Comparatives

Vanguard vs Hargreaves Lansdown: Which is More Valuable?

If you're weighing up Vanguard vs Hargreaves Lansdown, you're not alone. These two platforms sit at opposite ends of the UK investment spectrum: one is low-cost and laser-focused on passive investing, the other is packed with features, funds, and flexibility.

But which one actually delivers the best value for your pension or ISA?

In this in-depth Vanguard vs Hargreaves Lansdown comparison, we’ll break down fees, ISAs, SIPPs, investment range, platform experience, and more, so you can decide which platform fits your investment goals.

What’s the real difference?

At first glance, both platforms help you invest in funds, open a SIPP or an ISA, and manage your money online. But the similarities stop here.

Vanguard is a low-cost platform built for long-term, passive investing. You get access to a limited set of Vanguard-only funds, simple fee structures, and very few distractions.

Read our Vanguard review to learn more.

Hargreaves Lansdown is one of the UK’s biggest full-service investment platforms. It offers access to shares, thousands of funds, detailed research, tools, and customer support, but at a higher cost.

Read our Hargreaves Lansdown review to learn more.

Is your money safe?

Both platforms are authorised and regulated by the Financial Conduct Authority (FCA) and your investments are protected under the Financial Services Compensation Scheme (FSCS), up to £85,000 per person, per institution.

Vanguard is globally established and owned by its own funds, meaning there are no outside shareholders pushing for profit.

Hargreaves Lansdown is a FTSE 100 company with over 1.9 million clients and decades of experience.

Bottom line: both are secure and trustworthy for UK investors.

Stocks and Shares ISA: What’s the difference?

Both platforms offer some of the best Stocks and Shares ISAs, but they serve different types of investors.

Vanguard ISA

- Built for passive investing only; you can’t buy individual shares or third-party funds.

- You’ll pay: £4 per month (£48/year) if your ISA is under £32,000.

- 0.15% annually, capped at £375/year, for larger accounts or if you use the managed ISA.

- Fund fees range from 0.06% to 0.79%, depending on what you invest in.

- 0.20% additional fee if you use the managed ISA service.

- No dealing charges or extras.

Hargreaves Lansdown ISA

- Full access to shares, ETFs, funds, trusts, gilts, bonds, ideal for active portfolios.

- You’ll pay:

- 0.45% platform fee on fund holdings (tiered down above £250k).

- For shares, ETFs, and investment trusts: £3.75/month or 0.45% on £10,000 holdings.

- Share dealing fees between £5.95 and £11.95 per trade, depending on how often you trade.

If you want total control and a wide fund universe, Hargreaves Lansdown’s ISA gives you everything, at a price. If you want to build a long-term portfolio with minimal fuss and low fees, Vanguard’s ISA wins for simplicity and cost.

Vanguard SIPP vs Hargreaves Lansdown: Passive value or full-service?

If you're investing for retirement, both platforms offer a Self-Invested Personal Pension (SIPP), but again, the experience is very different.

Vanguard SIPP

- You can only invest in Vanguard’s own funds—no shares or external ETFs.

- Fees:

- £4/month (£48/year) for SIPPs under £32,000.

- 0.15% annually, capped at £375, for larger accounts or managed SIPPs.

- Fund charges range from 0.06% to 0.79%.

- 0.30% additional fee if you opt for the managed SIPP.

- Direct debit from £100/month, or one-off payments of £500+.

- No dealing fees, no extra layers. Purely passive.

Hargreaves Lansdown SIPP

- Invest in anything: funds, shares, ETFs, gilts

- Research tools, drawdown options, retirement calculators

- Fees:

- Up to 0.45% platform charge (tiered down above £250k).

- Trading fees from £5.95–£11.95, depending on trade volume.

- Intro offer: 40% off platform fees for six months for new SIPP accounts.

- Direct debit from £25/month, or one-off payments of £100+.

Vanguard’s SIPP is ideal for low-cost, long-term investors who just want to drip-feed into funds and watch them grow. Hargreaves Lansdown suits more hands-on investors, especially those who want retirement planning tools and more control as they near drawdown age.

Which one’s cheaper?

This is where the difference between the two becomes crystal clear.

| Fee Type | Vanguard | Hargreaves Lansdown | |||

| Platform/Account Fee | 0.15% annually (capped at £375) | No charges | |||

| Fund Trading | Free | 0.45% for funds (tiered) | |||

| Share Dealing | Not available | £11.95 per UK share deal (tiered to £5.95 for frequent traders) | |||

| SIPP Fee | 0.15% (capped at £375) | Same tiered structure (up to 0.45%) | |||

| Minimum Investment | £500 or £100/month | £25 a month |

| Fee Type | Vanguard | Hargreaves Lansdown |

| Platform/Account Fee | 0.15% annually (capped at £375) | No charges |

| Fund Trading | Free | 0.45% for funds (tiered) |

| Share Dealing | Not available | £11.95 per UK share deal (tiered to £5.95 for frequent traders) |

| SIPP Fee | 0.15% (capped at £375) | Same tiered structure (up to 0.45%) |

| Minimum Investment | £500 or £100/month | £25 a month |

Vanguard is significantly cheaper for fund-based portfolios, especially larger ones. Hargreaves Lansdown becomes expensive if you're holding a sizeable ISA or SIPP and mostly invest in funds.

