Reviews

Freetrade Review

Freetrade, a broker that is part of IG Group has become one of the most popular fintech and online brokers in the UK and Europe due to its freemium model, easy-to-use platform, and access to many stocks and ETFs.

Today, we will provide an in-depth review of the online broker, explaining its products and assets, key features, pros and cons, customers' opinions, safety, and quality of customer service.

What is Freetrade?

Founded in 2016 and headquartered in London, Freetrade is a pioneering commission-free broker that extends its services across Europe and beyond. This innovative platform satisfies both novice and experienced investors, offering an extensive selection of over 6,200 investment vehicles, such as stocks, fractional shares, investment trusts, over-the-counter (OTC) stocks, special purpose acquisition companies (SPACs), and initial public offerings (IPOs).

Pros and Cons

| Pros of Freetrade | Cons of Freetrade | ||

| ✅ Commission-Free Trading: Buy and sell UK, US, and European stocks and ETFs without paying per-trade fees. | ❌ Foreign Exchange Fees: FX fees on non-GBP trades (up to 0.99% on the free plan). | ||

| ✅ User-Friendly App: Intuitive interface ideal for beginners and casual investors. | ❌ Limited Research Tools: Lacks in-depth analytics and real-time market data found in more advanced platforms. | ||

| ✅ Fractional Shares: Allows investment in high-priced US stocks with smaller amounts. | ❌ Paid Plans for Key Features: Features like SIPP access, advanced orders, and ISAs are behind a paywall. | ||

| ✅ Range of Account Types: Offers GIA, ISA, and SIPP (with paid plans). | |||

| ✅ Flexible Subscription Plans: Choose between free or paid tiers depending on your needs. | |||

| ✅ Interest on Cash: Earn up to 5% AER on uninvested cash (with Plus plan). | |||

| ✅ No Inactivity or Withdrawal Fees: Keeps long-term use cost-effective. |

| Pros of Freetrade | Cons of Freetrade |

| ✅ Commission-Free Trading: Buy and sell UK, US, and European stocks and ETFs without paying per-trade fees. | ❌ Foreign Exchange Fees: FX fees on non-GBP trades (up to 0.99% on the free plan). |

| ✅ User-Friendly App: Intuitive interface ideal for beginners and casual investors. | ❌ Limited Research Tools: Lacks in-depth analytics and real-time market data found in more advanced platforms. |

| ✅ Fractional Shares: Allows investment in high-priced US stocks with smaller amounts. | ❌ Paid Plans for Key Features: Features like SIPP access, advanced orders, and ISAs are behind a paywall. |

| ✅ Range of Account Types: Offers GIA, ISA, and SIPP (with paid plans). | |

| ✅ Flexible Subscription Plans: Choose between free or paid tiers depending on your needs. | |

| ✅ Interest on Cash: Earn up to 5% AER on uninvested cash (with Plus plan). | |

| ✅ No Inactivity or Withdrawal Fees: Keeps long-term use cost-effective. |

Main Features

The table below summarises the main features of the Freetrade broker we will examine in detail in this review:

| Features | Explanation | ||

| Regulation | Freetrade is regulated by the Financial Conduct Authority in the United Kingdom (FRN: 783189). | ||

| Investment Options | Over 6,200 investment choices including stocks, fractional shares, and ETFs. | ||

| Financial Compensation Claims in case of bankruptcy (FSCS) | Up to £85,000 | ||

| Account types | Stock and shares ISA, Self-invested Personal Pension (SIPP), and General Investment Account (GIA) | ||

| Pricing Plan | Basic plan, Standard plan (£4.99 monthly or £59.88 annually), and Plus plan (£9.99 monthly or £119.88 monthly) | ||

| Minimum deposit | No minimum deposit requirement | ||

| Deposit method | Bank transfer, Credit/Debit card, Apple Pay, and Google Pay | ||

| Deposit and withdrawal fee | None | ||

| Trading Platform | Proprietary in-app trading platform on mobile devices and Web service for desktops | ||

