Reviews

Freedom24 Review

In this Freedom24 review, we will analyse how the broker works, the options it provides for investing in financial markets, and its fee structure. We will also look into other investment products, consider user feedback, and evaluate the platform.

- Invest globally with over 43,000 stocks and ETFs.

- Covered Call ETFs with a target yield of 8–12%.

- Open an account, deposit funds, and get up to 20 free stocks.

- Weekly investment ideas with a historical return of 16%.

- Grow with confidence with a broker chosen by over 500,000 clients.

Investing involves risk. Access subject to a suitability test. Promotion subject to T&Cs.

Pros and Cons

| Pros of Freedom24 | Cons of Freedom24 | ||

| ✅ Direct access to more than 3,600 ETFs and 43,000+ global stocks | ❌ Does not offer derivatives or CFDs | ||

| ✅ Easy to use and intuitive | ❌ Withdrawal fee | ||

| ✅ Regular investment ideas from Bloomberg-awarded analysts | ❌ Does not allow trading with fractional shares | ||

| ✅ Free demo account, no minimum deposit | |||

| ✅ Competitive trading fees from €0.02 per share | |||

| ✅ Up to 20 gift stocks for new customers (after account top-up) | |||

| ✅ Part of a NASDAQ-listed holding |

| Pros of Freedom24 | Cons of Freedom24 |

| ✅ Direct access to more than 3,600 ETFs and 43,000+ global stocks | ❌ Does not offer derivatives or CFDs |

| ✅ Easy to use and intuitive | ❌ Withdrawal fee |

| ✅ Regular investment ideas from Bloomberg-awarded analysts | ❌ Does not allow trading with fractional shares |

| ✅ Free demo account, no minimum deposit | |

| ✅ Competitive trading fees from €0.02 per share | |

| ✅ Up to 20 gift stocks for new customers (after account top-up) | |

| ✅ Part of a NASDAQ-listed holding |

Main Features

Here is a short summary of the main features of Freedom24, which will be discussed in detail in the following sections:

- Regulation: CySEC

- Financial Assets: Stocks and ETFs, stock options, bonds

- Markets: Global broker (USA, Europe, and Asia)

- Account Types: 2

- Commissions:

- Smart in EUR plan = 0.02$/€ per share + 2$/€ per order

- All inclusive in EUR plan = 0.5% +0.012€ per share + 1.2$/€ per order

- Minimum Deposit: 0$/€

- Platform: Proprietary

- Contact:

- Email: [email protected]

- Phone: +357 25 25 77 85

- Live Chat

Is it safe?

As always, it’s essential to consider whether respected regulatory authorities supervise the broker—and if so, which ones.

Freedom24 is a brokerage firm operating within the European Union and is subject to the relevant rules and regulations of this jurisdiction. Specifically, Freedom24 is regulated by CySEC (the Cyprus Securities and Exchange Commission) under registered license number 275/15.

Adding to its credibility, Freedom24’s parent company, Freedom Holding Corp (FRHC), is publicly listed on the Nasdaq stock exchange, which provides an additional layer of transparency and regulatory oversight.

Freedom24 offers investor protection under the Cypriot Investor Compensation Fund, which covers investors up to €20,000 in the event of the company’s insolvency.

It is important for investors to understand that protections may vary depending on the regulatory framework governing the broker.

- Invest globally with over 43,000 stocks and ETFs.

- Covered Call ETFs with a target yield of 8–12%.

- Open an account, deposit funds, and get up to 20 free stocks.

- Weekly investment ideas with a historical return of 16%.

- Grow with confidence with a broker chosen by over 500,000 clients.

Investing involves risk. Access subject to a suitability test. Promotion subject to T&Cs.

Fees, Deposits and Withdrawals

Account Minimum

Freedom24 offers flexibility with no minimum deposit required to open an account, making it accessible for investors with varying budgets. The platform provides different fee plans, such as the ‘Smart’ and ‘All inclusive’ plans.

This system allows users to experience the platform before committing to the costs associated with the premium plan.

Account Fee

Freedom24 does not impose monthly or annual account maintenance fees.

Deposit Fee

Deposits via bank transfer are free. Deposits via debit/credit card incur a 0.12% fee per transaction, regardless of the client's tariff.

