Brokers

Moneybox Review UK

Managing finances through innovative apps has become increasingly popular in today's digital age and among these, Moneybox, is a remarkable option for those looking to save and invest effortlessly in the UK. In this review, we will explain in depth what Moneybox is, its regulations, the products that it offers, the main conditions, and all the relevant factors to help you see if Moneybox is good for you. .

Moneybox is a UK-based financial technology company founded in 2016 by entrepreneurs Ben Stanway and Charlie Mortimer. The company provides a mobile app designed to help users save and invest their money. Since its launch, Moneybox has aimed to make financial management accessible to everyone, regardless of their financial situation. The app offers a variety of savings and investment products, and it's tailored to be user-friendly. Moneybox has grown significantly since it launched its services, reaching 1 million users.

Their offer is mostly focused on long-term savings such as ISAs, Pension, Mortgage calculations or Round-ups with a special focus on UK residents to maximise their earnings and tax benefits.

Pros and Cons

| Pros of Moneybox | Cons of Moneybox | ||

| ✅User-friendly: Easy to navigate and set up savings. | ❌Fees: Monthly charges can affect returns, especially for small balances. | ||

| ✅Round-ups: Automatically saves small amounts from purchases. | ❌Limited investment options: No individual stocks, just ETFs and index funds. | ||

| ✅Tax-efficient accounts: Includes ISAs, SIPPs, and GIAs. | ❌No educational content: Lacks detailed resources for beginners. | ||

| ✅Regular savings: Set up recurring contributions. | ❌Investment risk: Value can fluctuate with the market. |

| Pros of Moneybox | Cons of Moneybox |

| ✅User-friendly: Easy to navigate and set up savings. | ❌Fees: Monthly charges can affect returns, especially for small balances. |

| ✅Round-ups: Automatically saves small amounts from purchases. | ❌Limited investment options: No individual stocks, just ETFs and index funds. |

| ✅Tax-efficient accounts: Includes ISAs, SIPPs, and GIAs. | ❌No educational content: Lacks detailed resources for beginners. |

| ✅Regular savings: Set up recurring contributions. | ❌Investment risk: Value can fluctuate with the market. |

Is Moneybox safe?

Moneybox, as an FCA-regulated company in the UK, is registered with the Financial Services Compensation Scheme (FSCS), which provides coverage per individual up to £85,000 (not per account in case you have more) for (only) the investment products in case of any shortfall or event of firm insolvency. Furthermore, Moneybox uses the UK broker Winterflood Securities to hold the investment as a custodian, which is also covered by the FSCS in the same amount.

Please note that Moneybox has segregated accounts and different entities away from the company, so these are safe in the worst-case scenario. It's not part of the company's balance sheet, meaning the debtors cannot access it.

In the case of the Cash ISA, Moneybox uses several banks, such as HSBC, Santander, Lloyds, or Bank of Scotland, among others, to hold the cash. As a protective measure, they cannot hold more than 50% of the total funds in a single bank at any given moment.

Given all these protective measures, we can definitely say that this company is safe to use. However, depending on the services, we highly recommend checking the parties that provide the services, as this might change and become more complex.

Accounts and Available Investment Products

Moneybox offers a wide range of long-term savings products with tax efficiency granted by investment savings accounts (ISAs), pension plans, savings accounts, and round-ups. Let's dig further into them:

Stocks and Shares ISA

This type of Investment Savings Account (ISA) offered by Moneybox allows you to invest in the stock market. It offers an annual allowance of £20,000. As with any other ISA, all the profits generated within those £20,000 invested are tax-free.

Under this account, you can invest in individual US stocks, exchange-traded funds (ETFs) or investment funds offered by different providers such as iShares or Fidelity.

Finally, all your non-invested cash will have an interest of 3.25% AER (variable) within the same account. Furthermore, thanks to their round-ups and automated investment plans, it allows you to deposit and invest periodically.

Applicable fees and conditions:

- Monthly Subscription fee: £1 (free for the first 3 months)

- Moneybox Platform fee: 0.45% annually - This is 0.45% of the value of your investments per year. This fee is calculated based on the amount at the end of the day but is charged monthly.

