Brokers

Interactive Brokers vs eToro Comparison UK

This article was updated as of May 20th 2025.

In recent years, both Interactive Brokers and eToro have experienced significant growth in terms of market share and performance. Currently, they hold prominent positions in the market.

While these two platforms have distinct features, they also share certain similarities. In this article, we will thoroughly analyse their characteristics and perform a detailed comparison of Interactive Brokers Vs eToro.

What are they?

Interactive Brokers

Interactive Brokers, established in 1978 by Thomas Peterffy, stands as a testament to his pioneering spirit in computer-assisted trading. Peterffy recognised the potential of computers in accessing global markets and executing trades at significantly lower costs compared to traditional brokerage firms.

The company's foundation is remarkable, considering that Peterffy initially received only $100 from his parents, which he transformed into a substantial sum by creating a brokerage that has now earned an enormous reputation.

Initially, Interactive Brokers operated as a market maker on the Nasdaq stock market, actively participating in trading on both sides of the market for several highly active over-the-counter (OTC) securities. Currently, Interactive Brokers has developed into an online brokerage firm, offering an extensive range of products and services available to both individual and institutional clients.

Read our Interactive Brokers review to learn more.

eToro

eToro's history traces back to its founding in 2007 when it was driven by a vision to revolutionise the trading landscape.

In 2010, eToro introduced its trading platform and worked to develop a remarkable market strategy, which has driven the company to its current status as a leading and highly respected brokerage firm.

Today, eToro is distinguished as one of the most recommended brokers in the industry, a reward to its innovative approach and success in reshaping the trading world.

Read our eToro review to learn more.

Are they safe?

Regulation and security are essential elements when considering brokers. In the case of Interactive Brokers and eToro, which have gained significant attention, it is important to understand the mechanisms in place to secure clients' funds when dealing on these platforms.

Interactive Brokers

Interactive Brokers has one of the strictest regulatory schemes, having obtained approval from globally recognised agencies, including:

- The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA)

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Central Bank of Ireland (ICB) within the EU

These regulatory bodies impose stringent requirements, making Interactive Brokers a highly secure option for traders. In the case of UK investors, the main regulatory body is the FCA when opening an account with them.

In addition to its regulatory bodies, Interactive Brokers UK holds money in a segregated account. This means that in the event of a failure, these funds will be returned to clients rather than treated as recoverable assets by general creditors. In the event of a shortfall, clients could be compensated up to £85,000 (FSCS) in the event of bankruptcy, ensuring the safety of clients' money.

eToro

eToro adheres to various regulatory frameworks across different countries, ensuring compliance and investor protection:

- eToro (UK) Ltd. operates under the regulation of the Financial Conduct Authority (FCA) in the United Kingdom.x

- eToro AUS Capital Limited is an Australian company authorised by the Australian Securities and Investments Commission (ASIC).

- eToro (Europe) Ltd., based in Cyprus, is regulated by the Cyprus Securities and Exchange Commission (CySEC).

eToro is not legally allowed to use or reinvest clients' funds. Therefore, if insolvency occurs, eToro Money ensures your funds are fully protected, aside from the cost of returning them to you. By safeguarding all client funds, eToro Money is NOT required to comply with the Financial Services Compensation Scheme (FSCS), which only protects up to £85,000 in case of a bank default. Instead, eToro Money is committed to securing all your funds in full.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

- Low trading commissions.

- Wide range of products.

- Interest up to 4.83% on accounts in USD and 3.49% in euro.

Investing in financial products involves a certain level of risk.

Available Products

When comparing the product and market offerings of Interactive Brokers and eToro, it's important to consider the differences in assets and products to choose the best broker for your strategy and goals. Let's examine their respective offerings more closely.

Interactive Brokers

Interactive Brokers focuses more on experienced investors and traders, and their product range reflects this focus. The platform offers an extensive range of products such as:

- Real stocks and ETFs, including fractional shares

- Options from over 30 market centres

- Futures on over 30 market centres

- Spot forex with over 100 currencies available

- CFDs on forex, stocks, indices, and metals.

Additionally, Interactive Brokers operates in over 140 countries across five continents, offering various products suitable for different markets. The platform has been created to please experienced traders with in-depth knowledge of the available products, ensuring a magnific trading experience.

eToro

eToro offers a slightly more simplified product selection than Interactive Brokers.

It includes stocks, ETFs, and cryptocurrencies, and CFDs on various financial assets such as stocks, currencies, futures, indices, and commodities. eToro provides investment options across short, medium, and long-term durations, with or without leverage.

eToro is one of the best copy trading platforms. It lets clients copy the portfolios of top traders, adding a social element to the platform and making it easy to trade successfully without much effort.

Commissions and Trading Fees

When comparing trading fees between Interactive Brokers and eToro, it's clear that these two brokers are quite different and serve different types of customers, as we'll explain in the next sections.

Interactive Brokers

Interactive Brokers offers competitive and low commissions across different markets. However, its cost structure may appear quite overwhelming and confusing. Trading costs and non-trading costs differ according to markets and products, as explained below.

Stocks and ETFs

Interactive Brokers typically offer low commissions for stocks and ETFs. The commissions are volume-based, meaning the cost per share is calculated as a percentage of the trading value, with minimum and maximum limits. ETF fees follow the same structure as those for stocks.

| Market | Commission/share | Minimum | Maximum | ||||

| North America | |||||||

| United States | $0.005 | $1 | 1% | ||||

| Canada | CAD 0.01 | CAD 1 | 0.5% | ||||

| Mexico | 0.1% | MXN 60 | No | ||||

| Europe | |||||||

| United Kingdom | 0.05% | £3 | No | ||||

| Belgium, France, Germany, Spain, Italy, Netherlands | 0.05% | €3 | No | ||||

| Switzerland | 0.05% | CHF 5 | No | ||||

| Austria | 0.10% | €4 | No | ||||

| Poland | 0.1% | PLN 15 | No | ||||

| Norway, Sweden | 0.05% | NOK/SEK 49 | No | ||||

| Portugal | 0.15% | €6 | No | ||||

| Estonia, Latvia, Lithuania | 0.2% | €10 | No | ||||

| Hungary | 0.1% | HUF 200 | No | ||||

| Asia-Pacific | |||||||

| Australia | 0.08% | AUD 6 | No | ||||

| Hong Kong | 0.08% | HKD 18 | No | ||||

| Japan | 0.08% | JPY 80 | No | ||||

| Singapore | 0.08% | USD 2.5 | No |

| Market | Commission/share | Minimum | Maximum |

| North America | |||

| United States | $0.005 | $1 | 1% |

| Canada | CAD 0.01 | CAD 1 | 0.5% |

| Mexico | 0.1% | MXN 60 | No |

| Europe | |||

| United Kingdom | 0.05% | £3 | No |

| Belgium, France, Germany, Spain, Italy, Netherlands | 0.05% | €3 | No |

| Switzerland | 0.05% | CHF 5 | No |

| Austria | 0.10% | €4 | No |

| Poland | 0.1% | PLN 15 | No |

| Norway, Sweden | 0.05% | NOK/SEK 49 | No |

| Portugal | 0.15% | €6 | No |

| Estonia, Latvia, Lithuania | 0.2% | €10 | No |

| Hungary | 0.1% | HUF 200 | No |

| Asia-Pacific | |||

| Australia | 0.08% | AUD 6 | No |

| Hong Kong | 0.08% | HKD 18 | No |

| Japan | 0.08% | JPY 80 | No |

| Singapore | 0.08% | USD 2.5 | No |

Forex

Interactive Brokers uses a volume-based commission structure, so higher trading volumes lead to lower commission rates.

| Monthly traded amount | Commission | Minimum | |||

| USD ≤ 1,000,000,000 | 0.20 basis points of the trade value | $2.00 | |||

| USD 1,000,000,001 - 2,000,000,000 | 0.15 basis points of the trade value | $1.50 | |||

| USD 2,000,000,001 - 5,000,000,000 | 0.10 basis points of the trade value | $1.25 | |||

| USD > 5,000,000,000 | 0.08 basis points of the trade value | $1.00 |

| Monthly traded amount | Commission | Minimum |

| USD ≤ 1,000,000,000 | 0.20 basis points of the trade value | $2.00 |

| USD 1,000,000,001 - 2,000,000,000 | 0.15 basis points of the trade value | $1.50 |

| USD 2,000,000,001 - 5,000,000,000 | 0.10 basis points of the trade value | $1.25 |

| USD > 5,000,000,000 | 0.08 basis points of the trade value | $1.00 |

Mutual funds

Non-U.S. residents can purchase thousands of mutual funds outside the U.S. without transaction fees. However, most other funds have a commission of €4.95 per trade (or currency equivalent).

The fee structure is percentage-based:

| Country of the fund | Fee | Minimum | Maximum | ||||

| US funds with no transaction fees | 0% | $0 | $0 | ||||

| Euronext fixed pricing structure | 0.1% of the trade value | €4 | €29.00 | ||||

| Other funds | €4.95 | N/A | N/A |

| Country of the fund | Fee | Minimum | Maximum |

| US funds with no transaction fees | 0% | $0 | $0 |

| Euronext fixed pricing structure | 0.1% of the trade value | €4 | €29.00 |

| Other funds | €4.95 | N/A | N/A |

Bonds

Interactive Brokers generally maintain low bond fees based on trading volume and include a minimum amount.

| Bonds | Volume | Commission | Minimum | Maximum | |||||

| US Corporate | Nominal value ≤ $10,000 | 0.10% * nominal value | $1 | $250 or 1% of market value, whichever is lower | |||||

| US Treasuries | Nominal value ≤ $1,000,000 | 0.002% * nominal value | $5 | No | |||||

| United Kingdom | Market value ≤ £10,000 | 0.10% * market value | No | No | |||||

| Hong Kong Government | Market value ≤ HKD 15,000,000 | 0.08% * market value | HKD 18 | No |

| Bonds | Volume | Commission | Minimum | Maximum | |||||

| US Corporate | Nominal value ≤ $10,000 | 0.10% * nominal value | $1 | $250 or 1% of market value, whichever is lower | |||||

| US Treasuries | Nominal value ≤ $1,000,000 | 0.002% * nominal value | $5 | No | |||||

| United Kingdom | Market value ≤ £10,000 | 0.10% * market value | No | No | |||||

| Hong Kong Government | Market value ≤ HKD 15,000,000 | 0.08% * market value | HKD 18 | No |

Futures

Just like with options, Interactive Brokers charges fees based on the number of contracts traded for futures. Here are some examples:

| Futures | Commission per contract | ||

| United Kingdom | £1.70 | ||

| United States | $0.85 | ||

| Canada | CAD 2.40 | ||

| Australia | AUD 5 | ||

| Hong Kong | HDK 20 |

| Futures | Commission per contract |

| United Kingdom | £1.70 |

| United States | $0.85 |

| Canada | CAD 2.40 |

| Australia | AUD 5 |

| Hong Kong | HDK 20 |

CFDs

Interactive Brokers offers low CFD trading fees:

| CFD | Monthly traded amount | Commission per share | Minimum | ||||

| CFD on US stocks | ≤ $300,000 | $0.005 | $1.0 | ||||

| CFD on European stocks | ≤ 10,000,000€ | 0.05% | €3.0 | ||||

| CFD on Australian stocks | ≤ 10,000,000 AUD | 0.05% | AUD 5.0 | ||||

| CFD on Hong Kong stocks | ≤ HKD 300,000,000 | 0.05% | HKD 12.0 | ||||

| CFD on Japanese stocks | ≤ 9,000,000,000 | 0.03% | JPY 100.0 | ||||

| CFD on US 500 index | - | 0.005% | $1.0 | ||||

| CFD on UK 100 index | - | 0.005% | £1.0 | ||||

| CFD on Japan 225 index | - | 0.01% | JPY 40.0 | ||||

| CFD on currencies | ≤ 1,000,000,000 | 0.20 basis points * trade value | $2.0 |

| CFD | Monthly traded amount | Commission per share | Minimum |

| CFD on US stocks | ≤ $300,000 | $0.005 | $1.0 |

| CFD on European stocks | ≤ 10,000,000€ | 0.05% | €3.0 |

| CFD on Australian stocks | ≤ 10,000,000 AUD | 0.05% | AUD 5.0 |

| CFD on Hong Kong stocks | ≤ HKD 300,000,000 | 0.05% | HKD 12.0 |

| CFD on Japanese stocks | ≤ 9,000,000,000 | 0.03% | JPY 100.0 |

| CFD on US 500 index | - | 0.005% | $1.0 |

| CFD on UK 100 index | - | 0.005% | £1.0 |

| CFD on Japan 225 index | - | 0.01% | JPY 40.0 |

| CFD on currencies | ≤ 1,000,000,000 | 0.20 basis points * trade value | $2.0 |

Additionally, Interactive Brokers is very interesting due to its low non-trading service fees. There are no charges for deposits, inactivity, or account maintenance. However, a small fee applies to additional monthly withdrawals (£10 per withdrawal, with the first one each month being free).

eToro

eToro's fee structure is much simpler. The platform charges several types of fees:

- Conversion Fee: Accounts are only in USD, so depositing or withdrawing GBP requires covering a variable conversion fee.

- Spread: This variable cost is included in the prices shown on the platform.

- Overnight Fee: This applies if CFD positions remain open overnight.

- Withdrawal Fee: A fee of $5 per withdrawal.

- Inactivity Fee: Charged after 12 months of inactivity.

However, you still need to cover the spread, as shown below:

| Financial product | Spread | ||

| Currencies | Starting from 1 Pip | ||

| Commodities | Starting from 2 Pips | ||

| Stock Indices | Starting from 0.75 points | ||

| Stocks and ETFs (CFDs) | 0.15% | ||

| Cryptocurrencies | 1% |

| Financial product | Spread |

| Currencies | Starting from 1 Pip |

| Commodities | Starting from 2 Pips |

| Stock Indices | Starting from 0.75 points |

| Stocks and ETFs (CFDs) | 0.15% |

| Cryptocurrencies | 1% |

ISAs and SIPPs

| Feature | Interactive Brokers | eToro | |||

| ISA Type | Stocks & Shares ISA | Stocks & Shares ISA | |||

| SIPP Availability | Through approved SIPP Administrators | Directly via eToro | |||

| Minimum Deposit | None | None | |||

| Monthly Fees | £3 (ISA/SIPP) | £4.99 (Standard ISA); £9.99 (Plus SIPP) | |||

| Trading Fees | £3 per trade (UK/Europe); $0.005/share (US) | Commission-free | |||

| Flexibility | Non-flexible ISA | Flexible ISA | |||

| Currency | GBP only | GBP only | |||

| Investment Options | Broad range (stocks, options, futures, etc.) | Stocks, ETFs, investment trusts | |||

| SIPP Contributions | Personal contributions only | Personal contributions only | |||

| Employer Contributions | Not supported | Not supported |

| Feature | Interactive Brokers | eToro |

| ISA Type | Stocks & Shares ISA | Stocks & Shares ISA |

| SIPP Availability | Through approved SIPP Administrators | Directly via eToro |

| Minimum Deposit | None | None |

| Monthly Fees | £3 (ISA/SIPP) | £4.99 (Standard ISA); £9.99 (Plus SIPP) |

| Trading Fees | £3 per trade (UK/Europe); $0.005/share (US) | Commission-free |

| Flexibility | Non-flexible ISA | Flexible ISA |

| Currency | GBP only | GBP only |

| Investment Options | Broad range (stocks, options, futures, etc.) | Stocks, ETFs, investment trusts |

| SIPP Contributions | Personal contributions only | Personal contributions only |

| Employer Contributions | Not supported | Not supported |

Interactive Brokers: Best for experienced investors who want global market access and powerful tools. If you're comparing SIPP vs ISA, IBKR offers a strong SIPP route via administrators, while their ISA is ideal for tax-efficient investing with low trading costs.

eToro: A solid choice for beginners and passive investors seeking the best stocks and shares ISA experience with a user-friendly app and commission-free trading. eToro also simplifies pension investing with a directly managed SIPP.

Trading platform

After reviewing the commissions and fees, let's focus on the trading platforms. Interactive Brokers and eToro share one thing in common: both use their own custom-designed platforms, each aiming to be the best trading platform in its category by offering significant value and a competitive edge.

Interactive Brokers

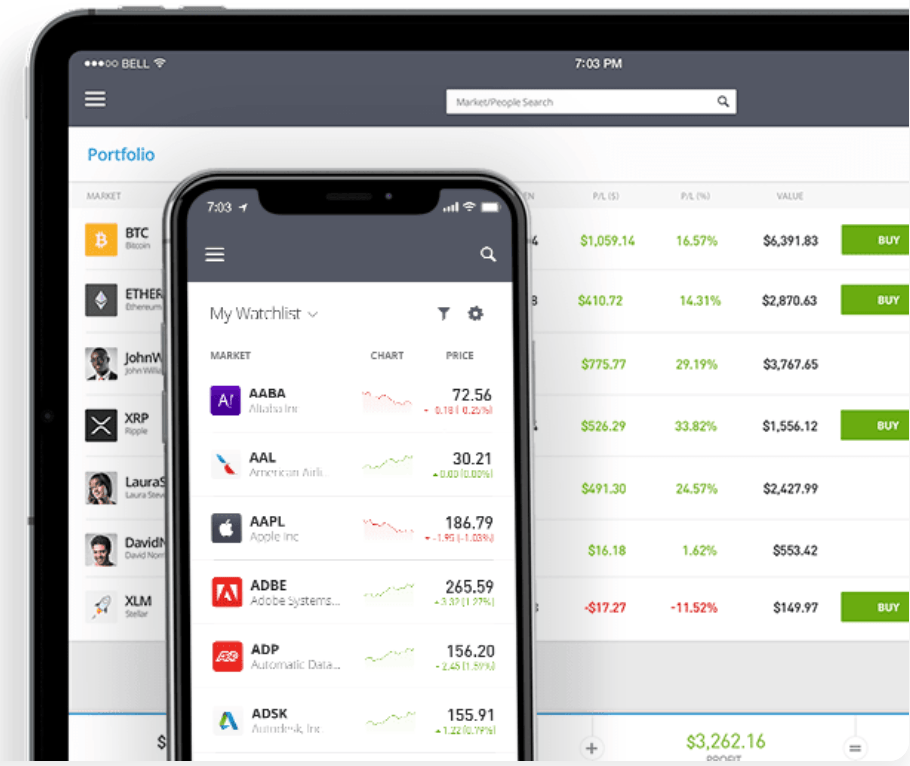

Interactive Brokers delivers a feature-rich platform with tools and resources designed for specialised investors. It's accessible as a web application or a downloadable app for PC and Mac. The two web platforms available are Client Portal and Webtrader.

The platform primarily targets professional investors and may take some time to learn. Its features aren't always intuitive for beginners.

Interactive Brokers also offers a mobile platform for iOS and Android devices, allowing clients to trade and manage their investments on the go.

eToro's Trading Platform

eToro provides a proprietary trading platform known for its user-friendly and intuitive interface, making it accessible to a wide range of traders, from beginners to experienced investors.

The platform is web-based and can be accessed through a browser without any downloads. It offers a seamless trading experience for various financial assets, such as stocks, ETFs, currencies, and cryptocurrencies.

Unique Features:

- CopyTrader:

- Replicate Popular Investors: CopyTrader lets users copy the portfolios of successful traders, making it great for beginners and passive investors.

- Assess Performance: Users can view the traders' profiles and annual and monthly performance records, which are public.

- Risk Score: Each trader receives a risk score, and detailed statistics such as the number of trades per week, average holding period, and performance charts are available.

- Investment Minimum: The minimum investment for using this feature is $200, but it allows customisation based on user preferences and risk tolerance.

- Smart Portfolios:

- Automated Investments: Smart Portfolios provide automated investment solutions.

- Optimised Returns: These portfolios are intelligently diversified to optimise returns, considering users' risk levels and investment goals.

*Past performance is not an indication of future results

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and

you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Examples of eToro's Investing Opportunities:

- Theme-Based Investing:

- Invest in portfolios centered around themes like future payment systems, drone tech, renewable energies, and more.

- "Star" Trader Portfolios:

- Invest in portfolios featuring a selection of standout traders on the platform.

No Additional Fees:

These portfolios don't have extra management fees or commissions, except for fees tied to the underlying assets. CFD allocation is clearly indicated so users can verify performance, asset distribution, and investment strategy.

Portfolio Creation:

- Smart Portfolios are created using eToro's algorithms, which rely on machine learning and data science.

- External Partners: Sometimes, eToro's external partners also help design these portfolios.

Simplicity:

Though the strategy may seem complex, eToro provides a user-friendly solution, making it easy for investors to access diverse investment opportunities across various assets.

*Past performance is not an indication of future results

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

- Low trading commissions.

- Wide range of products.

- Interest up to 4.83% on accounts in USD and 3.49% in euro.

Investing in financial products involves a certain level of risk.

Deposits and withdrawals of funds

When choosing between Interactive Brokers and eToro, it's important to consider how each platform handles deposits and withdrawals, including the conditions, requirements, and overlooked details. Here is a breakdown of how these processes differ:

Interactive Brokers Deposit & Withdrawal Fees

Deposits:

- Bank Transfers: Generally free, but third-party bank fees may apply.

- Physical Currency: Not accepted; if attempted, a special handling fee of 1% (minimum $50) is charged.

- Minimum Deposit: £0

Withdrawals:

- Free Withdrawal: One free withdrawal per calendar month.

- Subsequent Withdrawals:

- Bank Wire: $10 USD

- SEPA/BACS: $1 USD

- Checks: $4 USD

- Currency Conversion: IBKR accounts are multi-currency; conversion fees may apply when transferring between currencies.

eToro Deposit and Withdrawal Fees:

Deposits:

- Free for all methods, including bank transfers, debit/credit cards, and e-wallets.

- Minimum Deposit: $50

Withdrawals:

- USD Accounts: Flat $5 fee per withdrawal, with a minimum of $30.

- GBP & EUR Accounts: Free withdrawals.

- Processing Times:

- eToro Money: Instant

- Bank Transfers: Up to 10 business days

- Credit/Debit Cards & E-wallets (e.g., PayPal, Skrill): Up to 2 business days

- Currency Conversion: 0.5% fee applies when depositing or withdrawing in currencies other than USD.

Research and Education

eToro Research & Education:

eToro offers a variety of educational resources to help users improve their trading and investing skills. The platform provides a comprehensive Academy with beginner-friendly courses covering topics like trading basics, technical analysis, and portfolio management.

Additionally, eToro features a Social Feed, where traders can share insights, strategies, and market updates. The CopyTrading feature allows users to learn from and copy the strategies of more experienced traders. For more advanced learners, eToro hosts webinars and guides, which offer in-depth analysis and expert insights into various trading techniques and investment strategies.

Interactive Brokers Research & Education:

Interactive Brokers offers an extensive range of research and educational tools designed for both beginner and professional investors. Their Trader Workstation (TWS) provides access to real-time data, advanced charting, and a wide variety of market reports from top financial institutions. The platform also features IBKR Campus, which offers educational resources covering everything from basic trading concepts to complex financial strategies.

Interactive Brokers also provides webinars, articles, and video tutorials to help users enhance their trading skills. With access to expert analysis, comprehensive market research, and educational content, Interactive Brokers ensures that traders have the tools they need to make informed decisions.

Customer Service

Quality customer service is crucial when comparing Interactive Brokers and eToro. Here’s how each broker handles support:

Customer service at Interactive Brokers

- Contact Methods:

- Phone Support: Available 24/7 via a dedicated phone line

- Email and Chat: Additional support is available through email and live chat.

- FAQs: A comprehensive FAQ section is available to answer common questions.

Customer service at eToro

- Support Channels:

- Live Chat: Users can engage with customer support via live chat.

- Help Panel: The platform has a "Help" option for submitting support tickets. Response times are generally quick.

- FAQs: A well-organised FAQ section addresses common questions.

However, eToro does not offer phone support for inquiries or complaints, which might be a consideration for those who prefer direct communication.

Which Broker is Better: Interactive Brokers or eToro?

Both Interactive Brokers and eToro are reputable brokers offering extensive financial products and are regulated by the UK's Financial Conduct Authority (FCA). However, each broker is more suitable to a different audience, offering them with unique features and strengths:

Interactive Brokers:

- Product Range: Provides a comprehensive range of financial products, including futures, options, currencies, stocks, ETFs, and CFDs.

- Audience: Designed for advanced investors and professionals handling high trading volumes.

- Pricing: Operates on a volume-based fee structure with minimum and maximum thresholds.

- Customer Support: Offers 24/7 support via phone, email, and chat.

- Platform: More suitable for experienced users and traders with complex tools and resources.

eToro:

- Social Trading: Features CopyTrader, enabling users to replicate successful traders' portfolios.

- Ease of Use: Designed with user-friendly technology for beginners.

- Product Range: Specialises in stocks, ETFs, currencies, CFDs, and cryptocurrencies (limited in the UK).

- Pricing: Offers competitive fees with 0% commissions on stocks, ETFs, and low-cost CFDs.

- Customer Support: Provides live chat and ticket support but lacks phone support.

Conclusion:

- Interactive Brokers is ideal for experienced investors looking for diverse assets and sophisticated tools.

- eToro is best for beginner investors seeking a simple, affordable platform with unique social trading features.

Ultimately, your decision should align with your investing experience, investment goals, and preferred platform features.

- Equities, ETFs, crypto both real and derivatives

- Social trading e copy trading

- User-friendly platform and demo account

61% of investor accounts lose money by trading CFDs with this provider.

- Low trading commissions.

- Wide range of products.

- Interest up to 4.83% on accounts in USD and 3.49% in euro.

Investing in financial products involves a certain level of risk.

Summary of the comparative analysis

| Aspects to compare | Interactive Brokers | eToro | |||

| Regulator | CySEC FCA ICB | CySEC FCA ASIC | |||

| Products available | Stocks and ETFs Currency pairs Futures Bonds Options CFDs | Stocks and ETFs Currency pairs Indices Ready-made portfolios CFDs Cryptocurrencies | |||

| Trading fees | Variable, based on trading volume | Spread might apply | |||

| Customer service | Phone, mail, chat, website form | Live chat, ticket support | |||

| Platform | Several platforms supported | Browser-based, mobile phone | |||

| Strengths | ✅Access to countless assets ✅24/7 customer service ✅Platform for professional traders | ✅Social trading (Copytrading). ✅Real assets & CFDs, cryptocurrency | |||

| Weaknesses | ❌Not very intuitive for beginners | ❌Base currency is USD only (FX change fee) ❌Minimum bank transfer of $500 ($50 via other methods) | |||

| Investor/Trader profile | Recommended for experienced traders/investors | Recommended for beginners Experts can join the social trading programme for extra income |

| Aspects to compare | Interactive Brokers | eToro |

| Regulator | CySEC FCA ICB | CySEC FCA ASIC |

| Products available | Stocks and ETFs Currency pairs Futures Bonds Options CFDs | Stocks and ETFs Currency pairs Indices Ready-made portfolios CFDs Cryptocurrencies |

| Trading fees | Variable, based on trading volume | Spread might apply |

| Customer service | Phone, mail, chat, website form | Live chat, ticket support |

| Platform | Several platforms supported | Browser-based, mobile phone |

| Strengths | ✅Access to countless assets ✅24/7 customer service ✅Platform for professional traders | ✅Social trading (Copytrading). ✅Real assets & CFDs, cryptocurrency |

| Weaknesses | ❌Not very intuitive for beginners | ❌Base currency is USD only (FX change fee) ❌Minimum bank transfer of $500 ($50 via other methods) |

| Investor/Trader profile | Recommended for experienced traders/investors | Recommended for beginners Experts can join the social trading programme for extra income |

FAQ

Can I trade cryptocurrencies on Interactive Brokers?

No, Interactive Brokers does not offer cryptocurrency to UK residents. If you want to buy and sell crypto, you may want to consider eToro instead. An alternative might be ETFs on crypto.

What is the minimum deposit required to open an account with Interactive Brokers?

Interactive Brokers has different minimum deposit requirements depending on the type of account you wish to open. For individual or joint accounts, the minimum deposit is $0, meaning there is no specific minimum requirement. However, to trade on margin or access certain features, a minimum deposit of $2,000 is typically required.

Can I transfer my existing ISA to IBKR or eToro?

Yes, both platforms allow ISA transfers. However, make sure you're transferring to a similar account type (Stocks & Shares ISA). Always check with the provider for any specific requirements.

Disclaimer: