Reviews

Lloyds Bank Review

Lloyds Bank is a name most Brits know, whether it’s your first current account or the place you set up your mortgage. But now, it's not just about saving, it’s about growing.

With more everyday investors looking for safe, no-fuss ways to enter the market, Lloyds Bank Investing is stepping into the spotlight. The big question: Is it actually worth your money and your trust in 2025?

Let’s see whether investing with Lloyds Bank fits your goals, or if you’re better off elsewhere.

Pros and Cons

| Pros of Lloyds Bank | Cons of Lloyds Bank | ||

| ✅ A brand you already trust with your money. | ❌ £11 per trade isn’t the cheapest around. | ||

| ✅ Clean, beginner-friendly interface. | ❌ Research tools are on the light side. | ||

| ✅ Fund investing for just £1.50 a pop. | ❌ Not ideal for active traders or stock market enthusiasts. | ||

| ✅ ISA and pension options, all under one roof. |

| Pros of Lloyds Bank | Cons of Lloyds Bank |

| ✅ A brand you already trust with your money. | ❌ £11 per trade isn’t the cheapest around. |

| ✅ Clean, beginner-friendly interface. | ❌ Research tools are on the light side. |

| ✅ Fund investing for just £1.50 a pop. | ❌ Not ideal for active traders or stock market enthusiasts. |

| ✅ ISA and pension options, all under one roof. |

Account types and assets

Lloyds Bank Investing could be an entry point into the stock market without needing to be a whizz. It’s part of the same Lloyds Bank you already know, but built to help you grow wealth, not just store it.

You’ve got three main routes, such as a Share Dealing Account, a Stocks and Shares ISA, or a SIPP (Self-Invested Personal Pension). Whether you want to put your ISA allowance to work or build a long-term pension pot, Lloyds has a plan for you.

The investment options themselves are pretty straightforward: UK and international shares, ETFs, ready-made funds, and investment trusts. It’s not a wild crypto broker or a forex trader’s dream. This is for people who want simplicity, trust, and control over their future.

And if you already bank with Lloyds, everything syncs into your regular dashboard. You can have one login and one platform to manage everything with maximum convenience.

Fees and charges

Here’s what you’ll be working with:

- £1.50 for funds, which is great if you’re investing monthly.

- FX charges of 1% (otherwise commission-free international trading)

- UK stocks are charged at £11 per trade (or £8 if you make more than eight transactions per quarter)

- £20 account admin charge every six months (due in October and April)

- SIPP charge of 0.25%

So, if you’re planning to buy and hold, or invest regularly with an ISA, investing with Lloyds Bank can actually be pretty cost-efficient. But if you’re logging in daily to chase chart patterns, the £11 trade fee might sting a little.

Minimum Deposit and Withdrawals

Minimum Deposit:

Share Dealing Account: There is no minimum deposit requirement to open a Share Dealing Account.

Regular Investment Plan: You can start investing with as little as £25 per month.

Fixed Term Deposits: A minimum deposit of £10,000 is required to open a Fixed Term Deposit account.

Withdrawals:

Share Dealing Account: There are no specific withdrawal fees mentioned for the Share Dealing Account. However, it's important to consider any potential charges related to transferring funds or selling investments.

Regular Investment Plan: Withdrawals from the Regular Investment Plan are subject to the terms and conditions of the specific investments held within the plan. It's advisable to review these terms to understand any potential withdrawal fees.

Fixed Term Deposits: Withdrawals from Fixed Term Deposits are generally not permitted until the end of the term. Early withdrawal may result in penalties or loss of interest.