- Currency conversion fees: 0.45%

- Transaction fees: £0 (no fees)

- Deposit/Withdrawal: N/A

- Minimum amount: £1

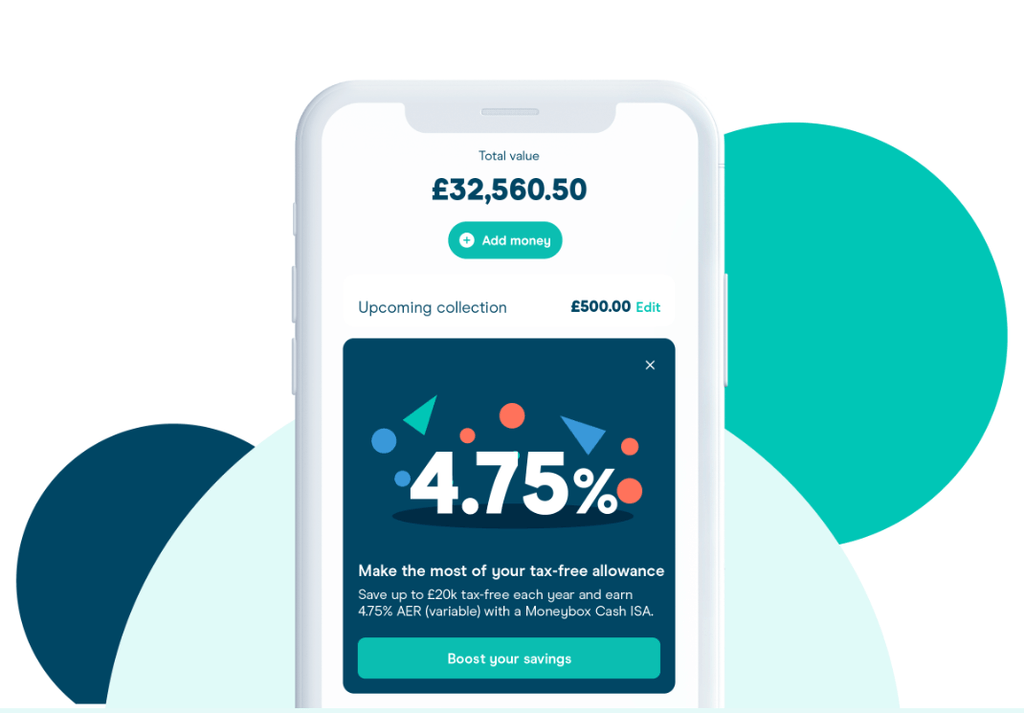

Cash ISA

Within the same ISA setup as the previous one, Moneybox offers a Cash ISA account to generate interest on your allowance. As with any other ISA, all the interest generated within the first £20,000 added is tax-free.

Applicable fees and conditions:

- Current rate: 4.80% AER (variable*) - Promotion of 0.62% bonus for the first 12 months

- Monthly Subscription Fee: This does not apply to this account.

- Moneybox Platform fee: This does not apply to this account.

- Deposit/Withdrawal fees: Open with £500, with up to 3 withdrawals every 12 months without impacting your rate.

*Variable: this fee is updated as of 29th July 2025. Rates can change.

Junior ISA (JISA)

A Junior ISA (JISA) allows you to invest in your child's future with tax exemptions. Under these accounts, you can place an annual allowance of up to £9,000. These accounts are only available as long as the child is under 18. Once they reach that age, they can access the money.

With the Moneybox Junior ISA—often ranked among the best Junior ISAs in the UK for ease of use and low minimums— you can invest in individual US stocks, exchange-traded funds (ETFs), or investment funds from various providers, including iShares and Fidelity.

Additionally, any cash in your account that you haven't invested will earn an interest rate of 3.25% AER (variable). The account also supports making regular deposits and investments through features like automated investment plans.

