Reviews

DEGIRO UK Review

With 3 million customers across Europe, DEGIRO has established itself as a top choice among investors. In fact, it is now the broker with the largest user base in Europe as of this year.

Given its prominence, this article will take an in-depth look at DEGIRO, examining its strengths, weaknesses, security measures, platform usability, commissions, and the wide range of assets available for investment.

Pros and Cons

| Pros of DEGIRO | Cons of DEGIRO | ||

| ✅ Low commissions and other fees | ❌ No demo account | ||

| ✅ Selection of free ETFs | ❌ No fractional shares | ||

| ✅ Access to a large number of markets | ❌ No forex or cryptocurrencies | ||

| ✅ Expansive product catalogue | |||

| ✅ User-friendly trading platform |

| Pros of DEGIRO | Cons of DEGIRO |

| ✅ Low commissions and other fees | ❌ No demo account |

| ✅ Selection of free ETFs | ❌ No fractional shares |

| ✅ Access to a large number of markets | ❌ No forex or cryptocurrencies |

| ✅ Expansive product catalogue | |

| ✅ User-friendly trading platform |

Main features

Let's briefly see the features of this broker:

- Regulation: BaFin and AFM

- Guarantee fund: €20,000 (German Investor Protection Scheme)

- Financial assets: stocks and ETFs, options, futures, bonds, and warrants

- Markets: More than global 30 markets

- Account types: Basic, Active, Trader, and Day Trader

- Commissions:

- London Stock Exchange: £1.75 + handling £1

- Selected ETFs: €0 + €1

- Options and futures: €0.75

- Minimum deposit: €0.1

- Platform: Proprietary

Safety

To address this concern, we'll look at two key areas: DEGIRO's regulatory oversight and the protection of your funds.

In the UK, DEGIRO is supervised by the Financial Conduct Authority (FCA). As part of flatexDEGIRO Bank AG, it's also regulated by Germany’s BaFin.

Your funds are kept in a separate entity, so even in the event of bankruptcy, they remain secure. If that entity were to fail—though highly unlikely—DEGIRO is covered by the German Investor Compensation Scheme, which protects up to 90% of your losses (up to €20,000).

Available Investment Products

One of the most highly regarded aspects of DEGIRO is its extensive range of markets and products.

It is important to understand that DEGIRO acts as an execution broker. It should be noted that DEGIRO positions itself as a low-cost broker, focusing on providing a user-friendly platform designed for beginner investors or those without extensive trading experience.

Let's have a look at each asset class individually.

| Stocks and ETFs | DEGIRO provides access to over 50 stock exchanges and more than 5,000 ETFs, including the largest international markets and several smaller European stock exchanges. | ||

| Mutual Funds | While DEGIRO does offer investment funds, it's true that the catalogue is relatively limited, comprising only 64 funds. However, these funds provide exposure to offerings managed by renowned entities like BlackRock or Vanguard. | ||

| Bonds | DEGIRO facilitates trading diverse bond types, both government and corporate, boasting an extensive catalogue of over 650 debt products. Notably, the selection includes prominent European countries' public debt bonds, such as those from the Netherlands, Portugal, France, Belgium, and Germany. | ||

| Options and Futures | Through DEGIRO, it is also possible to trade some derivatives, mainly options and futures from markets such as Brussels, Amsterdam, Madrid, Nymex, or Eurex. With DEGIRO, you will have access to 11 options markets and 13 futures. |

| Stocks and ETFs | DEGIRO provides access to over 50 stock exchanges and more than 5,000 ETFs, including the largest international markets and several smaller European stock exchanges. |

| Mutual Funds | While DEGIRO does offer investment funds, it's true that the catalogue is relatively limited, comprising only 64 funds. However, these funds provide exposure to offerings managed by renowned entities like BlackRock or Vanguard. |

| Bonds | DEGIRO facilitates trading diverse bond types, both government and corporate, boasting an extensive catalogue of over 650 debt products. Notably, the selection includes prominent European countries' public debt bonds, such as those from the Netherlands, Portugal, France, Belgium, and Germany. |

| Options and Futures | Through DEGIRO, it is also possible to trade some derivatives, mainly options and futures from markets such as Brussels, Amsterdam, Madrid, Nymex, or Eurex. With DEGIRO, you will have access to 11 options markets and 13 futures. |

What markets are available?

