Reviews

Hargreaves Lansdown Review

If you're looking into investment platforms or stockbrokers in the UK, you've likely come across Hargreaves Lansdown. As a well-established broker and FTSE 100 member, it manages approximately £120 billion in assets.

However, choosing the best investment platform depends on your experience, investment volumes, and tax considerations. We're here to guide you.

But is Hargreaves Lansdown UK´s number 1 investment platform? This review provides an unbiased look at the Hargreaves Lansdown platform, covering its key features, commissions and fees, available products, customer reviews, and our expert opinion.

What is it?

Hargreaves Lansdown is a major UK financial company founded on July 1st, 1981. It's listed on the London Stock Exchange as part of the FTSE 100 index and manages over £155 billion in investments. It is trusted by 1.9 million clients.

Based in Bristol, the company provides brokerage services across the UK. They offer funds, shares, and similar products to retail investors in the UK, Canada, and Europe, allowing them to manage different investments in one place.

How They Work

- Account Services: Hargreaves Lansdown provides an account to manage your investments, providing access to various investment options, trading tools, market updates, and calculators.

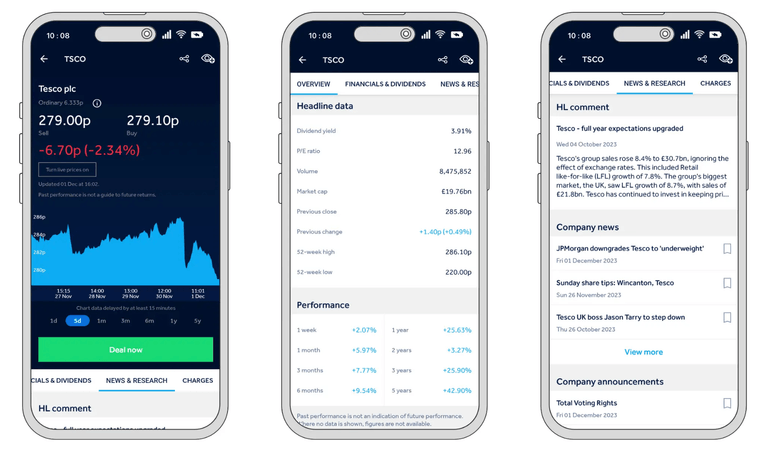

- Trading App: Their user-friendly trading app, compatible with iOS and Android, allows you to monitor your portfolio and make transactions on the go.

- Website: The website is easy to navigate, offering investment guides and market insights.

Costs and Fees

While Hargreaves Lansdown is a trusted member of the UK's financial services industry, it charges relatively high commissions and fees, which may discourage investors with smaller portfolios.

Investment Options

Hargreaves Lansdown provides access to over 3,000 funds, bonds, ETFs, and shares across UK, Canadian, and European markets. Despite higher fees, it remains a trusted and safe broker, offering a comprehensive range of financial products.

Main Features

Here's a summary of the key features offered by Hargreaves Lansdown:

| Main Features | Description | ||

| Regulation | Regulated by the UK's Financial Conduct Academy (FCA) | ||

| Markets and Available Products | Funds, Shares, Investment trusts, Exchange-traded Funds (ETFs) and Gilts and bonds | ||

| Financial Compensation Claims in case of bankruptcy | Up to £85,000 | ||

| Account types/ Products | Stocks and shares, ISA Share dealing account, Lifetime ISA (LISA) Self-invested personal pension (SIPP) Junior SIPP Junior ISA (JISA) Active Savings | ||

| Minimum Deposit | The minimum deposit for the HL Fund and Share Account is £1 Minimum sum investment into the Fund is £100 | ||

| Deposit method | Debit card and Bank transfer | ||

| Deposit and Withdrawal Fees | None | ||

| Trading Platform | Proprietary in-app and web-based trading platform | ||

| Base Currency | £ | ||

| Foreign Currency Exchange | First £5,000 – 1% FX fee; Over £5,000 – 0.75% FX fee; Over £10,000 – 0.50% FX fee; Over £20,000 – 0.25% FX fee |

