Comparatives

Vanguard vs Trading 212 UK: Which Platform Works Best for You?

Vanguard and Trading 212 represent two distinct yet popular options for UK investors, each tailored to different styles and goals. Vanguard excels in long-term investing with a laser focus on low-cost index funds and diversified portfolios, though it has introduced a £4 monthly fee for smaller accounts under £32,000.

In contrast, Trading 212 appeals to more active or cost-conscious investors with no platform or trading fees, a slick mobile interface, and access to stocks, ETFs, fractional shares, and ISAs—making it highly accessible and flexible. This comparison unpacks their key differences in fees, investment options, platform usability, and suitability for UK users.

Let's find out which one is right for you!

How do these brokers compare?

| Regulation | FCA | FCA | |||

| Variety of Assets | 12,000+ global stocks & ETFs, commodities, forex | Stocks, ETFs, funds and bonds | |||

| ISA Available | Stocks and Shares ISA, General Investment Account | Stocks and Shares ISA, SIPP, ISA, Junior ISA, and General Account | |||

| User Experience & Interface | Excellent for beginners; clean UI | Simple and focused; minimal tools | |||

| More info | Trading 212 review | Vanguard review |

| Feature | Trading 212 | Vanguard |

|---|---|---|

| Regulation | FCA | FCA |

| Variety of Assets | 12,000+ global stocks & ETFs, commodities, forex | Stocks, ETFs, funds and bonds |

| ISA Available | Stocks and Shares ISA, General Investment Account | Stocks and Shares ISA, SIPP, ISA, Junior ISA, and General Account |

| User Experience & Interface | Excellent for beginners; clean UI | Simple and focused; minimal tools |

| More info | Trading 212 review | Vanguard review |

What are the differences?

Vanguard is all about simplicity and long-term growth. It’s designed for investors who want to drip money into index funds or ETFs and leave it alone.

Trading 212 is geared toward active, hands-on investing. You can pick individual stocks, trade ETFs, and even invest fractionally, all without paying trading commissions.

There’s no “better” platform overall; it depends on how you like to invest. But the contrast is clear: set-it-and-forget-it vs control-it-yourself.

Account types

Both platforms offer a Stocks and Shares ISA, but beyond that, they start to diverge.

- Vanguard offers a SIPP, ISA, Junior ISA, and General Investment Account. All are focused on long-term, passive investing using Vanguard funds.

- Trading 212 offers a General Investment Account and a Stocks and Shares ISA. There's no SIPP option, so if you’re planning to invest for retirement, you’ll need to look elsewhere.

So, for tax-efficient pension investing, Vanguard wins. But for flexible investing with zero-commission trading, Trading 212’s ISA or GIA may suit you better.

ISA Accounts Compared

Both platforms offer a Stocks and Shares ISA, but they work very differently.

Vanguard ISA

- Access to Vanguard’s own range of low-cost funds (index funds, LifeStrategy, ETFs)

- No individual stocks

- 0.15% annual account fee

- Great for passive investing and long-term goals

Trading 212 ISA

- Access to UK and international shares, ETFs, and fractional shares

- No pre-built portfolios

- No account or trading fees

- More control, more responsibility

So what’s better?

If you want a simple, low-cost ISA where you don’t have to think about your portfolio every week, Vanguard is the better choice. But if you want flexibility and the ability to hand-pick stocks or ETFs, Trading 212’s ISA offers far more freedom.

Comparing Broker Costs

| Fee Type | Trading 212 | Vanguard | |||

| Platform/Account Fee | £0 | 0.15% annually (capped at £375) | |||

| Trading Fees | £0 for all stocks and ETFs | N/A (Vanguard doesn’t offer stock trading) | |||

| Fund Charges | N/A | 0.06%–0.79% depending on the fund | |||

| FX Fee | 0.15% | N/A |

| Fee Type | Trading 212 | Vanguard |

| Platform/Account Fee | £0 | 0.15% annually (capped at £375) |

| Trading Fees | £0 for all stocks and ETFs | N/A (Vanguard doesn’t offer stock trading) |

| Fund Charges | N/A | 0.06%–0.79% depending on the fund |

| FX Fee | 0.15% | N/A |

On paper, Trading 212 wins the fee war, but only for a certain type of investor.

If you’re buying individual shares, Trading 212 is the clear winner on cost. But if you're building a long-term portfolio with index funds or ETFs, Vanguard’s low fund fees and flat platform charge can still be very cost-effective.