| Currency Exchange Fee | 0.59% | ||

| Interest on Uninvested Cash | Earn between 1% to 5% interest on cash balances depending on your plan level. |

| Features | Explanation |

| Regulation | Freetrade is regulated by the Financial Conduct Authority in the United Kingdom (FRN: 783189). |

| Investment Options | Over 6,200 investment choices including stocks, fractional shares, and ETFs. |

| Financial Compensation Claims in case of bankruptcy (FSCS) | Up to £85,000 |

| Account types | Stock and shares ISA, Self-invested Personal Pension (SIPP), and General Investment Account (GIA) |

| Pricing Plan | Basic plan, Standard plan (£4.99 monthly or £59.88 annually), and Plus plan (£9.99 monthly or £119.88 monthly) |

| Minimum deposit | No minimum deposit requirement |

| Deposit method | Bank transfer, Credit/Debit card, Apple Pay, and Google Pay |

| Deposit and withdrawal fee | None |

| Trading Platform | Proprietary in-app trading platform on mobile devices and Web service for desktops |

| Currency Exchange Fee | 0.59% |

| Interest on Uninvested Cash | Earn between 1% to 5% interest on cash balances depending on your plan level. |

Is it safe?

When choosing a broker, regulation and investor protection are paramount, as they safeguard your investments against unforeseen events like bankruptcy. This also speaks to the overall reliability and safety of the investment platform.

Is Freetrade Safe and Reliable?

Yes, Freetrade is considered a safe and reliable broker, prioritising the security of your investments. It is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, ensuring adherence to strict rules and transparent conduct.

Key Safety and Reliability Features:

- Segregated Bank Accounts: Your funds are held separately from Freetrade's operational funds, protecting them from company liabilities.

- Nominee Account Protection: UK-listed investments are held by Freetrade Nominee Limited, which cannot trade, further shielding your assets from the company's financial obligations.

- Secure Custody Systems: Freetrade uses CREST for UK assets and the Depository Trust and Clearing Corporation (DTCC) for US investments, ensuring your shares are held securely within central securities depositories.

- FSCS Protection: Freetrade is part of the Financial Services Compensation Scheme (FSCS), meaning your eligible assets are protected up to £85,000 in the unlikely event of Freetrade's failure.

- Robust Regulatory Backing: Alongside the FCA, Freetrade also operates under the oversight of the SEC (for its US operations), cementing its status as a dependable platform for all investor types.

These measures collectively ensure that your assets remain protected and retrievable, even in the unlikely event of the broker's bankruptcy.

Available Investment Products

Freetrade, a pioneering broker platform, offers UK and international investors the opportunity to engage with a broad array of financial assets. With over 6,200 stocks and ETFs from the UK, US, and Europe, and the ability to trade fractional shares, Freetrade stands out for its commission-free model. This review will delve into the various assets available on Freetrade, highlighting the benefits and features of each.

Stocks

Stocks represent fractional ownership in a company, making shareholders partial owners. Stocks are considered a higher-risk investment due to their value fluctuations based on company performance and market perception. Freetrade users can choose from an extensive range of over 6,200 stocks, facilitating broad market access.

Fractional Shares

Fractional shares, or "stock slices," allow investors to own a portion of a stock, making it easier to invest in high-priced stocks without committing to a full share. This approach democratises investment, with dividends paid proportionally to share ownership. For instance, owning a quarter share entitles you to a quarter of the dividends distributed.

ETFs (Exchange-Traded Funds)

ETFs are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds, but trade close to their net asset value during the trading day. Freetrade offers over 400 ETFs, enabling investors to diversify their portfolios without the high fees typically associated with active management.

Investment trusts

Investment trusts are publicly traded companies that invest in a fixed portfolio of assets. They are known for trading at a discount or premium to their Net Asset Value (NAV). With access to over 150 investment trusts, Freetrade provides opportunities for portfolio diversification and potential capital growth.

Bonds

While primarily offering equity-based assets, Freetrade also allows its users to invest in bond ETFs. These funds are ideal for investors seeking regular income and lower risk compared to stocks.

