Reviews

IG Broker Review UK

IG is one of the main financial derivatives brokers, providing access to the forex market and other assets via CFDs and spread betting. The broker generates high confidence due to its size and the fact that IG Group, the parent company, is listed on the London Stock Exchange. As of this writing, it offers more than 18,000 underlying assets to trade.

IG is also one of the most experienced brokers, founded in 1974 in England and headquartered in London. Since its foundation, it has expanded its operations globally, with offices in the United States, Australia, China, and other countries.

Pros and Cons

| Pros of IG Broker | Cons of IG Broker | ||

| ✅ Wide Range of Markets: Access to over 18,000 markets. | ❌ Inactivity Fee: £12 per month after two years of inactivity. | ||

| ✅ Regulated and Secure: FCA regulated with client funds held in segregated accounts. | ❌ Limited Payment Options: Fewer options compared to some competitors. | ||

| ✅ Advanced Platforms: Multiple trading platforms, including MetaTrader 4 and ProRealTime | ❌ No Cryptocurrency Trading: Not available for retail investors in the UK. | ||

| ✅ Educational Resources: Extensive educational tools and resources. | |||

| ✅ Customer Service: 24/7 support with multiple contact options. |

| Pros of IG Broker | Cons of IG Broker |

| ✅ Wide Range of Markets: Access to over 18,000 markets. | ❌ Inactivity Fee: £12 per month after two years of inactivity. |

| ✅ Regulated and Secure: FCA regulated with client funds held in segregated accounts. | ❌ Limited Payment Options: Fewer options compared to some competitors. |

| ✅ Advanced Platforms: Multiple trading platforms, including MetaTrader 4 and ProRealTime | ❌ No Cryptocurrency Trading: Not available for retail investors in the UK. |

| ✅ Educational Resources: Extensive educational tools and resources. | |

| ✅ Customer Service: 24/7 support with multiple contact options. |

Key Features

| Regulation | Regulated by the Financial Conduct Authority (FCA) in the UK. | ||

| Financial Compensation Scheme | Up to £85,000 under the FSCS. | ||

| Products | Spread betting, CFDs, and real shares. | ||

| Markets | Forex, stocks, bonds, indices, commodities, ETFs, IPOs, sector trading, options, futures. | ||

| Account Types | Spread betting, CFD trading, demo, share dealing, smart portfolios. | ||

| Minimum Deposit | No minimum for bank transfers; £250 for PayPal, credit/debit cards. | ||

| Fees | Variable spreads and commissions. | ||

| Withdrawal Fee | No withdrawal fees. | ||

| Inactivity Fee | £12 per month after two years of inactivity. | ||

| Platforms | MetaTrader 4, ProRealTime, IG Online Platform, L2 Platform (DMA), mobile applications, L2 Dealer and US Options and Futures. |

| Feature | Details |

|---|---|

| Regulation | Regulated by the Financial Conduct Authority (FCA) in the UK. |

| Financial Compensation Scheme | Up to £85,000 under the FSCS. |

| Products | Spread betting, CFDs, and real shares. |

| Markets | Forex, stocks, bonds, indices, commodities, ETFs, IPOs, sector trading, options, futures. |

| Account Types | Spread betting, CFD trading, demo, share dealing, smart portfolios. |

| Minimum Deposit | No minimum for bank transfers; £250 for PayPal, credit/debit cards. |

| Fees | Variable spreads and commissions. |

| Withdrawal Fee | No withdrawal fees. |

| Inactivity Fee | £12 per month after two years of inactivity. |

| Platforms | MetaTrader 4, ProRealTime, IG Online Platform, L2 Platform (DMA), mobile applications, L2 Dealer and US Options and Futures. |

Is IG safe?

IG Markets is highly regulated, providing a safe trading environment for its clients. The company is regulated by the FCA in the UK (register number 195355) and holds licenses in various jurisdictions, including:

- Germany: BaFin

- Australia: ASIC

- South Africa: FSCA

- Singapore: MAS

- Japan: JFSA, METI, MAFF

IG adheres to strict transparency and fairness standards as a publicly listed company. Client funds are held in segregated accounts at Tier 1 banks, protecting them from the broker's operational risks.

