £1).

Lightyear ISA launch

Lightyear UK has recently launched stock and shares ISAs:

- No management fee (£0 annual fee and no custody fees)

- Trading fees inside the ISA are the same low rates as the GIA

- Flexible ISA, meaning you can withdraw and replace funds in the same tax year without losing allowance

- Annual contribution limit is £20k as per HMRC.

Apart from the Lightyear stocks and shares ISAs, which is quickly becoming one of the best stocks and shares ISAs on the market, the company also has cash ISAs:

- Pays interest at a competitive variable rate (tracks Bank of England base rate). Currently ~4.25% AER (as of July 2025) is paid on GBP balances

- No account fee, no withdrawal penalties (it’s an easy-access, flexible ISA)

- Essentially lets you use Lightyear as a high-yield savings account with FSCS protection, tax-free.

- Interest accrues daily and is paid monthly.

Trading Platforms

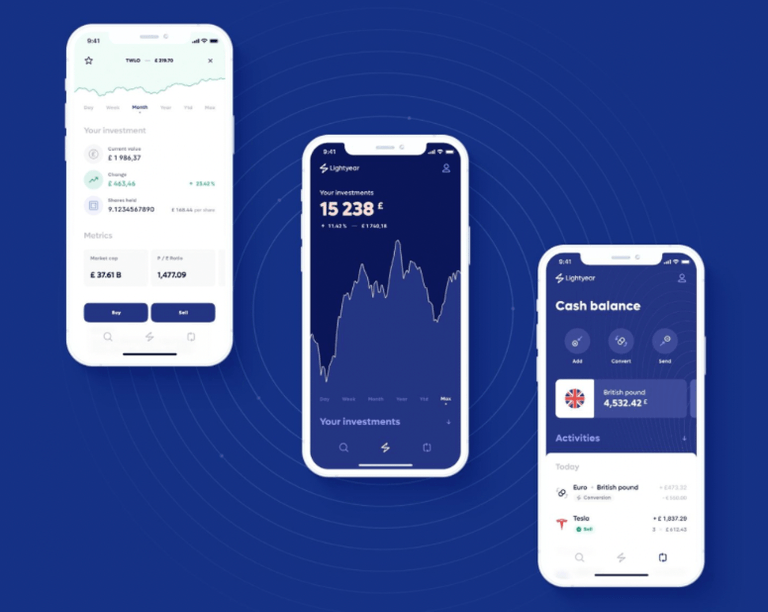

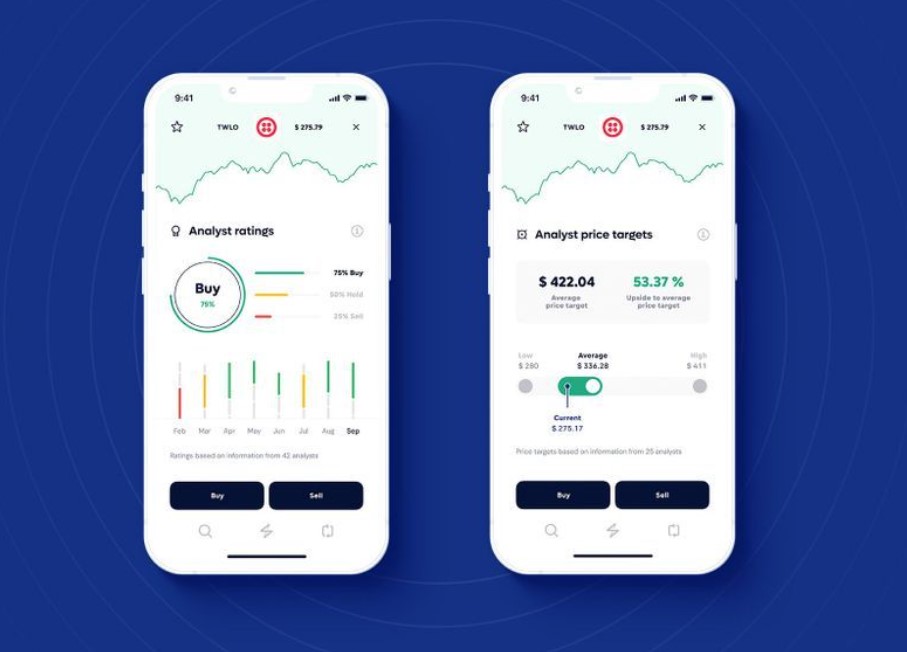

Lightyear is built as a mobile-first platform, with highly-rated apps on both Apple App Store with 4.7 stars and Google Play rating it with 4 stars. Both provide a substantial number of reviews as well, making the result reliable.

The app’s interface is clean and beginner-friendly. Users report that it’s easy to navigate and execute trades within seconds.

Key features on mobile include real-time pricing, price alerts, interactive charts, stock search with filters, watchlists, and in-app news. It supports limit orders and basic repeat orders, but not advanced conditional orders beyond that.

In 2023, Lightyear launched a full-featured web trading platform, allowing access via desktop browser. The web app mirrors most mobile functionality: you can register, fund your account, and trade without needing the phone app.

The web interface has been expanded with advanced tools – e.g. stock screeners and comparison tools. The web platform also introduced downloadable account statements and tax reports for convenience.

👉 Read here for more information on the best investment apps

Research and Education

Lightyear provides educational content and a fairly intuitive interface for beginners. New users are encouraged to explore the app’s features (like interactive tutorials or tooltips within the app).