Investment Options

Vanguard:

- Funds & ETFs Only:

Vanguard UK offers investment exposure exclusively through their own mutual funds and ETFs, such as LifeStrategy funds (e.g., LifeStrategy 60% equity), FTSE 100, S&P 500 trackers, and more. - Ready-Made Portfolios:

Their LifeStrategy range offers diversified, risk-aligned portfolios out of the box, ideal for “set and forget” investors. - Account Types:

Investors can use Vanguard via ISA, SIPP, Junior ISA, GIA, and a Managed ISA option, which involves professionally curated portfolios (average cost ~0.62%). - Limitations:

You cannot trade individual shares, investment trusts, bonds, commodities, or crypto via Vanguard UK, they focus solely on their fund product suite. - Vanguard ETFs Available:

Many Vanguard ETFs (e.g., VUSA – S&P 500 UCITS, VWRL – All‑World) are available to buy via Trading 212. However, some funds like LifeStrategy are not.

Trading 212:

- Vast Access to Stocks & ETFs:

Trading 212 provides access to over 12,000 global stocks and ETFs, including fractional shares, with minimum investment starting at just £1. - No Mutual Funds:

Unlike Vanguard, Trading 212 does not offer mutual funds—only ETFs and stocks (plus CFDs for experienced traders). - Flexible Account Types:

It supports Invest accounts, Stocks & Shares ISAs (tax-efficient), and Cash ISAs, with no platform or trading fees. - Other Features:

Offers “Pies” (ready-made portfolios), AutoInvest, and share lending options. Uninvested cash can earn interest and be easily moved between ISA types.

👉 Read here for more on the best ETFs to invest in 2025

Minimum Deposit and Withdrawals

Trading 212:

- Invest Account & Stocks & Shares ISA

- £1 minimum deposit and investment per transaction.

- Bank transfers may have a higher minimum (around £10) depending on your provider.

- CFD Account

- Minimum deposit is £10.

- Additional Notes

- Deposits via card, Google Pay, Apple Pay, etc., are free up to a total of £2,000; beyond that, a 0.7% fee applies.

- Bank transfers remain free regardless of amount.

Vanguard:

- Initial Lump Sum

- The minimum required to open a Vanguard account is £500.

- Monthly Direct Debit

- Alternatively, you can start with a £100 monthly direct debit instead of a lump sum.

- Flexibility

- Once the account is established, you can make additional one-off deposits at any time, even below £100. Direct debit amounts can also be lowered or paused as needed.

Both brokers charge no withdrawal fee.

Trading Platforms

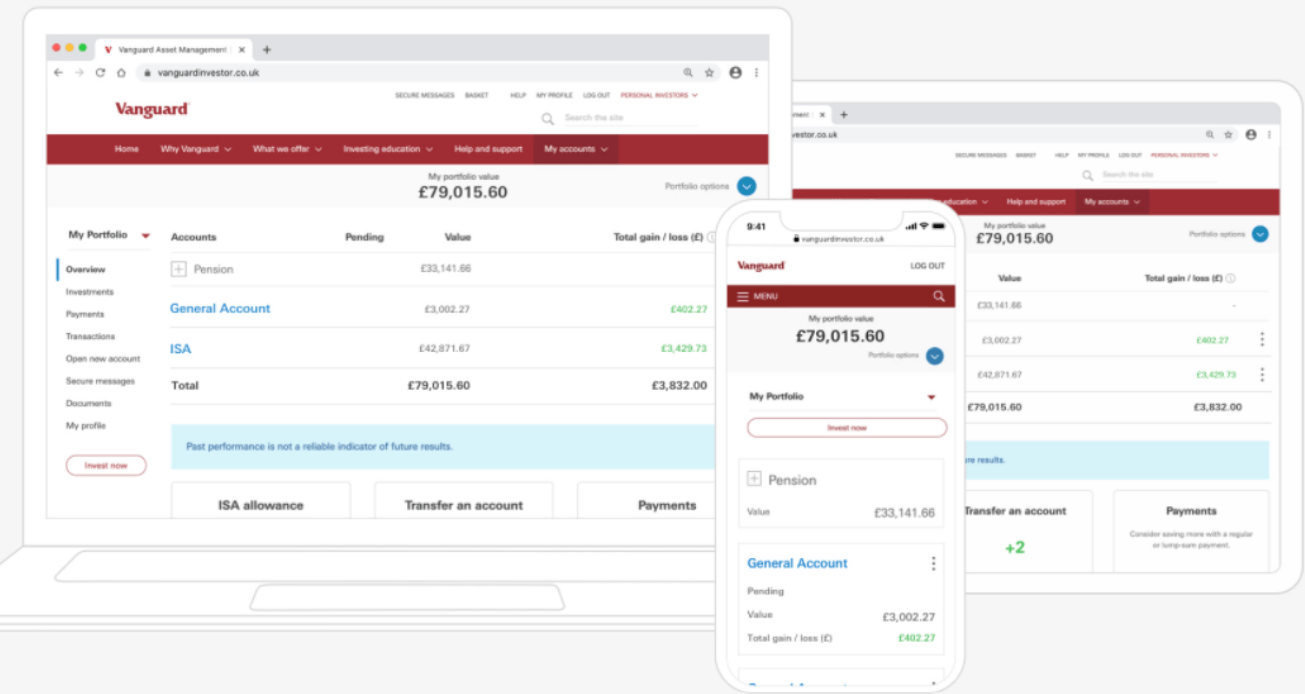

Vanguard’s platform is clean and stripped back. There’s no fancy UI or trading dashboard, it’s made for long-term investors who just want to set their allocations and monitor progress. It’s fully web-based, and while there’s a mobile app, it’s basic compared to most brokers.

Vanguard is built for clarity. The platform is basic, but easy to navigate, and support is available via phone and secure message if you need help.

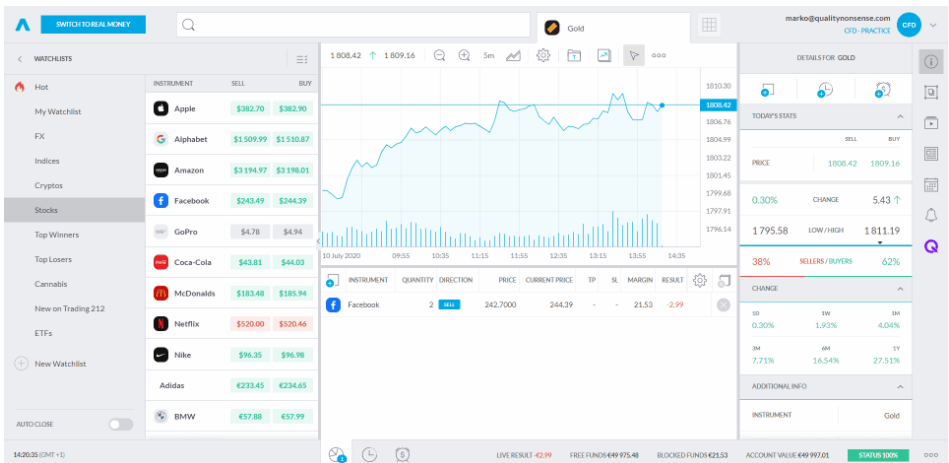

Trading 212, by contrast, is all about design and speed. You can trade stocks, set limit orders, browse charts, and monitor performance, all from your phone. The app is one of the most polished in the UK market, making it easy to buy and sell on the go.

Trading 212’s app is smooth, fast, and intuitive, but customer support is limited to online chat and can sometimes be slow to respond. There’s no phone support, so you’ll need to be comfortable figuring things out on your own.

If you want sleek tools and daily access to your investments, Trading 212 wins. If you just want to “set and forget” your portfolio, Vanguard does the job without distractions.

Overall, both brokers provide some of the best trading platforms, but if you want a helping hand or prefer to speak to someone, Vanguard may feel more reassuring. If you’re tech-savvy and independent, Trading 212 puts everything at your fingertips.