| Main Features | Description |

| Regulation | Regulated by the UK's Financial Conduct Academy (FCA) |

| Markets and Available Products | Funds, Shares, Investment trusts, Exchange-traded Funds (ETFs) and Gilts and bonds |

| Financial Compensation Claims in case of bankruptcy | Up to £85,000 |

| Account types/ Products | Stocks and shares, ISA Share dealing account, Lifetime ISA (LISA) Self-invested personal pension (SIPP) Junior SIPP Junior ISA (JISA) Active Savings |

| Minimum Deposit | The minimum deposit for the HL Fund and Share Account is £1 Minimum sum investment into the Fund is £100 |

| Deposit method | Debit card and Bank transfer |

| Deposit and Withdrawal Fees | None |

| Trading Platform | Proprietary in-app and web-based trading platform |

| Base Currency | £ |

| Foreign Currency Exchange | First £5,000 – 1% FX fee; Over £5,000 – 0.75% FX fee; Over £10,000 – 0.50% FX fee; Over £20,000 – 0.25% FX fee |

Pros and Cons

| Pros of Hargreaves Lansdown | Cons of Hargreaves Lansdown | ||

| ✅FTSE 100 Company: Well-established and trusted brand | ❌High Fees: Some fees can be higher than competitors | ||

| ✅Wide Range of Investments: Stocks, funds, ETFs, and more | ❌No Fractional Shares: Can't buy partial shares | ||

| ✅User-Friendly Platform: Easy to navigate for beginners | ❌Limited Investment Options for Advanced Traders: Not ideal for active traders | ||

| ✅Excellent Customer Support: Accessible and helpful service | ❌Minimum Investment Amounts: Some accounts require minimum deposits | ||

| ✅Investment Tools and Research: Comprehensive tools for investors | |||

| ✅ISA and Pension Options: Offers tax-efficient accounts |

| Pros of Hargreaves Lansdown | Cons of Hargreaves Lansdown |

| ✅FTSE 100 Company: Well-established and trusted brand | ❌High Fees: Some fees can be higher than competitors |

| ✅Wide Range of Investments: Stocks, funds, ETFs, and more | ❌No Fractional Shares: Can't buy partial shares |

| ✅User-Friendly Platform: Easy to navigate for beginners | ❌Limited Investment Options for Advanced Traders: Not ideal for active traders |

| ✅Excellent Customer Support: Accessible and helpful service | ❌Minimum Investment Amounts: Some accounts require minimum deposits |

| ✅Investment Tools and Research: Comprehensive tools for investors | |

| ✅ISA and Pension Options: Offers tax-efficient accounts |

Is it safe?

Yes – Hargreaves Lansdown is authorised and regulated by the Financial Conduct Authority (FCA), ensuring it operates under strict UK financial rules. Client funds are held in segregated accounts, meaning your money is kept separate from the company’s own funds.

Your investments are also protected by the Financial Services Compensation Scheme (FSCS), offering up to £85,000 in compensation if the firm fails.

Additional safety measures include two-factor authentication, nominee account structures, and oversight by a dedicated treasury committee. These protections make Hargreaves Lansdown a secure choice for UK investors, whether you're investing in pensions, stocks, or savings.

Available Investment Products

Hargreaves Lansdown Limited, a broker platform and financial institution, offers various forms of individual savings and pension accounts with access to various investment options, one of its strongest features when compared to other platforms such as Vanguard vs Hargreaves Lansdown.

Here is a detailed list of products that Hargreaves Lansdown gives you access to:

Individual Savings and Pension Accounts

Hargreaves Lansdown provides various accounts, including one of the best Stocks and Shares ISAs, Junior ISAs, SIPPs, and Fund & Share Accounts. Here's a quick overview of the different investments available:

Funds

These pooled investments are managed by professionals and spread across shares and bonds Hargreaves Lansdown offers access to over 3,000 funds, with market-beating discounts and free insights from their research team. There are no commission fees for buying or selling.