Withdrawal Fee

Withdrawals via bank transfer cost €7 per transaction. Withdrawals via debit/credit card are subject to a 0.65% fee, with a minimum charge of €/$2 per transaction.

Deposits via bank transfer are free. Deposits via debit/credit card incur a 0.12% fee per transaction, regardless of the client's tariff.

Inactivity Fee

Freedom24 does not charge inactivity fees for dormant accounts.

OTC Trading Fees

Brokerage Fee: 0.12% of the trade. Depository Fee: $30 per trade.

Trading Fees

Is Freedom24 a cheap broker? The fees at Freedom24 vary depending on the asset and the plan you choose. Some plans offer free monthly maintenance, making them competitive for everyday trading.

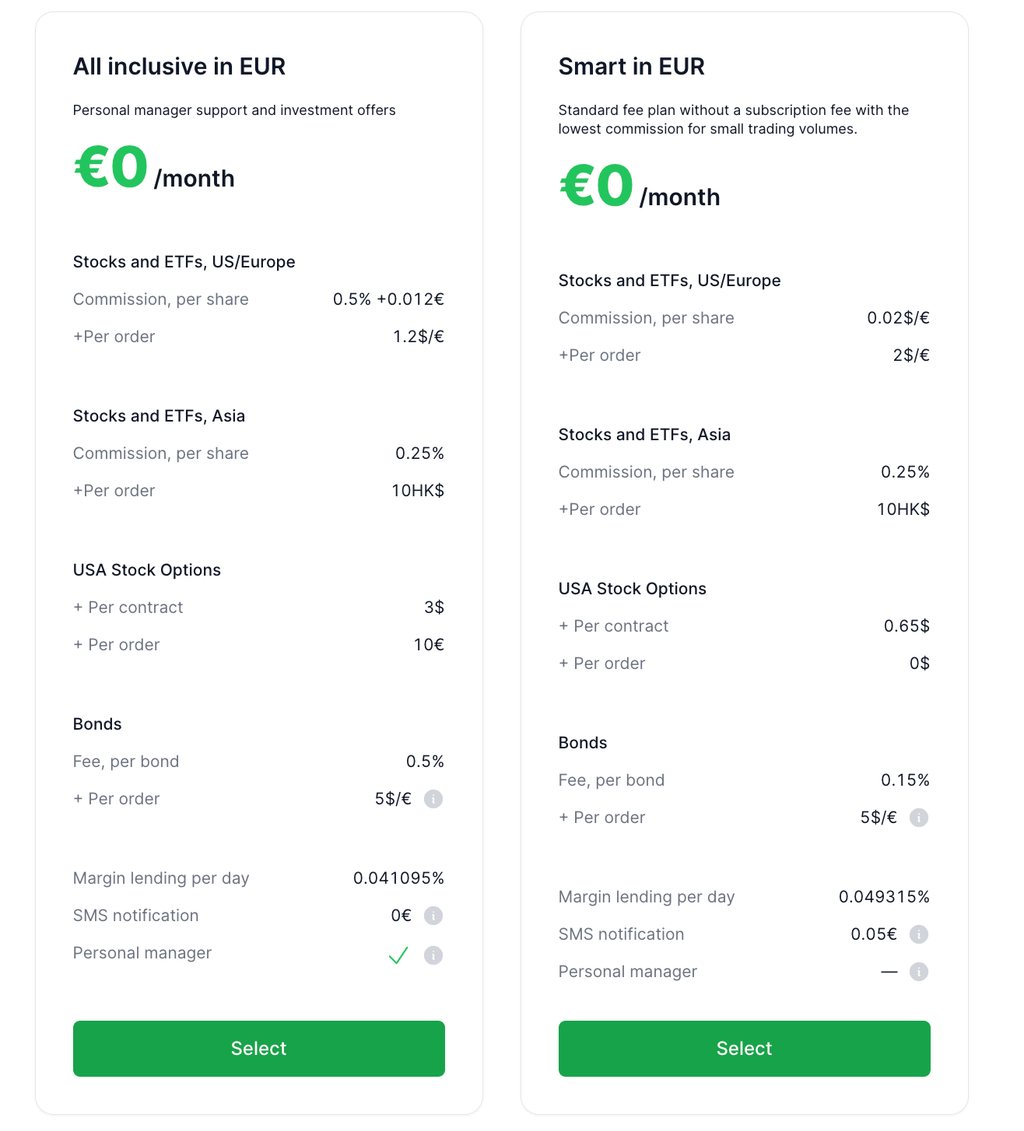

There are two main types of fee plans:

- Smart in EUR Account Commissions:

- US / Europe Stocks and ETFs: This rate applies to any US or European stock.