Applicable fees and conditions:

- Monthly Subscription fee: £1 (free for the first 3 months)

- Moneybox Platform fee: 0.45% annually—This is 0.45% of the value of your investments per year. The fee is calculated based on the amount at the end of the day but is charged monthly.

- Currency conversion fees: 0.45%

- Deposit/Withdrawal: N/A

- Minimum amount: £1

Lifetime ISA (LISA)

A Lifetime ISA (LISA) is a type of Individual Savings Account (ISA) created specifically to help individuals save for their first home or their retirement. With a LISA, the UK government contributes with a 25% bonus up to a £1,000 yearly maximum. The maximum allowance to place every year is £4,000.

You can use the Lifetime ISA to buy your first house up to the value of £450,000 anywhere in the UK and the account must be opened for 12 months before you can use it to buy a house.

Moneybox offers 2 types of Lifetime ISA: Cash Lifetime ISA or Stocks & Shares Lifetime ISA

Cash Lifetime ISA

The Cash Lifetime ISA offered by Moneybox allows you to earn interest on your allowance with one of the market-leading interest rates of 4.70% AER (variable) then 3.30%.

Save up to £4,000 and get £1,000 bonus free each year.

Note that withdrawing money from an ISA is typically tax-free, but a 25% government penalty applies if you withdraw funds from a Lifetime ISA for any reason other than buying your first home or for retirement after age 60. This effectively means you could get back less than you originally contributed, so it’s important to plan withdrawals carefully.

Stocks & Shares Lifetime ISA

The Stocks & Shares Lifetime ISA is similar to the Cash LISA, with the difference that your allowance is placed in funds. This has the pros that if you invest in the long run, it can offer higher returns. However, it's important to mention that it carries more risk, as you might lose part of your investment as well.

With this option, you can invest in different strategies depending on your risk profile: Cautious, Balanced, or Adventurous. The composition of your investments in each strategy changes, and it could generate more returns with more risk (Adventurous) or less expected returns with lower risk (Cautious).

Applicable fees and conditions:

- Monthly Subscription fee: £1 (free for the first 3 months)

- Moneybox Platform fee: 0.45% annually—This is 0.45% of the value of your investments per year. The fee is calculated based on the amount at the end of the day but is charged monthly.

- Annual fund provider costs: Like any other investment fund, the product could charge entry/exit fees or management fees, depending on the funds invested.

- Transaction fees: £0 (no fees)

- Minimum amount: £1

Saving Accounts Moneybox

One of the most interesting products available at Moneybox is savings accounts, which range from 2.90% AER to 4.34% AER, depending on the notice period.

What does the notice period mean? It means the number of days you must wait between the order to withdraw your savings and the moment you receive it. It could be from 32 to 120 days.

In the following table, we will mention all the offered savings accounts so you can compare them which one suits you better:

| Savings Account Type | Interest applicable (annual) - Variable* | Main conditions | |||

| Simple Saver account | 2.90% AER | You can withdraw whenever you want but limited to once per month. Can boost your interest rate to 3.90% AER by opening a qualifying Moneybox account. | |||

| 32 Day Notice | 4.03% AER | It takes 32 days from the moment you give the order to withdraw your funds. | |||

| 95 Day Notice | 4.34% AER | It takes 95 days from the moment you give the order to withdraw your funds. |

| Savings Account Type | Interest applicable (annual) - Variable* | Main conditions |

| Simple Saver account | 2.90% AER | You can withdraw whenever you want but limited to once per month. Can boost your interest rate to 3.90% AER by opening a qualifying Moneybox account. |

| 32 Day Notice | 4.03% AER | It takes 32 days from the moment you give the order to withdraw your funds. |

| 95 Day Notice | 4.34% AER | It takes 95 days from the moment you give the order to withdraw your funds. |

All the above accounts can be opened with just £1 and are protected by the FSCS up to £85,000.

General Investment Account

The General Investment Account (GIA) with Moneybox allows you to invest without the tax benefits of an ISA. It's a flexible option for those who have already used up their ISA allowance or want to invest more than the ISA limit.

