Reviews

Vanguard Review UK: Go-To Platform for UK Investors in 2025

If you're here, chances are you're either fed up with confusing investment platforms that nickel and dime you, or you're trying to get started without falling into that trap. Either way, Vanguard has probably landed on your radar.

Known for its low fees and no-frills approach, it promises to strip back the complexity of investing. But is it really the right fit for you?

In this Vanguard review, we take a hard look at what it actually delivers for UK investors. From fees and funds to what it's like using the platform day to day, we’ll break it all down, so you can figure out whether it fits your goals, your style, and your wallet.

What is Vanguard?

Vanguard helped shape the entire passive investing movement. Founded in 1975 by John Bogle, Vanguard launched the world’s first index fund and made low-cost investing its core mission.

Today, it manages more than $10 trillion globally and has been operating in the UK since 2009. What makes it different is that Vanguard is owned by its own funds, not outside shareholders. That means no pressure to crank up profits. Instead, fees are kept low and more value goes back to you.

Many Vanguard investment reviews highlight this unique structure as a major reason why it appeals to long-term investors, especially those looking for low-cost ISAs, including the best stocks and shares ISAs, and pensions without hidden extras.

Pros and cons

| Pros of Vanguard | Cons of Vanguard | ||

| ✅Low-cost investment options | ❌Limited to Vanguard's own funds | ||

| ✅User-friendly platform | ❌Minimum monthly fee may impact small investors | ||

| ✅Strong regulatory oversight | ❌No access to individual stocks or third-party funds | ||

| ✅Comprehensive educational resources | |||

| ✅Suitable for long-term, passive investing. |

| Pros of Vanguard | Cons of Vanguard |

| ✅Low-cost investment options | ❌Limited to Vanguard's own funds |

| ✅User-friendly platform | ❌Minimum monthly fee may impact small investors |

| ✅Strong regulatory oversight | ❌No access to individual stocks or third-party funds |

| ✅Comprehensive educational resources | |

| ✅Suitable for long-term, passive investing. |

Main Features

- Regulation: Regulated by the FCA

- Investor protection: Up to £85,000 by the FSCS

- Financial assets: Over 85 funds, including index funds, ETFs, and ready-made portfolios.

- Markets: UK, US, Europe, and global markets (212 in the US and 216 funds outside of the US)

- Account types: Stocks and Shares ISA, Personal Pension, Junior ISA, General Account

- Fees:

- Account fee: £48 a year for under £32,000, 0.15% (max. £375 a year) for over £32,000

- Fund management costs from 0.06% to 0.79%

- Minimum deposit: single payment of at least £500 or regular payment for at least £100 per month.

- Platform: Web trading platform and iOS and Android mobile apps

- Address: 4th Floor, The Walbrook Building, 25 Walbrook, London EC4N 8AF.

- Email: [email protected]

- Phone: 0800 587 0460

- Live chat

Is your money secure?

Vanguard UK is fully regulated by the Financial Conduct Authority (FCA), so it meets strict standards for handling your money. If something were to go wrong, you're covered by the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 of your investments.

For cautious investors, this is a solid safety net, especially if you're moving a large ISA or pension pot over.

What can you invest in?

Vanguard offers a range of investment products, including:

- Index and active funds

- Exchange-Traded Funds (ETFs)

- LifeStrategy Funds (ready-made portfolios with different risk levels)

- ESG funds

- Target Retirement Funds for retirement planning

Account types and fees

Fund fees start at a rock-bottom 0.06%, which is ideal if you’re investing in index trackers for the long haul. Even the priciest funds rarely top 0.8%, which keeps more of your money working for you.

Also, the account fee is 0.15% annually for balances over £32,000; £4/month for balances under £32,000.

This simplicity benefits investors, especially those with larger portfolios. However, for smaller investments, the £4 monthly fee may be relatively higher compared to other platforms.