Commodities

Investors at Freetrade can trade in various commodities, including hard commodities like metals and energy, soft commodities such as agricultural products, and even renewable energy sources. This sector provides a good hedge against inflation and portfolio diversification.

Account Types

Freetrade offers three distinct types of individual savings accounts, each tailored to different investment needs and financial goals. These include the Stocks and Shares ISA, Self-invested Personal Pension (SIPP), and General Investment Account (GIA). Here's a detailed look at each to help you determine which fits your investment strategy best.

Stocks and Shares ISA Account

The Freetrade Stocks and Shares ISA provides a tax-efficient way to invest in a diverse range of assets, from stocks and shares to bonds and ETFs. This account shields your investments from UK taxes on dividends and capital gains.

Annual Investment Limit:

For the tax year 2025/26, you can invest up to £20,000 in an ISA. This can be allocated to one ISA or spread across various ISAs.

Key Features:

- Commission-Free: Buy and sell stocks and shares at zero fees.

- Tax-Free Dividends: Enjoy returns without any UK tax.

- Fractional Shares: Invest as little as £2 in top companies.

- Rapid Trading: Unlimited commission-free instant trades within market hours.

- Customer Support: Priority service included in the Standard and Plus plans.

Charges Overview:

- Monthly Fee: £5.99 for Standard Plan; £11.99 for Plus Plan.

- Foreign Exchange Fee: Additional 0.59% on Standard Plan; 0.39% on Plus Plan.

ISA Account Fees

| Charges | Standard Plan | Plus Plan | |||

| Monthly fee | £5.99 | £11.99 | |||

| Share dealings | Free | Free | |||

| Overseas share dealings | Exchange rate +0.59% | Exchange rate +0.39% | |||

| Transfer in (Deposit) | Free | Free | |||

| Transfer out (Withdrawal) – UK stock or cash | Free | Free | |||

| Transfer Out – US stock | £17 per holding | £17 per holding |

| Charges | Standard Plan | Plus Plan |

| Monthly fee | £5.99 | £11.99 |

| Share dealings | Free | Free |

| Overseas share dealings | Exchange rate +0.59% | Exchange rate +0.39% |

| Transfer in (Deposit) | Free | Free |

| Transfer out (Withdrawal) – UK stock or cash | Free | Free |

| Transfer Out – US stock | £17 per holding | £17 per holding |

Self-invested Personal Pension (SIPP) Account

Take Control of Your Retirement Savings

The Freetrade SIPP account offers a flexible approach to pension investments, allowing you to manage your retirement funds actively. This account suits those looking to consolidate their pensions and make active investment choices.

Contribution and Tax Relief:

Contribute up to 100% of your salary with tax relief, up to an annual limit of £40,000.

Key Features:

- Inclusive Fee: Included in the Plus plan with no growth penalty.

- Pension Consolidation: Combine old pensions for easier management.

- Instant Trades: Unlimited commission-free trades available.

Charges Overview:

- Monthly Fee: £11.99 under the Plus plan.

- Foreign Exchange Fee: 0.39% on overseas share dealings.

Key Features of the Freetrade SIPP Account

- SIPP is automatically included in the Plus plan, and no additional fee as the pension pot grows.

- Combine pension – the Freetrade platform allow you to combine old pensions to make it easy to track investment performance

- Instant trades – unlimited commission-free instant trades during the stock market trading hour

SIPP Fees

| Charges | Plus plan | ||

| Monthly fee | £11.99 | ||

| Share dealing | Free | ||

| Overseas share dealing (Currency Exchange) | Exchange rate +0.39% | ||

| Transfer in (Deposit) | Free | ||

| Transfer out (Withdrawal) | Free | ||

| US stock transfer out | £17 per holding |

| Charges | Plus plan |

| Monthly fee | £11.99 |

| Share dealing | Free |

| Overseas share dealing (Currency Exchange) | Exchange rate +0.39% |

| Transfer in (Deposit) | Free |

| Transfer out (Withdrawal) | Free |

| US stock transfer out | £17 per holding |

General Investment Account (GIA)

Flexibility Without Limits

The GIA offers a flexible investment solution without the tax efficiencies of an ISA or SIPP. This account is ideal if you've maxed out your tax-advantaged contributions or seek broader investment opportunities.