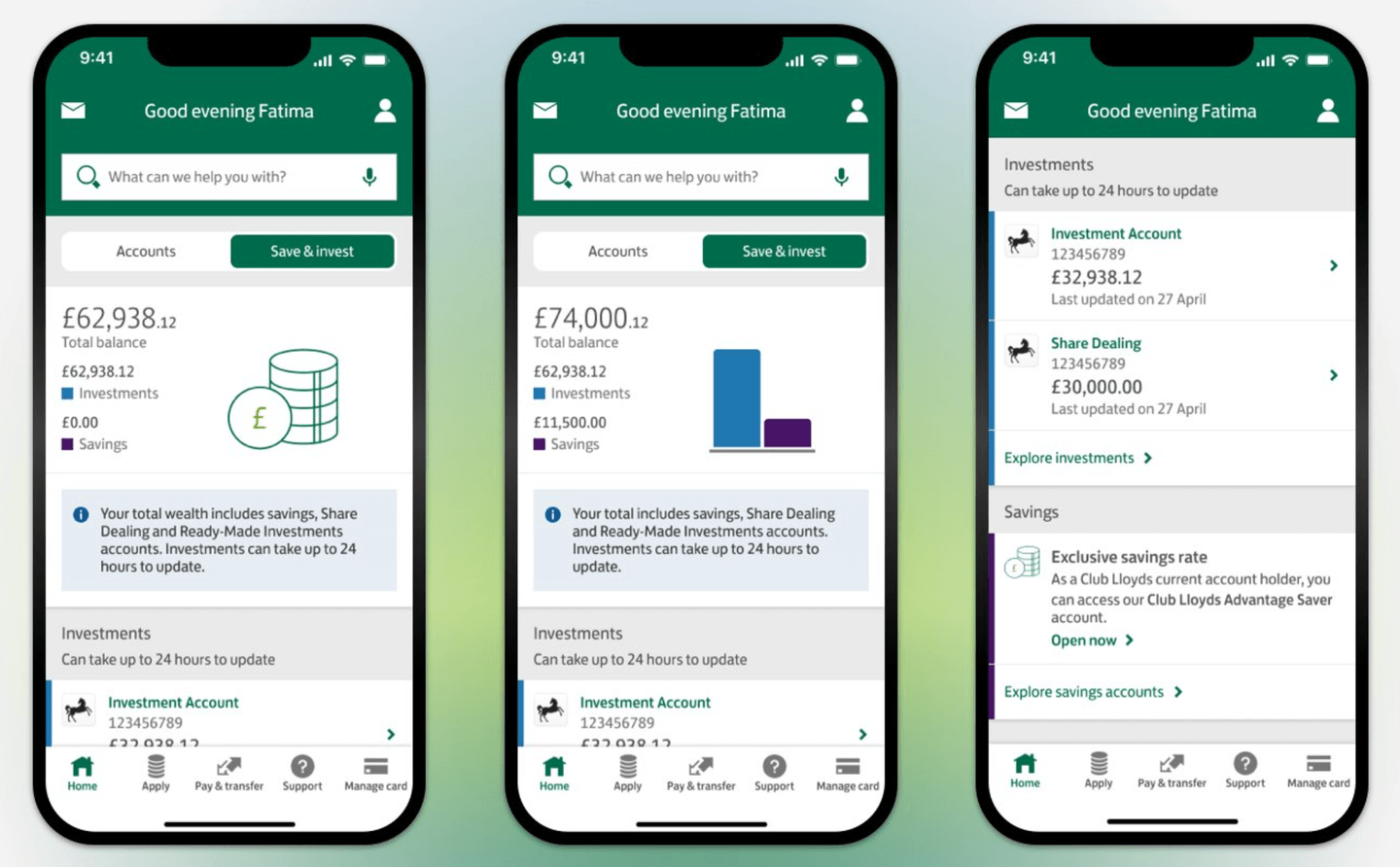

Mobile App

This is where Lloyds plays to its strengths. The whole experience feels familiar because it is. The investing side is baked right into the same app or website you already use to check your balance or pay the gas bill.

Opening an account is easy. Placing a trade is even easier, with no clunky interfaces, no pop-ups demanding to install third-party plug-ins. Just log in and invest.

That said, if you’re expecting advanced charting tools, Level 2 data, or an AI bot whispering hot stock tips in your ear, you’ll be left wanting. Lloyds Bank Investing is about simplicity, not thrills. And for many first-time or hands-off investors, that’s exactly what they’re looking for.

Customer service

Support is available through the same channels you’d use for everyday banking:

- Phone support: 0345 606 0560

- Secure in-app messaging

- Help and support centre with investing FAQs and guides

You’re not getting 24/7 trading desks or real-time live chat, but reviews tend to be positive for basic account help and setup queries. And for existing customers, there's comfort in the fact that you're dealing with a well-established brand rather than a faceless fintech.

Who should consider investing with Lloyds Bank?

Lloyds Bank Investing isn’t trying to compete with crypto apps or high-frequency trading platforms; instead, it’s aiming right at:

- Existing Lloyds customers looking to dip into investing.

- First-time investors who want to keep things simple.

- ISA savers who want tax-free growth without the learning curve.

If that sounds like you, this platform might be an ideal match. You’re not overwhelmed with bells and whistles; you’re offered a clear path to start growing your money in a familiar setting.

But if you’re craving more control, cheaper trading, or more adventurous investment options, you might want to look at a few competitors.

Final verdict

Nowadays, there are many platforms with zero-commission trades, app-first experiences, and a buffet of global stocks and crypto tokens.

But here’s what they don’t have: the reassurance of a high street bank, integrated banking and investing, and the feeling that everything is in one place.

So, while they’re ideal for more hands-on traders or tech-savvy users, investing with Lloyds Bank might feel like the smoother choice if you just want to get started, stay consistent, and not worry about anything too complex.

If you already bank with Lloyds, like the idea of low-effort ISA investing, and prefer simplicity over endless options, Lloyds Bank Investing makes a whole lot of sense. It’s not built for fast-paced trading or exotic markets, but that’s not the brief.

It’s built for people who want to grow their money without jumping through hoops or downloading another app. And in that department, it absolutely delivers.

In a nutshell, while Lloyds Bank Investing may not deliver what many neo-brokers do, it’s a solid choice for anyone into passive investing or a trustworthy platform to handle their savings, SIPP, ISA, or start with their first ready-made portfolios.

FAQs

Is Lloyds Bank good for beginners?

Yes, especially if you’re already a Lloyds customer. It’s intuitive, safe, and easy to start.

What can I invest in with Lloyds Bank?

You can buy UK and global shares, ETFs, investment funds, and trusts. Plus, Stocks and Shares ISAs and pensions are available.

Are there any hidden fees?

There are no sneaky charges, but do keep an eye on that £11 per trade cost if you plan to invest frequently.

Can I open a Stocks and Shares ISA with Lloyds Bank?

Absolutely, and it’s one of the platform’s strongest features for long-term savers. Lloyds is often considered by investors looking for the best stocks and shares ISA thanks to its straightforward platform, range of investment options, and trusted brand.

How do I start investing with Lloyds Bank?

Just log into your online banking, hit “Investments,” choose your account type, and follow the instructions to open your new account.