Education

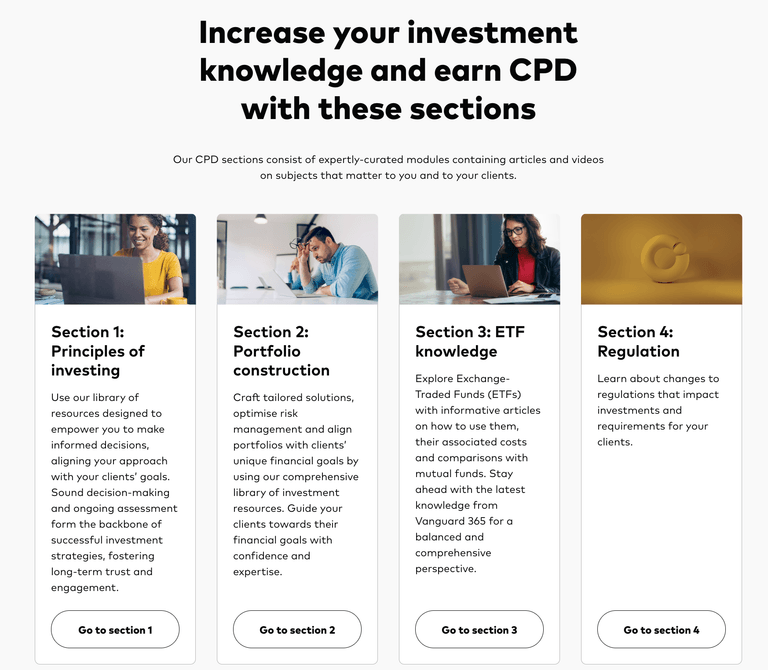

Vanguard UK offers a well-structured and comprehensive learning platform targeted at professional advisors and serious retail investors:

- Vanguard 365 – Investment Knowledge Modules

These include in-depth writings, videos, and self-paced quizzes on core topics like diversification, goal-setting, cost minimisation, rebalancing strategies, and portfolio construction. The materials are tailored for planners and advisers but offer strong foundational insight for any thoughtful investor. - Additional CPD Content

Beyond investment theory, Vanguard provides content on client relationship management, financial planning, and practice development—ideal for financial professionals seeking professional development credits and best practice guidance.

- Format & Depth

Educational offerings combine both articles and short video lessons, usually under 5 minutes, often coupled with quizzes to reinforce learning. While professionally oriented, they strongly emphasise disciplined investing principles and low-cost fund strategies.

Trading 212's approach is more beginner-friendly and accessible through its platform and help hub:

- Demo (Practice) Account

Offers a £50,000 simulated trading environment to test strategies and get comfortable with live-market mechanics without risking real money. A favourite among new users for building confidence. - In-App Tutorials & Learning Hub

Offers snackable lesson content covering basics like order types, reading charts, portfolio diversification, dollar-cost averaging, and risk fundamentals. Written guides and FAQs help bridge knowledge gaps.

- Video & YouTube Library

Hundreds of tutorial-style videos and walkthroughs hosted on Trading 212’s YouTube channel, ranging from platform navigation to foundational investing concepts. - Community Discussion & Peer Learning

Active user forum where beginners share strategies, ask questions, and seek guidance—for example, users recommend using the practice account and YouTube tutorials to learn.

Which one is better for beginners?

This depends entirely on what kind of beginner you are.

If you’re looking to start investing with minimal effort, Vanguard is perfect. You can pick a LifeStrategy fund, automate your contributions, and ignore the markets entirely if you want.

If you’re the kind of beginner who wants to learn by doing, and you’re interested in choosing your own stocks or diversifying with ETFs, Trading 212 gives you the tools and the free trades to do it.

But Trading 212 gives you choice but no guidance. There’s no real hand-holding. You’ll need to do your own research. Vanguard, on the other hand, limits your options but keeps things incredibly straightforward.

Final verdict

Both Vanguard and Trading 212 offer solid, low-cost ways to invest in the UK. But they serve two completely different investor profiles.

If you’re looking for long-term, low-maintenance investing, especially through an ISA or SIPP, Vanguard is hard to beat. It’s built for simplicity, with low fees and proven performance, making it ideal for hands-off investors.

But if you want more control, access to individual shares, and a slick mobile app to manage everything on the go, Trading 212 might be the better fit. It’s cost-effective, flexible, and perfect for active investors who want to make their own calls.

In the end, it comes down to your investing style: passive growth vs active control. Now you know what each platform brings to the table, so you can pick the one that fits you.

FAQs

Is your money safe?

Both platforms are FCA-regulated and covered by the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 if the company fails.

- Vanguard has a long global track record and is owned by its own funds, so it’s not under pressure from outside shareholders.

- Trading 212 is newer, but still regulated in the UK and holds client funds in segregated accounts.

So, from a safety perspective, both are secure choices for UK investors.

Is Trading 212 cheaper than Vanguard?

For stock and ETF trading, yes, Trading 212 charges no trading or account fees. But if you’re investing in index funds through an ISA, Vanguard’s low ongoing fees may still work out cheaper.

Can I open an ISA with both Trading 212 and Vanguard?

You can only pay into one Stocks and Shares ISA per tax year. But you can open an ISA on both platforms and use one for new contributions and the other for transfers.

Which is better for long-term investing in the UK?

If you want to set up a long-term plan and leave it to grow, Vanguard is better. If you want to stay more involved and actively choose investments, Trading 212 gives you the tools.