Tax Considerations:

Subject to Capital Gains Tax and dividend tax on profits above £6,000 for CGT and £1,000 for dividends in the tax year 2023/24.

Key Features:

- Unrestricted Investing: There is no limit on the amount you can invest.

- Commission-Free Trading: No fees on buying or selling within the account.

- Accessibility: Available on all Freetrade pricing plans.

Fees and Charges

The Freetrade broker has three pricing plans: the Basic, the Standard, and the Plus plan. Below are the main differences among them:

| Basic Plan | Standard Plan | Plus Plan | |||||

| Fee | £0.00 per month | £4.99 per month, £59.88 billed annually | £9.99 per month, £119.88 billed annually | ||||

| Available products | 1500 stocks, including popular shares and ETFs | Full range of 6200+ US, UK, and EU stocks and ETFs | Full range of 6200+ US, UK, and EU stocks and ETFs | ||||

| Account types | General Investment Account | General Investment Account Stocks and Shares ISA | General Investment Account Stocks and Shares ISA Personal Pension | ||||

| Commission | Commission-free | Commission-free | Commission-free | ||||

| Range of Stocks | 4800+ | 6200+ | 6200+ | ||||

| US Fractional shares | YES | YES | YES | ||||

| Automatic Order Types | NO | YES | YES | ||||

| Exchange rate fee | Exchange rate +0.99% FX fee | Exchange rate +0.59% FX fee | Exchange rate +0.39% FX fee | ||||

| Customer Service | Basic | Basic | Priority | ||||

| Interest rate | 1% AER interest on uninvested cash up to £2,000 | 3% AER interest on uninvested cash up to £2,000 | 5% AER interest on uninvested cash up to £3,000 | ||||

| Advanced stock fundamentals | NO | YES | YES | ||||

| Trading app | In-app | In-app | In-app Freetrade Web beta |

| Basic Plan | Standard Plan | Plus Plan | |

| Fee | £0.00 per month | £4.99 per month, £59.88 billed annually | £9.99 per month, £119.88 billed annually |

| Available products | 1500 stocks, including popular shares and ETFs | Full range of 6200+ US, UK, and EU stocks and ETFs | Full range of 6200+ US, UK, and EU stocks and ETFs |

| Account types | General Investment Account | General Investment Account Stocks and Shares ISA | General Investment Account Stocks and Shares ISA Personal Pension |

| Commission | Commission-free | Commission-free | Commission-free |

| Range of Stocks | 4800+ | 6200+ | 6200+ |

| US Fractional shares | YES | YES | YES |

| Automatic Order Types | NO | YES | YES |

| Exchange rate fee | Exchange rate +0.99% FX fee | Exchange rate +0.59% FX fee | Exchange rate +0.39% FX fee |

| Customer Service | Basic | Basic | Priority |

| Interest rate | 1% AER interest on uninvested cash up to £2,000 | 3% AER interest on uninvested cash up to £2,000 | 5% AER interest on uninvested cash up to £3,000 |

| Advanced stock fundamentals | NO | YES | YES |

| Trading app | In-app | In-app | In-app Freetrade Web beta |

Deposit and Withdrawal Options

Freetrade offers straightforward and efficient methods for depositing and withdrawing funds, designed to accommodate users' various preferences.

Deposit Options and Charges

Bank Transfer:

- Method: Link a UK-authorised bank account to your Freetrade account for seamless transfers.

- Fees: No deposit fees charged by Freetrade.

Debit Card Transfer:

- Method: Use a debit card linked to your bank account for deposits.

- Fees: No deposit fees charged by Freetrade.