One of GIRO's most famous features is the wide range of markets it offers, which sets it apart from other financial intermediaries. DEGIRO, in particular, provides access to multiple markets that are not generally available through other platforms and at a significantly lower cost.

For instance, it stands out as one of the few intermediaries allowing retail users to directly access markets like Turkey, Australia, and several European markets.

However, it's important to be aware of some limitations that exist in markets like Hong Kong and Canada.

- Hong Kong: While you can place orders for execution in the Hong Kong market, it's important to note that you may not see the live quote price. Additionally, there is a possibility that your order might not be executed.

- Canada: Specific companies may require you to buy and sell shares in lots of 100 shares each. Trading individual shares might not be possible, and you'll need to adhere to the lot size requirement.

Types of accounts

DEGIRO offers four different types of accounts for diverse trading preferences: Basic, Active, Trader, and Day Trader. When you register, a basic account will be created for you. To change the account type, you must fulfil several requirements, as detailed below.

You can upgrade to an Active or Trader account to access leverage and short positions. The main difference: Active allows up to 50% margin use, while Trader allows up to 100%.

The Day Trader profile extends trading hours (8am–9:30pm CET) but is aimed at experienced traders. It must be activated manually through DEGIRO support and isn’t usually recommended for most users.

Fees and costs

DEGIRO is a low-cost broker that stands out for its competitive costs in North American and exotic markets and does not have custody fees or charges for dividend processing.

However, it's important to consider that the broker does apply a handling fee for certain assets, such as funds and stocks.

Fees for stocks

Each share trade will be subject to a fixed handling fee of £1 (or equivalent for stocks in other currencies). In addition to this, the commission varies based on which exchange the stock is listed:

| Exchange | Commission | Handling fee | |||

| UK | £1.75 | £1 | |||

| US | €1 | €1 |

| Exchange | Commission | Handling fee |

| UK | £1.75 | £1 |

| US | €1 | €1 |

Fees for exchange-traded funds (ETFs)

Another important feature of DEGIRO is that there is a wide list of ETFs, making DEGIRO one of the best ETF brokers. Also, there is a rich selection of commission-free ETFs:

| Commission | Handling fee | ||||

| Selected ETFs | €0 | €1 | |||

| Global ETFs | €2 | €1 |

| Commission | Handling fee | |

| Selected ETFs | €0 | €1 |

| Global ETFs | €2 | €1 |

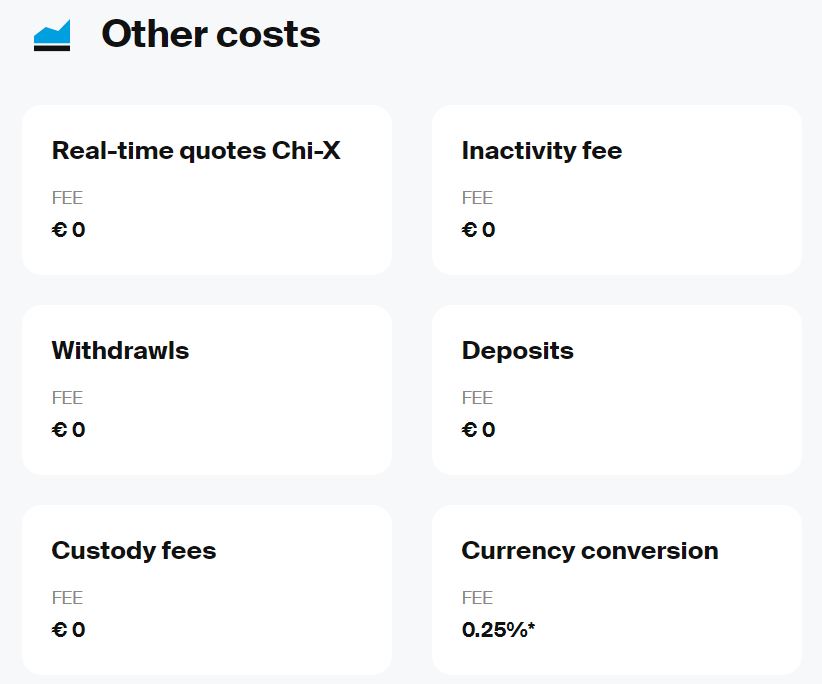

Non-trading fees

Finally, DEGIRO does not charge commissions for inactivity, deposits and withdrawals of capital:

Trading platform

As part of this DEGIRO review, let's delve into its trading platform.