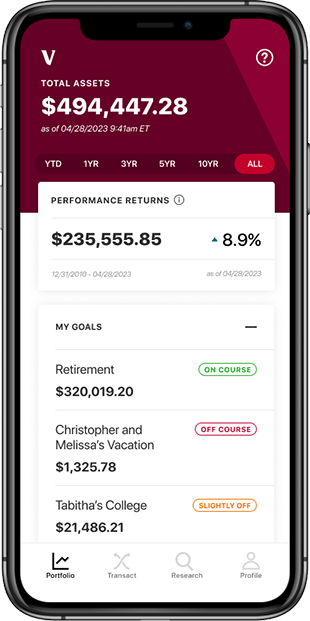

Trading platforms

Vanguard’s app doesn’t try to impress you with flashy charts or social trading tools — and that’s by design. It’s built for clarity, not complexity, making it a solid choice for ISA investors who want to check their balance, top up, and get on with their day.

While many Vanguard ISA reviews highlight its low fees and simplicity, some investors may find the limited access to third-party funds a drawback — especially if they’re looking for the flexibility offered by the best trading platform options on the market.

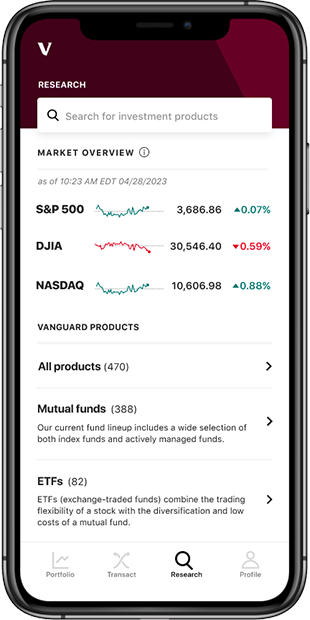

Research and education

Vanguard’s education centre is built for people who want to learn the basics without getting overwhelmed. From asset allocation tools to beginner-friendly articles, the platform makes it easier to invest with confidence, even if you're just starting out.

That said, the focus is clearly on long-term, passive investing. If you're after deep technical research or trading insights, you’ll find it a bit barebones.

Bottom line: Is Vanguard right for you?

If you’re investing for the long haul and want a low-cost ISA or pension you can leave to grow without babysitting it, Vanguard is hard to beat. It’s not built for trading, and you won’t get flashy features or access to third-party funds, but that’s the tradeoff for some of the lowest fees in the UK.

For beginners, this platform cuts through the noise. For seasoned investors with more complex needs, it might be too stripped back.

Either way, it’s earned its reputation—and this is one investment platform that still puts value before volume.

FAQ

Is Vanguard regulated in the UK?

Yes, Vanguard Asset Management, Ltd. is authorised and regulated by the Financial Conduct Authority (FCA). This ensures your money is handled under strict UK investment standards.

Can I transfer my existing ISA or pension to Vanguard?

Yes, you can transfer an existing Stocks and Shares ISA or pension from another provider. Vanguard doesn’t charge any fees for incoming transfers, but check if your current provider does. Many Vanguard ISA reviews mention how smooth the transfer process is.

Is Vanguard good for beginners?

If you're looking for low-cost investing with minimal fuss, Vanguard is one of the best options in the UK, especially for passive, long-term strategies. It’s not designed for trading individual stocks, but for most beginner investors, that's a feature, not a bug.

How does Vanguard compare to other platforms in the UK?

Compared to platforms like Vanguard vs Hargreaves Lansdown or AJ Bell, Vanguard keeps things simpler and cheaper, but also more limited. You only get access to Vanguard’s own funds. If that fits your style, it's a standout. If you want more fund choices or advanced trading tools, others may offer more flexibility.

Opening a Vanguard account: A step-by-step guide

- Visit the Vanguard UK website.

- Select your preferred account type (e.g., ISA, General Account).

- Complete the online application form.

- Verify your identity with the required documents.

- Fund your account with a minimum of £500 or set up a £100 monthly contribution.

The process is user-friendly, designed to accommodate both novice and experienced investors.

What is their customer service like?

Vanguard keeps things mostly online when it comes to customer service, with phone and live chat support available during working hours. The team is known for quick, professional responses, but if you prefer in-person advice or round-the-clock phone lines, this might feel a bit limited.

Vanguard provides customer support via:

- Phone: 0800 587 0460 (Monday to Friday, 9am–5pm)

- Email: [email protected]

- Live Chat: Available through the website

For many UK investors focused on ISAs or pensions, the online-first setup works just fine. But it’s something to weigh if you want more handholding.