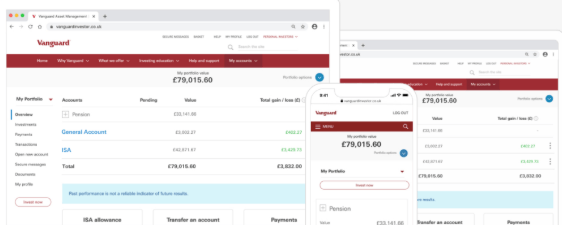

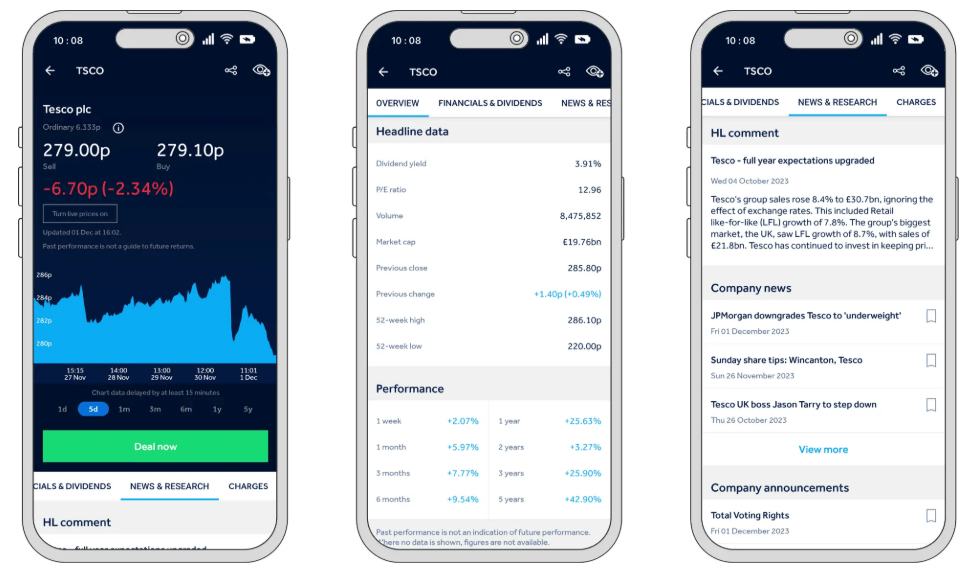

Platform and user experience

Vanguard’s platform is minimal and purpose-built for long-term investing. It’s functional, but barebones, ideal if you’re managing a passive ISA or SIPP and just want to check your balance or make top-ups. The mobile app works, but it’s not built for frequent engagement.

Hargreaves Lansdown, on the other hand, offers a more polished experience. Its platform is loaded with features: watchlists, price alerts, detailed research tools, and slick performance dashboards. The mobile app mirrors the desktop platform almost entirely, making it a better fit for active investors who want to check, trade, and tweak on the go.

If you want simplicity, Vanguard works. If you want a one-stop shop with research, tools, and full visibility, Hargreaves Lansdown delivers.

👉 More information: What are the 9 Best Trading Platforms in the UK?

Support and research

Vanguard offers basic support via phone and secure message, and its help centre covers the essentials. But it doesn’t offer much in terms of research, guidance, or education; it’s assumed you already know what you’re doing.

Hargreaves Lansdown goes all in on content and tools. From model portfolios and fund shortlists to analyst reports, calculators, and how-to guides, it’s designed to support both beginners and experienced investors. If you value hand-holding, research, or just like staying informed, HL has the edge here.

Which one is better for beginners?

If you want to invest without overthinking it, Vanguard is ideal. You can pick a diversified LifeStrategy fund, automate contributions, and let it grow with minimal effort. There are no complex decisions or tools to learn.

Hargreaves Lansdown offers far more control, but also more responsibility. Beginners can benefit from HL’s model portfolios, fund shortlists, and education centre, but it’s easier to over-complicate things or rack up costs if you’re not careful.

For true “set-and-forget” investors, Vanguard wins. For beginners who want to learn and explore as they go, HL might be a better long-term fit.

Final verdict: Which platform delivers more value?

Vanguard is a great fit if you want low fees, zero distractions, and a solid place to grow your ISA or pension over time. It’s not built for trading or portfolio micromanagement, but for many UK investors, that’s the point.

Hargreaves Lansdown offers a completely different experience: full flexibility, loads of research tools, and access to nearly every type of investment on the market. It’s more expensive, but if you want control and support in one place, it could be worth the cost.

FAQs

Which is cheaper—Vanguard or Hargreaves Lansdown?

For fund-based portfolios, Vanguard is significantly cheaper. Hargreaves Lansdown charges higher platform fees, especially for larger portfolios.

Can I open a Stocks and Shares ISA with both?

Yes, but you can only pay into one ISA per tax year. You can, however, transfer your ISA between providers at any time.

Which platform is better for SIPP investing?

If you’re looking for passive, long-term pension growth, Vanguard’s SIPP is hard to beat on cost. If you want more investment choice and tools, Hargreaves Lansdown offers more flexibility and retirement planning features.

Can I trade shares with Vanguard?

No, Vanguard doesn’t offer share dealing. You can only invest in its own range of funds and ETFs.