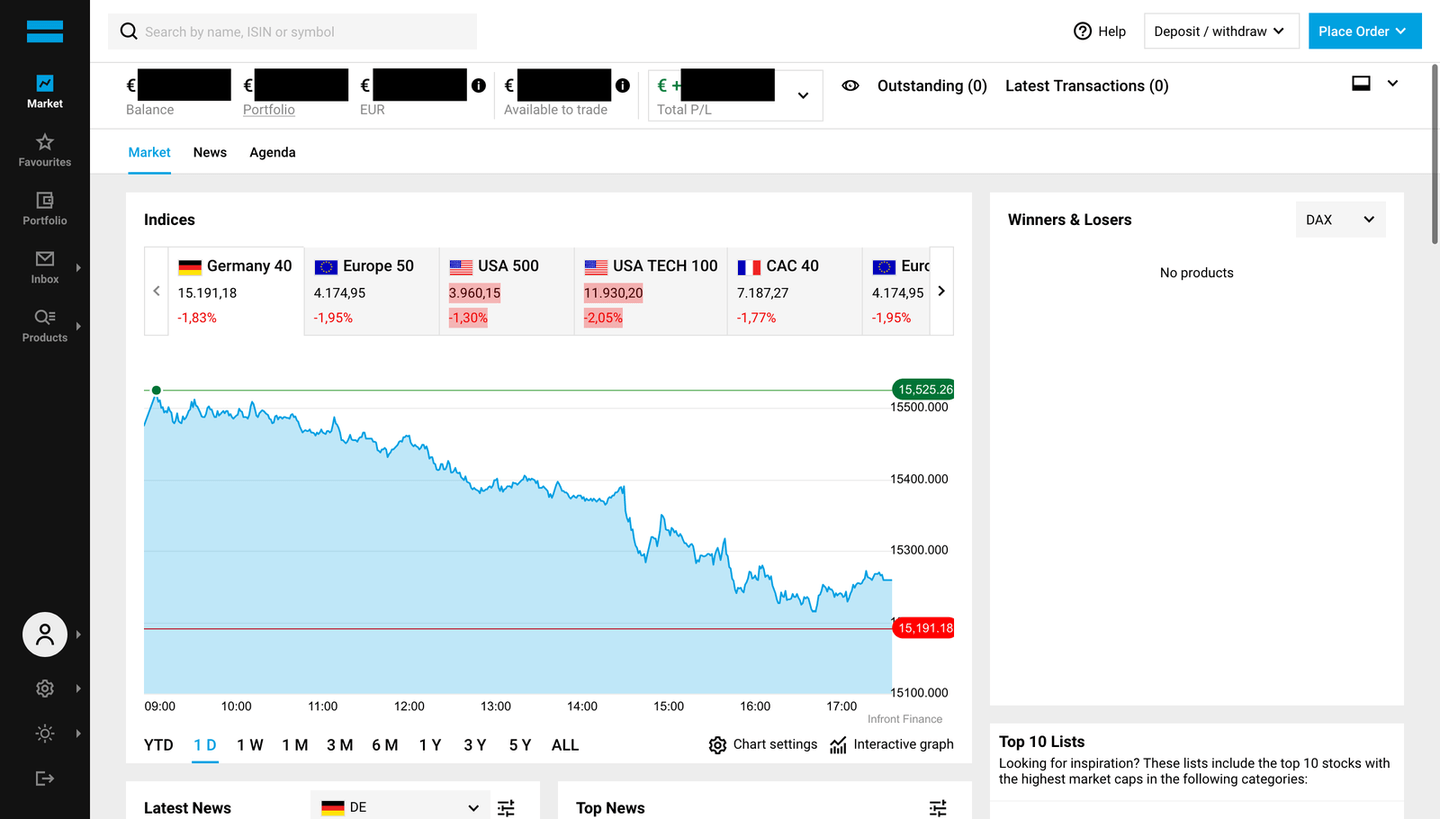

DEGIRO offers a user-friendly and straightforward proprietary platform, which can be considered an advantage or disadvantage depending on the user's experience level.

The platform's simplicity makes it easy for novice users to search for assets and execute trades seamlessly. However, for more advanced users who are accustomed to sophisticated platforms like Metatrader or ProRealTime, DEGIRO's platform may seem limited in terms of available functionalities.

Firstly, the Market section provides users with a comprehensive global view of the market situation. It presents daily variations of global indices, offering insights into the performance of various markets. Additionally, the platform displays a list of top-performing stocks and those experiencing significant declines, giving users a snapshot of the current market trends.

The other sections allow you to check other information, such as:

- Portfolio shows a history of closed trades and your current open trades.

- Account shows information about deposits and withdrawals, commissions and and others.

- Orders section contains all the orders waiting to be executed and the history of placed orders.

- The transaction section shows a list of all your trades.

- The Reports section includes all the annual reports, which include all the necessary information to complete taxation reports.

- Favourites section contains a list of all your favourite assets.