- Commission per share: 0.02$/€

- + Per order: 2$/€

- Asian Stocks and ETFs:

- Commission per share: 0.25%

- + Per oder: 10HK$

- USA Stock Options:

- + Per contract: 0.65$

- + Per order: 0$

- Bonds:

- Fee per bond: 0.15%

- + Per order: 5$/€

- Margin lending per day - 0.049315%

- SMS notification - 0.05€

- All inclusive in EUR Account Commissions:

- US / Europe Stocks and ETFs: This rate applies to any US or European stock.

- Commission per share: 0.5% + 0.012€

- + Per order: 1.2$/€

- Asian Stocks and ETFs:

- Commission per share: 0.25%

- + Per oder: 10HK$

- USA Stock Options:

- + Per contract: 3$

- + Per order: 10$

- Bonds:

- Fee per bond: 0.5%

- + Per order: 5$/€

- Margin lending per day - 0.041095%

- SMS notification - 0€

- Personal Manager - Yes

The minimum deposit and commissions are straightforward, making it easy to manage your investments without unexpected fees.

- Invest globally with over 43,000 stocks and ETFs.

- Covered Call ETFs with a target yield of 8–12%.

- Open an account, deposit funds, and get up to 20 free stocks.

- Weekly investment ideas with a historical return of 16%.

- Grow with confidence with a broker chosen by over 500,000 clients.

Investing involves risk. Access subject to a suitability test. Promotion subject to T&Cs.

Available Investment Products

What can you invest in using Freedom24? Let's have a look at their main products:

Shares

Freedom24 allows you to invest in the stock market by offering a selection of over 40,000 stocks from major markets in the USA, Europe, and Asia.

ETFs

Freedom24 provides direct access to more than 3,600 ETFs for retail investors, spanning diverse regional markets and industry sectors worldwide. Catering to the needs of both long-term and mid-term investors, the broker offers a broad selection of funds, including:

- Swap-based overnight ETFs – serving as flexible alternatives to fixed income instruments with monthly payouts.

- Dividend ETFs – providing diversified exposure to large- and mid-cap dividend-paying stocks across global markets.

- Short-term Bond ETFs – generating predictable income ( 4,7%–6,3%) through highly liquid sovereign and corporate bonds in EUR and USD.

- Covered call ETFs – delivering additional income through option premiums on top of regular dividend distributions, with the best covered call ETFs, UK investors can access offering an attractive blend of yield and downside protection.

- Index ETFs - tracking major global and local indices to gain broad market exposure at low cost.

Bonds

Freedom24 gives you access to a broad selection of global bonds directly through its platform, without the need for complex trade-desk orders. Investors can get started from just €/$1,000, and you are expected to receive the nominal value at maturity, provided the issuer does not default. Bonds typically offer periodic coupon payments and can help diversify long-term investment portfolios.

The platform also provides flexibility when it comes to selecting bonds, allowing you to filter by yield, rating or maturity. And while bonds are typically held until maturity, it’s also possible to sell them earlier at market price in case liquidity is needed.

Options and Futures

Although it is not its primary market, Freedom24 does allow investment in options on various financial assets. In fact, it offers options on different stocks in the US market.

Moreover, the broker offers some of the lowest prices in Europe for US corporate option contracts, as we will see in the fees section.

Take advantage of options trading with Freedom24, where you will gain the following benefits:

- Fixed income: Thanks to the premium received (in case of sale)

- Risk hedging

- Limited risks

- Trading and speculation

You will also find a limited selection of futures.

- Invest globally with over 43,000 stocks and ETFs.

- Covered Call ETFs with a target yield of 8–12%.

- Open an account, deposit funds, and get up to 20 free stocks.

- Weekly investment ideas with a historical return of 16%.