How does Lightyear compare to its competitors?

Below is a comparison of Lightyear and its main competitors, highlighting the key features that differentiate them. This comparison includes a DEGIRO review and a Hargreaves Lansdown review, both of which provide valuable insights into how these platforms stack up against Lightyear. By considering their regulations, account types, fees, and additional services, you'll get a clearer picture of which platform suits your investment needs best. Whether you're looking for a flexible ISA or a platform with low-cost trading, this breakdown will help you make an informed decision and choose from the best stock brokers UK available.

| Feature | Lightyear | DEGIRO | Freetrade | eToro | Hargreaves Lansdown | ||||||

| Regulation | FCA (UK), BaFin (Germany) | FCA (UK), AFM (Netherlands) | FCA (UK) | FCA (UK), CySEC (EU) | FCA (UK) | ||||||

| Account Types | Individual accounts | Basic, Active, Trader, Day Trader | General investment accounts | Individual, Joint, ISA | Investment and ISAs | ||||||

| Markets | UK, EU, US Stocks, ETFs | 30+ global markets | UK, US, European Stocks & ETFs | 2,000+ global markets | UK & International | ||||||

| Minimum Deposit | £0 | €0.10 | £0 | £0 | £1,000 | ||||||

| Fees | Commission-free trading | Low commissions | Free for UK stocks | Spread-based fees | Higher transaction fees |

| Feature | Lightyear | DEGIRO | Freetrade | eToro | Hargreaves Lansdown | ||||||

| Regulation | FCA (UK), BaFin (Germany) | FCA (UK), AFM (Netherlands) | FCA (UK) | FCA (UK), CySEC (EU) | FCA (UK) | ||||||

| Account Types | Individual accounts | Basic, Active, Trader, Day Trader | General investment accounts | Individual, Joint, ISA | Investment and ISAs | ||||||

| Markets | UK, EU, US Stocks, ETFs | 30+ global markets | UK, US, European Stocks & ETFs | 2,000+ global markets | UK & International | ||||||

| Minimum Deposit | £0 | €0.10 | £0 | £0 | £1,000 | ||||||

| Fees | Commission-free trading | Low commissions | Free for UK stocks | Spread-based fees | Higher transaction fees |

Bottom Line

Lightyear’s ideal user is a “modern investor” who wants to invest in stocks and ETFs for growth or savings goals, without excessive cost or complexity.

This could be a complete novice starting an investment journey, or an experienced investor who is tired of high fees and clunky interfaces at traditional brokers. Even seasoned investors who already use platforms like Hargreaves Lansdown or Interactive Brokers might use Lightyear for a portion of their portfolio, such as holding an ISA on Lightyear to take advantage of free account fees, or using it for its multi-currency cash park earning 4%+ interest.

However, truly expert traders (day traders, technical analysts) will probably supplement Lightyear with other platforms that offer the advanced functionality they need.

👉 Read more on what is technical analysis here

In a nutshell, Lightyear is best for beginner to intermediate investors and cost-conscious investors of any level. It’s arguably not the best sole platform for an advanced trader who needs a full suite of trading instruments and analytics.

FAQs

What is Lightyear?

Lightyear is a fresh take on investing, built to cut through the nonsense of hidden fees and outdated brokerage models. Founded in 2020 by ex-Wise execs Martin Sokk and Mihkel Aamer, Lightyear was born out of sheer frustration with how expensive and complicated investing had become. Determined to change that, they launched the platform in the UK in 2021, offering a cleaner, more transparent way to trade.

Backed by big-name investors like Virgin Group and Wise’s co-founder Taavet Hinrikus, Lightyear didn’t waste any time scaling up. By 2022, it had secured $25 million in funding and expanded across 22 European countries, growing its user base past 240,000.

Lightyear keeps adding game-changing features: multi-currency accounts that sidestep pricey FX fees, business investment accounts for entrepreneurs, and now, Stocks & Shares ISAs to keep UK investors’ gains tax-free.

Does Lightyear offer a demo account?

Lightyear does not offer a demo or paper trading account for users. Because you can deposit as little as £1 and buy fractional shares from £1, new investors can test the waters with very small amounts of real money.

Is Lightyear for beginners or experts?

Lightyear is particularly friendly for novice investors. The app has educational prompts (for example, reminders that “your capital is at risk” and tips like not investing money you can’t afford to lose). They also have an introductory guide in their FAQs about things to consider before investing (emergency funds, diversification, etc.)

Does Lightyear offer ISAs and how do their Stocks & Shares ISA work?

Yes, Lightyear now offers both a Stocks & Shares ISA and a Cash ISA for UK customers. The Stocks & Shares ISA allows you to invest in stocks and ETFs tax-free (up to the £20,000 annual ISA allowance) and any capital gains or dividends are sheltered from tax. Lightyear’s ISA is particularly attractive because it has no account fee or ISA fee at all.

How do you open a Lightyear account?

Below you can see how to open a Lightyear account in 5 steps:

- Download the mobile app or visit the website

- Provide your personal details, such as email, phone number, and create a password.

- Choose account type (personal/GIA, business account or ISA)

- Verify identity (KYC).

- Fund your account and start investing.

What is Lightyear's customer service like?

Lightyear’s customer support is currently available via email only (support @lightyear.com). There is no live chat or phone support line, which is a notable limitation. Users must send an email or use the in-app help form, and then await a response. Support is not 24/7. It operates during business hours on UK weekdays.