Shares

Buy shares to gain a stake in a company and earn dividends. Hargreaves Lansdown offers a low-cost way to buy shares in the UK, US, Canada, and Europe, with free info and alerts. Limit orders and stop-loss tools are included at no extra cost.

Exchange-traded funds (ETFs)

ETFs are like funds, but they trade on stock exchanges like shares. Choose from over 2,000 ETFs and related products with free trading tools and no annual management fee. The cost per trade is tiered based on the number of deals made in the previous month:

- 0-9 trades: £11.95 per deal

- 10-19 trades: £8.95 per deal

- 20+ trades: £5.95 per deal

Investment Trusts

These companies trade on the stock exchange, pooling investments across shares, property, and other assets. Hargreaves Lansdown offers over 400 Investment Trusts and Real Estate Investment Trusts (REITs), with free trading tools.

Gilts and Corporate Bonds

Invest in government (gilts) or corporate bonds to earn interest. Hargreaves Lansdown provides access to over 700 bonds with no annual fees.

Cash

You can open your account with a cash deposit and decide on investments later. Your deposit is safe and can grow with interest.

Hargreaves Lansdown provides a wide array of investments to build your portfolio efficiently and securely.

Account Types and Fees

Hargreaves Lansdown offers a variety of investment and savings accounts tailored to different needs and stages in life, each with specific features and conditions:

Stocks and Shares ISA Account

In this Hargreaves Lansdown Stocks and Shares ISA review, we explore a tax-efficient way to invest in a wide range of assets, including stocks, funds, and bonds. This type of ISA is designed to help individuals grow their wealth while benefiting from tax-free gains and income. Opening a Stocks and Shares ISA with Hargreaves Lansdown is quick and straightforward, giving you access to a broad selection of investment options and powerful tools to help grow your savings tax-free.

- Contribution Limit: £20,000 per year.

- Tax Benefits: Tax-free growth and withdrawals.

- Fees:

- Funds up to £250,000: 0.45%.

- Shares: 0.45%, capped at £45 annually.

Lifetime ISA (LISA)

- Age Requirement: Available to individuals aged 18 to 39.

- Contribution Limit: £4,000 per year, part of the overall £20,000 ISA limit.

- Government Bonus: 25% on contributions, valid for first home purchases or retirement savings.

- Fees: Similar to Stocks and Shares ISA.

Fund and Share Account

- Contribution Limits: Unlimited.

- Flexibility: Allows trading of shares, funds, and other securities.

- Tax: Use tax-free dividends, capital gains, and personal savings allowances.

Self-Invested Personal Pension (SIPP)

- Tax Relief: Up to 45% (47% for Scottish taxpayers).

- Withdrawals: 25% can be withdrawn tax-free; the rest is taxed as income.

- Fees:

- Funds up to £250,000: 0.45%.

- Shares: 0.45%, capped at £200 annually.

Junior Accounts (Junior ISA and Junior SIPP)

A tax-efficient savings and investment account for children under 18. Parents and guardians can save up to £9,000 annually to support the child’s future financial needs.

- Contribution Limit for Junior ISA: £9,000 per year.

- Junior SIPP: Operates similarly to adult SIPPs but is managed by guardians until the child turns 18.

- Fees: For Junior SIPP, similar to adult SIPP rates, Junior ISA has no account charges, ensuring all contributions go directly toward the child's future.

Other Services Offered

- Hargreaves Lansdown Cash ISA – A cash ISA is a type of savings account that allows you to earn interest-free of UK income tax. You can put up to £20,000 into your cash ISA in a tax year. This is the maximum amount you can put in all your ISAs within the 2023/2024 tax year.

- Ready-made Portfolios – Hargreaves Lansdown's ready-made portfolio is an easy way to start investing if you're looking to invest but unsure where to start. The portfolio is an all-in-one type. Overall, the financial institution provides a portfolio of funds, and you are responsible for the amount you want to invest in each fund.

- Hargreaves Lansdown Wealth Shortlist – The wealth shortlist selects funds in various sectors. Hargreaves Lansdown believes that they have the best potential within their sectors. This helps potential investors build a well-balanced and diversified portfolio.

- Foreign Currency Exchange—With the Hargreaves Lansdown foreign currency exchange, you can transfer more than 40 different currencies, which will be converted to their base currency. This service is available online or over the phone with a representative.

- Spread Betting and CFDs—Hargreaves Lansdown allows you to trade CFDs and spread bets through its partner, IG Group.

- Annuity – Annuity is a retirement product and one of the methods to withdraw from your pension pot. The program allows you to swap some or all of your pension for a regular income that guarantees you payment for life.

- Drawdown—This is a retirement payment option in which you take a variable income from the pension pot while keeping some invested. You can take up to 25% of the pension pot at once as a tax-free lump sum.

- Fund Finder—This feature on the Hargreaves Lansdown platform allows you to search for a particular fund by sector, fund type, unit type, provider, and more.

- Hargreaves Lansdown Transfer—This financial institution allows you to transfer investments to or away from their platform at no charge. You can transfer existing Pensions, ISAs, and Investments to any broker free of charge or to Hargreaves Lansdown with zero fees. You can perform this transfer online or by sending the transfer form by post.

Other Trading Fees

| Description | Charge | ||

| UK Stamp Duty | 0.5% on purchase of UK shares (rounded up to the nearest £5 for residual shares) | ||

| Panel on Takeover and Mergers | £1 on UK shares deals over £10,000 | ||

| Irish Stamp Duty | 1% on purchases of Irish shares | ||

| French Financial Transaction Tax | 0.3% on some French shares | ||

| Italian Financial Transaction Tax | 0.1% of the trade value, a minimum charge of £20 | ||

| Telephone share dealing | 1% of the trade value, minimum charge of £20, and Maximum charge of £50 | ||

| Direct Debit investment for FTSE 250 shares and selected investment trusts and ETFs | £1.50 per stock per month | ||

| Automated sales to cover charges (selling fund units or shares to cover fees) | £1.50 per deal for shares. No charge for fund | ||

| Quarterly statement and valuation (paperless) | No charge | ||

| Quarterly statement and valuation (paper) | £20 + VAT per year |

| Description | Charge |

| UK Stamp Duty | 0.5% on purchase of UK shares (rounded up to the nearest £5 for residual shares) |

| Panel on Takeover and Mergers | £1 on UK shares deals over £10,000 |

| Irish Stamp Duty | 1% on purchases of Irish shares |

| French Financial Transaction Tax | 0.3% on some French shares |

| Italian Financial Transaction Tax | 0.1% of the trade value, a minimum charge of £20 |

| Telephone share dealing | 1% of the trade value, minimum charge of £20, and Maximum charge of £50 |

| Direct Debit investment for FTSE 250 shares and selected investment trusts and ETFs | £1.50 per stock per month |

| Automated sales to cover charges (selling fund units or shares to cover fees) | £1.50 per deal for shares. No charge for fund |

| Quarterly statement and valuation (paperless) | No charge |

| Quarterly statement and valuation (paper) | £20 + VAT per year |

When it comes to costs, some investors may wonder: is Hargreaves Lansdown expensive? Hargreaves Lansdown charges a 0.45% annual account fee on Stocks and Shares ISAs (capped for larger portfolios), along with dealing charges of £11.95 per trade, which reduce with frequent trading. While not the cheapest platform on the market, many investors feel the high-quality service, research tools, and customer support justify the cost—especially for long-term, hands-off investors.

Deposit and Withdrawal Options

Hargreaves provides easy, free, and straightforward deposit and withdrawal methods.

Deposit Methods

- Debit Card: If you can access your Hargreaves Lansdown account online, you can add money using your debit card by selecting the 'add money' tab. This method is instant.