Apple and Google Pay:

- Method: Make deposits directly to Freetrade using Apple Pay or Google Pay. This option is particularly fast, offering instant transfers.

- Limit: This method uses a lifetime deposit limit of £250.

- Requirements: The default billing address in Google or Apple Pay settings must match the address registered with Freetrade.

- Fees: No deposit fees are charged by Freetrade, but be aware of potential external fees like exchange rates.

Withdrawal Options and Charges

Bank Transfer Only:

- Method: Withdrawals from your Freetrade account can only be made through a linked bank transfer.

- Time Frame: The funds typically reach your bank account in 2-3 business days, although it can take up to 5 business days in some cases.

- Fees: Freetrade does not charge fees for withdrawals.

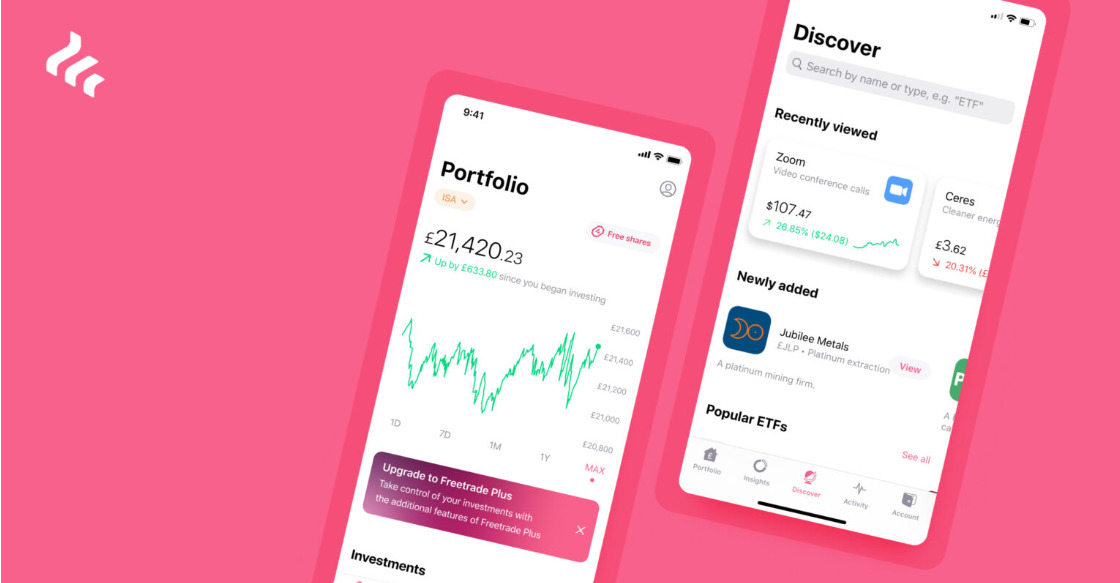

Mobile App Features

Platform Availability:

- Compatibility: The Freetrade app is designed to work perfectly on Android and iOS devices, ensuring broad accessibility for all users.

- Mobile-Only: Freetrade does not currently offer a desktop application. All trading activities are confined to the mobile app, which is optimised for a mobile-first trading experience.

Awards and Recognition:

- Recognition: For three years, the Freetrade app has been recognised as one of the best online trading apps, a reward for its user-friendly design and robust functionality.

Advanced Features for Plus Plan Members

Desktop Trading:

- Exclusive to Plus Plan: While the primary interface is mobile, Freetrade offers desktop trading capabilities exclusively to customers on the Plus plans. This feature allows for enhanced asset and portfolio management through a desktop device, catering to the needs of more advanced traders.

Customer Service

Freetrade is committed to providing exceptional customer service to ensure a smooth trading experience. Whether through the app, website, or social media, Freetrade offers several convenient ways to access support and information.

Resources and Tool

To help users get the right information about the platform, their investments, and market analysis, Freetrade provides several educational resources for its users. These resources include:

User Ratings

As a rapidly growing broker, Freetrade has amassed thousands of user reviews across various platforms, providing insight into customer satisfaction with their services. Here's what users are saying about their experiences with Freetrade.

