Reviews

Trading 212 Review: Pros and Cons

In the following article, we present a complete review of the Trading 212 broker, an online broker that has become famous for its simplicity of use and the friendliness of its platform, at affordable commissions. But is it as good a broker as it seems?

Let's check it out!

What is it and how does it work?

Trading 212 is an online investment platform regulated by the UK's Financial Conduct Authority (FCA). It is well-known for offering commission-free investments and compared with many other brokers like freetrade vs trading 212.

Originally from Bulgaria, Trading 212 has over 2.5 million clients worldwide and has gained the trust of global investors. The platform allows users to instantly buy shares of popular companies and invest in fractional shares starting from just €1. Users can create and customise diversified portfolios based on their financial goals.

Additionally, Trading 212 offers multi-currency accounts, enabling deposits and investments in thirteen different currencies, which helps save on exchange rate costs. Most importantly, it offers daily interest on cash not invested in the account. For example, accounts opened in pounds can earn up to 4.5% interest on uninvested cash. Interest rates vary for other currencies, providing different rates for uninvested funds.

However, for other currencies, these are the interest rates with which Trading 212 currently remunerates uninvested funds.

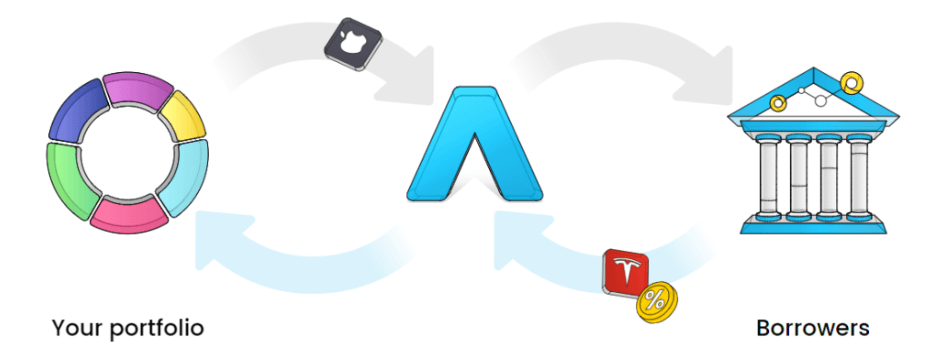

On the other hand, we must highlight a unique feature that very few brokers offer: the possibility of lending your shares to other investors so they can use them for short trading.

Typically, brokers engage in this practice without asking their clients' permission. However, with Trading 212, you can choose to lend your shares and receive interest for it. The broker splits the profits equally (50/50) between you and themselves. Furthermore, this will not affect your ability to sell your shares or collect dividends when you want to.

Key Features

| Regulatory body | FCA in the United Kingdom, CySEC in Cyprus, FSC (Bulgaria) and ASIC (Australia) | ||

| Protection Scheme | £85,000 by the FCA | ||

| Products available | +10,000 stocks and ETFs, Derivatives on various assets & ISA account avaialble | ||

| Markets | +30 European markets, USA, Canada and Asia. | ||

| Account types | Invest, ISA and demo | ||

| Supported Currencies | GBP, USD, EUR, and others | ||

| Trading Fees | Invest Account: No commissions (only 0.15% per FX exchange rate) | ||

| Minimum Deposit | £10 | ||

| Contact | Email: [email protected] | ||

| Inactivity Fee | No | ||

| Withdrawal Fee | No | ||

| Featured product | Account paid at 4.5% (in GBP) on the uninvested balance | ||

| Demo Account | Yes |

| Regulatory body | FCA in the United Kingdom, CySEC in Cyprus, FSC (Bulgaria) and ASIC (Australia) |

| Protection Scheme | £85,000 by the FCA |

| Products available | +10,000 stocks and ETFs, Derivatives on various assets & ISA account avaialble |

| Markets | +30 European markets, USA, Canada and Asia. |

| Account types | Invest, ISA and demo |

| Supported Currencies | GBP, USD, EUR, and others |

| Trading Fees | Invest Account: No commissions (only 0.15% per FX exchange rate) |

| Minimum Deposit | £10 |

| Contact | Email: [email protected] |

| Inactivity Fee | No |

| Withdrawal Fee | No |

| Featured product | Account paid at 4.5% (in GBP) on the uninvested balance |

| Demo Account | Yes |

Pros and Cons

| Pros of Trading 212 | Cons of Trading 212 | ||

| ✅ No fees for trading stocks, ETFs, or using the ISA account. | ❌ For certain stocks or during volatile periods, spreads may be higher than average. | ||

| ✅ Clean, intuitive app and web platform suitable for all experience levels. | ❌ Though separate from the Invest/ISA accounts, the CFD account offers leveraged products that can be risky for beginners. | ||

| ✅ Offers one of the best Stocks and Shares ISA, allowing tax-free investment returns for UK residents. | ❌ High demand periods have led to service delays or temporary access limitations in the past. | ||

| ✅ Access to UK, US, and European stocks, ETFs, and CFDs (in a separate account). | ❌ Some users report slow processing when transferring ISAs to or from Trading 212. | ||

| ✅ No hidden charges just for keeping your account open. | |||

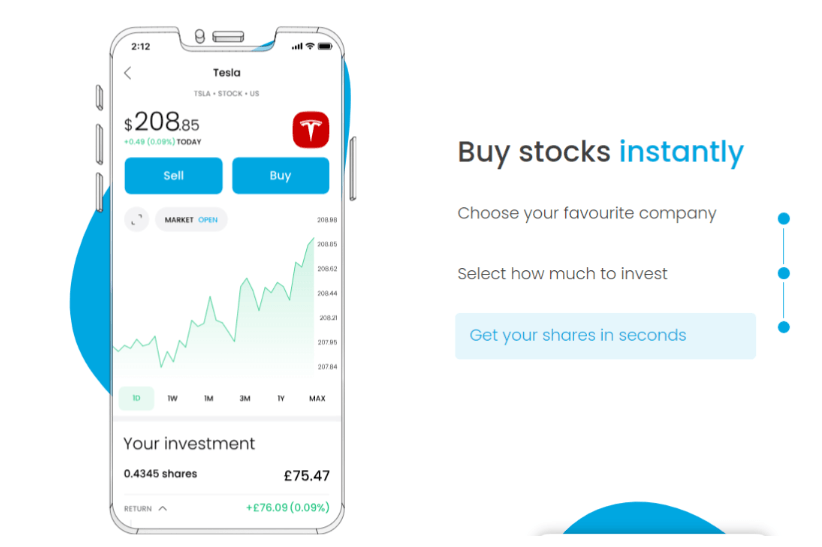

| ✅ Real-time buying and selling, especially for popular stocks. |

| Pros of Trading 212 | Cons of Trading 212 |

| ✅ No fees for trading stocks, ETFs, or using the ISA account. | ❌ For certain stocks or during volatile periods, spreads may be higher than average. |

| ✅ Clean, intuitive app and web platform suitable for all experience levels. | ❌ Though separate from the Invest/ISA accounts, the CFD account offers leveraged products that can be risky for beginners. |

| ✅ Offers one of the best Stocks and Shares ISA, allowing tax-free investment returns for UK residents. | ❌ High demand periods have led to service delays or temporary access limitations in the past. |

| ✅ Access to UK, US, and European stocks, ETFs, and CFDs (in a separate account). | ❌ Some users report slow processing when transferring ISAs to or from Trading 212. |

| ✅ No hidden charges just for keeping your account open. | |

| ✅ Real-time buying and selling, especially for popular stocks. |

Is it safe?

Trading 212 is a broker founded in 2007 in Bulgaria. However, the company later moved to England and maintained its Bulgarian entity. Today it has several branches, in the United Kingdom, Bulgaria, Cyprus and Australia.

Trading 212 has implemented robust security measures to protect its clients' funds and data . These are the three regulators by which it is supervised:

- FCA (UK): For UK customers. License number: 609146

- CySEC (Cyprus): Its regulation applies to most Western European countries

- FSC (Bulgaria)

- ASIC (Australia)

For UK customers, and per the FCA's CASS rules (chapter 6), clients' assets are held in a segregated account with a custodian, completely separated from Trading 212's assets. In addition, in the unlikely event of bankruptcy, the value of your client funds and assets is protected by the FSCS up to £85,000.

Available Products

The range of products varies according to the type of account chosen. Trading 212 is a broker for stocks and ETFs (including fractional ones), but it also offers derivatives on other types of products, such as indices, raw materials, and cryptocurrencies.

Stocks and ETFs

The broker offers more than 10,000 shares and ETFs from major global markets (NYSE, Nasdaq, LSE, Euronext, etc.). Additionally, it provides access to fractional shares and ETFs, starting from €1.

To learn more about ETFs, read our detailed guide: What is an ETF?

Shares Lending

On the other hand, it is notable that Trading 212 has a daily interest remuneration program on your portfolio. This is different from a remunerated balance account (which Trading 212 also offers); instead, it is remuneration for lending shares.

Thus, this program is based on lending your shares to another person who will trade with them (generally opening short positions). In exchange, the lender obtains a series of daily interest payments (shared with Trading 212), without giving up the right to receive dividends or the ability to sell the borrowed shares at any time.

Interests on your Uninvested Cash

Trading 212 also offers an interest on your uninvested cash service, available in up to 13 different currencies (all of which you can open an account with).

As of May 5th, 2025, the interest on uninvested cash is as follows, depending on the currency:

- GBP: 4.5% annually

- EUR: 2.4% annually

- USD: 4.1% annually

- Other currencies: The CZK (Czech koruna), PLN (Polish zloty), HUF (Hungarian forint), and DKK (Danish krone) also have very appealing interest rates, always above 2% (except CHF).

Regarding the conditions of this low-risk product, they are straightforward: Interest is calculated and paid daily on uninvested money. You can withdraw your money whenever you want without losing a single day of interest collection (conditions apply*).

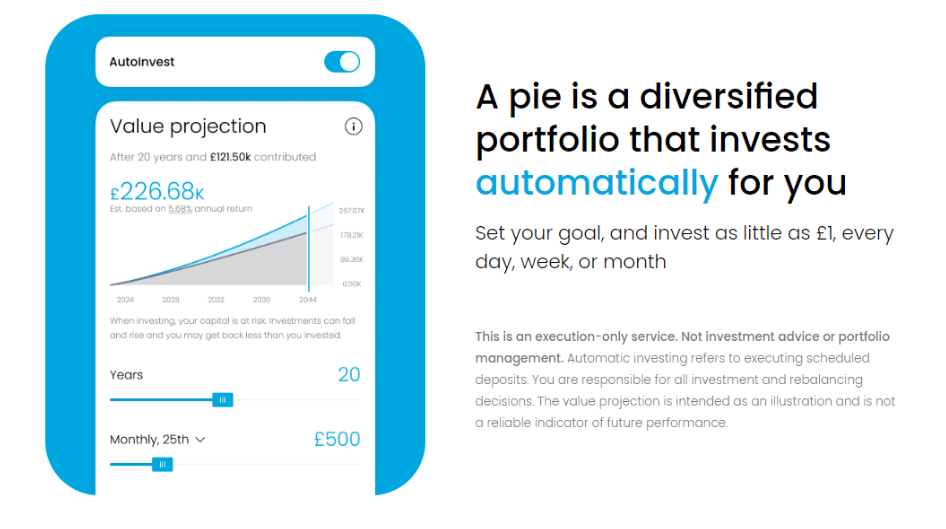

Investment Plans

Another interesting option are the investment plans that Trading 212 makes it easy to create from scratch (the broker calls them "pies"). Instead of investing in individual stocks or ETFs, you can create your own investment plan, choosing how much weighting to give to each of the products you select (stocks or ETFs).

Furthemore, you can enable the automatic deposits to invest regularly.

Payment Cards

Trading 212 offers a card service you can use on your daily spending. All the cash available in your account can generate interest at a 4.5% interest rate on your pounds. Among the main conditions are:

- 4.5% APY on your pounds

- 0.5% cashback on your spending

- 0 FX fee

- No monthly subscription

Account Types

Trading 212 offers 3 main accounts for UK residents. The differences are mostly in terms of products available and the tax-friendly account such as the ISA.

Trading 212 Invest

The Trading 212 Invest account stands out for being a multi-currency option, allowing investors to trade in multiple currencies and avoid FX costs.

Users can invest commission-free, although other fees may apply depending on the platform's terms and conditions. Trading 212 Invest enables users to buy shares instantly and offers the option to invest in fractional shares starting from €1, allowing investors to own parts of large companies such as Google, Amazon, and Apple.

Furthermore, you can build diversified portfolios across global markets, including the UK, US, and European exchanges, all from a single platform. The user-friendly mobile and web apps make it easy to monitor holdings, set price alerts, and automate investments through features like AutoInvest. While it’s well-suited for long-term investors, it’s important to note that Trading 212 Invest is not a tax-sheltered account, so gains may be subject to capital gains tax depending on your personal circumstances.

Trading 212 ISA

The ISA account offers the same conditions as the Invest account but it allows to do it under the tax-friendly system. With this account, UK residents can invest up to £20,000 per year without paying capital gains tax on their investment returns.

Like the Invest account, it supports commission-free trading and fractional shares. However, users can only open one Stocks and Shares ISA per tax year, and funds must come from within the UK. It’s ideal for long-term investors seeking to grow their wealth in a tax-efficient way.

Trading 212 CFD

The CFD (Contract for Difference) account is intended for more advanced traders who want to speculate on the price movements of financial instruments such as stocks, indices, forex, and commodities—without owning the underlying asset.

This account offers leveraged trading (up to 1:30 for retail clients), which increases both potential gains and risk.

Trading 212 earns money through spreads and overnight fees rather than commissions. CFDs are complex products and come with a high risk of losing money, so this account is best suited for experienced investors.

Fees

Trading 212's commission policy for stocks and ETFs is straightforward. Here's a breakdown:

- Shares and ETFs: Investment at 0 euros commission (other commissions may apply**)

- Custody or maintenance fee: Free

- Currency exchange rate: 0.15%

Non-Trading Fees

Trading 212 is also economical in terms of non-trading fees:

- Deposit (bank transfer): 0 euros

- Deposit (cards, Google Pay, etc.): 0.7%

- Withdrawal: 0 euros

- Minimum deposit: 10 euros (in euros)

- UK Stamp Duty: 0.5%

As you can see, their commission system is really simple and affordable. Regarding cash stocks and ETFs, Trading 212 is an economical and easy-to-operate broker.

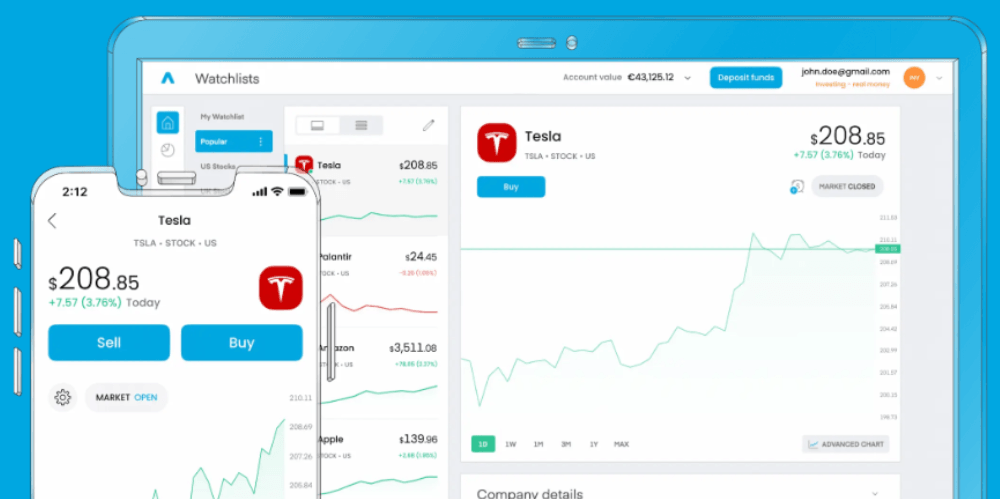

Platform

Trading 212 offers one of the best trading platforms that is very easy to use and navigate.

In addition to its spot stock account, it offers derivatives trading, featuring a trading platform for customisation and research. It includes useful tools such as alerts and notifications, portfolio and commission reports showing performance, accrued interest, and other useful data.

You can also customise trades in various ways and execute multiple maneuvers simultaneously on the same trading pair.

The platform includes around 50 technical indicators and 19 drawing tools to assist in trading decisions, covering almost all basic technical analysis studies.

Mobile App

Like a good online broker, Trading 212 also offers a trader app, which is quite intuitive and allows you to operate with your mobile phone from anywhere in the world. The mobile app has almost identical functionality compared to the web version.

It features a clean interface, integrated TradingView charts for technical analysis, real-time price alerts, and a demo account for risk-free practice. Security is strong, with biometric login and two-factor authentication.

While some users report occasional performance issues on certain devices, the app overall provides a seamless and efficient way to manage investments on the go.

Customer Service

Trading 212 has a customer support service that, according to several reviews, provides fast and direct information.

- ❌ Contact via phone: No

- ✅ Email: info @trading212.com

- ✅ Chatbot: Yes

- ✅ Office: Aldermary House, 10-15 Queen Street, London, EC4N 1TX

To use email support, a form must be filled out on the Trading 212 website and customer service is available 24/7. Furthermore, if you use the Chatbot, the average response time is less than 30 seconds.

Phone call support is not available.

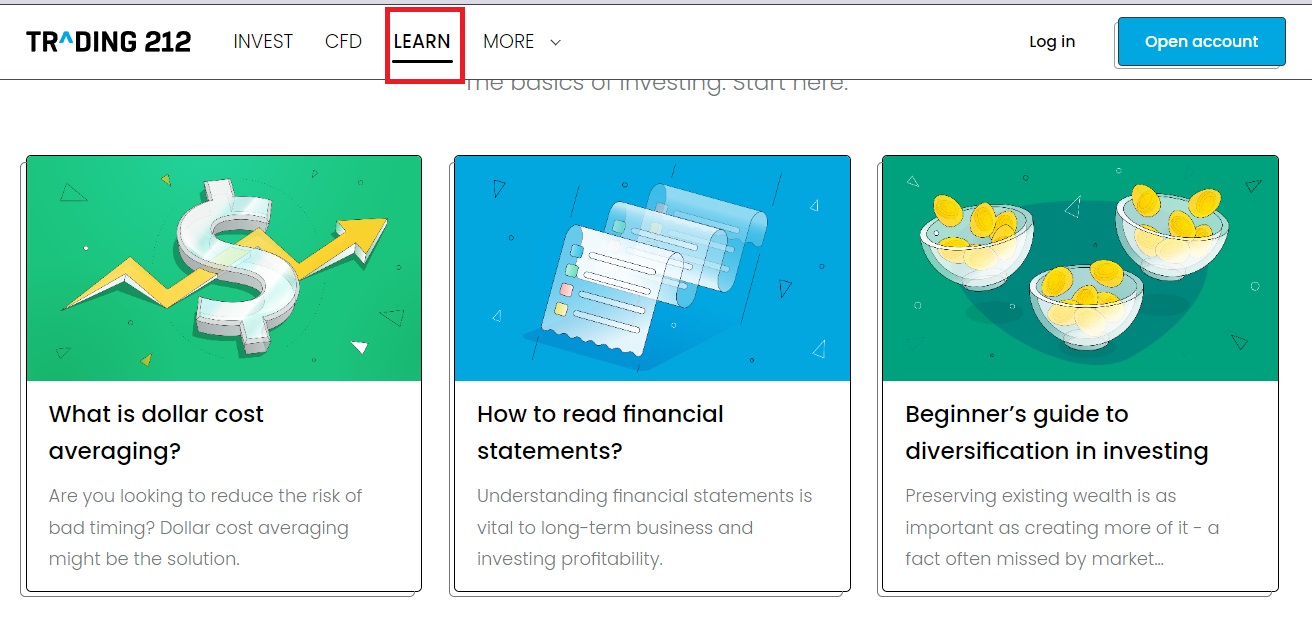

Training offered by Trading 212

Trading 212 offers text and video tutorials about their trading platform and trading basics, a great feature for beginners.

For example, its learning section contains many articles about investment strategies, financial statements, and guides.

If you go to their YouTube channel, you can find many tutorials about how their platform works and trends.

In short, the broker offers:

- Demo account.

- Platform tutorial videos.

- General educational videos.

- Quality educational articles.

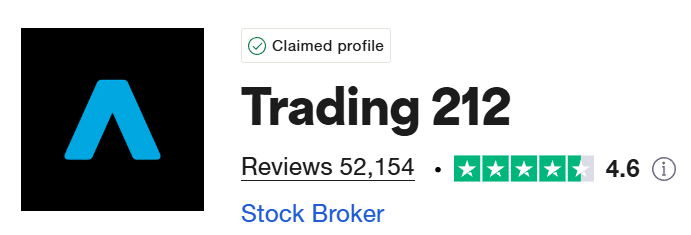

Ratings and Opinions

Due to its simplicity, ease of use, and straightforward commission system, Trading 212 enjoys positive reviews in online forums.

For example, on Trustpilot, with over 50,000 reviews, Trading 212 has an impressive rating of 4.6 stars out of 5. Users frequently praise its low commissions and user-friendly interface.

Similarly, Trading 212 has almost 200,000 reviews and 10 million downloads on the Google Play Store. It boasts a solid reputation and is rated 4.6 stars out of 5. Users appreciate its reliability and user-friendly design.

Our Opinion of Trading 212

All in all, let's pass our judgment on Trading 212.

Firstly, regulation is critical for any broker, and Trading 212 is regulated by various authorities across Europe, including the FCA in the UK, CySEC in Cyprus, the Financial Supervisory Commission in Bulgaria, and ASIC in Australia. These regulatory entities are known for their strict standards and regulations, which provide an additional layer of trust and security.

Trading 212 offers a wide range of products, including more than 10,000 shares and ETFs, including fractional shares that can be invested in from €1.

If we talk exclusively about stocks or ETFs, commissions are of the utmost importance. Trading 212 allows you to invest at zero commission (other commissions may apply**), with a maximum 0.15% commission on currency exchange. Undoubtedly, a modern broker allows you to invest with very little money in all global markets.

Perhaps the most notable aspect is its new remunerated account on uninvested cash, which, since mid-February, offers 5.2% APY on your pounds.

Finally, the Trading 212 trading platform is intuitive and easy to use, suitable for both novice and experienced investors. Fast and efficient customer support is also a plus, although it is only available via email, ensuring that users get the necessary assistance promptly.