- Telephone: You can contact the help contact Hargreaves Lansdown on 0117 980 9984 with your debit card details.

- By Post: You can send a cover letter quoting your client’s number, and the cheque will be payable to 'HLAM Client A/C.'

Withdrawal Methods

- Bank transfer – Provided your bank accepts Faster Payment, you can withdraw from the Hargreaves Lansdown app or website. The maximum amount you can request online per day is £9,999.

- Telephone: Hargreaves Lansdown must have cleared your Nominated Bank Account on record and set up your security details to use this method. You can contact them on 0117 980 9950 to request the withdrawal.

Customer Service

Hargreaves Lansdown offers highly-regarded and exclusive customer support via:

- Phone: 8am till 5pm on business days and 9:30am -12:30pm Saturday.

- Via message on their website

You can also book an in-person meeting with Hargreaves Lansdown's financial advisor at their London office, by telephone, or through one of their Bristol representatives.

Trading Platform

In this Hargreaves Lansdown app review, we look at their well-designed and easy-to-navigate trading app and website. The mobile app, available for both Android and iOS devices, offers a smooth user experience and is secured with Touch ID and Face ID to help protect against unauthorised access.

With the trading platforms, you can access your Hargreaves Lansdown online account and buy, sell, and manage transactions.

It´s worth mentioning that the platform feels a bit outdated compared to other available options and brokers, which can affect user experience. However, it still functions effectively.

User Reviews and Opinions

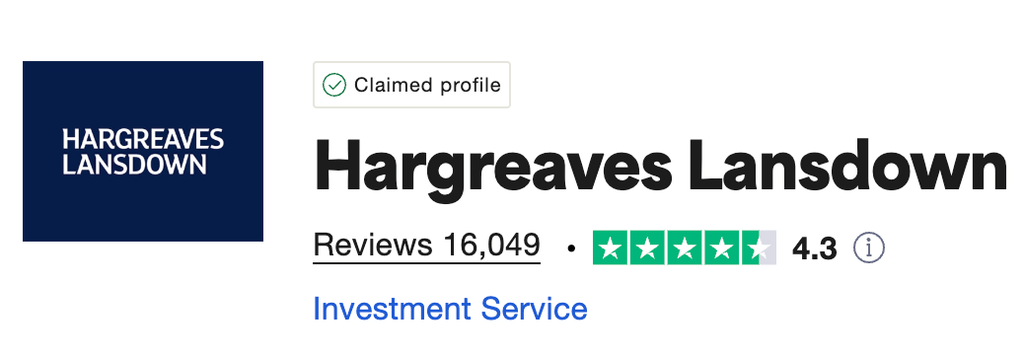

As an old financial institution still holding to its traditional styles of investment strategy, Hargreaves Lansdown has a 4.3 out of 5-star rating on Trustpilot from 16,000+ reviewers.

The majority of the reviews describe the platform's versatility and excellent customer service. However, it loses star ratings because it is expensive to manage for both small and large portfolios.

Also, the Hargreaves Lansdown app has over 1 million downloads on the Google Play Store and over 14,500 reviews and ratings, showing 4.5 out of 5-stars.

Compare Hargreaves Lansdown Competitors

| Feature | Hargreaves Lansdown | AJ Bell | Interactive Investor | Fidelity | |||||

| Account Types | Stocks and Shares ISA, SIPP, General Investment | Stocks and Shares ISA, SIPP, General Investment | Stocks and Shares ISA, SIPP, General Investment | Stocks and Shares ISA, SIPP, General Investment | |||||

| Investment Options | 2,500+ funds, 400+ REITs, stocks, ETFs | 2,500+ funds, stocks, ETFs | 40,000+ funds, stocks, ETFs, trusts | 2,500+ funds, stocks, ETFs | |||||

| Platform Fee | 0.45% for funds (up to £250k); lower for larger amounts | £1.50 to £9.99 per month (depending on account) | £9.99 per month | £0 platform fee for active accounts | |||||

| Trading Fees | £11.95 per trade (shares) | £9.95 per trade (shares) | £7.99 per trade (shares) | £10 per trade (stocks and shares | |||||

| Research & Tools | Excellent research, tools, and investment guides | Good research, fewer tools than HL | Extensive research and guides | Comprehensive research and tools | |||||

| Customer Support | Highly rated, available by phone, email, chat | Good customer service | Good customer service | Excellent customer service | |||||

| Mobile App | Intuitive, well-reviewed app | Good app, not as comprehensive as HL | Comprehensive app | User-friendly mobile app | |||||

| Minimum Investment | £100 minimum for funds, no minimum for stocks | £100 minimum for funds, no minimum for stocks | £100 minimum for funds, no minimum for stocks | £100 minimum for funds, no minimum for stocks | |||||

| ISA Contribution Limits | £20,000 per tax year | £20,000 per tax year | £20,000 per tax year | £20,000 per tax year | |||||

| Best For | Beginners to experienced investors seeking broad investment options and support | Lower fees, budget-friendly for regular investors | Active traders and investors who want low monthly fees | Low-cost investing with good research and tools |

| Feature | Hargreaves Lansdown | AJ Bell | Interactive Investor | Fidelity | |||||

| Account Types | Stocks and Shares ISA, SIPP, General Investment | Stocks and Shares ISA, SIPP, General Investment | Stocks and Shares ISA, SIPP, General Investment | Stocks and Shares ISA, SIPP, General Investment | |||||

| Investment Options | 2,500+ funds, 400+ REITs, stocks, ETFs | 2,500+ funds, stocks, ETFs | 40,000+ funds, stocks, ETFs, trusts | 2,500+ funds, stocks, ETFs | |||||

| Platform Fee | 0.45% for funds (up to £250k); lower for larger amounts | £1.50 to £9.99 per month (depending on account) | £9.99 per month | £0 platform fee for active accounts | |||||

| Trading Fees | £11.95 per trade (shares) | £9.95 per trade (shares) | £7.99 per trade (shares) | £10 per trade (stocks and shares | |||||

| Research & Tools | Excellent research, tools, and investment guides | Good research, fewer tools than HL | Extensive research and guides | Comprehensive research and tools | |||||

| Customer Support | Highly rated, available by phone, email, chat | Good customer service | Good customer service | Excellent customer service | |||||

| Mobile App | Intuitive, well-reviewed app | Good app, not as comprehensive as HL | Comprehensive app | User-friendly mobile app | |||||

| Minimum Investment | £100 minimum for funds, no minimum for stocks | £100 minimum for funds, no minimum for stocks | £100 minimum for funds, no minimum for stocks | £100 minimum for funds, no minimum for stocks | |||||

| ISA Contribution Limits | £20,000 per tax year | £20,000 per tax year | £20,000 per tax year | £20,000 per tax year | |||||

| Best For | Beginners to experienced investors seeking broad investment options and support | Lower fees, budget-friendly for regular investors | Active traders and investors who want low monthly fees | Low-cost investing with good research and tools |

More brokers reviewed for you

FAQs

Is Hargreaves Lansdown too expensive?

Some Hargreaves Lansdown fees and commissions are higher than those of their competitors, while others are lower. Also, the commission fees depend on the plan you want to invest in.

Can I still make a subscription to my ISA if I move to another country?

If you still reside within the European Economic Area (EEA) and can prove your eligibility for an ISA, you can invest money in or apply for an HL stock and shares ISA. If you move outside this area, Hargreaves Lansdown will no longer accept your subscription. This might have changed since Brexit.

Is Hargreaves Lansdown Good?

Yes! It's one of the UK's most trustworthy, reputable and oldest financial institutions, with a track record of excellence and commitment to serving its customers. It's also an FCA-registered financial platform and listed FTSE 100 company. Everything is very transparent.