Is IG regulated?

Yes, IG is a regulated broker. IG must comply with strict regulatory requirements and guidelines when handling its customers' funds. This regulatory status comes with several benefits for traders:

- Asset Protection: Under the FSCS, investors enjoy asset protection of up to £85,000 in case of bankruptcy.

- Segregated Accounts: Clients' funds are held by regulated Tier 1 banks in segregated accounts, unrelated to the broker's operations.

- Creditor Protection: Broker's creditors have no rights to clients' funds in the event of IG's bankruptcy.

- Negative Balance Protection: Customers cannot have a negative balance in their trading account, ensuring they cannot lose more than their deposit. Additionally, for an extra charge, IG provides guaranteed stop-loss orders for further protection.

Below is the protection amount by country:

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | |||

| Europe (except UK and Switzerland) | €20,000 | Federal Financial Supervisory Authority (BaFin) | |||

| Switzerland | ₣100,000 | Swiss Financial Market Supervisory Authority (FINMA) | |||

| USA | No protection | Commodity Futures Trading Commission (CFTC), National Futures Association (NFA) | |||

| Australia | No protection | Australian Securities and Investments Commission (ASIC) | |||

| International | No protection | Bermuda Monetary Authority (BMA) |

| Country | Protection Amount | Regulator |

|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) |

| Europe (except UK and Switzerland) | €20,000 | Federal Financial Supervisory Authority (BaFin) |

| Switzerland | ₣100,000 | Swiss Financial Market Supervisory Authority (FINMA) |

| USA | No protection | Commodity Futures Trading Commission (CFTC), National Futures Association (NFA) |

| Australia | No protection | Australian Securities and Investments Commission (ASIC) |

| International | No protection | Bermuda Monetary Authority (BMA) |

Available Investment Products

IG offers a broad range of financial products and markets, including:

- Stocks: Over 17,000 international stocks.

- Forex: A wide range of currency pairs, including majors, minors, and exotics.

- Indices: More than 80 indices worldwide.

- ETFs: Over 5,400 ETF markets.

- Commodities: Precious metals, energy, and agricultural products.

- Bonds: Bond futures and bond ETFs.

- Interest Rates: Speculate on multiple global interest rates.

- Volatility: Trade volatility indices such as the VIX and EU Volatility index.

Types of Accounts

IG Spread Betting Account

The Spread Betting Account allows traders to speculate on the price movements of a wide range of assets, including stocks, indices, forex, and commodities, without actually owning the underlying asset. It operates as a leveraged product, meaning traders can take larger positions with a smaller initial deposit.

The account offers access to over 17,000+ markets with no commissions, making it an attractive choice for those seeking low-cost trading. Additionally, profits from spread betting are often tax-free in some regions, further increasing its appeal.

CFD Trading Account

With a CFD Trading Account, traders can speculate on the price movements of a wide range of underlying assets, including stocks, indices, forex, and commodities, without owning the assets themselves. CFDs (Contracts for Difference) allow traders to profit from both rising and falling markets.

This account type supports leverage, which amplifies both potential gains and losses, enabling traders to maximise their exposure with a smaller initial capital. The flexibility and range of markets available make CFDs a popular choice among active traders.

Share Dealing Account

The Share Dealing Account is ideal for investors who prefer a more traditional approach to trading. It allows users to buy and hold stocks over the long term, providing access to over 13,000 stocks across global markets. UK shares are available for just £3 commission per trade.

This account type is perfect for investors seeking low-cost execution and the ability to manage their stock investments directly, making it a reliable option for long-term wealth building.

On top of this, IG also offers an ISA Share Dealing Account which is essentially a flexible stocks and shares ISA. It allows you to maximise returns by being more tax-efficient than a standard share dealing account. You can contribute up to £20,000 for the 2025/2026 tax year and any profits are tax-free.

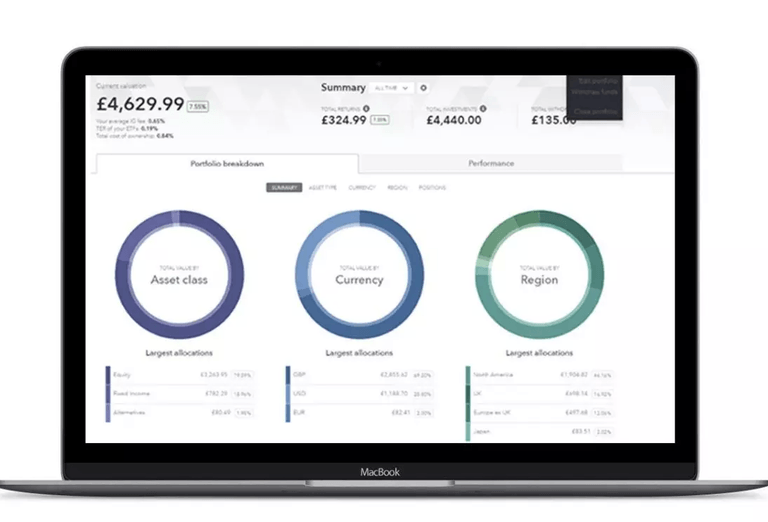

IG Smart Portfolios

IG Smart Portfolios are professionally managed portfolios tailored to individual risk profiles. These portfolios are created by IG's expert team and include a diversified mix of ETFs (Exchange-Traded Funds) that span multiple markets, sectors, and asset classes.

👉 Read here for more information on what is an ETF?

The portfolios are designed for investors who prefer a hands-off approach to investing while still gaining exposure to a broad range of assets. With varying risk levels, IG Smart Portfolios cater to both conservative and more aggressive investors.

IG Smart ISA Portfolio

IG Smart ISAs are professionally managed portfolios designed to help investors grow their wealth in a tax-efficient manner. These portfolios are created by IG’s team of experts and consist of a diversified mix of ETFs (Exchange-Traded Funds), covering multiple markets, sectors, and asset classes.

The portfolios are designed for investors who prefer a hands-off investment approach, providing exposure to a wide range of assets while benefiting from the tax advantages of an ISA.

With varying risk levels, IG Smart ISAs cater to different investor profiles, from conservative to more risk-tolerant individuals, ensuring a tailored investment strategy for all types of investors.

IG Demo Account

The IG Demo Account offers a risk-free way for beginners and experienced traders alike to practice and refine their trading skills. By using virtual money, users can familiarise themselves with the platform's features, tools, and functionalities without risking real capital.

It's an excellent opportunity to test out trading strategies and explore different asset classes before moving on to a live account. This account also provides access to live market data, allowing users to experience real-time trading conditions in a controlled, risk-free environment.

Commissions and Fees

IG generates profit via different commissions, spreads, and other fees, depending on your chosen type of account and asset. The most representative and burdensome for traders are usually trading fees, such as spreads or commissions. These are essentially the costs for opening, closing, and maintaining trading positions.

IG Stocks Commissions/Spreads

IG charges different fees for trading stocks, depending on your type of account. The lowest commission applies to the share dealing account, starting at £0 for US stocks (but you may need to cover a foreign exchange fee) and £3 for UK stocks.

- Spread Betting: This includes the variable spread fee and other fees depending on your strategy (e.g., an overnight fee if the position is left open overnight).

- CFDs on Stocks: Charge a commission per transaction.

IG Forex Spreads

In the forex market, the spreads applied vary depending on market conditions, such as the pair's volatility or liquidity. For example, for the EUR/USD pair (the most liquid pair), a minimum spread of 0.6 pips is applied.

| EUR/USD | 0.6 | 1.04 | 0.85 | ||||

| AUD/USD | 0.6 | 1.03 | 0.82 | ||||

| EUR/GBP | 0.9 | 1.89 | 1.40 | ||||

| GBP/USD | 0.9 | 1.83 | 1.40 |

| Market | Minimum Spread | Average Spread | Average Spread (00:00-21:00) |

|---|---|---|---|

| EUR/USD | 0.6 | 1.04 | 0.85 |

| AUD/USD | 0.6 | 1.03 | 0.82 |

| EUR/GBP | 0.9 | 1.89 | 1.40 |

| GBP/USD | 0.9 | 1.83 | 1.40 |

IG Indices Spreads

The minimum spread for trading indices is 0.4 for the US 500 and varies depending on the index chosen. Here are some examples of costs:

| FTSE 100 | 1 | ||

| Wall Street | 2.4 | ||

| Germany 40 | 1.2 | ||

| Australia 200 | 1 |

| Market | Minimum Spread |

|---|---|

| FTSE 100 | 1 |

| Wall Street | 2.4 |

| Germany 40 | 1.2 |

| Australia 200 | 1 |

Commodities Spreads/Commissions

Commodity trading involves a spread for CFDs or spread betting and a commission for shares.

| Spot Gold | 0.6 | ||

| Spot Silver | 3 | ||

| Crude Oil - US Crude | 6 | ||

| Crude Oil - Brent Crude | 6 |

| Market | Minimum Spread for Futures |

|---|---|

| Spot Gold | 0.6 |

| Spot Silver | 3 |

| Crude Oil - US Crude | 6 |

| Crude Oil - Brent Crude | 6 |

Swaps/Overnight Fees

The swap or “overnight premium” is the commission the broker applies for keeping a position open for more than one day. This cost varies depending on the market and the interest rates plus an administrative cost applied by the broker.

Depositing and Withdrawing

IG supports a variety of payment methods for both deposits and withdrawals:

- Credit/Debit Card

- PayPal

- Bank Transfer

The minimum deposit required to start trading with IG is £250. Deposits via PayPal and credit/debit cards require no minimum deposit and are typically processed instantly, allowing you to start trading right away. However, bank transfers may take a few days to reflect in your account.

For withdrawals, there are no withdrawal fees for PayPal or credit/debit card withdrawals, but there is a minimum amount of £100. Bank transfers, however, may be subject to a fee, and processing times vary—PayPal withdrawals usually take one working day, while bank transfers can take up to three days to complete.

There are also fees for withdrawals in other currencies:

| Account Type | Currency Conversion Charge | ||

| Non-leveraged accounts | 0.5% | ||

| Leveraged accounts | 0.8% |

| Account Type | Currency Conversion Charge |

| Non-leveraged accounts | 0.5% |

| Leveraged accounts | 0.8% |

IG Trading Platforms

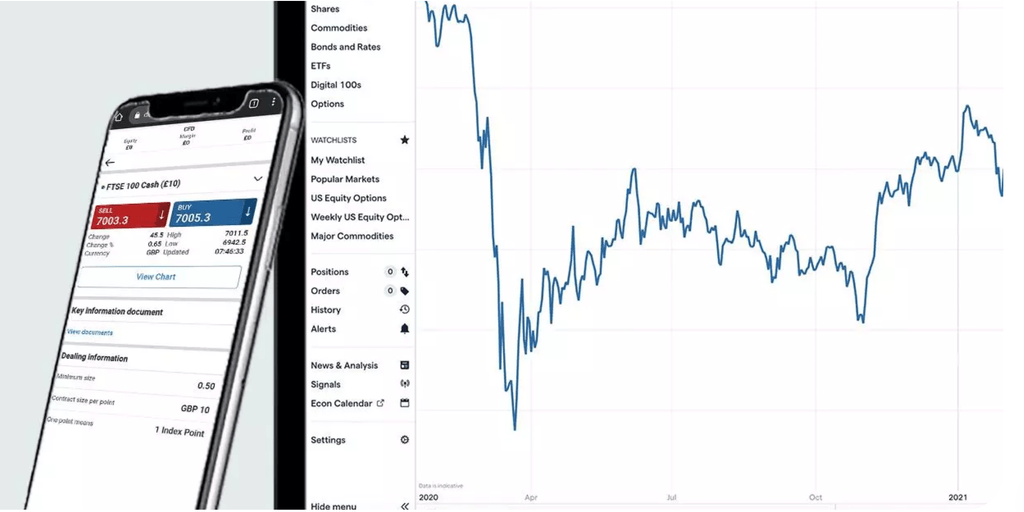

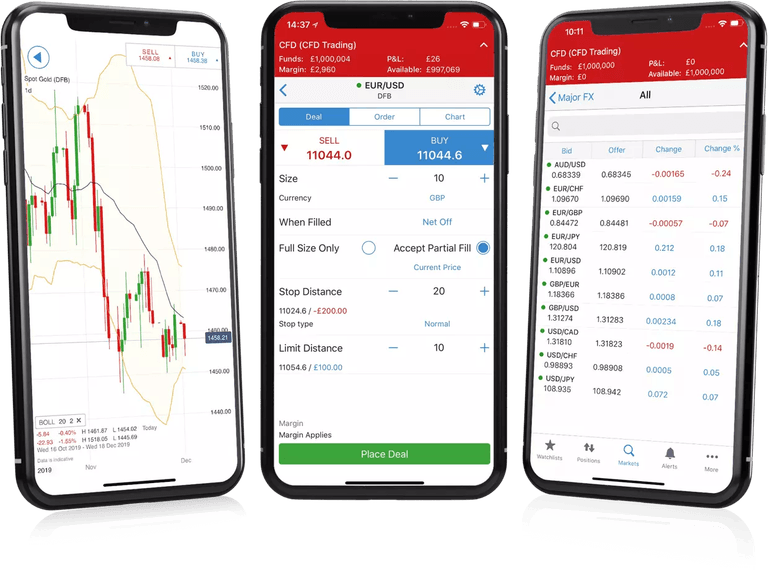

The choice of trading platforms at IG is broad, offering both proprietary and popular third-party platforms:

MetaTrader 4

MetaTrader 4 is perhaps the most popular platform on the market. A large number of traders use this tool due to its simplicity, customisability, depth of analysis, and a wealth of features.

However, for traders looking for more advanced capabilities, MetaTrader 5 offers even more tools for market analysis and trading, making it a top choice for many. When choosing the best broker for MetaTrader 5, it’s important to consider factors like commission fees, trading conditions, and available assets to ensure you get the most out of the platform.

One of the advantages of MetaTrader 4 is the ease of automatic trading strategies, thanks to its Expert Advisors (EAs). The trader does not need to have programming skills to create, install, or use this type of software. MetaTrader 5 also supports EAs and adds further flexibility with multi-asset trading, depth of market analysis, and more advanced charting features.

ProRealTime

ProRealTime is a professional trading platform with advanced analysis tools and a high degree of customisation. It allows for quick order execution, in-depth analysis, creation of custom indicators, automated trading, and backtests.

Access to ProRealTime charts costs £30 per month unless you place at least four trades during the calendar month.

IG Online Platform

IG's proprietary online platform is a powerful browser-based trading solution. It features numerous research tools, including trading signals, an economic calendar, and news, and its execution speeds average 0.014 seconds.

This is the trading solution offered by the broker itself, for the purpose of trading completely online, without the need for downloading.

The IG trading platform, in addition to having all the built-in research tools (news, signals, economic calendar, etc.), allows for efficient trading. With this platform it is possible to trade Turbo24, Barrier or Vanilla Options.

L2 Dealer (DMA)

The L2 Dealer platform provides direct market access (DMA) to the forex and stock markets, offering greater market depth, liquidity, and prices. Due to its complexity and features, it is recommended for professional traders.

This tool provides professional control of trading orders. It allows greater visibility and flexibility in trading.

To obtain DMA prices you only need to have a trading account with IG. However, you must be a premium client to trade stocks. To trade currencies directly you must be a professional client.

The L2 platform is free to download; however, depending on the market you need to view, a live data feed fee may apply.

US Options and Futures

IG provides access to US options and futures, offering traders the ability to speculate on the price movements of various US-based assets. These contracts allow greater leverage, enabling traders to manage risk and potentially amplify returns. Due to the complexity of these products, they are best suited for experienced traders.

The platform provides professional tools to manage options and futures orders, with flexibility in choosing expiry dates and strike prices for options, and the ability to trade on a range of US futures markets.

To access US options and futures, you simply need an IG trading account. However, you must be a professional client to trade US options and futures, as these products involve a higher level of risk.

The US options and futures are available for trading on IG's advanced platforms, which are free to download. Depending on the market and data requirements, additional fees may apply for real-time market data feeds.

Mobile App

IG’s mobile app allows for trading on the go, with an intuitive interface and full functionality. It is compatible with iOS and Android devices and can be downloaded from the App Store or Google Play.

From this application it is possible to control all the operations and management of the trading account. It is able to offer speed in the launching of orders (instant trading).

Resources and Tools

IG offers a comprehensive selection of educational resources and tools designed to support traders at all levels:

- Trading Strategies: IG provides valuable insights into various trading strategies, helping users understand and implement effective techniques for maximising profits and minimising risks.

- Market Updates: Real-time market updates keep traders informed of key events, trends, and movements across global markets, ensuring they can make timely and informed decisions.

- Webinars and Seminars: IG regularly hosts webinars and seminars that cover a wide range of trading topics. These interactive sessions are designed to enhance knowledge, improve trading skills, and address specific areas of interest for traders.

- IG Academy: A comprehensive educational platform offering structured courses tailored for beginners through to advanced traders. These courses cover everything from basic concepts to more sophisticated trading strategies and market analysis techniques.

- Economic Calendar: An essential tool for traders, the economic calendar provides updates on key economic events and reports, allowing traders to track scheduled events that could impact financial markets.

- Financial News: IG offers access to up-to-date financial news from trusted sources, helping traders stay informed on market movements, economic developments, and news that could affect their trading decisions.

With these tools, IG aims to support both new and experienced traders by providing the knowledge, resources, and insights necessary for success in the financial markets.

Bottom Line

IG Markets is a highly reputable broker, offering a comprehensive range of financial products and services. With its extensive market access, advanced trading platforms—widely regarded as some of the best trading platforms in the industry—and robust regulatory framework, IG suits both beginners and experienced traders. The broker's commitment to customer service and education further enhances its appeal.

Additionally, IG provides useful tools like market analysis, economic calendars, and a demo account, making it easier for traders to navigate the financial markets. With a solid reputation and a wealth of resources, IG stands out as a reliable choice for traders worldwide.

More brokers reviewed for you

FAQs

What is IG Markets UK?

Originally, IG was established under the name IG Investors Gold, allowing investors to speculate on the price of gold when currencies stopped being pegged to it. IG Investors Gold became the first spread betting company in the UK.

Today, IG is one of the largest providers of CFDs globally. As a market maker, IG buys and sells assets as a counterparty to the trader. For example, a market maker buys 10 shares in a company for £10 (ask price) from one trader and sells them to another trader for £10.05 (bid price). The difference between the ask and bid price represents the broker's profit. For trading in the currency and stock markets, IG offers direct market access (DMA), which is suitable for professional traders.

IG's business model focuses on excellent customer support, enabling each trader to reach their full potential. IG is under strict regulatory supervision and provides negative balance protection to retail traders, ensuring they cannot lose more than their deposited capital. However, this does not apply to professional trading accounts.

IG Markets UK is a leading financial derivatives broker offering access to forex and other assets via CFDs and spread betting. Founded in 1974, IG is one of the industry's oldest and most experienced brokers. The company is listed on the London Stock Exchange, providing an extra layer of trust and security.

How do you open an IG Account in the UK?

Opening an account with IG is straightforward. Here are the steps:

- Register Online: Provide your details and complete the appropriateness assessment.

- Verify Your Identity: Upload your passport or driving license and a utility bill or bank statement.

- Deposit Funds: No minimum deposit for bank transfers; £250 for PayPal or credit/debit cards.

What is their Customer Service like?

IG offers excellent customer service available 24/7 from 8 am Saturday to 10 pm Friday. Contact options include:

- Phone: 0800 195 3100

- Email: [email protected]

- Chatbot: Available on the website for instant assistance.

Is IG good for beginners?

Yes, IG is a great option for beginners. It offers the IG Academy with free courses, a demo account to practice risk-free, and easy-to-use platforms. Additionally, beginners can access market insights, news, and economic calendars to help make informed trading decisions.

What is the minimum deposit for IG broker?

There is no minimum deposit for bank transfers, and a deposit of £250 for card payment.