TrustPilot Reviews:

- Rating: Freetrade has an average rating of 4.1 out of 5 on TrustPilot, indicating a positive reception from its users within the investment community.

Google Play Store Reviews:

- Rating: On the Google Play Store, Freetrade boasts a higher rating of 4.7 out of 5, reflecting high satisfaction among Android users.

App Store Reviews:

- Rating: iOS users have rated Freetrade 4.3 out of 5 on the App Store, showcasing strong approval of the app’s performance on Apple devices.

How Does Freetrade Comapre to other Brokers?

| Freetrade | Hargreaves Landsdown | Interactive Investor | AJ Bell | ||||||

| Portoflio Value | £250,000 | £250,000 | £250,000 | £250,000 | |||||

| Subscription Fee | £9.99 (plus plan) | £0 (share dealing account) £3.75 (0.45% ISA fee) £16.67 (0.45% SIPP fee) | £21.99 (investor plan + SIPP) | £3.50 (0.25% dealing account fee) £3.50 (0.25% ISA fee) £10 (0.25% SIPP fee) | |||||

| Cost of UK Trade - dealing commission | £0 | £44.75 | £15.96 | £17.50 | |||||

| Monthly Cost | £29.49 | £159.92 | £132.90 | £89.50 |

| Freetrade | Hargreaves Landsdown | Interactive Investor | AJ Bell | ||||||

| Portoflio Value | £250,000 | £250,000 | £250,000 | £250,000 | |||||

| Subscription Fee | £9.99 (plus plan) | £0 (share dealing account) £3.75 (0.45% ISA fee) £16.67 (0.45% SIPP fee) | £21.99 (investor plan + SIPP) | £3.50 (0.25% dealing account fee) £3.50 (0.25% ISA fee) £10 (0.25% SIPP fee) | |||||

| Cost of UK Trade - dealing commission | £0 | £44.75 | £15.96 | £17.50 | |||||

| Monthly Cost | £29.49 | £159.92 | £132.90 | £89.50 |

Freetrade clearly stands out with its low-cost structure, offering £0 trading commissions and a simple £9.99 monthly fee for the Plus plan. In contrast, brokers like Hargreaves Lansdown and Interactive Investor charge higher fees for both subscriptions and trade commissions. AJ Bell falls in between, with lower trading costs but a higher monthly fee than Freetrade. Additionally, other platforms like Trading212 also provide an interesting outcome when comparing freetrade vs trading 212.

Final Verdict

Freetrade offers a solid foundation for new investors with its easy-to-use interface and zero-commission fee structure, making it an excellent entry-level platform. However, those with more experience in the markets who require detailed analytics might consider exploring additional platforms that offer advanced trading tools.

More brokers reviewed for you

FAQs

How does Freetrade make money if there are no commission fees?

Freetrade operates on a freemium model, where basic trading services are free, but additional services, such as ISA accounts or advanced order types, come with a monthly fee. They also earn revenue from currency exchange fees on trades in non-UK stocks and interest on cash held in accounts.

What is the minimum investment on Freetrade?

No minimum investment is required to start trading with Freetrade, making it ideal for beginners and those looking to start with small amounts. You can even purchase fractional shares with as little as £2.

Can I transfer my existing investments to Freetrade?

Yes, Freetrade supports transfers-in for Stocks and Shares ISAs, SIPPs, and general investment accounts. You can transfer your existing investments in the form of stocks or as cash from another brokerage to Freetrade by filling out a transfer form available in the app.

What types of accounts does Freetrade offer?

Freetrade offers several account types, including a General Investment Account (GIA), a Stocks and Shares ISA, and a Self-Invested Personal Pension (SIPP). Each account type caters to different investment needs and tax considerations.

Can I trade cryptocurrencies on Freetrade?

No, Freetrade currently does not support cryptocurrency trading. The platform focuses on stocks and ETFs, and it has not announced any plans to include cryptocurrencies as of now.