While there are no contribution limits, the returns are subject to Capital Gains Tax (CGT) once you exceed the annual allowance. Although the GIA provides a simple way to invest in diversified portfolios, it is important to consider the tax implications before using it as your primary investment account.

Moneybox's General Investment Account offers flexibility for investors who have exceeded their ISA allowance or wish to invest beyond its limits. Key features include:

- Contribution Limit: Invest up to £85,000 per week

- Starting Investment: Begin with a minimum of £1

- Taxation: Gains above £3,000 are subject to Capital Gains Tax, depending on individual circumstances

Additionally, the GIA provides access to a diverse range of tracker funds, including global and emerging market shares, technology, property, and healthcare sectors.

Pension

Moneybox also offers a Personal Pension plan designed to help individuals save for retirement with ease and flexibility. Through the Moneybox app, users can open a Self-Invested Personal Pension (SIPP), allowing them to consolidate existing pensions and manage their retirement savings efficiently, with a wide range of the best retirement investments.

Additionally, Moneybox offers socially responsible and Shariah-compliant funds, catering to diverse investment preferences, including those seeking halal trading brokers for ethical investing. By contributing to a Moneybox Pension, users can benefit from government tax relief on contributions, enhancing their retirement savings.

Moneybox offers a Personal Pension plan with competitive fees and a variety of investment options:

- Account Fees

- Monthly subscription fee: £0

- Annual Moneybox platform fee; balances up to £100,000 - 0.45%, balances over £100,000 - 0.15%

- Annual Fund provider costs: 0.11% - 0.64%

- Fund Provider Fees: These range from 0.14% to 0.63%, depending on the chosen fund. For example:

- Global Shares ESG: 0.20%

- BlackRock LifePath: 0.24 - 0.26%

- Fidelity Global Shares - 0.13%

- HSBC Islamic Global Equity Fund: 0.64%

Additionally, payments made into your pension won't be accessible until the minimum pension age, which is currently 55 and will increase to 57 in 2028.

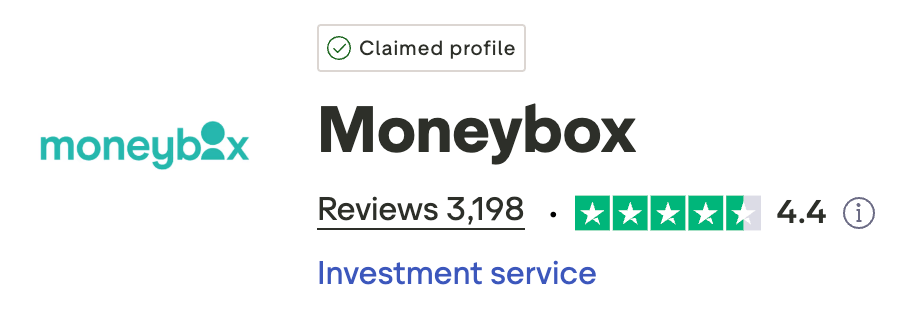

Customer Reviews

When opening an account at any place where we place our money, it's important to check the opinions of current users to understand their experience.

In our case, we looked at the opinions site Trustpilot, and we noticed that Moneybox has very good opinions, with a 4.4 out of 5 and more than 2,500 opinions.

The main positive opinions are regarding their competitive interest rates and great customer service, especially when transferring ISAs from other providers.

Among the worst opinions are the issues with the app for withdrawing the funds, as it takes some days and is sometimes endless.

How does Moneybox compare to other brokers?

| Feature | Moneybox | Freetrade | Hargreaves Lansdown | AJ Bell | |||||

| Account Types | Stocks & Shares ISA, Pensions, General Investment Account | Stocks & Shares ISA, General Investment Account | Stocks & Shares ISA, Pensions, General Investment Account, Investment Trusts | Stocks & Shares ISA, Pensions, General Investment Account, Investment Trusts | |||||

| Minimum Investment | £1 (General Investment Account) | £1 (Stocks & Shares ISA) | £100 (Stocks & Shares ISA) | £50 (Stocks & Shares ISA) | |||||

| Fees | 0.45% - 0.75% annual fee | Free (basic), £9.99/month (Plus) | £11.95 per trade, 0.45% annual fee | £9.95 per trade, 0.25% annual fee | |||||

| Tax Relief on Contributions | Yes (for Pensions) | No | Yes (for Pensions) | Yes (for Pensions) | |||||

| Withdrawal Fees | No fees for withdrawals | No fees for withdrawals | £25 per withdrawal (outside of monthly free withdrawals) | £25 per withdrawal (outside of monthly free withdrawals) |

| Feature | Moneybox | Freetrade | Hargreaves Lansdown | AJ Bell | |||||

| Account Types | Stocks & Shares ISA, Pensions, General Investment Account | Stocks & Shares ISA, General Investment Account | Stocks & Shares ISA, Pensions, General Investment Account, Investment Trusts | Stocks & Shares ISA, Pensions, General Investment Account, Investment Trusts | |||||

| Minimum Investment | £1 (General Investment Account) | £1 (Stocks & Shares ISA) | £100 (Stocks & Shares ISA) | £50 (Stocks & Shares ISA) | |||||

| Fees | 0.45% - 0.75% annual fee | Free (basic), £9.99/month (Plus) | £11.95 per trade, 0.45% annual fee | £9.95 per trade, 0.25% annual fee | |||||

| Tax Relief on Contributions | Yes (for Pensions) | No | Yes (for Pensions) | Yes (for Pensions) | |||||

| Withdrawal Fees | No fees for withdrawals | No fees for withdrawals | £25 per withdrawal (outside of monthly free withdrawals) | £25 per withdrawal (outside of monthly free withdrawals) |

Key Takeaways:

- Moneybox is a user-friendly platform with low entry barriers (starting from £1) and strong options for Shariah-compliant and ethical stocks and shares ISAS.

- Freetrade is a great choice for commission-free trading, but lacks pension options. Regardless, Freetrade is still a highly sought after broker, if you are interested in this broker, read our Freetrade review for more information.

- Hargreaves Lansdown is a more traditional broker offering a broad range of services and a wide selection of investment options, with a fee structure that includes per-trade costs. You can find out more with our Hargreaves Lansdown review.

- AJ Bell offers competitive pricing with lower fees for stocks and shares trading, making it attractive for those looking for low-cost investing and pension options. For more information, read our AJ Bell review.

Our Opinion

Moneybox is a great company for UK residents who want to maximize their investments. They offer a wide range of products under ISA schemes. The product is perfect for those who want to buy a first house with their Lifetime ISA as their main product.

In terms of regulation and protection, we could say that it is safe as it is regulated by the FCA, covered by the FSCS, and uses different entities with segregated assets.

However, we believe that Moneybox is not the best option for non-ISA users as their offer is quite limited, even after offering them investment accounts or savings accounts. There might be better options for these other products if you want to trade in the stock market.

FAQs

What is Moneybox?

Moneybox is a UK-based financial technology company founded in 2016 by entrepreneurs Ben Stanway and Charlie Mortimer. The company provides a mobile app designed to help users save and invest their money. Since its launch, Moneybox has aimed to make financial management accessible to everyone, regardless of their financial situation. The app offers a variety of savings and investment products, and it's tailored to be user-friendly. Moneybox has grown significantly since it launched its services, reaching 1 million users.

Who owns Moneybox?

Moneybox is privately held by equity after different financing rounds. Currently, it has more than 13 equity investors.

How do you withdraw money from Moneybox?

You can request to withdraw money by clicking on Settings and Withdrawals. Note that penalties may apply depending on the product.

Is Moneybox a bank?

No, moneybox is not a bank but a company with an investment services license and payment license by the FCA. Also, it uses different banks to provide services.

How can I contact Moneybox Safe?

You can contact Money Safe via email at [email protected] or by checking their extensive FAQ.

Do they offer a desktop platform?

No, Moneybox is only offered via mobile app.