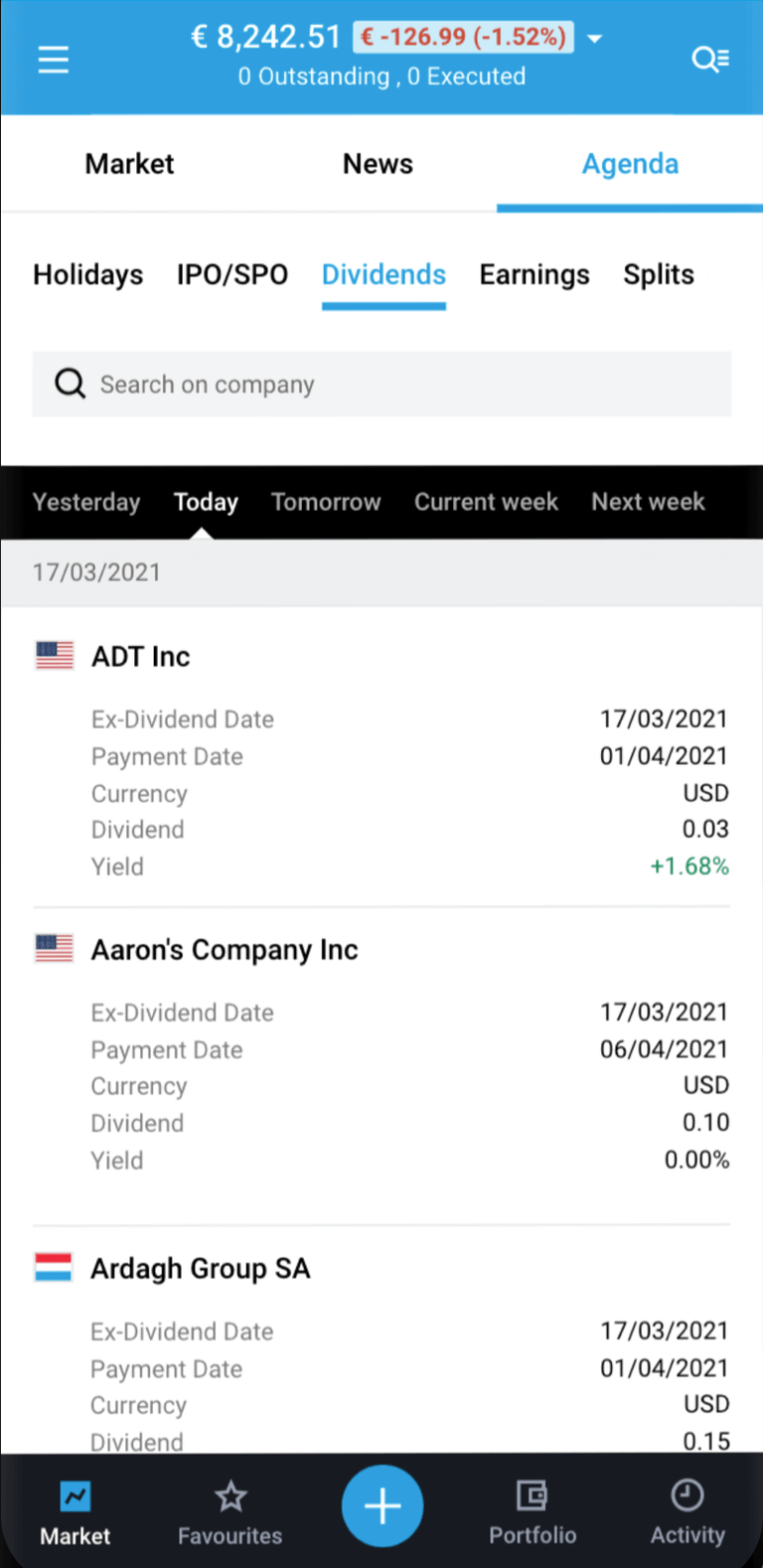

There is also a news section to check the latest market news. However, perhaps one of the most interesting sections is the Agenda.

This section lets you see a snapshot of the most important company information, such as dividends, yield, and planned dividend dates. As shown above, DEGIRO has a mobile app replicating the web or desktop platform.

Deposits and Withdrawals

When you create an account with DEGIRO, you need to link your bank account. For deposits and withdrawals, you can only use the same bank account. Processing may take 2-4 working hours, but there are no fees charged by DEGIRO.

ISAs

UK residents can benefit from excellent investment incentives, such as avoiding taxes on dividends, interest, and capital gains. This can significantly impact retirement timelines, potentially reducing them by five years or more.

However, DEGIRO does not offer any form of ISA (Investment Savings Account), be it Cash, Stocks and Shares, Innovative Finance, or Lifetime ISAs. If you are interested in buying one of the best Stocks and Shares ISAs, you might want to consider alternatives such as Hargreaves Lansdown or Interactive Brokers.

👉 Read our Hargreaves Lansdown review to learn more.

👉 Read our Interactive Brokers review to learn more.

Training & Education

DEGIRO offers a comprehensive knowledge section, providing free resources on general investing and trading. This includes the Investor's Academy, product guides, investment strategies, and even a blog.

Reviews

DEGIRO's reputation has garnered significant attention, given its status as the broker with the largest user base in Europe. As a result, there is a wealth of opinions and reviews about the platform.

While some critics have pointed out the lack of certain services and advanced features, many investors have found DEGIRO's platform user-friendly and commend its competitive fee structure. Generally, the investor community has expressed positive sentiments, although some reviews may be mixed, particularly from users seeking a more sophisticated and professional broker.

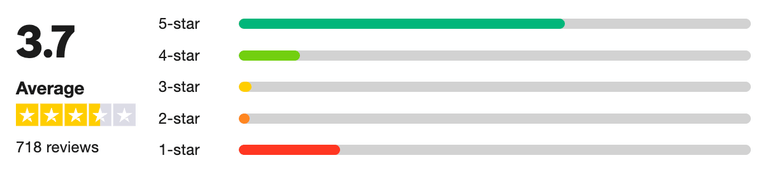

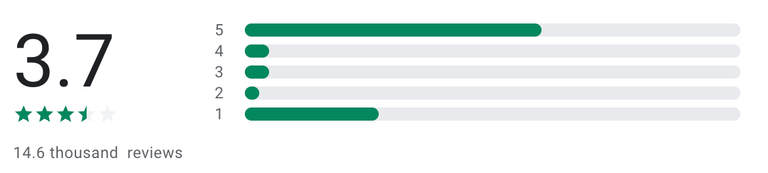

On Truspilot, one of the prominent forums for discussions on brokers and financial services, as well as Google Play, DEGIRO boasts an overall positive evaluation – 3.7 out of 5 stars, with majority of users rating it 5 stars.

The app has also gained recognition among some of the best investment apps, with over 1 million downloads.

Summary

DEGIRO is a safe, affordable, and user-friendly option for trading and investing in the largest global markets. Its key strengths include competitive rates, 0% commission ETFs, and access to many important global markets.

In conclusion, this DEGIRO review finds it one of the top stock brokers available, particularly for investors from Europe. With its competitive rates, wide market access, and ease of use, DEGIRO remains a preferred choice for many investors seeking a hassle-free and cost-effective trading experience.

If you're looking for more cost-efficient brokers, check out who we think are the best stock brokers in the UK and see if any of them stand out to you.

More brokers reviewed for you

FAQs

What is the history of DEGIRO?

DEGIRO was founded in 2008 as a firm that offered financial services to professional clients.

In September 2013 they launched their service for retail customers in the Netherlands. Subsequently, during 2014 and 2015, DEGIRO embarked on a journey of expansion into other European countries.

The platform launched in the UK in 2015 and expanded to other European countries including Italy, France, Spain, Portugal, Greece, Germany, Norway, Poland, the Czech Republic, and Hungary.

The year 2020 marked a crucial milestone for DEGIRO when it was acquired by Flatex AG (FTK.DE), leading to the formation of one of Europe's largest brokers. Together, they now boast over 1 million customers and facilitate more than 50 million transactions annually.

DEGIRO is listed on the primary stock exchange in Germany, and its stock price has witnessed remarkable growth.

Does DEGIRO have a demo account?

No, DEGIRO does not provide a demo account. However, you can deposit 0.01 to open an account for free.

Is it compatible with MT4?

No, DEGIRO only offers a proprietary trading platform.

Can you trade crypto?

No, you cannot access crypto if you open an account with DEGIRO.

How to open an account in 4 steps?

Opening a DEGIRO account is a swift and straightforward process that should only take a few minutes. Follow these steps to get started:

1. Go to the broker's homepage and click on the "Open an account" button.

2. Provide your personal details, such as your email, username, and password

3. Once you have received the email confirmation of the account, you must accept the terms and conditions.

4. Next, complete your personal information and submit the necessary documents. It's important to note that to commence trading, you'll need to link your bank account.

Does DEGIRO have promotions?

Yes! 0% commission on ETFs and free training sources

DEGIRO offers certain ETFs without commissions. Each month, you can make an ETF trade with no commissions as long as it is not a short position. The following trades in the same ETF and during the same month will not include a commission fee if you place an order in the same direction (i.e., buy or sell) and the value is at least 1,000 currency units (GBP, USD, or EUR).

Does DEGIRO provide customer service?

DEGIRO's customer service can be contacted 24/7 via email. Phone service is also available on weekdays from 7am to 9pm (44 (0) 20 3695 7834).

Unlike other brokers, DEGIRO does not provide a live chat for quick assistance, and you may need to wait up to 1 working day to get a reply to your email.