- Grow with confidence with a broker chosen by over 500,000 clients.

Investing involves risk. Access subject to a suitability test. Promotion subject to T&Cs.

Trading Platform

Freedom Finance has its own platform, which Freedom24 also serves.

The platform is quite simple and has both advantages and disadvantages. It is friendly and intuitive for beginners, making it easy to start trading quickly, which is why it’s considered one of the best trading platforms for newcomers.

However, for those looking to professionalise their trading operations, it lacks advanced chart analysis tools and indicators such as moving averages.

Nevertheless, you can set price alerts and use stop-loss orders, among other features.

The platform is available on the web and also through its mobile app.

Opinions

As we've highlighted earlier, alongside its extensive range of products and services, Freedom24 receives commendation for its comprehensive customer service, encompassing all available service options. This sentiment is reflected in various opinions shared across different review platforms.

For instance, Trustpilot users rate the broker very positively, awarding it an average score of 4 out of 5 stars.

A similar story holds for the Google Play Store. With an average rating of 4.2 out of 5 stars, the platform enjoys substantial user trust. The volume of over 5,100 reviews contributes to a more robust and reliable average rating.

Education

Freedom24 Academy: A structured, multi-level online learning platform designed to transform beginners into confident investors, featuring practical courses on market fundamentals and strategies

Webinars & Tutorials: Includes video tutorials, webinars, and written guides covering essential investing topics like “Why is it important to invest?”

So, Freedom24 is also an integrated learning and research environment that combines an online Academy, webinars, video courses, plus actionable market analysis and investment ideas. Whether you're starting out or refining your strategy, Freedom24 provides substantial support to grow your skills and make informed investment decisions.

Customer Service

Freedom24 generally delivers strong, multilingual customer support through several channels, often praised for quick, helpful responses and guidance from dedicated managers. It has earned industry accolades and positive user feedback. Below is how you can contact them:

- Email: [email protected]

- Phone: +357 25 25 77 85

- Live Chat

Summary

Freedom24 offers a range of appealing features that position it as a strong choice among investment platforms. Its straightforward interface and access to global markets make it an attractive option for investors looking to diversify their portfolios. The platform is well-regarded by users, receiving positive feedback on sites like Trustpilot and the Google Play Store, which highlights its commitment to a good user experience.

While Freedom24 provides access to a wide range of markets and investment options, investors should carefully review the platform’s fees and services to ensure they meet their individual needs.

For those seeking alternatives, it’s worth exploring other platforms known for their comprehensive service and reliability. Especially for those focused on equity investing, choosing from the best brokers for stocks and shares can provide competitive pricing, advanced trading tools, and dedicated customer support.

More brokers reviewed for you

FAQs

What is it and how does it work?

Freedom24 is an online brokerage that provides access to global financial markets, allowing users to trade stocks, bonds, ETFs, and options. It is part of Freedom Holding Corp (FRHC), listed on the Nasdaq with a market capitalisation of more than $10 billion as of July 2025. It is a good fit for long-term investors focused on real securities and classic stock market tools with strong analytical support and intuitive interface.

How to Open a Freedom24 Account?

Initiating an account with this broker is straightforward and entirely online. Here are the 5 steps to follow:

- Go to the Freedom Finance website and click to open a new account.

- Fill in your personal data and verify your identity (KYC).

- Read and agree with the terms and conditions.

- Verify your identity to activate your account.

- Deposit your funds

- Done! You can start trading.

This entire process usually takes no longer than 10 minutes.

Is Freedom24 regulated?

Yes, Freedom24 is a European investment firm regulated by the CySEC under licence 275/15. It operates under the MiFID II framework, which governs investment firms across the EU.

What is their customer service like?

The customer service team is available via different methods to help you out with any issues or inquiries. It's worth noting that the broker does not have an office in the UK. You can reach out via:

Submitting a ticket on their web version

The business hours are Monday to Friday, 9:00 AM to 9:00 PM UTC+2.

What happens if Freedom24 goes bankrupt?

For UK clients of Freedom24, if the broker goes bankrupt, they are protected by the Cyprus Investor Compensation Fund (ICF), which offers compensation up to €20,000. Client funds are typically segregated from the broker's own, offering additional protection in the event of financial difficulties.

Disclaimer: